Agricultural Pesticide Market Report

Published Date: 02 February 2026 | Report Code: agricultural-pesticide

Agricultural Pesticide Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Agricultural Pesticide market, outlining current trends, segmentation, regional insights, technological advancements, and forecasts from 2023 to 2033. It aims to equip stakeholders with essential data and insights for strategic planning.

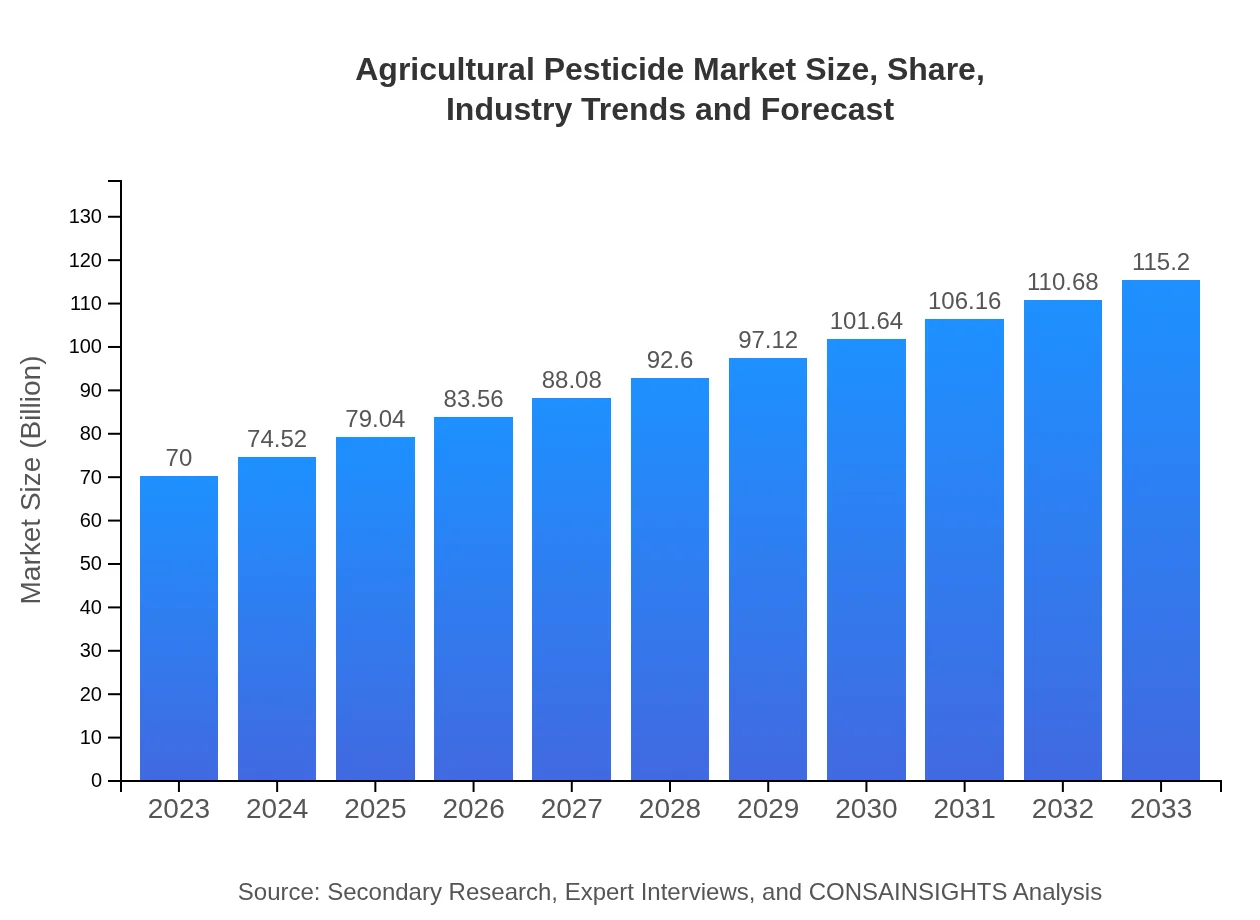

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $70.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $115.20 Billion |

| Top Companies | Bayer AG, Corteva Agriscience, Syngenta AG, FMC Corporation, Monsanto Company |

| Last Modified Date | 02 February 2026 |

Agricultural Pesticide Market Overview

Customize Agricultural Pesticide Market Report market research report

- ✔ Get in-depth analysis of Agricultural Pesticide market size, growth, and forecasts.

- ✔ Understand Agricultural Pesticide's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agricultural Pesticide

What is the Market Size & CAGR of the Agricultural Pesticide market in 2023?

Agricultural Pesticide Industry Analysis

Agricultural Pesticide Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agricultural Pesticide Market Analysis Report by Region

Europe Agricultural Pesticide Market Report:

Europe holds a substantial portion of the market, valued at $22.67 billion in 2023, rising to $37.31 billion by 2033. The implementation of stringent policies concerning pesticide usage is encouraging the growth of bio-pesticides and sustainable alternatives.Asia Pacific Agricultural Pesticide Market Report:

The Asia Pacific region is witnessing significant growth in the Agricultural Pesticide market, valued at $13.10 billion in 2023 and expected to reach $21.57 billion by 2033. Increasing agricultural production, combined with government support and technological adoption, is driving growth in countries like India and China.North America Agricultural Pesticide Market Report:

North America shows strong market potential with an estimated value of $24.07 billion in 2023, projected to reach $39.61 billion by 2033. The rise in organic farming practices and stringent pest control measures are propelling market growth in the region, particularly in the U.S.South America Agricultural Pesticide Market Report:

In South America, the Agricultural Pesticide market was valued at $1.12 billion in 2023, projected to grow to $1.84 billion by 2033. Brazil remains a key player, with increased demand for crop protection measures due to a growing agricultural sector.Middle East & Africa Agricultural Pesticide Market Report:

In the Middle East and Africa, the Agricultural Pesticide market was estimated at $9.04 billion in 2023 and is anticipated to reach $14.87 billion by 2033, driven by increasing agricultural practices and need for pest control solutions.Tell us your focus area and get a customized research report.

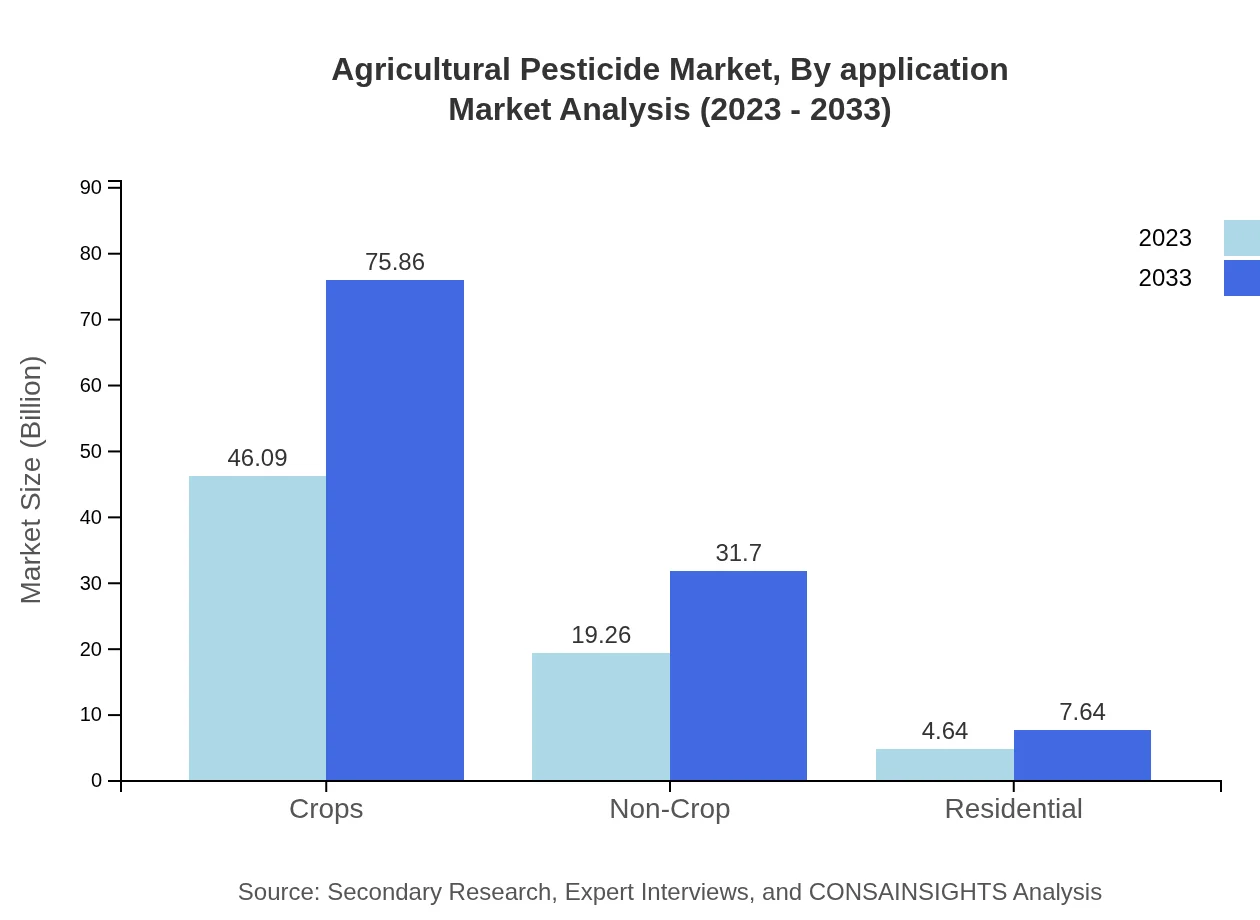

Agricultural Pesticide Market Analysis By Product Category

The market for Agricultural Pesticides by product category is dominated by Crops, valued at $46.09 billion in 2023 with a significant market share of 65.85%. Non-Crop applications follow at $19.26 billion (27.52% share), while Residential applications are valued at $4.64 billion (6.63% share). In terms of growth, Crops segment is expected to reach $75.86 billion by 2033, while Non-Crop applications will grow to $31.70 billion.

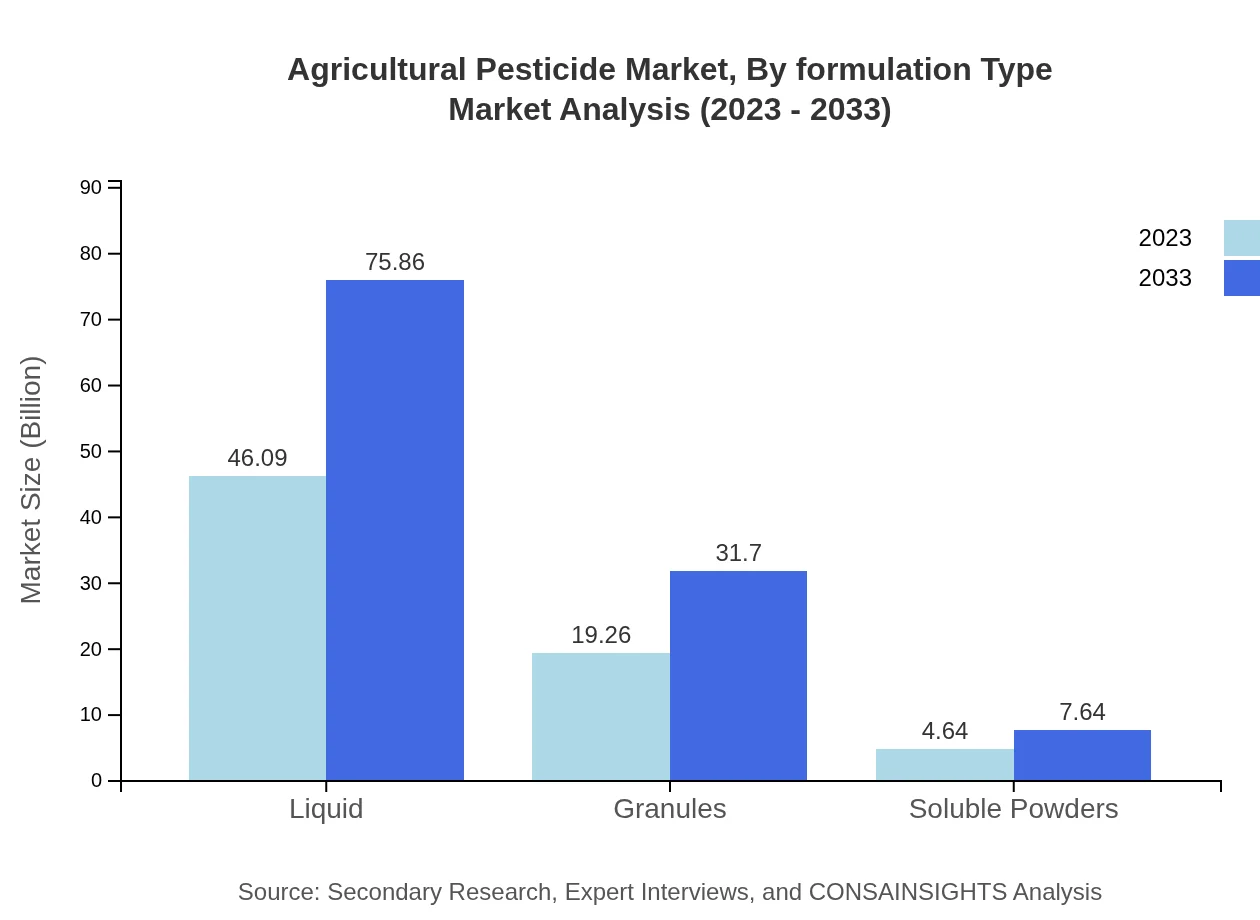

Agricultural Pesticide Market Analysis By Formulation Type

By formulation type, Liquid products dominate the Agricultural Pesticide market with a value of $46.09 billion in 2023 (65.85% share). This is followed by Granules at $19.26 billion (27.52% share) and Soluble Powders at $4.64 billion (6.63% share). The Liquid segment is projected to increase to $75.86 billion by 2033.

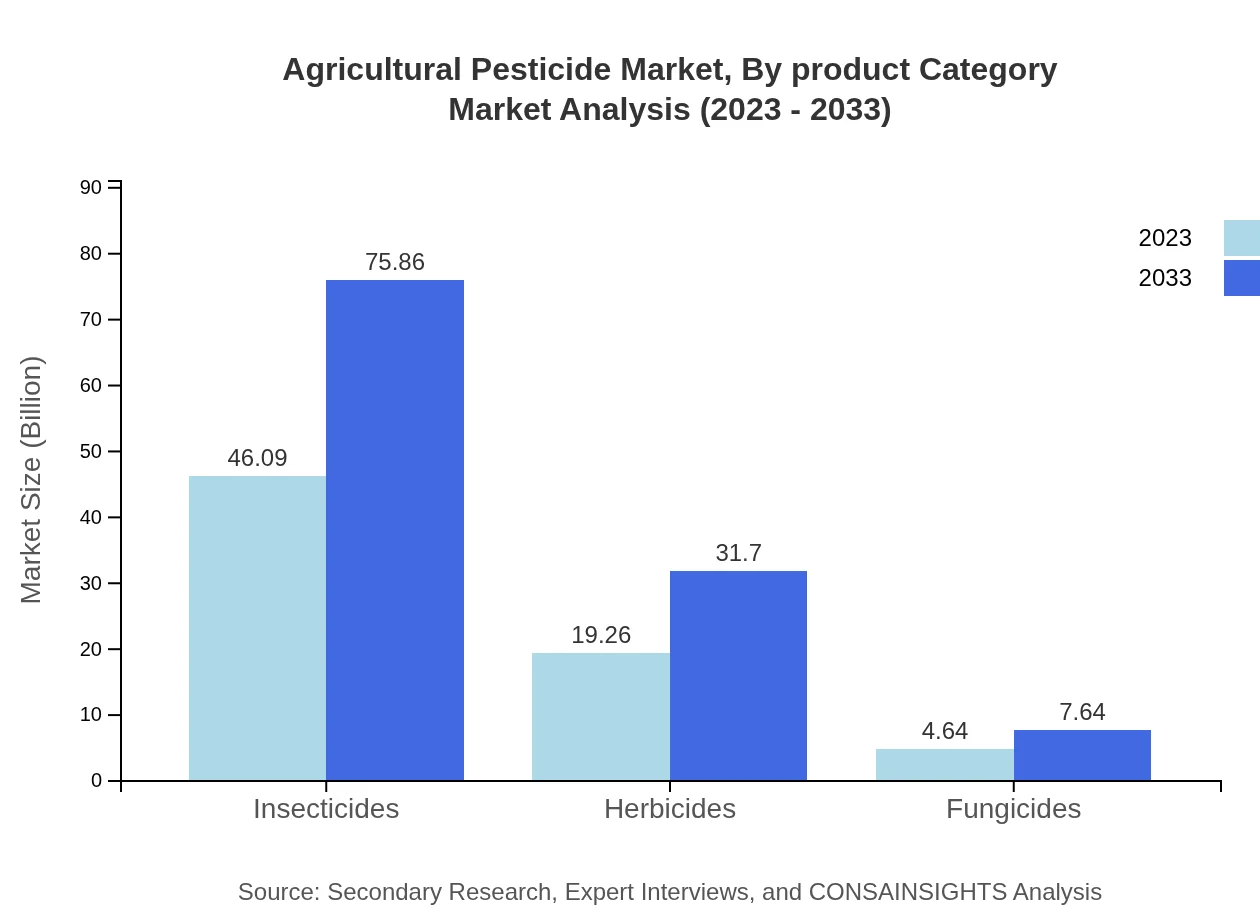

Agricultural Pesticide Market Analysis By Application

In terms of application, the Agricultural Pesticide market genres into Insecticides, valued at $46.09 billion (65.85% share) in 2023, followed by Herbicides at $19.26 billion (27.52% share) and Fungicides at $4.64 billion (6.63%). The Insecticides segment is expected to reach $75.86 billion by 2033.

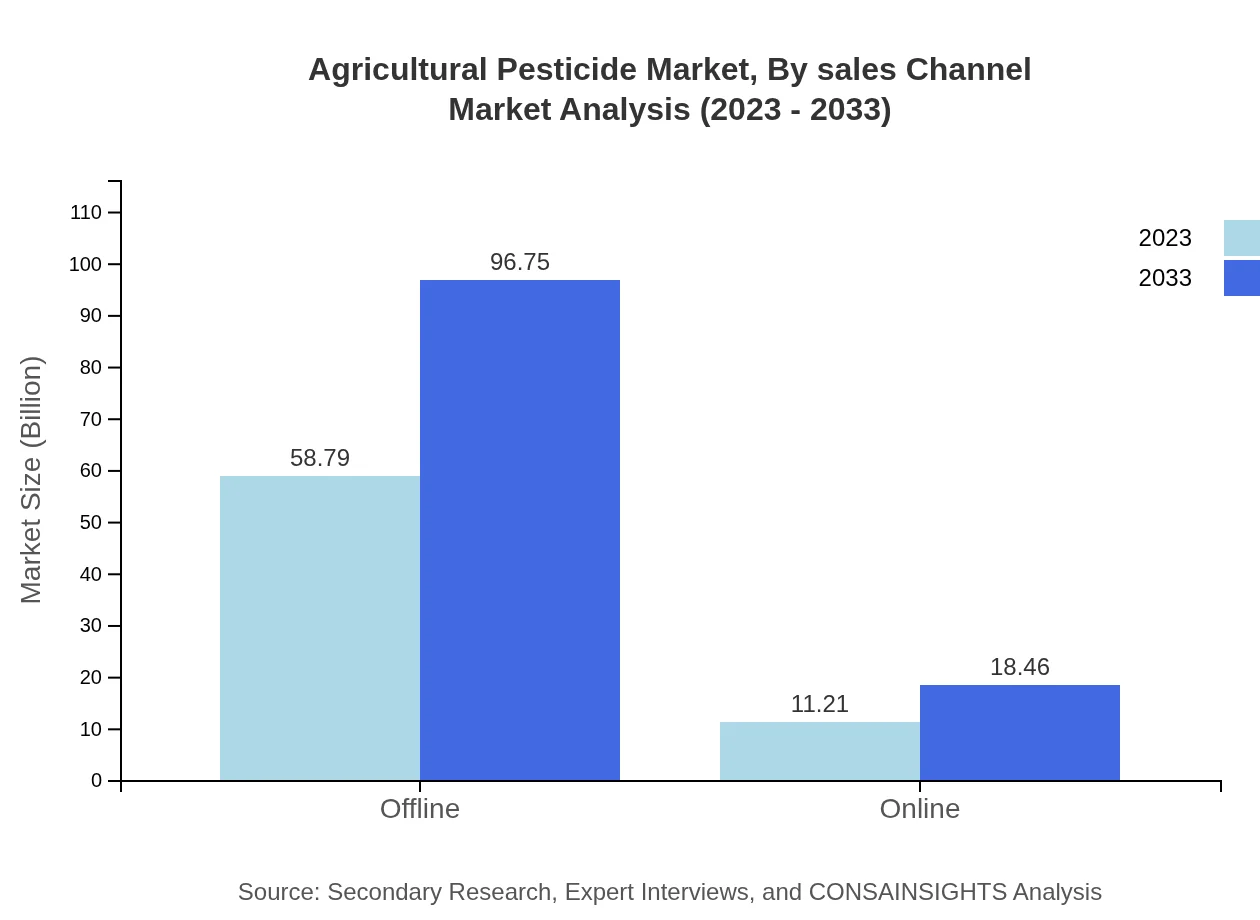

Agricultural Pesticide Market Analysis By Sales Channel

Analyzing sales channels, the Offline market is valued at $58.79 billion (83.98% share) in 2023, while Online sales represent $11.21 billion (16.02% share). The Offline segment is anticipated to grow to $96.75 billion by 2033, reflecting the shift toward digital sales channels.

Agricultural Pesticide Market Analysis By Compatibility

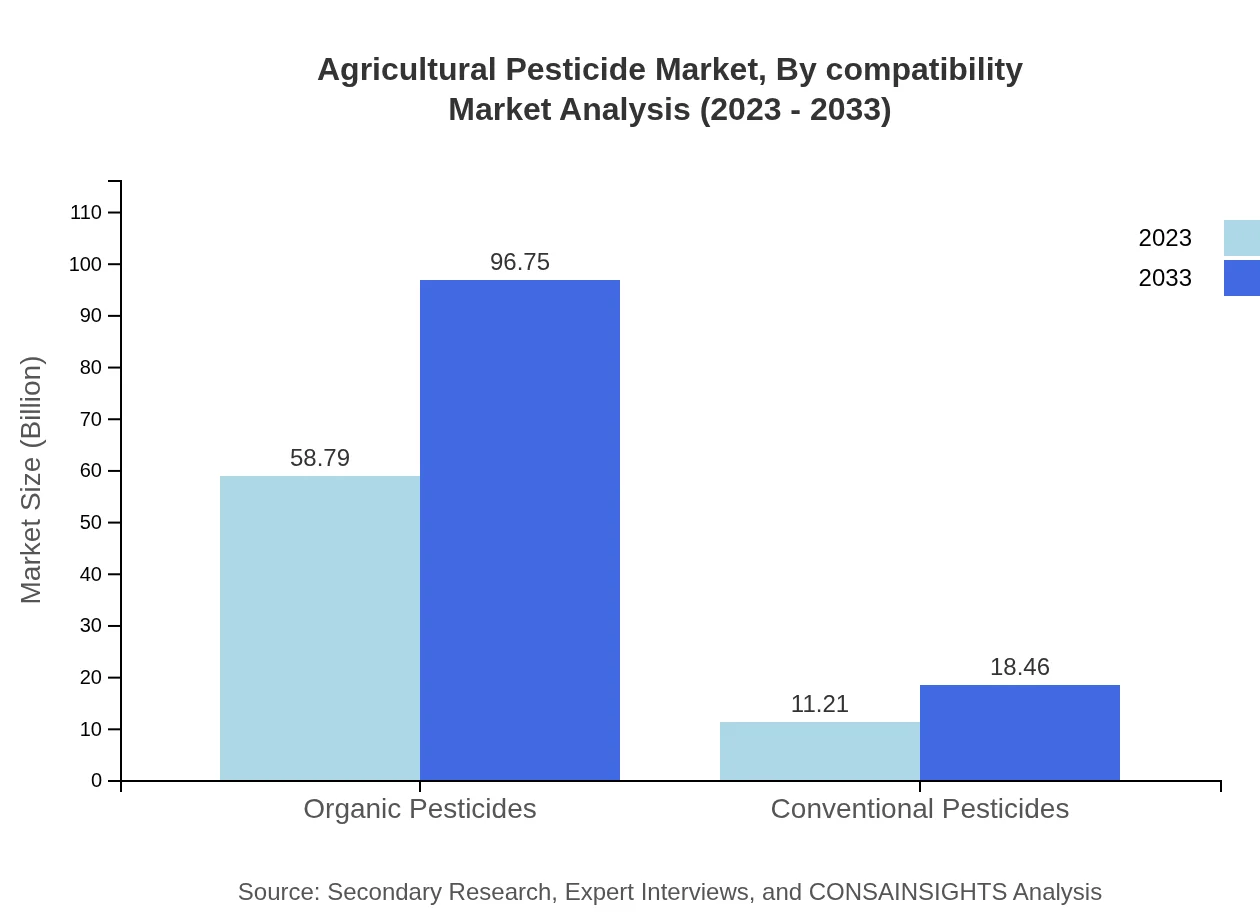

The market for Organic Pesticides is projected to reach $96.75 billion by 2033 from $58.79 billion in 2023 (83.98% share), while Conventional Pesticides are expected to grow from $11.21 billion (16.02% share) in 2023 to $18.46 billion by 2033. The rising demand for organic produce significantly boosts the Organic Pesticides segment.

Agricultural Pesticide Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agricultural Pesticide Industry

Bayer AG:

Bayer AG is a global leader in the agricultural sector, specializing in crop science and actively investing in sustainable agricultural solutions.Corteva Agriscience:

Corteva is known for its innovative offerings in seeds and crop protection, focusing on sustainability and helping farmers to increase productivity.Syngenta AG:

Syngenta AG is committed to improving crop yield and resilience through research and introduces products that address critical pest challenges.FMC Corporation:

FMC Corporation offers a diverse range of crop protection solutions, emphasizing on integrating sustainability into their practices.Monsanto Company:

Monsanto, now part of Bayer, focuses on genetically modified crops and high-performance pesticides, enhancing sustainable farming.We're grateful to work with incredible clients.

FAQs

What is the market size of agricultural Pesticide?

The agricultural pesticide market is valued at approximately $70 billion in 2023 and is projected to grow at a CAGR of 5% until 2033, indicating robust growth potential and highlighting its significance in the global agricultural supply chain.

What are the key market players or companies in this agricultural Pesticide industry?

Key players in the agricultural pesticide market include major multinational corporations such as Bayer AG, Syngenta AG, BASF SE, Corteva Agriscience, and FMC Corporation, all of which are pivotal in shaping industry trends and innovations.

What are the primary factors driving the growth in the agricultural pesticide industry?

Factors driving growth include the increasing global population leading to higher food demand, advancements in pesticide formulations, rising adoption of precision agriculture, and the need for pest and disease control to maintain crop yields.

Which region is the fastest Growing in the agricultural Pesticide?

The fastest-growing region in the agricultural pesticide market is North America, where the market size is expected to expand from $24.07 billion in 2023 to $39.61 billion by 2033, driven by technological advancements and strong agricultural practices.

Does ConsaInsights provide customized market report data for the agricultural Pesticide industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the agricultural pesticide industry, providing detailed insights and analytics that align with unique business objectives and market challenges.

What deliverables can I expect from this agricultural Pesticide market research project?

Deliverables from the agricultural pesticide market research project typically include detailed market analysis, comprehensive reports, regional and segment data insights, trend evaluations, and executive summaries to aid strategic decision-making.

What are the market trends of agricultural Pesticide?

Current trends in the agricultural pesticide market include a shift towards organic pesticides, increasing use of integrated pest management techniques, the rise of digital farming technologies, and a focus on sustainability and environmental concerns in pesticide production.