Aerospace Valves Market Report

Published Date: 22 January 2026 | Report Code: aerospace-valves

Aerospace Valves Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aerospace Valves market, covering market trends, size, segmentation, and regional insights for the forecast period from 2023 to 2033.

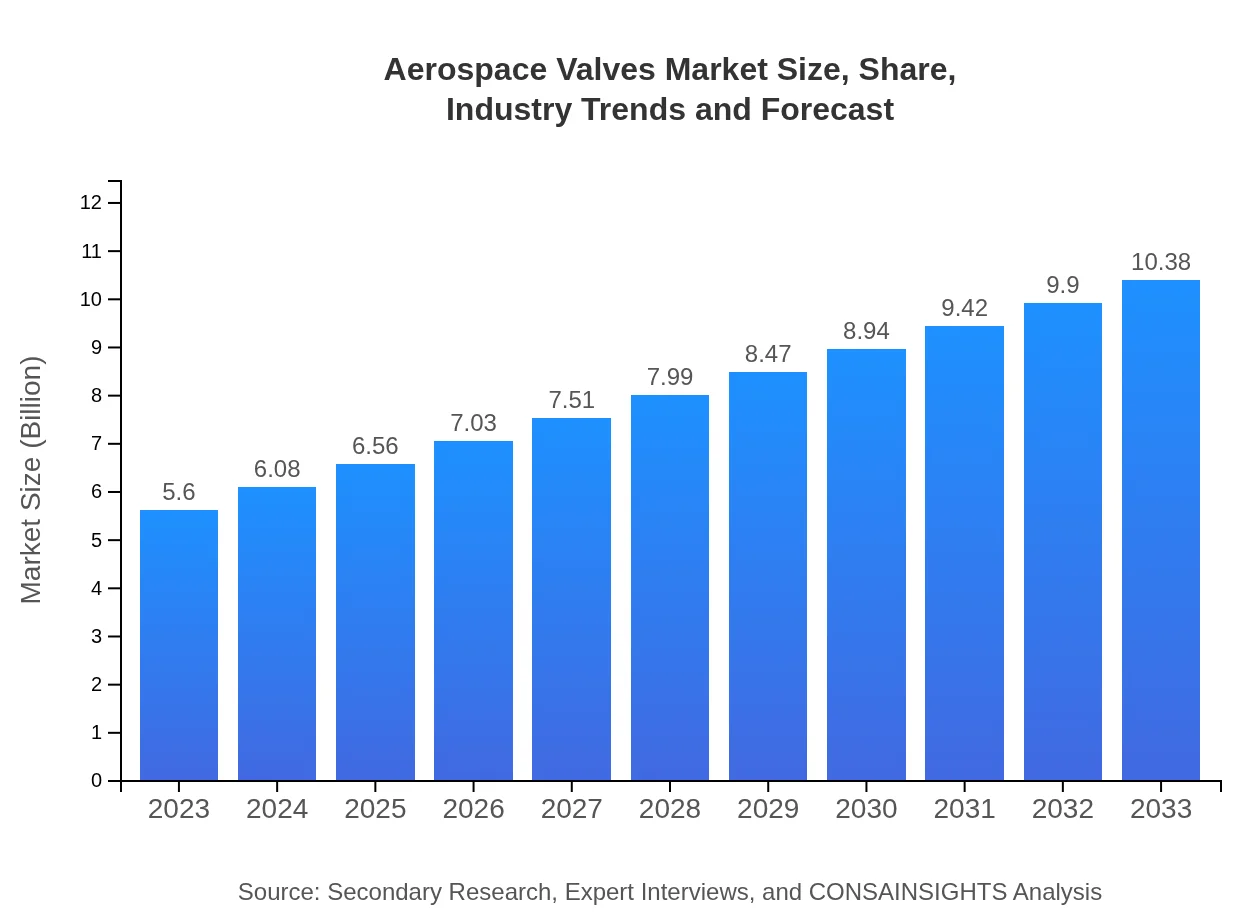

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.38 Billion |

| Top Companies | Honeywell International Inc., Parker Hannifin Corporation, Moog Inc., Boeing Company, Emerson Electric Co. |

| Last Modified Date | 22 January 2026 |

Aerospace Valves Market Overview

Customize Aerospace Valves Market Report market research report

- ✔ Get in-depth analysis of Aerospace Valves market size, growth, and forecasts.

- ✔ Understand Aerospace Valves's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerospace Valves

What is the Market Size & CAGR of Aerospace Valves market in 2023?

Aerospace Valves Industry Analysis

Aerospace Valves Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerospace Valves Market Analysis Report by Region

Europe Aerospace Valves Market Report:

In Europe, the market is forecasted to grow from $2.08 billion in 2023 to $3.85 billion in 2033. Major aerospace hubs such as France, Germany, and the UK are driving this growth through innovative aerospace technologies and increased production of commercial and military aircraft.Asia Pacific Aerospace Valves Market Report:

In the Asia Pacific region, the Aerospace Valves market is projected to grow from $0.91 billion in 2023 to $1.69 billion in 2033. This growth is attributed to an increase in air travel demand, investment in new aircraft, and advancements in aerospace technology within countries like China and India.North America Aerospace Valves Market Report:

North America represents a substantial portion of the Aerospace Valves market, estimated at $1.80 billion in 2023 and projected to reach $3.33 billion by 2033. The U.S. is the leading player, with strong demand fueled by major aerospace manufacturers and a robust defense sector.South America Aerospace Valves Market Report:

The South American market for Aerospace Valves is expected to rise from $0.35 billion in 2023 to $0.64 billion by 2033. Growth prospects are driven by an uptick in regional air travel and investments in military aviation, particularly in Brazil and Argentina.Middle East & Africa Aerospace Valves Market Report:

The Middle East and Africa are expected to see the Aerospace Valves market size increase from $0.47 billion in 2023 to $0.87 billion by 2033, primarily driven by growing investments in defense and air transportation infrastructure.Tell us your focus area and get a customized research report.

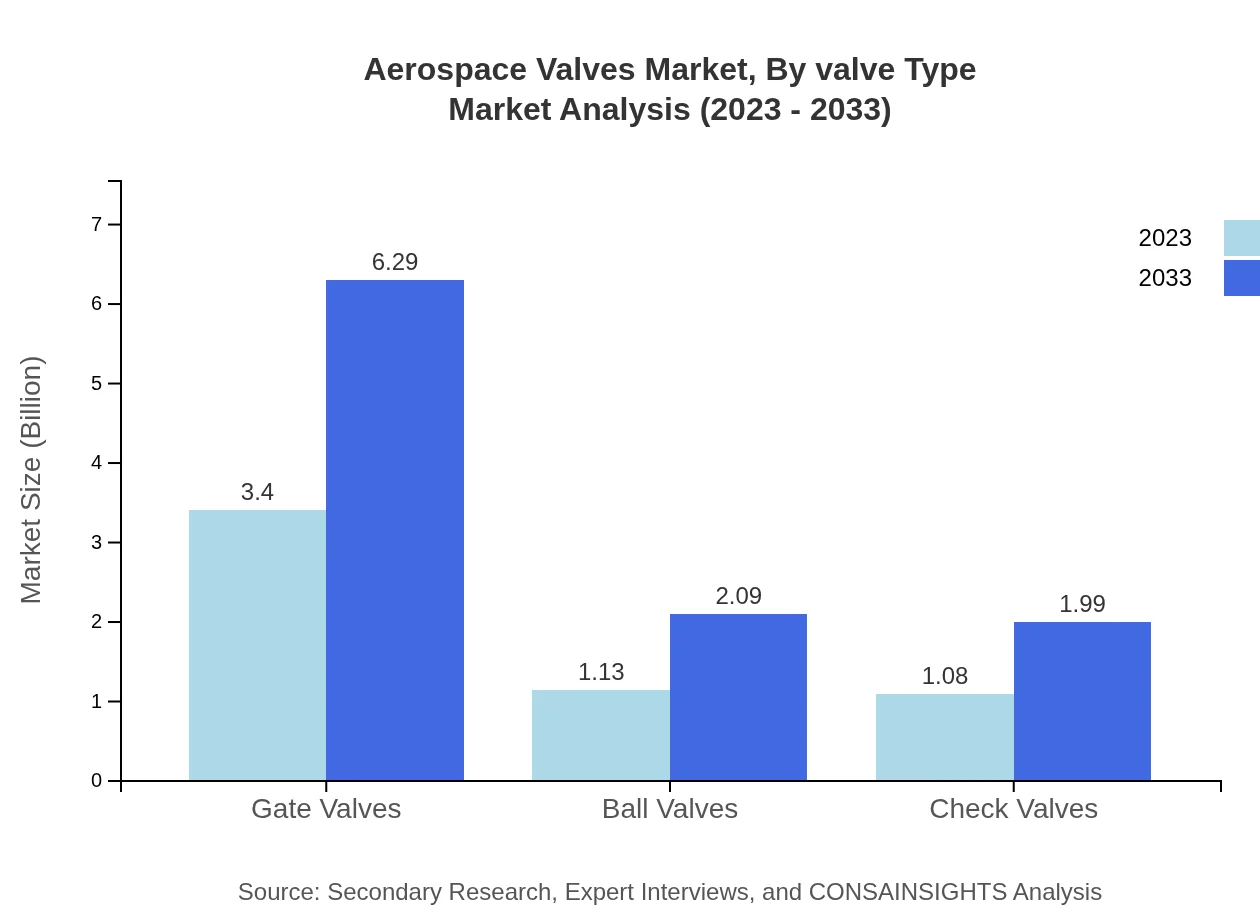

Aerospace Valves Market Analysis By Valve Type

The Aerospace Valves market is segmented by valve type, including electromechanical valves (60.63% share in 2023), pneumatic valves (20.15% share), hydraulic valves (19.22% share), and others. By 2033, the sizes are projected to be $6.29 billion for electromechanical valves and $2.09 billion for pneumatic valves, reflecting continued demand for automated control systems and reliability.

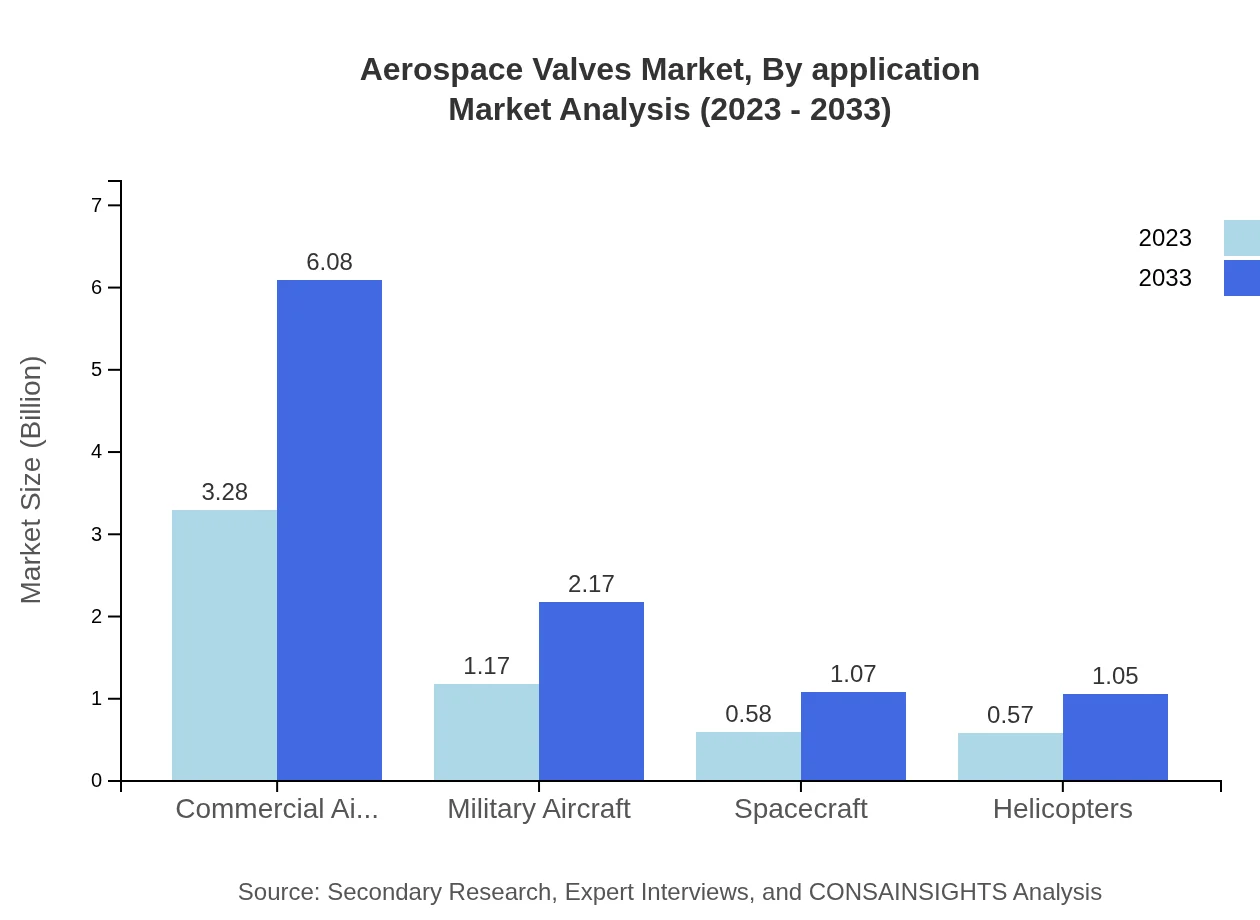

Aerospace Valves Market Analysis By Application

The Aerospace Valves market is segmented by application, primarily involving commercial aircraft (58.6% share), military aircraft (20.95% share), spacecraft (10.3% share), and helicopters (10.15% share). With commercial aircraft expected to reach $6.08 billion by 2033, this segment will remain the largest driver of market activity.

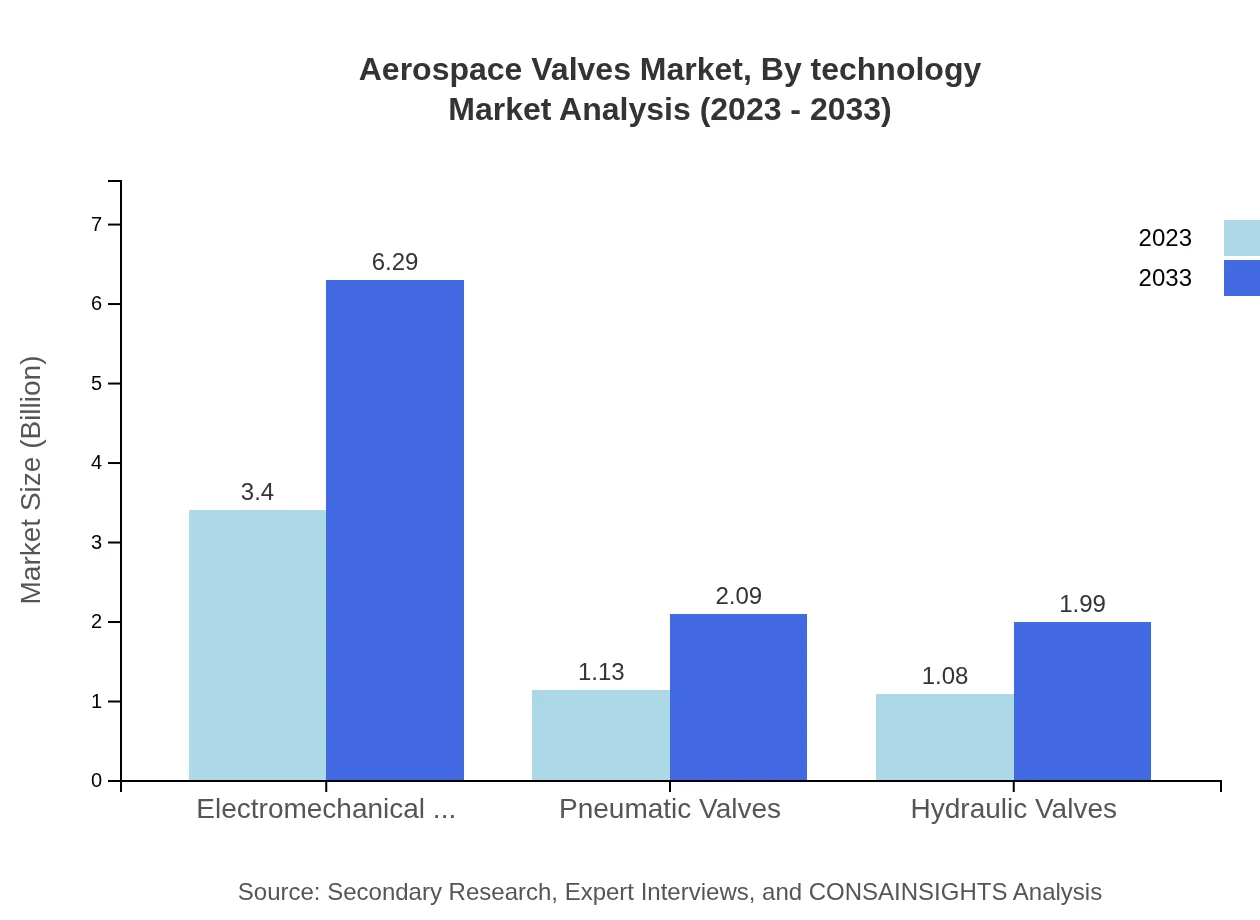

Aerospace Valves Market Analysis By Technology

The market segments by technology include manual and electromechanical controls. Electromechanical systems are forecasted to dominate the market due to their efficiency and precision, reflecting a trend towards automation in aerospace systems.

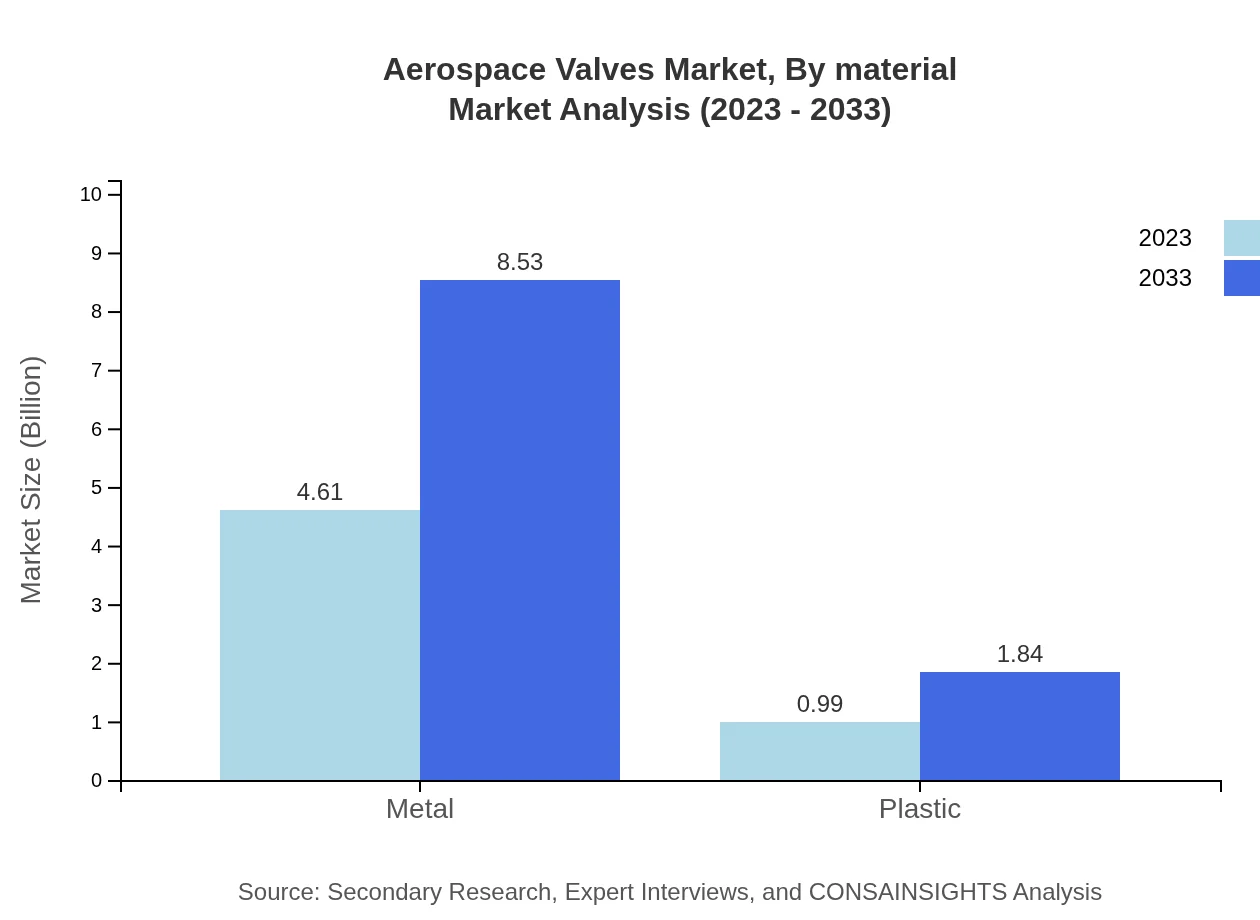

Aerospace Valves Market Analysis By Material

Materials used in the aerospace valves market include metal (82.24% share) and plastic (17.76% share), with metal expected to grow significantly by 2033 due to its durability and suitability for high-pressure applications.

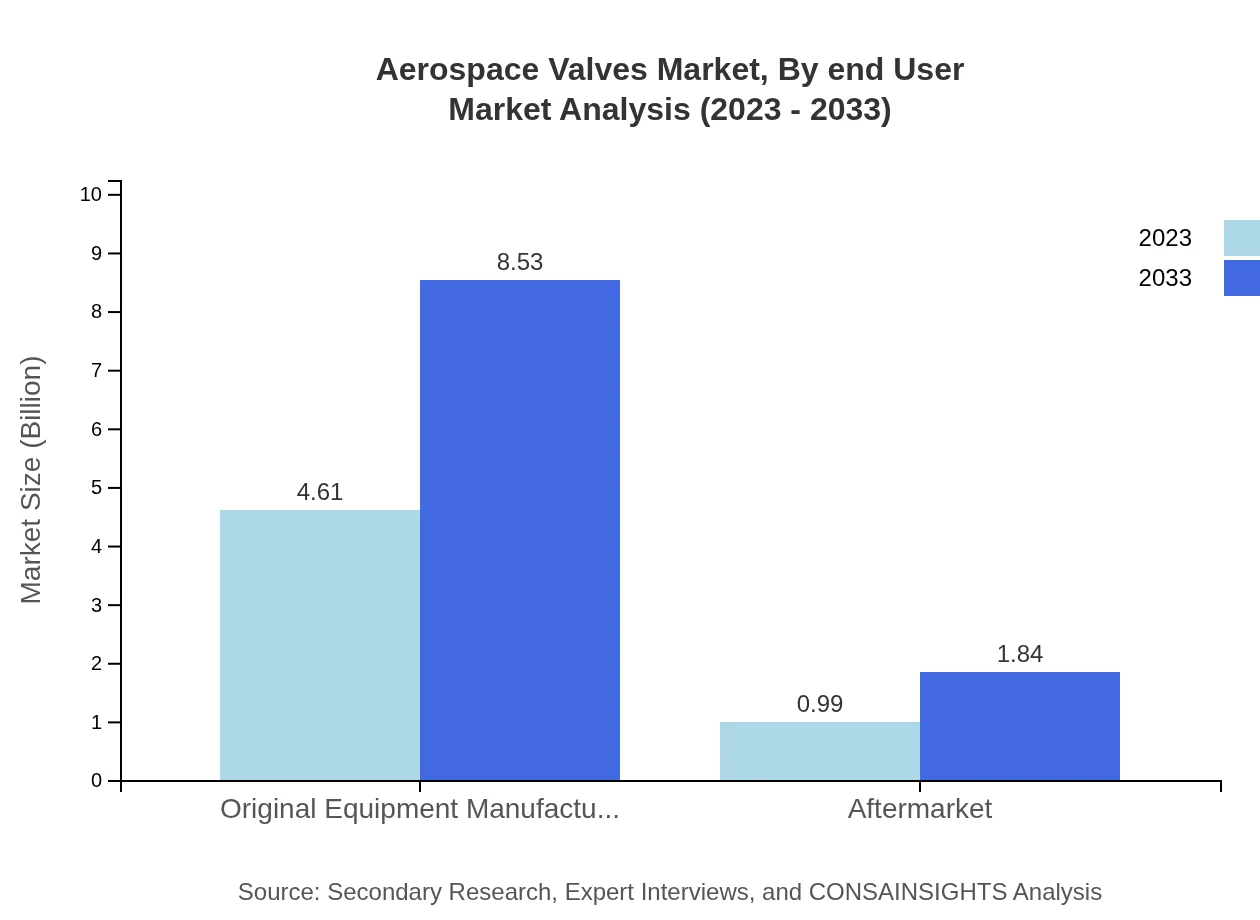

Aerospace Valves Market Analysis By End User

The principal end-users in the aerospace valves market consist of Original Equipment Manufacturers (OEMs), which account for 82.24% of the segment in 2023, and the aftermarket segment. The OEMs are projected to see growth from $4.61 billion to $8.53 billion by 2033 as new aircraft models continue to be developed.

Aerospace Valves Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerospace Valves Industry

Honeywell International Inc.:

A multinational conglomerate specializing in aerospace and defense, Honeywell offers advanced aerospace valves that cater to both commercial and military applications.Parker Hannifin Corporation:

Well-known for its motion and control technologies, Parker Hannifin provides a range of aerospace valves, focusing on innovative engineering solutions to enhance efficiency.Moog Inc.:

Moog is a leader in precision control components and systems for aerospace applications, emphasizing high-performance valve designs tailored for demanding environments.Boeing Company:

As a leading aerospace manufacturer, Boeing's integrated systems include a variety of valves designed for commercial aircraft, military applications, and satellite technologies.Emerson Electric Co.:

Emerson is involved in various sectors and provides a wide array of aerospace valves, focusing on introducing smart valve solutions for enhanced system control.We're grateful to work with incredible clients.

FAQs

What is the market size of Aerospace Valves?

The global Aerospace Valves market is projected to reach a size of $5.6 billion by 2033, growing from $5.6 billion in 2023, at a compound annual growth rate (CAGR) of 6.2%.

What are the key market players or companies in the Aerospace Valves industry?

Key players in the Aerospace Valves industry include major manufacturers specializing in aerospace components. Some are involved in creating innovative valve technologies aimed at enhancing efficiency and reliability in aerospace applications.

What are the primary factors driving the growth in the Aerospace Valves industry?

Growth in the Aerospace Valves industry is driven by increasing demand for commercial and military aircraft, advancements in valve technologies, and growing investment in aerospace infrastructure globally, alongside enhancing safety regulations.

Which region is the fastest Growing in the Aerospace Valves market?

The fastest-growing region in the Aerospace Valves market is Europe, where the market is expected to grow from $2.08 billion in 2023 to $3.85 billion by 2033, reflecting strong aerospace production capabilities.

Does ConsaInsights provide customized market report data for the Aerospace Valves industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Aerospace Valves industry, allowing businesses to obtain insights that directly relate to their operational and strategic requirements.

What deliverables can I expect from this Aerospace Valves market research project?

Expect detailed market analysis reports, including market size forecasts, competitive landscape assessments, key market trends, and future outlooks for different segments within the Aerospace Valves industry.

What are the market trends of Aerospace Valves?

Current trends in the Aerospace Valves market include increasing usage of lightweight materials, the rise of electromechanical valves, and a push towards automation and smart technologies in valve operations.