Agrochemical And Pesticide Market Report

Published Date: 02 February 2026 | Report Code: agrochemical-and-pesticide

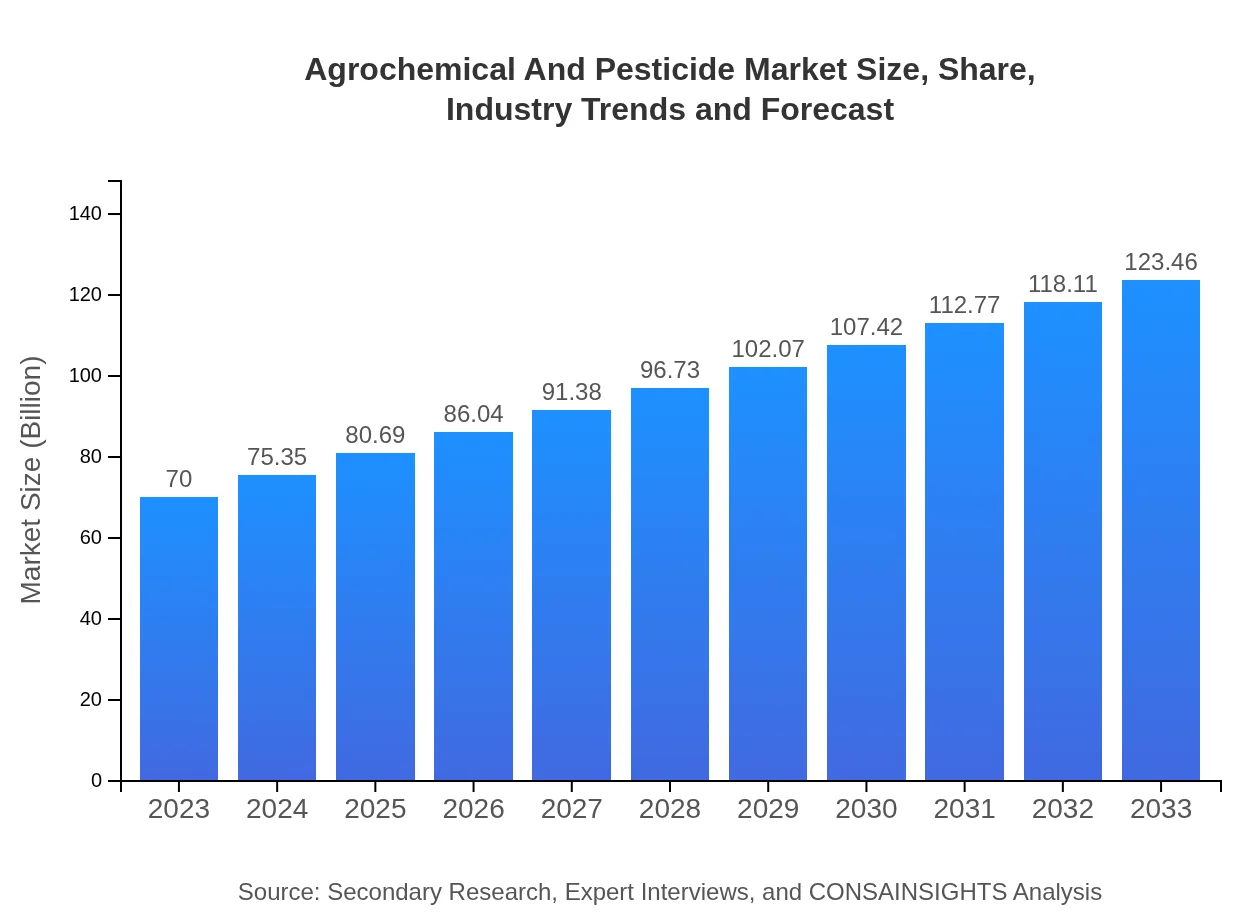

Agrochemical And Pesticide Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Agrochemical and Pesticide market, highlighting key trends, growth opportunities, and regional dynamics, accompanied by market size forecasts and a detailed segmentation approach for the period from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $70.00 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $123.46 Billion |

| Top Companies | Bayer Crop Science, Syngenta AG, BASF SE, Dow AgroSciences, FMC Corporation |

| Last Modified Date | 02 February 2026 |

Agrochemical And Pesticide Market Overview

Customize Agrochemical And Pesticide Market Report market research report

- ✔ Get in-depth analysis of Agrochemical And Pesticide market size, growth, and forecasts.

- ✔ Understand Agrochemical And Pesticide's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agrochemical And Pesticide

What is the Market Size & CAGR of Agrochemical And Pesticide market in 2023?

Agrochemical And Pesticide Industry Analysis

Agrochemical And Pesticide Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agrochemical And Pesticide Market Analysis Report by Region

Europe Agrochemical And Pesticide Market Report:

Europe's Agrochemical and Pesticide market was valued at $17.56 billion in 2023, projected to escalate to $30.96 billion by 2033. Strict regulations concerning pesticide usage and a shift towards organic farming practices heavily influence this market.Asia Pacific Agrochemical And Pesticide Market Report:

In the Asia Pacific region, the Agrochemical and Pesticide market was valued at $14.60 billion in 2023, projected to grow to $25.75 billion by 2033. The region is driven by rapid agricultural expansion, increased demand for crop yields, and government incentives for sustainable practices.North America Agrochemical And Pesticide Market Report:

North America displays a market size of $24.44 billion in 2023, with forecasts of growing to $43.10 billion by 2033. High adoption of precision farming technologies and stringent regulations favoring environmentally friendly products are key growth drivers.South America Agrochemical And Pesticide Market Report:

The South American market stands at $5.19 billion in 2023, expected to reach $9.16 billion by 2033. Factors boosting growth include rising commodity prices and an increase in biotech crop adoption, enhancing pest management practices.Middle East & Africa Agrochemical And Pesticide Market Report:

The Middle East and Africa market is valued at $8.21 billion in 2023, anticipated to grow to $14.48 billion by 2033. The disparity in agricultural practices and rising income levels in some regions contribute to market growth.Tell us your focus area and get a customized research report.

Agrochemical And Pesticide Market Analysis Herbicides

Global Agrochemical and Pesticide Market, By Product Market Analysis (2023 - 2033)

Herbicides account for a substantial market share, with a size of $40.19 billion in 2023, projected to reach $70.89 billion by 2033. Representing 57.42% of the total market share, their essential role in crop protection is pivotal.

Agrochemical And Pesticide Market Analysis Insecticides

Global Agrochemical and Pesticide Market, By Application Market Analysis (2023 - 2033)

Insecticides, valued at $15.54 billion in 2023 and expected to grow to $27.41 billion by 2033, hold a market share of 22.2%. Their vital contribution to controlling pest populations is crucial for securing crop yields.

Agrochemical And Pesticide Market Analysis Fungicides

Global Agrochemical and Pesticide Market, By Chemical Type Market Analysis (2023 - 2033)

With a market size of $7.04 billion in 2023 projected to grow to $12.41 billion by 2033, fungicides hold 10.05% of the market share. Their importance in managing fungal diseases affecting crops cannot be understated.

Agrochemical And Pesticide Market Analysis Biopesticides

Global Agrochemical and Pesticide Market, By Formulation Market Analysis (2023 - 2033)

Biopesticides are increasingly gaining traction, with market size growing from $7.23 billion in 2023 to $12.75 billion by 2033, accounting for 10.33% market share. Their eco-friendliness and effectiveness are major drivers.

Agrochemical And Pesticide Market Analysis Farmers

Global Agrochemical and Pesticide Market, By End-User Market Analysis (2023 - 2033)

Farmers dominate this market segment, with a size of $57.13 billion in 2023 projected to reach $100.75 billion by 2033, holding an 81.61% market share. The demand from this segment drives continuous innovation.

Agrochemical And Pesticide Market Analysis Distributors and retailers

Global Agrochemical and Pesticide Market, By End-User Market Analysis (2023 - 2033)

Distributor and retailer contributions reflect a size of $12.87 billion in 2023, projected to grow to $22.70 billion by 2033, accounting for 18.39%. Their role in supply chain dynamics is essential.

Agrochemical And Pesticide Market Analysis Crop protection

Global Agrochemical and Pesticide Market, By Application Market Analysis (2023 - 2033)

Crop protection is vital, representing $57.13 billion in 2023, expected to grow to $100.75 billion by 2033, holding an 81.61% share. This segment's focus on safeguarding crops underpins the entire industry.

Agrochemical And Pesticide Market Analysis Non Crop application

Global Agrochemical and Pesticide Market, By Application Market Analysis (2023 - 2033)

Non-crop applications will grow from $12.87 billion in 2023 to $22.70 billion by 2033, representing 18.39%. Their niche in sectors outside traditional farming contributes diversely.

Agrochemical And Pesticide Market Analysis Liquid formulation

Global Agrochemical and Pesticide Market, By Formulation Market Analysis (2023 - 2033)

Liquid formulations dominate with $57.13 billion in 2023, projected to rise to $100.75 billion by 2033, holding 81.61% share. The convenience of application and effectiveness are critical advantages.

Agrochemical And Pesticide Market Analysis Solid formulation

Global Agrochemical and Pesticide Market, By Formulation Market Analysis (2023 - 2033)

Solid formulations are witnessing growth from $12.87 billion in 2023 to $22.70 billion by 2033, representing 18.39%. Their prolonged shelf life and ease of transport are attractive features.

Agrochemical And Pesticide Market Analysis Synthetic agrochemicals

Global Agrochemical and Pesticide Market, By Chemical Type Market Analysis (2023 - 2033)

Synthetic agrochemicals will see growth from $57.13 billion in 2023 to $100.75 billion by 2033, capturing 81.61%. Their application efficiency and volume dictate significant market share.

Agrochemical And Pesticide Market Analysis Natural agrochemicals

Global Agrochemical and Pesticide Market, By Chemical Type Market Analysis (2023 - 2033)

Natural agrochemicals are experiencing rapid growth, projected to increase from $12.87 billion in 2023 to $22.70 billion by 2033, accounting for 18.39%. The trend toward sustainable practices fuels their adoption.

Agrochemical And Pesticide Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agrochemical And Pesticide Industry

Bayer Crop Science:

A leading global player known for its advanced product portfolio, including herbicides, insecticides, and fungicides. Bayer actively invests in research and development for innovative agricultural solutions.Syngenta AG:

A prominent company focusing on crop protection and seeds, Syngenta has a vast portfolio of agrochemicals that cater to diverse agricultural needs globally.BASF SE:

With a strong emphasis on sustainability, BASF develops chemical products that optimize crop yields while reducing environmental impacts, contributing significantly to the agrochemical market.Dow AgroSciences:

Dow provides a comprehensive range of solutions in the agrochemical sector, focusing on innovative products and services that enhance efficiency and agricultural productivity.FMC Corporation:

A key player in specialty chemicals, FMC Corporation offers unique solutions for pest control and protection, with a strong emphasis on biopesticides as part of their product line.We're grateful to work with incredible clients.

FAQs

What is the market size of Agrochemical and Pesticide?

The global agrochemical and pesticide market is valued at approximately $70 billion in 2023, with a projected CAGR of 5.7% leading up to 2033.

What are the key market players or companies in the Agrochemical and Pesticide industry?

Key players in the agrochemical and pesticide industry include Bayer AG, Syngenta AG, BASF SE, Corteva Agriscience, and FMC Corporation. These companies contribute significantly to market innovations and product diversity.

What are the primary factors driving the growth in the Agrochemical and Pesticide industry?

Key growth factors for the agrochemical and pesticide industry include the increasing global demand for food, advancements in agricultural technology, and the necessity for sustainable farming practices to combat pests and diseases.

Which region is the fastest Growing in the Agrochemical and Pesticide market?

The fastest-growing region in the agrochemical and pesticide market is Asia Pacific, moving from $14.6 billion in 2023 to an estimated $25.75 billion in 2033, fueled by agricultural expansion and rising crop yields.

Does ConsaInsights provide customized market report data for the Agrochemical and Pesticide industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the agrochemical and pesticide sector, taking into account unique market dynamics and requirements.

What deliverables can I expect from an Agrochemical and Pesticide market research project?

From a market research project on agrochemicals and pesticides, you can expect deliverables such as market size assessments, growth forecasts, competitive landscape analysis, and regional and segment-specific data.

What are the market trends of Agrochemical and Pesticide?

Current market trends in the agrochemical and pesticide sector include growing adoption of biopesticides, increased focus on integrated pest management, and innovations in formulations to enhance efficacy and reduce environmental impact.