Aerospace Service Robotics Market Report

Published Date: 03 February 2026 | Report Code: aerospace-service-robotics

Aerospace Service Robotics Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Aerospace Service Robotics market, covering comprehensive insights, market trends, regional analysis, and forecast data from 2023 to 2033, aimed at investors and stakeholders in the aerospace sector.

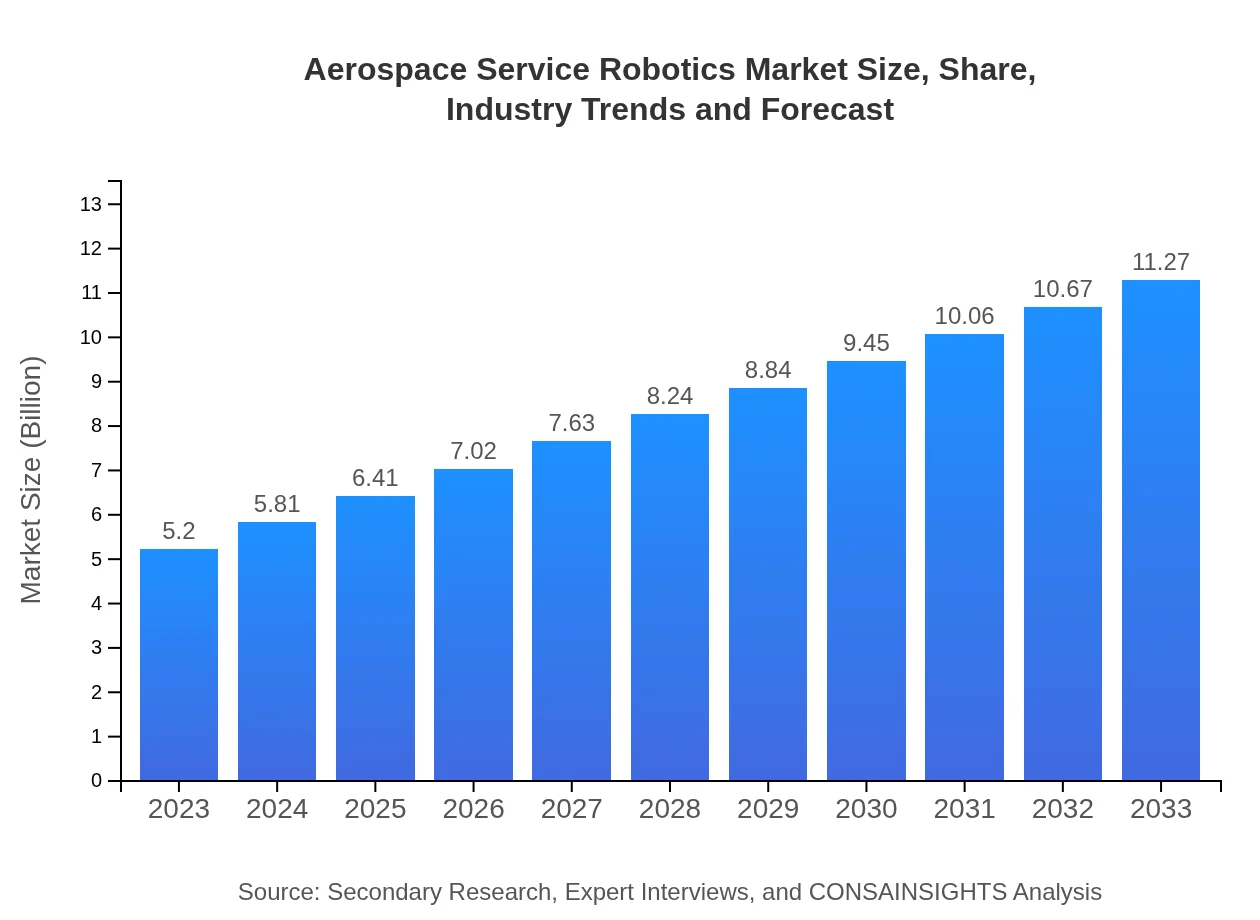

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.27 Billion |

| Top Companies | Lockheed Martin, Northrop Grumman, Boeing , General Dynamics, Airbus |

| Last Modified Date | 03 February 2026 |

Aerospace Service Robotics Market Overview

Customize Aerospace Service Robotics Market Report market research report

- ✔ Get in-depth analysis of Aerospace Service Robotics market size, growth, and forecasts.

- ✔ Understand Aerospace Service Robotics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerospace Service Robotics

What is the Market Size & CAGR of Aerospace Service Robotics market in 2023?

Aerospace Service Robotics Industry Analysis

Aerospace Service Robotics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerospace Service Robotics Market Analysis Report by Region

Europe Aerospace Service Robotics Market Report:

By 2023, Europe’s market is estimated at $1.40 billion, growing to $3.04 billion by 2033. The region’s commitment to innovation and sustainable technology initiatives, along with strong aerospace regulations, significantly boosts the adoption of robotics solutions, facilitating improved operational efficiencies in air transport.Asia Pacific Aerospace Service Robotics Market Report:

In 2023, the Asia Pacific Aerospace Service Robotics market is valued at $1.03 billion and is projected to grow to $2.23 billion by 2033. Countries like China and Japan are leading the charge with increased defense expenditure and technological advancements in robotics, stimulating the adoption of automation solutions across multiple aerospace applications.North America Aerospace Service Robotics Market Report:

North America holds the largest market share, valued at $1.93 billion in 2023, anticipated to reach $4.19 billion by 2033. The presence of major aerospace manufacturers and a robust defense sector continue to propel advancements in aerospace service robotics, particularly in military and commercial applications.South America Aerospace Service Robotics Market Report:

The South American market, valued at $0.47 billion in 2023, is expected to rise to $1.02 billion in 2033. The growth is primarily driven by increasing investments in aerospace infrastructure and the adoption of robotics technology aimed at modernization efforts in the region.Middle East & Africa Aerospace Service Robotics Market Report:

The Middle East and Africa market stands at $0.37 billion in 2023 and is projected to grow to $0.80 billion in 2033. The emphasis on upgrading aerospace infrastructure and increasing governmental support for defense applications foster a conducive environment for adopting service robotics in this region.Tell us your focus area and get a customized research report.

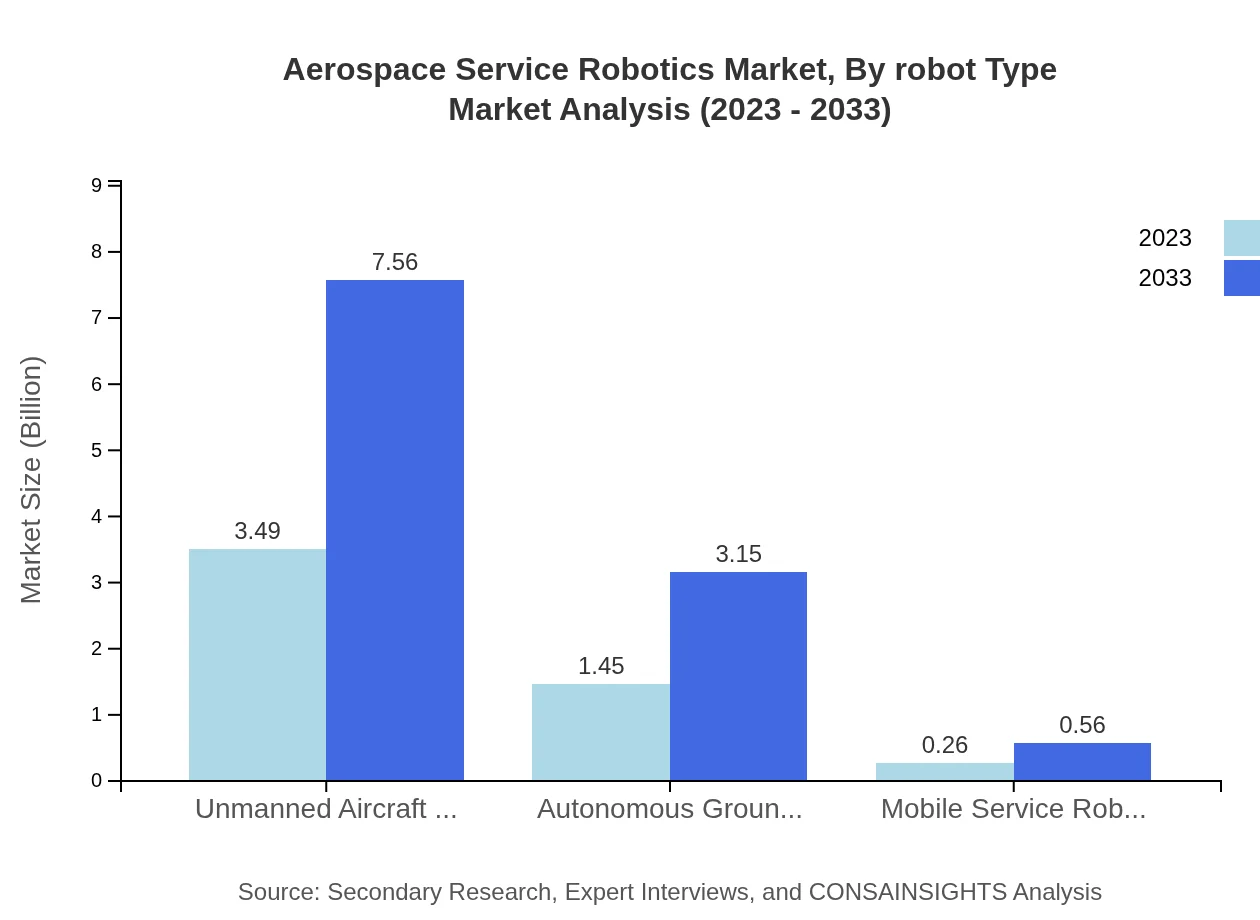

Aerospace Service Robotics Market Analysis By Robot Type

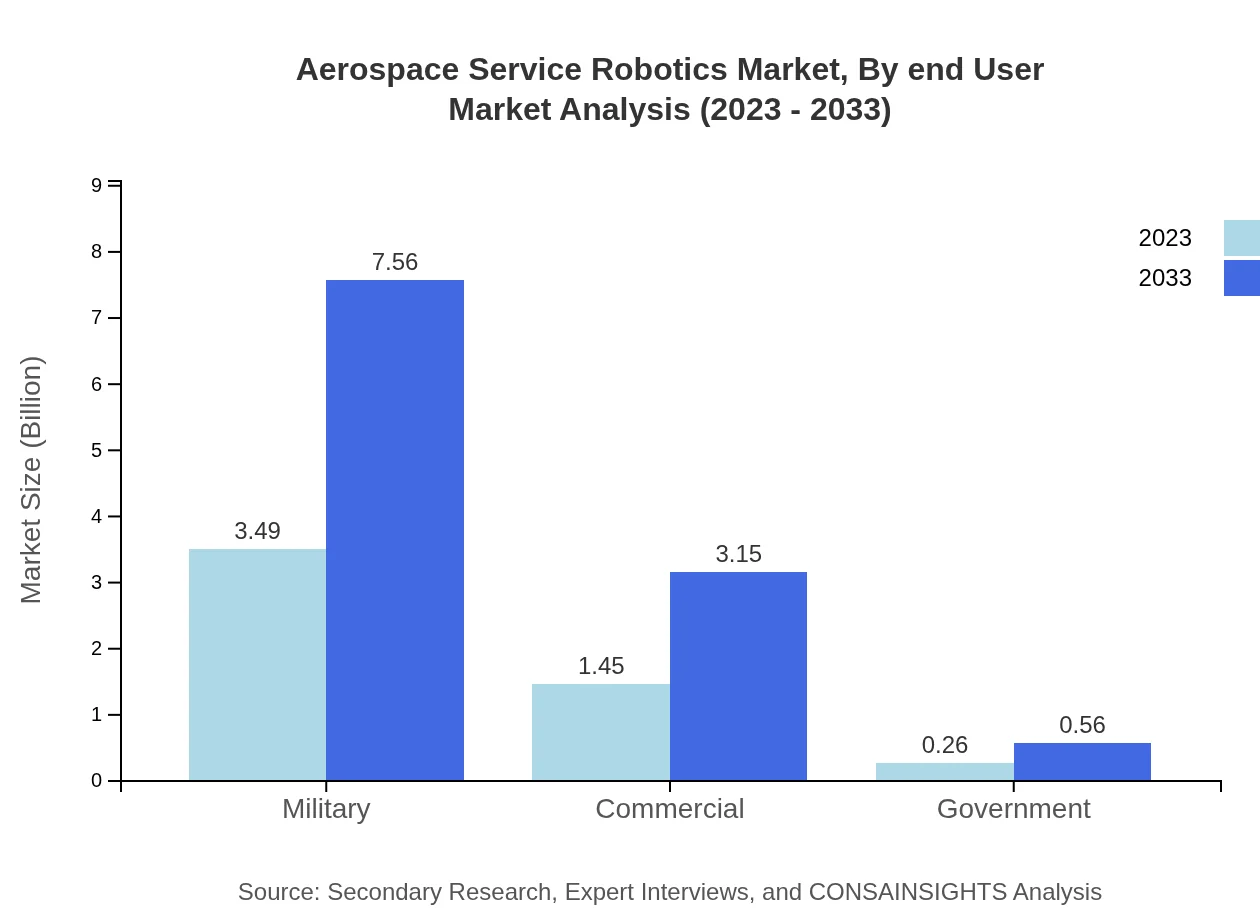

The analysis indicates that the Military segment commands the largest market share, accounting for $3.49 billion in 2023 and expected to reach $7.56 billion by 2033, maintaining a share of 67.04%. The Commercial sector follows with a valuation of $1.45 billion in 2023, set to grow to $3.15 billion, holding a consistent share of 27.97%. Government applications, while smaller, also show growth potential with a market size expected to reach $0.56 billion by 2033.

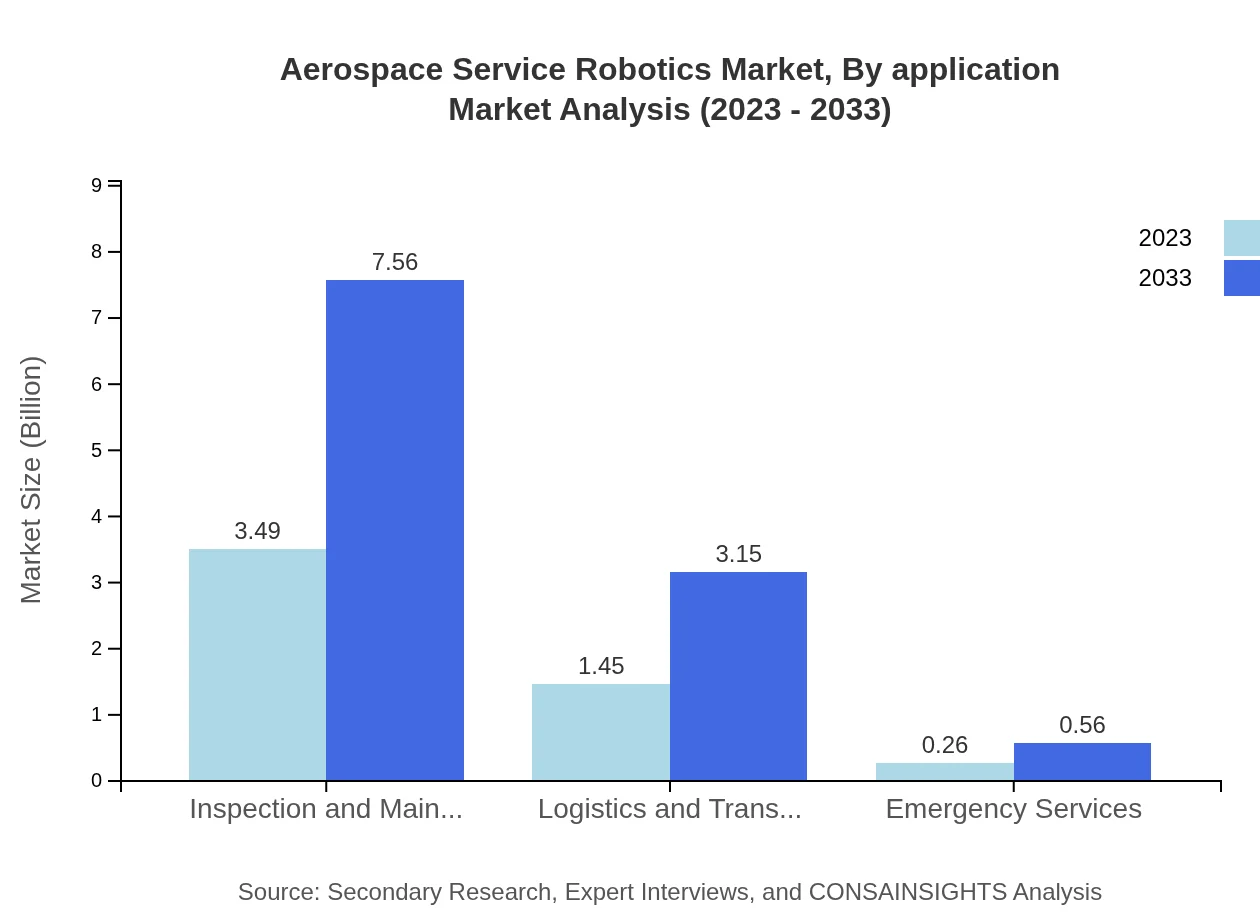

Aerospace Service Robotics Market Analysis By Application

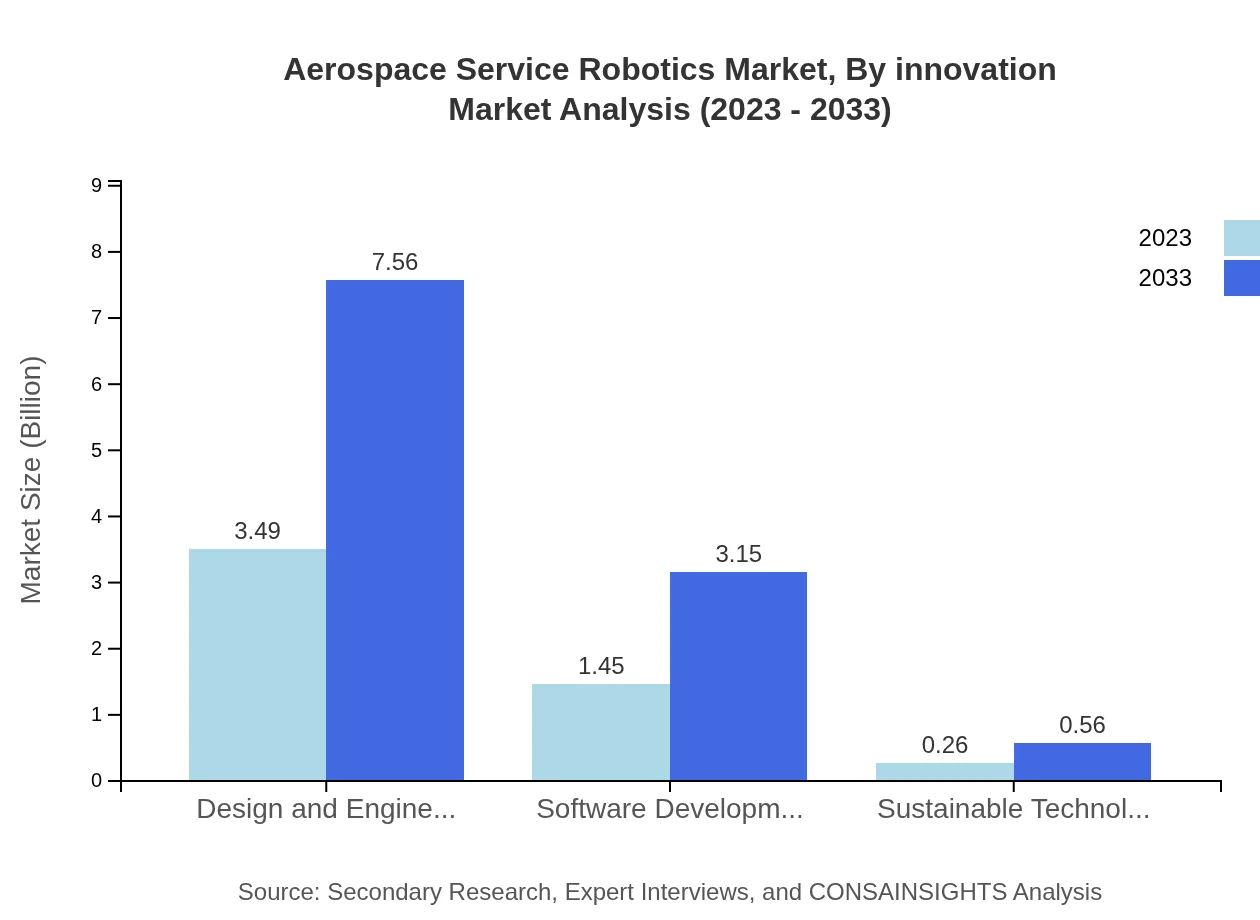

The segmentation by application reflects significant demand across Design and Engineering, Software Development, Inspection and Maintenance, and Logistics and Transportation applications. Design and Engineering lead with a size of $3.49 billion in 2023 and expected growth to $7.56 billion by 2033. Software Development and Logistics and Transportation show equal growth patterns, reflecting the industry’s adaptability to incorporate robotic software solutions.

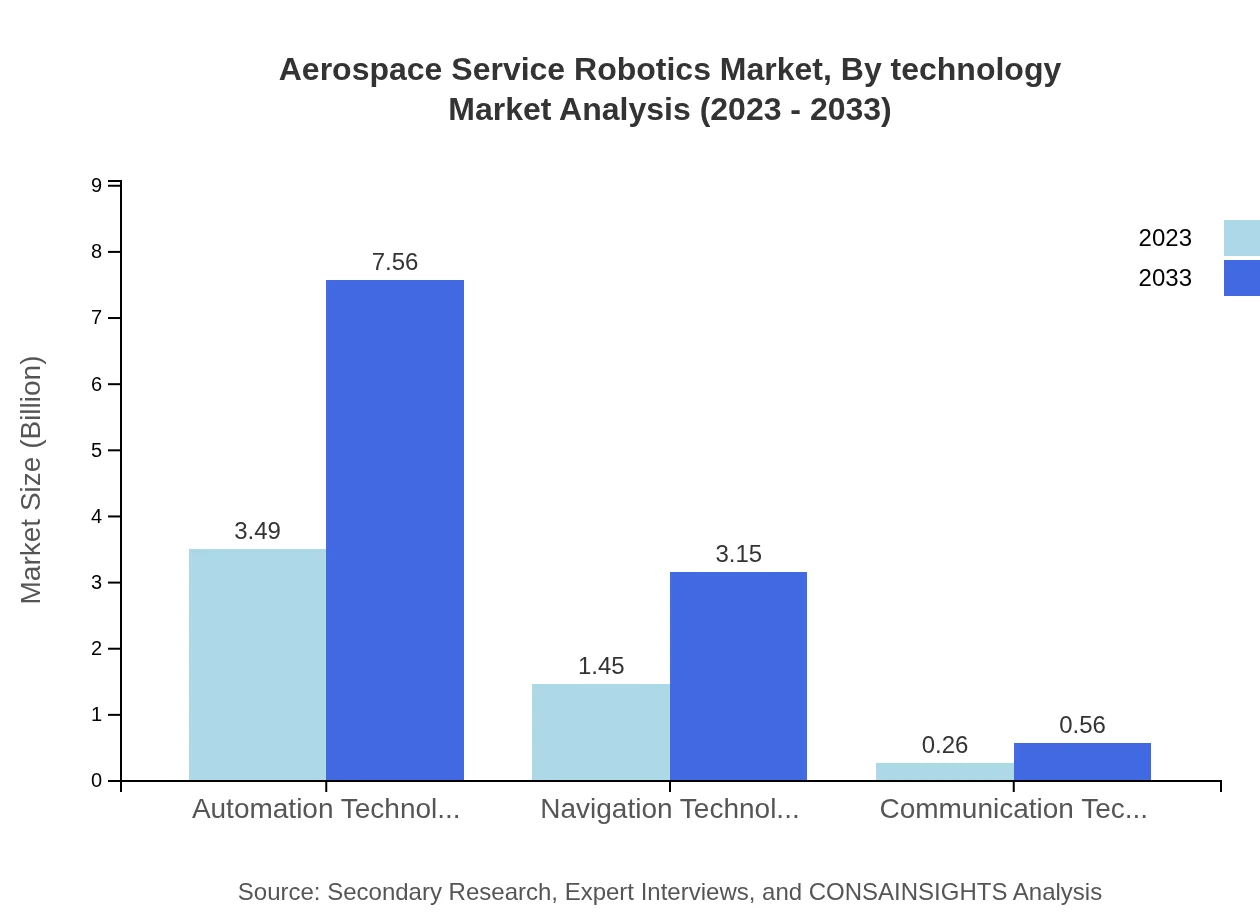

Aerospace Service Robotics Market Analysis By Technology

Breaking down by technology, Automation Technology takes precedence with a size of $3.49 billion in 2023, growing to $7.56 billion by 2033. Navigation Technology and Communication Technology also see robust growth, indicating a comprehensive integration of advanced technologies across applications, enhancing overall operational efficiency.

Aerospace Service Robotics Market Analysis By End User

End-users of aerospace service robotics include military, commercial, and government entities. The military segment dominates the usage share, reflecting significant investments in robotic systems for operational efficiency. Commercial applications are increasingly adopting robotics solutions to streamline operations and logistics, reinforcing the need for innovation in this space.

Aerospace Service Robotics Market Analysis By Innovation

To complement the advancements, significant efforts are being placed in innovation within the robotics ecosystem, particularly focusing on AI integration, autonomous systems, and advanced material applications. These innovations play a crucial role in determining operational capabilities and enhancing the performance metrics of aerospace service robotics, setting the stage for future developments.

Aerospace Service Robotics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerospace Service Robotics Industry

Lockheed Martin:

A leading aerospace and defense company, Lockheed Martin specializes in developing advanced aerospace technologies including robotics for military applications, focusing on enhancing operational efficiencies.Northrop Grumman:

Northrop Grumman is known for its innovative robotics solutions in various defense sectors, enhancing capabilities in military operations and aircraft maintenance through advanced service robotics.Boeing :

Boeing integrates advanced robotics into its manufacturing processes and services, driving efficiency and safety improvements in the aerospace sector.General Dynamics:

General Dynamics develops various robotic solutions aimed at enhancing military and government operations, focusing on automation technologies that increase operational effectiveness.Airbus:

Airbus is employing robotics in its assembly processes and is at the forefront of innovation in aerospace service robots for commercial applications, facilitating streamlined operations.We're grateful to work with incredible clients.

FAQs

What is the market size of aerospace Service Robotics?

The aerospace service robotics market is projected to reach a size of $5.2 billion by 2033, growing at a compound annual growth rate (CAGR) of 7.8% from its current valuation.

What are the key market players or companies in this aerospace Service Robotics industry?

Key players in the aerospace service robotics industry include major aerospace manufacturers, specialized robotics firms, and technology companies dedicated to developing robotic solutions for inspections, maintenance, and other applications in aerospace.

What are the primary factors driving the growth in the aerospace service robotics industry?

The growth is driven by technological advancements, increasing demand for automation in aerospace operations, and the need for enhanced efficiency and safety in maintenance activities within the industry.

Which region is the fastest Growing in the aerospace service robotics market?

The North American region is currently the fastest-growing market, expanding from $1.93 billion in 2023 to $4.19 billion by 2033, driven by technological innovation and demand for advanced robotics solutions.

Does ConsaInsights provide customized market report data for the aerospace Service Robotics industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, helping organizations make informed decisions based on detailed analyses of trends and forecasts in the aerospace service robotics sector.

What deliverables can I expect from this aerospace Service Robotics market research project?

Expected deliverables include comprehensive market analysis reports, data on regional trends, competitive benchmarking, and insights on customer preferences, ensuring clients receive actionable intelligence.

What are the market trends of aerospace Service Robotics?

Current trends include the integration of AI in robotics, an increased focus on sustainability, and the rising adoption of unmanned aircraft systems and autonomous ground vehicles in aerospace applications.