Agriculture Analytics Market Report

Published Date: 02 February 2026 | Report Code: agriculture-analytics

Agriculture Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Agriculture Analytics market from 2023 to 2033, exploring current trends, regional insights, and future forecasts. It seeks to offer a comprehensive understanding of market dynamics, segmentation, and the role of technology in shaping the industry.

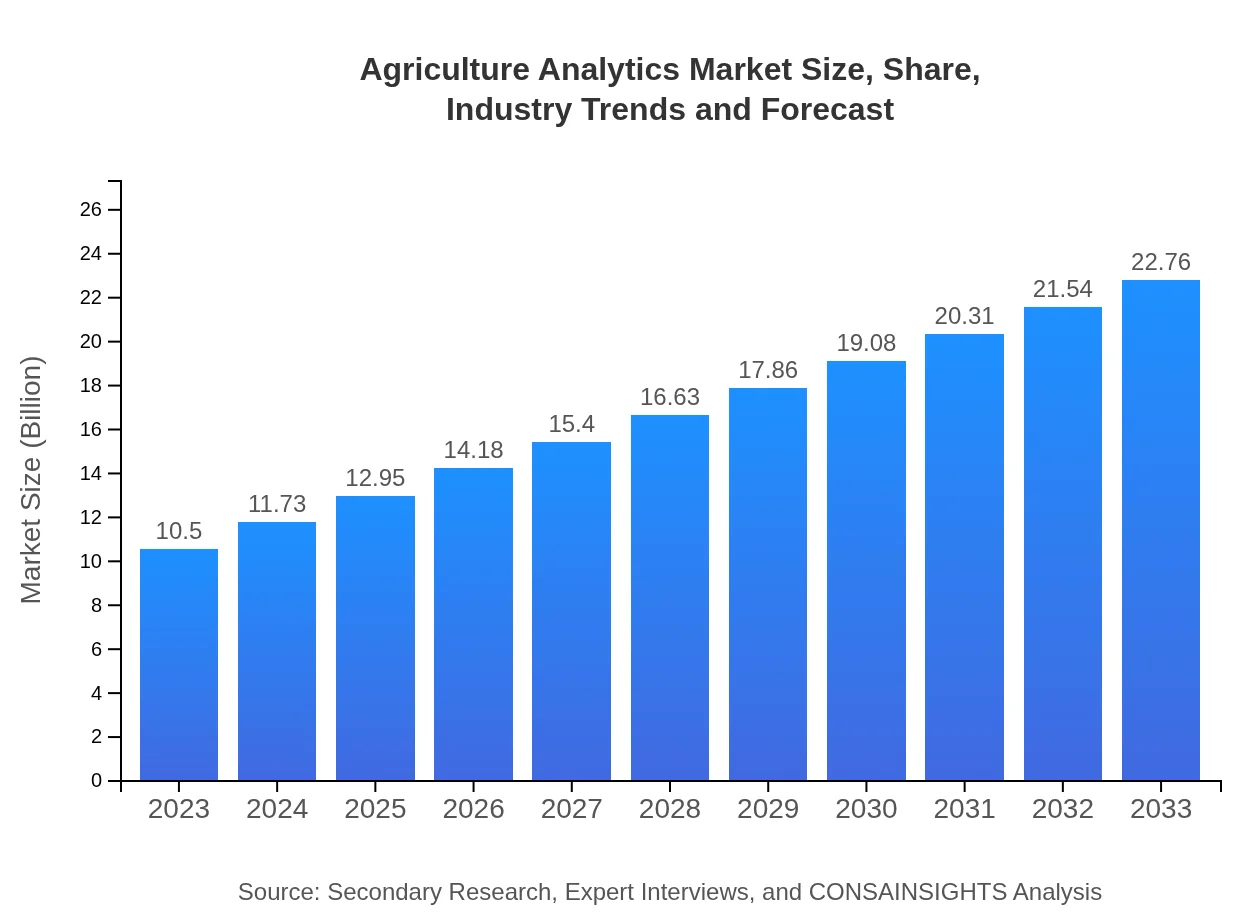

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $22.76 Billion |

| Top Companies | IBM, Monsanto, Trimble, SAS, Aker Smart Farming |

| Last Modified Date | 02 February 2026 |

Agriculture Analytics Market Overview

Customize Agriculture Analytics Market Report market research report

- ✔ Get in-depth analysis of Agriculture Analytics market size, growth, and forecasts.

- ✔ Understand Agriculture Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agriculture Analytics

What is the Market Size & CAGR of Agriculture Analytics market in 2023?

Agriculture Analytics Industry Analysis

Agriculture Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agriculture Analytics Market Analysis Report by Region

Europe Agriculture Analytics Market Report:

Europe's Agriculture Analytics market, valued at $2.71 billion in 2023, is projected to grow to $5.87 billion by 2033. The European Union's focus on sustainable farming practices and environmental regulations further drives the demand for agricultural analytics to minimize ecological impacts.Asia Pacific Agriculture Analytics Market Report:

The Asia Pacific region is a rapidly growing hub for agriculture analytics, projected to expand from $2.04 billion in 2023 to $4.42 billion by 2033. This growth is driven by increased investments in agriculture technology and the adoption of data analytics across various farming practices to boost output and ensure food security.North America Agriculture Analytics Market Report:

North America holds one of the largest shares of the Agriculture Analytics market, with anticipated growth from $3.86 billion in 2023 to $8.36 billion by 2033. This region is at the forefront of technology adoption in agriculture, with many model farms implementing advanced analytics for enhanced operational efficiency.South America Agriculture Analytics Market Report:

In South America, the market size is expected to increase from $0.61 billion in 2023 to $1.32 billion by 2033. The region benefits from its diverse agricultural productivity, prompting farmers to adopt analytics for crop management and optimization amid changing climatic conditions.Middle East & Africa Agriculture Analytics Market Report:

The Middle East and Africa are expected to see an increase from $1.28 billion in 2023 to $2.78 billion by 2033. With an emphasis on food security and enhancing agricultural productivity, there is a growing need for analytics to address the challenges posed by arid conditions and resource limitations.Tell us your focus area and get a customized research report.

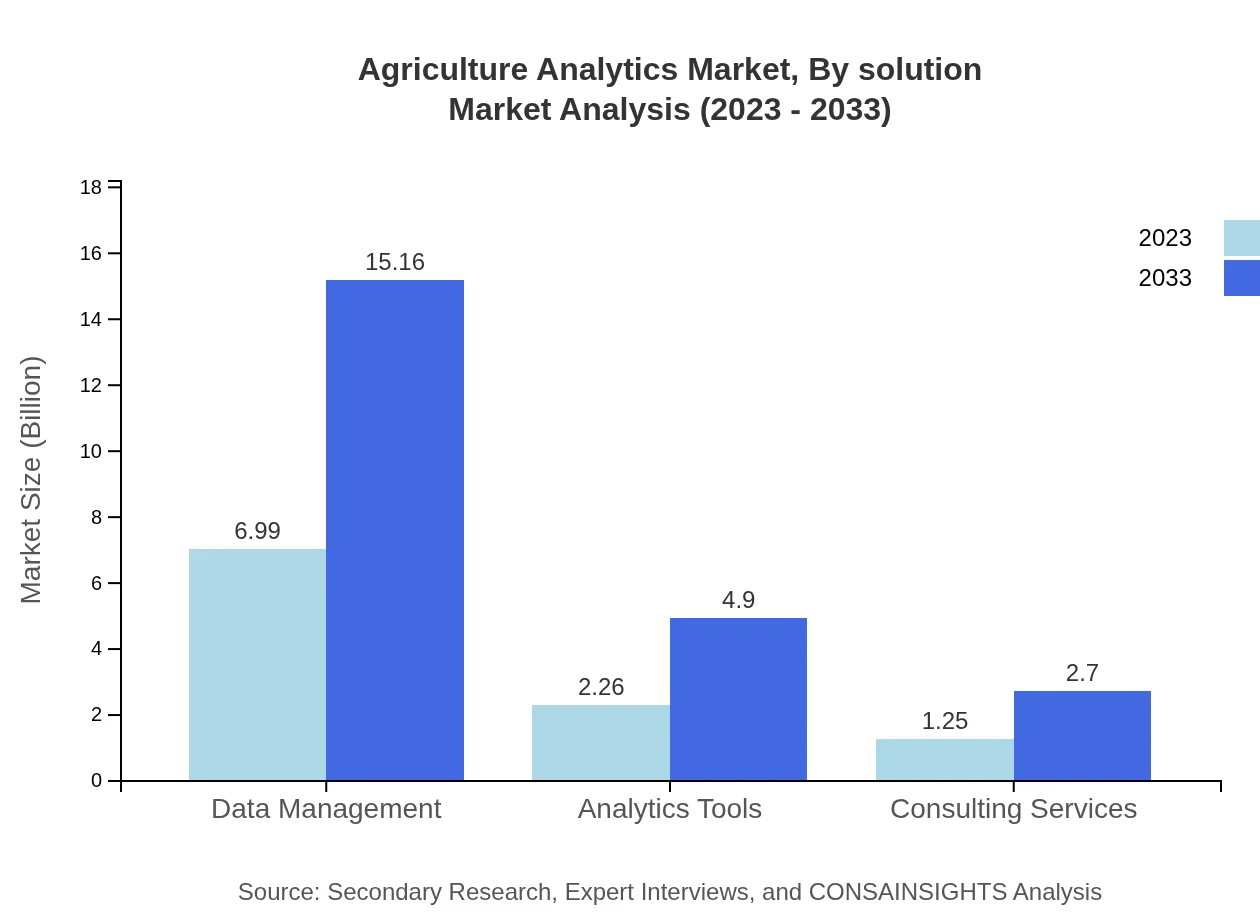

Agriculture Analytics Market Analysis By Solution

The global agriculture analytics market is segmented by solution, which includes data management ($6.99 billion in 2023, projected to $15.16 billion by 2033, 66.61% market share), analytics tools ($2.26 billion in 2023, projected to $4.90 billion by 2033, 21.53% market share), consulting services ($1.25 billion in 2023, projected to $2.70 billion by 2033, 11.86% market share), representing substantial portions of the market. Each solution contributes uniquely to improving the productivity and sustainability of farming.

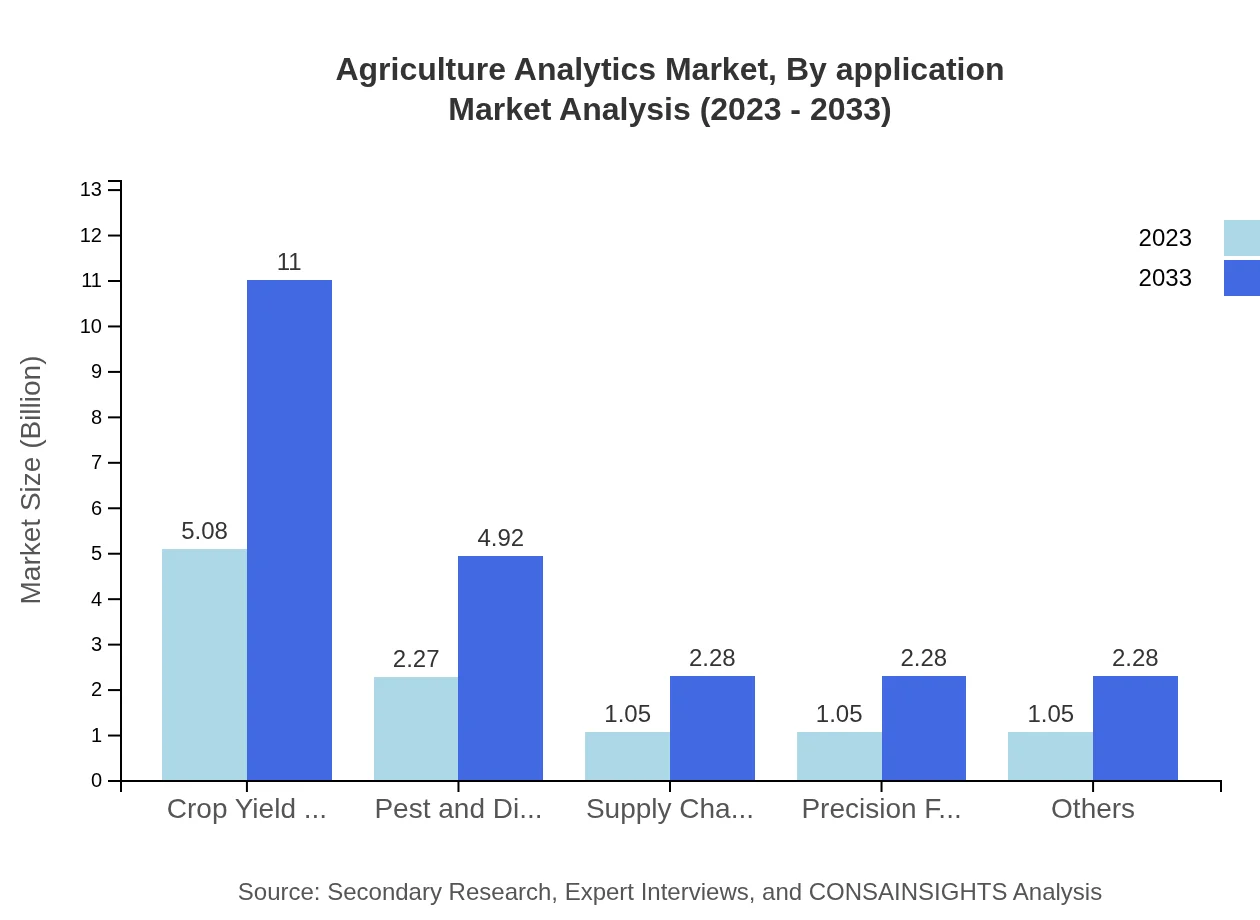

Agriculture Analytics Market Analysis By Application

In terms of application, the market segments encompass crop yield optimization ($5.08 billion in 2023, reaching $11 billion by 2033, 48.34% market share), pest and disease management ($2.27 billion in 2023, reaching $4.92 billion by 2033, 21.61% market share), and supply chain optimization ($1.05 billion in 2023, reaching $2.28 billion by 2033, 10.02% market share), showcasing various priorities for agricultural analytics.

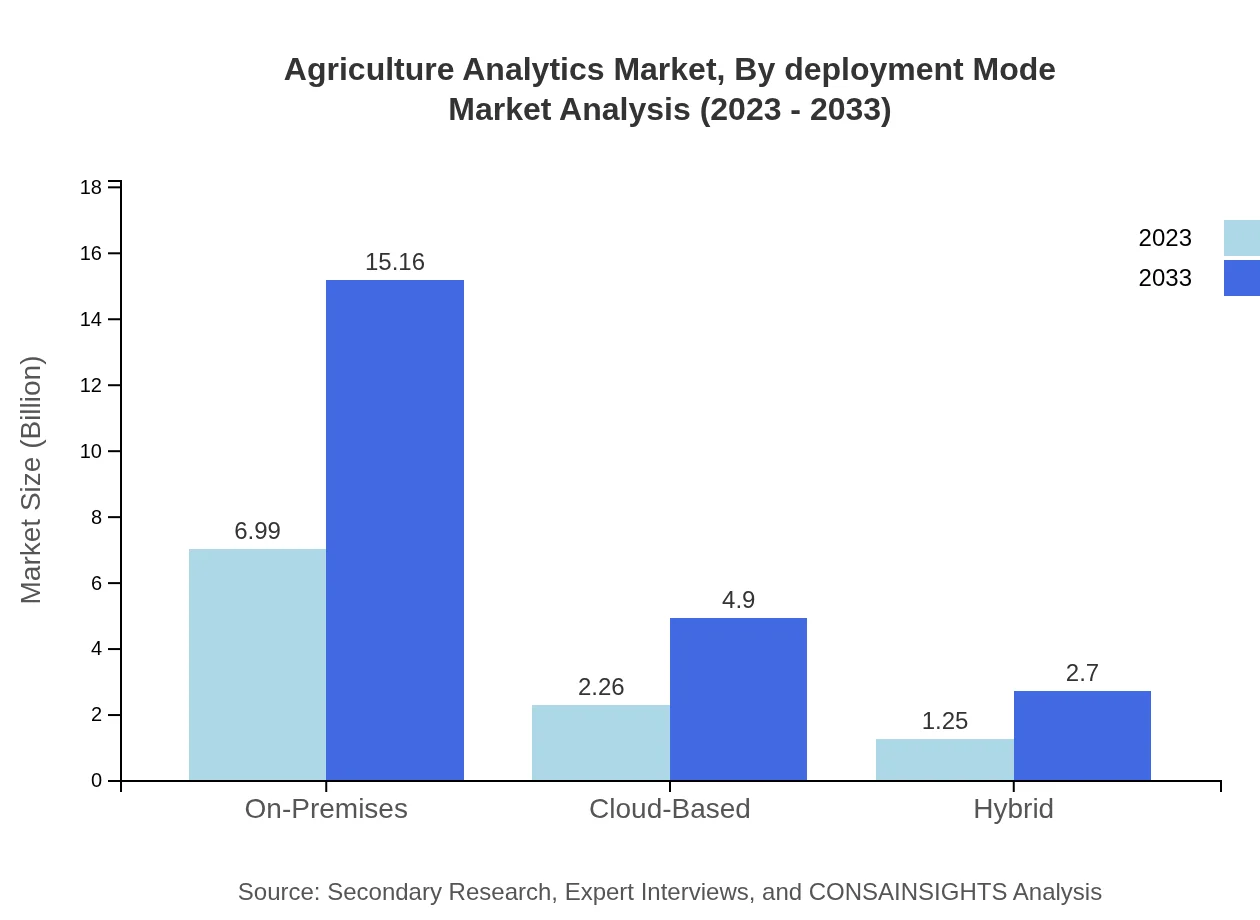

Agriculture Analytics Market Analysis By Deployment Mode

The deployment mode segment features on-premises solutions, which hold a significant share with $6.99 billion in 2023 projected to grow to $15.16 billion by 2033 (66.61% market share), cloud-based solutions ($2.26 billion in 2023, growing to $4.90 billion by 2033, 21.53%), illustrating the transition to flexible computing. Hybrid models are also seeing increased adoption due to their flexibility.

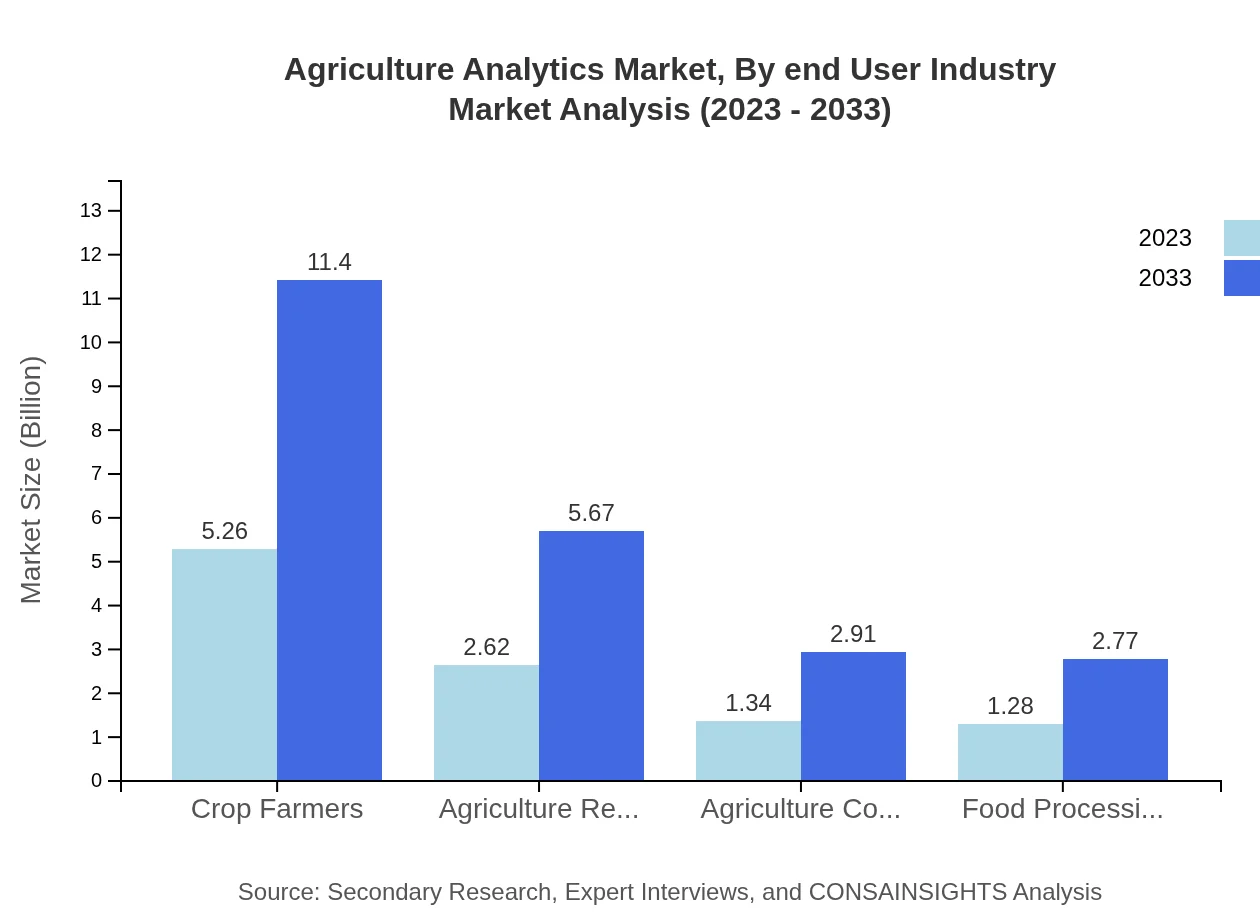

Agriculture Analytics Market Analysis By End User Industry

End-user segmentation reveals crop farmers leading the market with a size of $5.26 billion in 2023, anticipated to reach $11.40 billion by 2033 (50.1% market share), followed by agriculture research institutions ($2.62 billion in 2023, increasing to $5.67 billion by 2033, 24.91% market share). The food processing industry also plays a crucial role in analytics adoption, with market shifts towards analytics for quality control and supply chain management.

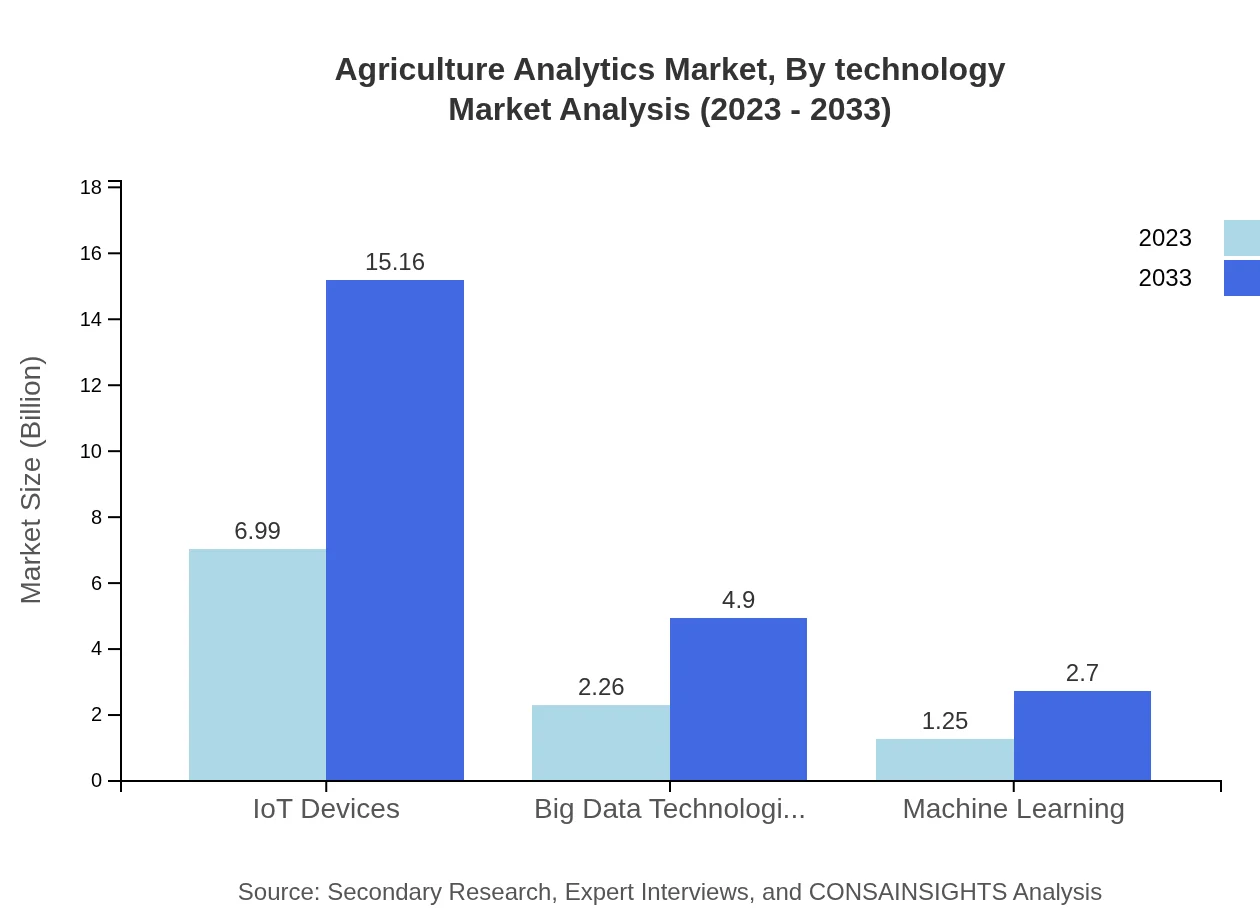

Agriculture Analytics Market Analysis By Technology

Key technologies in the agriculture analytics market include machine learning ($1.25 billion in 2023, rising to $2.70 billion by 2033, 11.86% market share) and big data technologies ($2.26 billion in 2023, growing to $4.90 billion by 2033, 21.53%). These technologies are crucial in processing large datasets, enabling real-time analytics that drive decision-making in agricultural practices.

Agriculture Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agriculture Analytics Industry

IBM:

IBM is a pioneer in data analytics and cloud-based solutions, offering a comprehensive suite of tools dedicated to agricultural sustainability.Monsanto:

Monsanto provides innovative biotechnology and data-driven solutions, greatly impacting yield optimization and resource management for farmers.Trimble:

Trimble specializes in advanced agricultural solutions that use technology to enhance precision farming practices.SAS:

SAS focuses on analytics software and solutions, aiding agricultural businesses in optimizing operations and decision-making.Aker Smart Farming:

Aker Smart Farming integrates sensors and analytics, providing insights that help farmers improve productivity and traceability.We're grateful to work with incredible clients.

FAQs

What is the market size of agriculture Analytics?

The agriculture analytics market is currently valued at approximately $10.5 billion and is projected to grow at a compound annual growth rate (CAGR) of 7.8%. This growth is indicative of increasing adoption of technology-driven solutions in the agriculture sector.

What are the key market players or companies in the agriculture Analytics industry?

Key players in the agriculture analytics industry include major companies like IBM, Trimble Inc., and SAP, which are leading in providing advanced analytics tools, IoT solutions, and consulting services aimed at optimizing farming practices and enhancing crop yields.

What are the primary factors driving the growth in the agriculture Analytics industry?

Growth in the agriculture analytics market is driven by factors including the increasing demand for food due to population growth, advancements in technology like IoT and machine learning, and the need for sustainable farming practices to improve productivity and reduce resource consumption.

Which region is the fastest Growing in the agriculture Analytics?

North America is identified as the fastest-growing region in the agriculture analytics market, expanding from $3.86 billion in 2023 to $8.36 billion by 2033, reflecting heightened adoption of tech-oriented agricultural solutions in the region.

Does ConsaInsights provide customized market report data for the agriculture Analytics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the agriculture analytics industry, allowing clients to gain detailed insights based on unique requirements and market conditions.

What deliverables can I expect from this agriculture Analytics market research project?

Clients can expect comprehensive deliverables including detailed market size analysis, growth forecasts, segment breakdowns, competitive landscape evaluations, regional insights, and tailored recommendations to inform strategic decision-making.

What are the market trends of agriculture Analytics?

Current trends in the agriculture analytics market include the rise of precision farming, increasing integration of artificial intelligence for predictive analytics, and a growing focus on sustainability through data-driven farming approaches, enhancing crop management and efficiency.