Agricultural Films Market Report

Published Date: 02 February 2026 | Report Code: agricultural-films

Agricultural Films Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Agricultural Films market, providing insights into market size, trends, regional analysis, and forecasts from 2023 to 2033, alongside industry dynamics and key players shaping the market.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

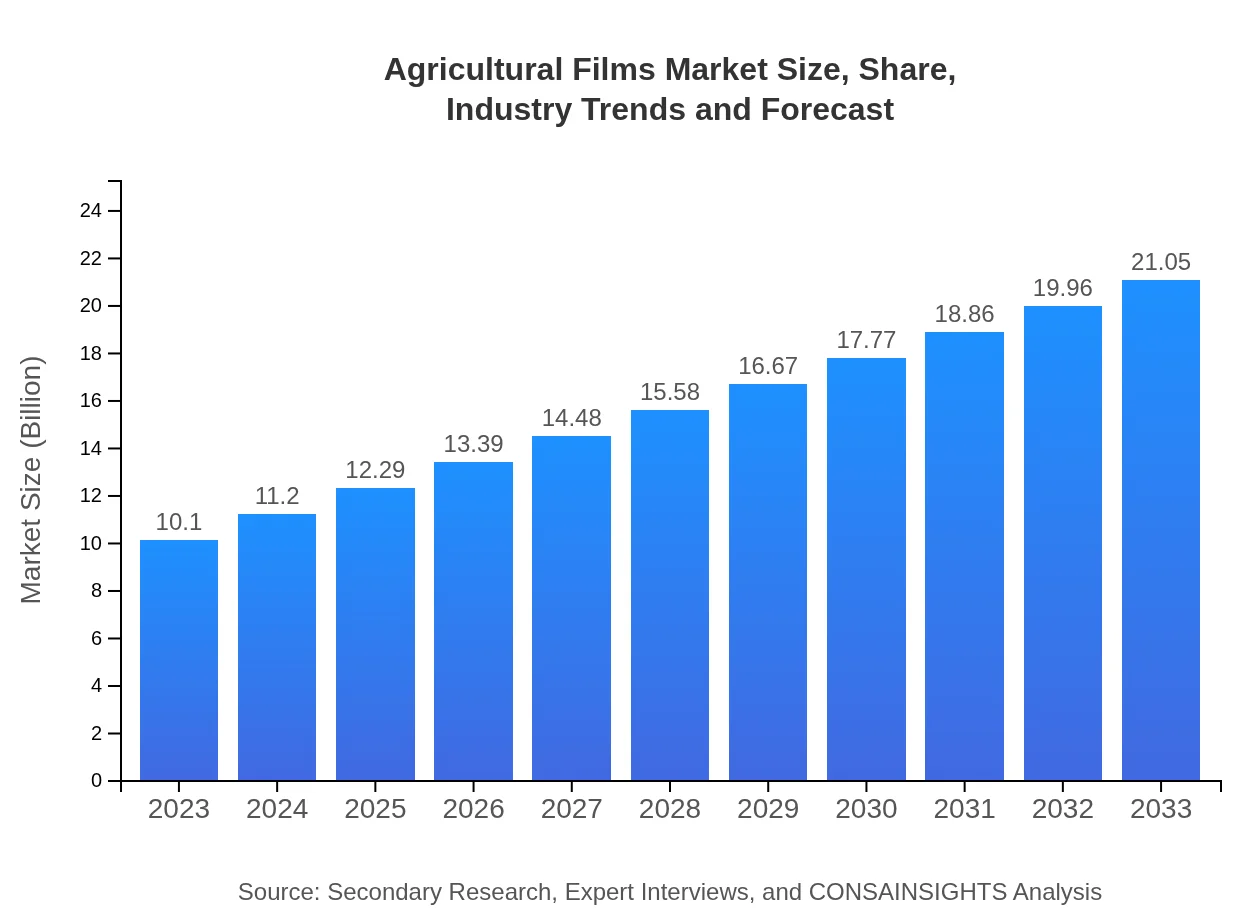

| 2023 Market Size | $10.10 Billion |

| CAGR (2023-2033) | 7.4% |

| 2033 Market Size | $21.05 Billion |

| Top Companies | Berry Global, Inc., BASF SE, Coveris Holdings S.A., Reynolds Polymer Technology, Inc., Novamont S.p.A. |

| Last Modified Date | 02 February 2026 |

Agricultural Films Market Overview

Customize Agricultural Films Market Report market research report

- ✔ Get in-depth analysis of Agricultural Films market size, growth, and forecasts.

- ✔ Understand Agricultural Films's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agricultural Films

What is the Market Size & CAGR of Agricultural Films market in 2023-2033?

Agricultural Films Industry Analysis

Agricultural Films Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agricultural Films Market Analysis Report by Region

Europe Agricultural Films Market Report:

Europe shows robust growth, increasing from $3.28 billion in 2023 to $6.84 billion by 2033. The region's stringent regulations on agricultural practices and a shift towards sustainable farming methods are pivotal in this expansion.Asia Pacific Agricultural Films Market Report:

The Asia Pacific region is anticipated to see a surge from $1.91 billion in 2023 to $3.98 billion by 2033, driven by rising agricultural practices and increasing investments in agri-tech solutions. High crop production demands alongside government initiatives promoting modern farming are major contributors to this growth.North America Agricultural Films Market Report:

In North America, the market is projected to grow from $3.42 billion in 2023 to $7.12 billion by 2033. This growth is supported by advanced agricultural practices, high consumption rates of plastic films, and ongoing innovations in agricultural technologies.South America Agricultural Films Market Report:

The South American market, while currently smaller at $0.09 billion in 2023, is set to double to $0.18 billion by 2033, primarily driven by the increasing adoption of modern agricultural techniques and enhanced focus on food security.Middle East & Africa Agricultural Films Market Report:

The Middle East and Africa market is expected to rise from $1.40 billion in 2023 to $2.92 billion by 2033. Growing investment in the agricultural sector and a rising awareness of effective crop management techniques contribute to this growth trajectory.Tell us your focus area and get a customized research report.

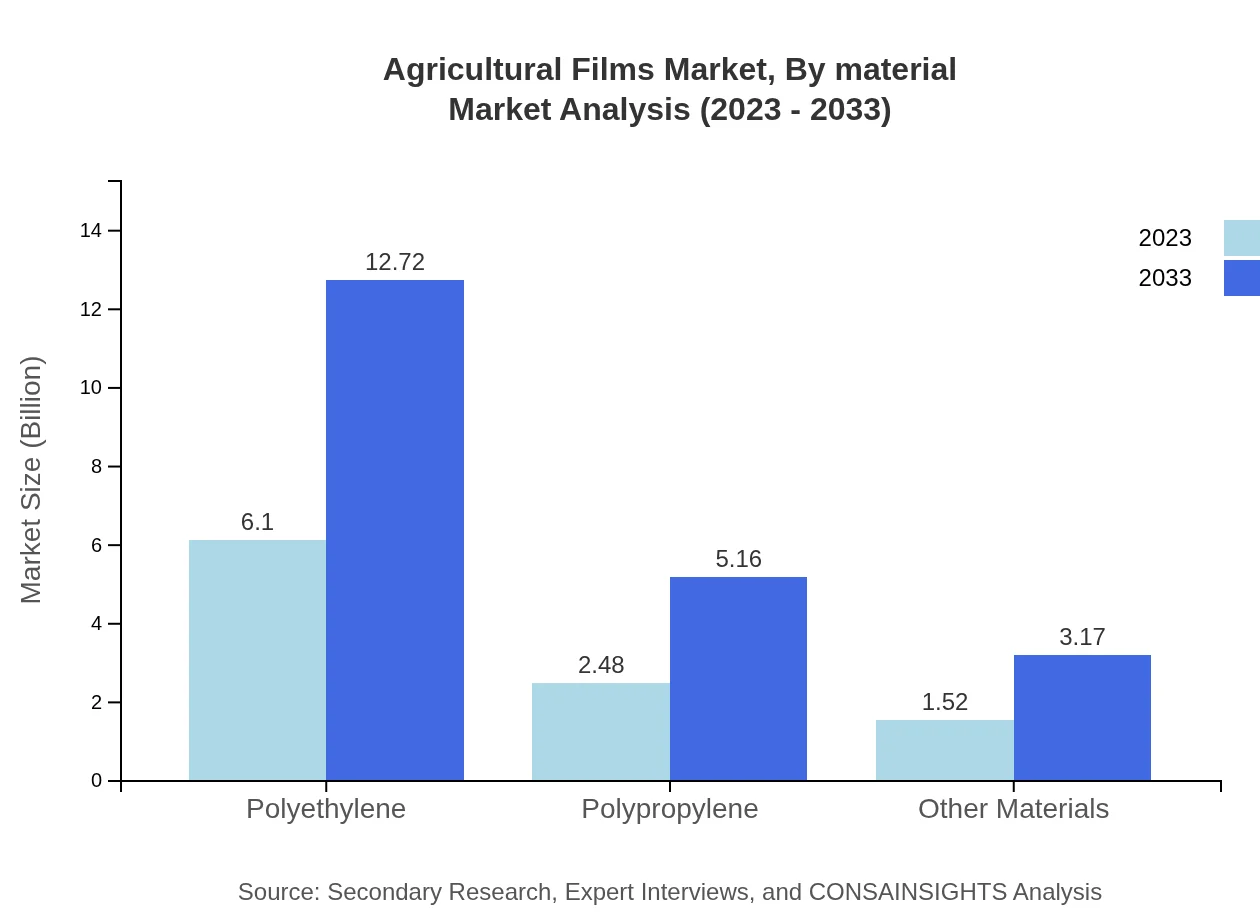

Agricultural Films Market Analysis By Material

Polyethylene remains the dominant material, accounting for $6.10 billion in 2023 and projected to rise to $12.72 billion by 2033, representing a 60.43% market share. Polypropylene follows, growing from $2.48 billion in 2023 to $5.16 billion by 2033, maintaining a 24.51% share. Other biodegradable materials are also gaining traction, reflecting a growing preference for environmentally friendly choices in agriculture.

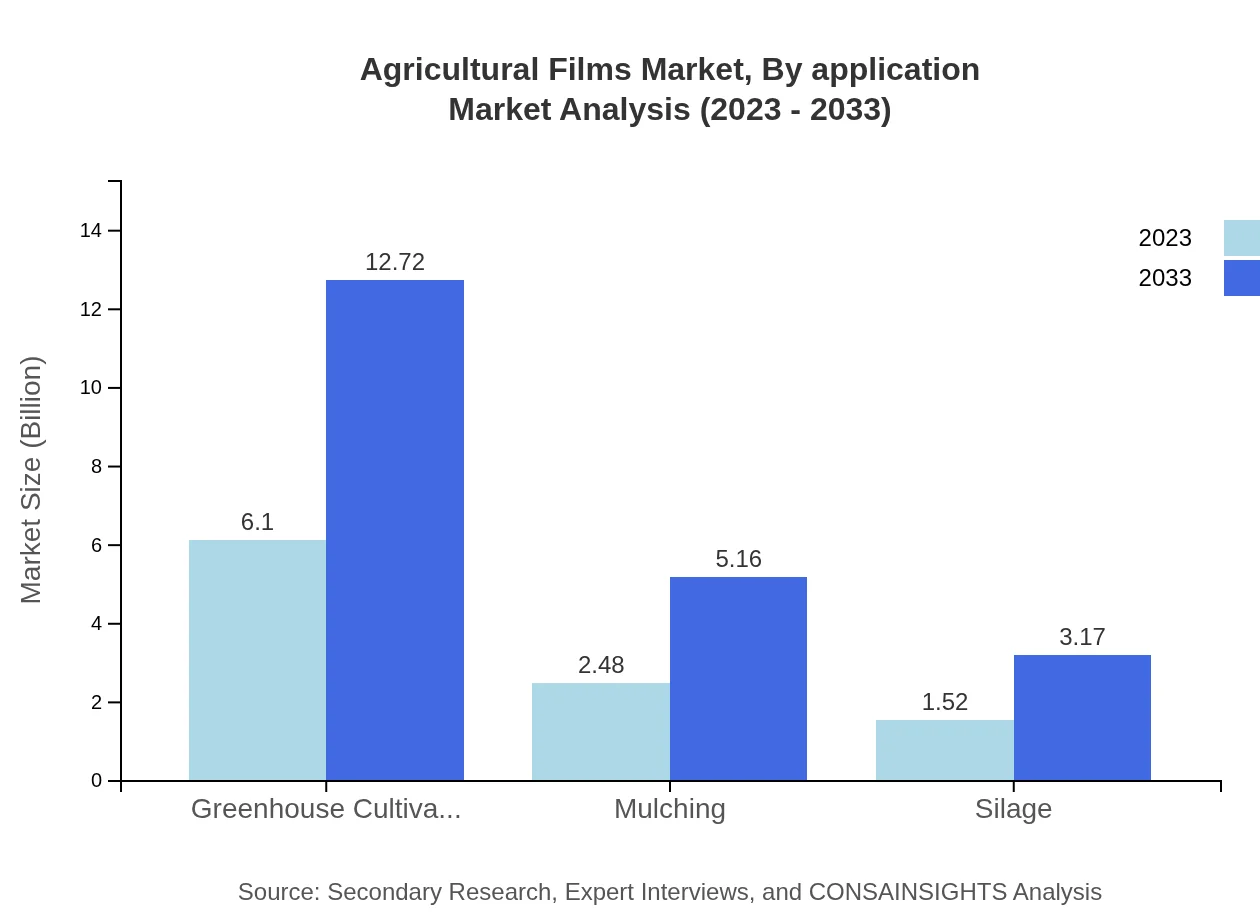

Agricultural Films Market Analysis By Application

Application-wise, greenhouse cultivation leads with $6.10 billion in 2023, growing to $12.72 billion by 2033, holding a significant 60.43% market share. Mulching is another key segment, expanding from $2.48 billion to $5.16 billion, while silage applications are expected to grow from $1.52 billion to $3.17 billion, reflecting increased demand for effective crop storage solutions.

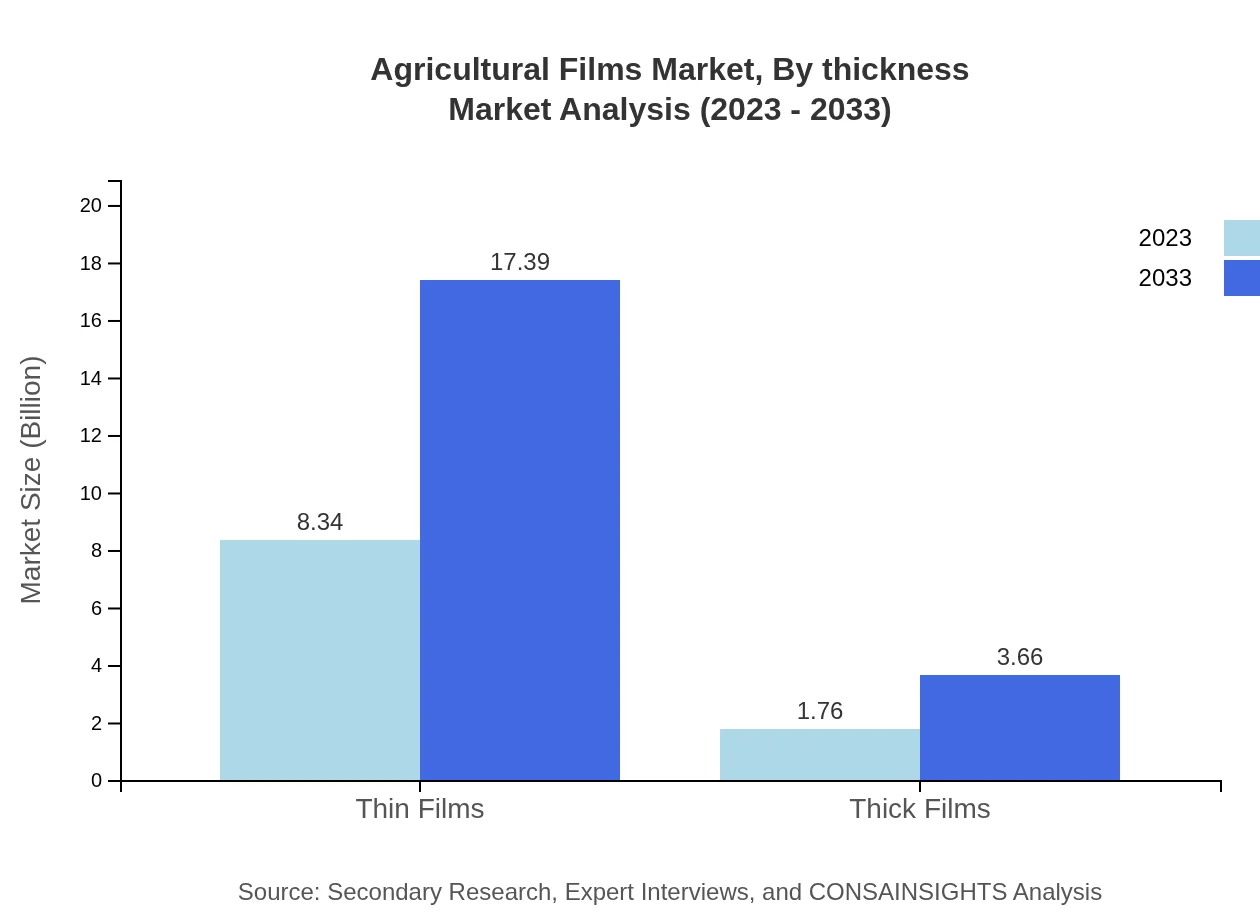

Agricultural Films Market Analysis By Thickness

Thin films dominate the market with $8.34 billion projected for 2023 to $17.39 billion by 2033, indicating an 82.61% share, due to their light weight and efficient usage in various agricultural applications. Thick films, growing from $1.76 billion to $3.66 billion, make up the remaining share, favored for applications requiring more durability.

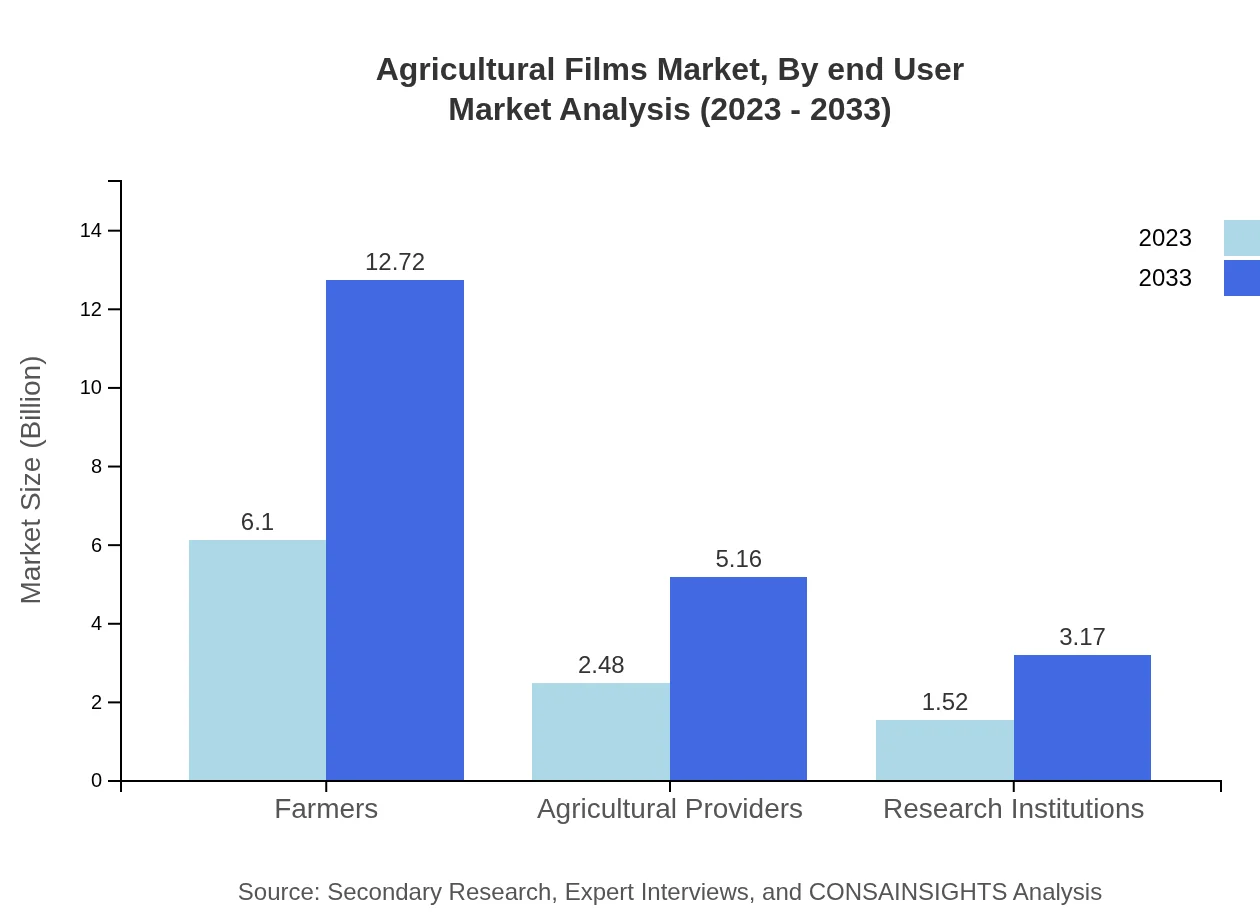

Agricultural Films Market Analysis By End User

Farmers remain the largest end-users, with a market size of $6.10 billion in 2023 anticipated to double to $12.72 billion by 2033, representing a consistent 60.43% share. Agricultural providers and research institutions collectively support sustainable practices, with respective market increases reflecting a balance between development and practical application.

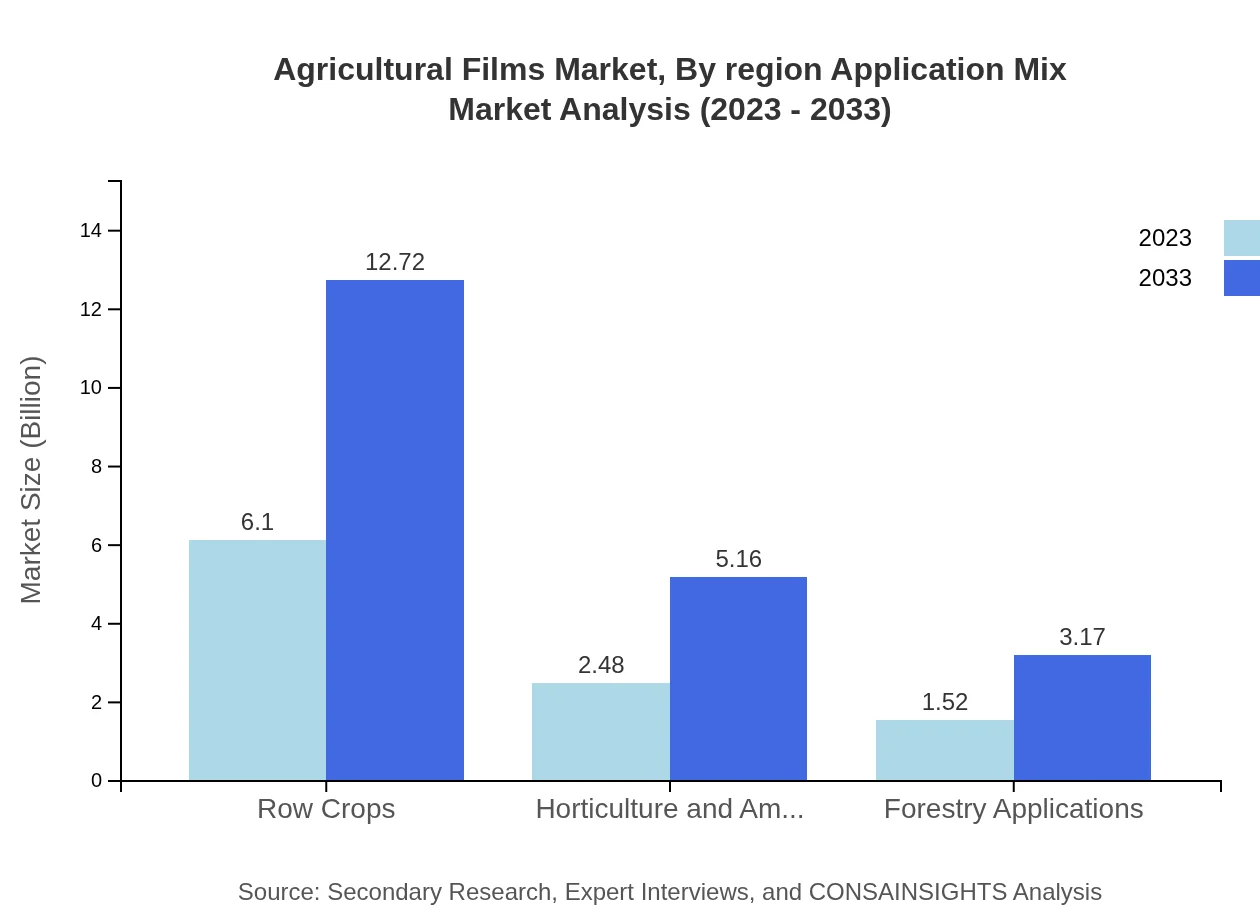

Agricultural Films Market Analysis By Region Application Mix

The application mix reveals growth across all regions, with North America and Europe leading in technology adoption. Asia-Pacific follows closely due to escalating agricultural consumption, while trends in South America and Africa emphasize resilience through advanced agricultural practices, highlighting a gradually equalized development in the Agricultural Films market across global regions.

Agricultural Films Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agricultural Films Industry

Berry Global, Inc.:

Known for its vast assortment of plastic products, including agricultural films, Berry focuses on innovative, sustainable film technologies to enhance crop production.BASF SE:

As a leader in the chemical industry, BASF produces a range of agricultural films with a significant emphasis on sustainability and crop protection.Coveris Holdings S.A.:

Coveris specializes in flexible packaging and agricultural films, providing tailored solutions for farmers to improve yield and efficiency.Reynolds Polymer Technology, Inc.:

A pioneer in film technology, Reynolds Polymer offers advanced agricultural films designed for resilience and enhanced crop efficacy.Novamont S.p.A.:

A frontrunner in developing biodegradable films, Novamont emphasizes eco-friendly solutions that cater to the evolving demands of the agriculture sector.We're grateful to work with incredible clients.

FAQs

What is the market size of agricultural Films?

The agricultural films market is valued at $10.1 billion in 2023 and is expected to grow at a CAGR of 7.4%, reaching significant market size by 2033. This growth reflects the increasing adoption of agricultural films in various applications.

What are the key market players or companies in this agricultural Films industry?

Key players in the agricultural films market include prominent manufacturing companies that specialize in producing polyethylene, polypropylene, and other materials. Notably, these players significantly drive innovation and quality standards in agricultural film production.

What are the primary factors driving the growth in the agricultural Films industry?

Growth in the agricultural films industry is propelled by increased agricultural productivity demands, advanced farming techniques, and rising investments in sustainable farming practices. Technological innovations, particularly in film composition, also contribute to this market expansion.

Which region is the fastest Growing in the agricultural Films?

North America shows the fastest growth in the agricultural films market, projected to grow from $3.42 billion in 2023 to $7.12 billion in 2033. This region's robust agricultural sector plays a crucial role in driving demand for agricultural films.

Does ConsaInsights provide customized market report data for the agricultural Films industry?

Yes, ConsaInsights offers customized market report data tailored to the agricultural films industry. Our insights are designed to meet specific client requirements, enabling stakeholders to make informed decisions based on current market conditions and trends.

What deliverables can I expect from this agricultural Films market research project?

Expect comprehensive reports that include market size, trends, forecasts, and analysis by segment and region. Our deliverables also provide actionable insights and recommendations for strategic planning in the agricultural films sector.

What are the market trends of agricultural Films?

Market trends in agricultural films highlight a shift towards biodegradable options and enhanced film technologies. Additionally, growing environmental awareness influences the demand for smarter, more sustainable agricultural practices and materials in the industry.