Aerospace Fasteners Market Report

Published Date: 22 January 2026 | Report Code: aerospace-fasteners

Aerospace Fasteners Market Size, Share, Industry Trends and Forecast to 2033

This report examines the global Aerospace Fasteners market from 2023 to 2033, providing insights into market size, trends, and growth potential. It covers segmentation, regional analysis, technology advancements, and profiles of leading companies in the industry.

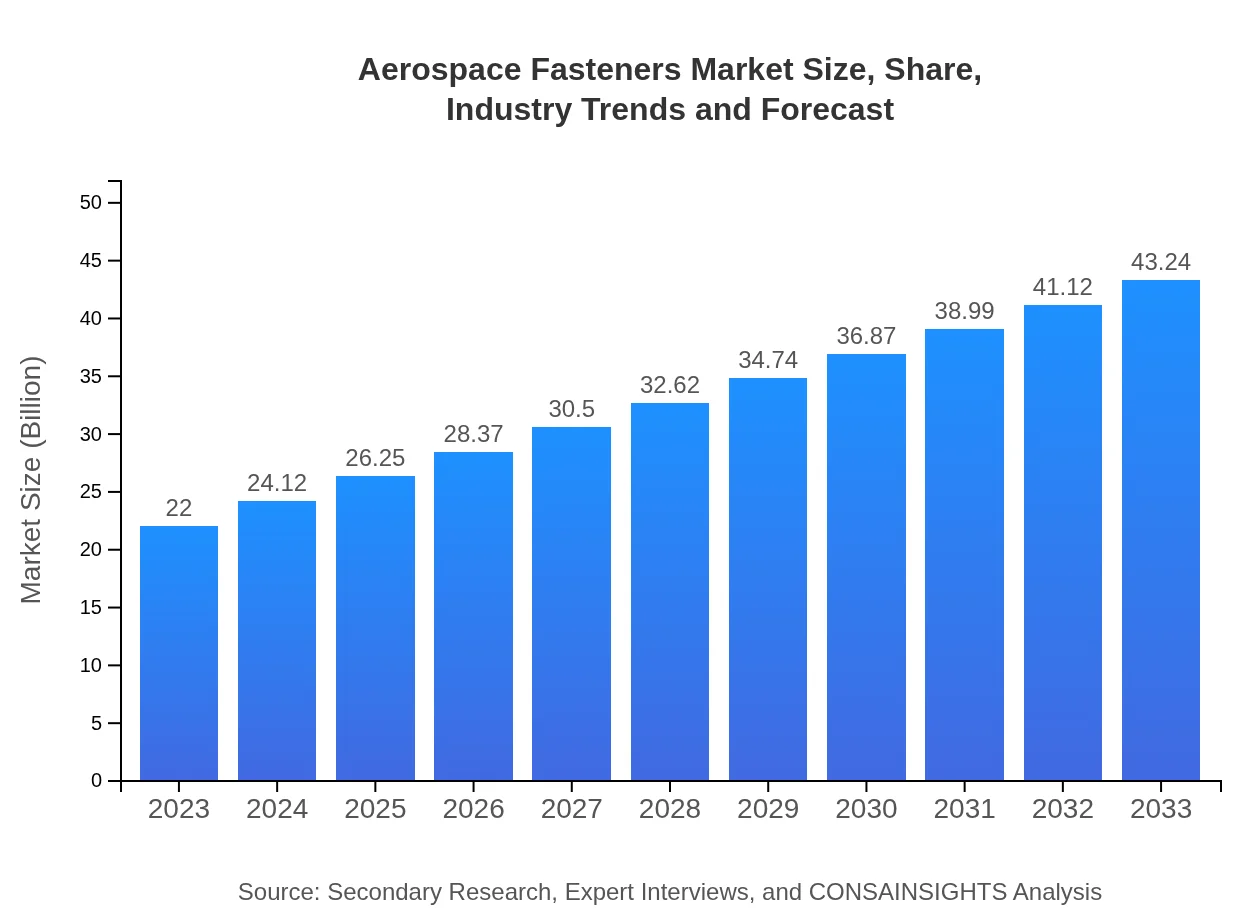

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $22.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $43.24 Billion |

| Top Companies | LISI Aerospace, Bollhoff, Penn Engineering, Huck Fasteners |

| Last Modified Date | 22 January 2026 |

Aerospace Fasteners Market Overview

Customize Aerospace Fasteners Market Report market research report

- ✔ Get in-depth analysis of Aerospace Fasteners market size, growth, and forecasts.

- ✔ Understand Aerospace Fasteners's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerospace Fasteners

What is the Market Size & CAGR of Aerospace Fasteners market in 2033?

Aerospace Fasteners Industry Analysis

Aerospace Fasteners Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerospace Fasteners Market Analysis Report by Region

Europe Aerospace Fasteners Market Report:

In Europe, the Aerospace Fasteners market is projected to grow significantly, increasing from $5.85 billion in 2023 to $11.51 billion by 2033. This growth is fueled by the EU’s focus on advancing aerospace engineering capabilities and the increasing demand for fuel-efficient and environmentally compliant aviation technologies.Asia Pacific Aerospace Fasteners Market Report:

The Asia Pacific region is expected to exhibit significant growth in the Aerospace Fasteners market, reaching $8.96 billion by 2033, up from $4.56 billion in 2023. This growth is spurred by increasing aircraft production rates in countries like China and India, alongside a burgeoning defense sector. The growing middle class and rising air travel demand contribute to heightened investments in aviation infrastructure.North America Aerospace Fasteners Market Report:

North America remains the largest market for Aerospace Fasteners, projected to reach $15.82 billion by 2033 from $8.05 billion in 2023. The presence of major aircraft manufacturers, such as Boeing and Lockheed Martin, along with continuous innovations in aerospace technology, are critical factors in this region's growth.South America Aerospace Fasteners Market Report:

In South America, the Aerospace Fasteners market is anticipated to grow from $1.39 billion in 2023 to $2.72 billion by 2033. This growth is largely driven by the expansion of regional airlines and government investments in improving the local aerospace capabilities, particularly in Brazil, Argentina, and Chile.Middle East & Africa Aerospace Fasteners Market Report:

The Middle East and Africa market is expected to grow from $2.15 billion in 2023 to $4.23 billion by 2033. Increased investments in military capabilities and infrastructure development, especially in Gulf Cooperation Council (GCC) countries, drive this growth, supporting an expanding aviation industry.Tell us your focus area and get a customized research report.

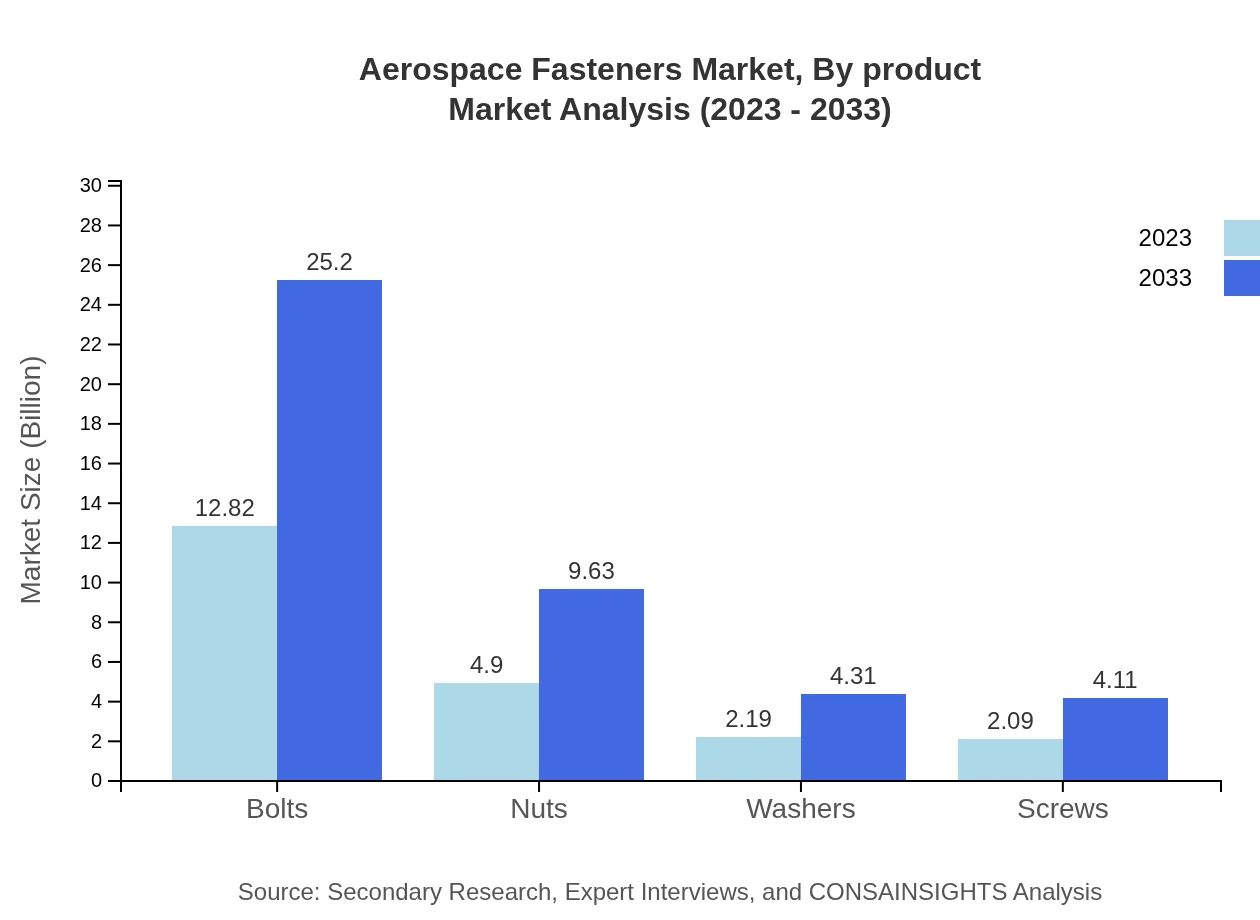

Aerospace Fasteners Market Analysis By Product

The product segment of Aerospace Fasteners includes Bolts, Nuts, Washers, and Screws. Bolts hold the largest market share and are anticipated to grow from $12.82 billion in 2023 to $25.20 billion by 2033. Nuts share a significant portion as well, with a market size of $4.90 billion in 2023 projected to increase to $9.63 billion by 2033. Washers and Screws, although smaller in comparison, are expected to see steady growth reflecting the overall market expansion.

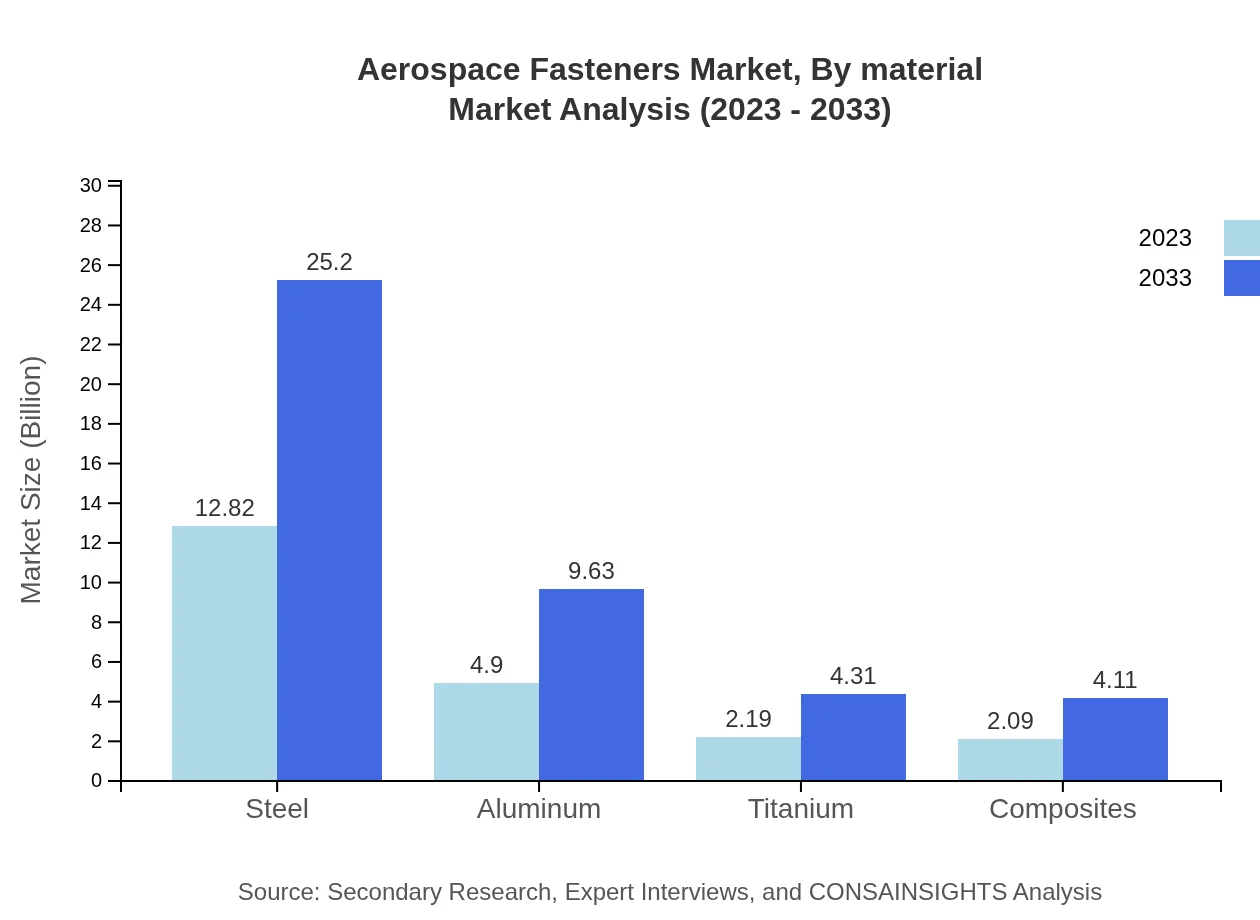

Aerospace Fasteners Market Analysis By Material

The market by material encompasses Steel, Aluminum, Titanium, and Composites. Steel dominates this segment with a size of $12.82 billion in 2023, foreseen to double by 2033. Aluminum holds a significant market share due to its lightweight properties and is forecasted to grow from $4.90 billion to $9.63 billion. Titanium and Composites, while smaller, are increasingly used in advanced applications due to their strength-to-weight ratios.

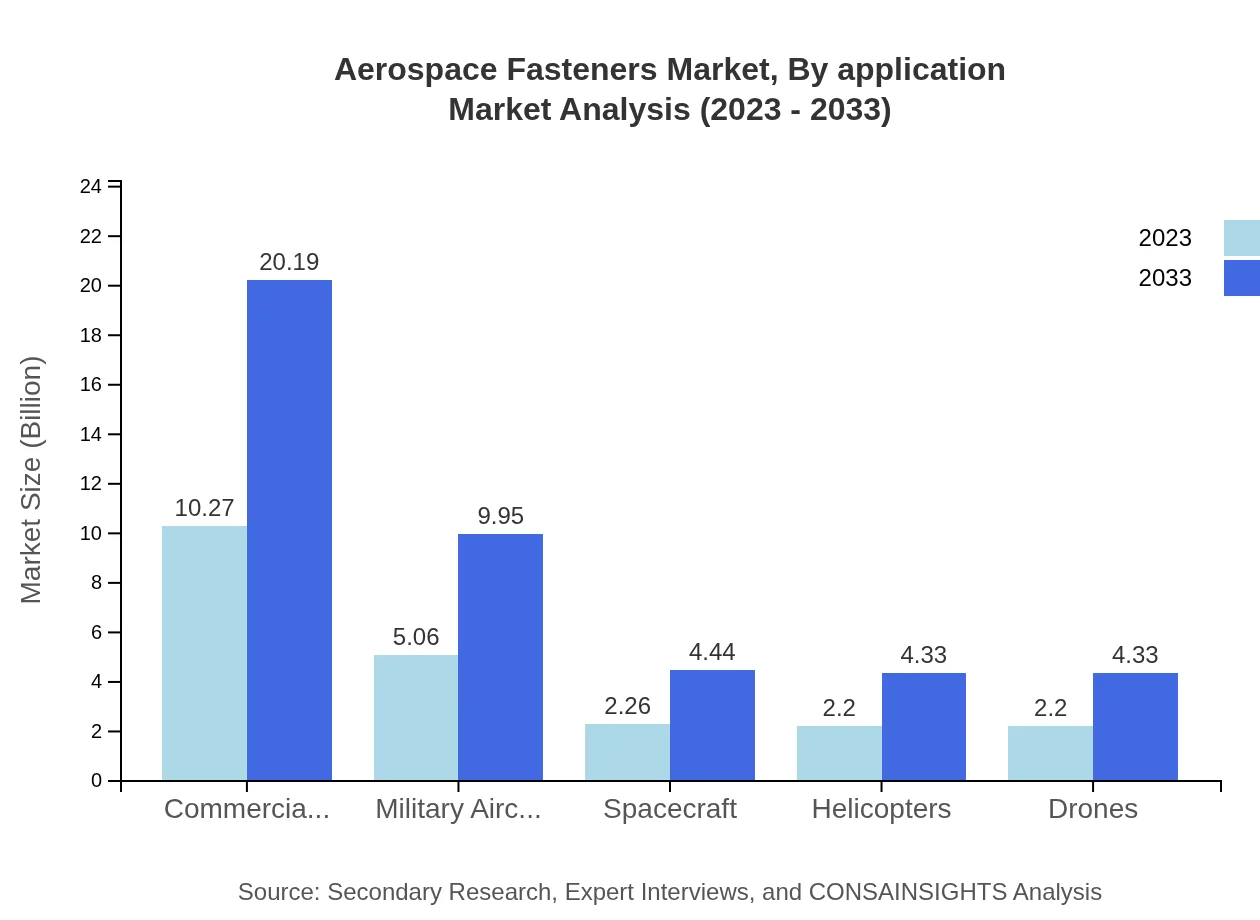

Aerospace Fasteners Market Analysis By Application

The application segment breaks down into Commercial Aircraft, Military Aircraft, Spacecraft, Helicopters, and Drones. Commercial Aircraft holds a dominant position with a market size of $10.27 billion in 2023 growing to $20.19 billion by 2033. Military applications are equally significant, projecting to rise from $5.06 billion to $9.95 billion as defense investments remain robust.

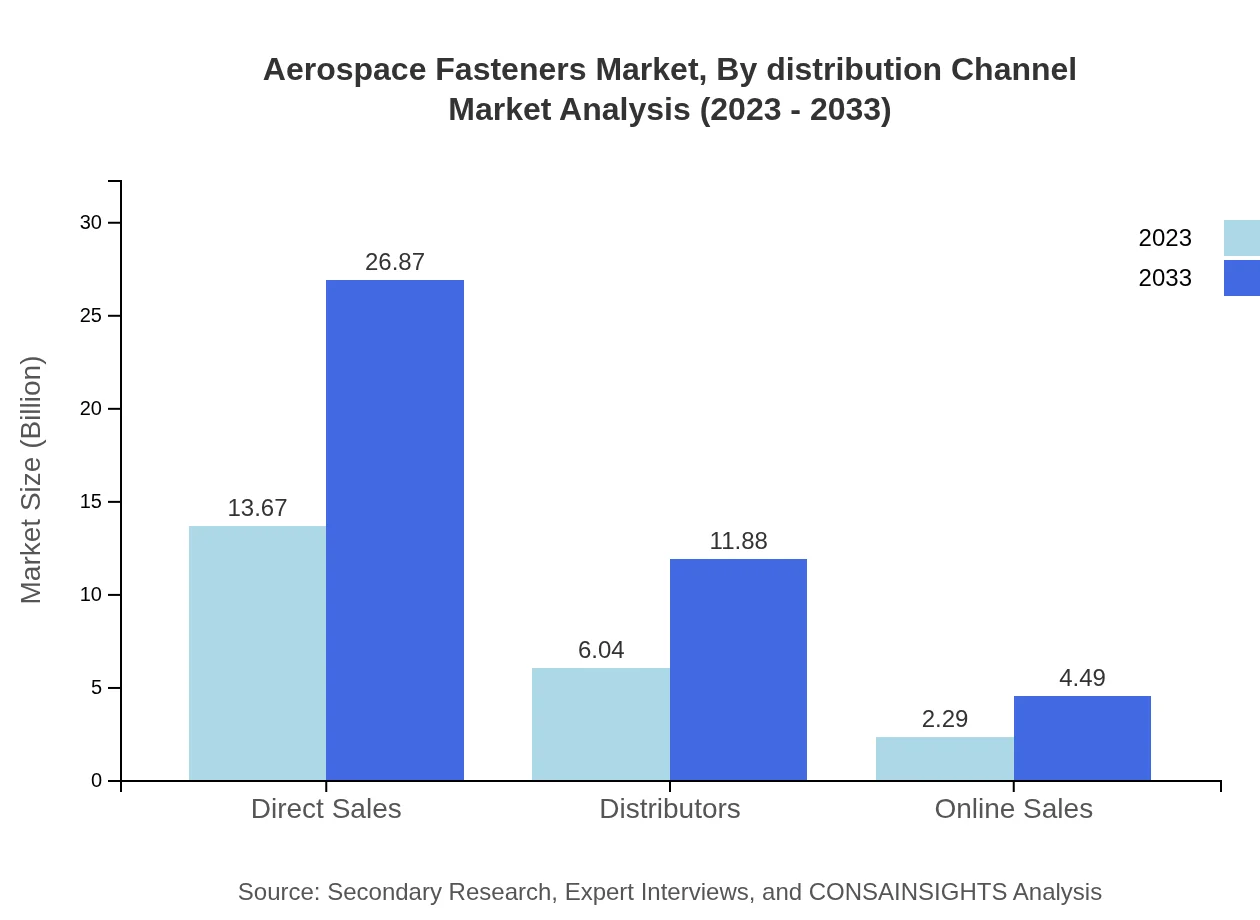

Aerospace Fasteners Market Analysis By Distribution Channel

Distribution channels include Direct Sales, Distributors, and Online Sales, with Direct Sales commanding a notable market share at $13.67 billion in 2023 and expected to reach $26.87 billion by 2033. Distributors also play a crucial role, projected to grow from $6.04 billion to $11.88 billion, reflecting the ongoing need for efficient supply chains.

Aerospace Fasteners Market Analysis By End User

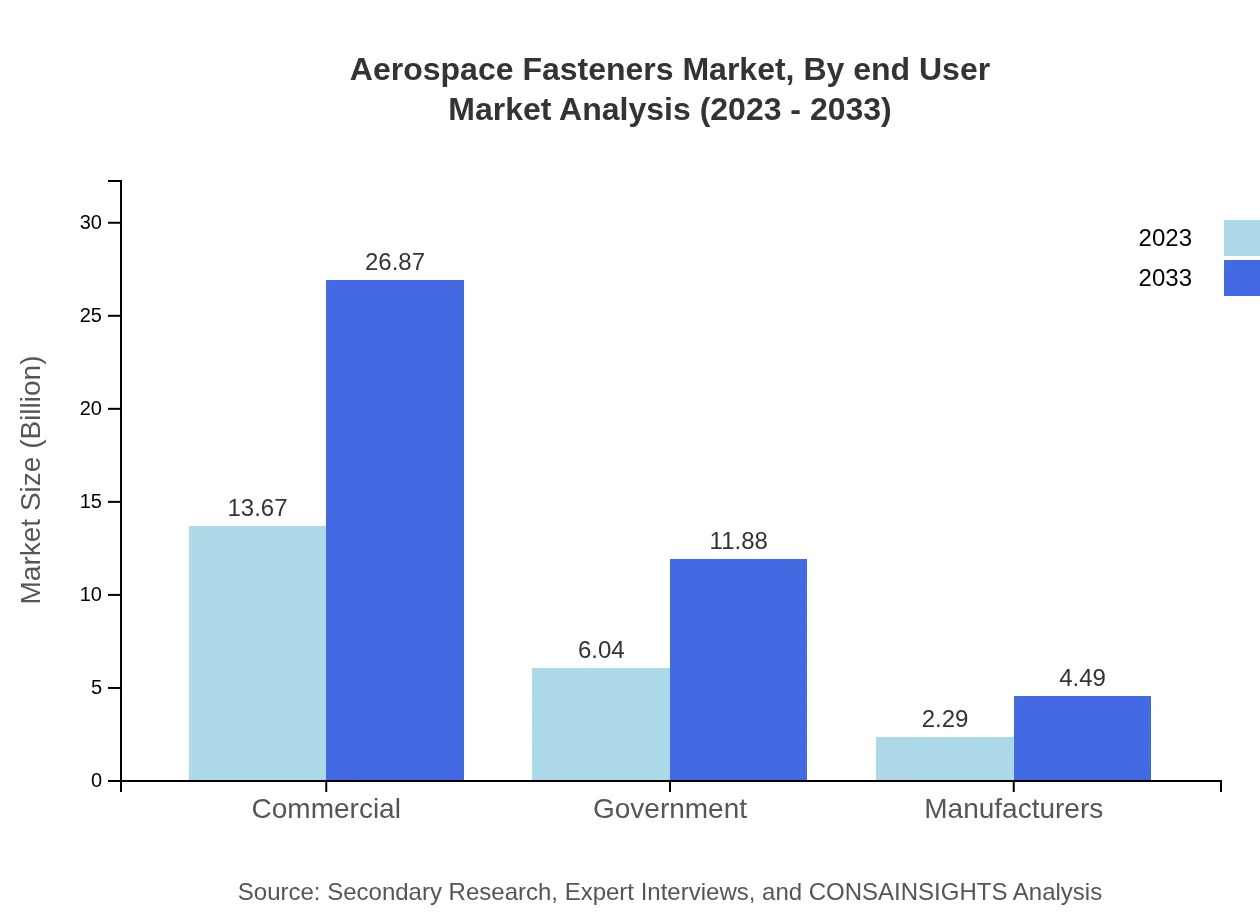

The end-user industry encompasses Commercial, Government, and Manufacturers. Commercial end-users comprise a significant share, expected to grow from $13.67 billion in 2023 to $26.87 billion by 2033. Government contracts are also substantial, growing from $6.04 billion to $11.88 billion, showcasing steady investment in military and civilian aviation initiatives.

Aerospace Fasteners Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerospace Fasteners Industry

LISI Aerospace:

LISI Aerospace is a global leader in the design and manufacture of aerospace fasteners and components, renowned for its innovative solutions and high-quality products that cater to various aerospace applications.Bollhoff:

Bollhoff specializes in fastening technology and offers a wide range of aerospace fasteners, recognized for their advanced engineering and precision manufacturing capabilities.Penn Engineering:

Penn Engineering develops and supplies fastening solutions for the aerospace sector, focusing on providing reliable components backed by extensive engineering support.Huck Fasteners:

Huck Fasteners provides high-performance fastening solutions for various aerospace applications, ensuring safety and reliability in critical environments.We're grateful to work with incredible clients.

FAQs

What is the market size of aerospace Fasteners?

The global aerospace fasteners market size is projected to reach approximately $22 billion by 2033, growing at a CAGR of 6.8%. This growth reflects the increasing demand for advanced fastening solutions in aerospace manufacturing.

What are the key market players or companies in this aerospace Fasteners industry?

Key players in the aerospace fasteners industry include major fastener manufacturers and suppliers, contributing significantly to market growth, innovation, and technological advancements in aerospace applications.

What are the primary factors driving the growth in the aerospace Fasteners industry?

The growth of the aerospace fasteners industry is driven by increasing air travel, advancements in aircraft technology, and the rising demand for lightweight materials, leading to an enhanced focus on high-performance fastening solutions.

Which region is the fastest Growing in the aerospace Fasteners?

North America is the fastest-growing region in the aerospace fasteners market, with expected growth from $8.05 billion in 2023 to $15.82 billion by 2033, driven by high aircraft manufacturing activities and R&D investments.

Does ConsaInsights provide customized market report data for the aerospace Fasteners industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the aerospace fasteners industry, ensuring clients receive insights that align with their business objectives.

What deliverables can I expect from this aerospace Fasteners market research project?

Deliverables from the aerospace fasteners market research project include comprehensive market analysis, trend assessments, competitive landscape insights, regional breakdowns, and forecasts for market growth and segmentation.

What are the market trends of aerospace Fasteners?

Current trends in the aerospace fasteners market include the increasing adoption of advanced materials, growth in commercial aviation, and the shift towards sustainability and eco-friendly fastening solutions.