Aerospace Filters Market Report

Published Date: 03 February 2026 | Report Code: aerospace-filters

Aerospace Filters Market Size, Share, Industry Trends and Forecast to 2033

This market report provides comprehensive insights into the Aerospace Filters industry, including market size forecasts, regional analyses, technological advancements, and key players. The report covers the forecast period from 2023 to 2033, aiming to equip stakeholders with actionable data for strategic decision-making.

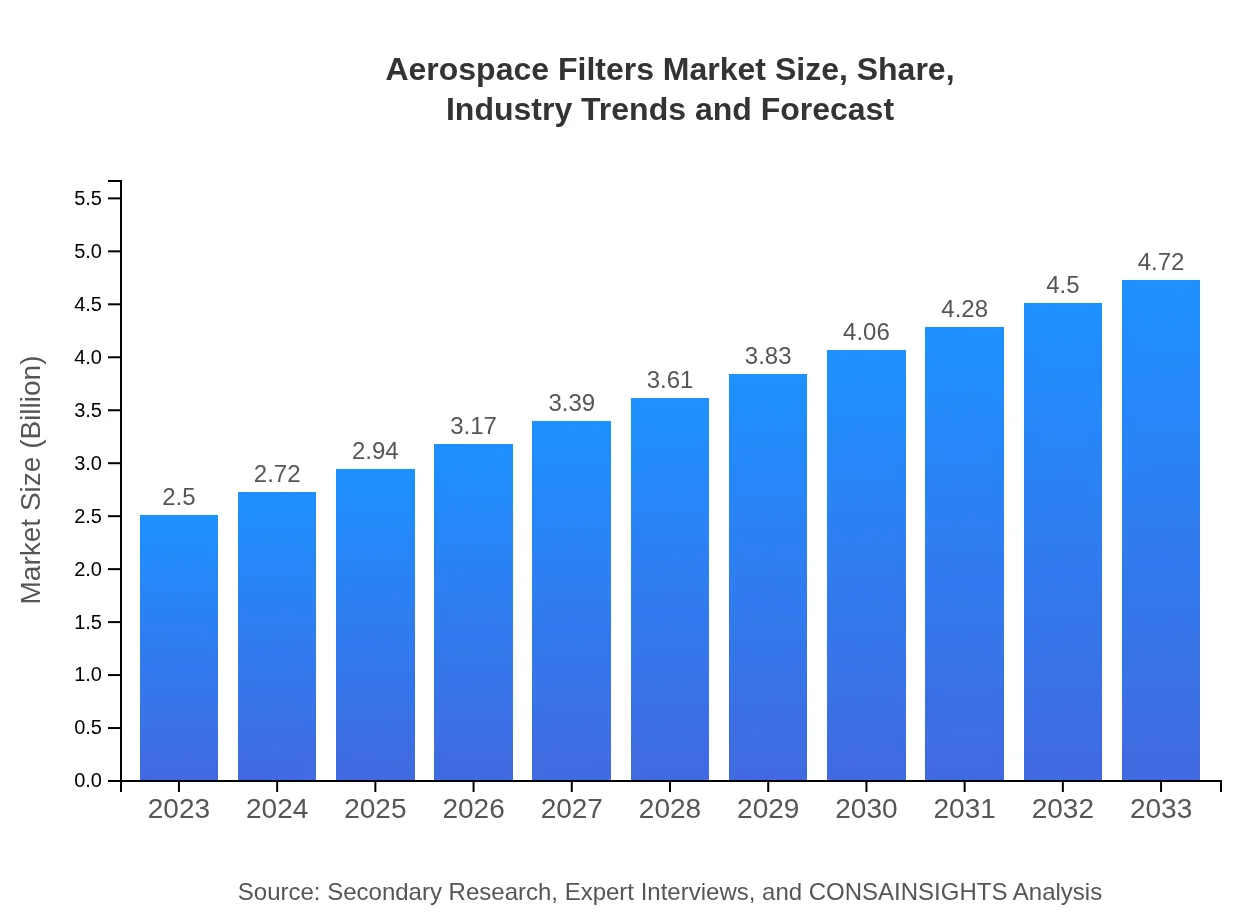

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.4% |

| 2033 Market Size | $4.72 Billion |

| Top Companies | Parker Hannifin Corporation, Donaldson Company, Inc., Hengst SE, 3M Company, Ultra Clean Technologies |

| Last Modified Date | 03 February 2026 |

Aerospace Filters Market Overview

Customize Aerospace Filters Market Report market research report

- ✔ Get in-depth analysis of Aerospace Filters market size, growth, and forecasts.

- ✔ Understand Aerospace Filters's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerospace Filters

What is the Market Size & CAGR of Aerospace Filters market in 2023?

Aerospace Filters Industry Analysis

Aerospace Filters Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerospace Filters Market Analysis Report by Region

Europe Aerospace Filters Market Report:

The European Aerospace Filters market is forecasted to increase from USD 0.84 billion in 2023 to USD 1.59 billion by 2033. As Europe emphasizes sustainable aviation, innovations in filter technologies are critical to meet stringent regulations while enhancing aircraft efficiency.Asia Pacific Aerospace Filters Market Report:

In the Asia Pacific region, the Aerospace Filters market is expected to grow from USD 0.46 billion in 2023 to USD 0.88 billion by 2033. This growth is fueled by the increasing air travel demand and rapid expansion of the aviation sector in countries like China and India, coupled with rising defense budgets.North America Aerospace Filters Market Report:

North America remains a significant player in the Aerospace Filters market, with estimates showing it will grow from USD 0.83 billion in 2023 to USD 1.57 billion in 2033. The region's advanced aerospace industry, coupled with major defense programs, supports substantial investment in filtration technologies.South America Aerospace Filters Market Report:

The South American market for Aerospace Filters is projected to grow from USD 0.09 billion in 2023 to USD 0.17 billion by 2033. This growth is largely driven by gradual recovery in air travel post-pandemic and growing military expenditure from regional governments.Middle East & Africa Aerospace Filters Market Report:

In the Middle East and Africa, the Aerospace Filters market is set to expand from USD 0.28 billion in 2023 to USD 0.52 billion by 2033. Significant investments in aviation infrastructure and military systems are the primary growth drivers in this region.Tell us your focus area and get a customized research report.

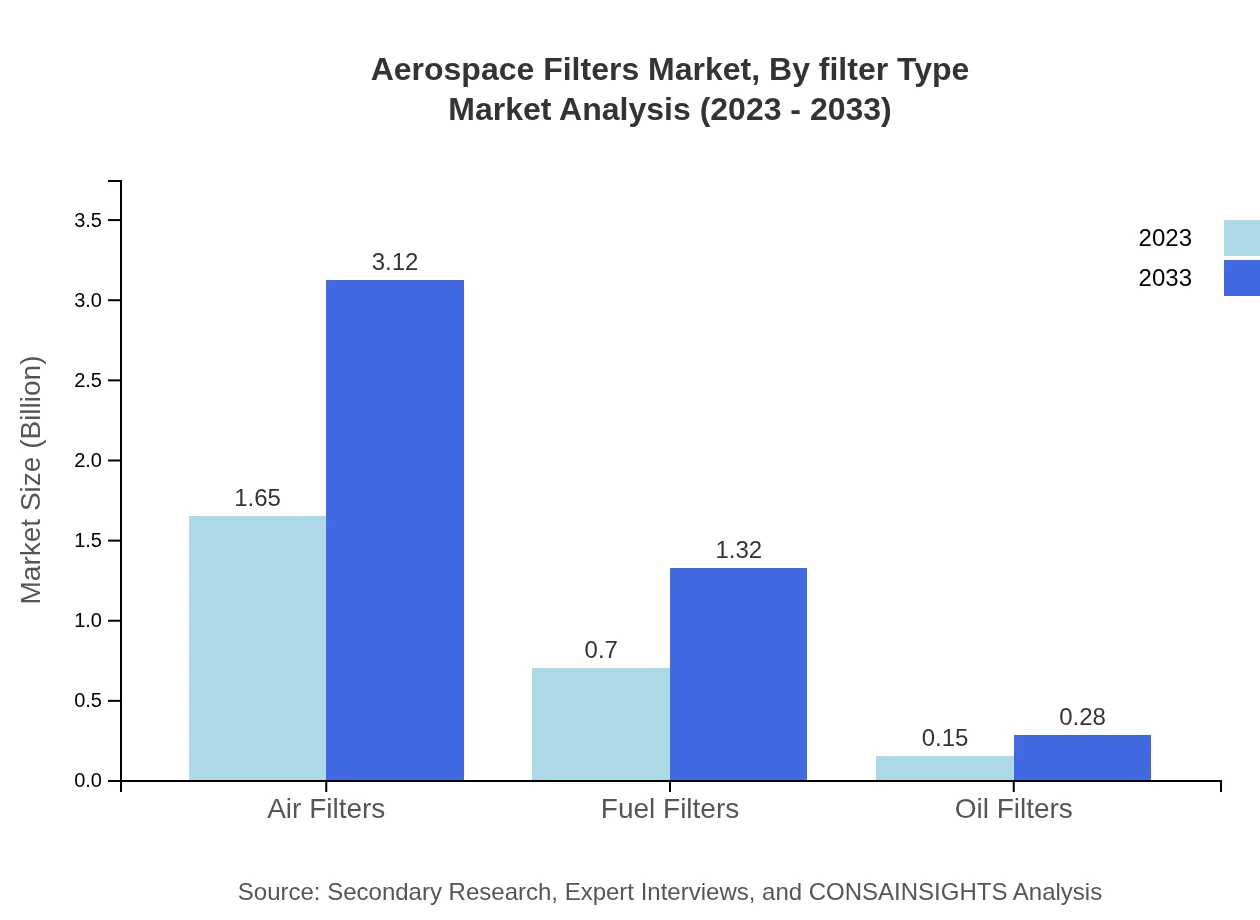

Aerospace Filters Market Analysis By Filter Type

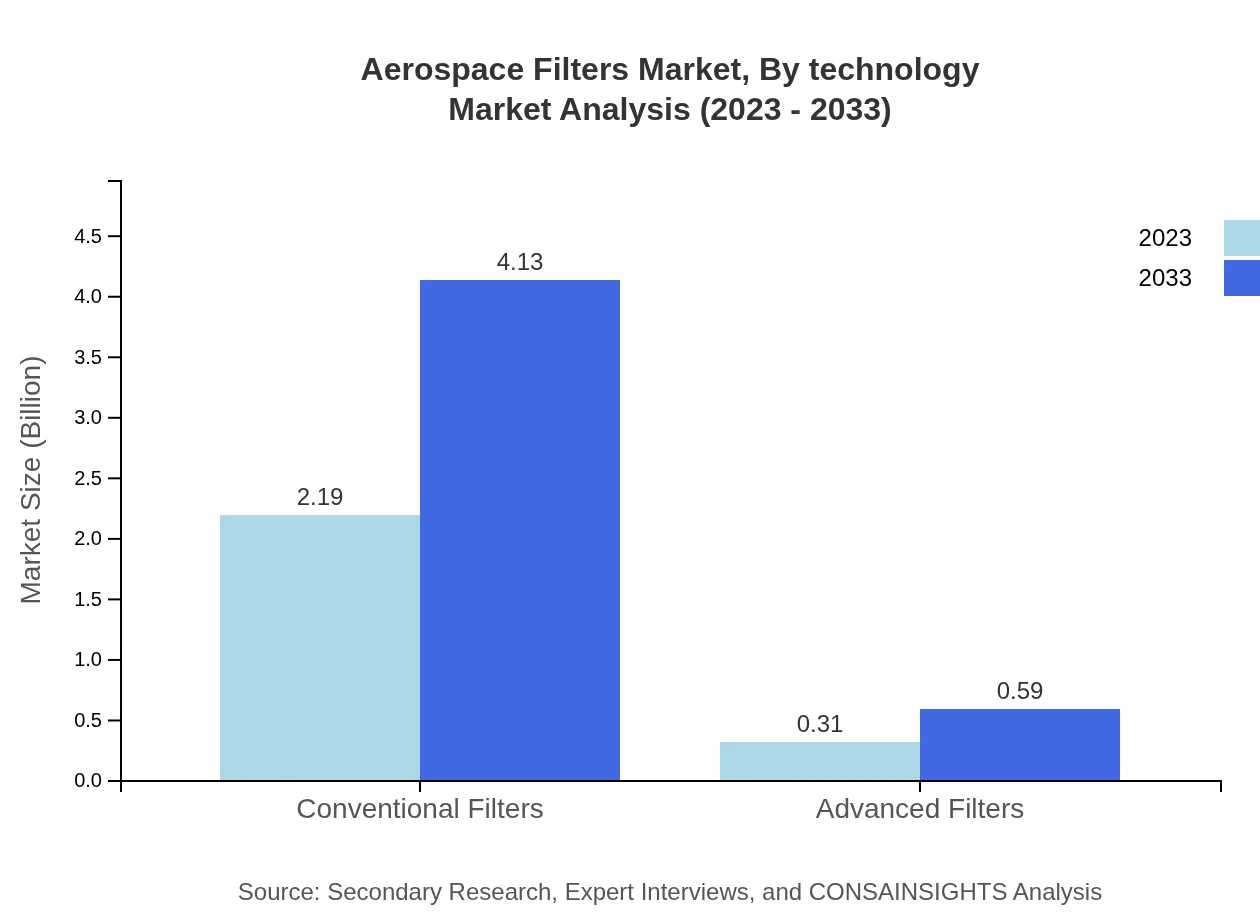

The market is segmented by filter type, with Conventional Filters and Advanced Filters leading in terms of market size. Conventional Filters are projected to grow from USD 2.19 billion in 2023 to USD 4.13 billion by 2033, maintaining a dominant share due to their widespread applicability. Advanced Filters, on the other hand, are showing promising growth that reflects the industry's shift towards specialized solutions, growing from USD 0.31 billion to USD 0.59 billion in the same period.

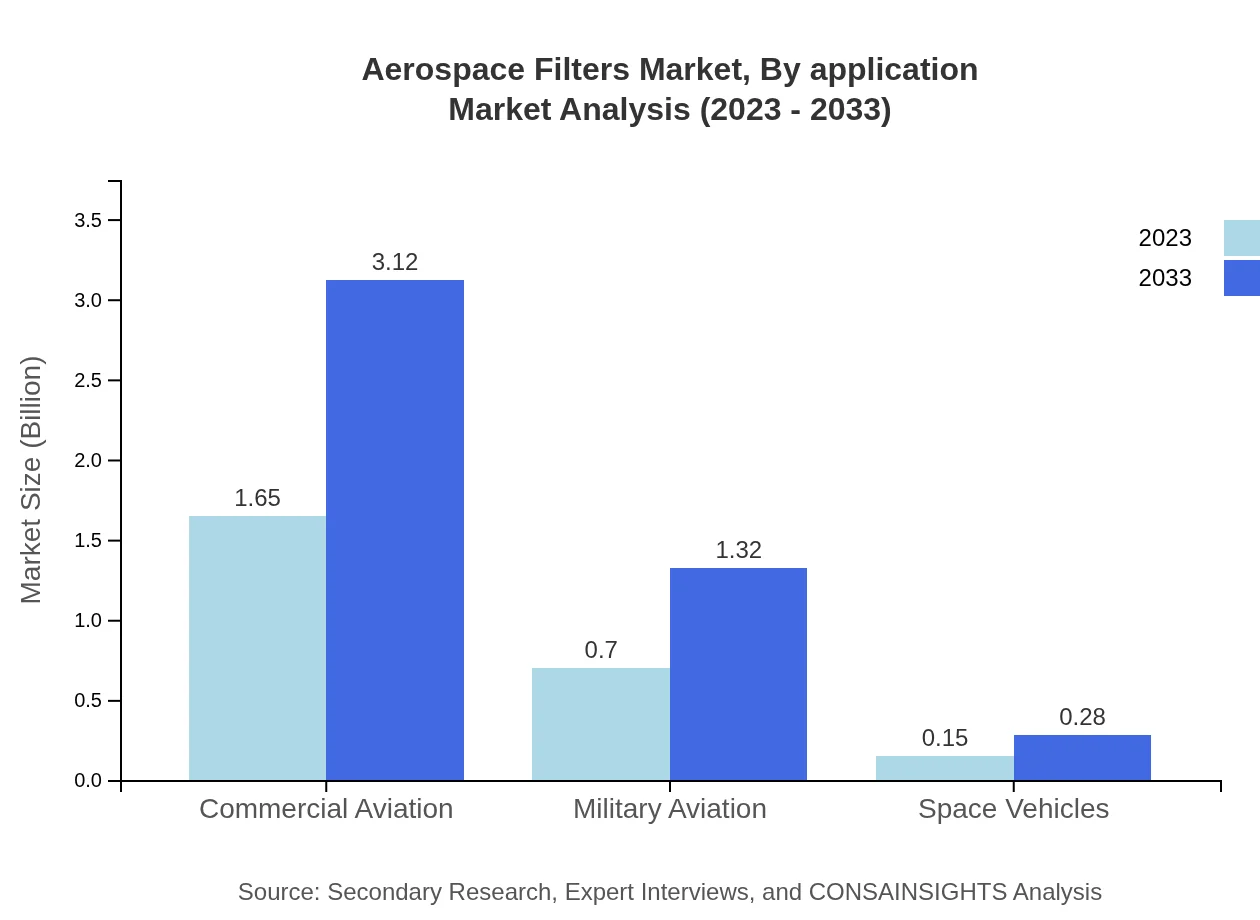

Aerospace Filters Market Analysis By Application

The application segmentation includes Commercial Aviation, Military Aviation, and Space Vehicles. Commercial Aviation, dominating the market with expected growth from USD 1.65 billion to USD 3.12 billion by 2033, accounts for the largest share. Military Aviation will also see growth from USD 0.70 billion to USD 1.32 billion, driven by increased defense procurement.

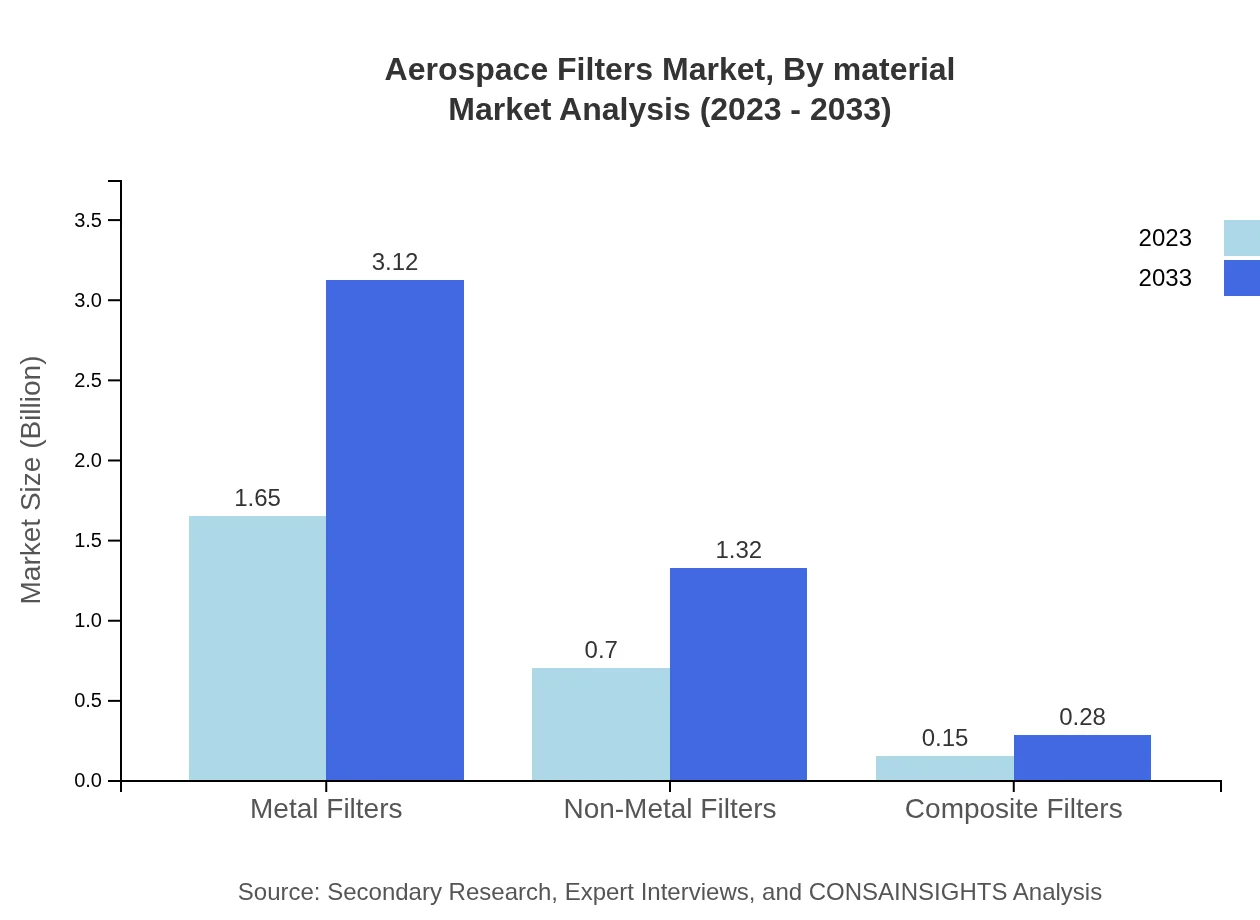

Aerospace Filters Market Analysis By Material

Filters are further categorized by material, with Metal Filters and Non-Metal Filters leading the market. Metal Filters are expected to grow from USD 1.65 billion in 2023 to USD 3.12 billion by 2033, while Non-Metal Filters will see growth from USD 0.70 billion to USD 1.32 billion. The preference for metal filters is attributed to their durability and performance under extreme conditions.

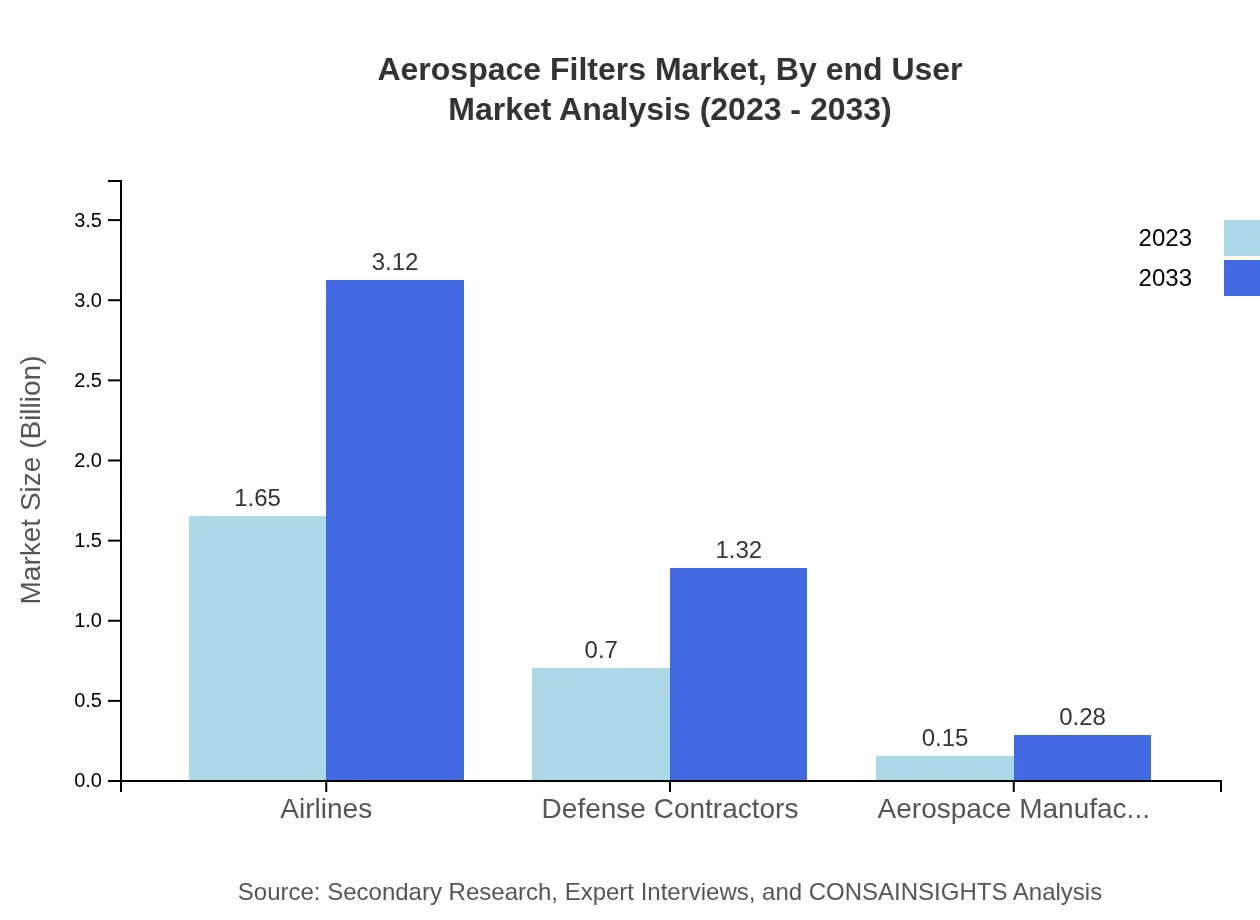

Aerospace Filters Market Analysis By End User

The end-user segmentation includes Airlines, Defense Contractors, and Aerospace Manufacturers. Airlines currently hold the largest market share and are anticipated to grow from USD 1.65 billion to USD 3.12 billion, reflecting the recovery and growth of global air travel.

Aerospace Filters Market Analysis By Technology

With technological advancement, the Aerospace Filters market is seeing the introduction of smart and advanced filtration systems. These technologies aim to improve efficiency and reduce maintenance costs, offering significant benefits. Filter technologies will enhance operational capabilities and drive market growth across all segments.

Aerospace Filters Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerospace Filters Industry

Parker Hannifin Corporation:

A global leader in motion and control technologies offering various filtration solutions for aerospace applications, emphasizing reliability and efficiency.Donaldson Company, Inc.:

Specializes in filtration systems, including aerospace filters, known for their innovative designs and products that enhance aircraft performance.Hengst SE:

A prominent manufacturer of advanced filtration solutions, providing innovative products to the aerospace and automotive industries.3M Company:

Offers filtration technology that includes aerospace filtering solutions, leveraging advanced materials and innovative designs.Ultra Clean Technologies:

Provides specialized filtration products and services for aerospace applications, focusing on improving performance and ensuring compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of aerospace Filters?

The global aerospace filters market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 6.4% till 2033, indicating substantial growth as demand for aviation projects increases.

What are the key market players or companies in the aerospace Filters industry?

Key players include major aerospace components manufacturers and suppliers, known for innovation and reliability such as Honeywell Aerospace, Parker Hannifin, Collins Aerospace, and others shaping the aerospace filters segment.

What are the primary factors driving the growth in the aerospace Filters industry?

Growth is driven by increasing air travel demand, technological advancements in filter materials, stringent safety regulations, and the rising focus on environmental sustainability in aircraft manufacturing.

Which region is the fastest Growing in the aerospace Filters?

The fastest-growing region is Europe, projected to grow from $0.84 billion in 2023 to $1.59 billion by 2033, followed closely by North America's growth from $0.83 billion to $1.57 billion.

Does ConsInsights provide customized market report data for the aerospace Filters industry?

Yes, ConsInsights offers customized market report data tailored to specific needs, aiding businesses in understanding unique market dynamics and enabling informed strategic decisions.

What deliverables can I expect from this aerospace Filters market research project?

Expect comprehensive reports featuring market size estimations, forecasts, competitive landscape analysis, regional insights, and segmentation details to strategically position your business.

What are the market trends of aerospace Filters?

Current trends include a shift towards advanced materials in filter production, increased collaboration between manufacturers and airlines, and growing integration of smart technology for enhanced filtration efficiency.