Agriculture Micronutrient Market Report

Published Date: 02 February 2026 | Report Code: agriculture-micronutrient

Agriculture Micronutrient Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Agriculture Micronutrient market, covering current trends, growth forecasts, and a detailed regional breakdown from 2023 to 2033. The insights include market size, technological advancements, and key players shaping the industry.

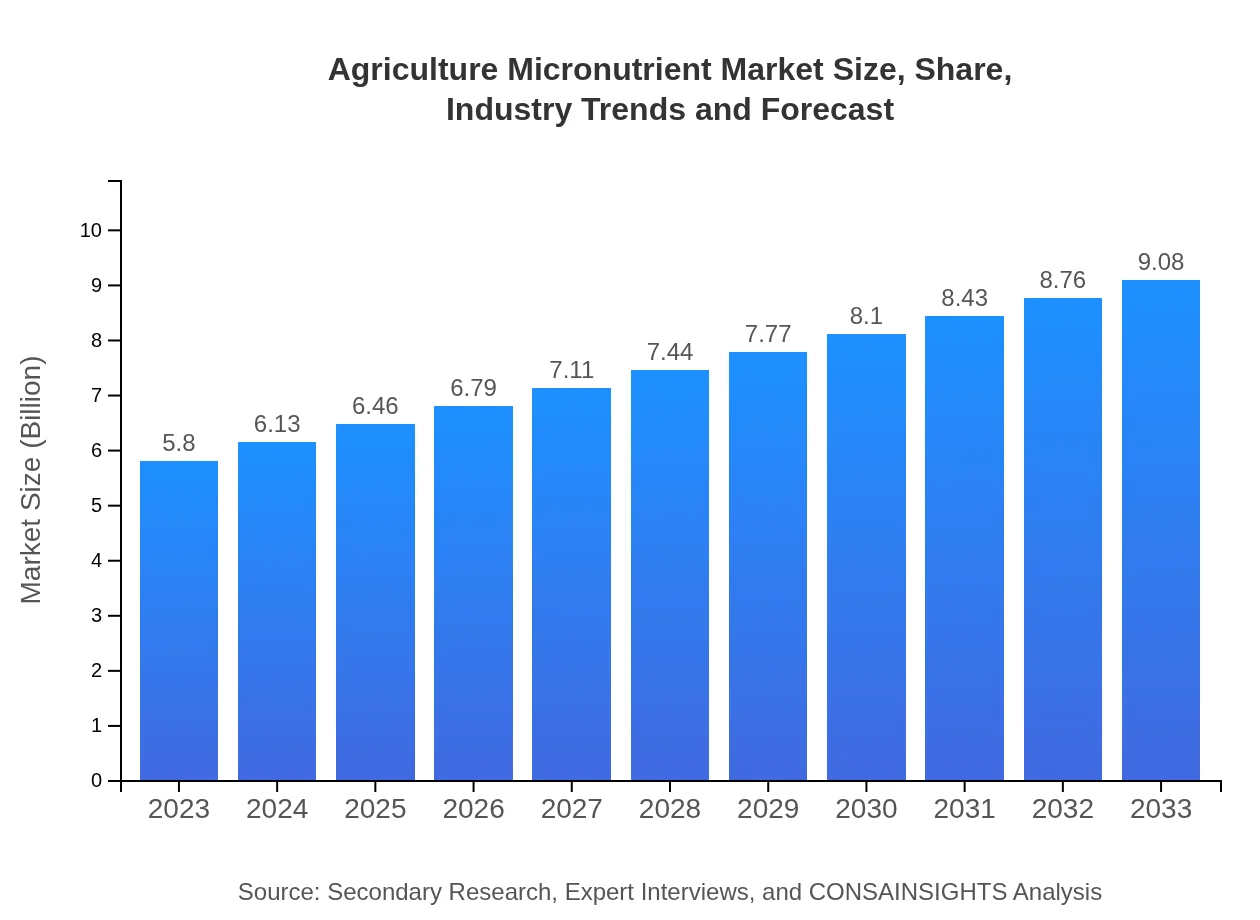

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $9.08 Billion |

| Top Companies | Nutrien Ltd., Yara International ASA, The Mosaic Company, BASF SE, Haifa Group |

| Last Modified Date | 02 February 2026 |

Agriculture Micronutrient Market Overview

Customize Agriculture Micronutrient Market Report market research report

- ✔ Get in-depth analysis of Agriculture Micronutrient market size, growth, and forecasts.

- ✔ Understand Agriculture Micronutrient's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agriculture Micronutrient

What is the Market Size & CAGR of Agriculture Micronutrient market in 2023?

Agriculture Micronutrient Industry Analysis

Agriculture Micronutrient Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agriculture Micronutrient Market Analysis Report by Region

Europe Agriculture Micronutrient Market Report:

The European market for agriculture micronutrients is poised for growth, with an estimated size of 1.52 billion USD in 2023, reaching 2.38 billion USD by 2033. Regulatory policies favoring sustainable agricultural practices, along with the rising demand for organic produce, are the main factors driving this trend.Asia Pacific Agriculture Micronutrient Market Report:

The Asia Pacific region holds a significant share of the agriculture micronutrient market, with an estimated market size of 1.13 billion USD in 2023, projected to grow to 1.77 billion USD by 2033. The rapid adoption of advanced farming techniques and increasing awareness among farmers regarding the importance of micronutrients are driving this growth.North America Agriculture Micronutrient Market Report:

North America is anticipated to witness robust growth, with market size increasing from 2.21 billion USD in 2023 to 3.45 billion USD by 2033. The advancement of agricultural technologies, coupled with a strong emphasis on organic farming, is bolstering the demand for micronutrients in this region.South America Agriculture Micronutrient Market Report:

In South America, the agriculture micronutrient market is expected to increase from 0.25 billion USD in 2023 to 0.40 billion USD in 2033. The growing demand for high-quality crops and government support in sustainable agricultural practices are key factors contributing to market growth in this region.Middle East & Africa Agriculture Micronutrient Market Report:

The Middle East and Africa market is experiencing gradual growth, with the market size expected to rise from 0.69 billion USD in 2023 to 1.08 billion USD by 2033. Awareness about the importance of micronutrients in improving crop outputs is slowly gaining traction in the region.Tell us your focus area and get a customized research report.

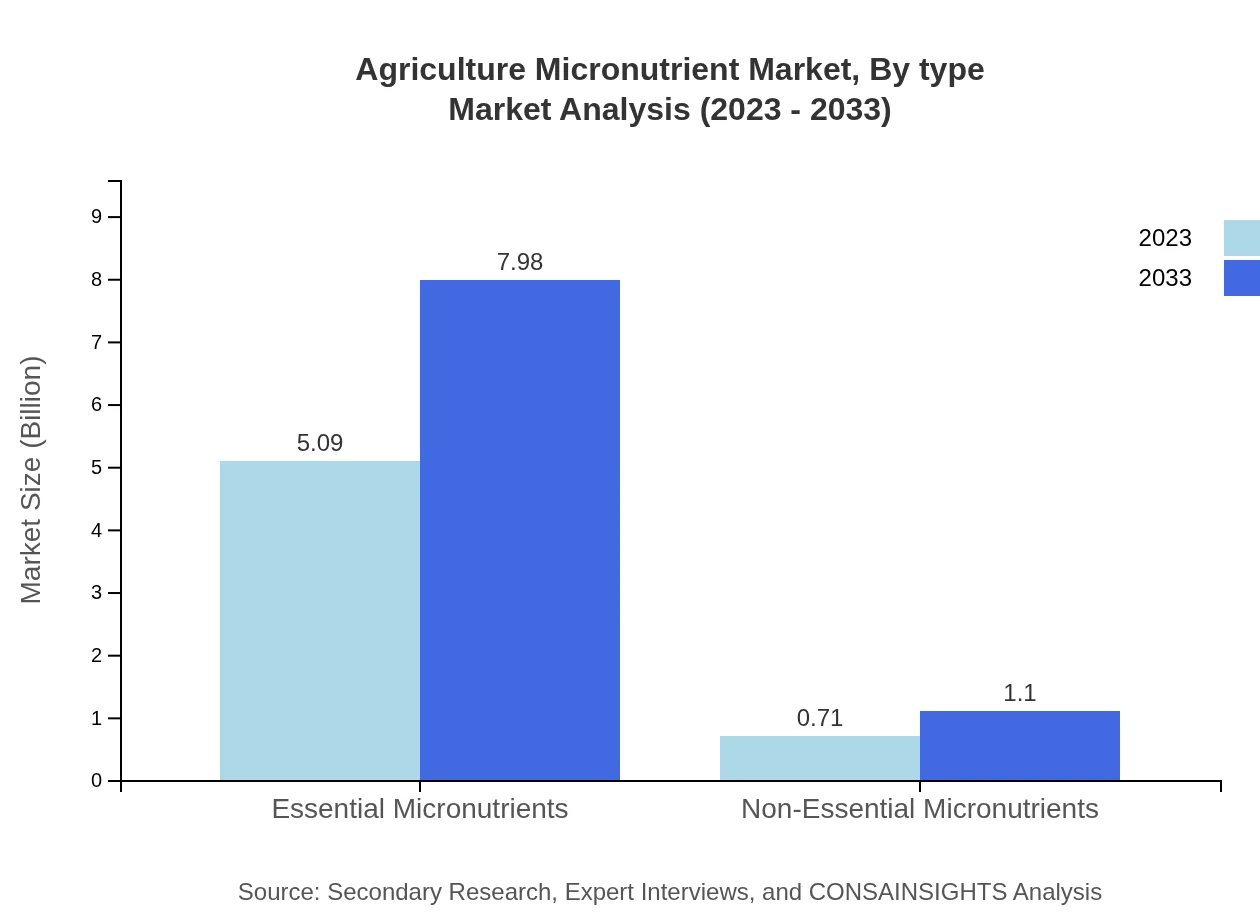

Agriculture Micronutrient Market Analysis By Type

The market is primarily segmented into essential and non-essential micronutrients. Essential micronutrients, which include zinc and iron, form the bulk of the market size at 5.09 billion USD in 2023, expected to grow to 7.98 billion USD by 2033. Non-essential micronutrients presently account for a lower market share, emphasizing the importance of essential ones which primarily drive demand.

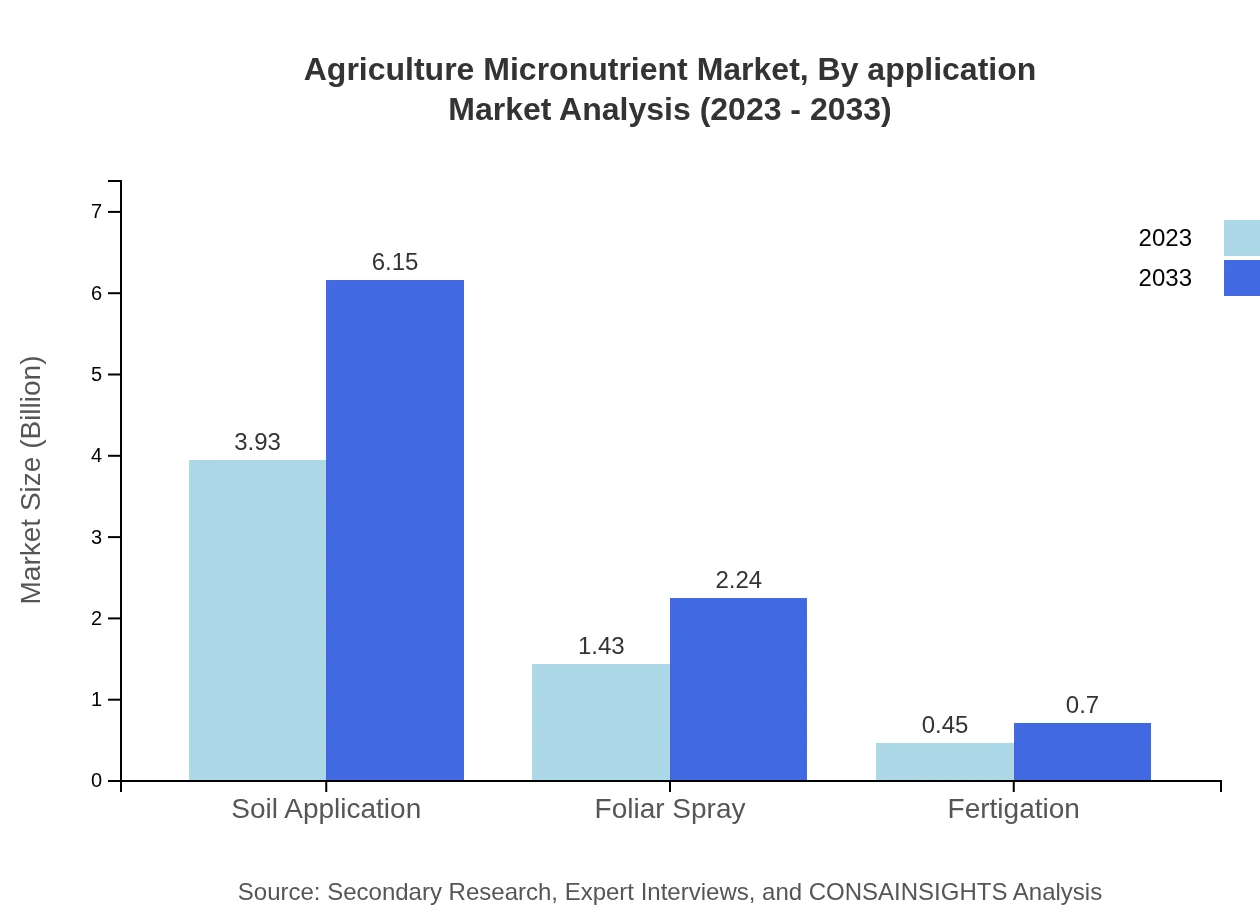

Agriculture Micronutrient Market Analysis By Application

The application segment highlights the significance of soil application, foliar spray, and fertigation. Soil application leads the market, with a size of 3.93 billion USD in 2023 and projected growth to 6.15 billion USD by 2033. Foliar spray and fertigation are also critical application methods, expected to enhance the effectiveness of micronutrient applications.

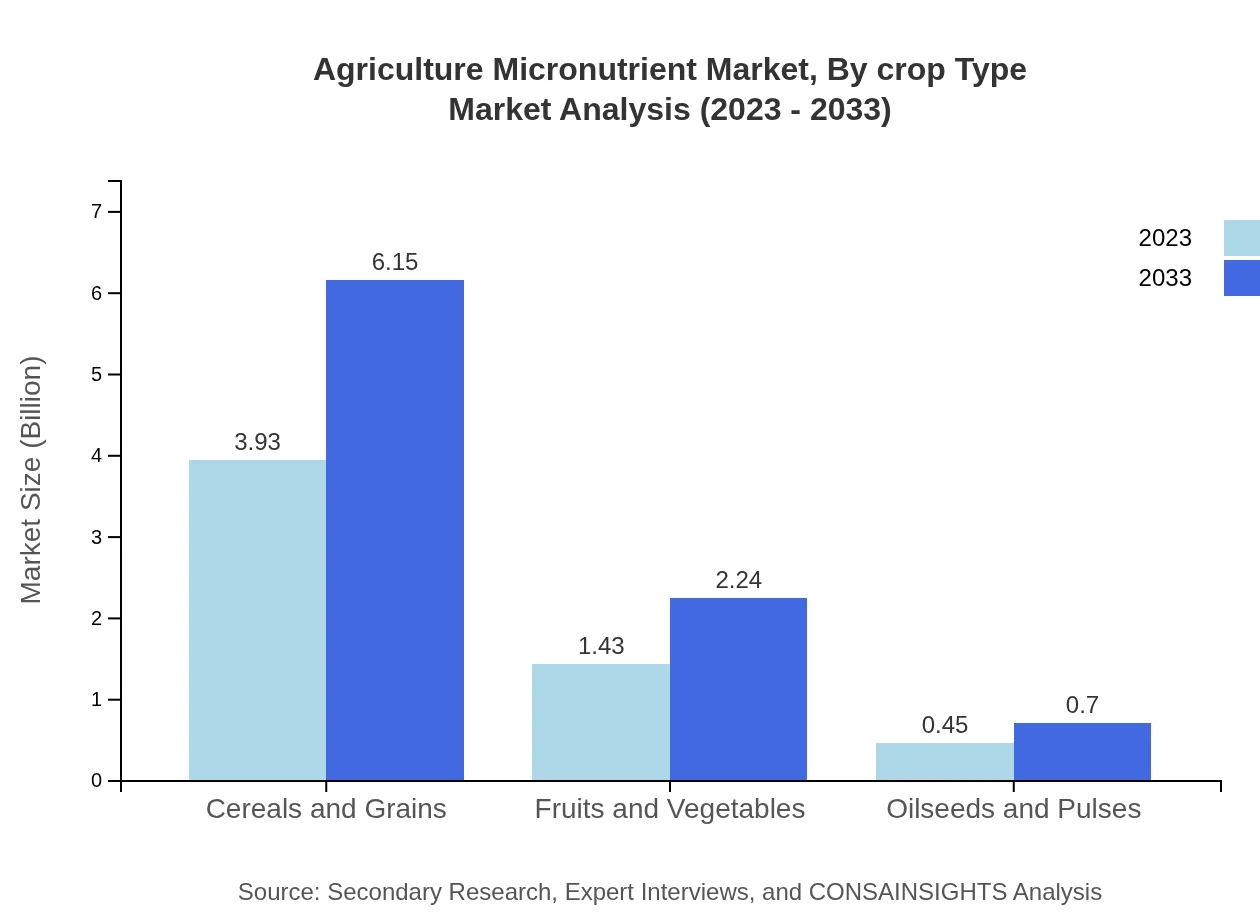

Agriculture Micronutrient Market Analysis By Crop Type

Cereals and grains dominate the crop type segmentation, accounting for a sizable market share valued at 3.93 billion USD in 2023, expected to reach 6.15 billion USD by 2033. Fruits and vegetables, followed by oilseeds and pulses, are also significant, indicating diverse applications of micronutrients within different farming practices.

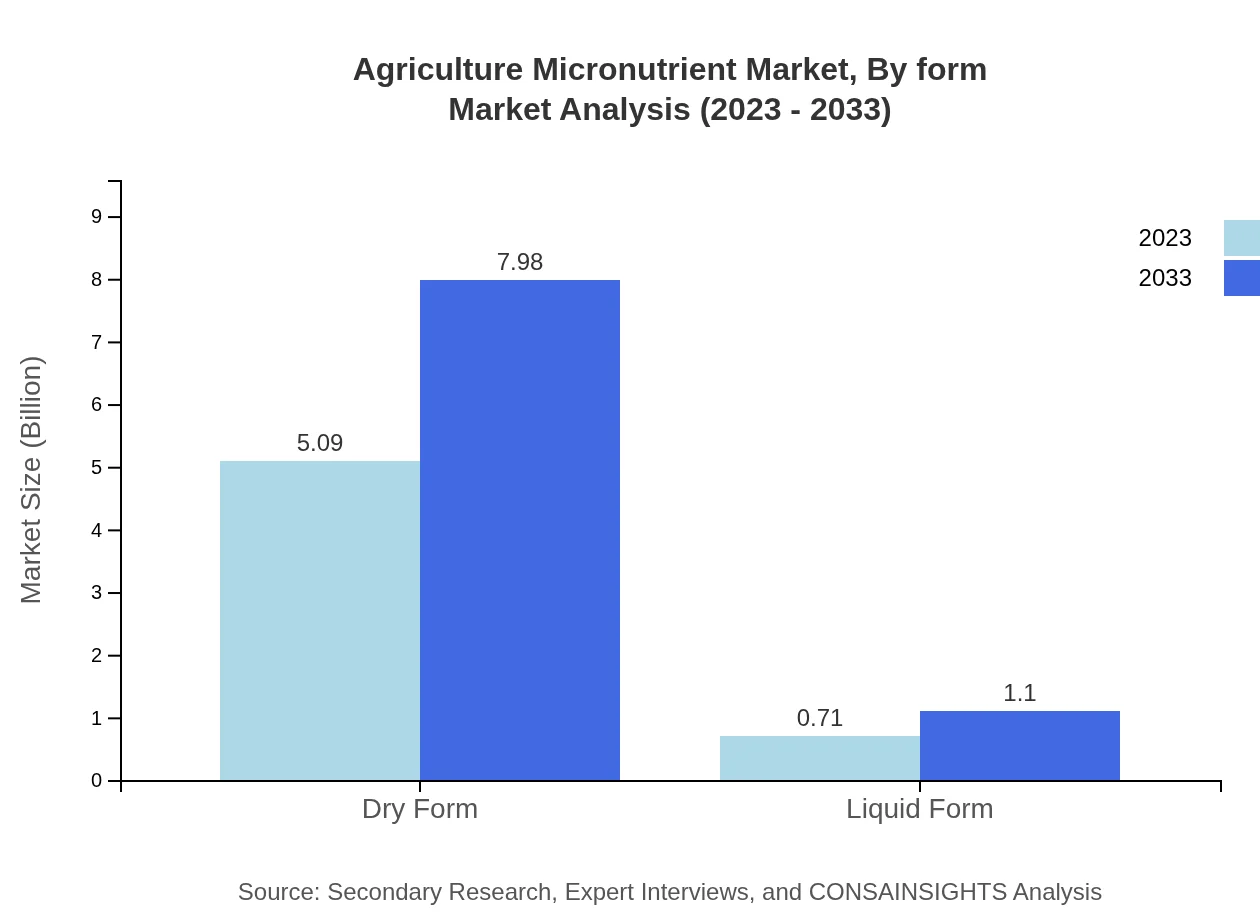

Agriculture Micronutrient Market Analysis By Form

Dry forms of micronutrients represent a substantial part of the market, with a size of 5.09 billion USD in 2023, forecasted to grow to 7.98 billion USD by 2033. Liquid forms are gaining traction, expected to rise from 0.71 billion USD in 2023 to 1.10 billion USD by 2033, reflecting shifting preferences towards versatile application methods.

Agriculture Micronutrient Market Analysis By Distribution Channel

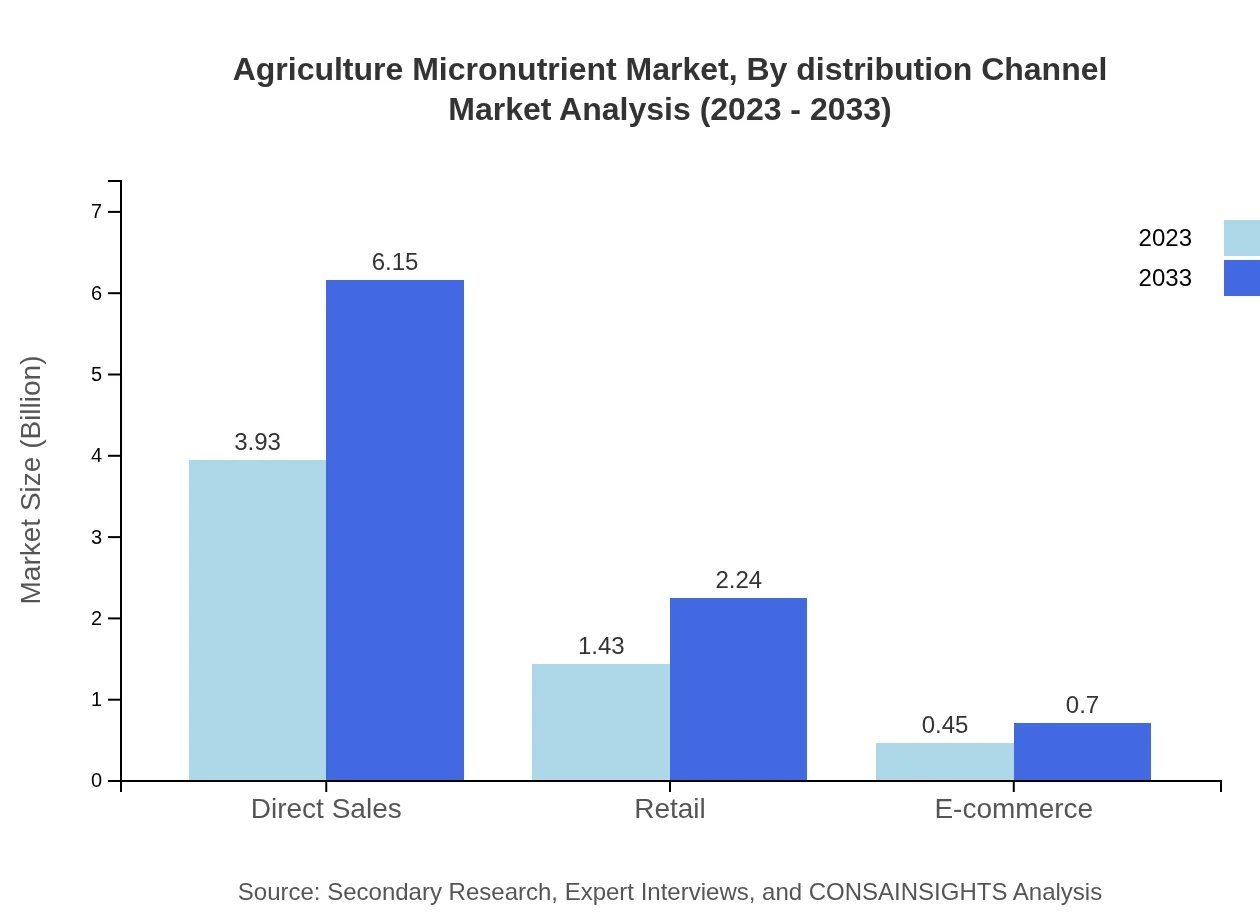

The agriculture micronutrient market is supported by direct sales as the leading distribution channel, valued at 3.93 billion USD in 2023, with projections to grow to 6.15 billion USD by 2033. Both retail and e-commerce channels are integral, representing 1.43 billion USD and 0.45 billion USD, respectively, highlighting the importance of accessibility to farm supplies.

Agriculture Micronutrient Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agriculture Micronutrient Industry

Nutrien Ltd.:

Nutrien is a leading provider of crop inputs and services, including a broad range of micronutrient products aimed at enhancing agricultural yield and soil health.Yara International ASA:

Yara is a global leader in crop nutrition, providing dedicated micronutrient solutions that improve plant health and productivity through advanced formulations.The Mosaic Company:

Mosaic specializes in crop nutrition and offers a range of micronutrient fertilizers and products that support sustainable agriculture.BASF SE:

BASF is a chemical company that integrates micronutrients into efficient crop protection solutions to optimize agricultural outputs.Haifa Group:

Haifa Group focuses on developing and marketing innovative fertilizers, including specialty micronutrients that enhance growth and crop quality.We're grateful to work with incredible clients.

FAQs

What is the market size of agriculture Micronutrient?

The global agriculture micronutrient market is currently valued at approximately $5.8 billion, with an expected CAGR of 4.5% from 2023 to 2033. This growth indicates increasing focus on soil health and crop yield enhancements.

What are the key market players or companies in the agriculture Micronutrient industry?

Major players in the agriculture micronutrient market include Nutrient Ag Solutions, Yara International, and Haifa Group. These companies drive innovation and market strategies, contributing significantly to industry growth.

What are the primary factors driving the growth in the agriculture Micronutrient industry?

Key drivers for the agriculture micronutrient market include increasing global food demand, advancements in agricultural technologies, and the rising awareness of soil health. Sustainable farming practices also contribute to this growth.

Which region is the fastest Growing in the agriculture Micronutrient?

The North America region is expected to grow the fastest, rising from $2.21 billion in 2023 to $3.45 billion in 2033. Asia-Pacific also shows considerable growth, increasing from $1.13 billion to $1.77 billion.

Does ConsaInsights provide customized market report data for the agriculture Micronutrient industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the agriculture micronutrient industry. This includes detailed insights and analysis aligned with unique business goals.

What deliverables can I expect from this agriculture Micronutrient market research project?

Deliverables include thorough market analysis, trend forecasts, competitive landscape assessments, and customized insights. This data will support informed decision-making and strategic planning for businesses.

What are the market trends of agriculture Micronutrient?

Current trends include a shift towards sustainable farming practices and increased reliance on precision agriculture. The demand for essential micronutrients remains high, with dry forms composition dominating the market share.