Agricultural Fumigants Market Report

Published Date: 02 February 2026 | Report Code: agricultural-fumigants

Agricultural Fumigants Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Agricultural Fumigants market, covering current trends, forecasts through 2033, and segmented insights on various market influences such as technology, product types, and regional dynamics.

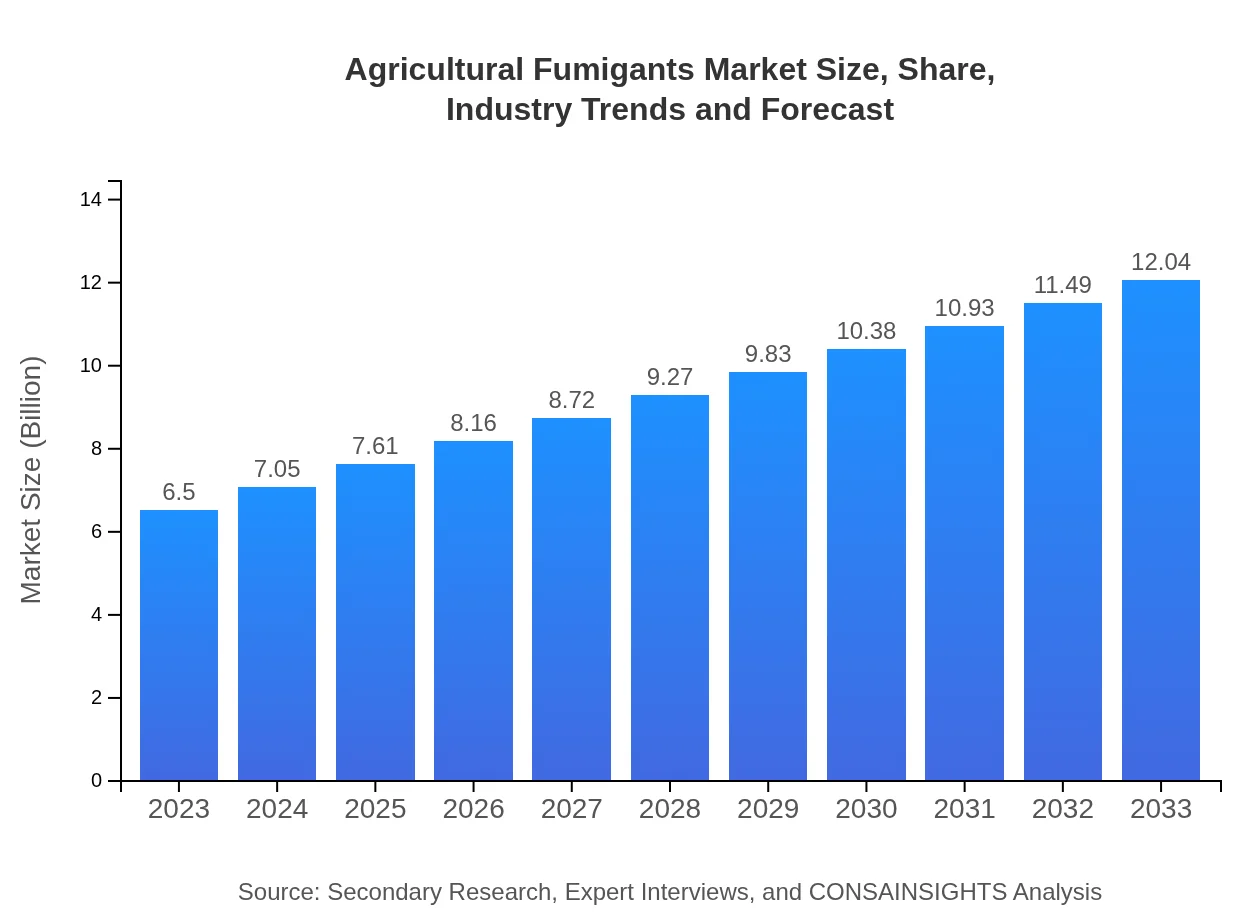

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $12.04 Billion |

| Top Companies | BASF SE, Draslovka Holding a.s., FMC Corporation, Syngenta AG, Nufarm Limited |

| Last Modified Date | 02 February 2026 |

Agricultural Fumigants Market Overview

Customize Agricultural Fumigants Market Report market research report

- ✔ Get in-depth analysis of Agricultural Fumigants market size, growth, and forecasts.

- ✔ Understand Agricultural Fumigants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agricultural Fumigants

What is the Market Size & CAGR of Agricultural Fumigants market in 2023?

Agricultural Fumigants Industry Analysis

Agricultural Fumigants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agricultural Fumigants Market Analysis Report by Region

Europe Agricultural Fumigants Market Report:

Europe shows a promising growth trajectory, with market size increasing from $1.61 billion in 2023 to $2.98 billion in 2033, backed by stringent regulations promoting sustainable agriculture practices and a shift towards integrated pest management.Asia Pacific Agricultural Fumigants Market Report:

The Asia Pacific region is poised for substantial growth, increasing from $1.41 billion in 2023 to $2.62 billion by 2033, as countries like India and China enhance their agricultural productivity through the adoption of advanced fumigation techniques.North America Agricultural Fumigants Market Report:

North America will hold a significant market share, with growth from $2.18 billion to $4.03 billion projected from 2023 to 2033, fueled by high pesticide demand and innovative fumigation technology investments.South America Agricultural Fumigants Market Report:

In South America, the market is projected to grow from $0.51 billion in 2023 to $0.95 billion in 2033, driven by rising agricultural exports and the need for efficient pest management in staple crops like soybeans and wheat.Middle East & Africa Agricultural Fumigants Market Report:

The Middle East and Africa will see gradual market expansion from $0.79 billion in 2023 to $1.46 billion by 2033, as investments in agricultural innovation rise and pest challenges increase in arable farming.Tell us your focus area and get a customized research report.

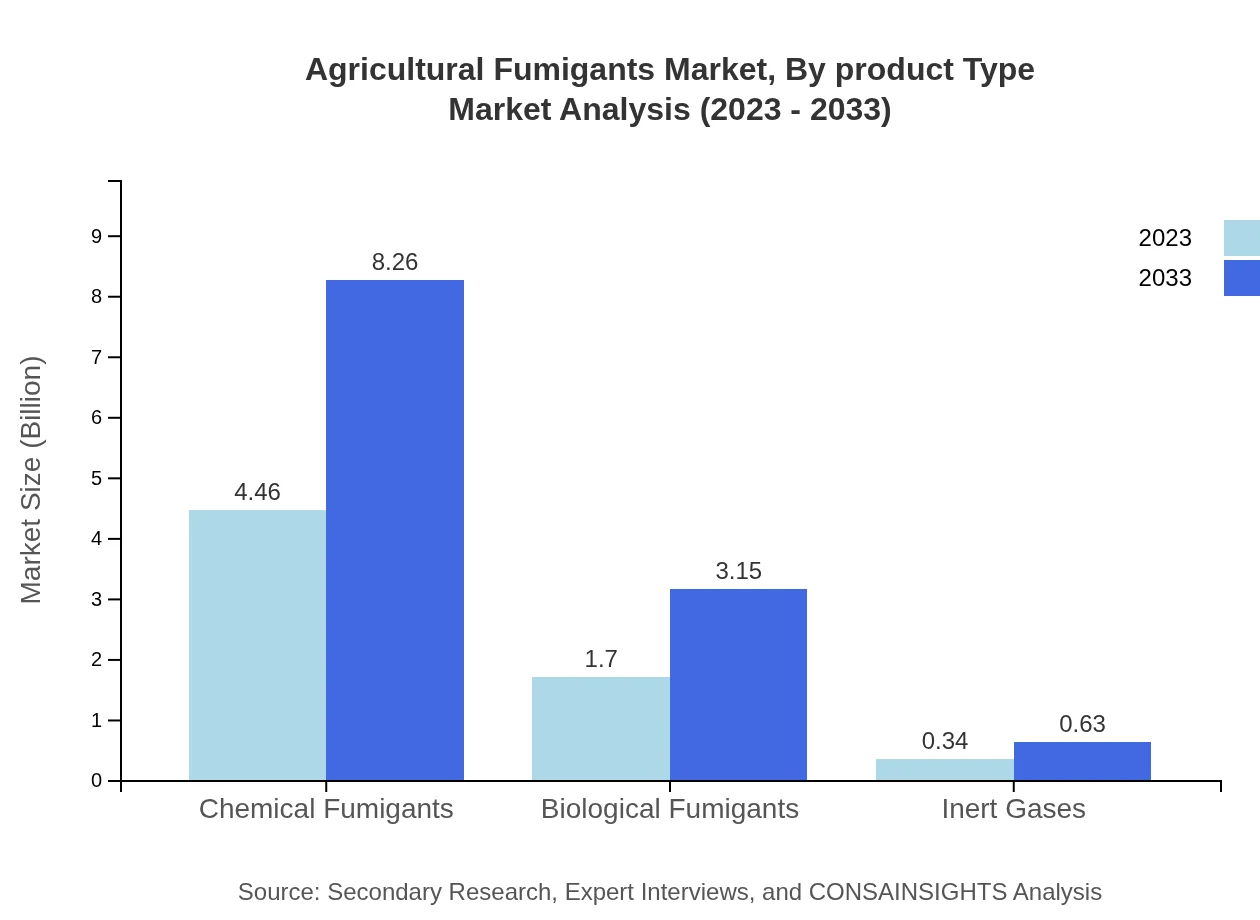

Agricultural Fumigants Market Analysis By Product Type

The market is segmented by product type into Chemical Fumigants, which hold the largest share at approximately 68.59% in 2023, and Biological Fumigants, which are gaining ground due to increasing health and environmental concerns. Inert gases represent a smaller segment but offer niche applications in specific settings.

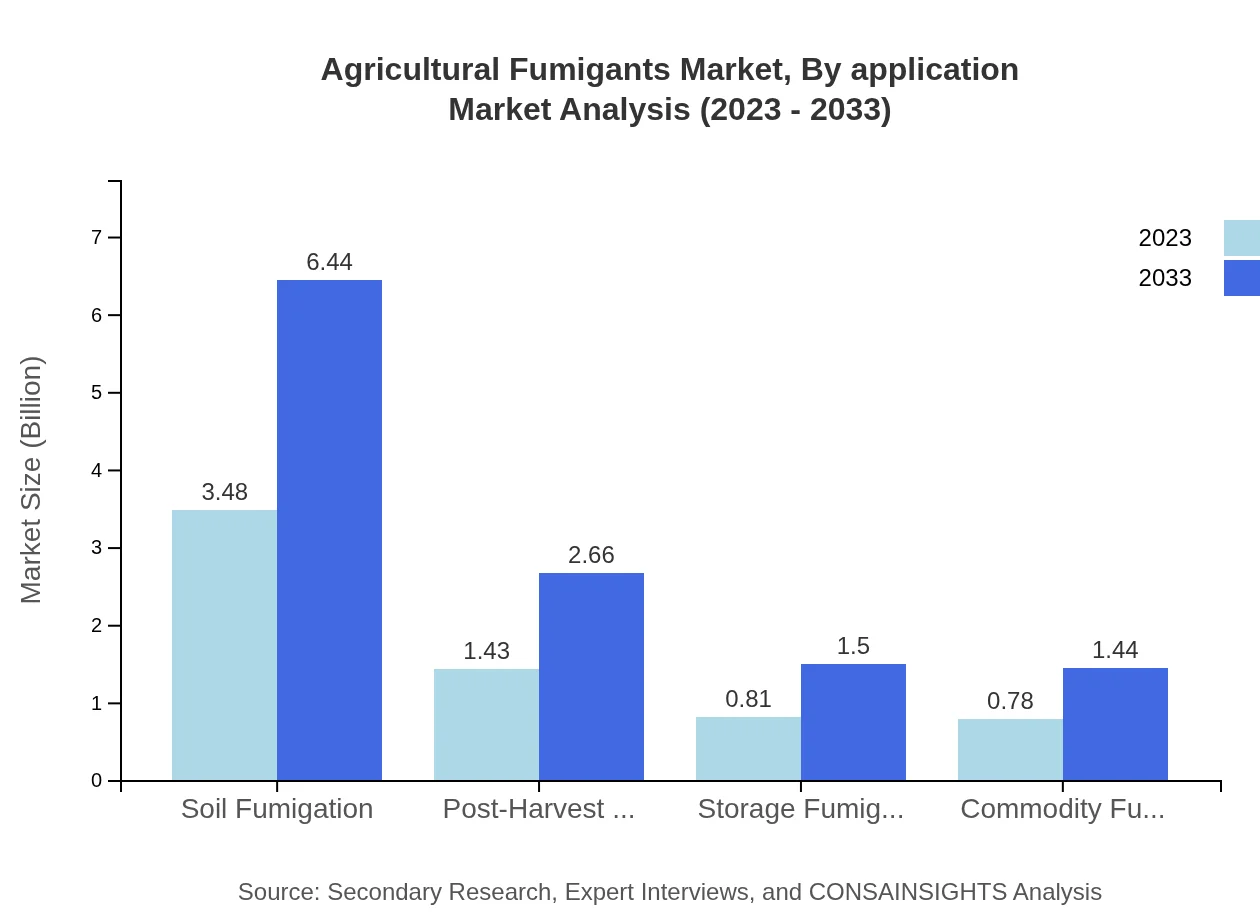

Agricultural Fumigants Market Analysis By Application

Soil fumigation is the leading application area, making up 53.51% of the market in 2023. Post-harvest applications and storage fumigation are also significant, particularly as the focus on food preservation grows amid rising population and consumption demands.

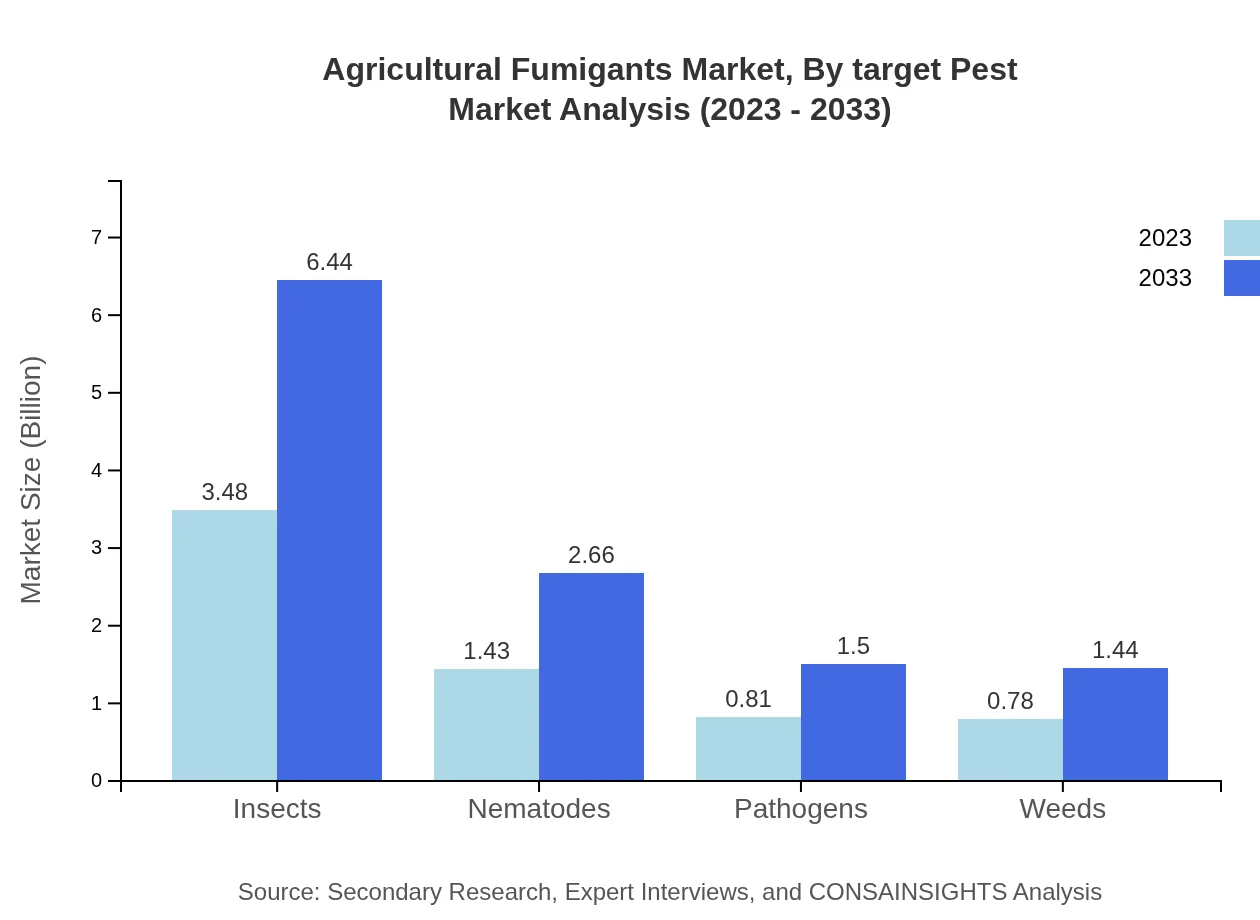

Agricultural Fumigants Market Analysis By Target Pest

The target pest segmentation indicates that insects are the principal target, contributing 53.51% to the market. Following insects are nematodes and pathogens, both vital in maintaining the yield of crops through effective pest management.

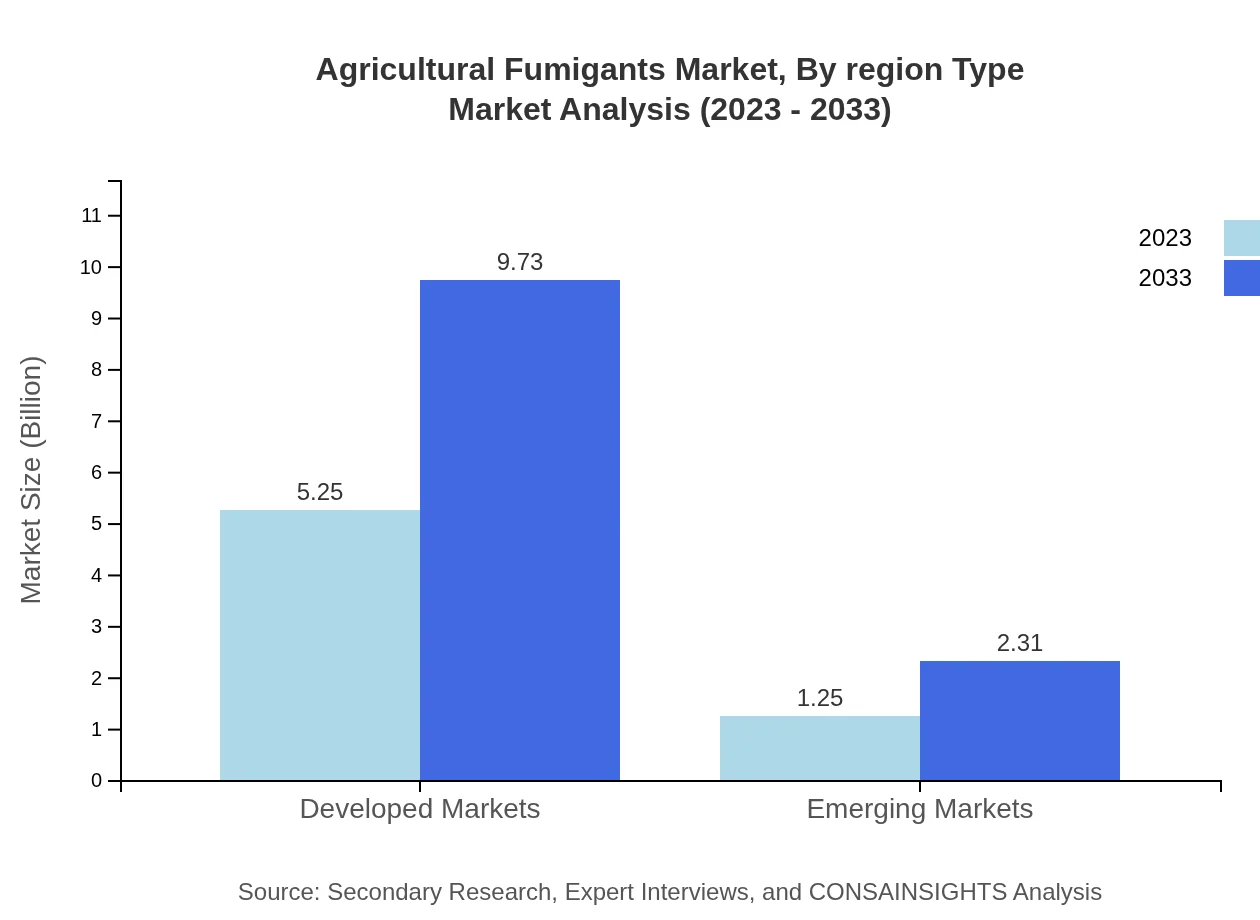

Agricultural Fumigants Market Analysis By Region Type

Regional segmentation highlights a distinctive growth pattern, with developed markets accounting for 80.8% of the market share in 2023. Emerging markets are increasing their stake, driven by development in agricultural practices and pest management technologies.

Agricultural Fumigants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agricultural Fumigants Industry

BASF SE:

BASF SE is a global leader in chemical manufacturing, notable in the agricultural fumigants sector for its innovative pest control products and commitment to sustainability.Draslovka Holding a.s.:

Draslovka is renowned for its expert production of non-toxic phosphine gas fumigants that safely manage pest populations in stored products.FMC Corporation:

FMC Corporation offers advanced crop protection solutions, including leading fumigant products crucial for managing agricultural pests.Syngenta AG:

Syngenta AG focuses on providing sustainable agricultural solutions and is recognized for its comprehensive line of fumigation products.Nufarm Limited:

Nufarm Limited specializes in agricultural chemicals, contributing significantly to the fumigant market with innovative solutions to pest and disease management.We're grateful to work with incredible clients.

FAQs

What is the market size of agricultural Fumigants?

The agricultural fumigants market is projected to reach approximately $6.5 billion by 2033, growing at a CAGR of 6.2%. This growth is driven by increasing agricultural production and the need for pest and disease management.

What are the key market players or companies in this agricultural Fumigants industry?

Key players in the agricultural fumigants market include major companies such as BASF SE, Dow AgroSciences, and Syngenta AG, among others, which are actively engaged in research, product development, and market expansion.

What are the primary factors driving the growth in the agricultural Fumigants industry?

The growth of the agricultural fumigants market is driven by rising demand for food, increased pest resistance, advancements in fumigant technology, and the necessity to protect crops from harmful pathogens, insects, and nematodes.

Which region is the fastest Growing in the agricultural Fumigants?

North America is the fastest-growing region in the agricultural fumigants market, expected to grow from $2.18 billion in 2023 to $4.03 billion by 2033, showcasing promising market expansion and adoption of advanced pest control solutions.

Does ConsaInsights provide customized market report data for the agricultural Fumigants industry?

Yes, ConsaInsights provides tailored market report data for the agricultural fumigants industry, allowing clients to access specific insights, historical data, and forecasts according to their unique requirements and market interests.

What deliverables can I expect from this agricultural Fumigants market research project?

Deliverables from the agricultural fumigants market research may include comprehensive reports, market forecasts, competitive analysis, segmentation insights, and trend assessment to inform strategic decisions and investment opportunities.

What are the market trends of agricultural Fumigants?

Market trends in agricultural fumigants include an increasing shift towards biopesticides, enhanced regulatory frameworks, integrated pest management practices, and innovations in formulation technologies aimed at improving efficacy and safety.