Air And Missile Defense Radar Market Report

Published Date: 31 January 2026 | Report Code: air-and-missile-defense-radar

Air And Missile Defense Radar Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report covers the Air And Missile Defense Radar sector, providing insights into market trends, size forecasts, and growth opportunities from 2023 to 2033.

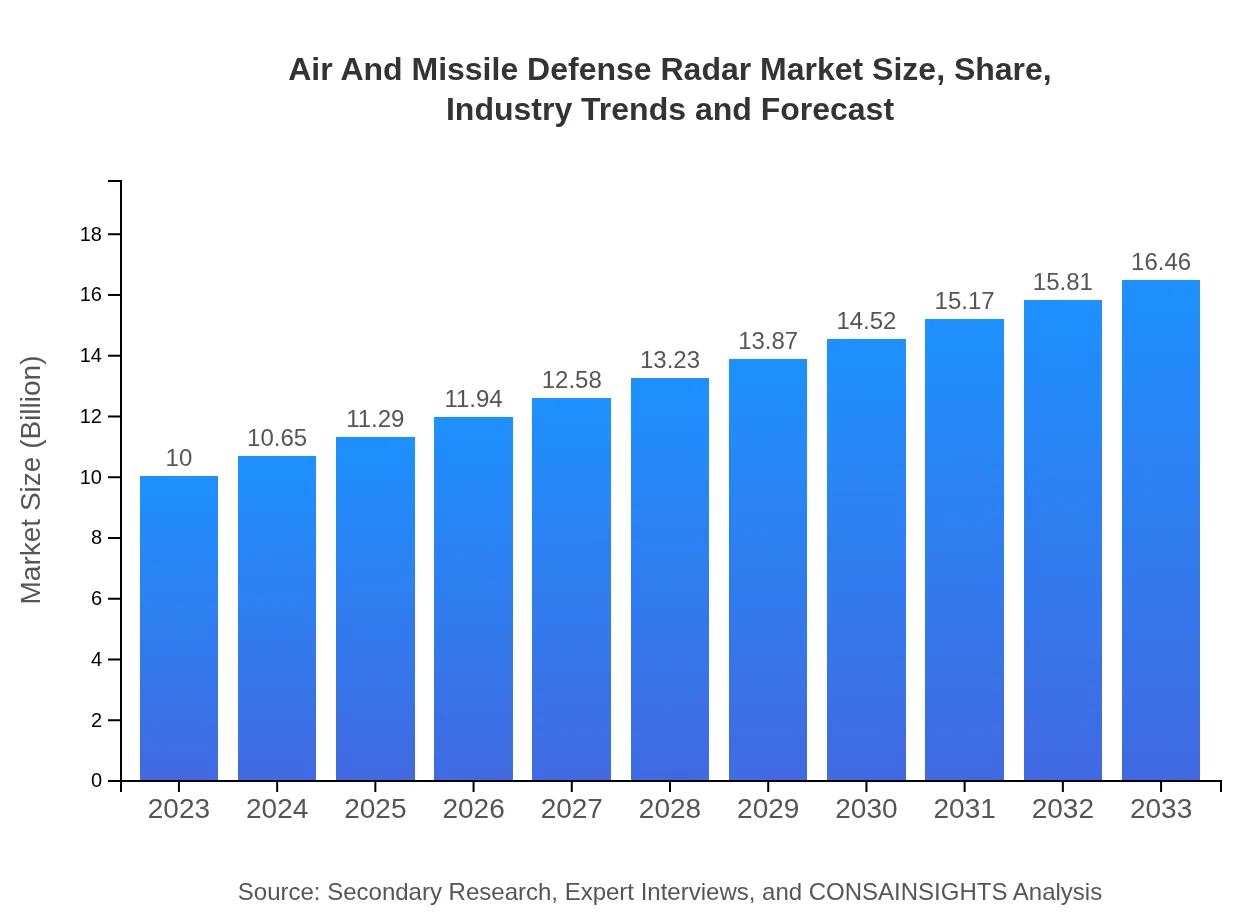

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Raytheon Technologies, Lockheed Martin Corporation, Northrop Grumman Corporation, Thales Group |

| Last Modified Date | 31 January 2026 |

Air And Missile Defense Radar Market Overview

Customize Air And Missile Defense Radar Market Report market research report

- ✔ Get in-depth analysis of Air And Missile Defense Radar market size, growth, and forecasts.

- ✔ Understand Air And Missile Defense Radar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Air And Missile Defense Radar

What is the Market Size & CAGR of Air And Missile Defense Radar market in 2023?

Air And Missile Defense Radar Industry Analysis

Air And Missile Defense Radar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

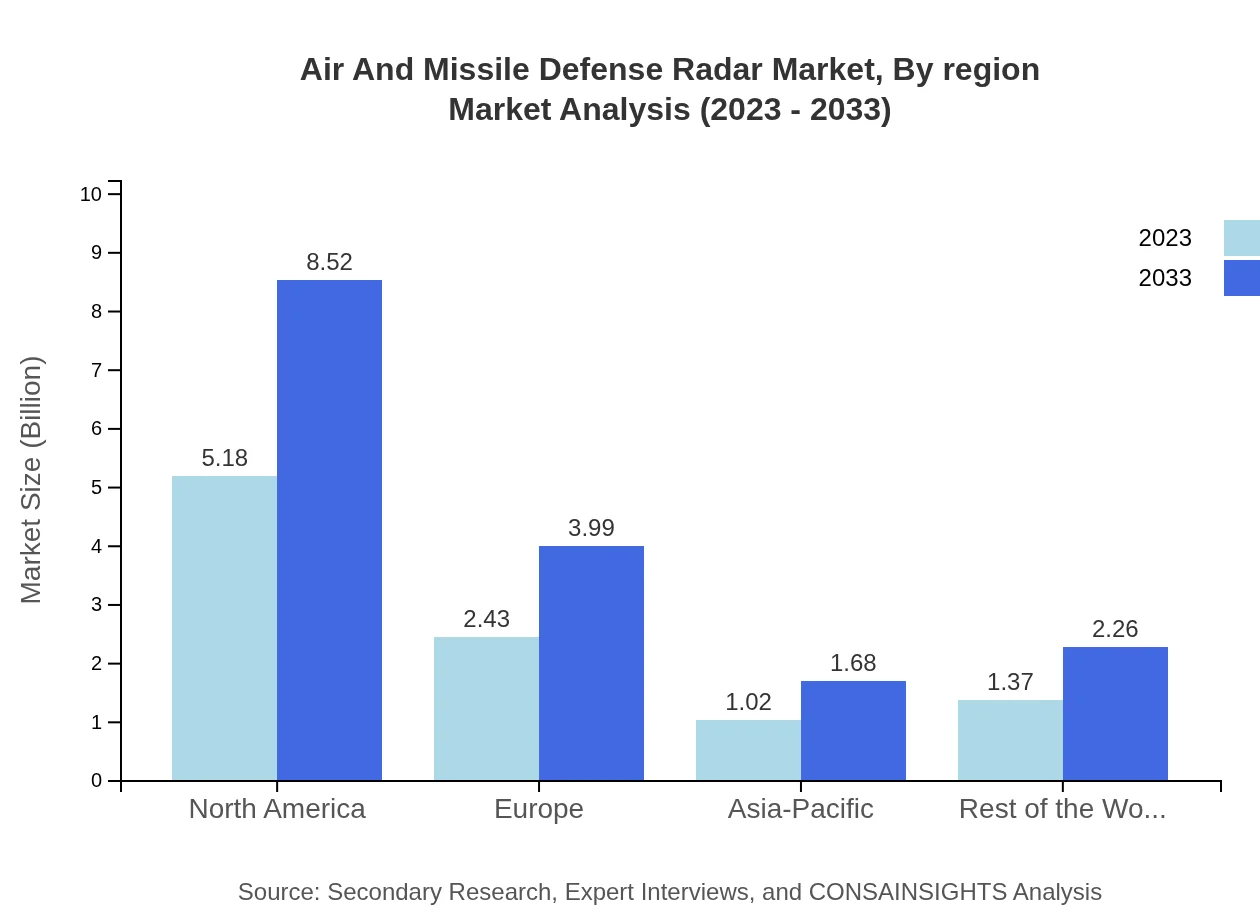

Air And Missile Defense Radar Market Analysis Report by Region

Europe Air And Missile Defense Radar Market Report:

Europe's market is projected to rise from $3.74 billion in 2023 to $6.16 billion by 2033. Increased political tensions and the necessity for enhanced defense mechanisms are leading European nations to enhance and expand their radar capabilities.Asia Pacific Air And Missile Defense Radar Market Report:

The Asia Pacific region is expected to witness a substantial increase in market size from $1.88 billion in 2023 to $3.09 billion by 2033. Strong investment from countries like India and China to enhance their military capabilities drives this growth, alongside an expanding defense budget aimed at both homeland security and offensive capabilities.North America Air And Missile Defense Radar Market Report:

North America remains a leader in the Air And Missile Defense Radar market, expected to grow from $3.24 billion in 2023 to $5.33 billion by 2033. The United States' significant investments in advanced defense technologies and military modernization initiatives are primary growth drivers.South America Air And Missile Defense Radar Market Report:

In South America, the Air And Missile Defense Radar market is expected to grow from $0.52 billion in 2023 to $0.86 billion in 2033. Regional security concerns and increasing collaboration with international defense partners are key factors enhancing the market in this area.Middle East & Africa Air And Missile Defense Radar Market Report:

The Middle East and Africa are anticipated to see the Air And Missile Defense Radar market expand from $0.62 billion in 2023 to $1.01 billion in 2033. Heightened security threats and military conflict make this region a focal point for defense investments.Tell us your focus area and get a customized research report.

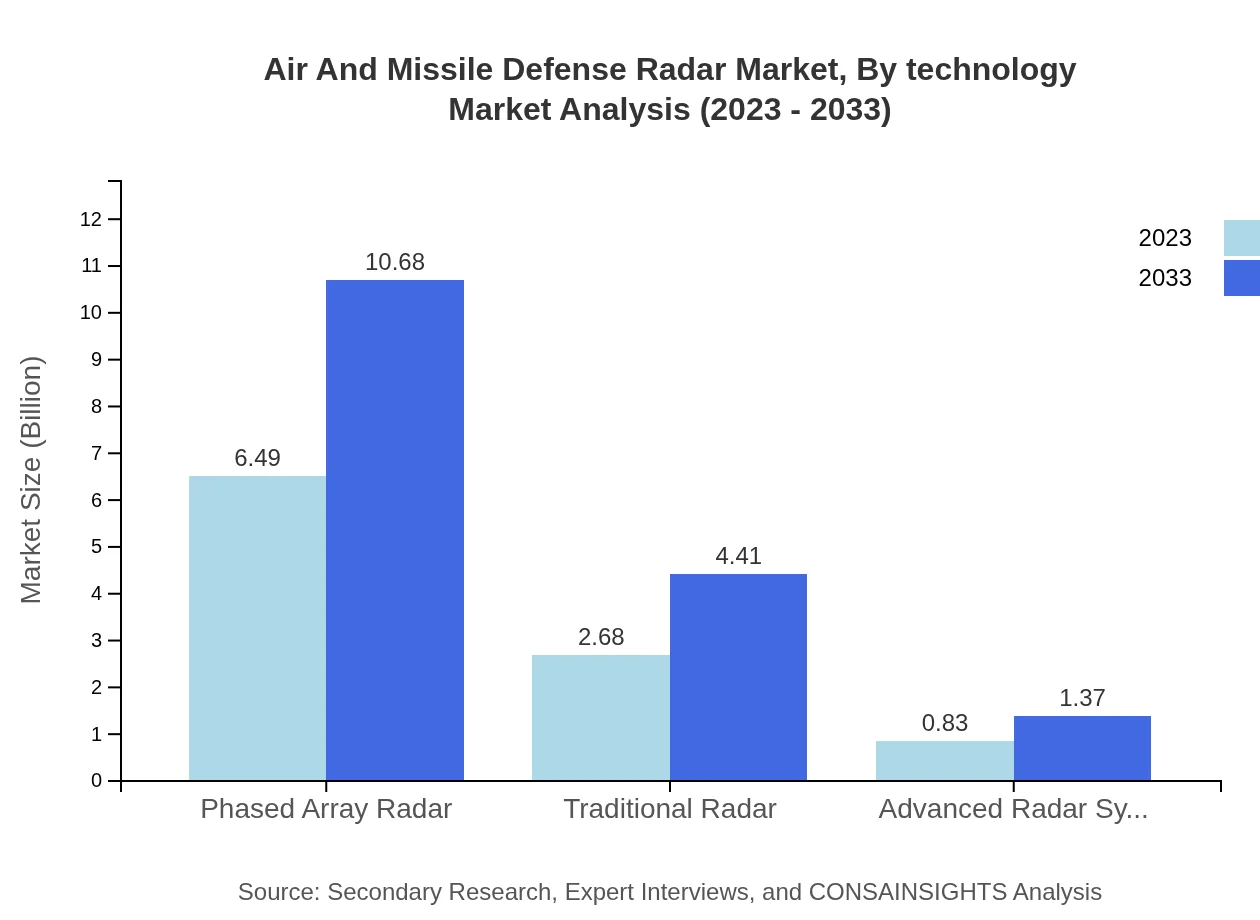

Air And Missile Defense Radar Market Analysis By Technology

The segmentation based on technology indicates that Phased Array Radar holds a dominant market share, projected to constitute 64.87% by 2033, supported by its superior tracking capabilities. Traditional radar systems along with advanced systems are also gaining traction, indicating a diversified technological landscape.

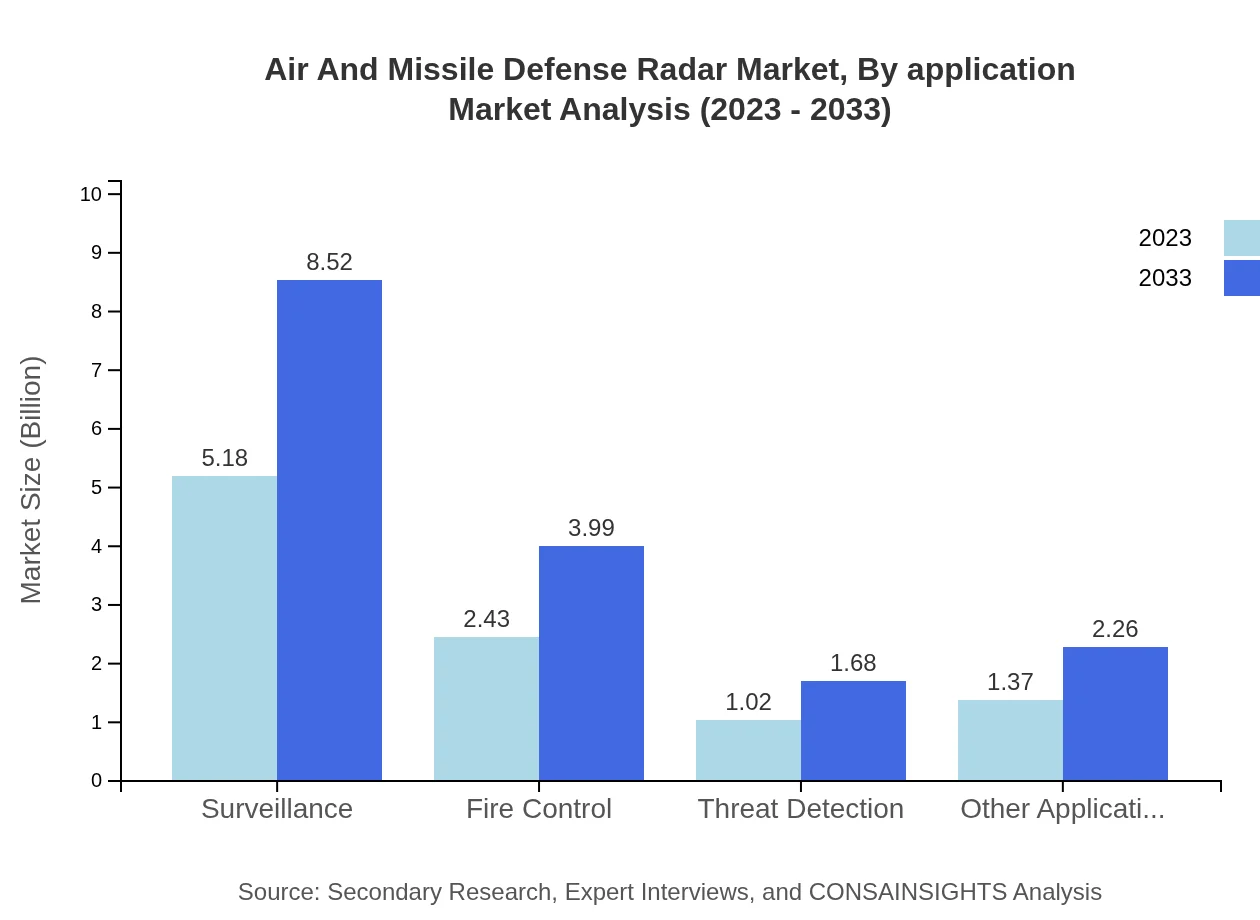

Air And Missile Defense Radar Market Analysis By Application

Militaries will continue to drive demand, holding a share of 64.87% in 2023. Surveillance applications lead in market share, attributed to ongoing monitoring of airspace and potential threats, reflecting the critical need for effective detection systems.

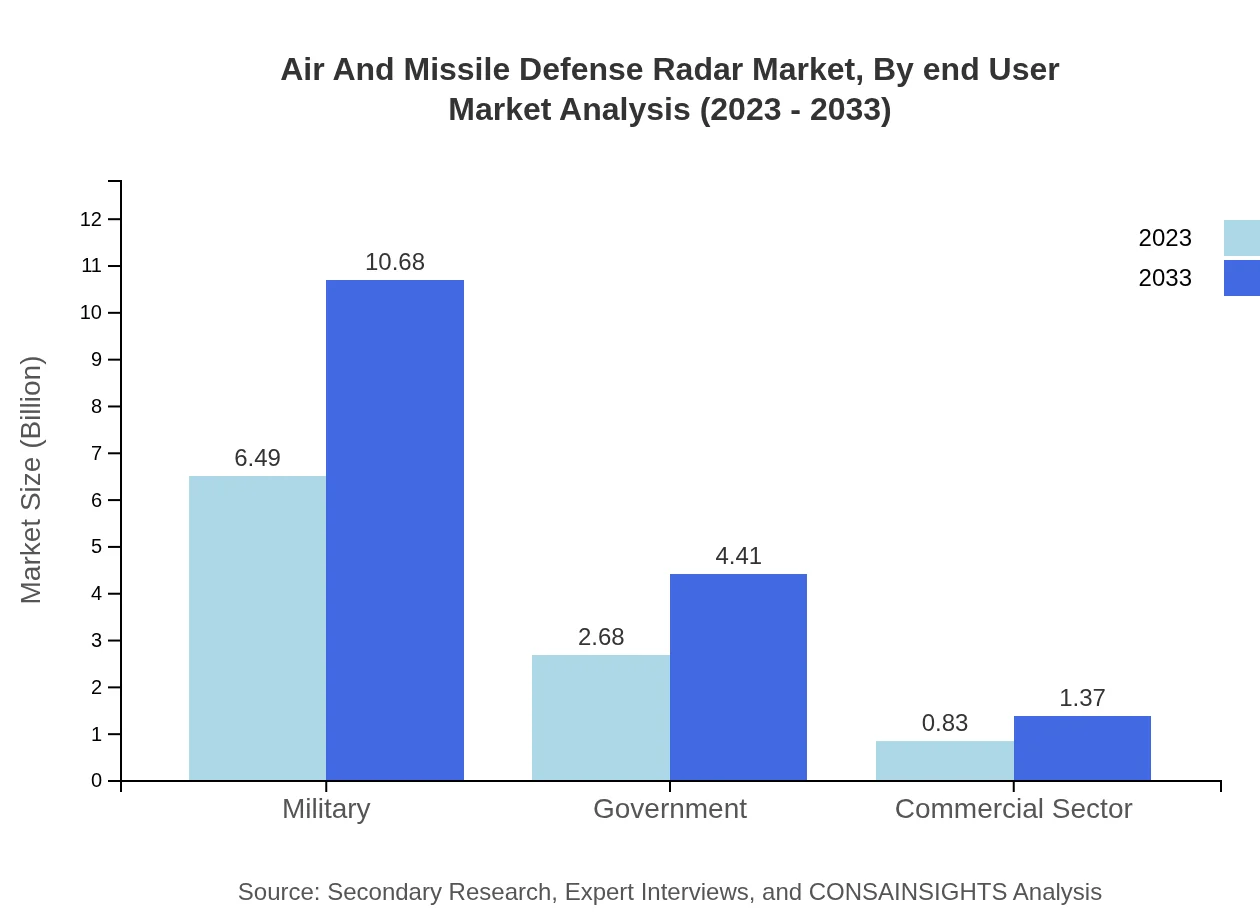

Air And Missile Defense Radar Market Analysis By End User

Military applications dominate the end-user segment, accounting for 64.87% of the overall market. Government utilization also shows significant presence, accounting for about 26.8%. This emphasizes the role of defense policies in stimulating demand in this sector.

Air And Missile Defense Radar Market Analysis By Region

Regional analysis depicts North America as the leading market holder due to technological advancements and geopolitical relations. Europe and Asia-Pacific display strong growth potential fueled by defense collaborations and investments.

Air And Missile Defense Radar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Air And Missile Defense Radar Industry

Raytheon Technologies:

A key player in advanced radar systems, Raytheon Technologies focuses on integrated defense solutions and cutting-edge radar technology.Lockheed Martin Corporation:

Lockheed Martin is renowned for its leadership in aerospace and defense technology, including sophisticated missile defense systems and radar applications.Northrop Grumman Corporation:

Northrop Grumman provides technological solutions across a variety of defense sectors, including robust air and missile defense radar systems.Thales Group:

Thales specializes in aerospace, transport, defense, and security markets with a strong focus on improving radar technologies to enhance surveillance and targeting.We're grateful to work with incredible clients.

FAQs

What is the market size of Air and Missile Defense Radar?

The global air and missile defense radar market is projected to reach approximately $10 billion by 2033, growing at a compound annual growth rate (CAGR) of 5% from 2023.

What are the key market players or companies in this industry?

Key players in the air and missile defense radar market include Raytheon Technologies, Northrop Grumman, Lockheed Martin, Thales Group, and BAE Systems. These companies lead due to their advanced technology and significant investments in R&D.

What are the primary factors driving the growth in the air and missile defense radar industry?

Growth factors include increasing defense budgets globally, the rising need for advanced surveillance systems, and the growing threat of airborne attacks. Technological advancements in radar systems further fuel market expansion.

Which region is the fastest Growing in the air and missile defense radar market?

Europe stands out as the fastest-growing region, expected to expand from $3.74 billion in 2023 to $6.16 billion by 2033. The demand for enhanced defense systems drives this growth.

Does ConsaInsights provide customized market report data for the air and missile defense radar industry?

Yes, ConsaInsights offers tailored market reports focused on the air and missile defense radar sector, allowing clients to gain insights specific to their interests and market positioning.

What deliverables can I expect from this air and missile defense radar market research project?

Deliverables include a comprehensive report detailing market size, trends, competitive analysis, forecasts, and insights segmented by region and application, along with actionable recommendations.

What are the market trends of air and missile defense radar?

Current trends include a shift towards advanced phased array radar systems, increased automation in defense technologies, and a focus on integrating AI and machine learning for improved threat detection and response.