Aerospace Bearings Market Report

Published Date: 22 January 2026 | Report Code: aerospace-bearings

Aerospace Bearings Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aerospace Bearings market from 2023 to 2033, focusing on market size, growth drivers, regional dynamics, segmentation, and anticipated trends. Insights into key players and future forecasts are also included to guide stakeholders in strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

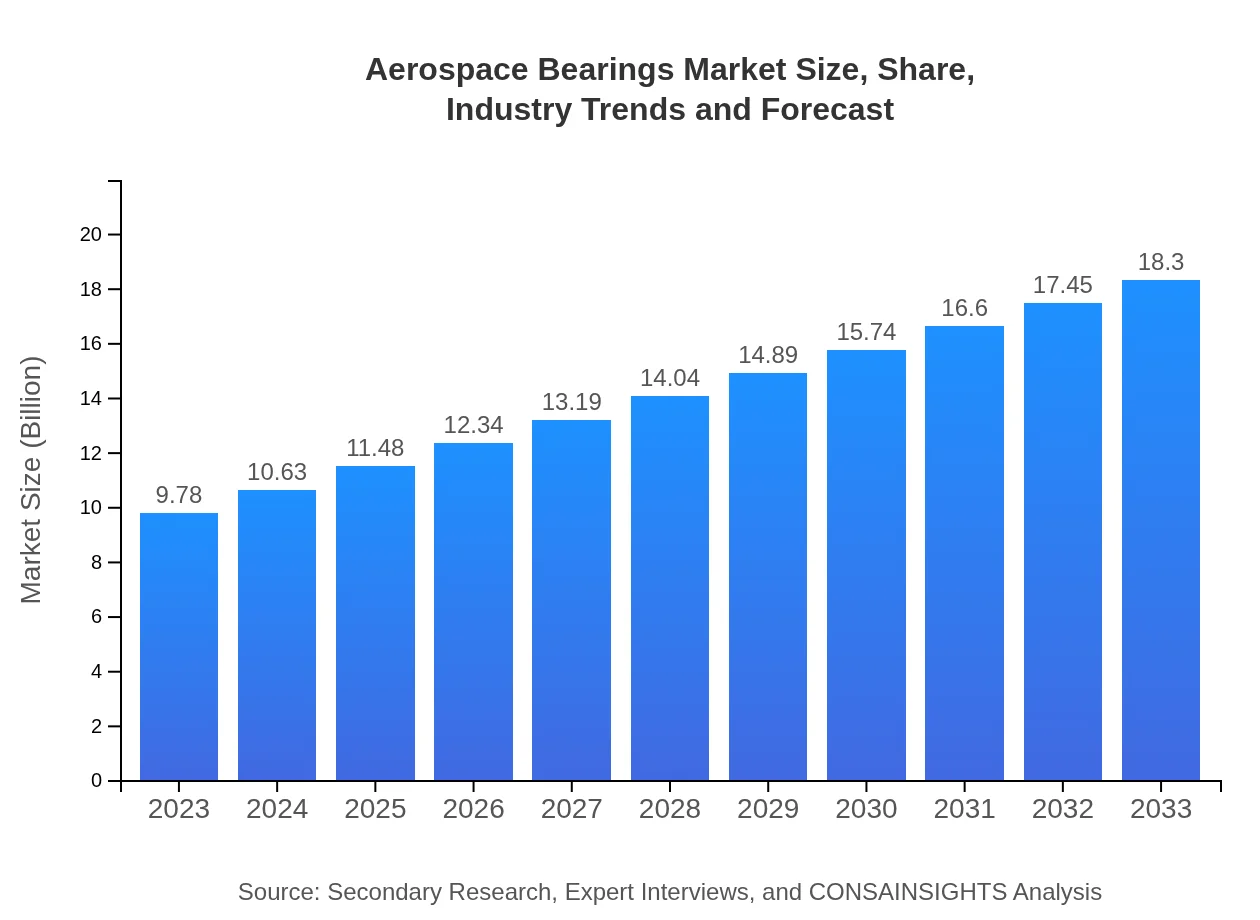

| 2023 Market Size | $9.78 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $18.30 Billion |

| Top Companies | SKF Group, NTN Corporation, Raytheon Technologies, Timken Company |

| Last Modified Date | 22 January 2026 |

Aerospace Bearings Market Overview

Customize Aerospace Bearings Market Report market research report

- ✔ Get in-depth analysis of Aerospace Bearings market size, growth, and forecasts.

- ✔ Understand Aerospace Bearings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerospace Bearings

What is the Market Size & CAGR of Aerospace Bearings market in 2023?

Aerospace Bearings Industry Analysis

Aerospace Bearings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerospace Bearings Market Analysis Report by Region

Europe Aerospace Bearings Market Report:

The European Aerospace Bearings market was valued at USD 2.64 billion in 2023 and is expected to double to USD 4.94 billion by 2033. This growth is fueled by the increasing production of environmentally friendly aircraft and investments in advanced aviation technologies.Asia Pacific Aerospace Bearings Market Report:

The Asia Pacific region, valued at USD 1.94 billion in 2023, is expected to experience strong growth, reaching USD 3.63 billion by 2033. Key drivers include increasing air travel demand, growing defense expenditures, and a rising number of aircraft manufacturers establishing operations within the region.North America Aerospace Bearings Market Report:

North America remains the leading region with a market size of USD 3.73 billion in 2023, anticipated to grow to USD 6.97 billion by 2033. The presence of major aerospace companies and ongoing defense projects drive consistent demand for high-performance bearings.South America Aerospace Bearings Market Report:

In South America, the Aerospace Bearings market was valued at USD 0.46 billion in 2023 and is projected to reach USD 0.85 billion by 2033. Although growth is slower compared to other regions, initiatives to enhance regional air travel infrastructure and local aerospace manufacturing are factors encouraging market expansion.Middle East & Africa Aerospace Bearings Market Report:

The Middle East and Africa aerospace bearings market, valued at USD 1.02 billion in 2023, is projected to grow to USD 1.90 billion by 2033 as the region invests in military capabilities and infrastructure enhancement, thus boosting demand.Tell us your focus area and get a customized research report.

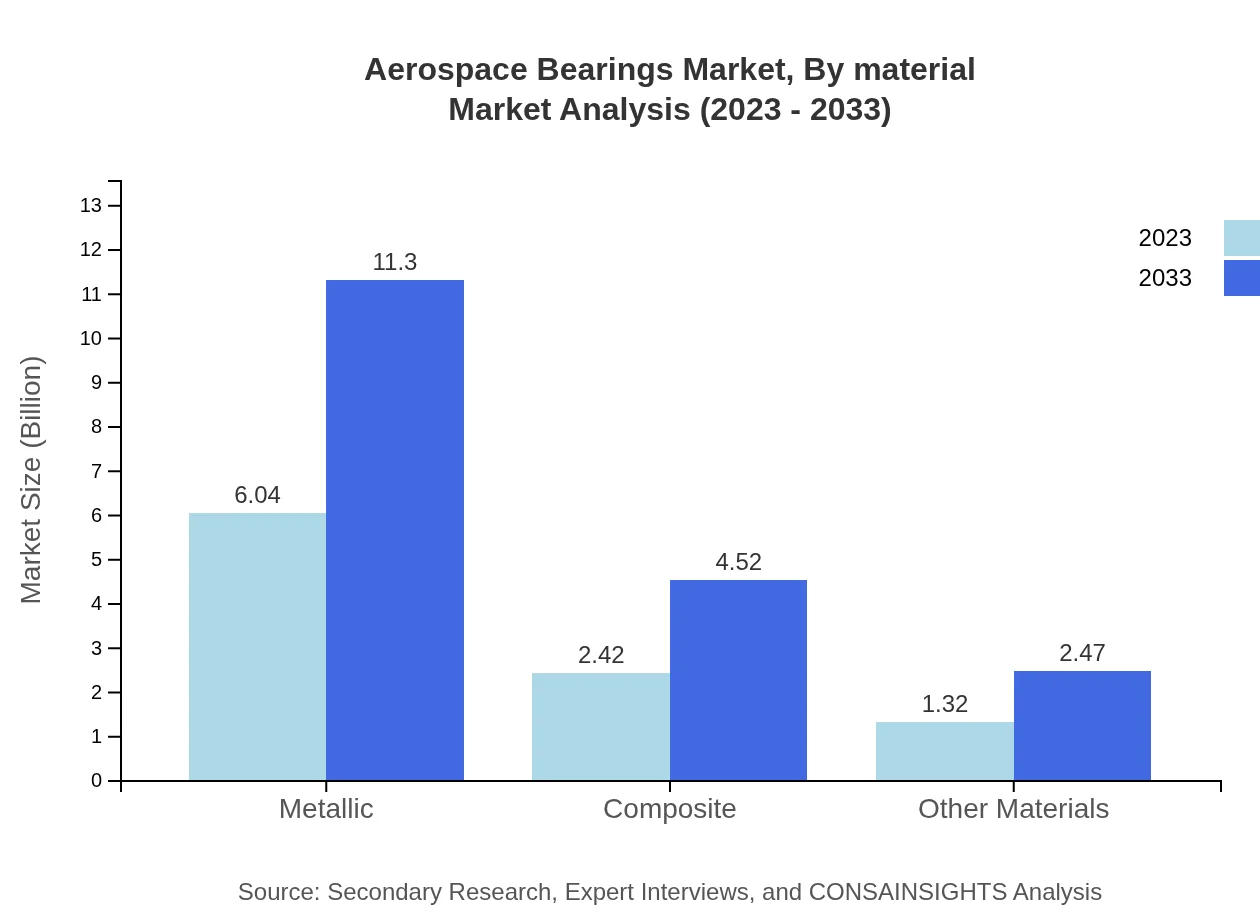

Aerospace Bearings Market Analysis By Material

The study of materials in the Aerospace Bearings market reveals that metallic materials maintain a significant share, valued at USD 6.04 billion in 2023, projected to increase to USD 11.30 billion by 2033, representing 61.76% market share. Composite materials, valued at USD 2.42 billion in 2023, show promise with expected growth to USD 4.52 billion, reflecting a 24.72% share. The adaptability of various materials enhances the performance of bearings in different aerospace applications.

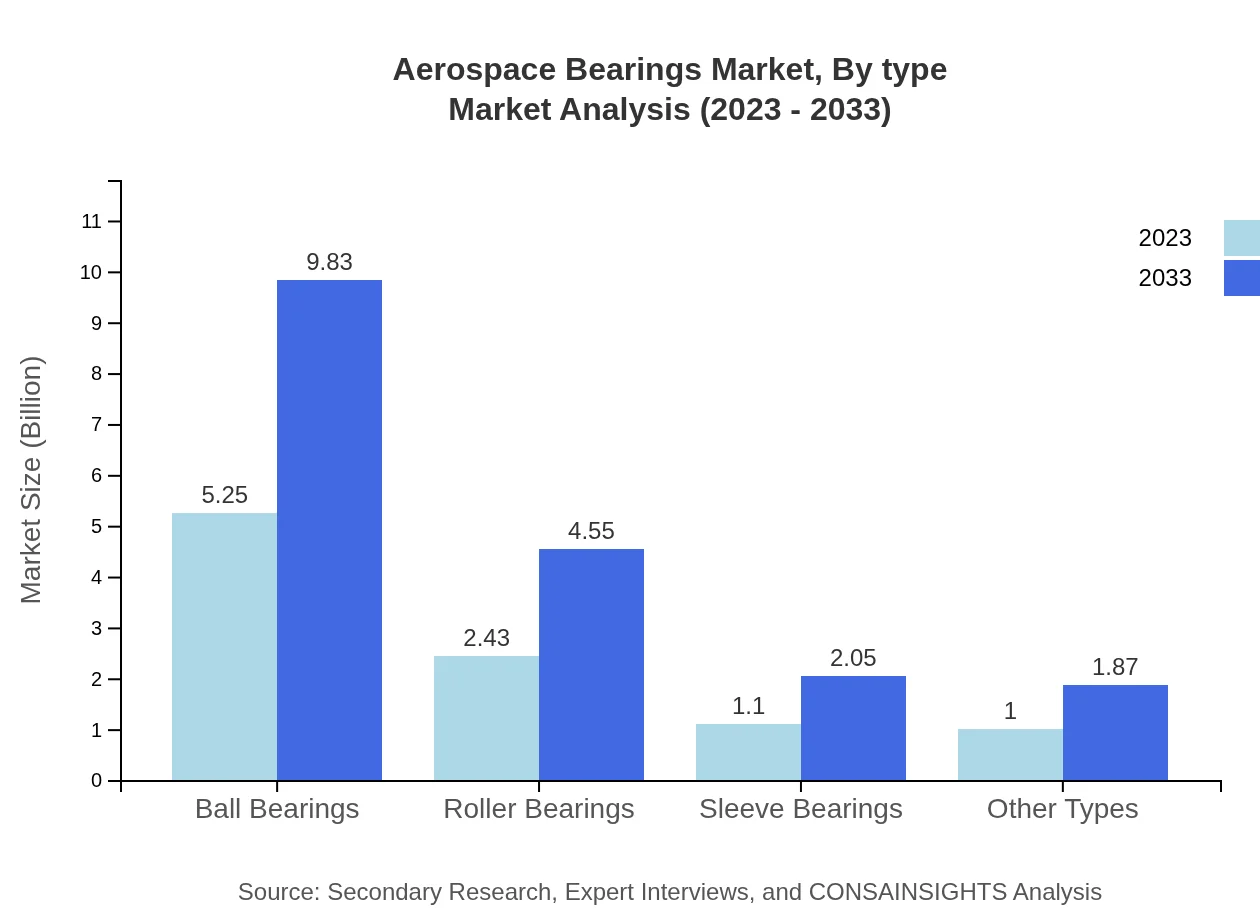

Aerospace Bearings Market Analysis By Type

The Aerospace Bearings market, segmented by type, indicates that ball bearings dominate the market with a valuation of USD 5.25 billion in 2023, expected to rise to USD 9.83 billion by 2033. Roller bearings follow, valued at USD 2.43 billion currently, projected to reach USD 4.55 billion. Sleeve bearings and other types also contribute significantly to the overall market, reflecting the diversity in requirement across different aircraft applications.

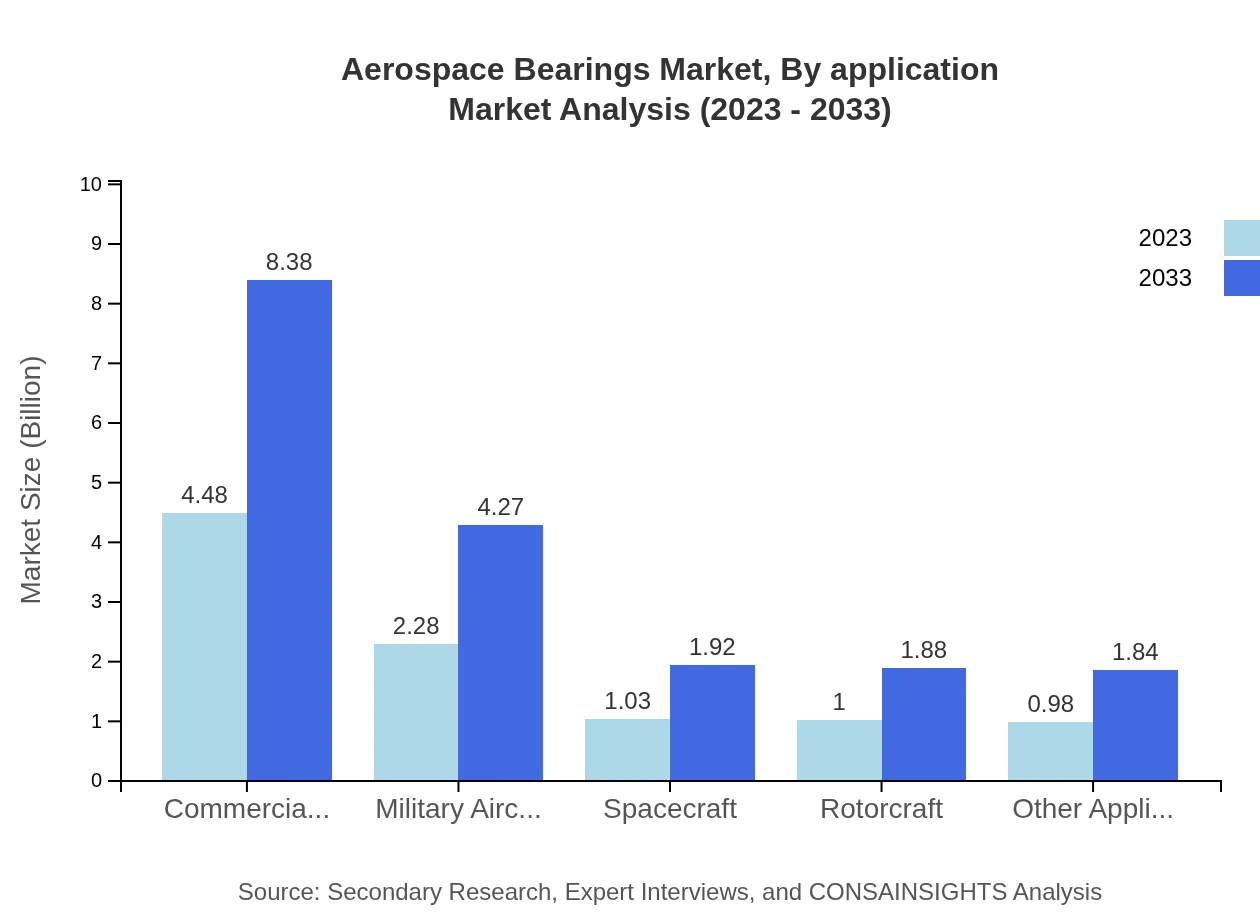

Aerospace Bearings Market Analysis By Application

Commercial aircraft constitute a major portion of the market, valued at USD 4.48 billion in 2023 and expected to grow to USD 8.38 billion over a decade. Military aircraft and spacecraft applications also represent crucial segments, valued at USD 2.28 billion and USD 1.03 billion respectively, with growth forecasts favoring increased defense spending and advancements in space technology.

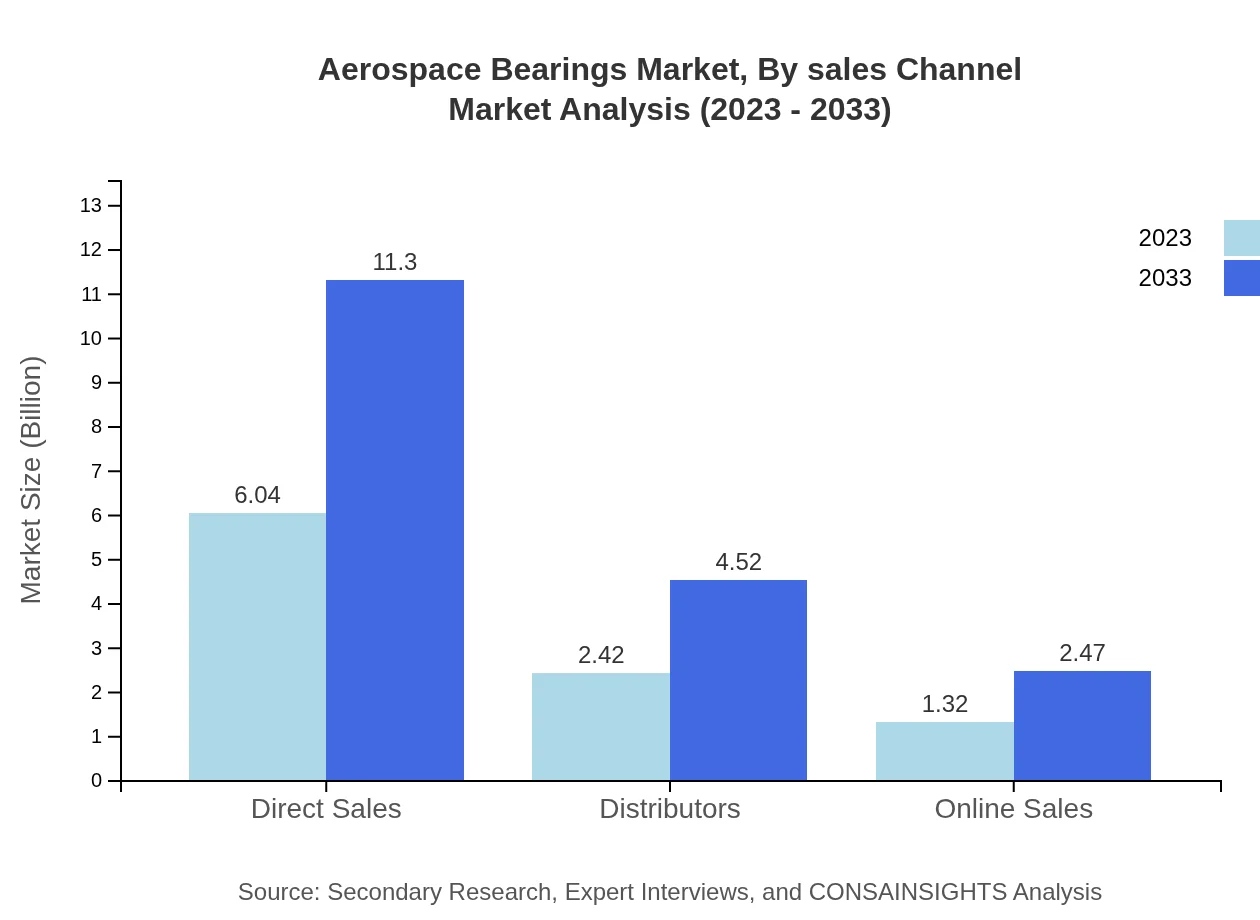

Aerospace Bearings Market Analysis By Sales Channel

Direct sales dominate with a market value of USD 6.04 billion in 2023, climbing to USD 11.30 billion by 2033. Distributors and online sales are also relevant, with focus growing on online channels due to digital transformation in the procurement process. The revenue distribution indicates the robust nature of direct sales in establishing customer trust and efficacy.

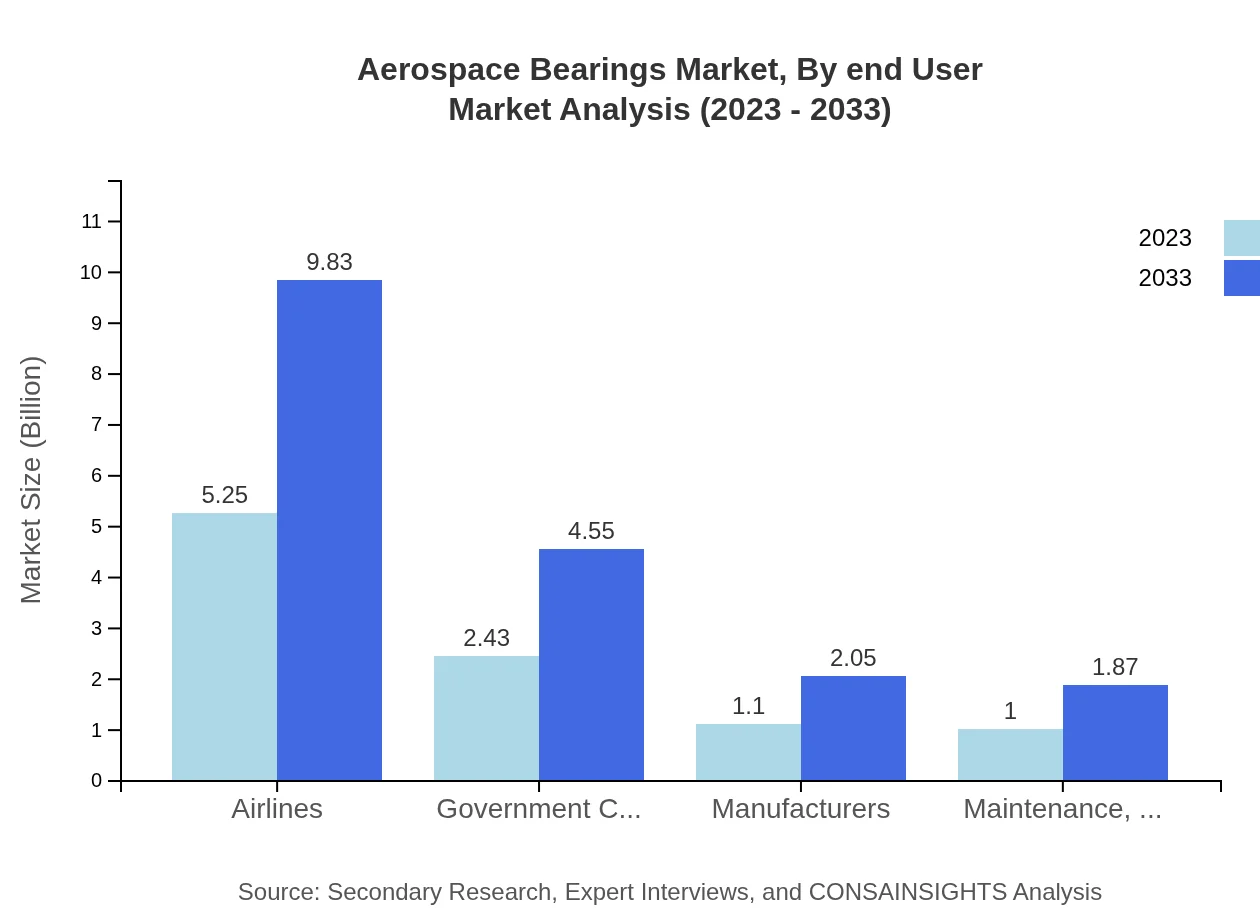

Aerospace Bearings Market Analysis By End User

Airlines make up the bulk of the end-user segment, valued at USD 5.25 billion with consistent growth prospects. Government contractors and manufacturers, valued at USD 2.43 billion and USD 1.10 billion respectively, are essential contributors as well, utilizing aerospace bearings for both operational and commercial purposes as defense budgets increase and manufacturing opportunities expand.

Aerospace Bearings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerospace Bearings Industry

SKF Group:

A leading global provider of bearings and sealing solutions, committed to innovation in aerospace components for improved reliability and performance.NTN Corporation:

One of the largest bearing manufacturers worldwide, producing specialized aerospace bearings that cater to various applications and environments.Raytheon Technologies:

A major player in aerospace and defense, known for producing sophisticated aerospace bearings designed for high-performance applications.Timken Company:

A well-established name in bearing manufacturing, providing a wide range of aerospace bearings noted for durability and cutting-edge design.We're grateful to work with incredible clients.

FAQs

What is the market size of Aerospace Bearings?

The global Aerospace Bearings market is projected to reach approximately $9.78 billion by 2033, growing at a CAGR of 6.3% from its current size of around $9.78 billion. This growth reflects the increasing demand for advanced bearings in the aerospace sector.

What are the key market players or companies in the Aerospace Bearings industry?

Key players in the Aerospace Bearings industry include industry giants like SKF, Timken, and Raytheon. These companies lead in innovation and technology, catering to the increasing demand for high-quality aerospace bearings and maintaining a significant share of the market.

What are the primary factors driving the growth in the Aerospace Bearings industry?

Growth drivers in the Aerospace Bearings industry include the rise in air travel, advancements in aerospace technology, increased military spending, and a growing focus on maintenance, repair, and operations (MRO). These factors collectively boost the demand for reliable aerospace bearings.

Which region is the fastest Growing in the Aerospace Bearings market?

The fastest-growing region in the Aerospace Bearings market is North America, projected to expand from $3.73 billion in 2023 to $6.97 billion by 2033, influenced by increasing flights and investments in aerospace infrastructure and technology.

Does ConsaInsights provide customized market report data for the Aerospace Bearings industry?

Yes, ConsaInsights offers customized market report data tailored to the unique requirements of various stakeholders in the Aerospace Bearings industry, ensuring pertinent insights and up-to-date information for informed decision-making.

What deliverables can I expect from this Aerospace Bearings market research project?

From the Aerospace Bearings market research project, you can expect comprehensive reports featuring market size analysis, growth forecasts, competitive landscape evaluations, and in-depth regional and segment data for better strategic planning.

What are the market trends of Aerospace Bearings?

Current market trends in the Aerospace Bearings sector include a shift towards lightweight materials, increased automation in manufacturing, and a rising demand for high-performance bearings tailored for specialized applications, influencing future market dynamics.