Agriculture Chemical Packaging Market Report

Published Date: 01 February 2026 | Report Code: agriculture-chemical-packaging

Agriculture Chemical Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Agriculture Chemical Packaging market spanning from 2023 to 2033, highlighting key insights, market dynamics, and growth projections for various segments and regions in this vital industry.

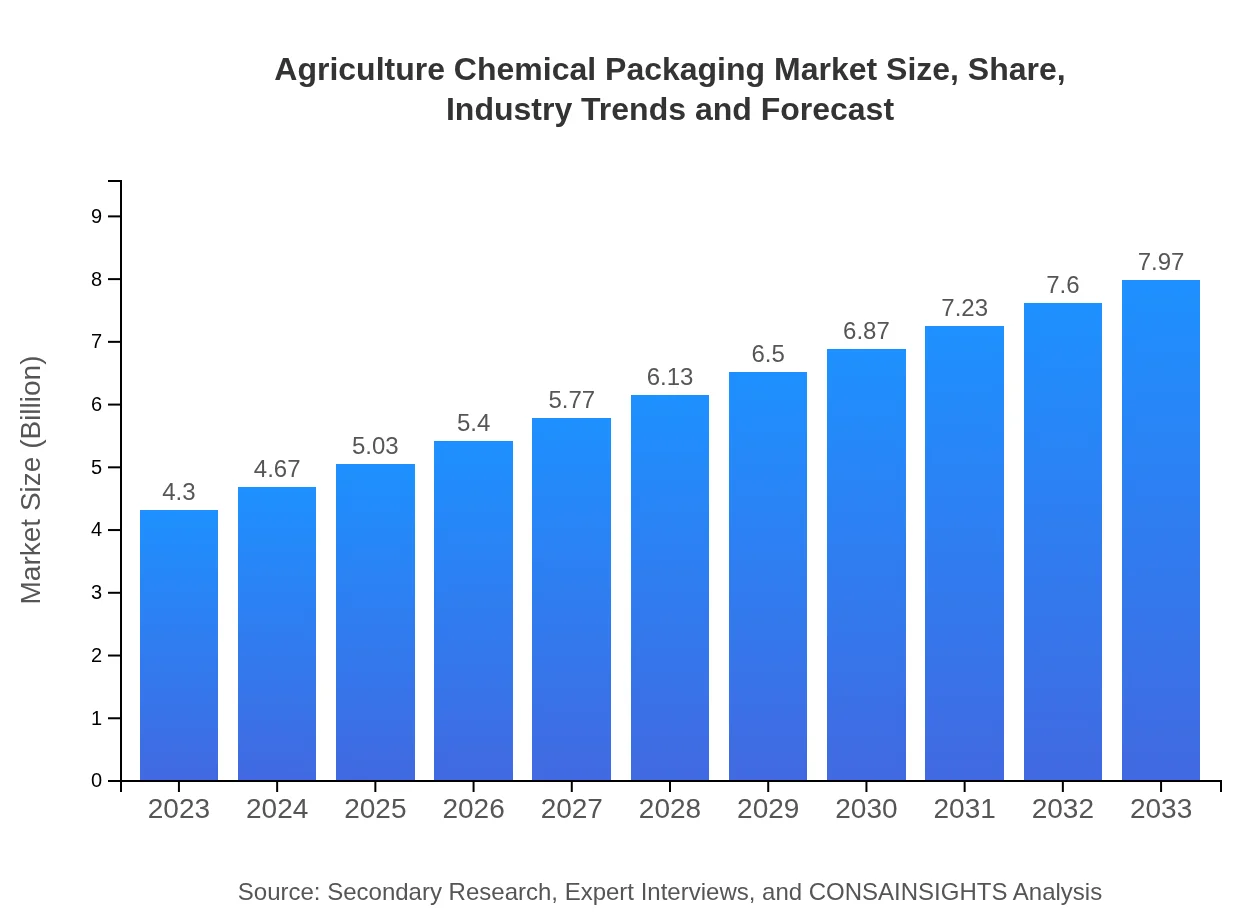

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.30 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $7.97 Billion |

| Top Companies | Amcor plc, Berry Global Group, Inc., Sealed Air Corporation, Mondi Group |

| Last Modified Date | 01 February 2026 |

Agriculture Chemical Packaging Market Overview

Customize Agriculture Chemical Packaging Market Report market research report

- ✔ Get in-depth analysis of Agriculture Chemical Packaging market size, growth, and forecasts.

- ✔ Understand Agriculture Chemical Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agriculture Chemical Packaging

What is the Market Size & CAGR of Agriculture Chemical Packaging market in 2023?

Agriculture Chemical Packaging Industry Analysis

Agriculture Chemical Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agriculture Chemical Packaging Market Analysis Report by Region

Europe Agriculture Chemical Packaging Market Report:

In Europe, the market will increase from $1.16 billion in 2023 to $2.15 billion by 2033. The focus on environmentally friendly packaging solutions and compliance with the EU's strict regulations on agricultural chemicals is facilitating market expansion.Asia Pacific Agriculture Chemical Packaging Market Report:

In the Asia Pacific region, the Agriculture Chemical Packaging market is expected to grow from $0.86 billion in 2023 to $1.59 billion by 2033. This positive trend is driven by increasing agricultural production and the adoption of advanced packaging technologies among countries like China and India.North America Agriculture Chemical Packaging Market Report:

North America is forecasted to grow from $1.49 billion in 2023 to $2.76 billion by 2033. The demand for sustainable packaging in the U.S. and Canada, propelled by stringent regulatory frameworks, is a major contributor to this growth.South America Agriculture Chemical Packaging Market Report:

The South America market, valued at $0.36 billion in 2023, is projected to reach $0.66 billion by 2033. Factors such as agricultural expansion and effective supply chain mechanisms contribute to its growth, with Brazil and Argentina being the pivotal markets.Middle East & Africa Agriculture Chemical Packaging Market Report:

The Middle East and Africa segment is expected to expand from $0.44 billion in 2023 to $0.82 billion by 2033, driven by rising agricultural activities and investments in sustainable practices across various nations.Tell us your focus area and get a customized research report.

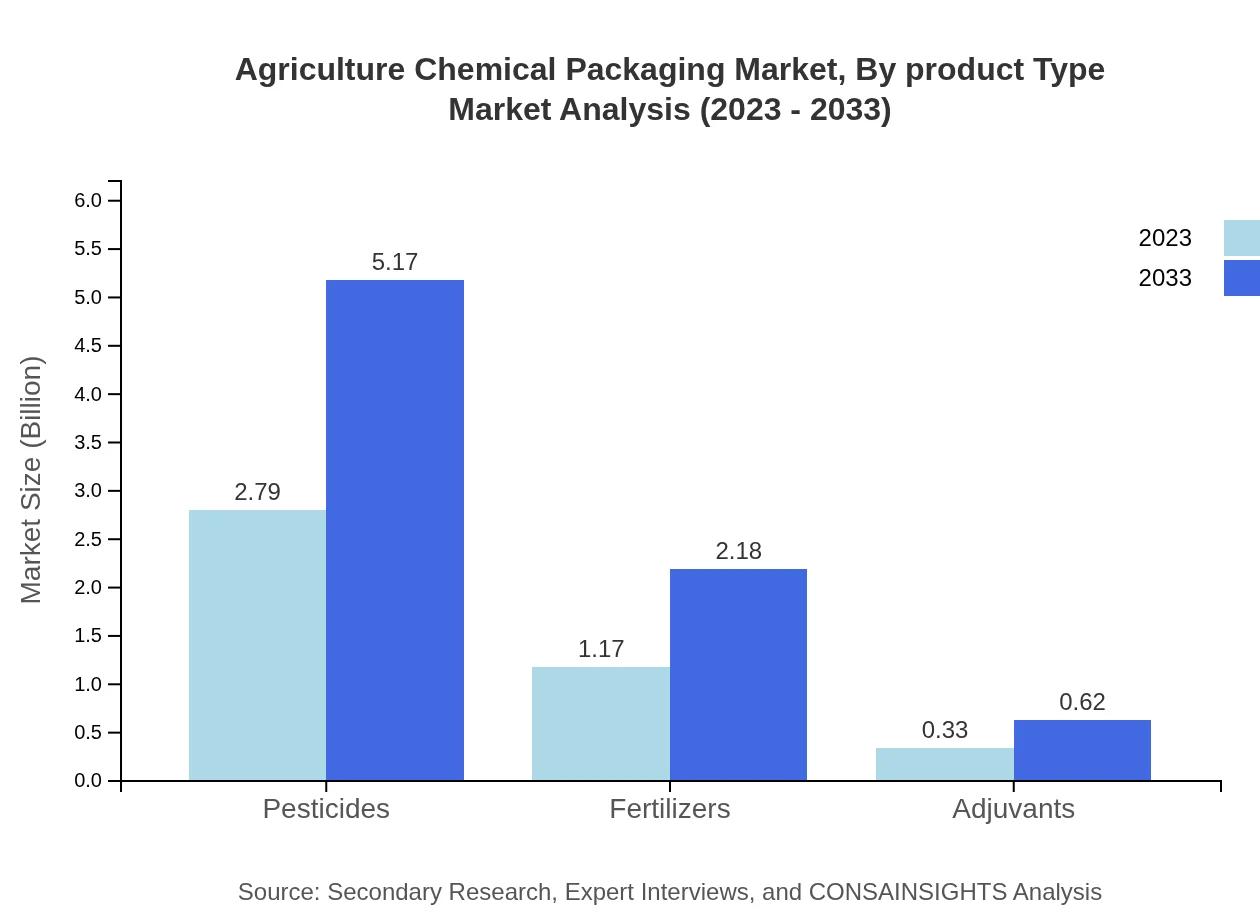

Agriculture Chemical Packaging Market Analysis By Product Type

The Agriculture Chemical Packaging Market by product type showcases significant growth across various segments, with pesticides leading the way, projected to grow from $2.79 billion in 2023 to $5.17 billion by 2033, capturing a significant market share. Fertilizers follow, with an increase from $1.17 billion to $2.18 billion in the same period, emphasizing the critical role of these products in agricultural productivity.

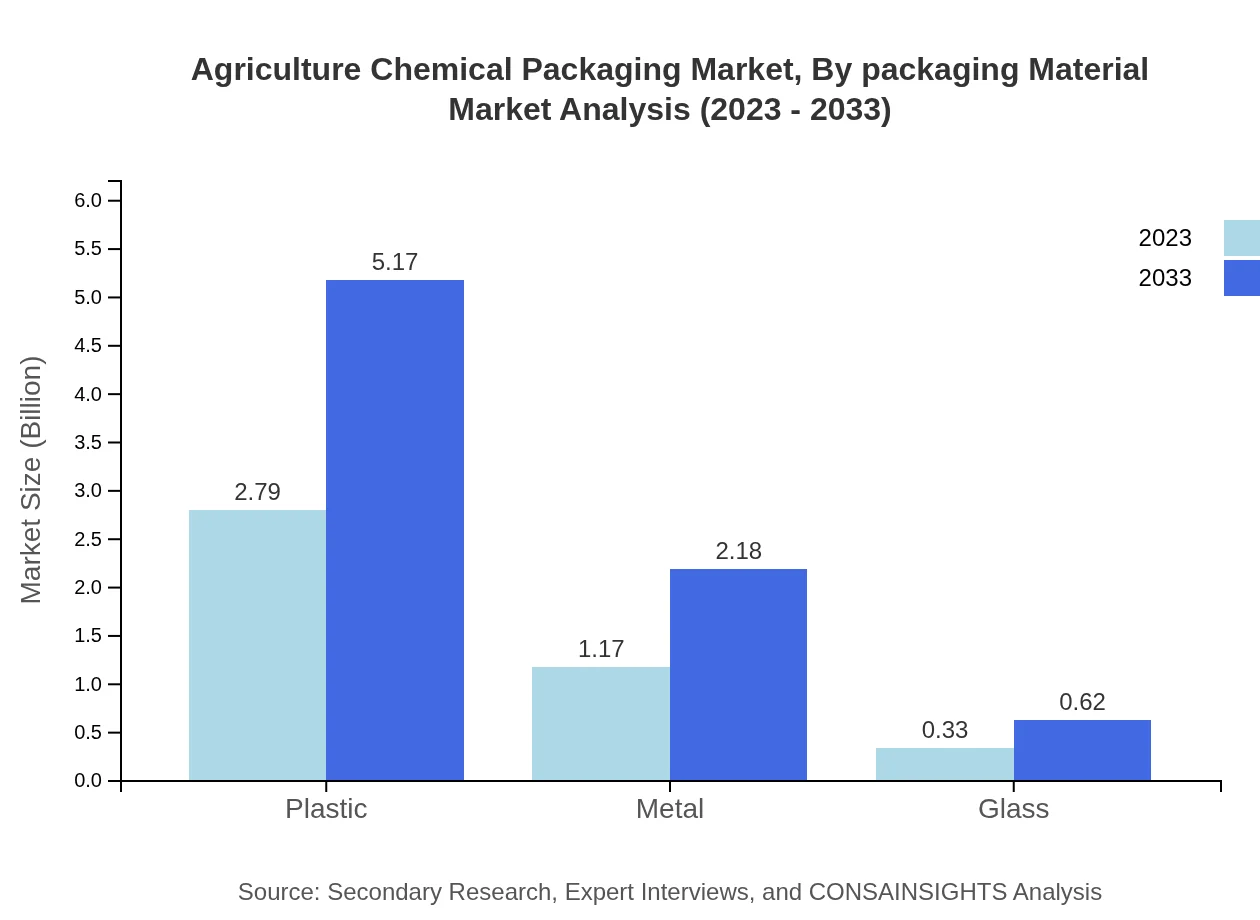

Agriculture Chemical Packaging Market Analysis By Packaging Material

Packaging materials play an important role in the Agriculture Chemical Packaging market, particularly plastic which accounted for a sizeable share at $2.79 billion in 2023, expected to rise to $5.17 billion by 2033. Metal and glass materials, although smaller segments, show growth trajectories due to their durability and recyclability, with metal increasing from $1.17 billion to $2.18 billion.

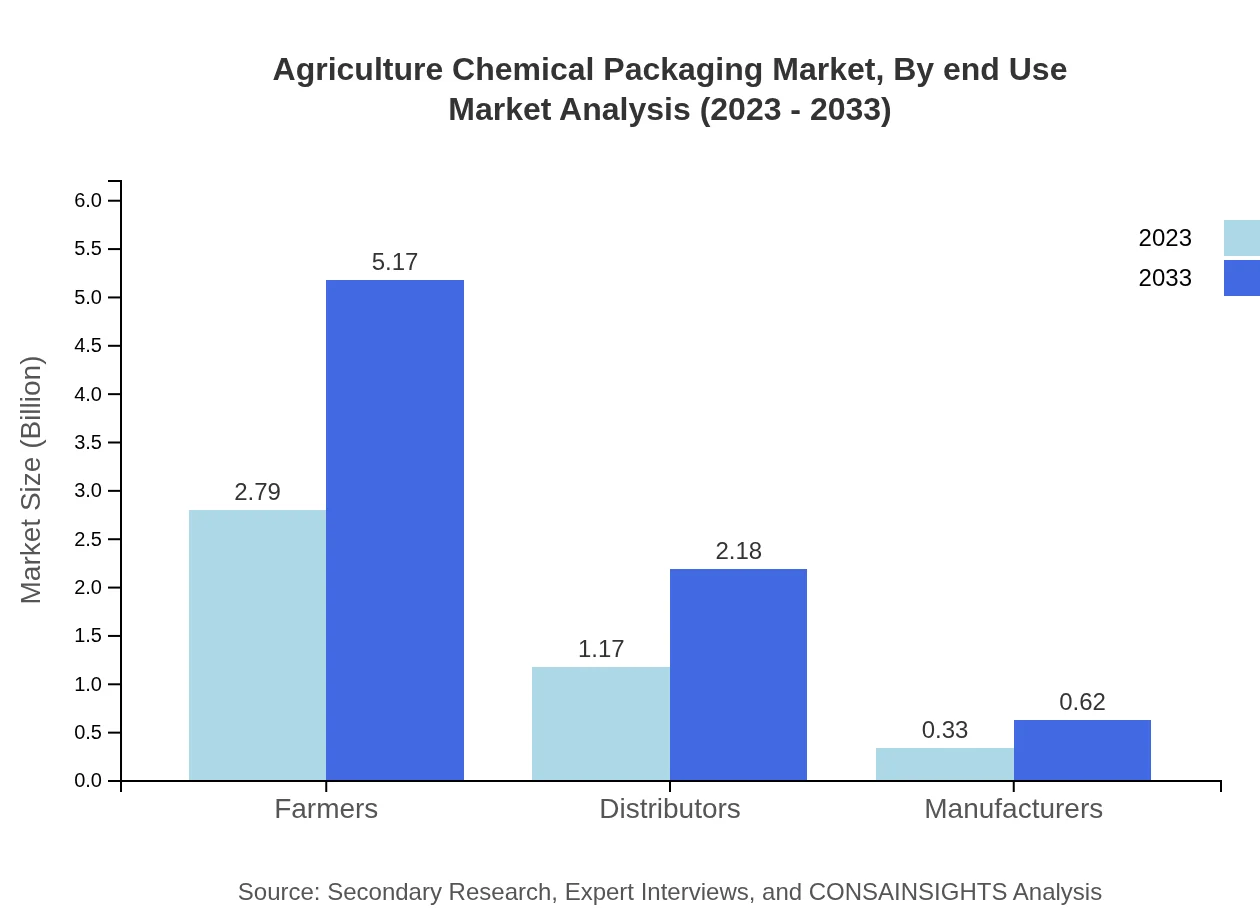

Agriculture Chemical Packaging Market Analysis By End Use

The agriculture chemical packaging market by end-use is becoming increasingly vital for farmers and distributors, with farmers holding a substantial share of $2.79 billion in 2023, anticipated to increase to $5.17 billion by 2033. Distributors are projected to grow from $1.17 billion to $2.18 billion, highlighting the importance of effective distribution channels in packaging.

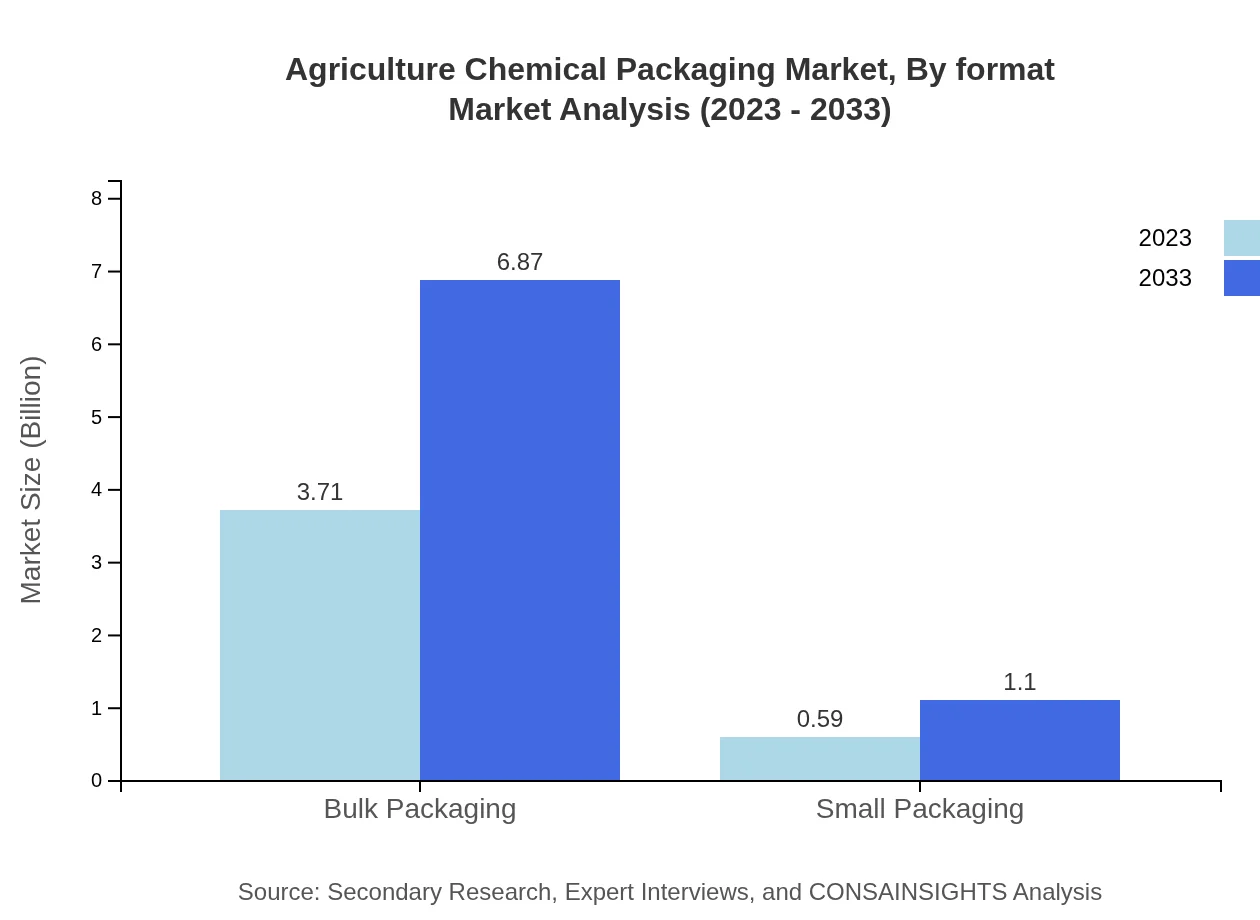

Agriculture Chemical Packaging Market Analysis By Format

In terms of format, flexible packaging is anticipated to dominate the Agriculture Chemical Packaging market, swelling from $3.71 billion in 2023 to $6.87 billion by 2033. This is contrasted with rigid packaging which is growing steadily, indicating a shift towards convenience and usability in packaging options.

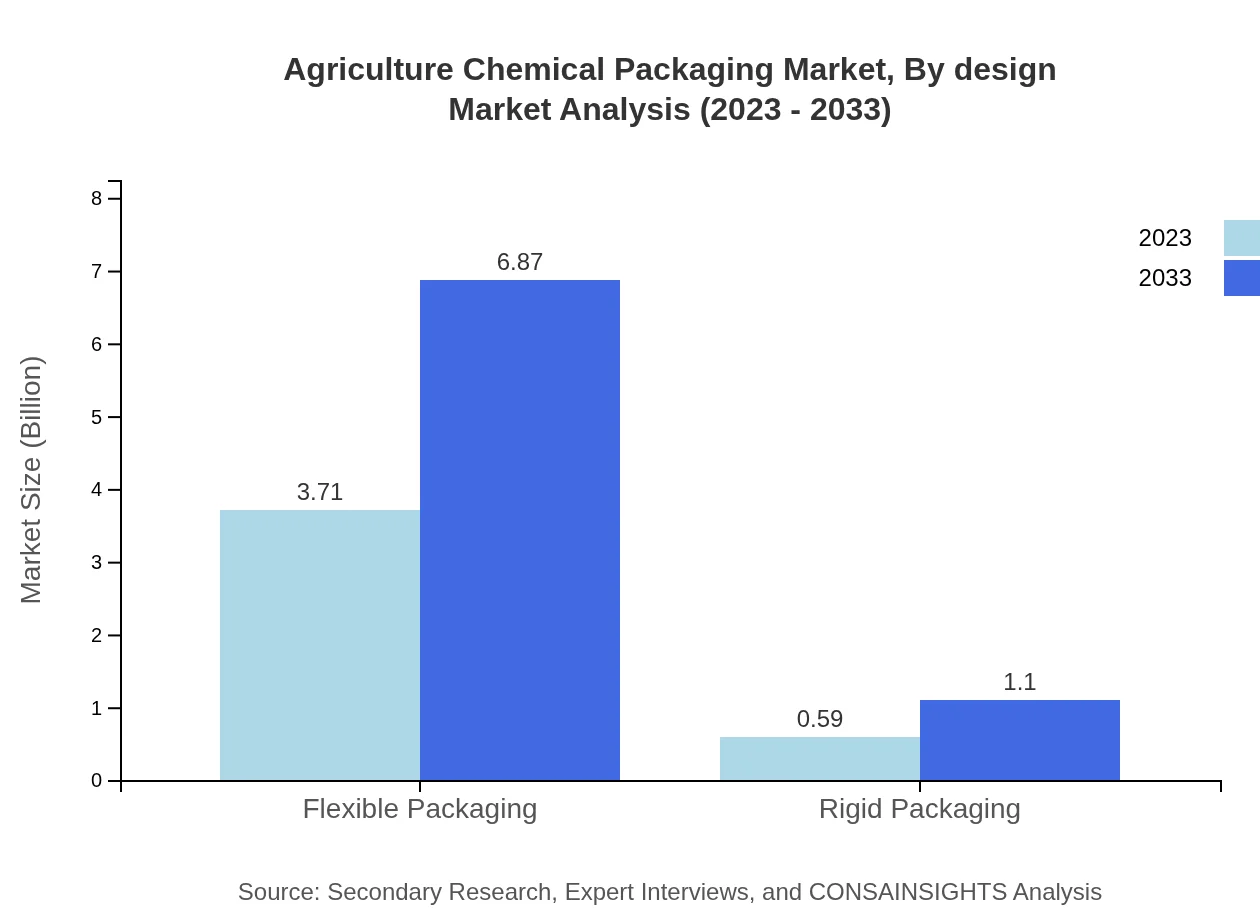

Agriculture Chemical Packaging Market Analysis By Design

Packaging design is crucial for product appeal and functionality, with trends leaning towards sustainable designs that reduce environmental impacts. Innovations in design will continue to shape the Agriculture Chemical Packaging market by enhancing consumer interactions and supporting tracking solutions for better product management.

Agriculture Chemical Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agriculture Chemical Packaging Industry

Amcor plc:

A leading global packaging company, Amcor plc specializes in innovative packaging solutions, including flexible and rigid packaging that meets the stringent requirements of the agriculture industry.Berry Global Group, Inc.:

Berry Global manufactures sustainable packaging products across several segments, including agriculture, focusing on advanced materials and innovative designs to enhance product usability.Sealed Air Corporation:

Known for its superior packaging solutions, Sealed Air Corporation serves the agricultural market with specialized coatings and packaging, enhancing the protection and shelf-life of agricultural chemicals.Mondi Group:

Mondi Group is recognized for its sustainable packaging solutions tailored for the agricultural sector, emphasizing recyclable and biodegradable materials to meet market demands.We're grateful to work with incredible clients.

FAQs

What is the market size of Agriculture Chemical Packaging?

The Agriculture Chemical Packaging market is valued at approximately $4.3 billion in 2023, with a projected CAGR of 6.2%, indicating robust growth prospects through 2033.

What are the key market players or companies in this Agriculture Chemical Packaging industry?

Key players in the Agriculture Chemical Packaging industry include major packaging companies and agricultural chemical firms focusing on innovation in sustainability and efficiency.

What are the primary factors driving the growth in the Agriculture Chemical Packaging industry?

Growth in the Agriculture Chemical Packaging industry is primarily driven by rising demand for sustainable packaging solutions, increasing agricultural chemicals use, and stringent regulations regarding pesticide transportation and storage.

Which region is the fastest Growing in the Agriculture Chemical Packaging?

The fastest-growing region in Agriculture Chemical Packaging is North America, projected to grow from $1.49 billion in 2023 to $2.76 billion by 2033, emphasizing its significant expansion potential.

Does ConsaInsights provide customized market report data for the Agriculture Chemical Packaging industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the Agriculture Chemical Packaging industry to meet various client needs.

What deliverables can I expect from this Agriculture Chemical Packaging market research project?

Expect detailed market analysis reports, regional insights, segment breakdowns, competitor analysis, and strategic recommendations tailored to the Agriculture Chemical Packaging market.

What are the market trends of Agriculture Chemical Packaging?

Key trends in Agriculture Chemical Packaging include a shift towards eco-friendly materials, increasing adoption of flexible packaging solutions, and technological advancements in packaging design.