Agrochemical Intermediates Market Report

Published Date: 02 February 2026 | Report Code: agrochemical-intermediates

Agrochemical Intermediates Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Agrochemical Intermediates market, including key insights, trends, and forecasts for the period from 2023 to 2033. It covers market size, industry dynamics, regional variations, and segment-specific insights that inform strategic decisions in the agrochemical sector.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

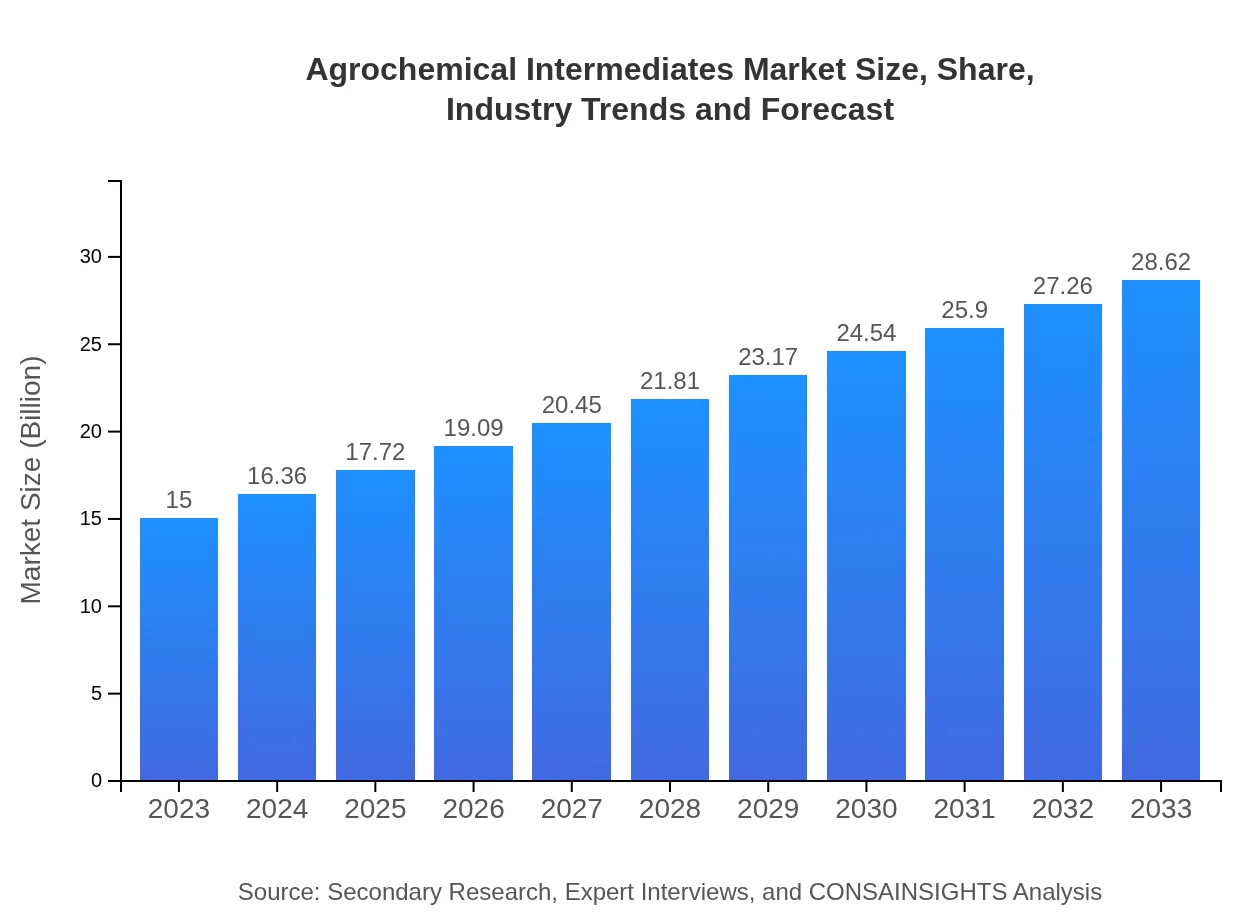

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $28.62 Billion |

| Top Companies | BASF SE, Syngenta AG, Bayer AG, DowDuPont |

| Last Modified Date | 02 February 2026 |

Agrochemical Intermediates Market Overview

Customize Agrochemical Intermediates Market Report market research report

- ✔ Get in-depth analysis of Agrochemical Intermediates market size, growth, and forecasts.

- ✔ Understand Agrochemical Intermediates's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agrochemical Intermediates

What is the Market Size & CAGR of Agrochemical Intermediates market in 2023?

Agrochemical Intermediates Industry Analysis

Agrochemical Intermediates Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agrochemical Intermediates Market Analysis Report by Region

Europe Agrochemical Intermediates Market Report:

Europe's market for agrochemical intermediates is forecasted to expand from $4.04 billion in 2023 to $7.71 billion by 2033. Stringent regulations regarding pesticides and chemical use prompt manufacturers to innovate and produce safer, more sustainable intermediates. The European Union's commitment to green agriculture further propels market development.Asia Pacific Agrochemical Intermediates Market Report:

The Asia-Pacific region is poised for rapid growth, with a market size projected to reach $6.23 billion by 2033 from $3.27 billion in 2023. Increased agricultural production driven by population growth and demand for high-yield crops are major factors. Countries like China and India are leading consumers of agrochemical intermediates due to their expansive agricultural sectors.North America Agrochemical Intermediates Market Report:

The North American agrochemical intermediates market, valued at $5.10 billion in 2023, is projected to grow to $9.73 billion by 2033. The U.S. and Canada are significant markets due to their advanced agricultural technology and strong regulations supporting sustainable farming practices. Innovations in genetically modified crops also drive demand for effective agrochemical solutions.South America Agrochemical Intermediates Market Report:

In South America, the market is expected to grow from $1.19 billion in 2023 to $2.27 billion by 2033. Brazil and Argentina are notable contributors, supported by a booming agribusiness sector that relies heavily on agrochemical products to enhance crop yields and manage pest pressures.Middle East & Africa Agrochemical Intermediates Market Report:

In the Middle East and Africa, the agrochemical intermediates market is projected to increase from $1.40 billion in 2023 to $2.68 billion by 2033. The region's agricultural growth is driven by initiatives to improve food security and optimize water use, particularly in arid zones where crop protection is vital.Tell us your focus area and get a customized research report.

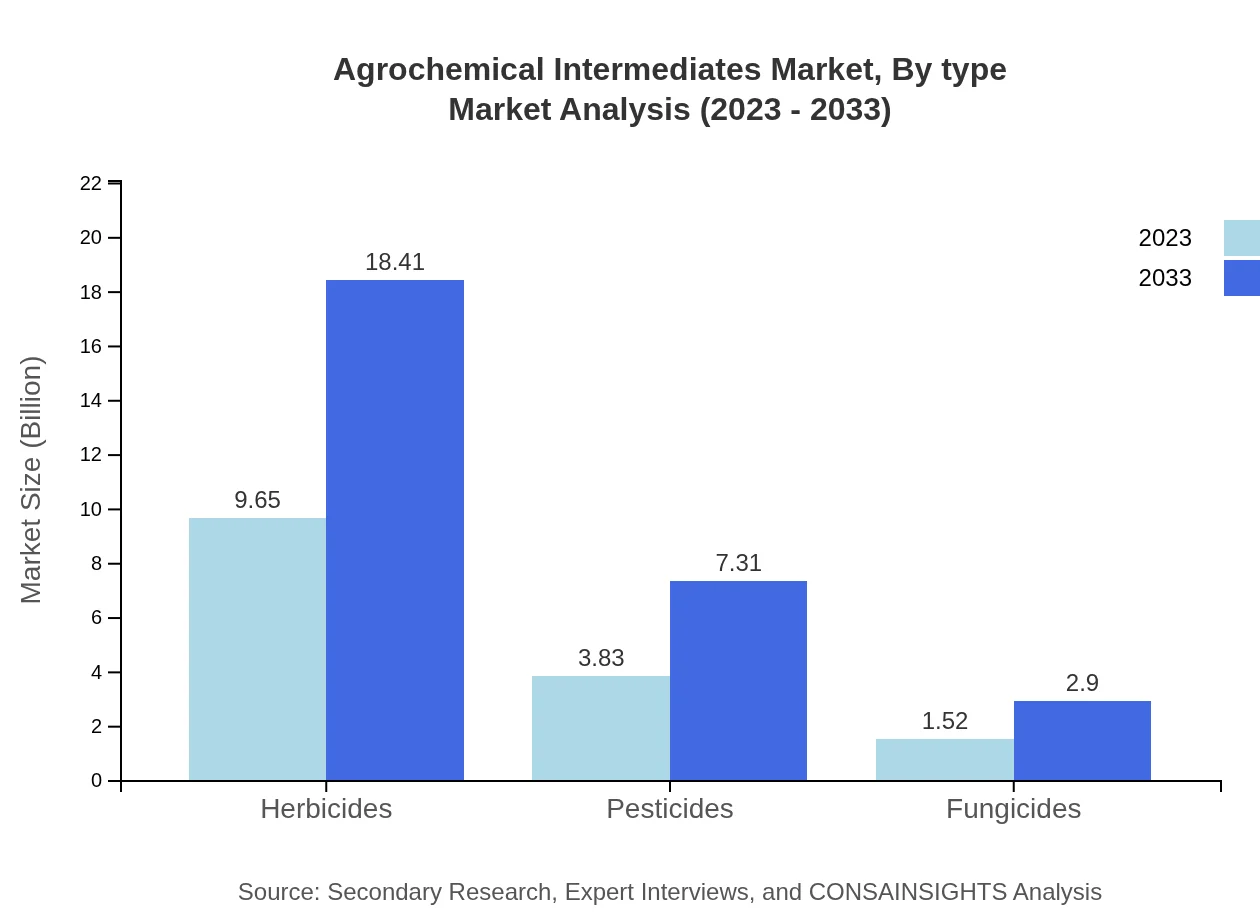

Agrochemical Intermediates Market Analysis By Type

The analysis reveals a robust growth in herbicides, with a market size of $9.65 billion in 2023, expected to double by 2033 to $18.41 billion. Herbicides hold a dominant share of 64.31% in the market. Pesticides and fungicides also show significant growth, with respective market sizes of $3.83 billion and $1.52 billion in 2023 expected to grow to $7.31 billion and $2.90 billion by 2033.

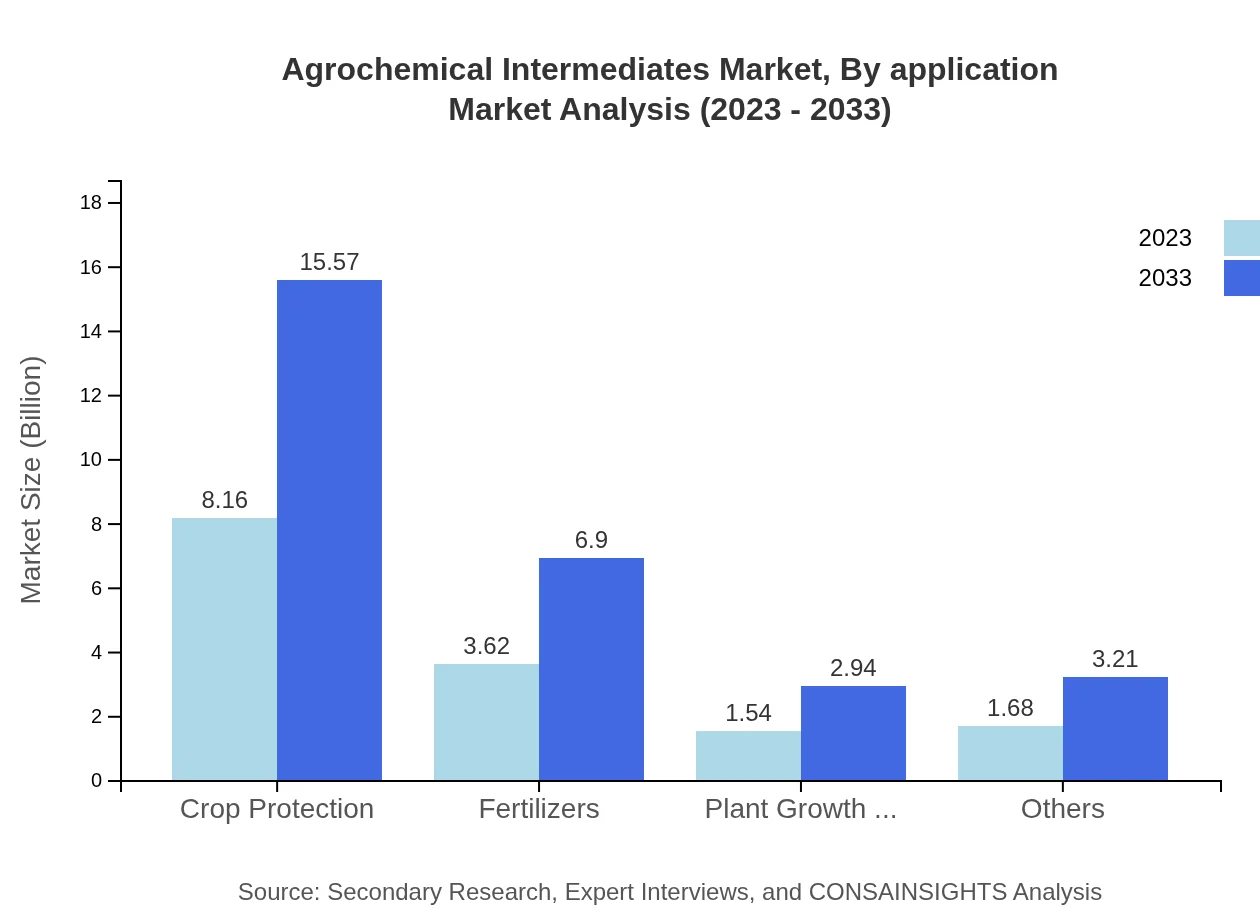

Agrochemical Intermediates Market Analysis By Application

The Agrochemical Intermediates market is primarily driven by agriculture, which accounts for 42.17% of the market share in 2023, valued at $6.33 billion. The horticulture sector follows closely, with a size of $3.73 billion in 2023, expected to grow significantly. Agrochemical intermediates are essential for promoting plant health and productivity across various agricultural practices.

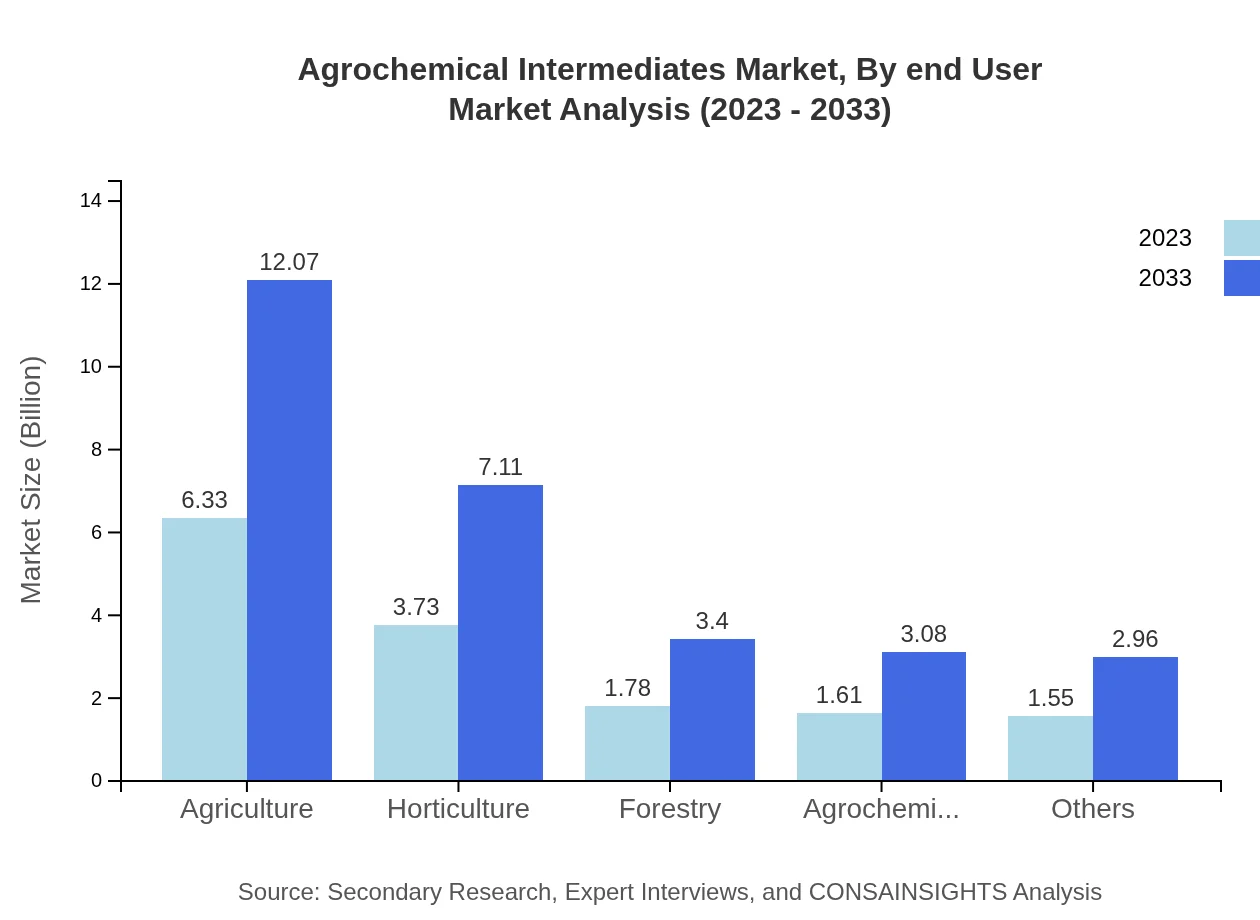

Agrochemical Intermediates Market Analysis By End User

Different end-user industries such as farming, gardening, and industrial land management drive the demand for agrochemical intermediates. The farming sector shows a strong reliance on intermediates for crop protection and yield enhancement, making it the largest end-user. The ongoing investments in agricultural development globally signify robust market growth.

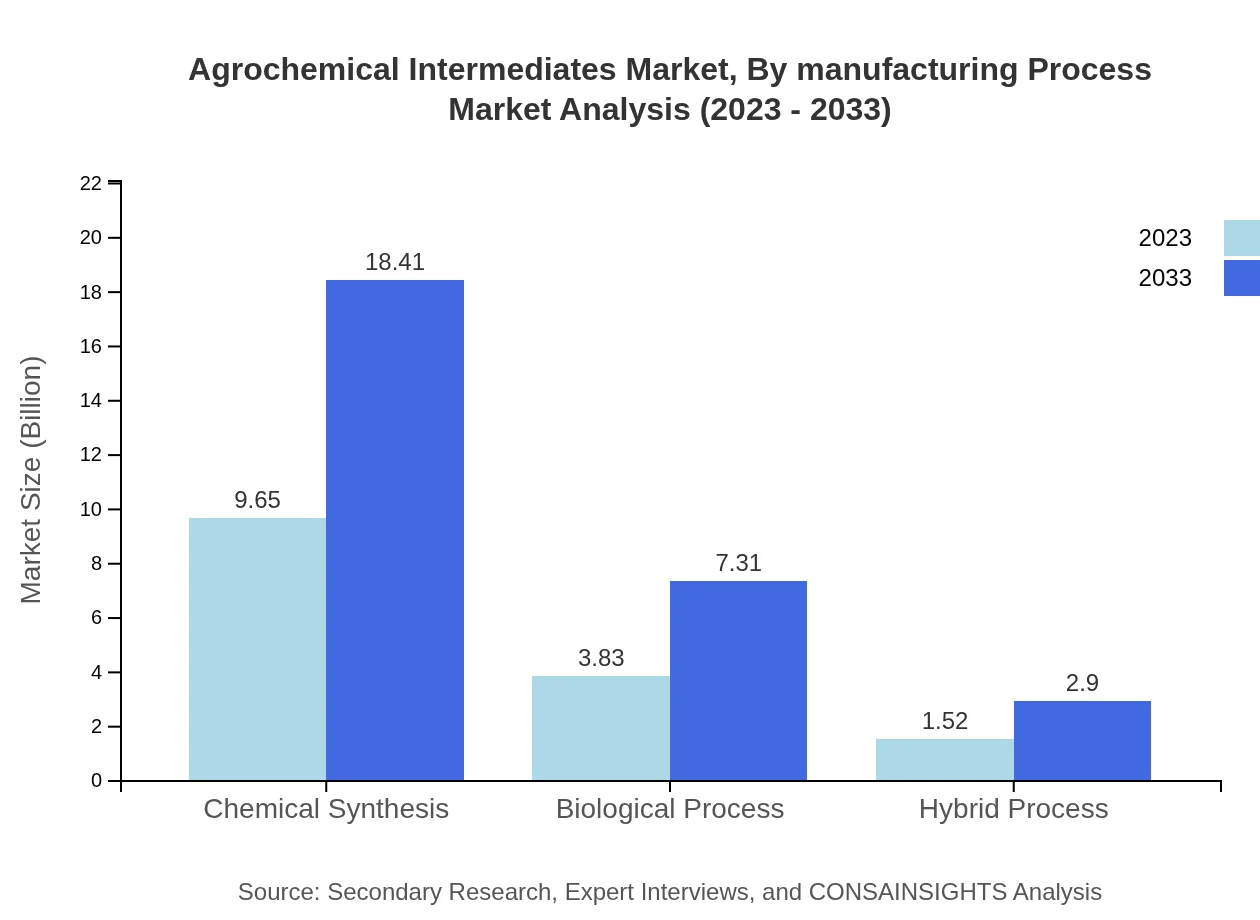

Agrochemical Intermediates Market Analysis By Manufacturing Process

The manufacturing processes for agrochemical intermediates are largely segmented into chemical synthesis, biological processes, and hybrid methods. Chemical synthesis encompasses the majority market share at 64.31%. However, biological processes are gaining traction, driven by the increasing demand for sustainable agricultural practices.

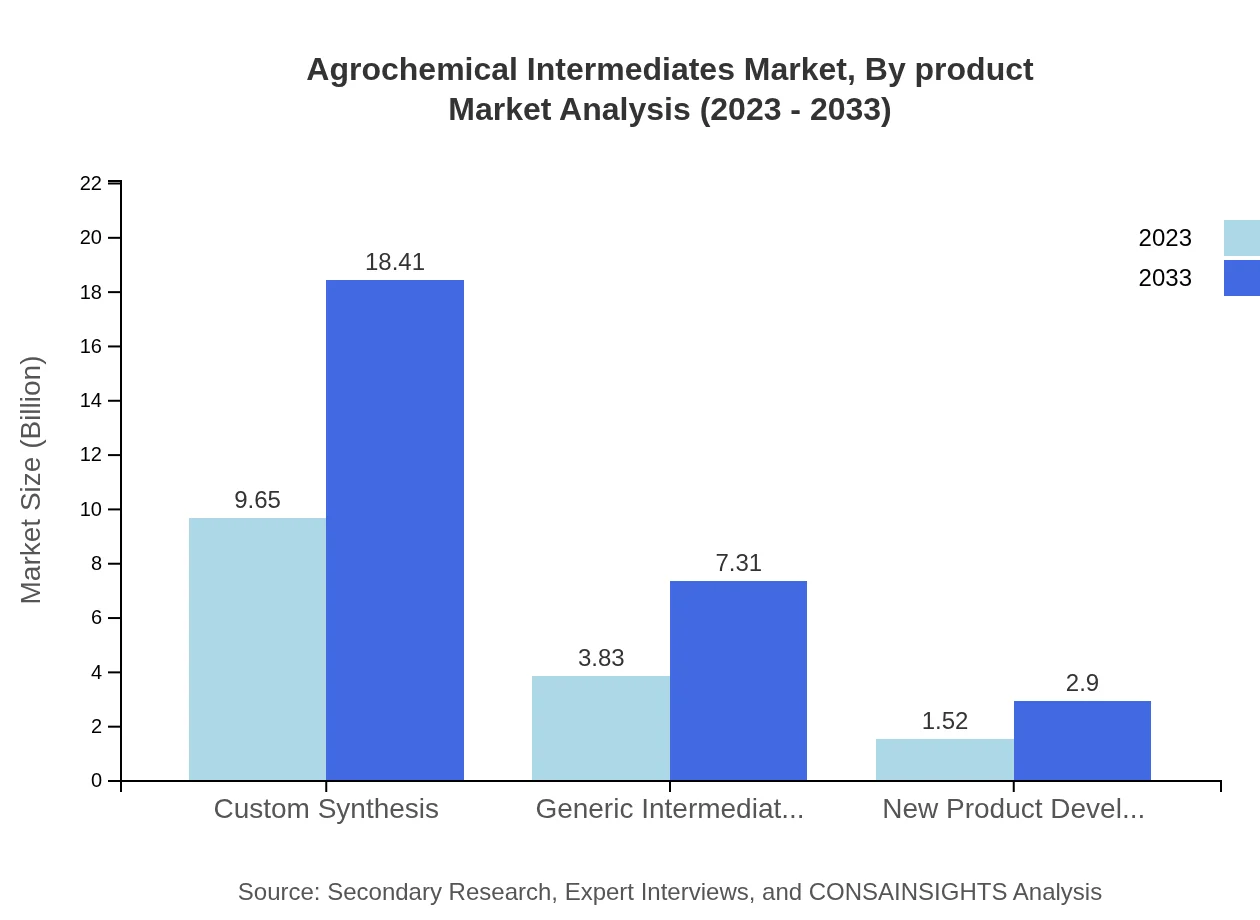

Agrochemical Intermediates Market Analysis By Product

Herbicides and fungicides represent critical products in the Agrochemical Intermediates market. By 2033, custom synthesis intermediates are expected to contribute more significantly, reflecting the trend towards specialized formulations catering to specific crop needs and pest challenges.

Agrochemical Intermediates Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agrochemical Intermediates Industry

BASF SE:

BASF is a global leader in the agrochemical sector, focusing on innovative product development and sustainable farming solutions. Their extensive portfolio includes various herbicides, insecticides, and intermediates.Syngenta AG:

Syngenta specializes in agrochemical products and seeds, offering a wide range of solutions that improve agricultural productivity. The company's focus on research and innovation drives its leadership in the intermediates market.Bayer AG:

Bayer, a prominent player in the agrochemical field, is known for its comprehensive range of crop protection products and its commitment to developing sustainable farming practices.DowDuPont:

DowDuPont operates in the agrochemical sector, providing various intermediates that support crop protection and management. Their R&D efforts focus on creating high-efficacy solutions for farmers.We're grateful to work with incredible clients.

FAQs

What is the market size of agrochemical Intermediates?

The agrochemical intermediates market is projected to grow from $15 billion in 2023, with a CAGR of 6.5%, indicating a robust expansion towards $20.8 billion by 2033.

What are the key market players or companies in this agrochemical Intermediates industry?

Key players in the agrochemical intermediates sector include major chemical manufacturers and agricultural solutions companies, which lead in innovation and market presence, significantly impacting market dynamics.

What are the primary factors driving the growth in the agrochemical Intermediates industry?

The growth drivers for agrochemical intermediates include rising agricultural productivity demands, increased crop protection needs, and advancements in chemical synthesis technologies that enhance product efficiency.

Which region is the fastest Growing in the agrochemical Intermediates?

The fastest-growing region in the agrochemical intermediates market is Asia Pacific, projected to grow from $3.27 billion in 2023 to $6.23 billion by 2033, reflecting a substantial market development.

Does ConsaInsights provide customized market report data for the agrochemical Intermediates industry?

Yes, ConsInsights offers customized market report data tailored to specific interests within the agrochemical intermediates sector, providing valuable insights that cater to unique business requirements.

What deliverables can I expect from this agrochemical Intermediates market research project?

Expect comprehensive deliverables, including in-depth market analysis, competitive landscape assessments, trend forecasts, and actionable insights specific to various agrochemical intermediates segments.

What are the market trends of agrochemical Intermediates?

Current trends in the agrochemical intermediates market include increased focus on sustainability, integration of advanced technologies in product development, and growing consumer preference for eco-friendly agricultural solutions.