Aerospace Plastics Market Report

Published Date: 03 February 2026 | Report Code: aerospace-plastics

Aerospace Plastics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aerospace Plastics market, covering key insights, trends, and forecasts from 2023 to 2033. It delves into market size, growth rates, segmentation, and regional dynamics affecting the industry.

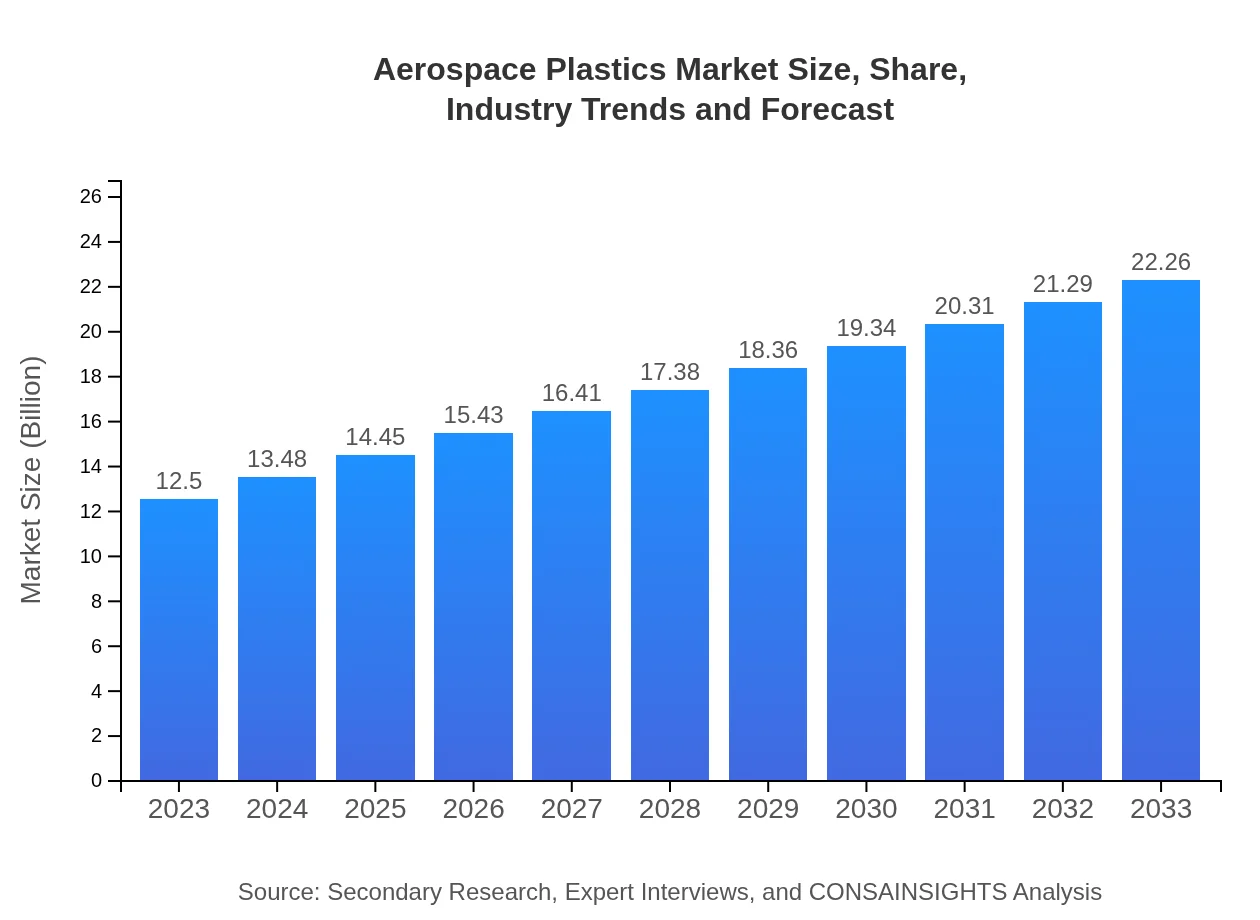

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $22.26 Billion |

| Top Companies | Boeing , Airbus, Toray Industries, Hexcel Corporation, Dow Chemical |

| Last Modified Date | 03 February 2026 |

Aerospace Plastics Market Overview

Customize Aerospace Plastics Market Report market research report

- ✔ Get in-depth analysis of Aerospace Plastics market size, growth, and forecasts.

- ✔ Understand Aerospace Plastics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerospace Plastics

What is the Market Size & CAGR of Aerospace Plastics market in 2023?

Aerospace Plastics Industry Analysis

Aerospace Plastics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerospace Plastics Market Analysis Report by Region

Europe Aerospace Plastics Market Report:

Europe's Aerospace Plastics market is expected to grow from $3.70 billion in 2023 to $6.60 billion in 2033. The region's focus on reducing carbon emissions and enhancing fuel efficiency is leading to increased investments in lightweight materials. Additionally, stringent regulations and a robust supply chain contribute to a favorable business environment for aerospace plastics.Asia Pacific Aerospace Plastics Market Report:

The Asia Pacific region is witnessing significant growth, with the market size expected to rise from $2.41 billion in 2023 to $4.30 billion by 2033. Countries like China and India are rapidly expanding their aerospace manufacturing capabilities, driven by increased demand for commercial aircraft and government initiatives. The region's focus on technological advancements and collaboration with international players further strengthens its market position.North America Aerospace Plastics Market Report:

North America remains the largest market, projected to increase from $4.41 billion in 2023 to $7.85 billion in 2033. The presence of leading aircraft manufacturers and suppliers in the U.S. and Canada, coupled with a strong emphasis on innovation and sustainability, drives solid growth in the aerospace plastics sector. Industry investments in R&D are accelerating the introduction of advanced materials.South America Aerospace Plastics Market Report:

In South America, the Aerospace Plastics market is set to grow from $0.97 billion in 2023 to $1.73 billion by 2033. While the region is smaller compared to others, Brazil's aerospace industry is emerging, driven by an increase in regional air traffic and investment in manufacturing infrastructure, signaling more opportunities for aerospace plastic applications.Middle East & Africa Aerospace Plastics Market Report:

The Middle East and Africa market size is anticipated to rise from $1 billion in 2023 to $1.79 billion in 2033. The growth is driven by the increasing demand for air travel and infrastructure development in the region. Countries such as the UAE are emerging as key players in the aviation sector, leading to more investment in advanced aerospace plastics for their fleet expansions.Tell us your focus area and get a customized research report.

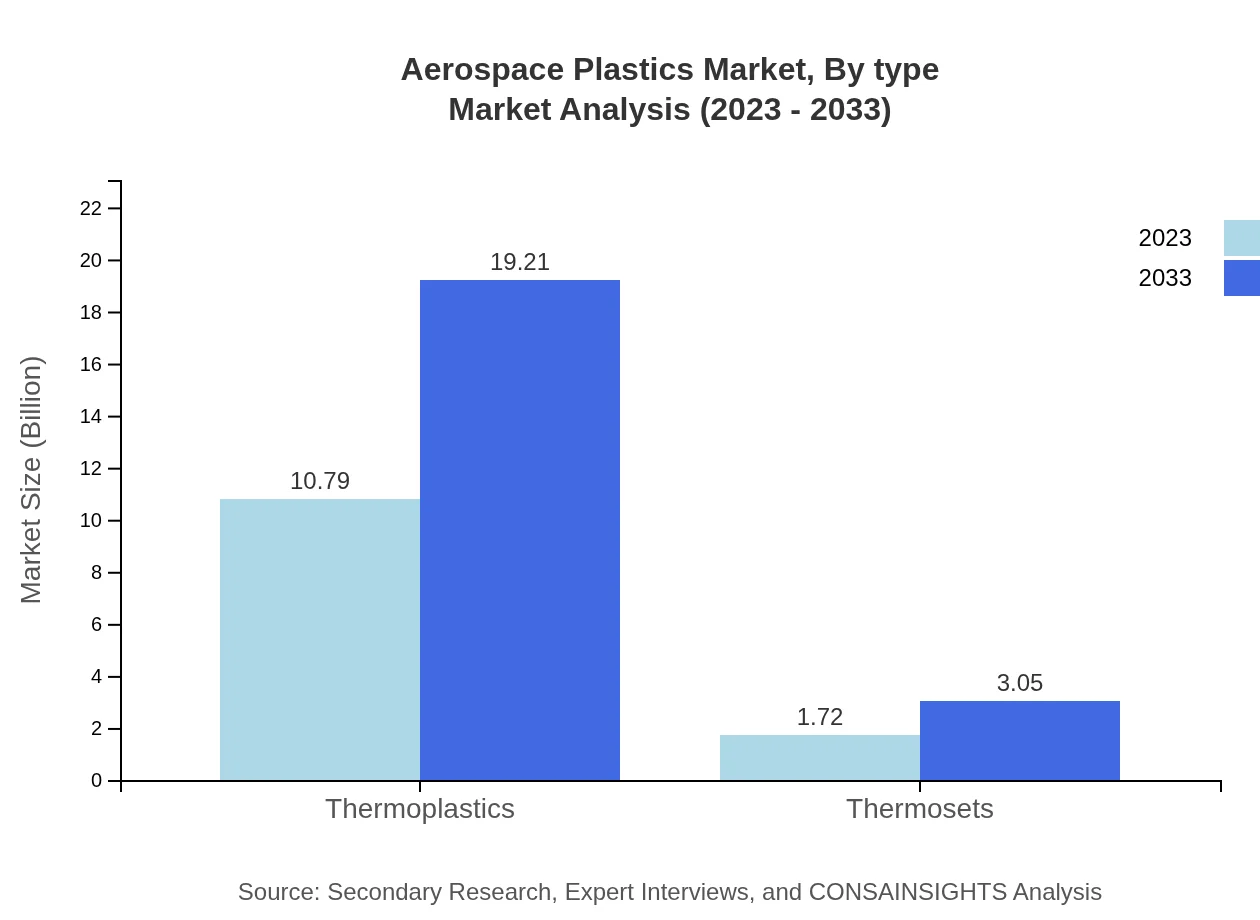

Aerospace Plastics Market Analysis By Type

In the Aerospace Plastics market, thermoplastics are projected to dominate, growing from $10.79 billion in 2023 to $19.21 billion by 2033. Thermoplastics account for 86.28% market share in 2023 and maintain this share throughout the forecast period. Thermosets, while smaller, also show growth from $1.72 billion to $3.05 billion, sustaining 13.72% share. The versatility of thermoplastics in various applications drives their adoption.

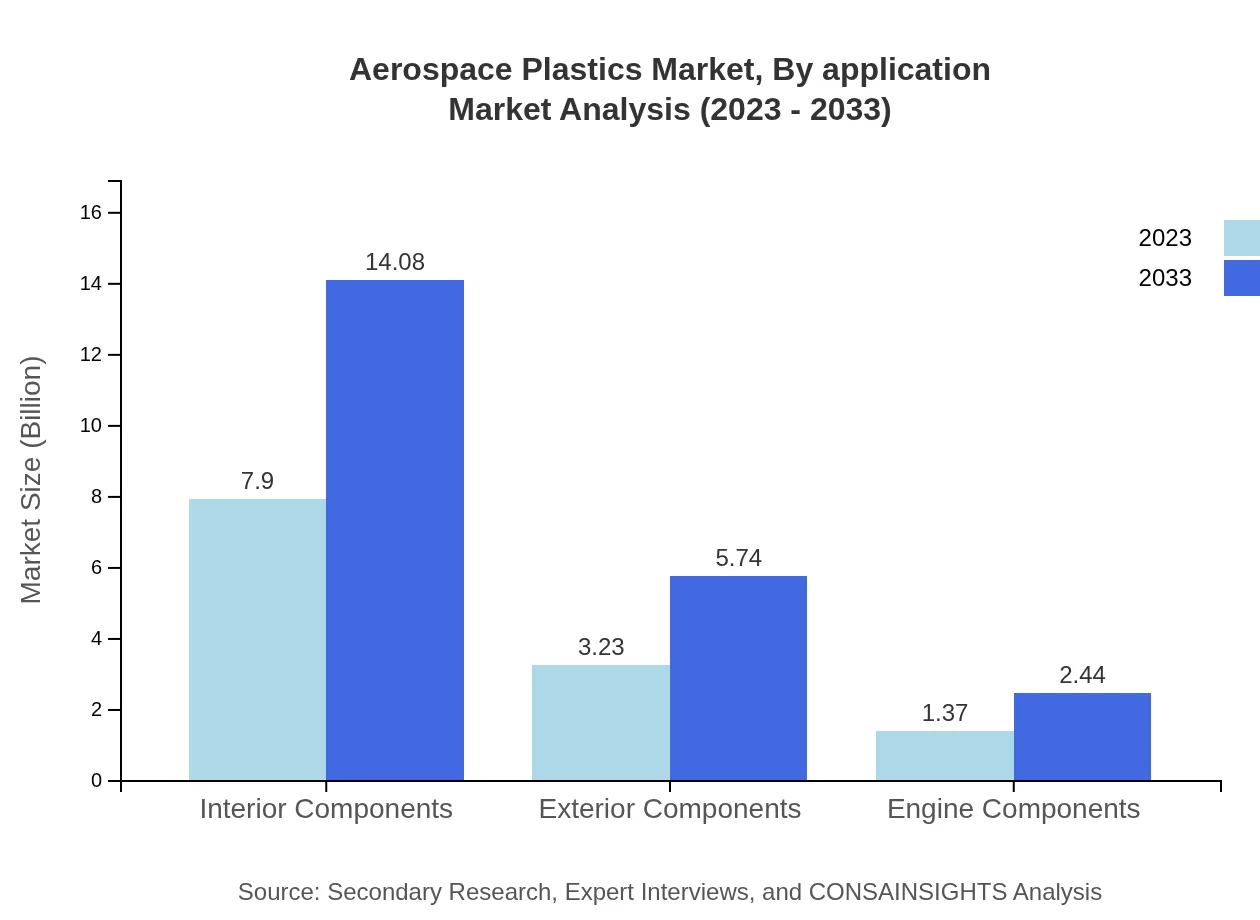

Aerospace Plastics Market Analysis By Application

Interior components are significant in the market, with a size increasing from $7.90 billion in 2023 to $14.08 billion by 2033. This segment holds a majority share of 63.23%. Exterior components, while smaller at $3.23 billion in 2023, are anticipated to reach $5.74 billion by 2033, making up 25.8% of the market. Engine components also contribute, expanding from $1.37 billion to $2.44 billion (10.97% share) driven by the demand for higher performance materials.

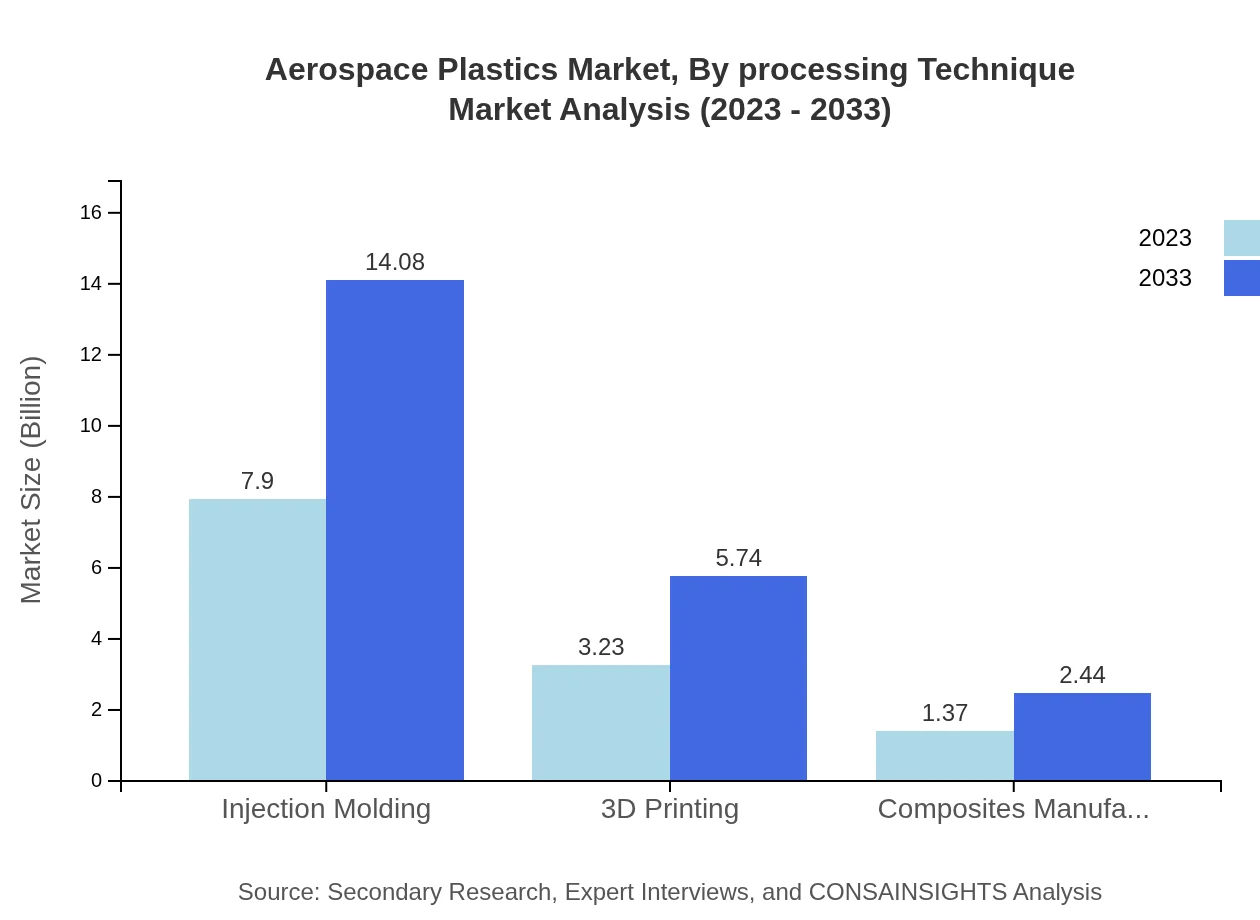

Aerospace Plastics Market Analysis By Processing Technique

Injection molding remains the primary processing technique, expected to grow from $7.90 billion in 2023 to $14.08 billion by 2033, maintaining a 63.23% share. 3D printing and composites manufacturing also show growth potential, with 3D printing rising from $3.23 billion to $5.74 billion (25.8% share) and composites manufacturing from $1.37 billion to $2.44 billion (10.97% share), reflecting the trend towards innovative production methods.

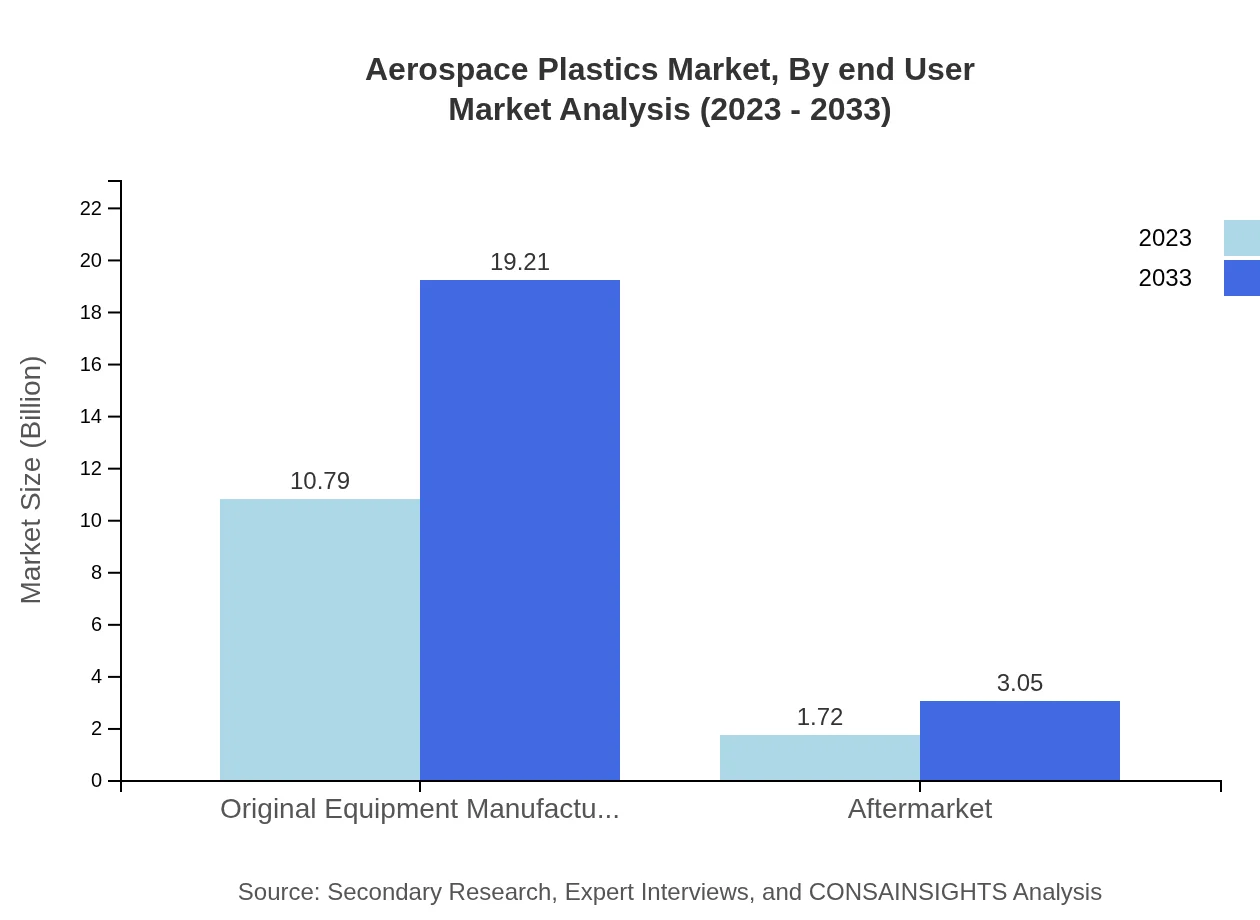

Aerospace Plastics Market Analysis By End User

The OEM segment dominates, forecasted to grow from $10.79 billion to $19.21 billion (86.28% share). The aftermarket segment, while smaller, is expanding from $1.72 billion to $3.05 billion (13.72% share), reflecting the growing importance of maintenance and aftermarket services in the aerospace industry.

Aerospace Plastics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerospace Plastics Industry

Boeing :

Boeing is a major player in the aerospace industry, known for its advanced aircraft solutions and significant use of aerospace plastics to enhance aircraft performance.Airbus:

Airbus is a leading aircraft manufacturer, heavily investing in lightweight materials and aerospace plastics to reduce emissions and improve fuel efficiency.Toray Industries:

Toray Industries specializes in carbon fiber and advanced plastics, supplying materials critical for aerospace applications and demonstrating leadership in innovation.Hexcel Corporation:

Hexcel is a prominent expert in composite materials, including aerospace plastics, focusing on high-performance solutions for the aerospace sector.Dow Chemical:

Dow provides a range of advanced materials, including aerospace plastics, playing a crucial role in enhancing the performance and sustainability of aircraft.We're grateful to work with incredible clients.

FAQs

What is the market size of aerospace Plastics?

The aerospace plastics market is estimated to reach $12.5 billion by 2033, growing at a CAGR of 5.8%. In 2023, the market stands at a significant size, indicating robust demand in the aerospace industry.

What are the key market players or companies in the aerospace Plastics industry?

Key players in the aerospace plastics market include significant aerospace manufacturers and material suppliers. Companies focus on innovation and sustainable practices to maintain and grow their market share in this competitive landscape.

What are the primary factors driving the growth in the aerospace Plastics industry?

Growth in the aerospace-plastics industry is driven by technological advancements, increased demand for lightweight materials, and the rise in air travel. Sustainability efforts and regulatory standards also impact material selection and growth.

Which region is the fastest Growing in the aerospace Plastics?

The aerospace plastics market is witnessing rapid growth in North America, projected to expand from $4.41 billion in 2023 to $7.85 billion by 2033. Europe and Asia Pacific also show promising growth trends.

Does ConsaInsights provide customized market report data for the aerospace Plastics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the aerospace plastics industry, enabling clients to make informed business decisions based on detailed insights.

What deliverables can I expect from this aerospace Plastics market research project?

Deliverables from the aerospace plastics market research project include comprehensive reports, trend analyses, segment data, and regional insights, facilitating a rounded view for strategic planning.

What are the market trends of aerospace Plastics?

Current trends in the aerospace plastics market include innovation in thermoplastics and thermosets, increased use of composite materials, and advancements in manufacturing methods like 3D printing and injection molding.