Aftermarket Parts In Construction Industry Market Report

Published Date: 02 February 2026 | Report Code: aftermarket-parts-in-construction-industry

Aftermarket Parts In Construction Industry Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aftermarket Parts in the Construction Industry, covering essential insights on market trends, size, and growth forecasts from 2023 to 2033. It also highlights the segmentation, regional dynamics, and technological advancements in this sector.

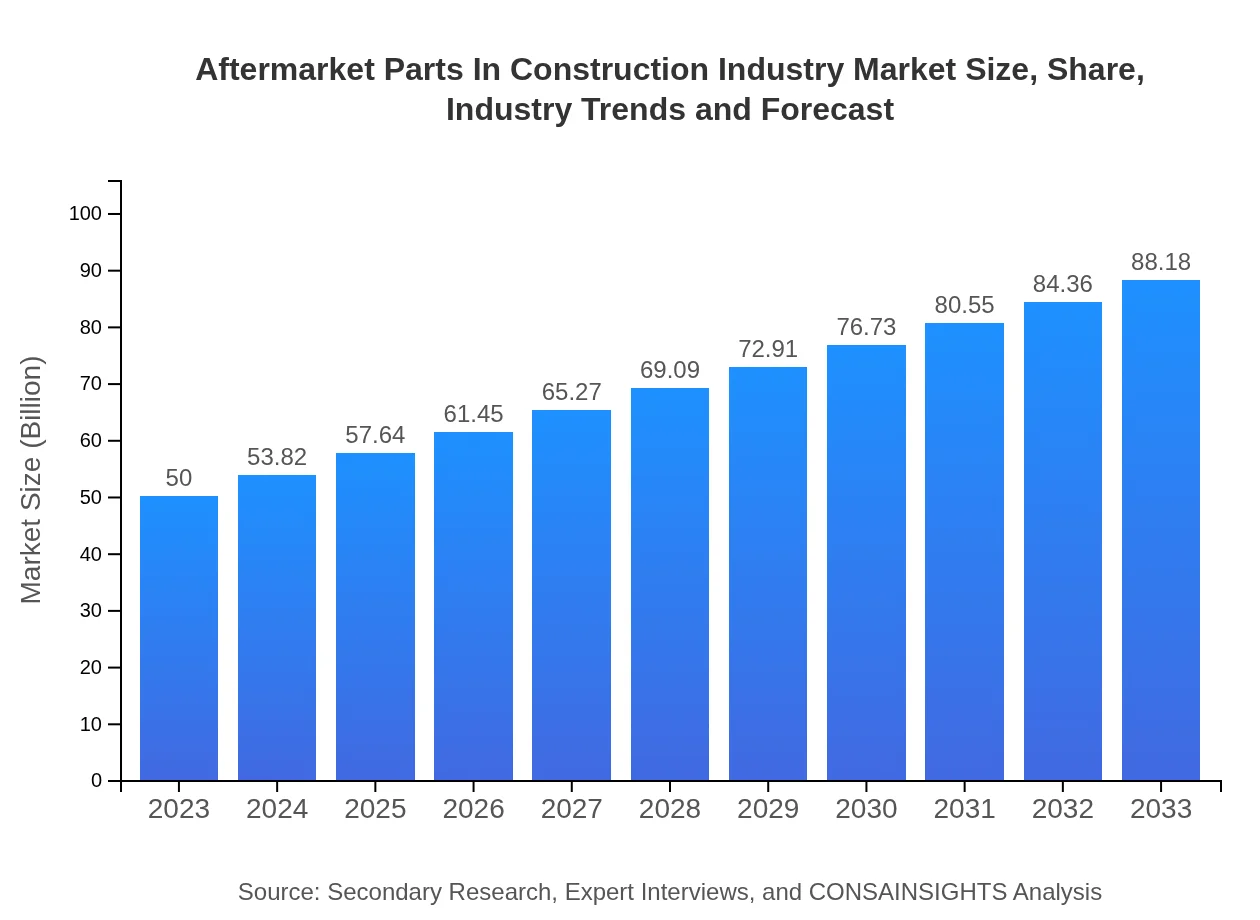

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $88.18 Billion |

| Top Companies | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery |

| Last Modified Date | 02 February 2026 |

Aftermarket Parts In Construction Industry Market Overview

Customize Aftermarket Parts In Construction Industry Market Report market research report

- ✔ Get in-depth analysis of Aftermarket Parts In Construction Industry market size, growth, and forecasts.

- ✔ Understand Aftermarket Parts In Construction Industry's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aftermarket Parts In Construction Industry

What is the Market Size & CAGR of Aftermarket Parts In Construction Industry market in 2033?

Aftermarket Parts In Construction Industry Industry Analysis

Aftermarket Parts In Construction Industry Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aftermarket Parts In Construction Industry Market Analysis Report by Region

Europe Aftermarket Parts In Construction Industry Market Report:

In Europe, the aftermarket parts market is valued at $12.49 billion in 2023 and projected to grow to $22.04 billion by 2033. The growth is driven by stringent regulatory requirements for machinery standards and increasing investments in construction activities.Asia Pacific Aftermarket Parts In Construction Industry Market Report:

In the Asia Pacific region, the market was valued at $10.45 billion in 2023 and is projected to reach $18.42 billion by 2033, growing significantly due to rapid urbanization, industrialization, and substantial investments in infrastructure projects.North America Aftermarket Parts In Construction Industry Market Report:

North America currently leads the market with a value of $17.41 billion in 2023, set to increase to $30.71 billion by 2033. The key drivers include the high demand for advanced machinery, replacement parts, and enhanced maintenance services across the region.South America Aftermarket Parts In Construction Industry Market Report:

South America represents a burgeoning market for aftermarket parts in construction, with a value of $4.18 billion expected in 2023, anticipated to grow to $7.37 billion by 2033. This growth is spurred by essential infrastructural upgrades and a rising number of construction projects.Middle East & Africa Aftermarket Parts In Construction Industry Market Report:

The Middle East and Africa market is projected to witness growth from $5.47 billion in 2023 to $9.65 billion by 2033, driven by flourishing construction projects and an increasing focus on improving the quality and longevity of construction equipment.Tell us your focus area and get a customized research report.

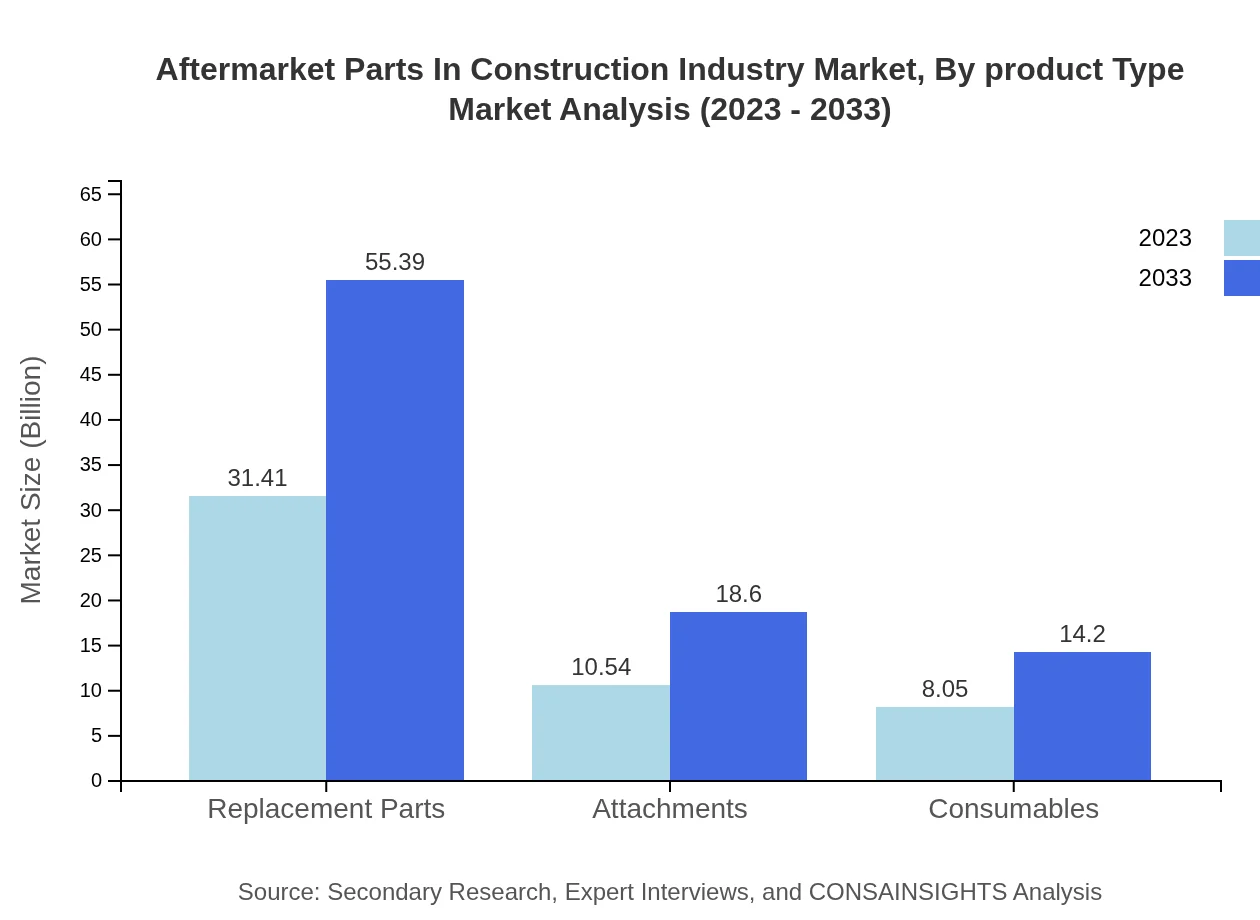

Aftermarket Parts In Construction Industry Market Analysis By Product Type

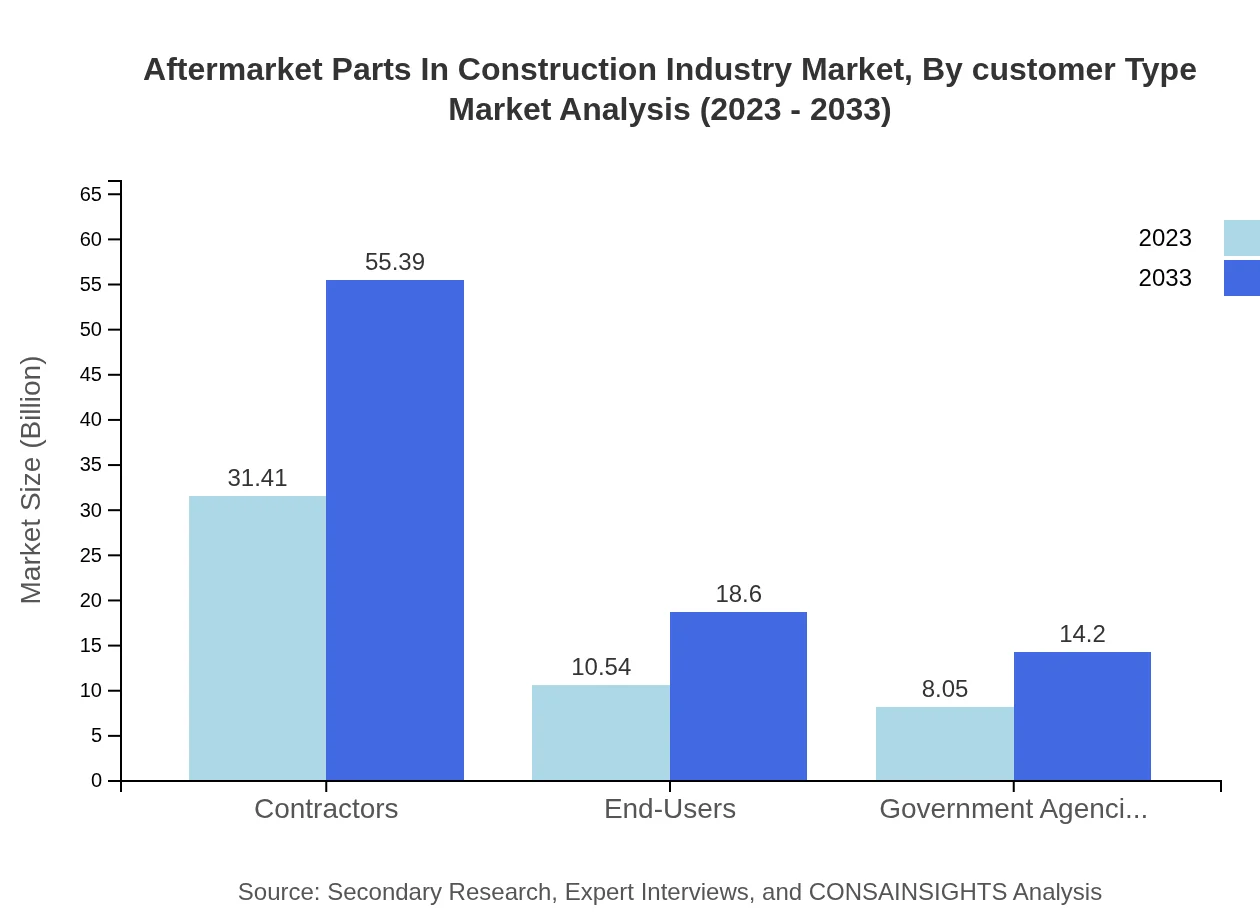

Replacement Parts dominate the market, with size estimates of $31.41 billion in 2023 and projected to reach $55.39 billion by 2033, maintaining a significant market share of 62.81%. Attachments account for approximately $10.54 billion in 2023 and expected to grow to $18.60 billion by 2033, representing 21.09% of the overall market. Consumables have a current market size of $8.05 billion, anticipated to rise to $14.20 billion over the same period, maintaining a share of 16.1%.

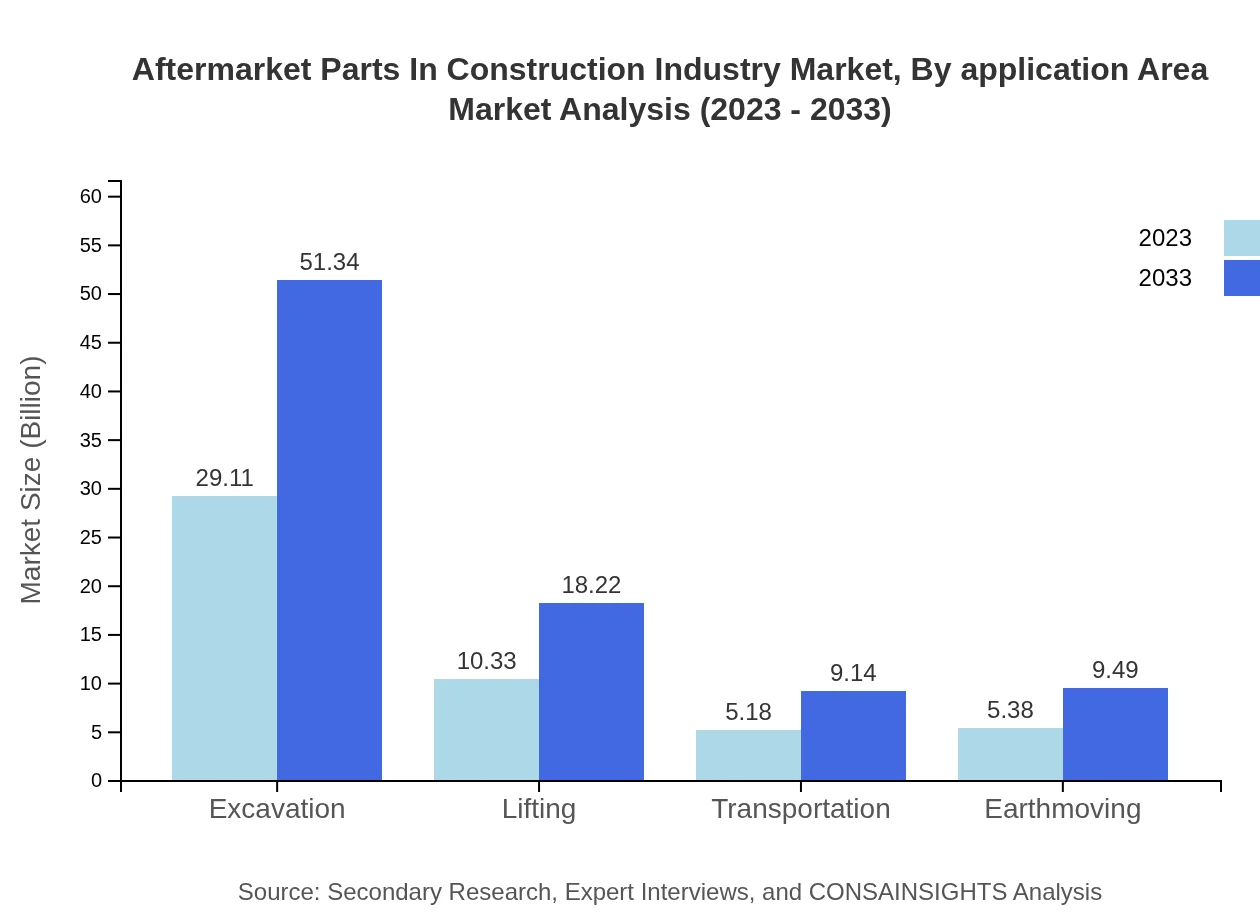

Aftermarket Parts In Construction Industry Market Analysis By Application Area

Excavation is a key application area with a market size of $29.11 billion in 2023, expected to grow to $51.34 billion by 2033, capturing a share of 58.22%. Lifting applications follow with $10.33 billion in 2023 and an increase to $18.22 billion by 2033, holding 20.66% of the market. Transportation and Earthmoving applications are also growing, with respective sizes of $5.18 billion and $5.38 billion in 2023.

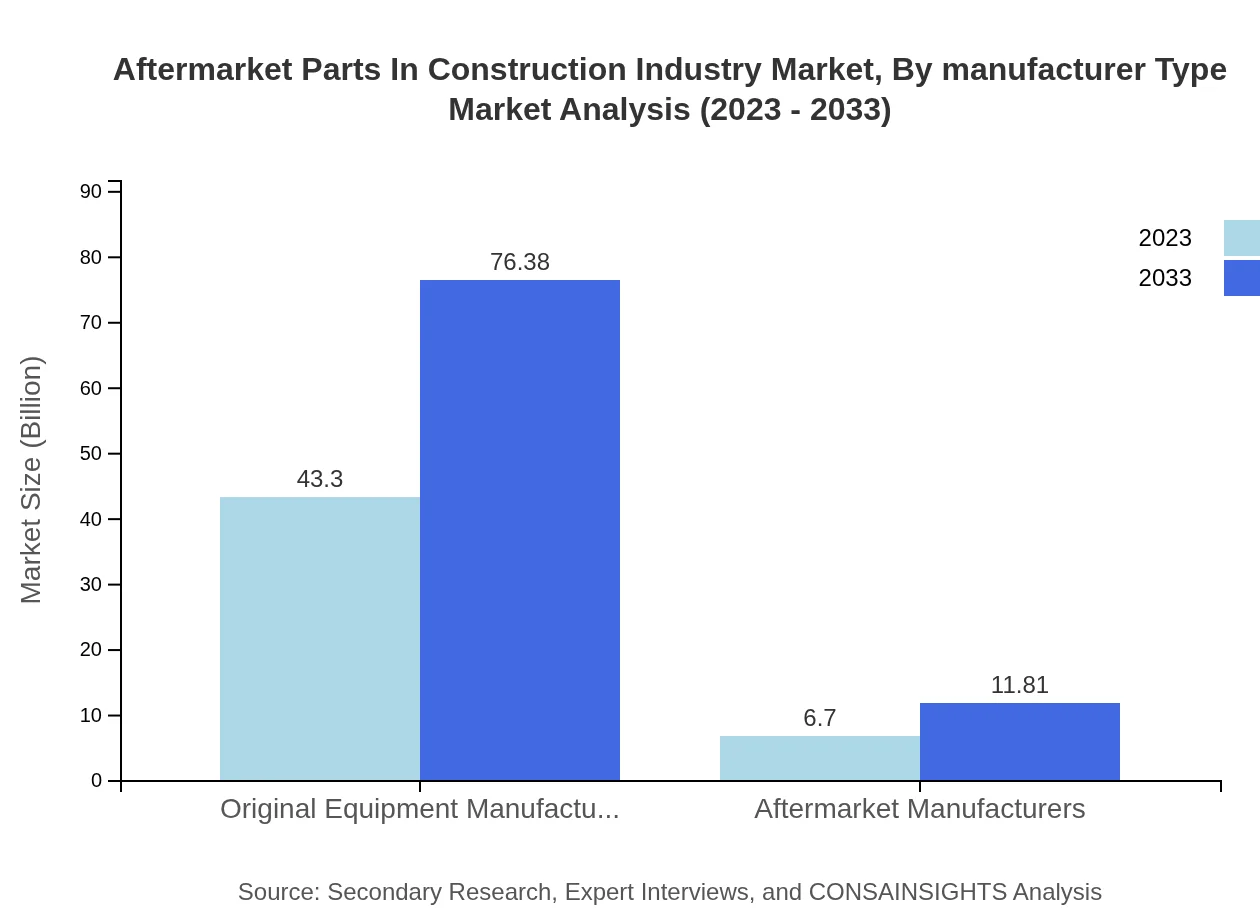

Aftermarket Parts In Construction Industry Market Analysis By Manufacturer Type

OEMs have a leading share in the market, valued at $43.30 billion in 2023 and projected to reach $76.38 billion by 2033, holding dominant market control at 86.61%. Aftermarket Manufacturers also contribute significantly with a market size of $6.70 billion in 2023, growing to $11.81 billion by 2033, which consists of 13.39%.

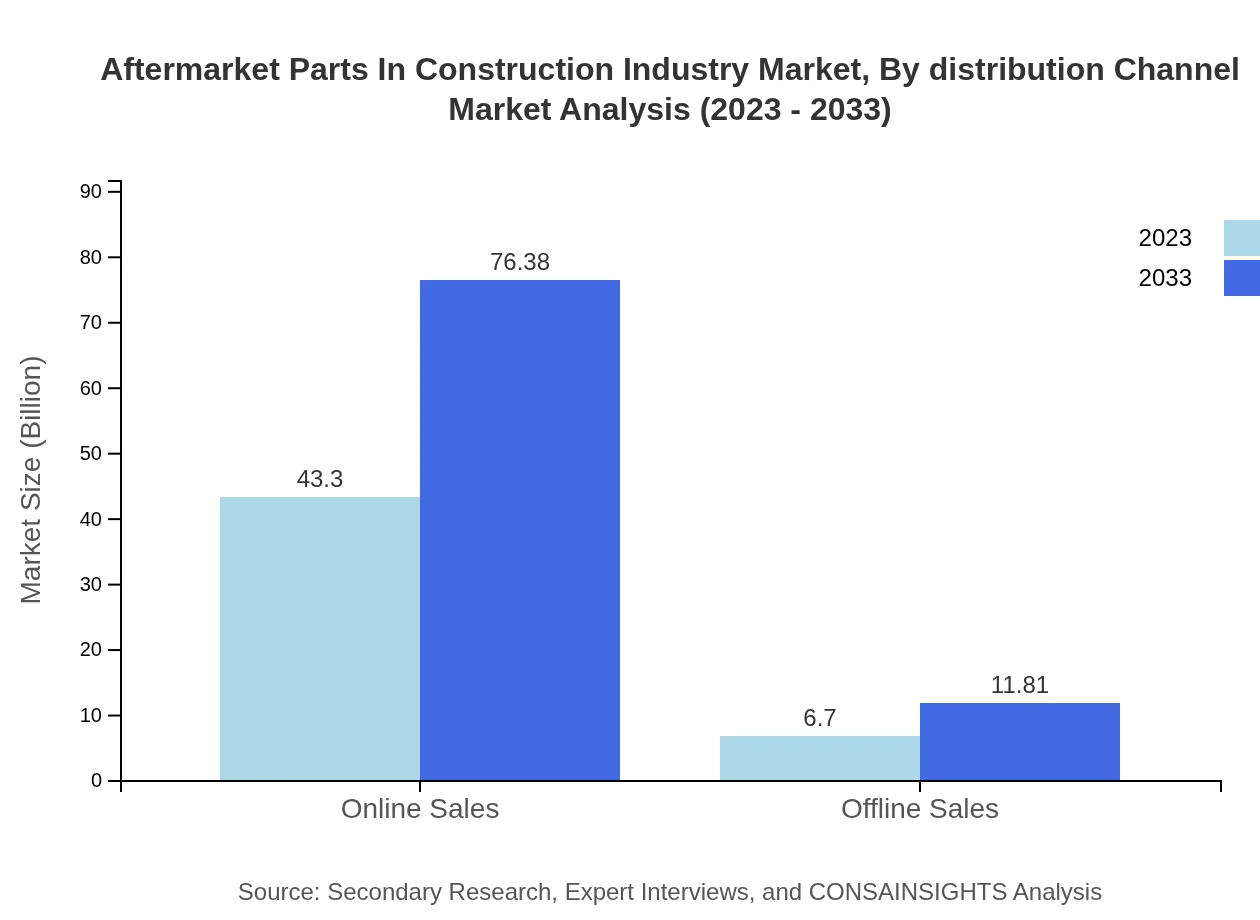

Aftermarket Parts In Construction Industry Market Analysis By Distribution Channel

Online Sales channels lead the market with $43.30 billion in 2023, projected to grow to $76.38 billion by 2033, covering 86.61% of the distribution share. Offline Sales channels are estimated at $6.70 billion in 2023, with expectations to reach $11.81 billion, commanding a 13.39% market share.

Aftermarket Parts In Construction Industry Market Analysis By Customer Type

The major customer types include Contractors, holding a leading market share of $31.41 billion in 2023 anticipated to grow to $55.39 billion by 2033. End-users and Government Agencies also represent significant segments, exhibiting respective sizes of $10.54 billion and $8.05 billion in 2023, with substantial growth expected.

Aftermarket Parts In Construction Industry Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aftermarket Parts In Construction Industry Industry

Caterpillar Inc.:

Caterpillar Inc. is a global leader in manufacturing construction and mining equipment, offering a vast range of aftermarket parts for enhancing equipment performance and reliability.Komatsu Ltd.:

Komatsu Ltd. is renowned for its innovative construction equipment and robust aftermarket support, ensuring high-quality replacement parts for customer loyalty.Volvo Construction Equipment:

Volvo CE not only manufactures a wide array of construction machinery but also focuses heavily on aftermarket services designed to improve machine efficiency.Hitachi Construction Machinery:

Hitachi is well-known for providing cutting-edge technology in heavy construction equipment, coupled with comprehensive aftermarket support.We're grateful to work with incredible clients.

FAQs

What is the market size of aftermarket Parts In Construction Industry?

The aftermarket parts market in the construction industry is projected to reach $50 billion in 2023, with an expected CAGR of 5.7% over the forecast period until 2033, driving significant growth and opportunities.

What are the key market players or companies in this aftermarket Parts In Construction Industry?

Key players in the aftermarket parts for the construction industry include major OEMs, aftermarket manufacturers, and suppliers of specialized parts, contributing significantly to market dynamics and competition.

What are the primary factors driving the growth in the aftermarket parts in construction industry?

Growth is driven by increasing construction activities, the push for machinery maintenance, evolving technology, and rising demand for efficient operational solutions in construction processes.

Which region is the fastest Growing in the aftermarket Parts In Construction Industry?

North America is expected to be the fastest-growing region, with market size projected to grow from $17.41 billion in 2023 to $30.71 billion by 2033, demonstrating strong demand for aftermarket parts.

Does ConsaInsights provide customized market report data for the aftermarket Parts In Construction Industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and parameters for the aftermarket parts in the construction industry, ensuring relevant insights.

What deliverables can I expect from this aftermarket Parts In Construction Industry market research project?

You can expect comprehensive reports including market size, competitive analysis, growth trends, and regional insights, along with actionable strategies and recommendations for stakeholders.

What are the market trends of aftermarket Parts In Construction Industry?

Current trends include rising adoption of digital solutions in sales, increasing environmental regulations driving sustainable practices, and an emphasis on product customization to meet diverse customer needs.