Agricultural Micronutrients Market Report

Published Date: 02 February 2026 | Report Code: agricultural-micronutrients

Agricultural Micronutrients Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Agricultural Micronutrients market, presenting insights on market size, growth trends, and dynamics from 2023 to 2033. Readers will gain a comprehensive understanding of the industry's structure, regional performance, and future forecasts.

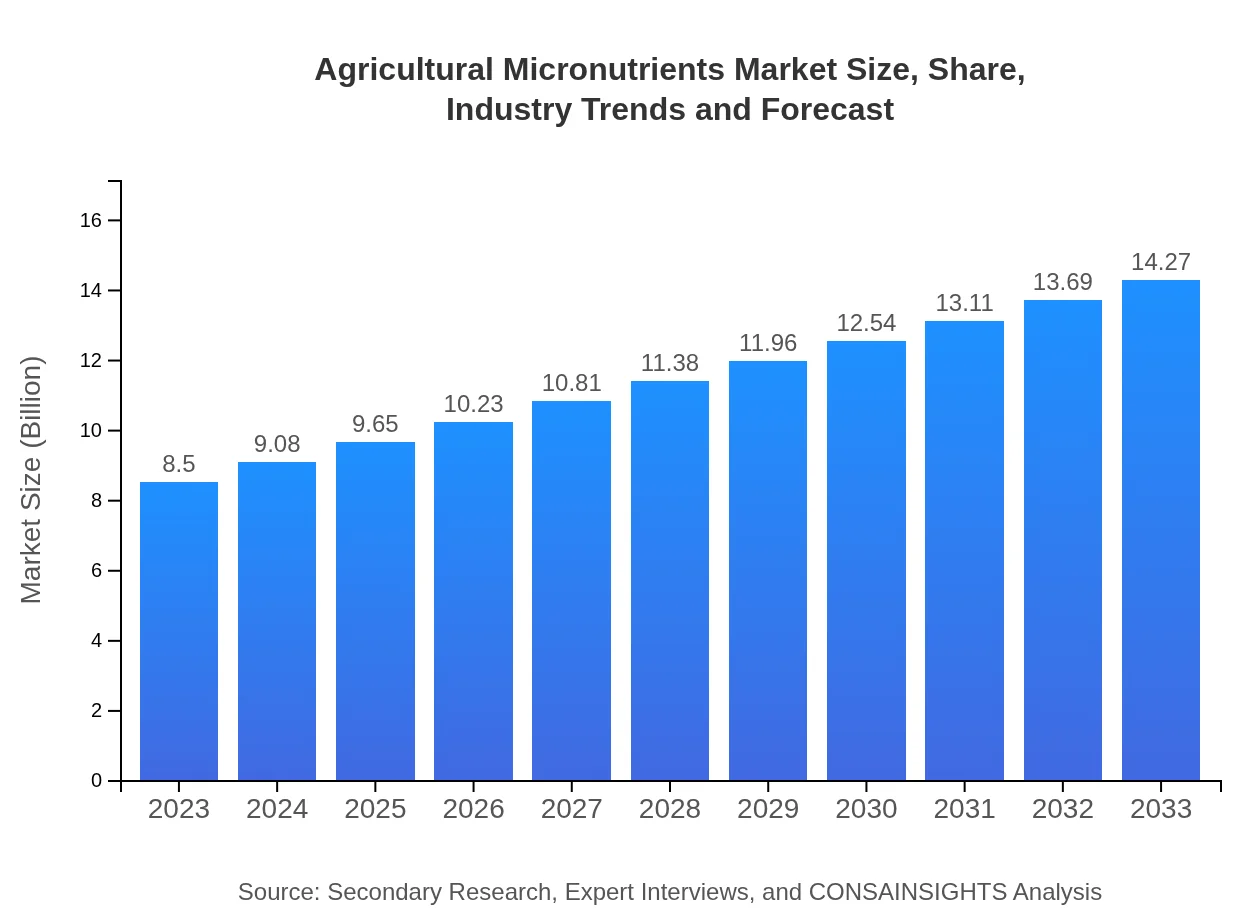

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $14.27 Billion |

| Top Companies | NutriAg, Yara International, BASF, Archer Daniels Midland Company (ADM), Haifa Group |

| Last Modified Date | 02 February 2026 |

Agricultural Micronutrients Market Overview

Customize Agricultural Micronutrients Market Report market research report

- ✔ Get in-depth analysis of Agricultural Micronutrients market size, growth, and forecasts.

- ✔ Understand Agricultural Micronutrients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agricultural Micronutrients

What is the Market Size & CAGR of Agricultural Micronutrients market in 2023?

Agricultural Micronutrients Industry Analysis

Agricultural Micronutrients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agricultural Micronutrients Market Analysis Report by Region

Europe Agricultural Micronutrients Market Report:

The European market is projected to grow from USD 2.16 billion in 2023 to USD 3.62 billion by 2033. Strict regulations regarding food production quality and the implementation of sustainable farming are key factors driving the adoption of micronutrients in Europe.Asia Pacific Agricultural Micronutrients Market Report:

In the Asia Pacific region, the Agricultural Micronutrients market is valued at approximately USD 1.75 billion in 2023, with projections of USD 2.94 billion by 2033. The rise in agricultural practices and increased adoption of advanced farming technologies significantly contribute to this growth. Additionally, countries like China and India dominate the market due to their vast agricultural landscapes and high food production demands.North America Agricultural Micronutrients Market Report:

In North America, the Agricultural Micronutrients market is expected to grow from USD 3.17 billion in 2023 to USD 5.33 billion by 2033. The market is driven by technological innovations in agriculture, increased awareness of micronutrient benefits, and substantial investments in sustainable farming practices.South America Agricultural Micronutrients Market Report:

The South American market is estimated to reach USD 0.44 billion in 2023, growing to USD 0.74 billion by 2033. The increasing focus on enhancing crop quality and yield due to competitive agricultural policies boosts the demand for micronutrients, particularly in the countries like Brazil and Argentina.Middle East & Africa Agricultural Micronutrients Market Report:

The Middle East and Africa market is estimated to grow from USD 0.98 billion in 2023 to USD 1.64 billion by 2033. The demand for micronutrients is being propelled by the need for improved agricultural productivity and efficient water management strategies in arid regions.Tell us your focus area and get a customized research report.

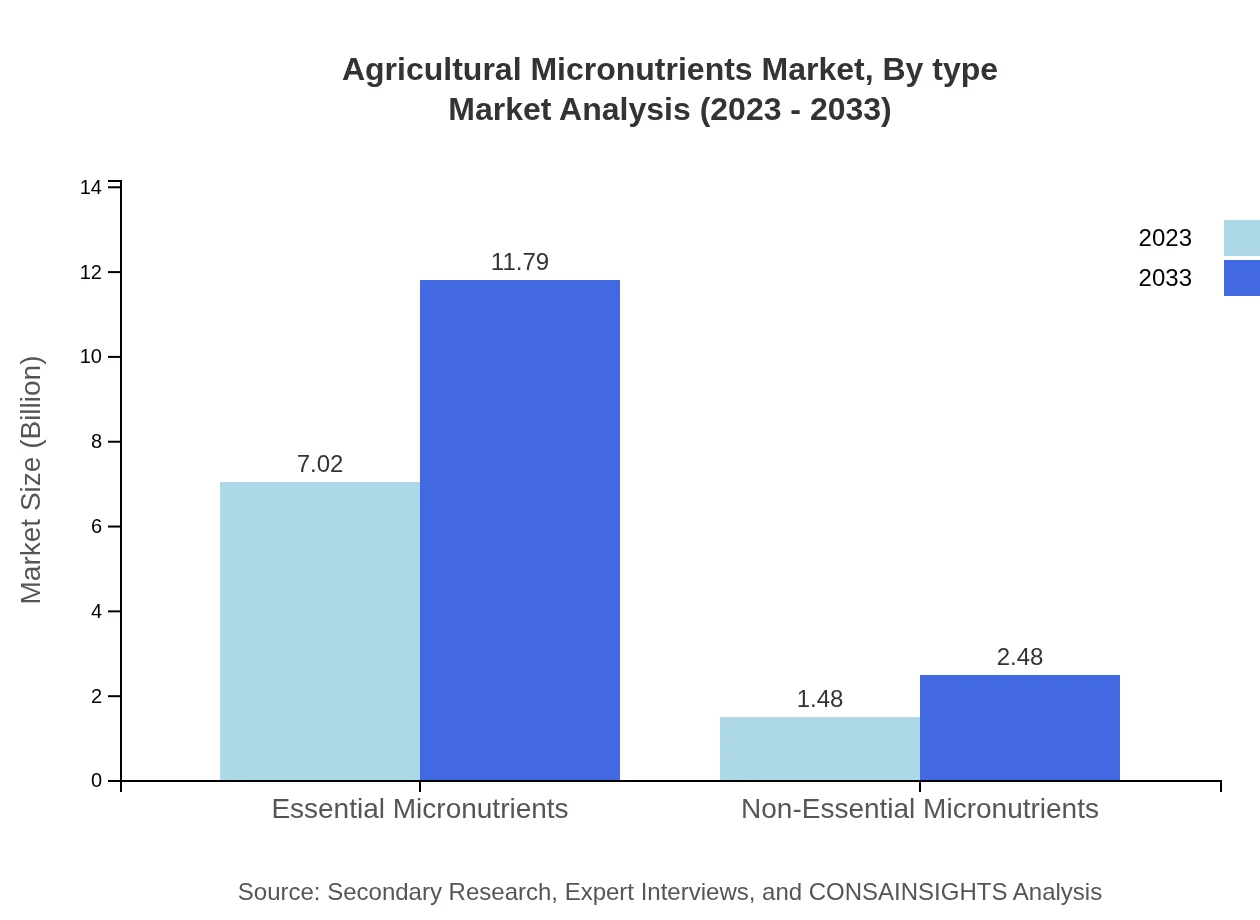

Agricultural Micronutrients Market Analysis By Type

In 2023, the essential micronutrients segment dominates the market with a size of USD 7.02 billion, expected to grow to USD 11.79 billion by 2033. Non-essential micronutrients, while smaller, are also poised for growth from USD 1.48 billion to USD 2.48 billion during the same period.

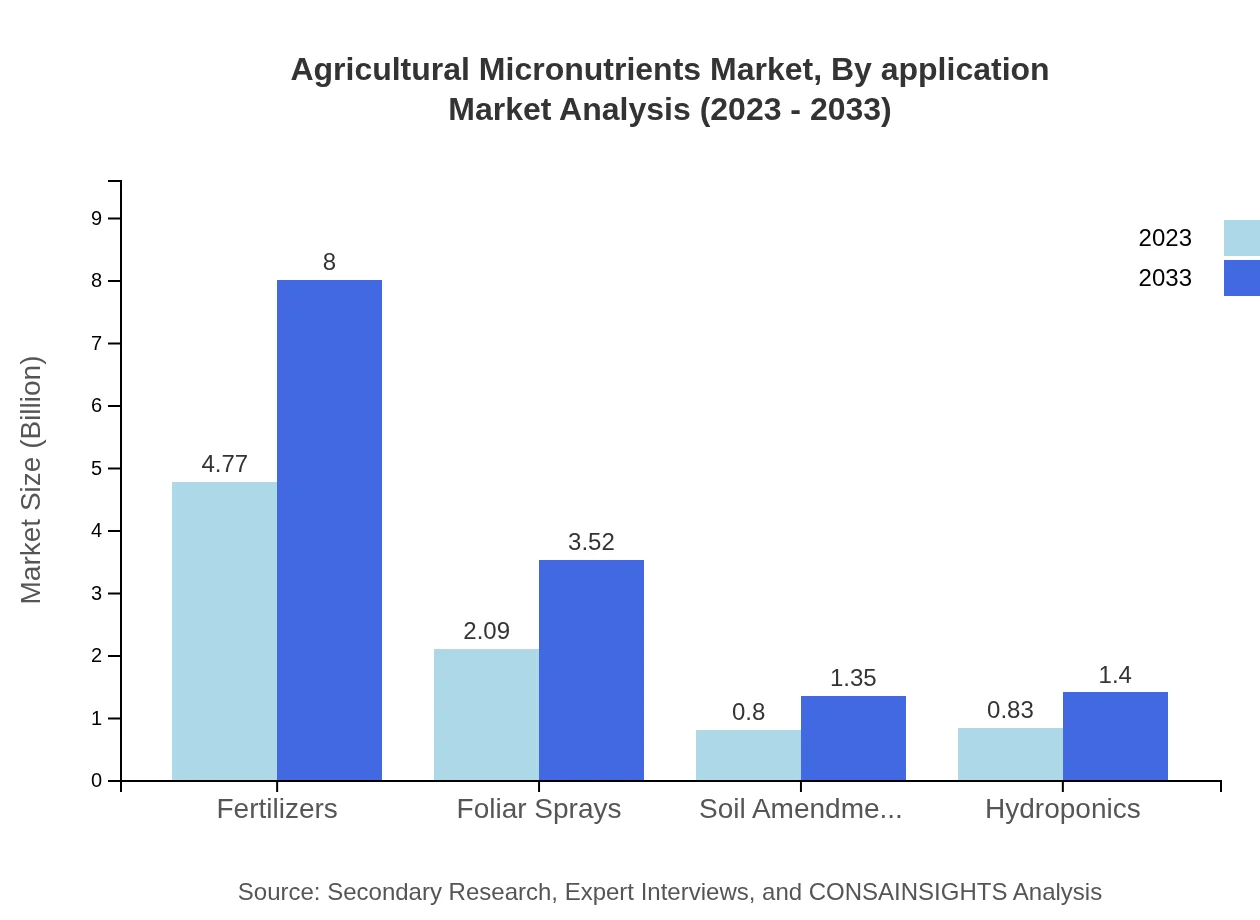

Agricultural Micronutrients Market Analysis By Application

Fertilizers are the leading application area for micronutrients, accounting for USD 4.77 billion in 2023, growing to USD 8.00 billion by 2033. Other applications include foliar sprays and soil amendments, reflecting the diverse ways micronutrients are utilized in modern agriculture.

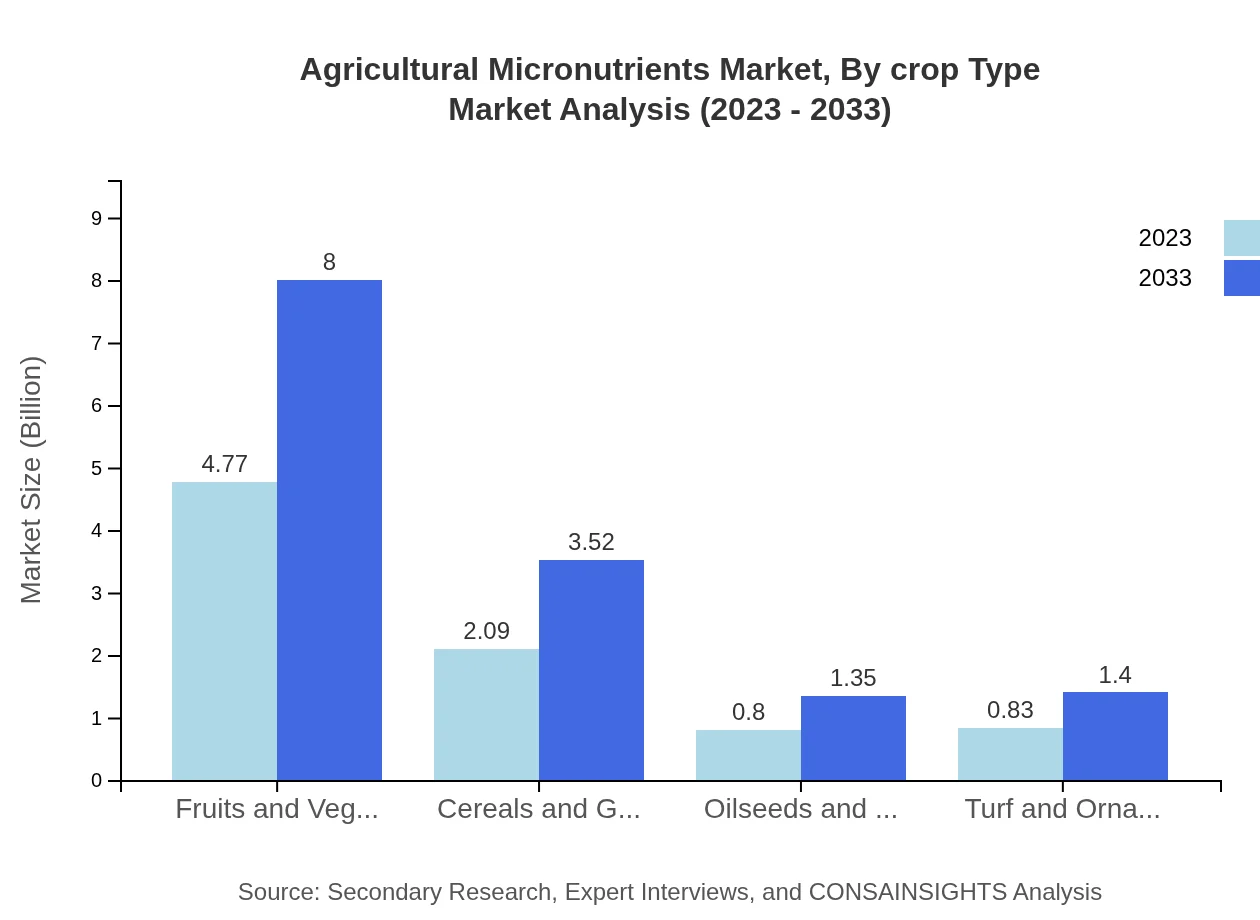

Agricultural Micronutrients Market Analysis By Crop Type

The fruits and vegetables segment holds the largest market share at 56.07% in 2023, with a market size of USD 4.77 billion, expected to reach USD 8.00 billion by 2033. Cereals and grains follow closely at a 24.64% market share, growing from USD 2.09 billion to USD 3.52 billion.

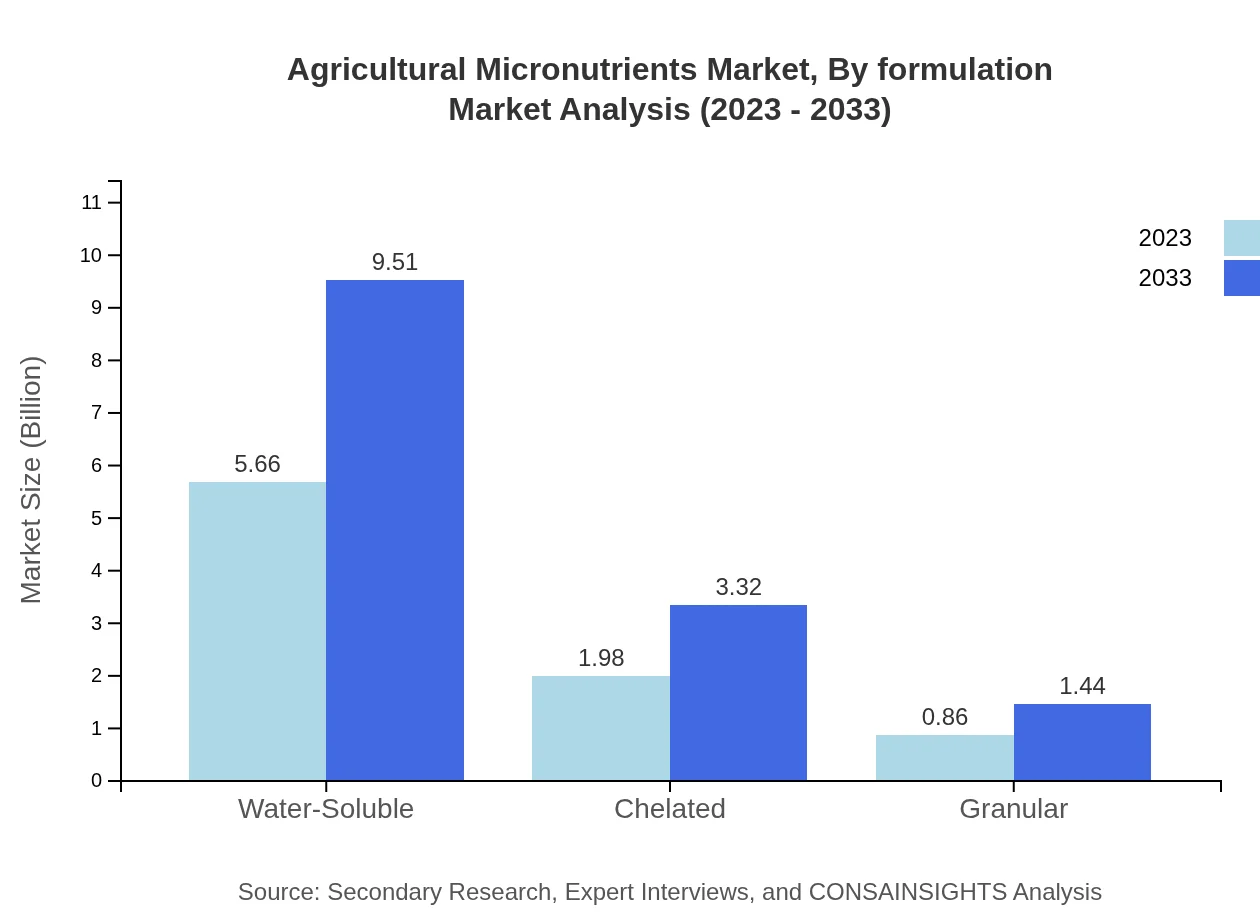

Agricultural Micronutrients Market Analysis By Formulation

Water-soluble micronutrients are crucial, accounting for USD 5.66 billion in 2023, projected to grow to USD 9.51 billion by 2033. Chelated formulations and granular forms also play essential roles, expanding accessibility and effectiveness of micronutrient delivery to crops.

Agricultural Micronutrients Market Analysis By Distribution Channel

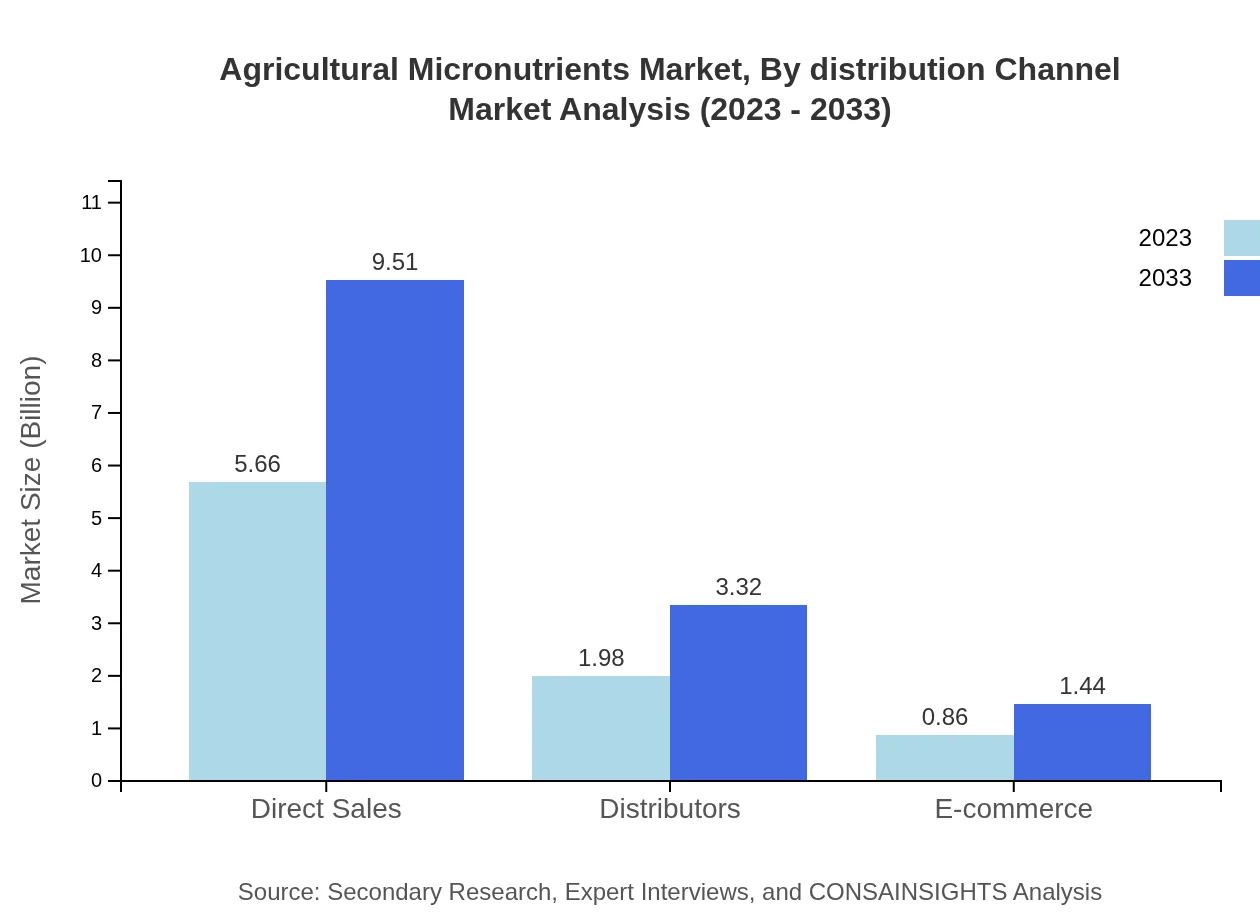

The direct sales channel represents the most significant distribution method, capturing USD 5.66 billion in 2023. E-commerce and distribution through retailers are also gaining traction, reflecting changing consumer behaviors and preferences in purchasing agricultural inputs.

Agricultural Micronutrients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agricultural Micronutrients Industry

NutriAg:

NutriAg is a leading provider of fertility and crop nutrition solutions that specializes in micronutrient products aimed at boosting agricultural productivity and sustainability.Yara International:

Yara International is a prominent player in the agricultural sector, known for its comprehensive range of fertilizers, including specialized micronutrients that support crop growth.BASF:

BASF is a global chemical company that offers a wide range of innovative solutions in crop protection and agricultural technology, including micronutrient fertilizers.Archer Daniels Midland Company (ADM):

ADM provides essential agricultural products and services, including a variety of micronutrient solutions that enhance crop yield and quality.Haifa Group:

Haifa Group specializes in high-quality specialty fertilizers and offers a range of micronutrient products tailored for various agricultural applications.We're grateful to work with incredible clients.

FAQs

What is the market size of agricultural Micronutrients?

The global agricultural micronutrients market was valued at approximately $8.5 billion in 2023 and is projected to grow at a CAGR of 5.2%, reaching significant expansion by 2033.

What are the key market players or companies in this agricultural Micronutrients industry?

Key players in the agricultural micronutrients market include major firms such as Nutrien Ltd., Yara International, The Mosaic Company, BASF SE, and FMC Corporation, all contributing significantly to market dynamics and innovations.

What are the primary factors driving the growth in the agricultural micronutrients industry?

Growth in the agricultural micronutrients market is driven by rising food demand, increased crop yields, soil nutrient depletion, and advancements in agricultural practices focused on sustainability and efficiency.

Which region is the fastest Growing in the agricultural Micronutrients?

The North American region is identified as the fastest-growing area in the agricultural micronutrients market, with a projected increase from $3.17 billion in 2023 to $5.33 billion by 2033.

Does ConsaInsights provide customized market report data for the agricultural Micronutrients industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the agricultural micronutrients industry, ensuring relevant insights and detailed analysis for decision-making.

What deliverables can I expect from this agricultural Micronutrients market research project?

From the agricultural micronutrients market research project, you can expect comprehensive reports including market size, trends, growth projections, competitive analysis, and detailed segment information.

What are the market trends of agricultural Micronutrients?

Current trends in the agricultural micronutrients market include increasing use of essential micronutrients, growth in water-soluble and chelated products, and a shift towards eco-friendly farming practices.