Aerostructures Market Report

Published Date: 03 February 2026 | Report Code: aerostructures

Aerostructures Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aerostructures market, covering insights on market size, segment performance, regional analysis, and industry trends for the forecast period 2023-2033.

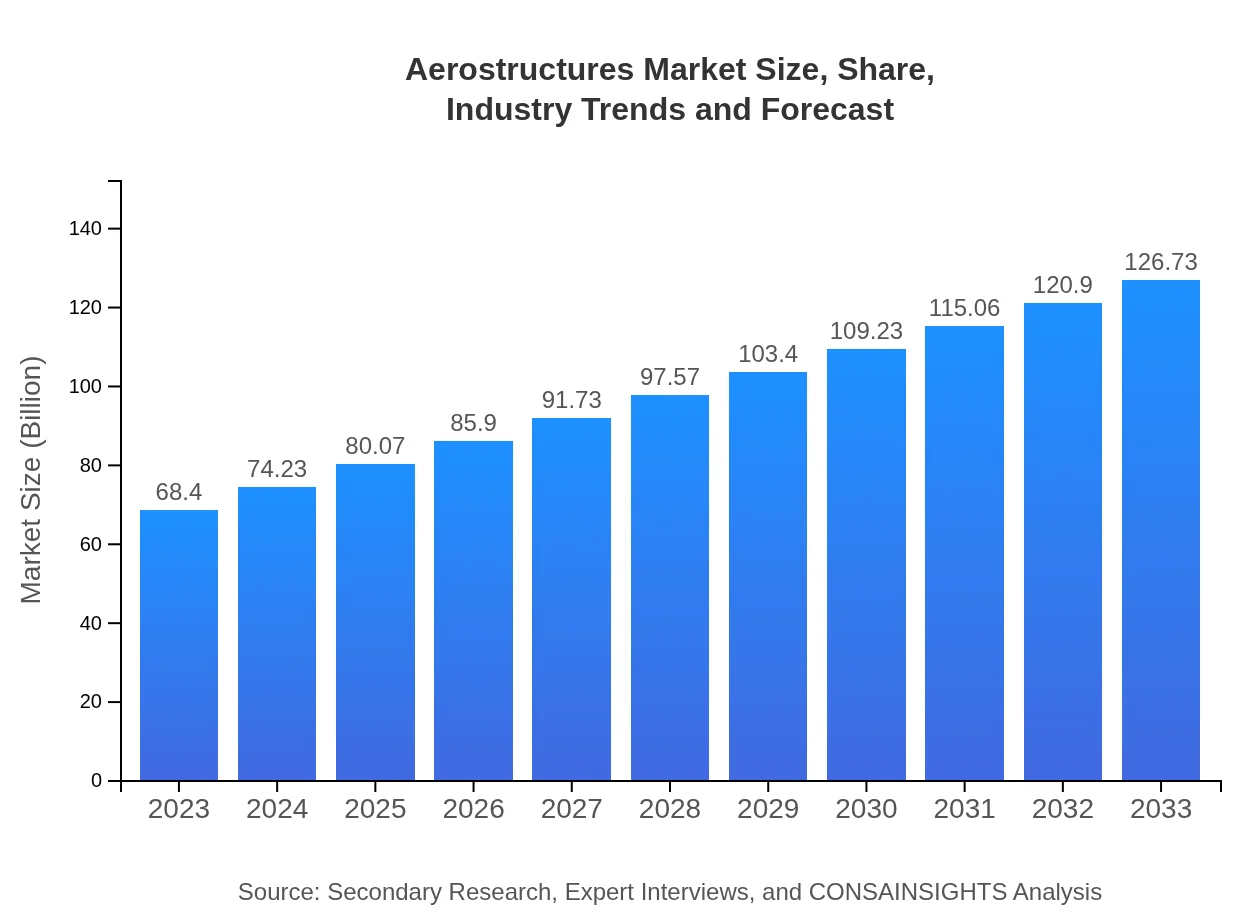

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $68.40 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $126.73 Billion |

| Top Companies | Boeing , Airbus, Lockheed Martin, Northrop Grumman |

| Last Modified Date | 03 February 2026 |

Aerostructures Market Overview

Customize Aerostructures Market Report market research report

- ✔ Get in-depth analysis of Aerostructures market size, growth, and forecasts.

- ✔ Understand Aerostructures's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aerostructures

What is the Market Size & CAGR of Aerostructures market in 2023?

Aerostructures Industry Analysis

Aerostructures Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aerostructures Market Analysis Report by Region

Europe Aerostructures Market Report:

Europe's Aerostructures market is anticipated to grow from USD 19.06 billion in 2023 to USD 35.32 billion by 2033. The region benefits from a robust aerospace manufacturing ecosystem featuring prominent players and a strong focus on innovation.Asia Pacific Aerostructures Market Report:

In the Asia Pacific region, the Aerostructures market is valued at USD 14.08 billion in 2023, with projections to reach USD 26.08 billion by 2033. This growth is largely driven by increasing air travel demand and significant investments in military aircraft, particularly in countries like India and China.North America Aerostructures Market Report:

North America holds one of the largest shares in the Aerostructures market, with a market size of USD 22.82 billion in 2023, projected to grow to USD 42.28 billion by 2033. The extensive presence of leading aerospace manufacturers and strong demand for defense technologies underpin this region's market strength.South America Aerostructures Market Report:

The South American market was valued at USD 2.92 billion in 2023, with expectations to grow to USD 5.41 billion by 2033. Growth is attributed to the burgeoning demand for commercial aircraft and increased defense spending in major countries like Brazil.Middle East & Africa Aerostructures Market Report:

The Middle East and Africa market was valued at USD 9.52 billion in 2023 and is expected to grow to USD 17.64 billion by 2033. The growth in this region is largely led by increasing military expenditures and the development of domestic aerospace capabilities.Tell us your focus area and get a customized research report.

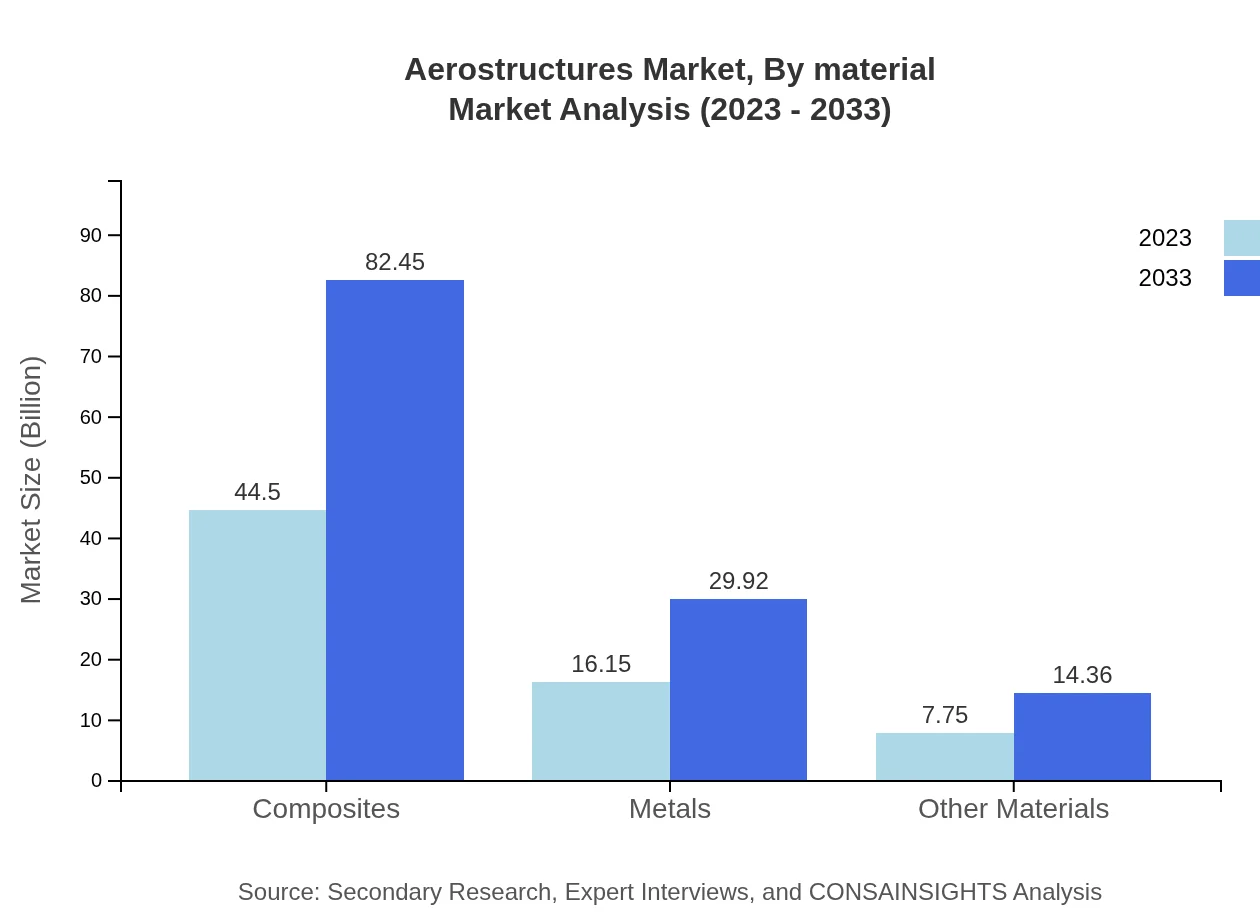

Aerostructures Market Analysis By Material

Materials play a crucial role in defining the performance attributes of Aerostructures. The major material categories include composites, metals, and other materials, with composites being the leading segment due to their lightweight and high-strength properties. In 2023, the composite segment accounted for approximately USD 44.50 billion, growing to USD 82.45 billion by 2033. Metals and other materials followed, contributing significantly to the overall market revenue.

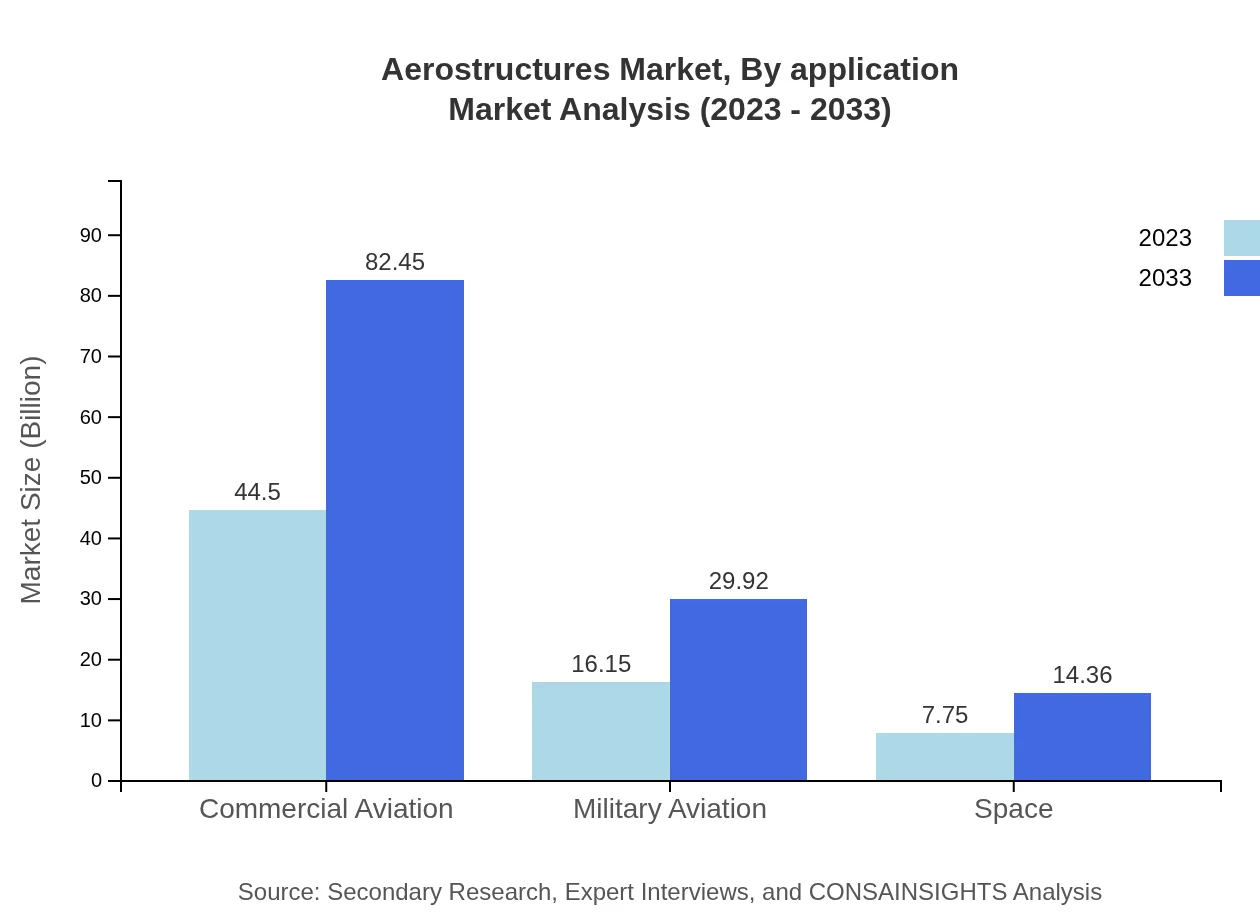

Aerostructures Market Analysis By Application

The application of Aerostructures is broadly classified into commercial aviation, military aviation, and space. The commercial aviation segment is expected to dominate due to rising passenger air travel, valued at USD 44.50 billion in 2023 and projected to reach USD 82.45 billion by 2033. Military aviation and space applications are also witnessing growth, driven by defense budgets and new space exploration initiatives.

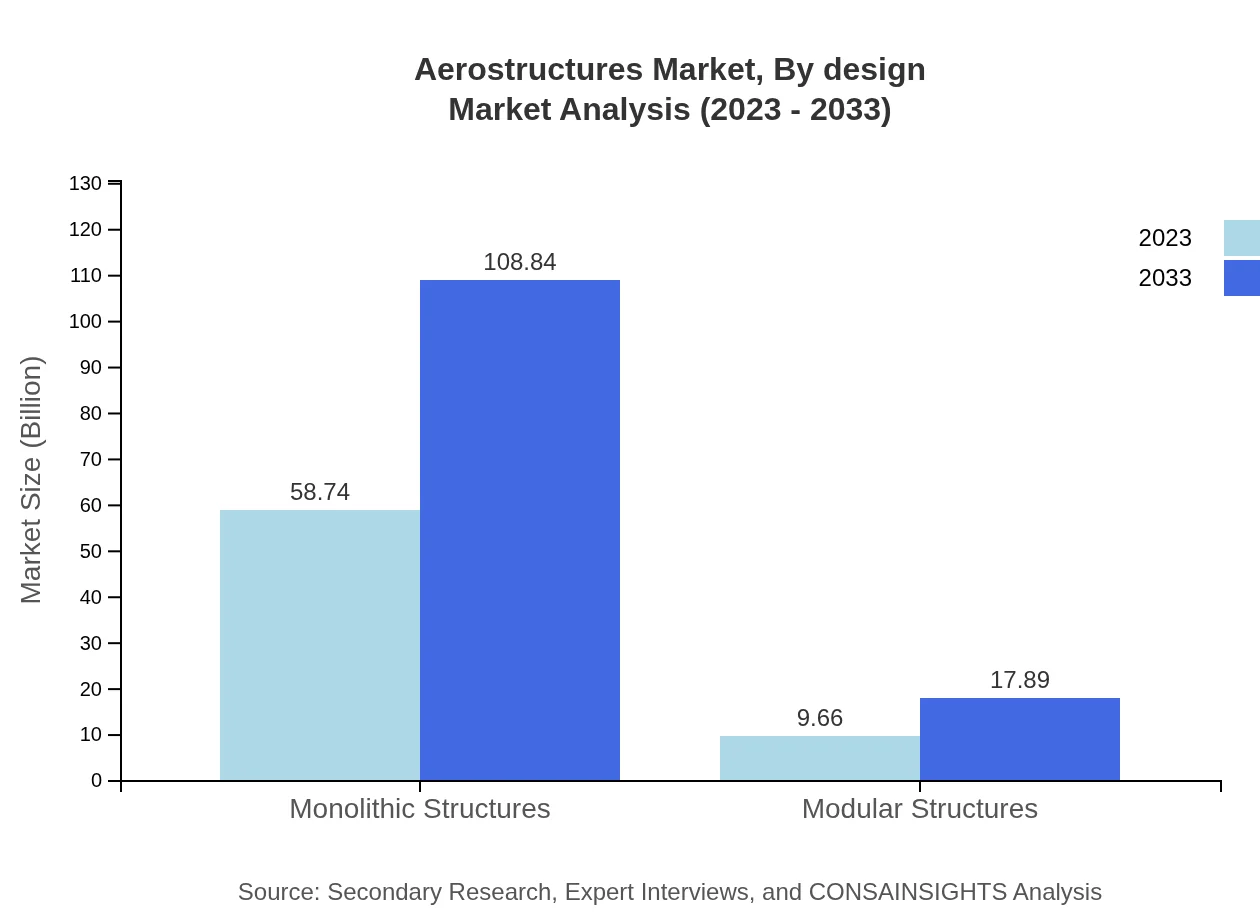

Aerostructures Market Analysis By Design

Aerostructures can be categorized based on design into monolithic and modular structures. Monolithic structures are anticipated to grow from USD 58.74 billion in 2023 to USD 108.84 billion by 2033, commanding a significant share of the market due to their structural integrity and efficiency. Modular designs are also gaining traction, projected to grow from USD 9.66 billion to USD 17.89 billion in the same period.

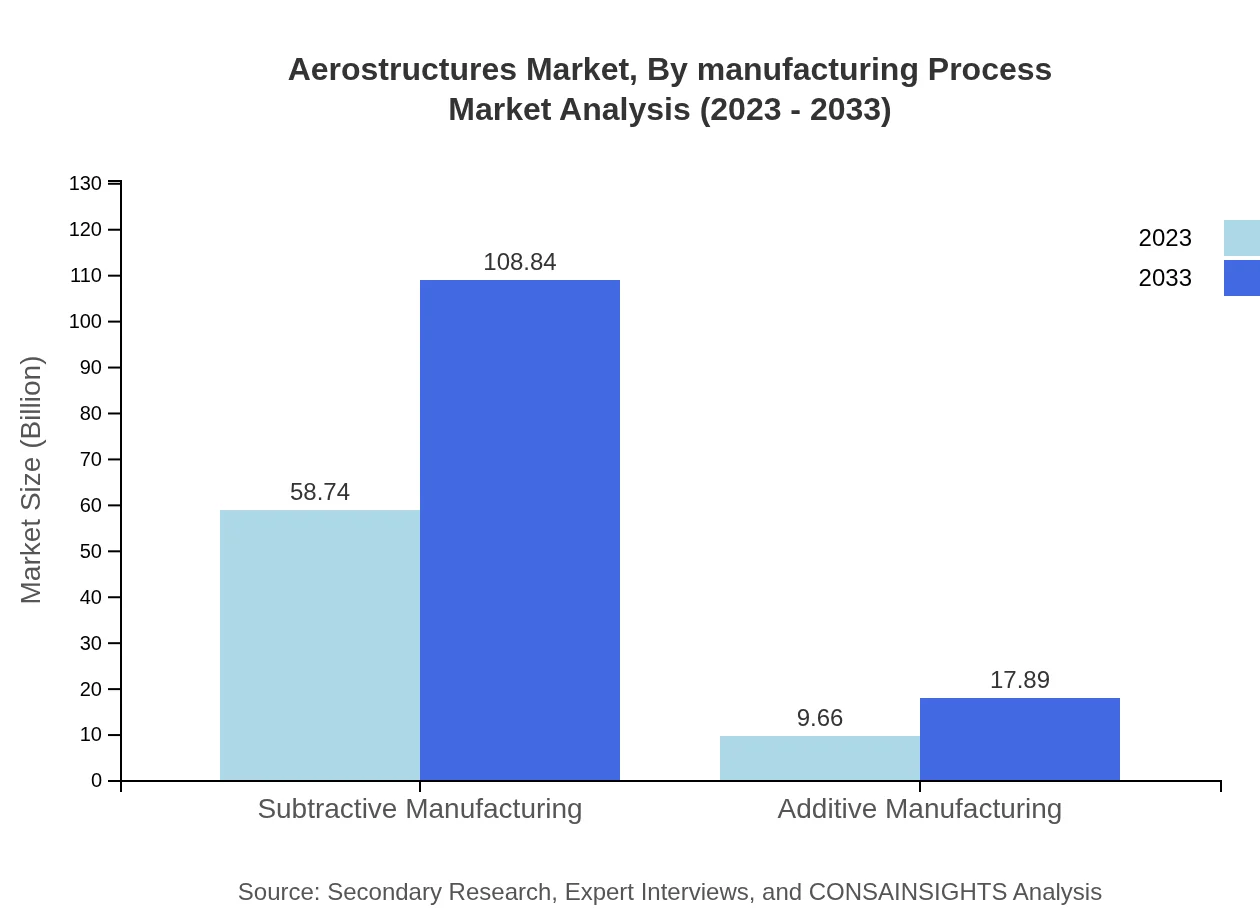

Aerostructures Market Analysis By Manufacturing Process

The manufacturing processes for Aerostructures include subtractive manufacturing and additive manufacturing. Subtractive processes were valued at USD 58.74 billion in 2023 and are projected to grow significantly, accounting for a substantial share due to their established methods. Additive manufacturing is expected to see rapid growth, moving from USD 9.66 billion in 2023 to USD 17.89 billion by 2033 as innovations in 3D printing gain traction.

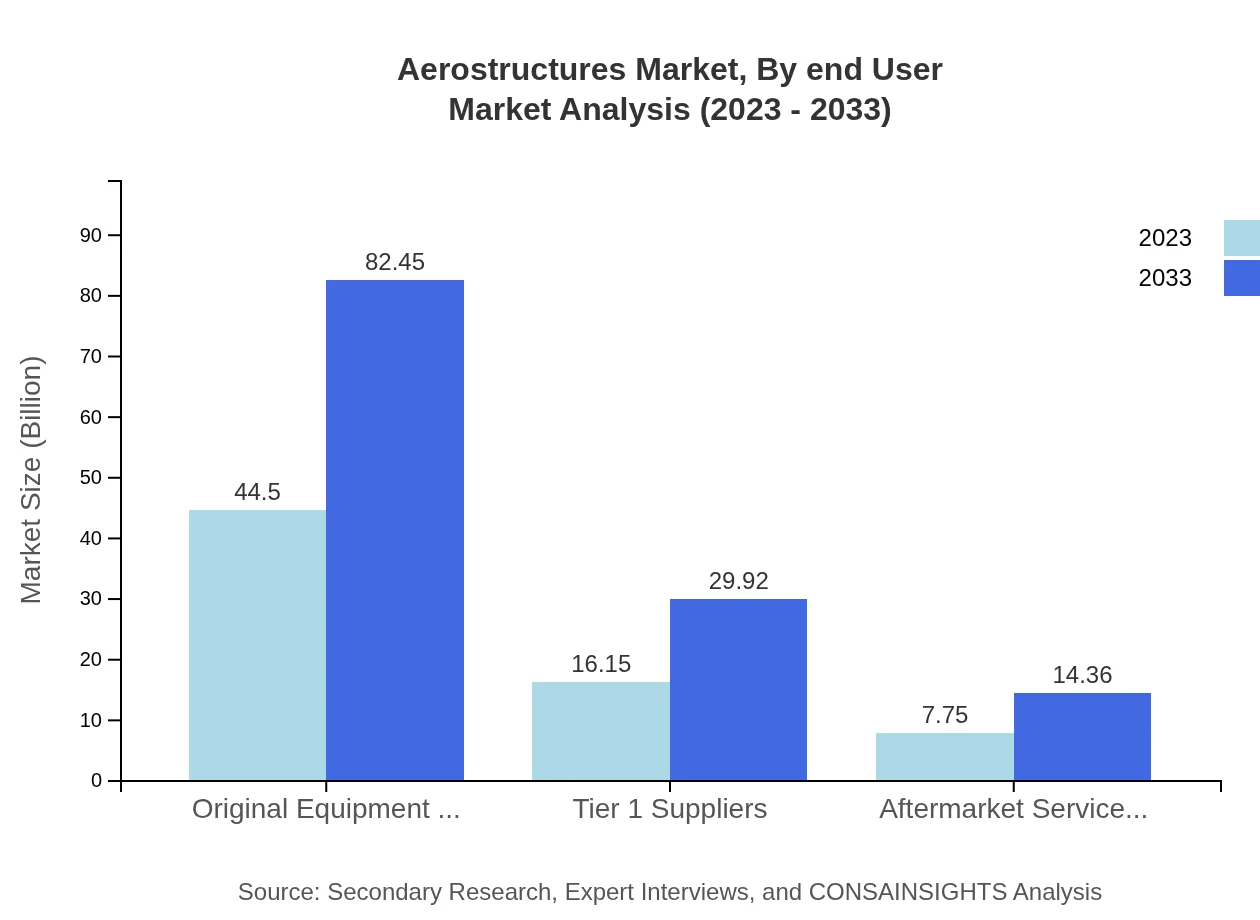

Aerostructures Market Analysis By End User

End users of Aerostructures include OEMs, Tier 1 suppliers, and aftermarket service providers. OEMs hold a dominant position in the market, valued at USD 44.50 billion in 2023 and expected to reach USD 82.45 billion by 2033. Tier 1 suppliers and aftermarket service providers are also integral to the ecosystem, with significant roles in ensuring continued performance and compliance in the aerospace industry.

Aerostructures Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aerostructures Industry

Boeing :

Boeing is one of the largest aerospace companies globally, known for its advanced technologies and comprehensive range of aerostructures utilized in both commercial and military aircraft.Airbus:

Airbus is a leading manufacturer of aircraft, offering innovative aerostructures and solutions, driving advancements in fuel efficiency and reduced environmental impact.Lockheed Martin:

As a major defense contractor, Lockheed Martin excels in the design and production of aerostructures for military applications, contributing significantly to national defense capabilities.Northrop Grumman:

Northrop Grumman is known for its cutting-edge technologies in space systems and military aerospace structures, supporting innovation in aeronautics.We're grateful to work with incredible clients.

FAQs

What is the market size of aerostructures?

The aerostructures market is projected to reach a size of $68.4 billion by 2033, growing at a CAGR of 6.2%. In 2023, the market is valued at $68.4 billion, indicating robust growth driven by advancements in aerospace technologies.

What are the key market players or companies in the aerostructures industry?

Key players in the aerostructures market include Boeing, Airbus, Lockheed Martin, and Northrop Grumman. These companies are pivotal in driving innovation and offering a broad range of aerostructure products essential for both military and commercial aviation.

What are the primary factors driving the growth in the aerostructures industry?

Key growth drivers for the aerostructures industry include increasing air travel demand, advancements in lightweight materials, and a rising focus on fuel efficiency. Enhanced R&D investment in aerospace technologies further contributes significantly to market expansion.

Which region is the fastest Growing in the aerostructures?

The fastest-growing region for the aerostructures market is projected to be Europe, with a market size expected to rise from $19.06 billion in 2023 to $35.32 billion by 2033, reflecting a strong inclination towards aviation safety and technological advancements.

Does ConsaInsights provide customized market report data for the aerostructures industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the aerostructures industry, allowing clients to gain targeted insights and detailed analyses that align with their business strategies and objectives.

What deliverables can I expect from this aerostructures market research project?

Deliverables from the aerostructures market research project typically include comprehensive market analysis reports, segment-wise data, growth forecasts, competitive landscape assessments, and actionable insights that support strategic decision-making.

What are the market trends of aerostructures?

Current trends in the aerostructures market include an increased focus on sustainability, advanced manufacturing processes such as additive manufacturing, and a shift towards digital technologies to enhance operational efficiencies in aerospace manufacturing.