Agricultural Biologicals Market Report

Published Date: 02 February 2026 | Report Code: agricultural-biologicals

Agricultural Biologicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Agricultural Biologicals market, highlighting current trends, market size, and forecasts from 2023 to 2033, along with insights on key segments and regional dynamics.

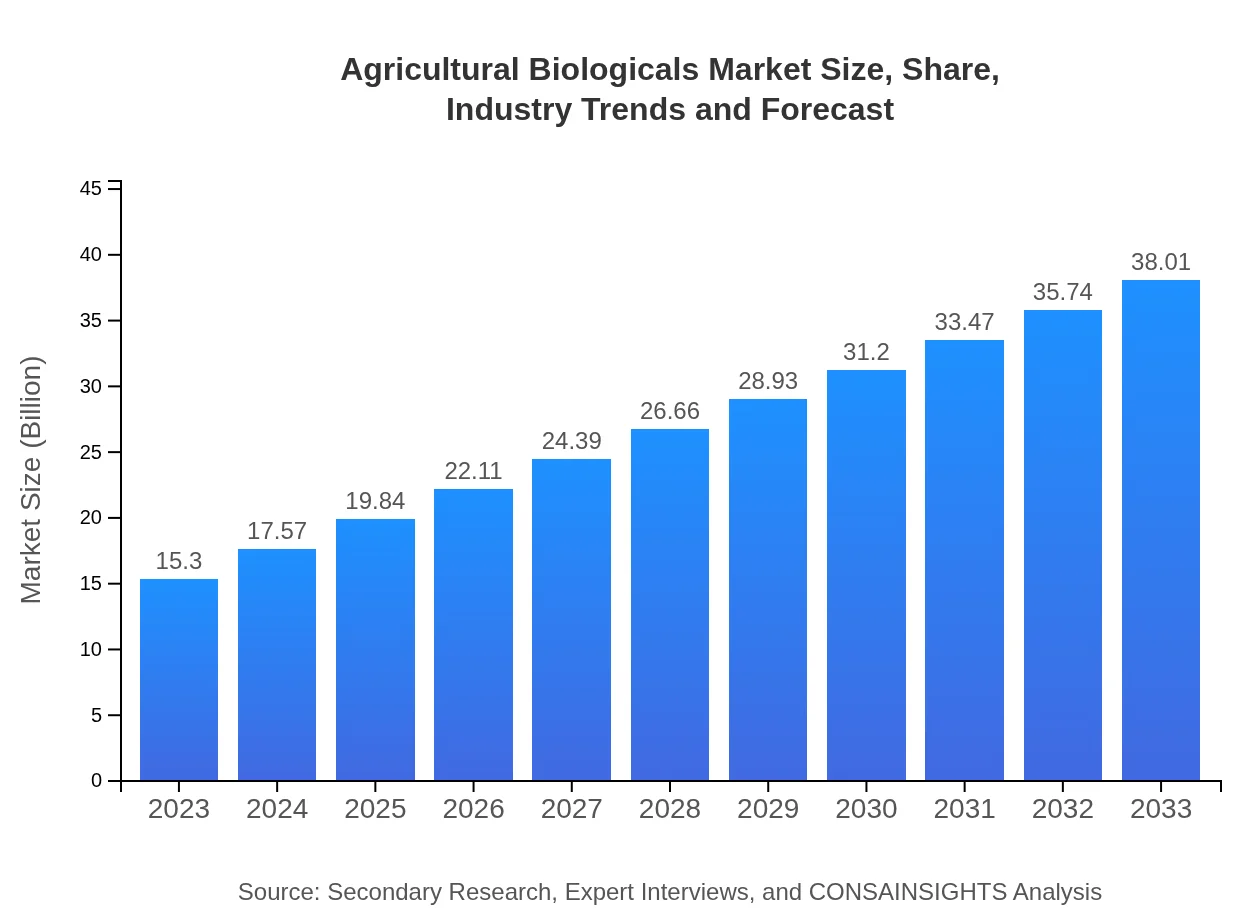

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $38.01 Billion |

| Top Companies | BASF, Syngenta, Bayer, FMC Corporation |

| Last Modified Date | 02 February 2026 |

Agricultural Biologicals Market Overview

Customize Agricultural Biologicals Market Report market research report

- ✔ Get in-depth analysis of Agricultural Biologicals market size, growth, and forecasts.

- ✔ Understand Agricultural Biologicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agricultural Biologicals

What is the Market Size & CAGR of Agricultural Biologicals market in 2023?

Agricultural Biologicals Industry Analysis

Agricultural Biologicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agricultural Biologicals Market Analysis Report by Region

Europe Agricultural Biologicals Market Report:

Europe’s Agricultural Biologicals market is projected to grow from 3.90 billion USD in 2023 to 9.69 billion USD in 2033. The EU’s regulatory framework promotes the use of biological products, and there is a growing consumer preference for organic food in the region, driving demand.Asia Pacific Agricultural Biologicals Market Report:

In the Asia Pacific region, the Agricultural Biologicals market is projected to reach 8.21 billion USD by 2033, growing from 3.30 billion USD in 2023. The increasing population, coupled with demand for sustainable agricultural practices, is driving this growth. Countries like China and India are focusing on reducing chemical input use and are thus adopting biological alternatives more rapidly.North America Agricultural Biologicals Market Report:

The North American market is expected to show a substantial increase from 5.09 billion USD in 2023 to 12.66 billion USD by 2033. With a strong emphasis on sustainable agriculture and organic farming, North America leads in innovative agricultural technology and bioproduct use.South America Agricultural Biologicals Market Report:

South America is anticipated to show significant growth, with the market expected to grow from 1.15 billion USD in 2023 to 2.85 billion USD in 2033. The region is known for its vast agricultural produce, and the increasing adoption of organic farming practices is bolstering the Agricultural Biologicals market.Middle East & Africa Agricultural Biologicals Market Report:

The Middle East and Africa market is forecasted to expand from 1.85 billion USD in 2023 to 4.61 billion USD in 2033. Governments are increasingly promoting sustainable farming practices, which is aiding the growth of Agricultural Biological products in these regions.Tell us your focus area and get a customized research report.

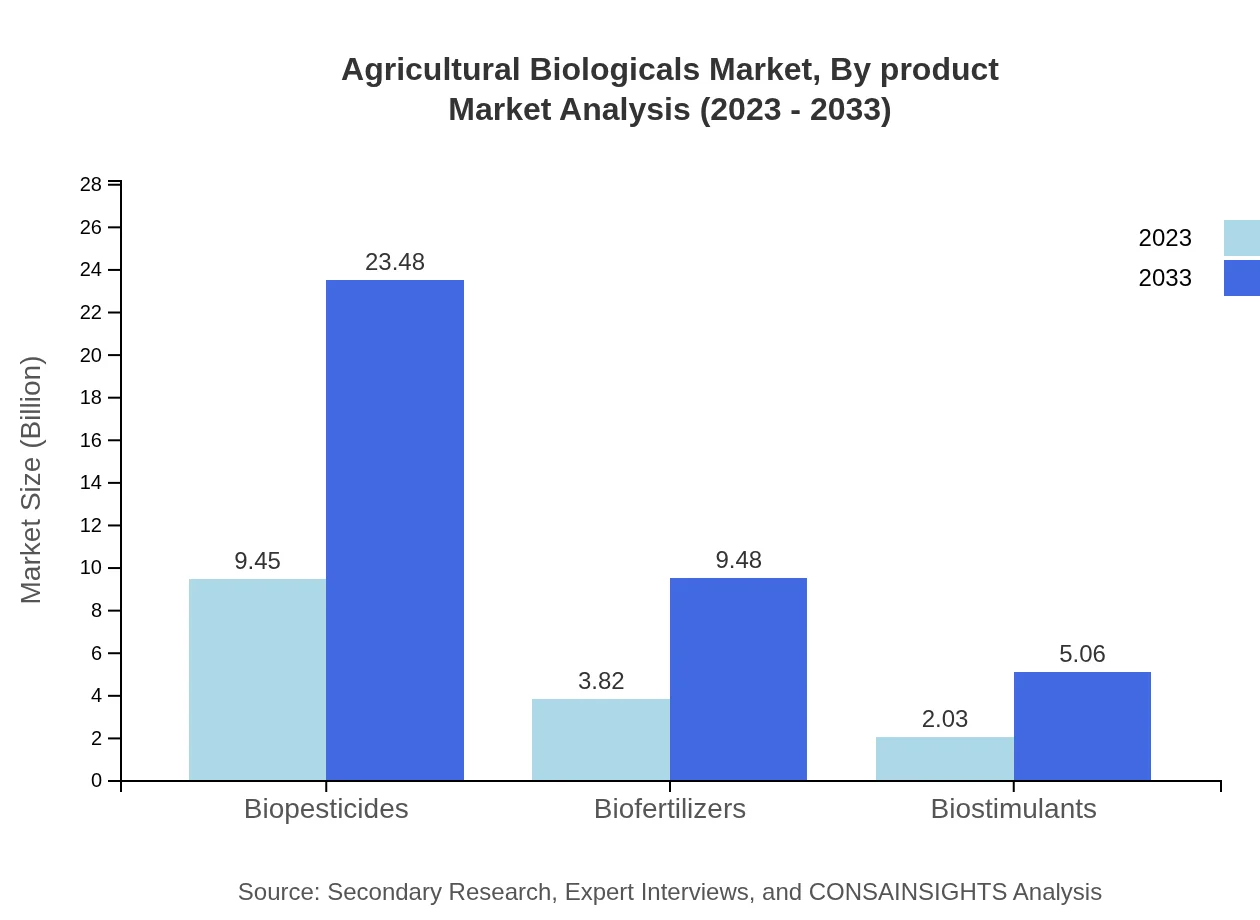

Agricultural Biologicals Market Analysis By Product

The product segmentation includes biopesticides, biofertilizers, and biostimulants. In 2023, biopesticides dominate the market with a share of 61.76%, valued at 9.45 billion USD, and are expected to reach 23.48 billion USD by 2033. Biofertilizers and biostimulants follow with shares of 24.94% and 13.30%, indicating their growing importance in enhancing soil health and crop yield.

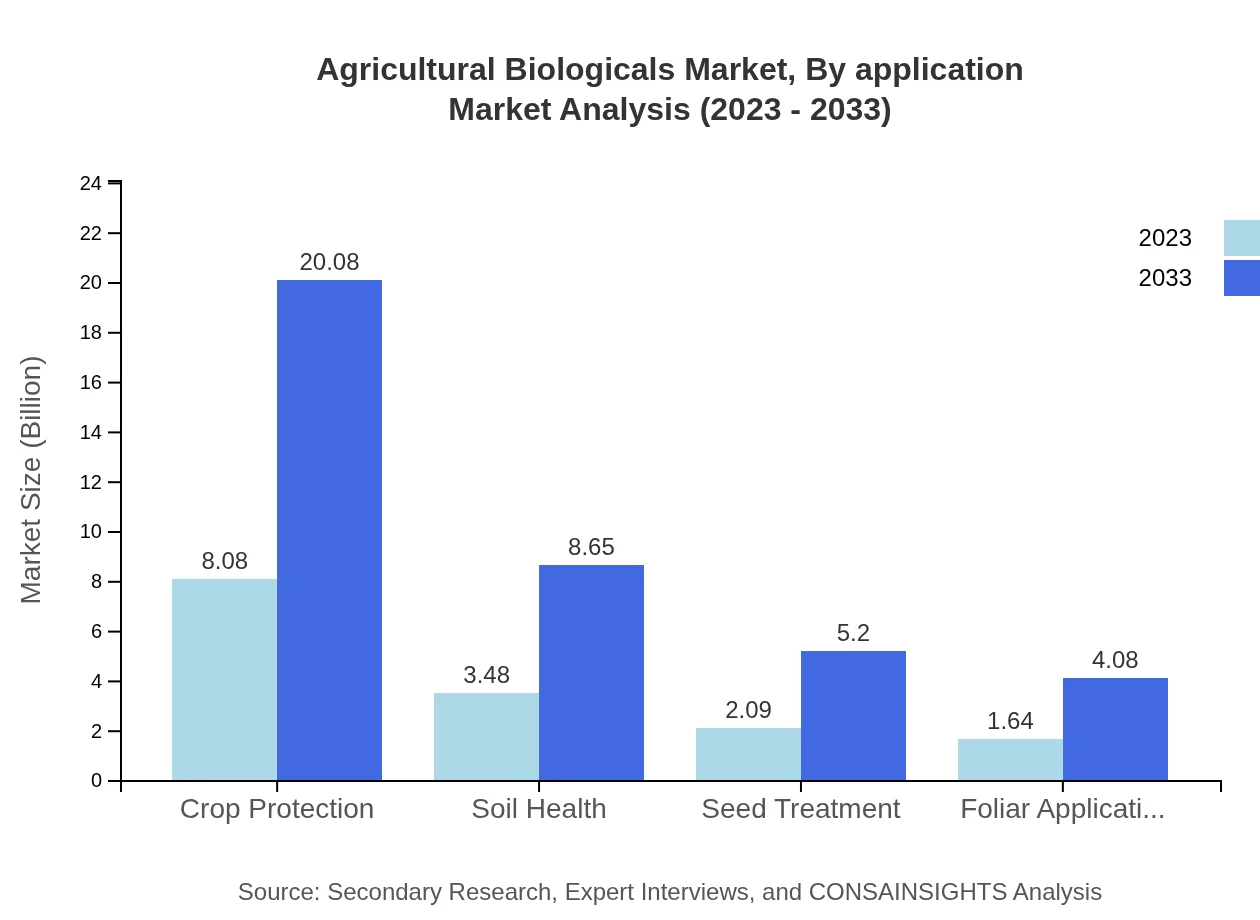

Agricultural Biologicals Market Analysis By Application

Applications include crop protection, soil health improvement, and seed treatment. Crop protection dominates the segment with a share of 52.82% in 2023 valued at 8.08 billion USD and projected to grow to 20.08 billion USD by 2033. Soil health and seed treatment are also significant, with expected growth as sustainability practices become mainstream.

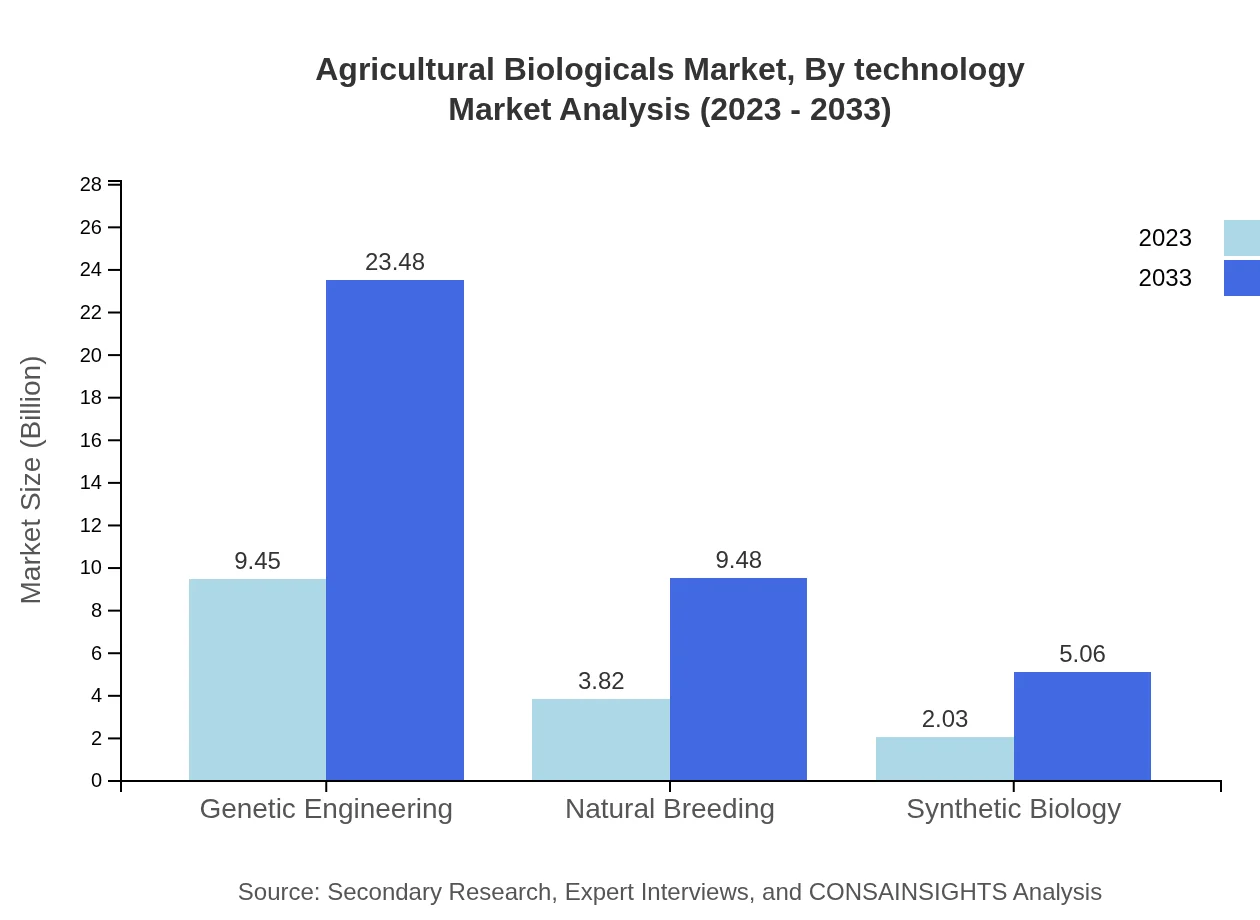

Agricultural Biologicals Market Analysis By Technology

Technological approaches in this market encompass genetic engineering, natural breeding, and synthetic biology. Genetic engineering shares approximately 61.76% of the market in 2023, valued at 9.45 billion USD, indicating its ongoing predominance. Natural breeding and synthetic biology are also seeing increased adoption for their sustainable implications in agriculture.

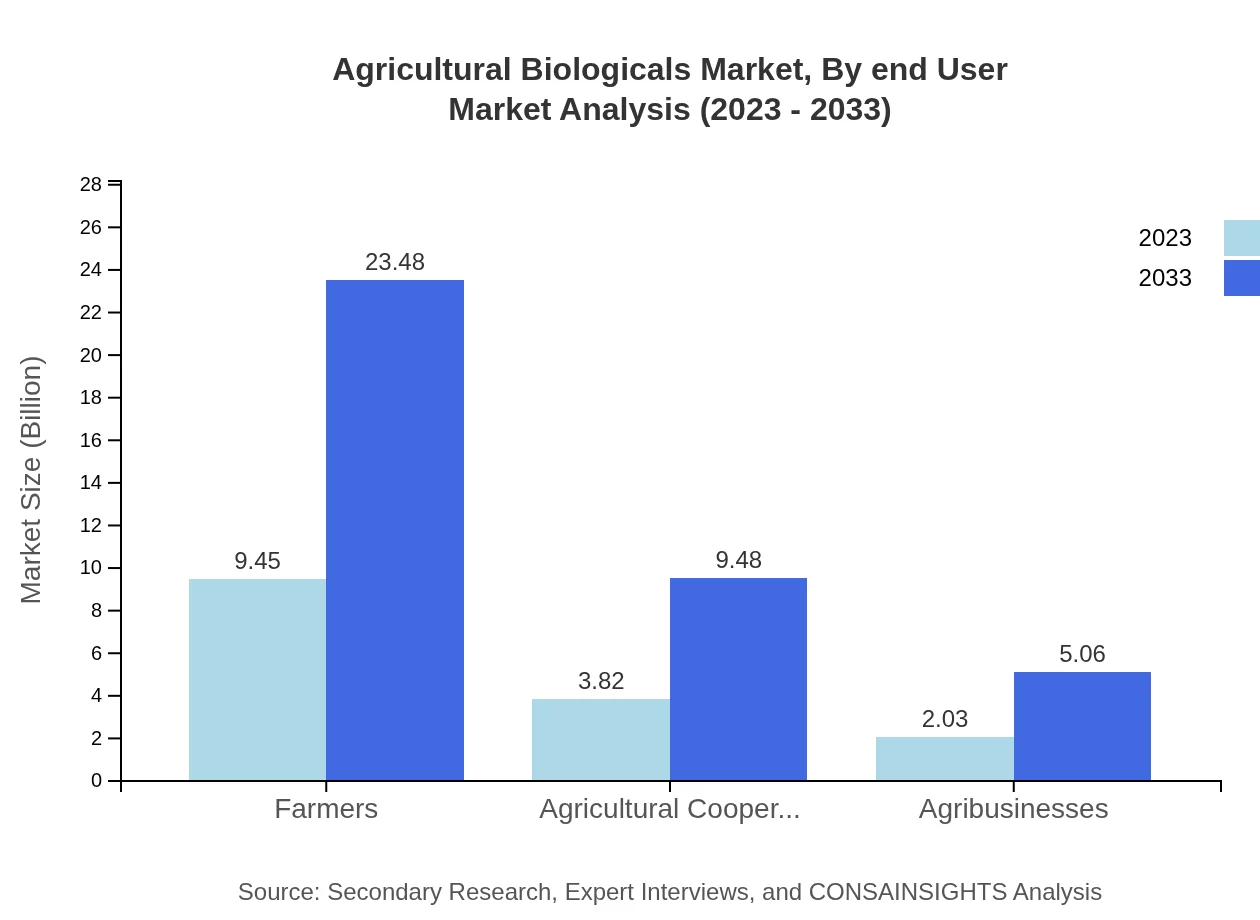

Agricultural Biologicals Market Analysis By End User

End-user segmentation consists of farmers, agricultural cooperatives, and agribusinesses. Farmers account for a significant portion of the market at approximately 61.76% with a value of 9.45 billion USD in 2023, expected to reach 23.48 billion USD by 2033, highlighting their pivotal role in adopting biological solutions for sustainable practices.

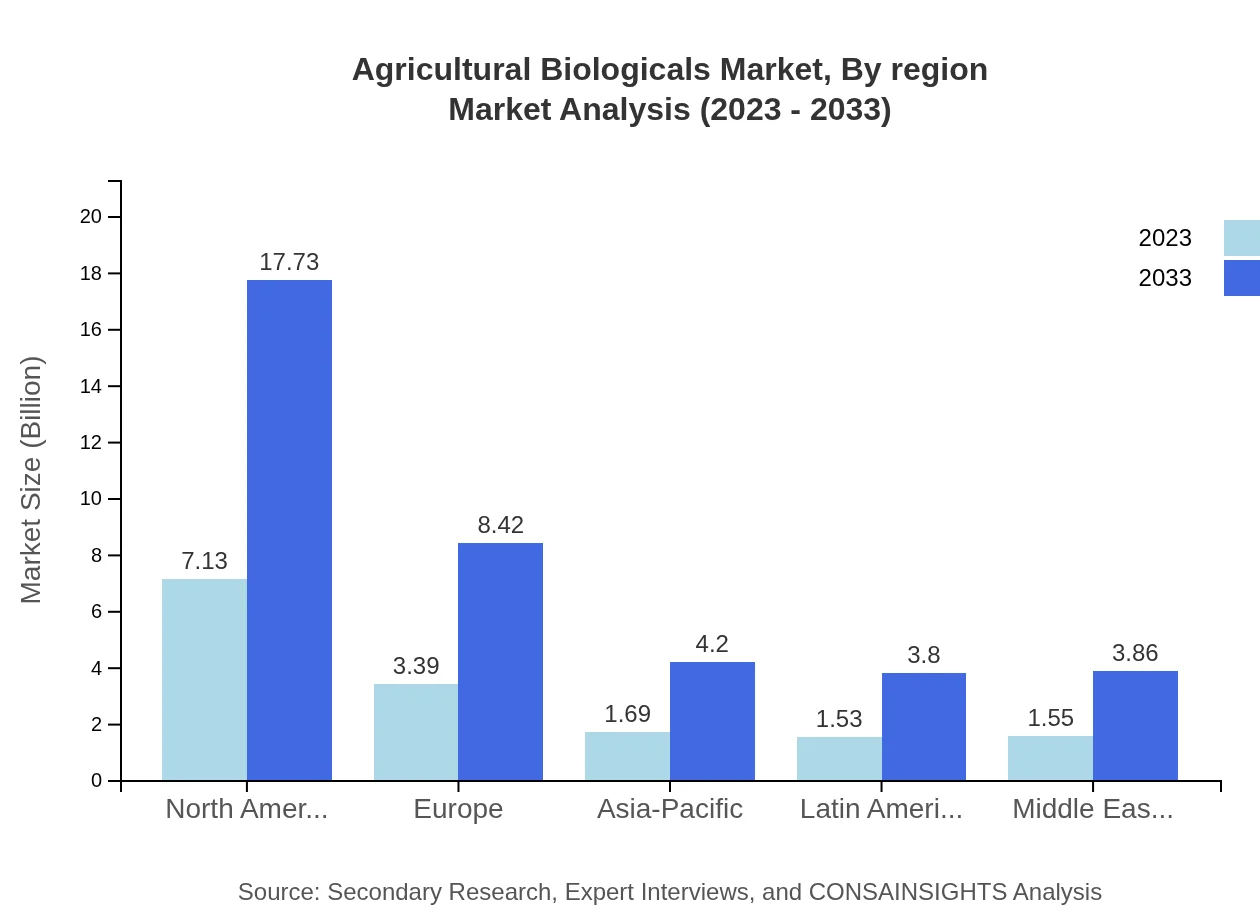

Agricultural Biologicals Market Analysis By Region

Regionally, North America, Europe, and Asia Pacific showcase the largest markets. North America led the market with 46.63% share in 2023 valued at 7.13 billion USD, while Europe holds 22.16% share valued at 3.39 billion USD. Asia Pacific is growing with 11.05% share valued at 1.69 billion USD, reflecting increasing adoption of biological products.

Agricultural Biologicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agricultural Biologicals Industry

BASF:

BASF is a leading global player in the Agricultural Biologicals sector, providing innovative solutions for crop protection and soil health. Their extensive R&D capabilities ensure continual advancement in biopesticides and fertilizers.Syngenta:

Syngenta is a prominent company known for its portfolio of biological products. The company invests heavily in sustainable agricultural practices to meet the growing demand for environmentally friendly agricultural inputs.Bayer:

Bayer offers a range of bioproducts aimed at enhancing crop health and yield. Its commitment to sustainability positions it prominently within the Agricultural Biologicals market.FMC Corporation:

FMC Corporation is recognized for its innovative biological solutions in crop protection, focusing on sustainability and efficacy to help farmers meet modern agricultural challenges.We're grateful to work with incredible clients.

FAQs

What is the market size of Agricultural Biologicals?

The Agricultural Biologicals market is estimated at $15.3 billion in 2023, with a projected CAGR of 9.2%. By 2033, the market is expected to reach approximately $34.5 billion, reflecting significant growth driven by increasing demand for sustainable agriculture.

What are the key market players or companies in the Agricultural Biologicals industry?

Key players in the Agricultural Biologicals market include major companies like Bayer AG, BASF SE, and Corteva Agriscience. These companies are known for their innovative practices in biopesticides, biofertilizers, and biostimulants to meet the evolving needs of the agricultural sector.

What are the primary factors driving the growth in the Agricultural Biologicals industry?

Growth in the Agricultural Biologicals industry is primarily driven by increasing awareness of sustainable agriculture practices, rising consumer demand for organic products, and stringent regulations on chemical pesticides. Additionally, advancements in biotechnology are spearheading innovations in agricultural solutions.

Which region is the fastest Growing in the Agricultural Biologicals market?

North America is the fastest-growing region in the Agricultural Biologicals market, with a market size of $5.09 billion in 2023, projected to reach $12.66 billion by 2033. Strong investment in research and development and emphasis on sustainable farming practices contribute to this growth.

Does ConsaInsights provide customized market report data for the Agricultural Biologicals industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the Agricultural Biologicals industry, allowing for in-depth analysis of market trends, competitive landscape, and growth opportunities based on individual business requirements.

What deliverables can I expect from this Agricultural Biologicals market research project?

Deliverables from the Agricultural Biologicals market research project include comprehensive market analysis reports, detailed segmentation data, competitive landscape summaries, custom insights on growth drivers, and forecasts based on current trends to aid strategic planning and decision-making.

What are the market trends of Agricultural Biologicals?

Current market trends in Agricultural Biologicals include a growing shift towards organic farming, increasing R&D investment in biotechnological innovations, and a surge in biopesticide adoption. The focus on crop protection and enhancing soil health is becoming more pronounced, driven by environmental concerns.