Agricultural Tires Market Report

Published Date: 02 February 2026 | Report Code: agricultural-tires

Agricultural Tires Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Agricultural Tires market, analyzing current trends, segmentation, regional insights, and future forecasts from 2023 to 2033. It aims to provide a comprehensive view of the market dynamics, industry growth prospects, and key players shaping the industry.

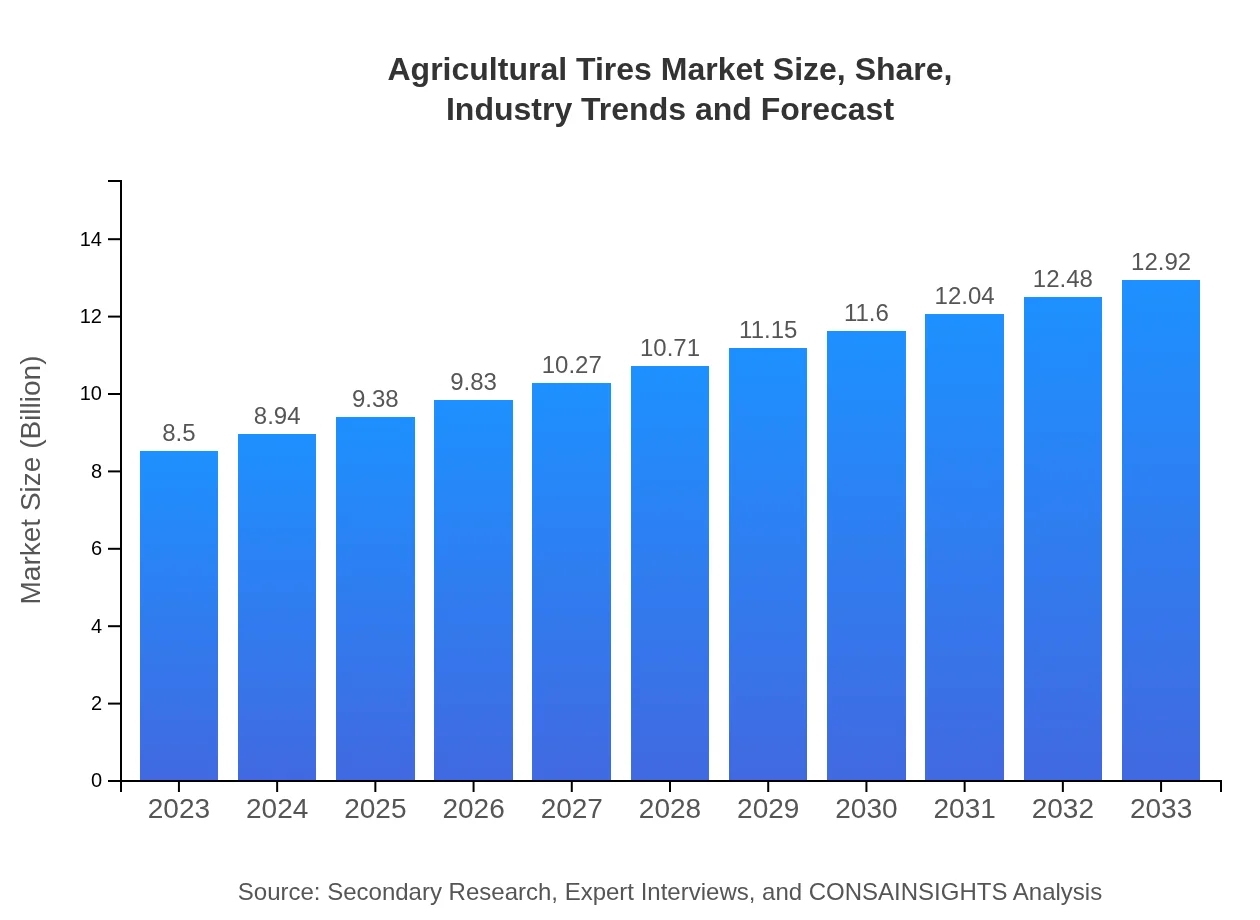

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $12.92 Billion |

| Top Companies | Michelin, Bridgestone, Goodyear, Continental, Yokohama |

| Last Modified Date | 02 February 2026 |

Agricultural Tires Market Overview

Customize Agricultural Tires Market Report market research report

- ✔ Get in-depth analysis of Agricultural Tires market size, growth, and forecasts.

- ✔ Understand Agricultural Tires's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agricultural Tires

What is the Market Size & CAGR of Agricultural Tires market in 2023?

Agricultural Tires Industry Analysis

Agricultural Tires Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agricultural Tires Market Analysis Report by Region

Europe Agricultural Tires Market Report:

The European Agricultural Tires market is set to rise from $2.38 billion in 2023 to $3.62 billion by 2033, propelled by stringent regulations focusing on sustainable farming practices and increased support for smallholder and medium farming systems. Innovations in tire technologies aimed at improving fuel efficiency in farming operations are also boosting the market.Asia Pacific Agricultural Tires Market Report:

In the Asia Pacific region, the Agricultural Tires market is projected to grow from $1.63 billion in 2023 to $2.48 billion by 2033. The growth is driven by increasing agricultural mechanization and the adoption of advanced farming techniques, especially in countries like China and India. Moreover, government initiatives to promote sustainable agricultural practices are further boosting market demand.North America Agricultural Tires Market Report:

North America, particularly the United States, holds a significant share of the Agricultural Tires market, expected to grow from $3.19 billion in 2023 to $4.85 billion by 2033. The emphasis on technology-driven farming and precision agriculture, coupled with a strong demand for durable performance tires in varied agricultural settings, supports this growth trajectory.South America Agricultural Tires Market Report:

The South American market for Agricultural Tires is anticipated to expand from $0.82 billion in 2023 to $1.25 billion by 2033. The region's rich agricultural landscape and the rise in export opportunities for various crops are key drivers. Furthermore, investments in modernizing farming equipment significantly contribute to the strong growth outlook.Middle East & Africa Agricultural Tires Market Report:

In the Middle East and Africa, the market is projected to grow from $0.48 billion in 2023 to $0.72 billion by 2033. The agricultural sector in this region is gradually modernizing, resulting in increased demand for efficient agricultural machinery, which in turn drives the need for specialized tires. The focus on food security is prompting investments in better farming equipment and technological solutions.Tell us your focus area and get a customized research report.

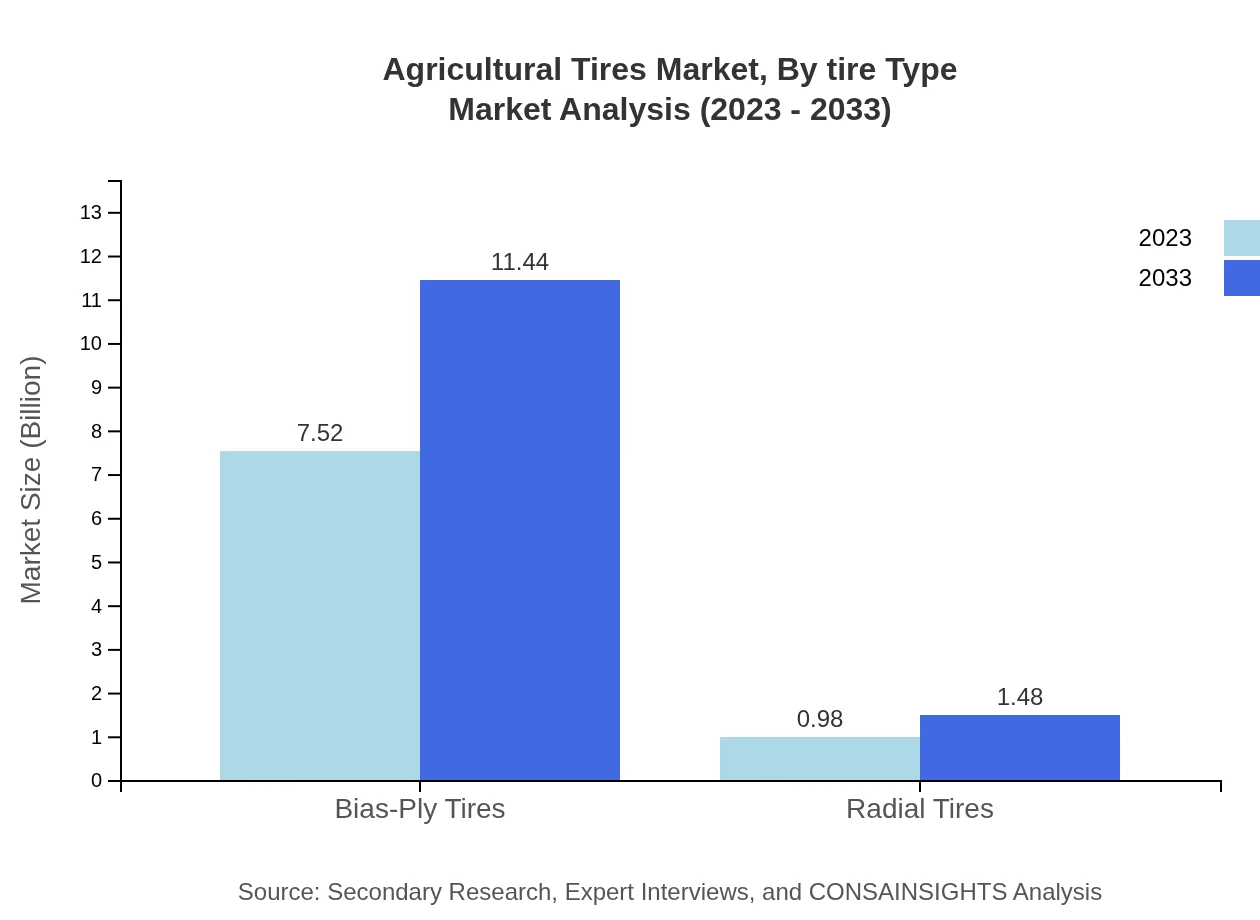

Agricultural Tires Market Analysis By Tire Type

In 2023, the Agricultural Tires market by tire type revealed that Bias-Ply Tires accounted for $7.52 billion, maintaining a market share of 88.51%. These tires are known for their durability and ability to provide better comfort on rough terrains. Conversely, Radial Tires reached a market size of $0.98 billion, representing a share of 11.49%. As the market evolves, Radial Tires are gaining traction due to their efficiency and performance over long distances.

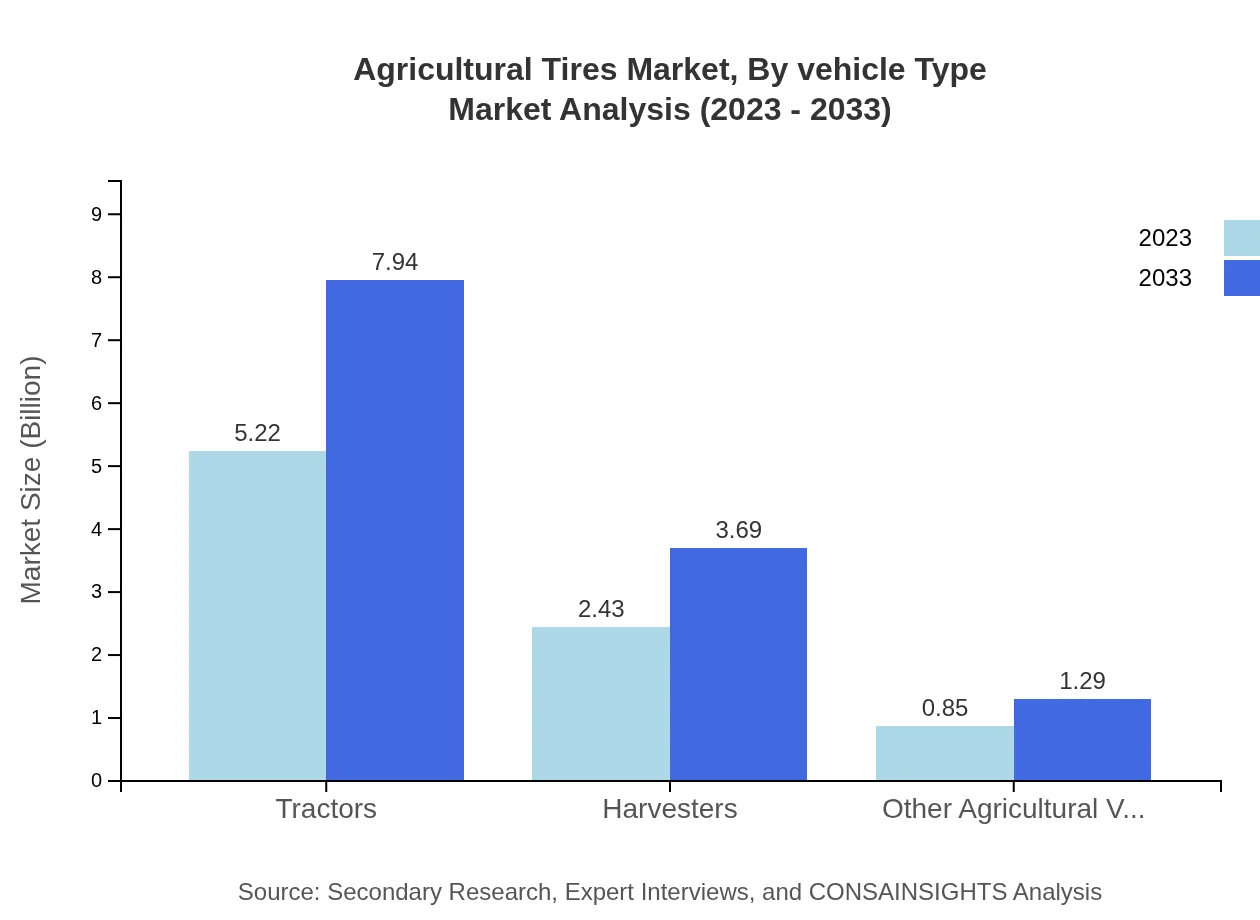

Agricultural Tires Market Analysis By Vehicle Type

For vehicle types, Tractors remain the dominant category within the Agricultural Tires market, accounting for a size of $5.22 billion in 2023, translating to a share of 61.43%. Harvesters are the next significant segment, reaching $2.43 billion with a share of 28.55%. The remaining share belongs to other agricultural vehicles, highlighting the importance of specialized tires tailored to this segment's unique operational requirements.

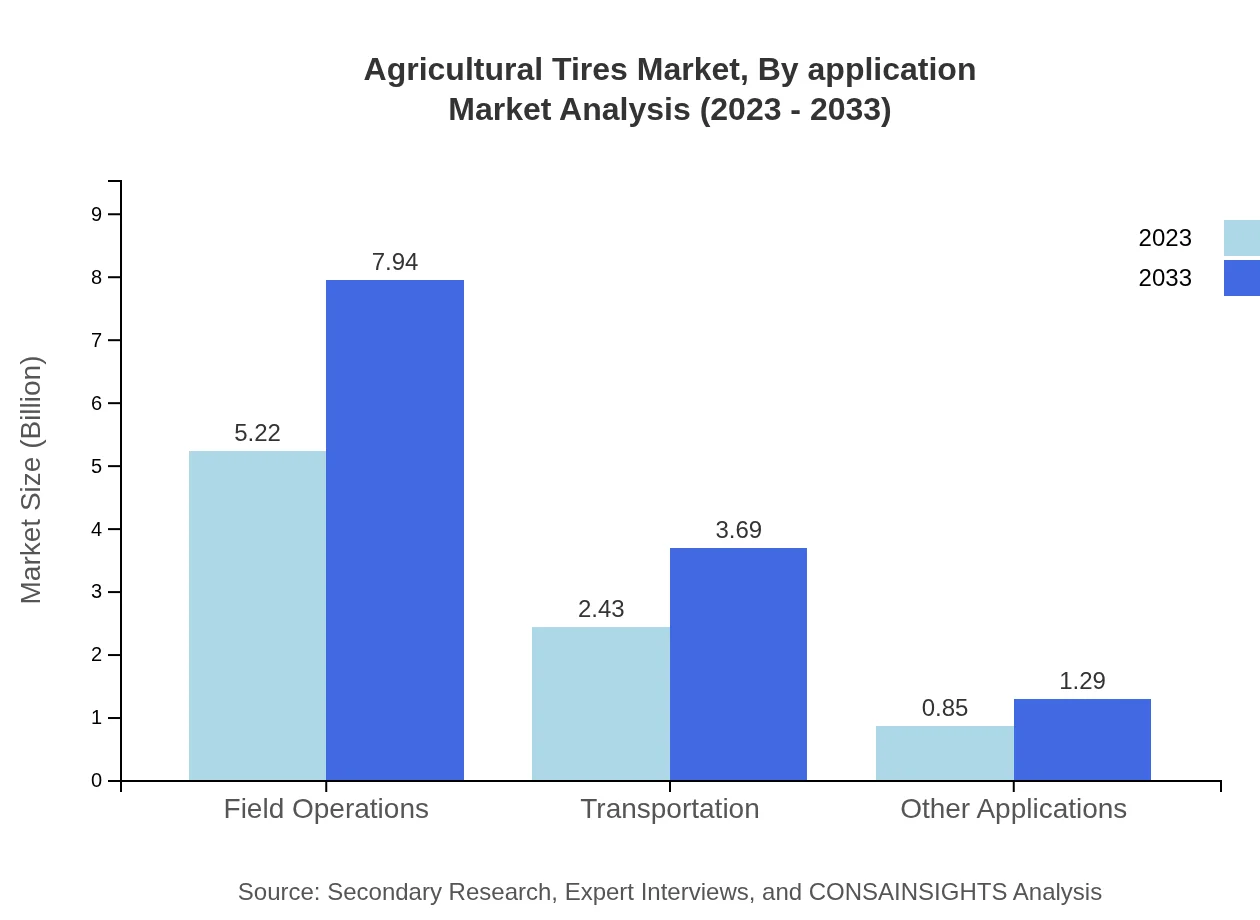

Agricultural Tires Market Analysis By Application

The application segment for Agricultural Tires in 2023 shows Field Operations commanding a size of $5.22 billion and a share of 61.43%. Transportation follows closely with a value of $2.43 billion at a 28.55% share. Other applications, including different types of agricultural operations, constitute a smaller market portion, indicating the necessity of versatile tires capable of performing across multiple functions.

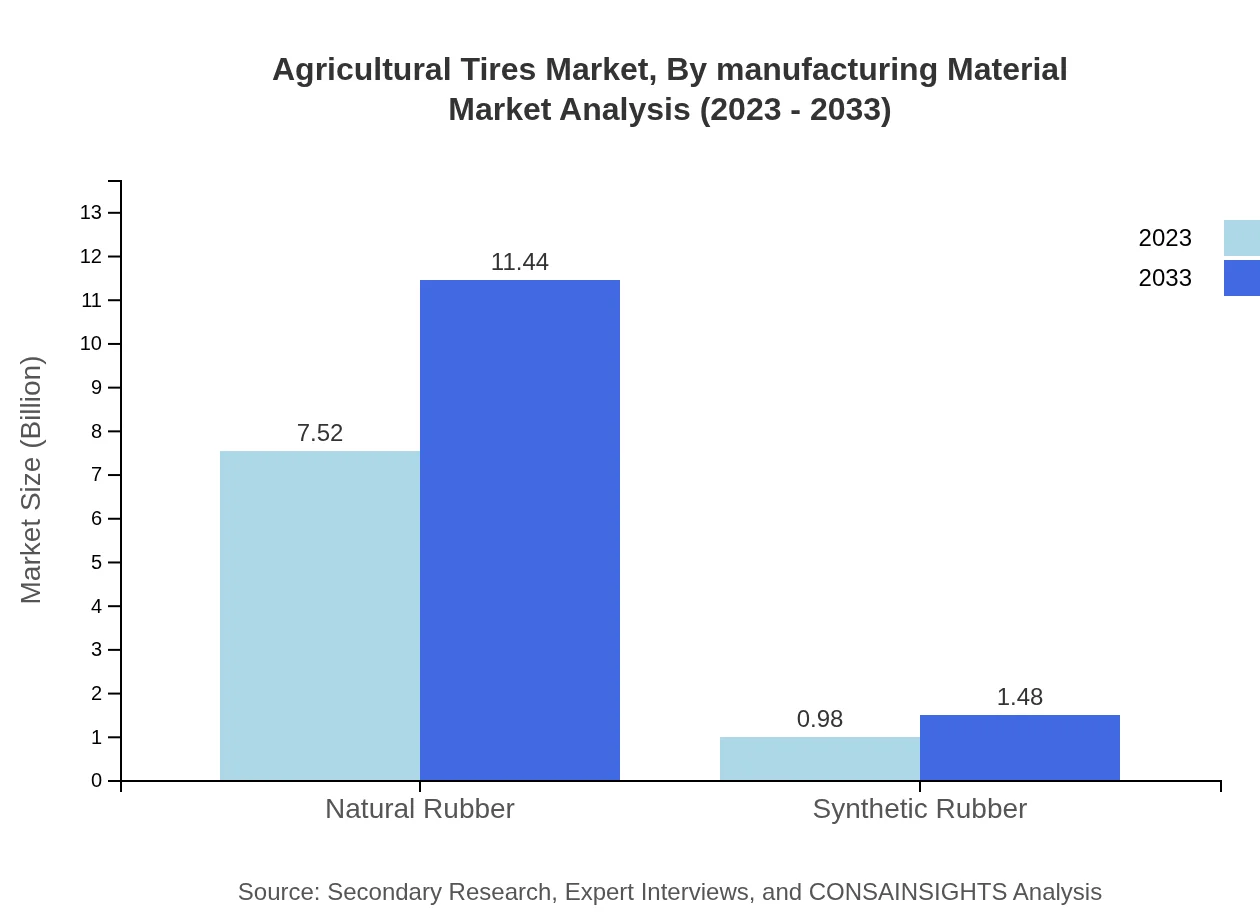

Agricultural Tires Market Analysis By Manufacturing Material

Natural Rubber leads the manufacturing material segment, valued at $7.52 billion and holding a significant share of 88.51% in 2023. This material's properties of flexibility and durability make it ideal for agricultural tires. In contrast, Synthetic Rubber, valued at $0.98 billion with a share of 11.49%, is expected to grow as manufacturers focus on tailoring materials to meet specific performance needs of modern agricultural tires.

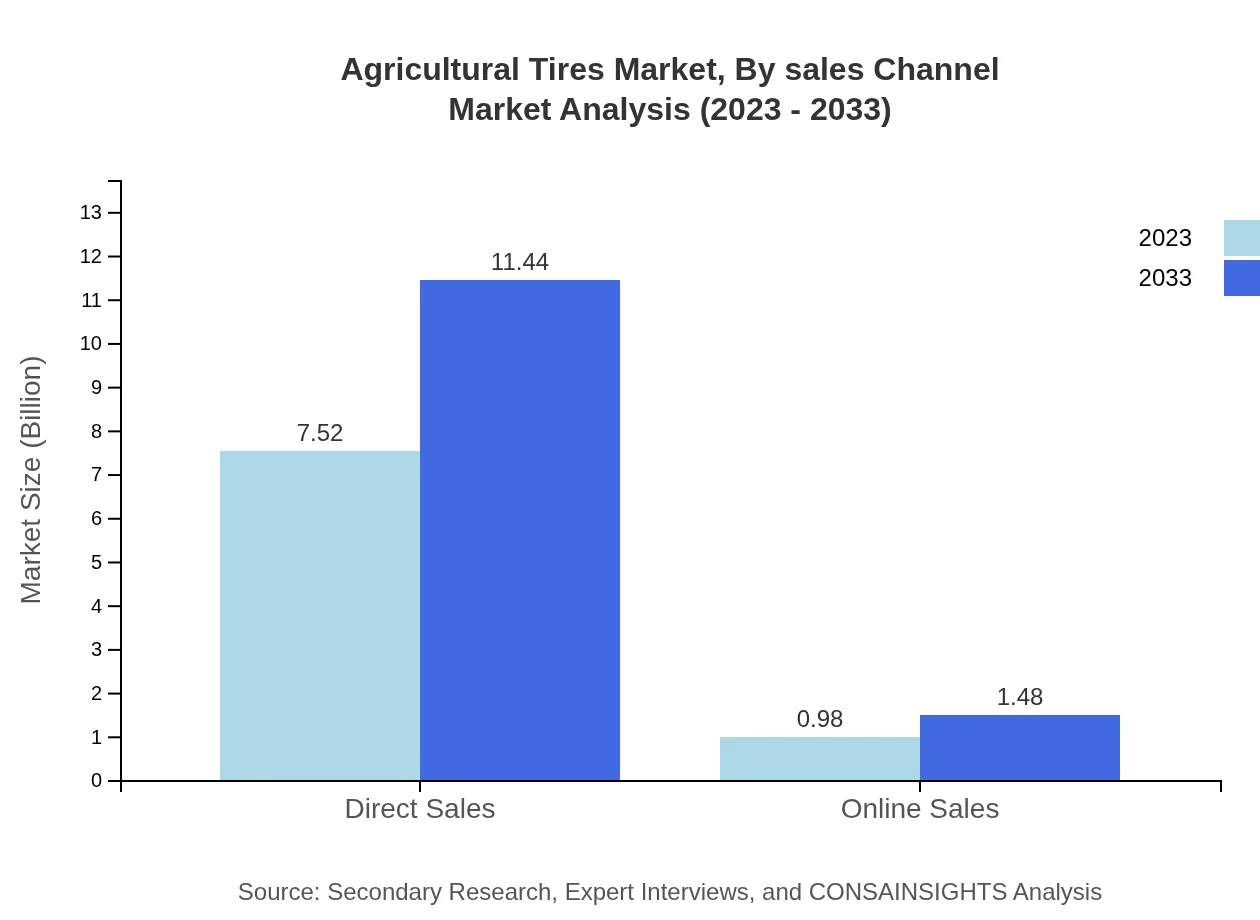

Agricultural Tires Market Analysis By Sales Channel

In terms of sales channel, Direct Sales dominate the Agricultural Tires market with a size of $7.52 billion in 2023 and a share of 88.51%. Online Sales are also emerging prominently, capturing a market size of $0.98 billion with an 11.49% share. This transition reflects shifting consumer behavior and the enhanced availability of products through digital platforms.

Agricultural Tires Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agricultural Tires Industry

Michelin:

A leading global tire manufacturer, Michelin emphasizes innovation and sustainability in its agricultural tire offerings, contributing significantly to market advancements.Bridgestone:

Bridgestone is a key player in agricultural tire production, focusing on high-performance products and investment in technology to enhance product functionality and durability.Goodyear:

Goodyear's extensive range of agricultural tires is supported by its commitment to performance and reliability, catering to various agricultural applications and machinery.Continental:

Continental’s innovative tire solutions are tailored to meet the growing demands of the agricultural sector, with an emphasis on advanced technology and safety.Yokohama:

Yokohama produces a specialized range of agricultural tires, focusing on high-quality materials and technology that enhance tire lifespan and performance in tough conditions.We're grateful to work with incredible clients.

FAQs

What is the market size of agricultural tires?

The global agricultural tires market is currently valued at approximately $8.5 billion, with a projected CAGR of 4.2% from 2023 to 2033, reflecting a robust growth trajectory.

What are the key market players or companies in this agricultural tires industry?

Key players in the agricultural tires industry include prominent manufacturers such as Michelin, Bridgestone, Goodyear, Continental, and BKT. These companies lead through innovation and a strong distribution network.

What are the primary factors driving the growth in the agricultural tires industry?

The growth in the agricultural tires industry is primarily driven by rising agricultural mechanization, increased demand for food production, technological advancements in tire manufacturing, and the expansion of farming operations globally.

Which region is the fastest Growing in the agricultural tires?

The North America region is the fastest-growing in the agricultural tires market, projected to grow from $3.19 billion in 2023 to $4.85 billion by 2033, reflecting strong investment in agricultural infrastructure.

Does ConsaInsights provide customized market report data for the agricultural tires industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the agricultural tires industry, including detailed insights and analysis.

What deliverables can I expect from this agricultural tires market research project?

Deliverables from the agricultural tires market research project include comprehensive reports, regional market analysis, competitor profiling, trend analysis, and market forecasts up to 2033.

What are the market trends of agricultural tires?

Current trends in the agricultural tires market include a shift towards eco-friendly tire materials, advancements in tire technology, increasing use of precision agriculture, and a growing preference for radial tires over bias-ply tires.