Ai In Fintech

Published Date: 24 January 2026 | Report Code: ai-in-fintech

Ai In Fintech Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on AI in Fintech provides an in-depth analysis of market trends, key insights, and forecasts for the period 2024 to 2033. It covers market size, industry dynamics, segmentation details, regional performance, technological innovations, and product analyses, offering invaluable guidance for investors and stakeholders in a rapidly evolving financial landscape.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

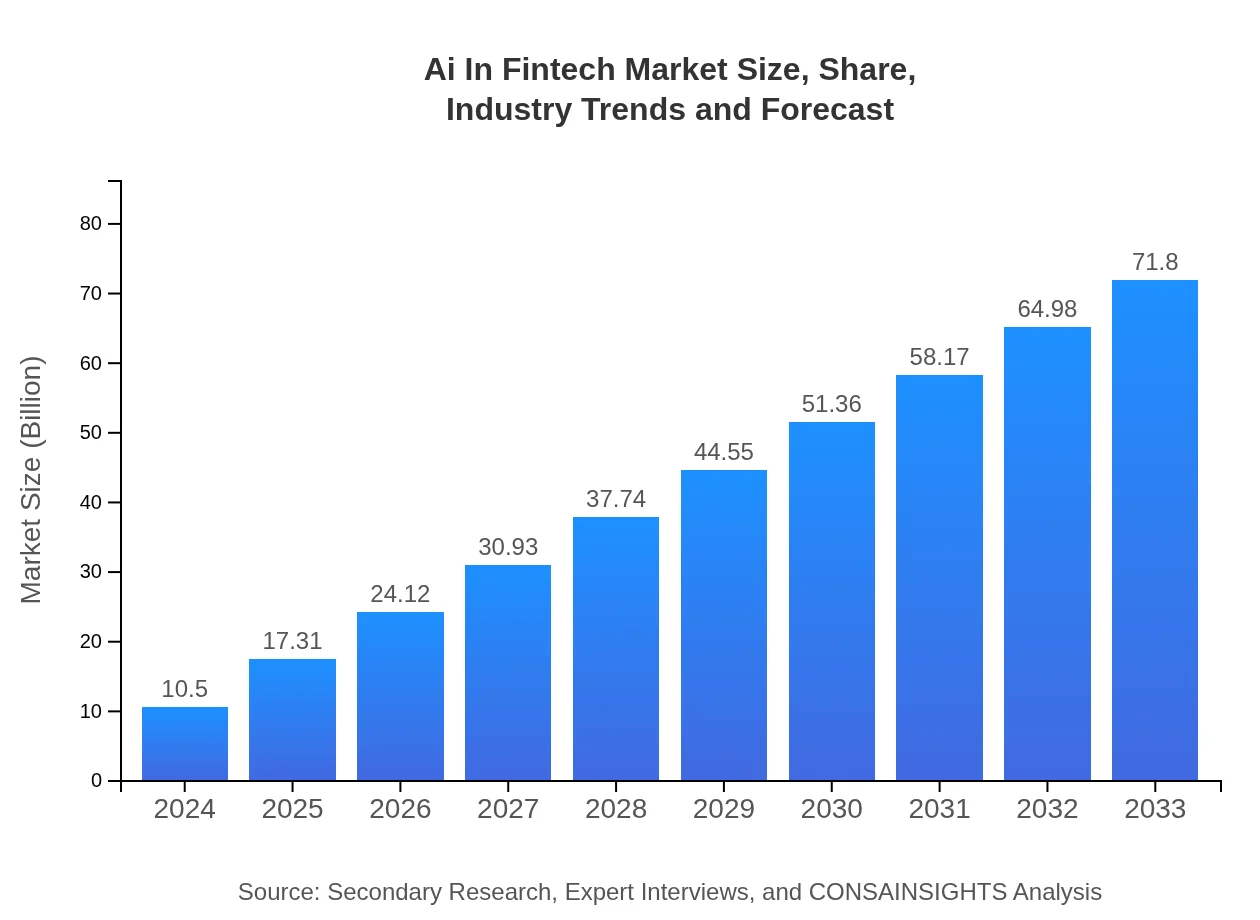

| 2024 Market Size | $10.50 Billion |

| CAGR (2024-2033) | 22.3% |

| 2033 Market Size | $71.80 Billion |

| Top Companies | FinTech Innovators Inc., AI Financial Solutions Ltd. |

| Last Modified Date | 24 January 2026 |

Ai In Fintech Market Overview

Customize Ai In Fintech market research report

- ✔ Get in-depth analysis of Ai In Fintech market size, growth, and forecasts.

- ✔ Understand Ai In Fintech's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Fintech

What is the Market Size & CAGR of Ai In Fintech market in 2024?

Ai In Fintech Industry Analysis

Ai In Fintech Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Fintech Market Analysis Report by Region

Europe Ai In Fintech:

Europe's market is set to expand from 3.43 in 2024 to 23.43 by 2033, bolstered by a strong emphasis on digital transformation, stringent data security regulations, and continuous innovation strategies among established financial institutions.Asia Pacific Ai In Fintech:

In Asia Pacific, the market is witnessing rapid growth with an increase from a 2024 market size of 2.05 to an expected 13.99 by 2033. The region is characterized by technological adoption, supportive government policies, and a surge in digital banking initiatives, driving robust expansion.North America Ai In Fintech:

North America remains a dominant player in the Fintech arena, with market expectations rising from 3.43 in 2024 to 23.45 by 2033. High investment in R&D, mature technology ecosystems, and proactive regulatory frameworks are major growth catalysts in this region.South America Ai In Fintech:

South America shows promising growth with its market value expected to scale from 0.87 in 2024 to 5.96 in 2033. Despite challenges in infrastructure, increasing financial inclusion and mobile banking trends are significantly contributing to market progress.Middle East & Africa Ai In Fintech:

The Middle East and Africa are emerging as vital markets for AI in Fintech, with projections of market growth from 0.73 in 2024 to 4.96 by 2033. Increasing investments in technology infrastructure and a growing demand for financial inclusion underpin this trend.Tell us your focus area and get a customized research report.

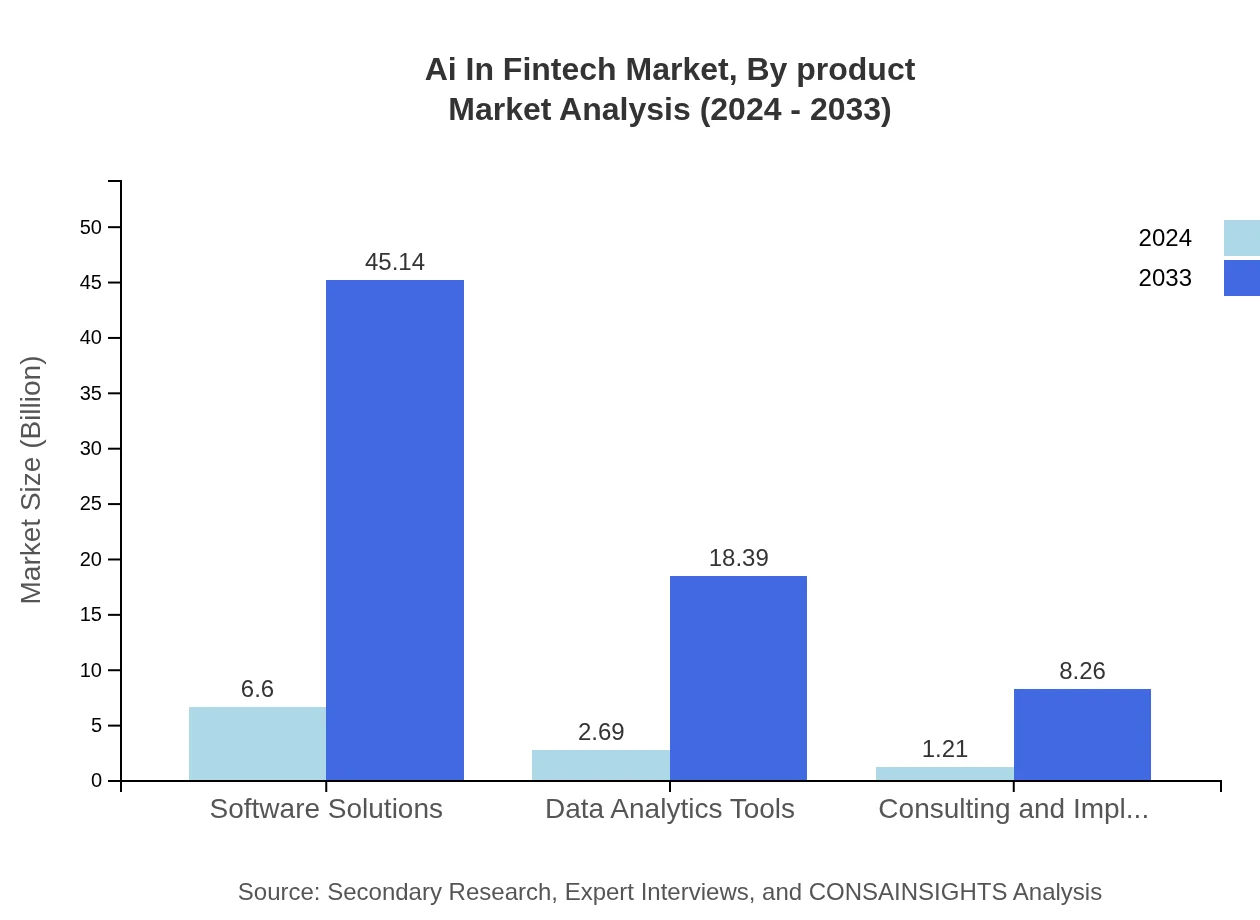

Ai In Fintech Market Analysis By Product

The by-product segmentation primarily includes software solutions, data analytics tools, and consulting and implementation services. Software solutions lead the segment with a market size of 6.60 in 2024 and are projected to expand to 45.14 by 2033, capturing a dominant share at 62.88%. Data analytics tools and consulting services, valued at 2.69 and 1.21 respectively in 2024, also contribute significantly to the overall market, underlining the importance of robust digital infrastructures in transforming financial operations.

Ai In Fintech Market Analysis By Application

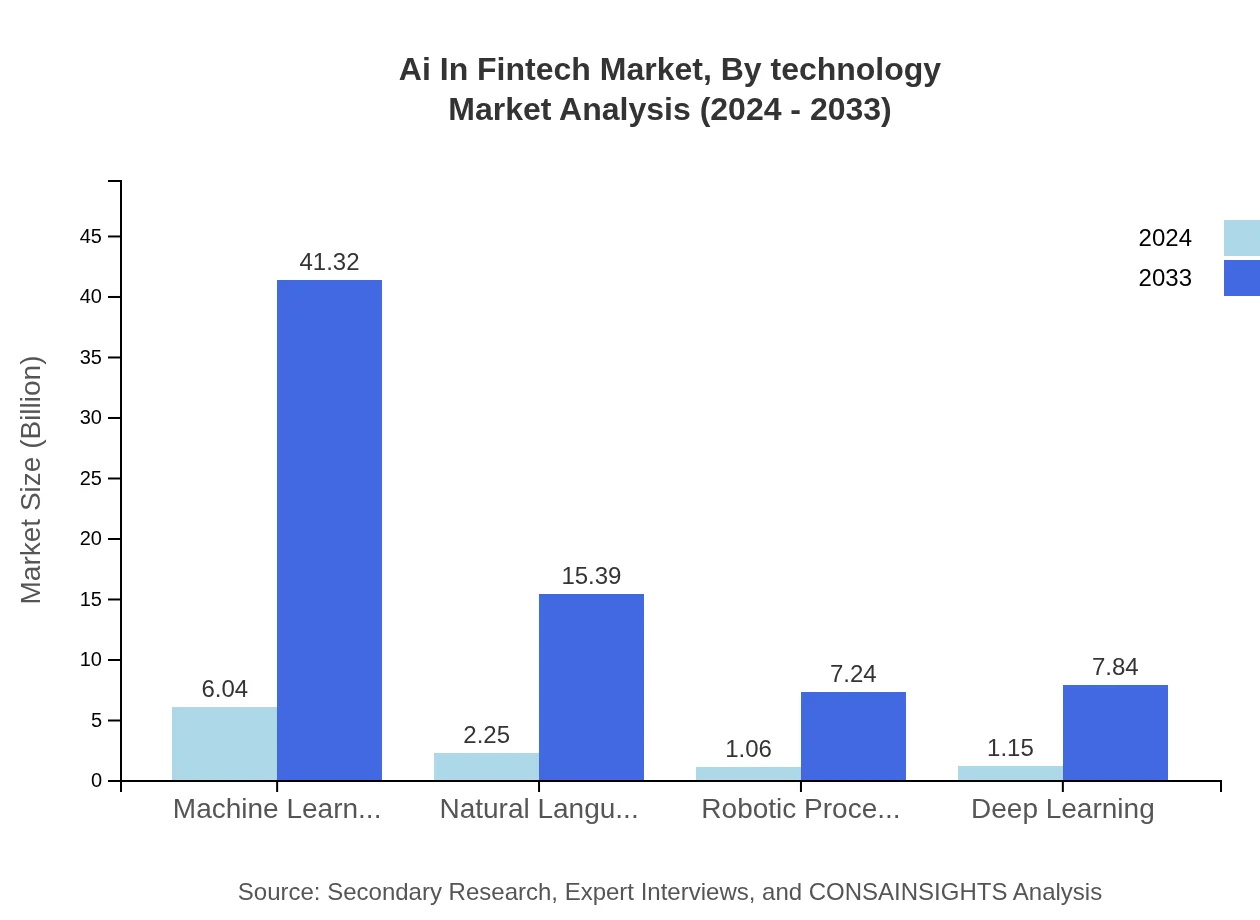

This segmentation examines key applications such as machine learning, natural language processing, robotic process automation, and deep learning. Machine learning stands out with a market size of 6.04 in 2024, growing to 41.32 by 2033 and representing over 57.55% of the segment. Natural language processing, along with robotic process automation and deep learning, supports enhanced customer interactions and operational automation, emphasizing diversified applications and value creation across the Fintech sector.

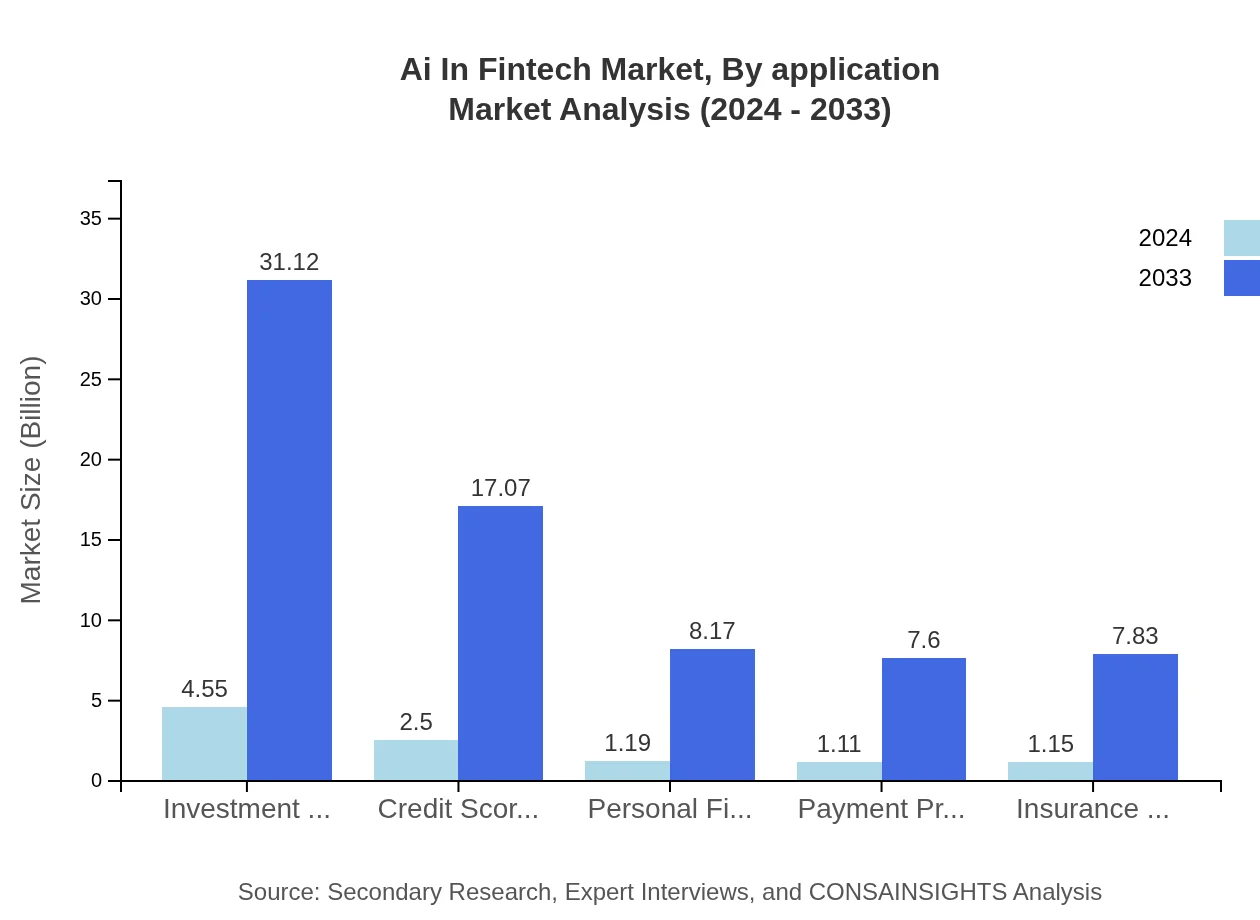

Ai In Fintech Market Analysis By Technology

The by-technology segment focuses on innovations in investment management, credit scoring, personal financial advice, and payment processing. Investment management, with a 2024 market value of 4.55 escalating to 31.12 by 2033, illustrates the transformative impact of AI. Complementary technologies like credit scoring and personalized financial advisory services are witnessing parallel growth trends. These advancements are critical in driving data analytics and automated decision-making processes, thereby reshaping traditional financial methodologies and enhancing customer-centric solutions.

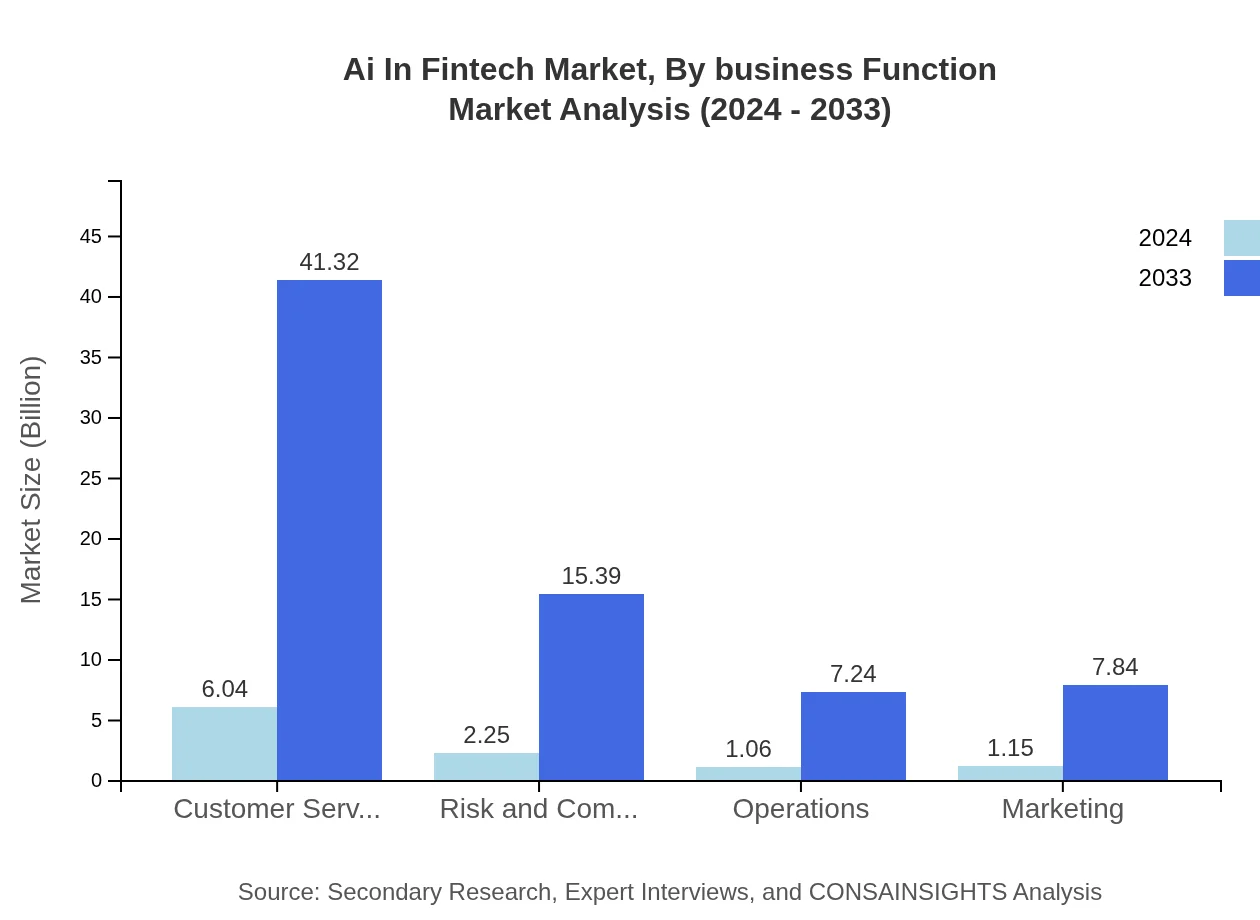

Ai In Fintech Market Analysis By Business Function

This segmentation breaks down the market into business functions including insurance underwriting, customer service, risk and compliance management, operations, and marketing. Customer service and risk management functions, with significant market sizes of 6.04 and 2.25 respectively in 2024, are projected to see substantial increases by 2033. Emphasis on these functions highlights the shift towards efficiency and enhanced business outcomes, as financial institutions leverage AI to optimize operational workflows, improve service quality, and mitigate risks effectively.

Ai In Fintech Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Fintech Industry

FinTech Innovators Inc.:

FinTech Innovators Inc. is a global leader known for pioneering AI-driven solutions that revolutionize payment processing, fraud detection, and customer service initiatives. Their innovative platforms set industry benchmarks and drive significant digital transformation across financial institutions.AI Financial Solutions Ltd.:

AI Financial Solutions Ltd. specializes in integrating machine learning and data analytics into financial service applications. Their cutting-edge technologies empower banks and investment firms to enhance operational efficiency, risk management, and personalized customer experiences.We're grateful to work with incredible clients.

FAQs

What is the market size of AI in Fintech?

The AI in Fintech market is projected to grow to $10.5 billion by 2024, with a robust CAGR of 22.3%. This signifies a strong demand in the sector driven by advancements in technology and customer expectations.

What are the key market players or companies in the AI in Fintech industry?

Key players in the AI in Fintech market include established financial institutions and innovative tech firms specializing in AI solutions. These companies drive significant advancements in payment processing, fraud detection, and customer service applications.

What are the primary factors driving the growth in the AI in Fintech industry?

The growth in the AI in Fintech industry is primarily driven by increased investment in digital transformation, the need for enhanced customer experiences, and the utilization of advanced analytics and machine learning technologies in financial operations.

Which region is the fastest Growing in the AI in Fintech?

The fastest-growing region in the AI in Fintech sector is North America, with projections indicating a market size expansion from $3.43 billion in 2024 to $23.45 billion by 2033, highlighting significant investment and innovation.

Does ConsaInsights provide customized market report data for the AI in Fintech industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the AI in Fintech industry. This includes detailed analysis and forecasts that help businesses make informed strategic decisions.

What deliverables can I expect from this AI in Fintech market research project?

Deliverables from the AI in Fintech market research project will include comprehensive reports, market trend analyses, key player assessments, and segmented data insights, facilitating informed decision-making and strategy development.

What are the market trends of AI in Fintech?

Current market trends in AI in Fintech include growing adoption of machine learning for fraud detection, increased use of natural language processing in customer service, and enhanced risk management solutions that leverage AI technologies.