Agricultural Packaging Market Report

Published Date: 02 February 2026 | Report Code: agricultural-packaging

Agricultural Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Agricultural Packaging market, exploring its current conditions, segmentations, and regional insights from 2023 to 2033. Key trends, forecasts, and the impact of technology on the market will also be discussed.

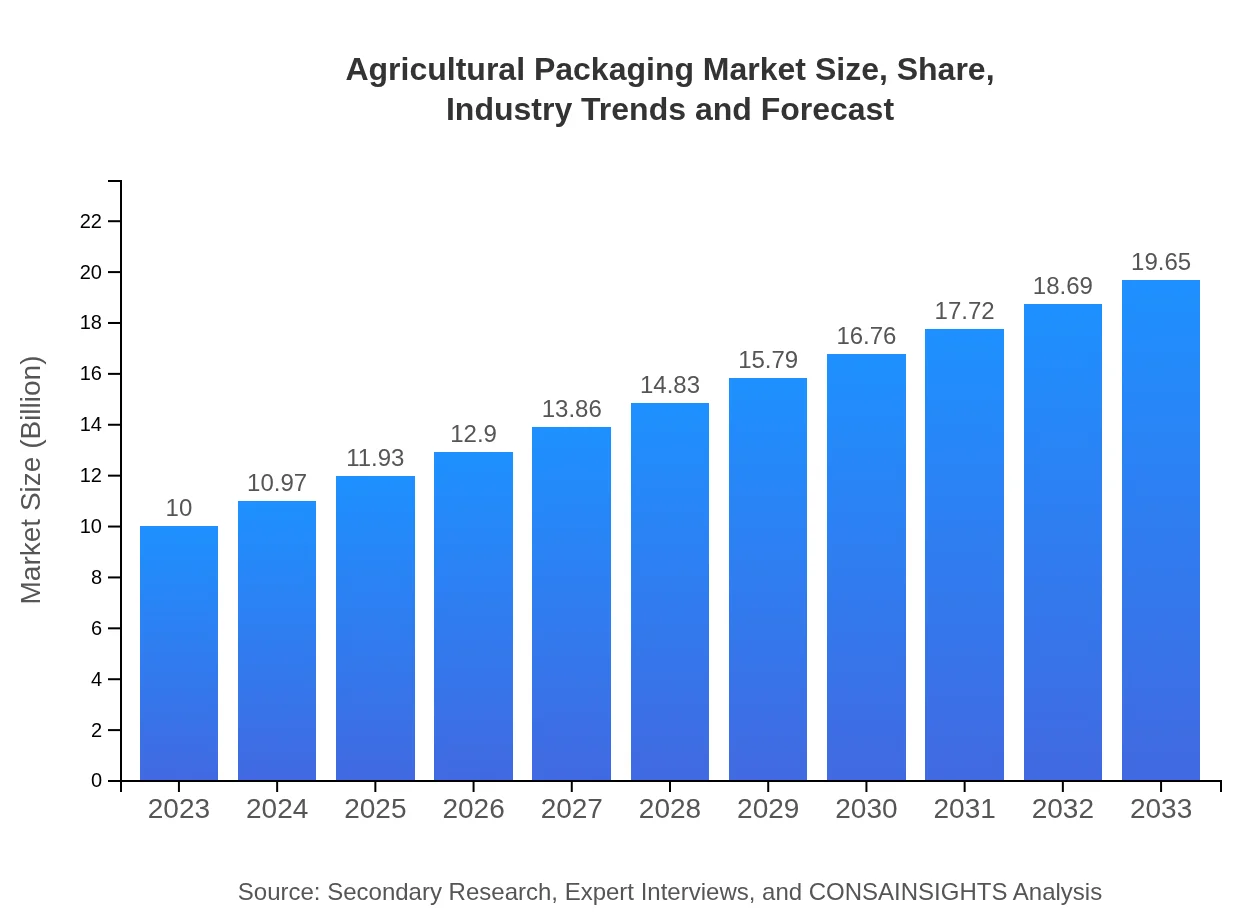

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $19.65 Billion |

| Top Companies | Amcor plc, Tetra Pak, Mondi Group, Sealed Air Corporation, Sonoco Products Company |

| Last Modified Date | 02 February 2026 |

Agricultural Packaging Market Overview

Customize Agricultural Packaging Market Report market research report

- ✔ Get in-depth analysis of Agricultural Packaging market size, growth, and forecasts.

- ✔ Understand Agricultural Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agricultural Packaging

What is the Market Size & CAGR of Agricultural Packaging market in 2023?

Agricultural Packaging Industry Analysis

Agricultural Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agricultural Packaging Market Analysis Report by Region

Europe Agricultural Packaging Market Report:

In Europe, the Agricultural Packaging market is set at $2.66 billion in 2023, projected to expand to $5.24 billion by 2033. Stringent regulations promoting sustainability in packaging are influencing market dynamics significantly.Asia Pacific Agricultural Packaging Market Report:

In the Asia Pacific region, the market is valued at $1.90 billion in 2023, projected to increase to $3.74 billion by 2033. Rapid urbanization and growing population are driving the demand for efficient agricultural practices and packaging solutions.North America Agricultural Packaging Market Report:

North America boasts a significant market size of $3.40 billion in 2023, anticipated to grow to $6.69 billion by 2033. The region's advanced agricultural techniques and focus on food safety catalyze the demand for various packaging solutions.South America Agricultural Packaging Market Report:

South America is a growing market with a value of $0.87 billion in 2023, expected to rise to $1.71 billion by 2033. With extensive agricultural land and investment in agricultural advancements, this region is pivotal for the Agricultural Packaging market.Middle East & Africa Agricultural Packaging Market Report:

The Middle East and Africa region, though smaller with a market size of $1.16 billion in 2023, is expected to grow to $2.28 billion by 2033, driven by agricultural development initiatives and improved logistics infrastructures.Tell us your focus area and get a customized research report.

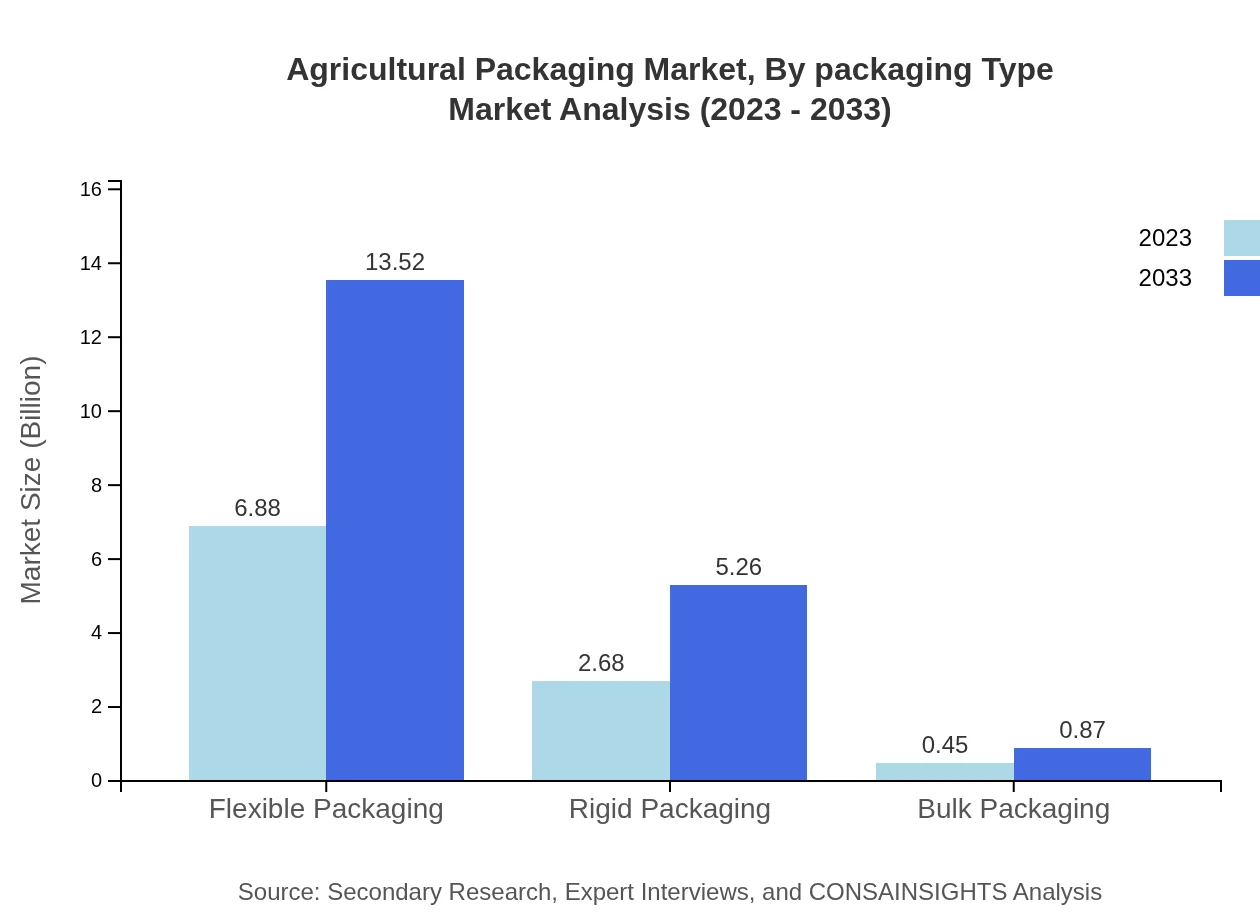

Agricultural Packaging Market Analysis By Packaging Type

Flexible packaging dominates the market with a size of $6.88 billion in 2023, and projected to reach $13.52 billion by 2033. Rigid packaging and bulk packaging together reflect the diversity in packaging applications across agricultural products.

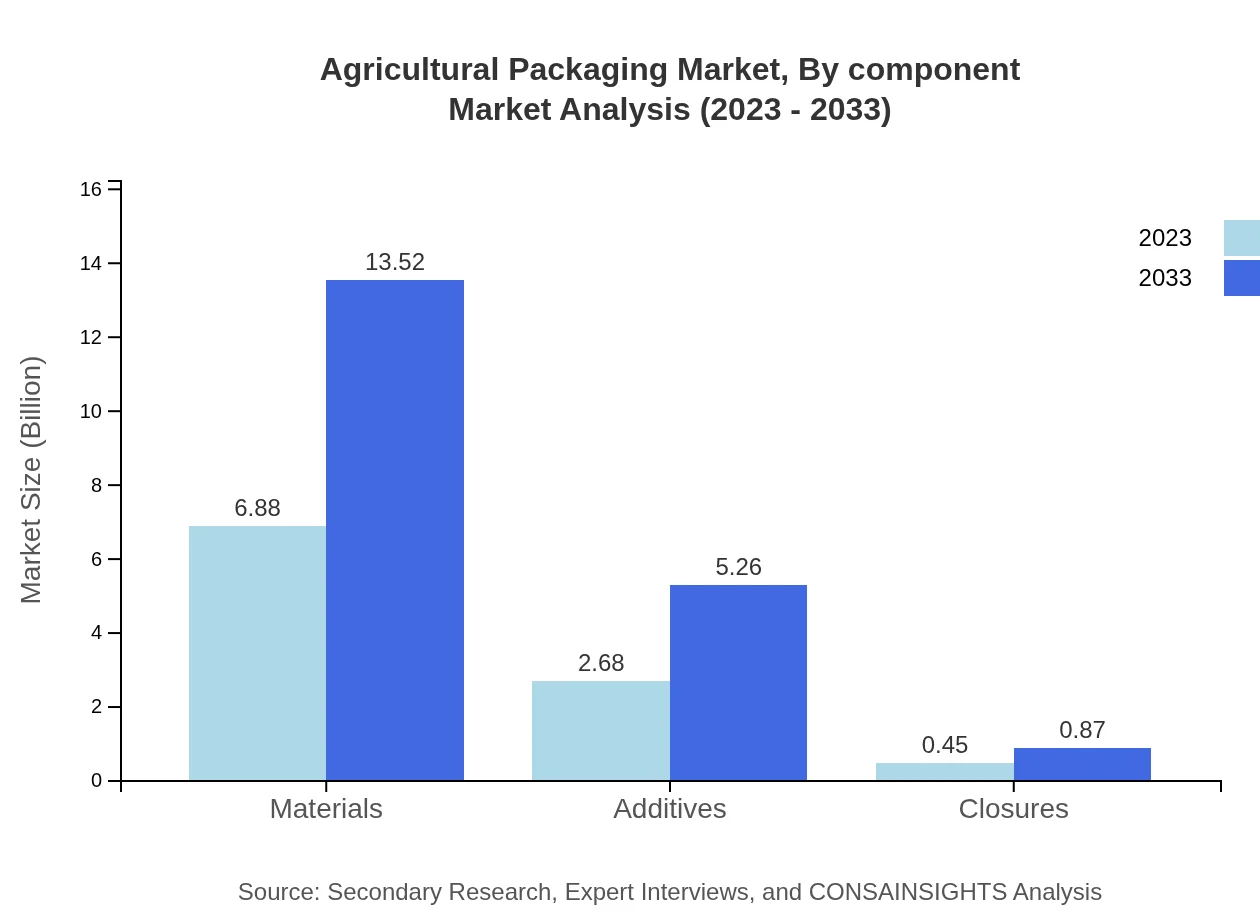

Agricultural Packaging Market Analysis By Component

Materials account for the largest share, valued at $6.88 billion in 2023 and estimated to grow to $13.52 billion by 2033, making them vital in the overall Agricultural Packaging scheme. Additives and closures also contribute significantly to enhancing packaging efficiency.

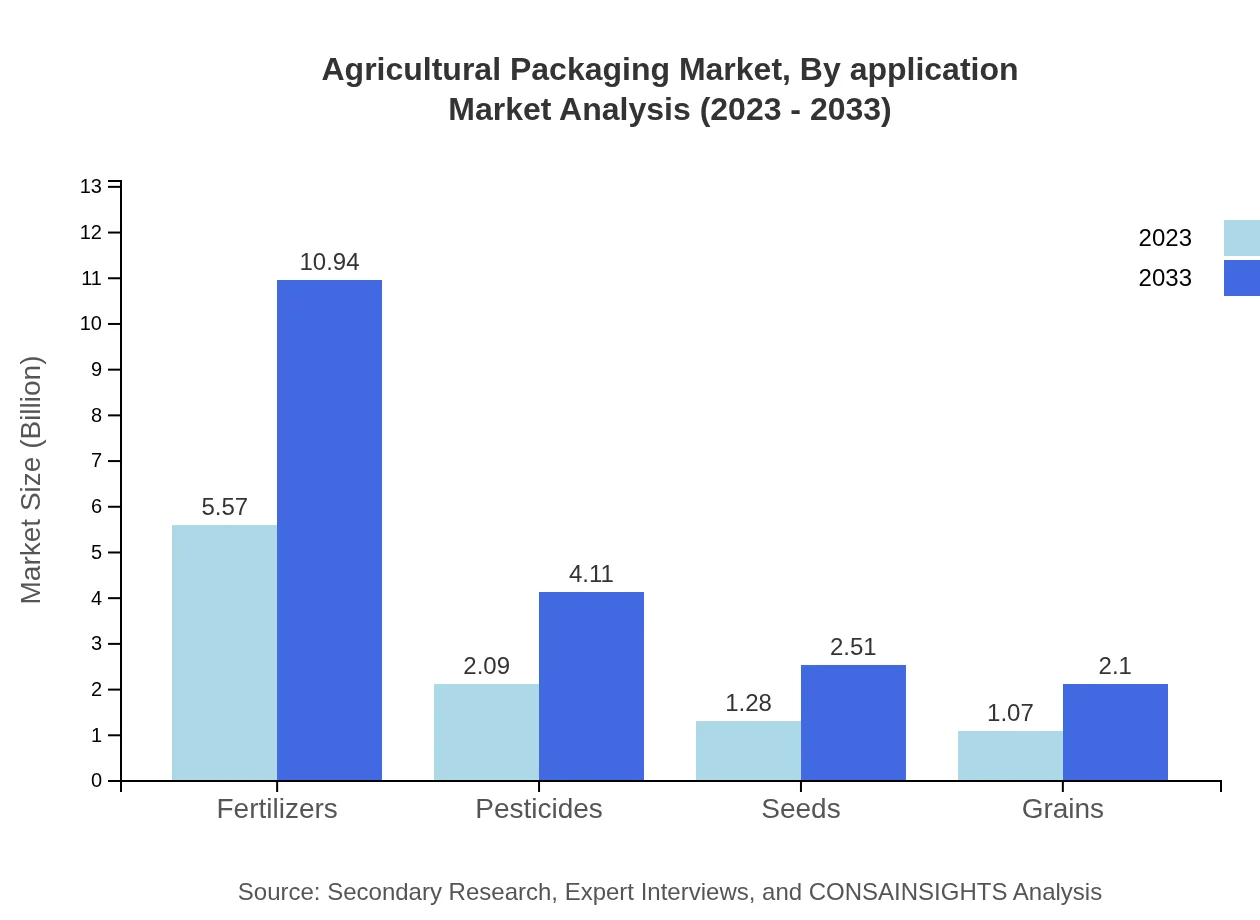

Agricultural Packaging Market Analysis By Application

Fertilizers constitute a major application segment valued at $5.57 billion in 2023 and projected to grow to $10.94 billion by 2033. The market for pesticides and seeds follows, reflecting the needs of varied agricultural practices.

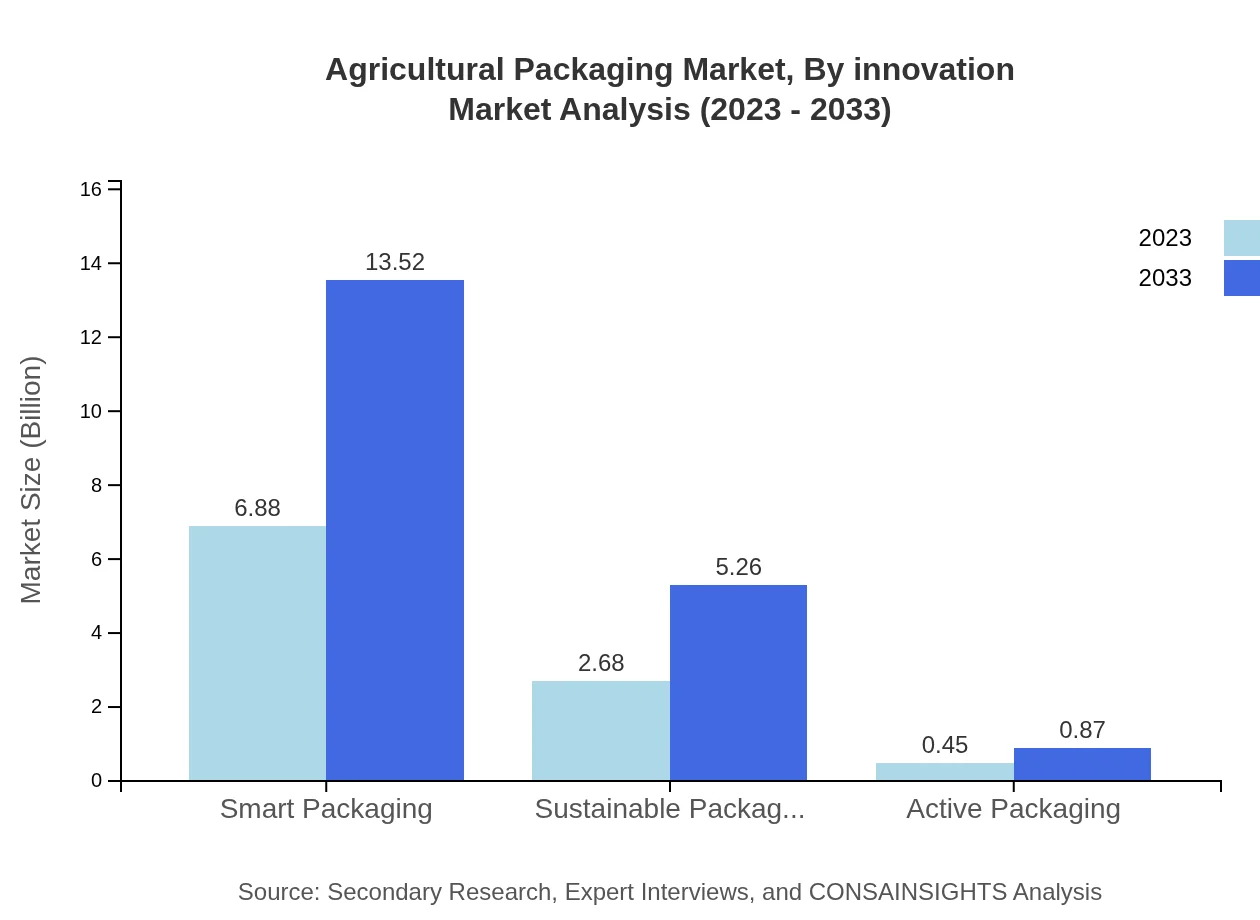

Agricultural Packaging Market Analysis By Innovation

Sustainable and smart packaging innovations are at the forefront, accounting for substantial market traction. The inclination toward biodegradable materials is reflected in market dynamics, with sustainability strategies being pivotal for future growth.

Agricultural Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agricultural Packaging Industry

Amcor plc:

A leading global packaging company known for its commitment to sustainability and innovative packaging solutions for the agricultural sector.Tetra Pak:

Renowned for its processing and packaging technologies, Tetra Pak focuses on providing sustainable solutions and industry innovations in agricultural packaging.Mondi Group:

Mondi is dedicated to developing innovative and sustainable packaging solutions, enhancing product protection and extending shelf life in agricultural applications.Sealed Air Corporation:

Specializes in food packaging solutions and has made significant strides in developing sustainable packaging that meets the needs of the agricultural market.Sonoco Products Company:

A versatile packaging provider known for its diversified packaging solutions, including sustainable packaging for agricultural products.We're grateful to work with incredible clients.

FAQs

What is the market size of agricultural Packaging?

The agricultural packaging market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 6.8% from 2023. This growth reflects increasing demands for improved packaging solutions that enhance product integrity, safety, and sustainability in the agricultural sector.

What are the key market players or companies in the agricultural Packaging industry?

Key players in the agricultural packaging industry include prominent companies such as Amcor, Sealed Air Corporation, and Mondi Group. These companies are known for their innovative solutions and commitment to sustainable practices, catering to the evolving needs of the agricultural sector.

What are the primary factors driving the growth in the agricultural packaging industry?

The growth of the agricultural packaging industry is driven by several factors including increased globalization of agricultural products, demand for sustainable packaging solutions, and advancements in technology that enhance packaging performance and functionality.

Which region is the fastest Growing in the agricultural packaging?

The fastest-growing region in the agricultural packaging market is North America, where the market size is expected to expand from $3.40 billion in 2023 to $6.69 billion by 2033, reflecting a robust growth trajectory in agricultural production and packaging technologies.

Does ConsaInsights provide customized market report data for the agricultural packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the agricultural packaging industry, allowing clients to gain in-depth insights and actionable intelligence to inform strategic decisions.

What deliverables can I expect from this agricultural packaging market research project?

Deliverables from the agricultural packaging market research project typically include comprehensive reports, market forecasts, trend analysis, competitive landscape evaluations, and data segmentation, providing clients with valuable insights for strategic planning.

What are the market trends of agricultural packaging?

Current market trends in agricultural packaging include a shift towards sustainable materials, increased adoption of smart packaging technologies, and a growing emphasis on flexible packaging solutions that cater to diverse agricultural products.