Ai In Oil Gas Market Report

Published Date: 22 January 2026 | Report Code: ai-in-oil-gas

Ai In Oil Gas Market Size, Share, Industry Trends and Forecast to 2033

This report explores the evolving landscape of the AI in oil and gas sector, providing insights into market conditions, size, and forecasted growth from 2023 to 2033. It encompasses industry trends, technology advancements, and regional analyses that shape this critical market.

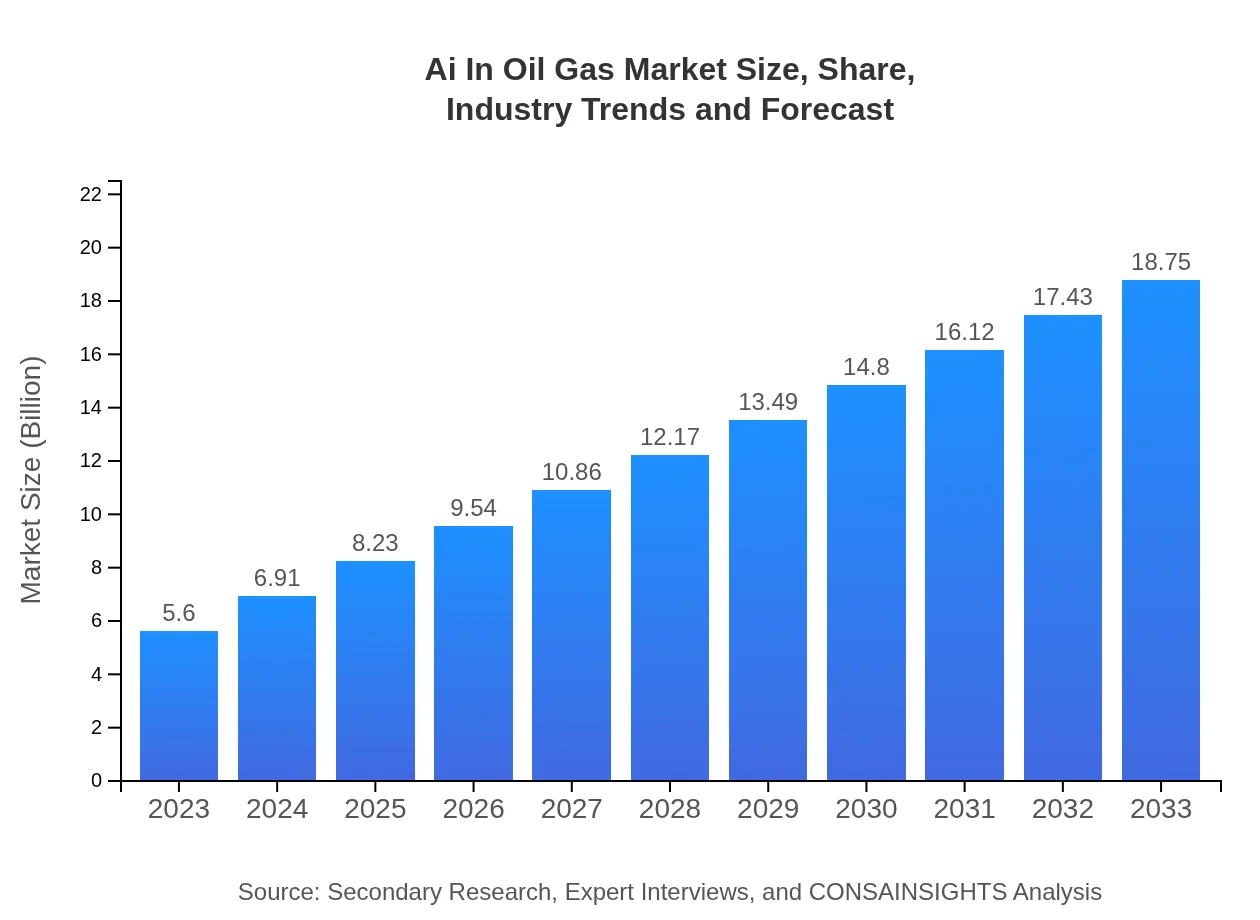

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $18.75 Billion |

| Top Companies | IBM, Schlumberger, Siemens , Halliburton, Baker Hughes |

| Last Modified Date | 22 January 2026 |

AI In Oil Gas Market Overview

Customize Ai In Oil Gas Market Report market research report

- ✔ Get in-depth analysis of Ai In Oil Gas market size, growth, and forecasts.

- ✔ Understand Ai In Oil Gas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Oil Gas

What is the Market Size & CAGR of AI In Oil Gas market in 2023 and 2033?

AI In Oil Gas Industry Analysis

AI In Oil Gas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

AI In Oil Gas Market Analysis Report by Region

Europe Ai In Oil Gas Market Report:

Europe sees a market increase from $1.77 billion in 2023 to $5.93 billion by 2033, with significant investments aimed at integrating AI into the regulatory frameworks pushing for greener operations, primarily in the North Sea and other strategic areas.Asia Pacific Ai In Oil Gas Market Report:

In 2023, the AI in oil and gas market in Asia Pacific is valued at approximately $1.04 billion, expected to grow to $3.49 billion by 2033. The region observes a rapid adoption of AI technologies due to rising oil demand, especially in countries like China and India, where automation and optimization of oil extraction processes are prioritized.North America Ai In Oil Gas Market Report:

In North America, the market is expected to grow from $1.98 billion in 2023 to $6.62 billion by 2033, with the USA leading the way in AI adoption for increased operational efficiency and safety standards in both offshore and onshore drilling activities.South America Ai In Oil Gas Market Report:

The South American market is projected to grow from $0.43 billion in 2023 to $1.45 billion by 2033. The focus on sustainable and efficient oil extraction processes is driving investments in AI, particularly in Brazil and Venezuela.Middle East & Africa Ai In Oil Gas Market Report:

In the Middle East and Africa, the market will expand from $0.38 billion in 2023 to $1.26 billion by 2033. Governments are increasingly investing in AI to boost operational efficiency and harness their vast oil reserves responsibly, while also responding to environmental concerns.Tell us your focus area and get a customized research report.

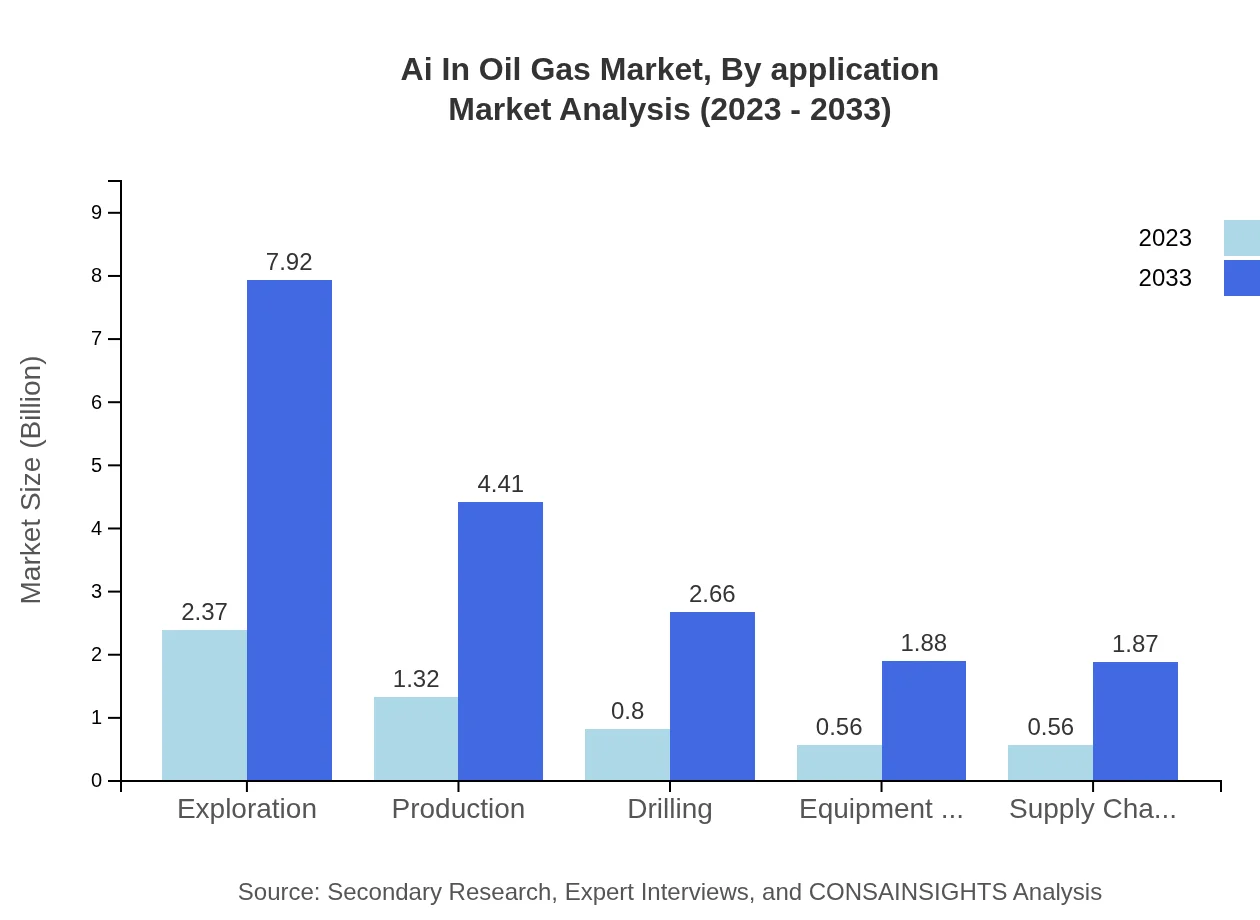

Ai In Oil Gas Market Analysis By Application

Exploration holds the largest share, with an estimated market size of $2.37 billion in 2023, and is projected to reach $7.92 billion by 2033. Production follows with $1.32 billion in 2023 and projected growth to $4.41 billion by 2033, emphasizing the need for enhanced extraction methods. Drilling operations are expected to grow from $0.80 billion to $2.66 billion, while equipment maintenance and supply chain management will also see substantial investments as firms prioritize AI-driven efficiencies.

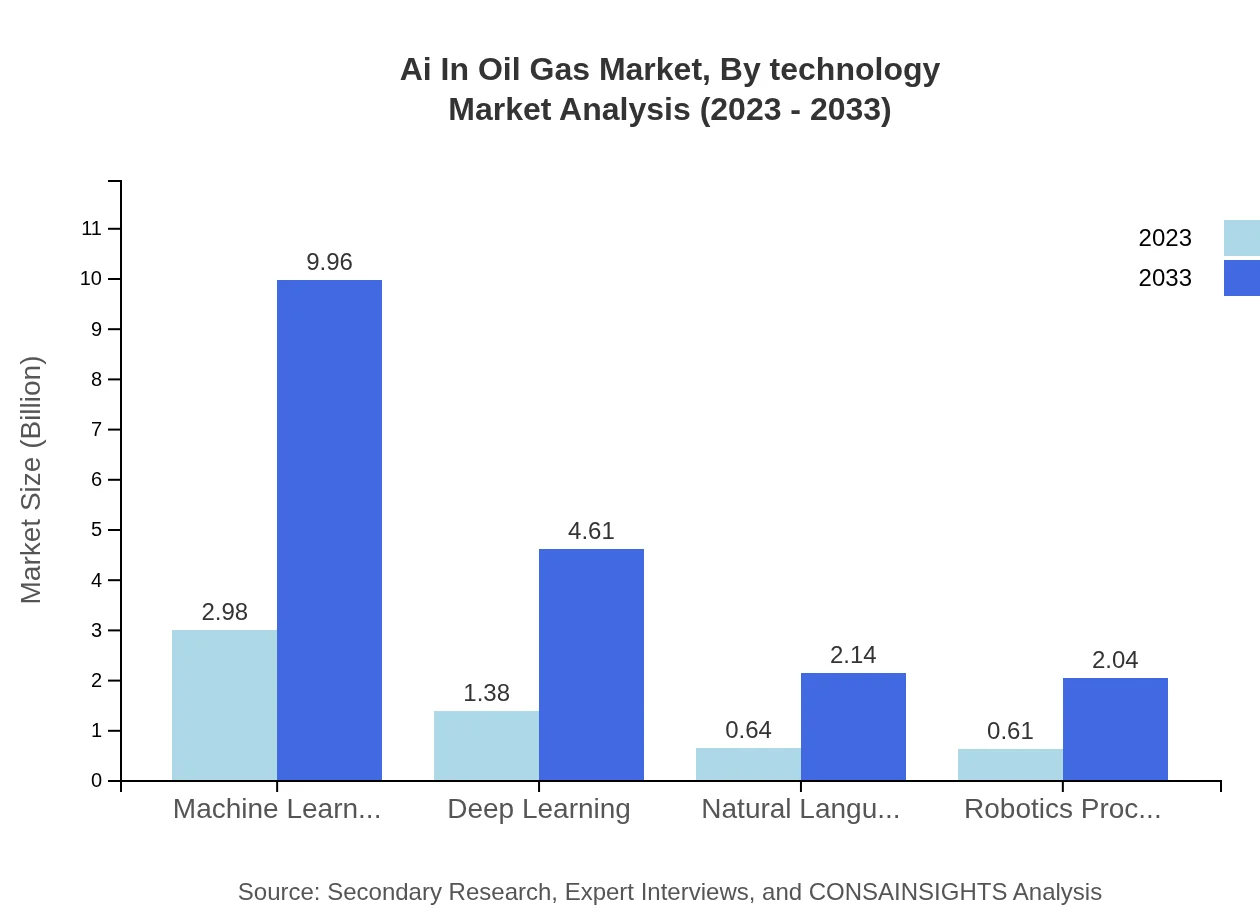

Ai In Oil Gas Market Analysis By Technology

Machine learning retains the dominant share, expected to grow from $2.98 billion in 2023 to $9.96 billion by 2033. Deep learning technologies will also gain traction, expanding from $1.38 billion to $4.61 billion. The adoption of natural language processing and robotics process automation is increasing as firms seek to automate processes and enhance decision-making capabilities, particularly in operational analytics and customer service aspects.

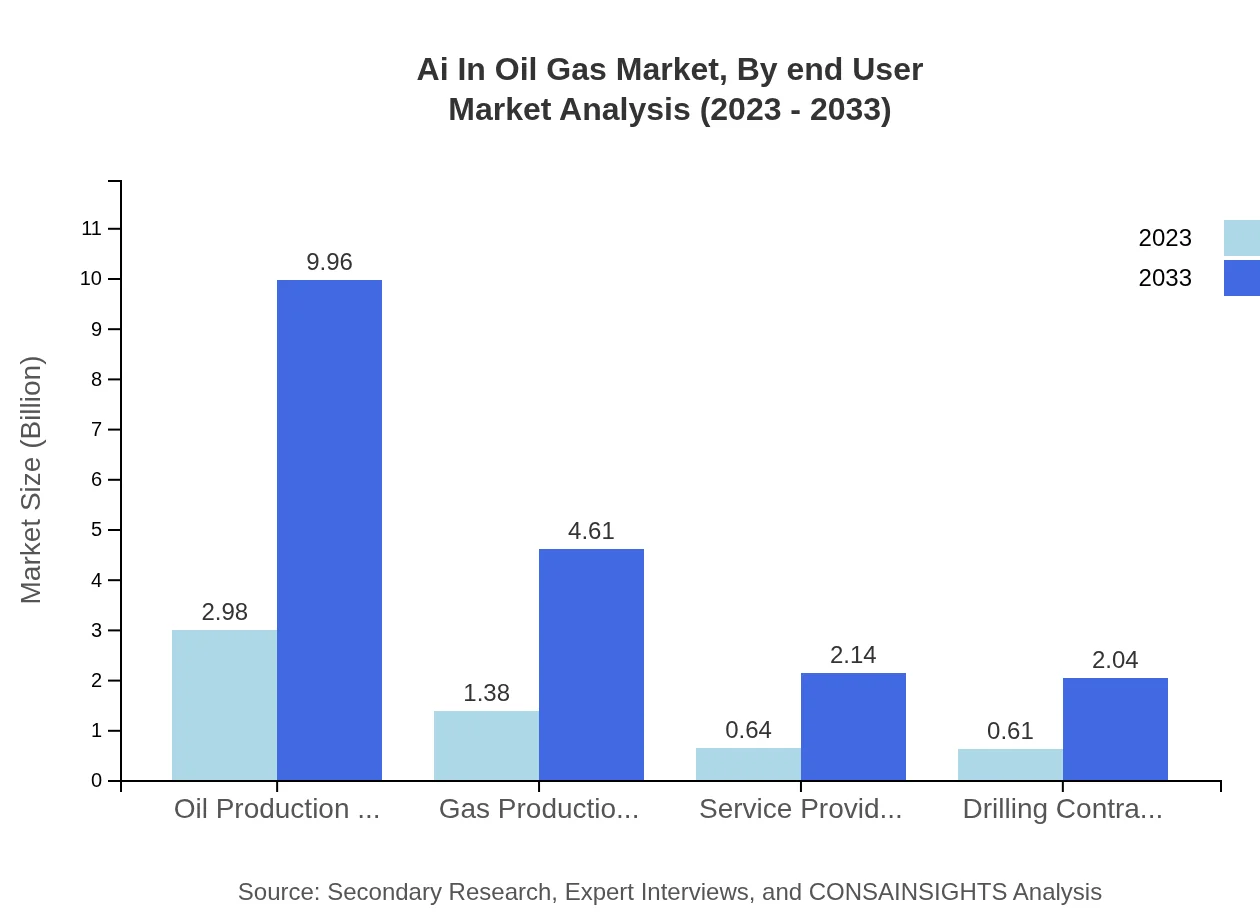

Ai In Oil Gas Market Analysis By End User

Major end-users include oil production companies with a projected market size growing from $2.98 billion in 2023 to $9.96 billion by 2033. Gas production companies will see growth from $1.38 billion to $4.61 billion, while service providers and drilling contractors are anticipated to increase their market share significantly as integration of AI becomes imperative for operational excellence.

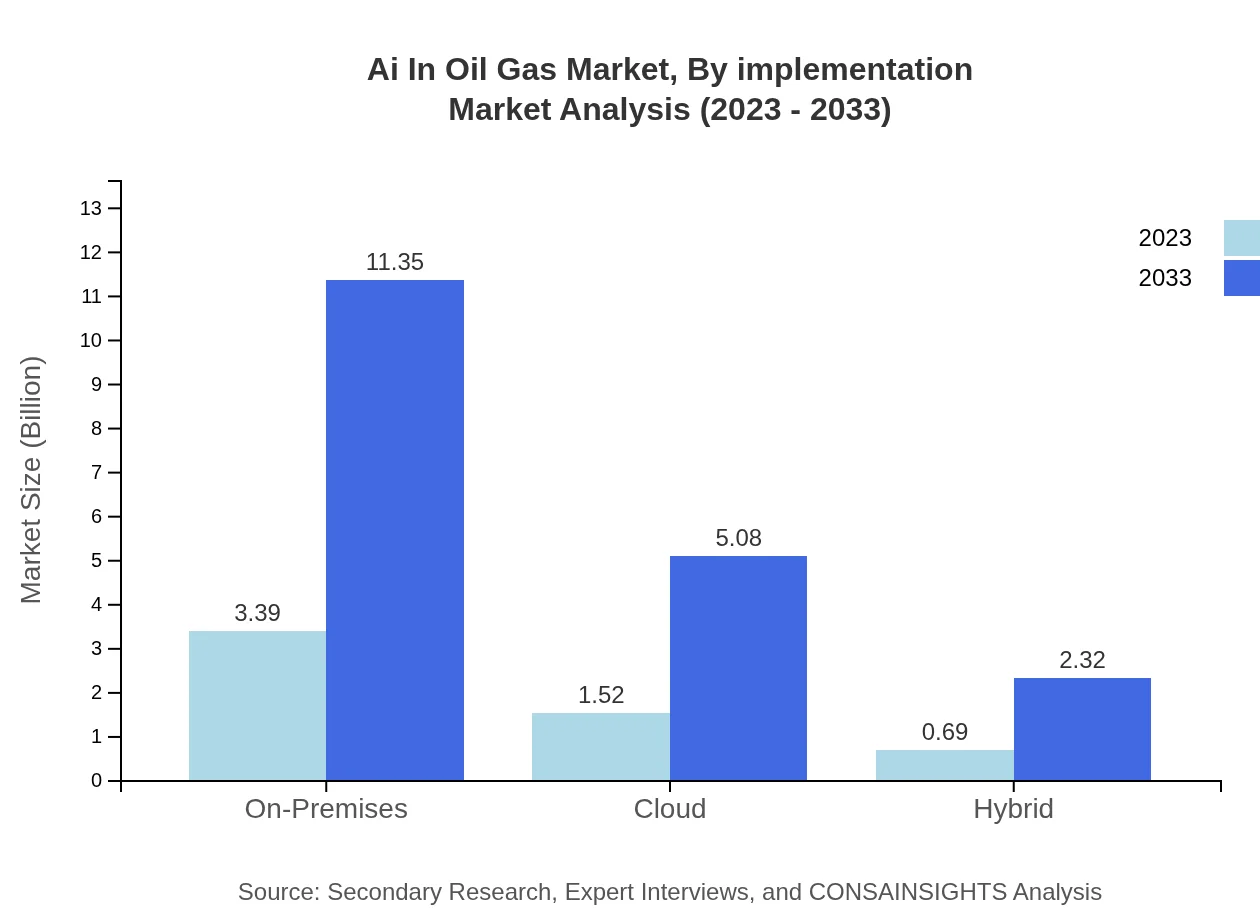

Ai In Oil Gas Market Analysis By Implementation

On-premises deployment remains prevalent with a market transition from $3.39 billion in 2023 to $11.35 billion by 2033, while cloud solutions are rapidly gaining popularity, expected to grow from $1.52 billion to $5.08 billion. Hybrid solutions are also seeing demand as companies seek flexibility in their operations.

AI In Oil Gas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in AI In Oil Gas Industry

IBM:

IBM provides AI-driven solutions tailored for the oil and gas industry, focusing on predictive maintenance and real-time data analytics to enhance operational efficiency.Schlumberger:

A leading oilfield services company that integrates advanced AI technologies in oil extraction processes, promoting efficient and safer drilling practices.Siemens :

Siemens brings AI to energy management processes, optimizing resource use across oil and gas operations, thereby reducing environmental impact.Halliburton:

Halliburton utilizes AI for hydraulic fracturing and drilling optimization, focusing on real-time data processing to facilitate decision-making in challenging environments.Baker Hughes:

Baker Hughes offers AI solutions that improve operational efficiencies in energy production and maintenance, catering specifically to both oil and gas sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of AI in Oil & Gas?

The AI in Oil & Gas market is valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 12.3%, reaching around $22.61 billion by 2033, reflecting significant advancements in technology adoption.

What are the key market players or companies in this industry?

Key players include Oil Production Companies, which hold 53.13% share, Gas Production Companies at 24.61%, and various service providers. Their strategic investments ensure continued innovation and competitiveness in the evolving AI landscape.

What are the primary factors driving the growth in the AI in Oil & Gas industry?

Factors driving growth include increased efficiency through automation, cost reduction measures, rising demand for real-time data analysis, and strategic initiatives towards sustainable energy. Moreover, technological advancements in machine learning foster innovation.

Which region is the fastest Growing in the AI in Oil & Gas?

North America is leading with a significant market size of $1.98 billion in 2023, expected to increase to $6.62 billion by 2033. This growth is driven by robust investments in technology and an established oil and gas infrastructure.

Does ConsainInsights provide customized market report data for the AI in Oil & Gas industry?

Yes, ConsainInsights offers customized market report data, providing tailored insights and analysis specific to client needs, ensuring stakeholders gain strategic advantages in the rapidly evolving AI in Oil & Gas sector.

What deliverables can I expect from this AI in Oil & Gas market research project?

You can expect comprehensive market insights, detailed segmentation analyses, competitive intelligence, growth forecasts, and regional analysis. Deliverables are structured to provide actionable insights to inform strategic decisions.

What are the market trends of AI in Oil & Gas?

Current trends include the rise of machine learning and automation technologies, an emphasis on predictive maintenance, a focus on data-driven decision-making, and an increasing shift towards cloud-based solutions to enhance operational efficiencies.