Air Based Remote Weapon Stations Market Report

Published Date: 03 February 2026 | Report Code: air-based-remote-weapon-stations

Air Based Remote Weapon Stations Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Air Based Remote Weapon Stations market from 2023 to 2033, highlighting market sizes, growth rates, regional insights, and industry trends. It aims to equip stakeholders with vital data for strategic decision-making and investment planning.

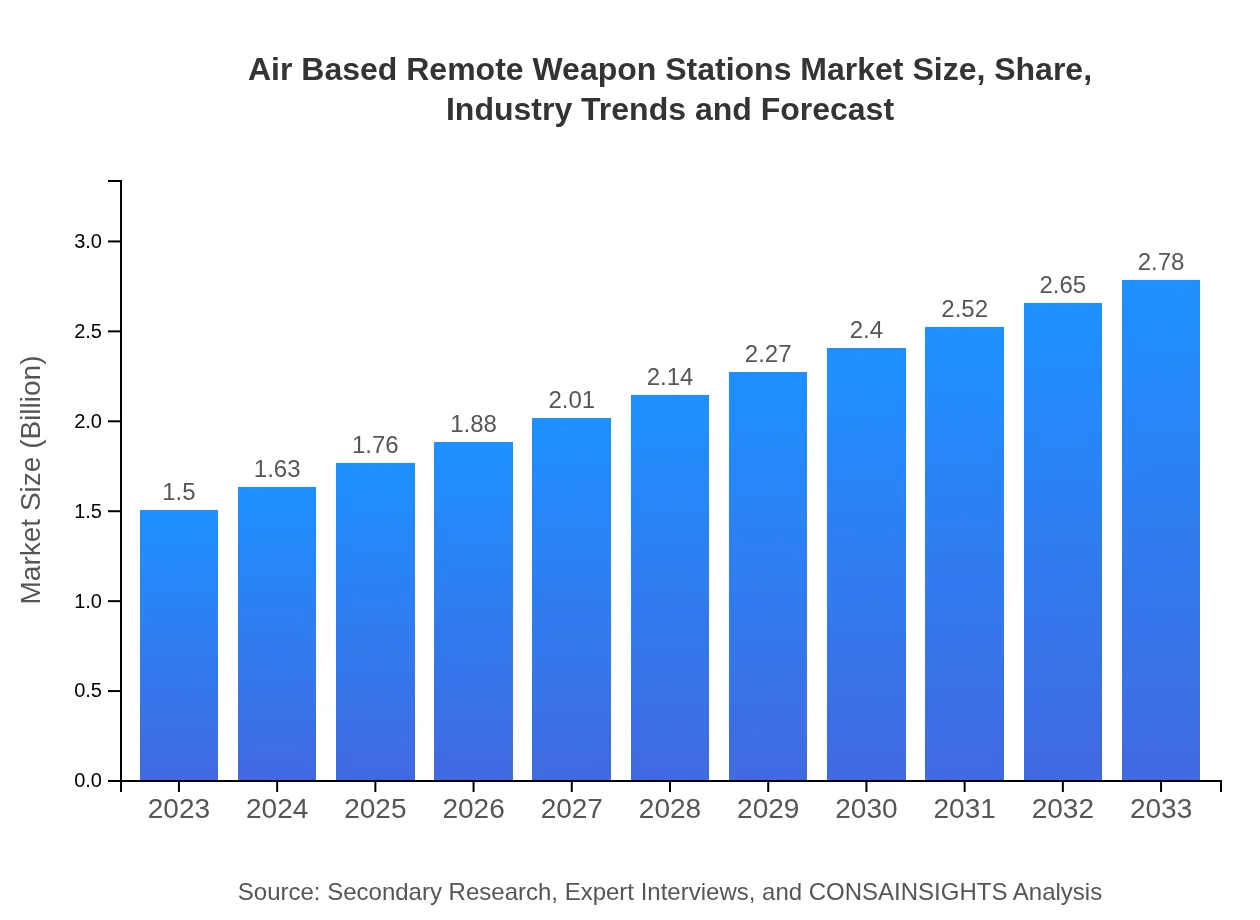

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Northrop Grumman, General Dynamics, Lockheed Martin |

| Last Modified Date | 03 February 2026 |

Air Based Remote Weapon Stations Market Overview

Customize Air Based Remote Weapon Stations Market Report market research report

- ✔ Get in-depth analysis of Air Based Remote Weapon Stations market size, growth, and forecasts.

- ✔ Understand Air Based Remote Weapon Stations's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Air Based Remote Weapon Stations

What is the Market Size & CAGR of Air Based Remote Weapon Stations market in 2023?

Air Based Remote Weapon Stations Industry Analysis

Air Based Remote Weapon Stations Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Air Based Remote Weapon Stations Market Analysis Report by Region

Europe Air Based Remote Weapon Stations Market Report:

Europe’s market is expected to grow from USD 0.47 billion in 2023 to USD 0.87 billion by 2033. Nations such as the UK, France, and Germany are focusing on enhancing their aerial combat capabilities which significantly drives market expansion in this region.Asia Pacific Air Based Remote Weapon Stations Market Report:

In the Asia-Pacific region, the market is expected to increase from USD 0.26 billion in 2023 to approximately USD 0.48 billion by 2033. Growth is driven by military modernization programs, particularly in nations such as India and China, where the integration of advanced air-based platforms enhances defense capabilities.North America Air Based Remote Weapon Stations Market Report:

North America dominates the Air Based Remote Weapon Stations market, with a projected value increase from USD 0.58 billion in 2023 to USD 1.07 billion in 2033. The rapid advancement of military technology and large defense budgets in the U.S. are significant contributors to this growth.South America Air Based Remote Weapon Stations Market Report:

The South American market, albeit smaller, is anticipated to grow from USD 0.06 billion in 2023 to USD 0.10 billion in 2033 as countries in this region begin investing in more sophisticated military technologies in response to internal security needs.Middle East & Africa Air Based Remote Weapon Stations Market Report:

The Middle East and Africa market is also on the rise from USD 0.14 billion in 2023 to an expected USD 0.26 billion in 2033, driven mainly by rising defense spending amid regional conflicts and the strategic importance of air dominance.Tell us your focus area and get a customized research report.

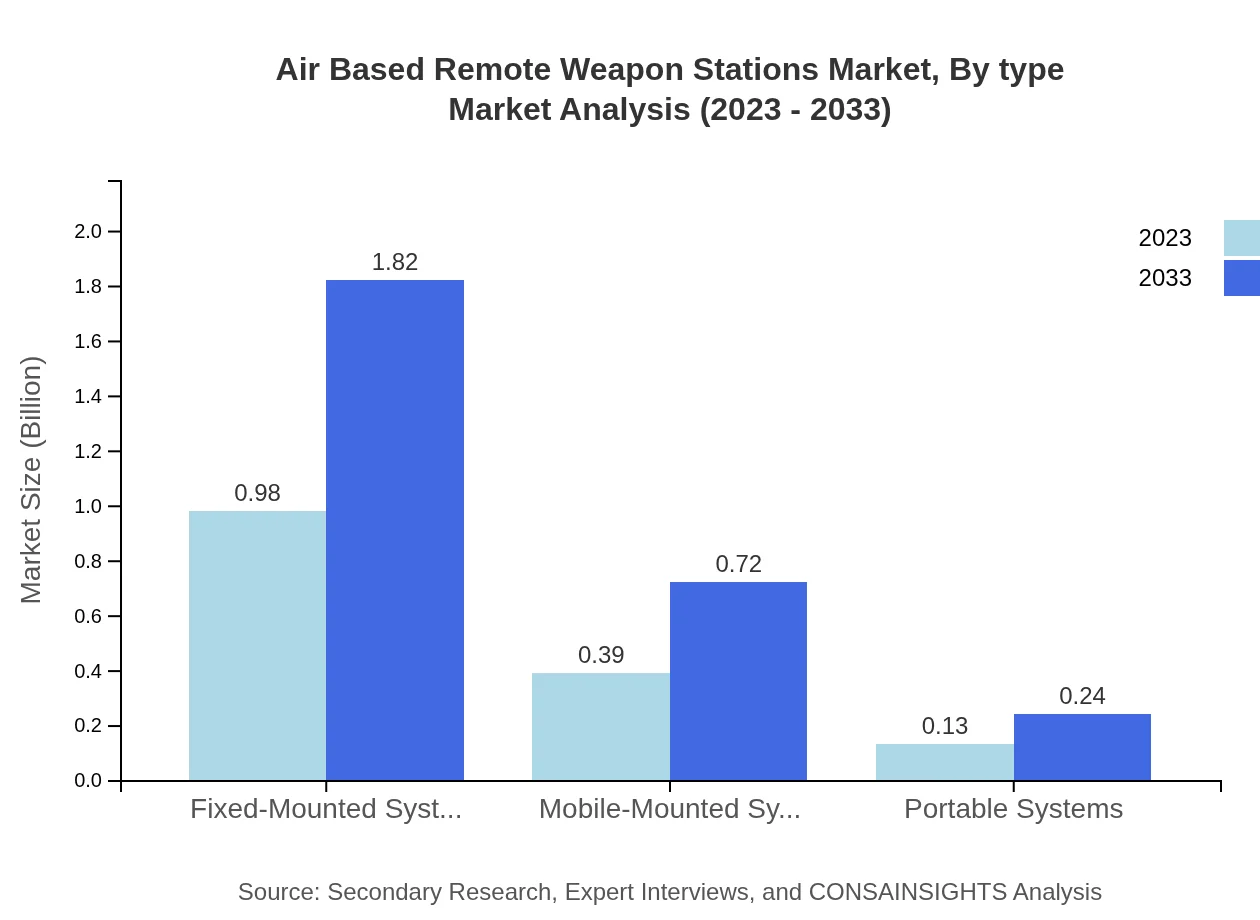

Air Based Remote Weapon Stations Market Analysis By Type

The market for Air Based Remote Weapon Stations by type consists of fixed-mounted systems, mobile-mounted systems, and portable systems. Fixed-mounted systems, representing the largest share, are expected to grow from USD 0.98 billion in 2023 to USD 1.82 billion by 2033, whereas mobile-mounted systems will rise from USD 0.39 billion to USD 0.72 billion over the same period. Portable systems remain the smallest segment but show promise with expected growth from USD 0.13 billion to USD 0.24 billion.

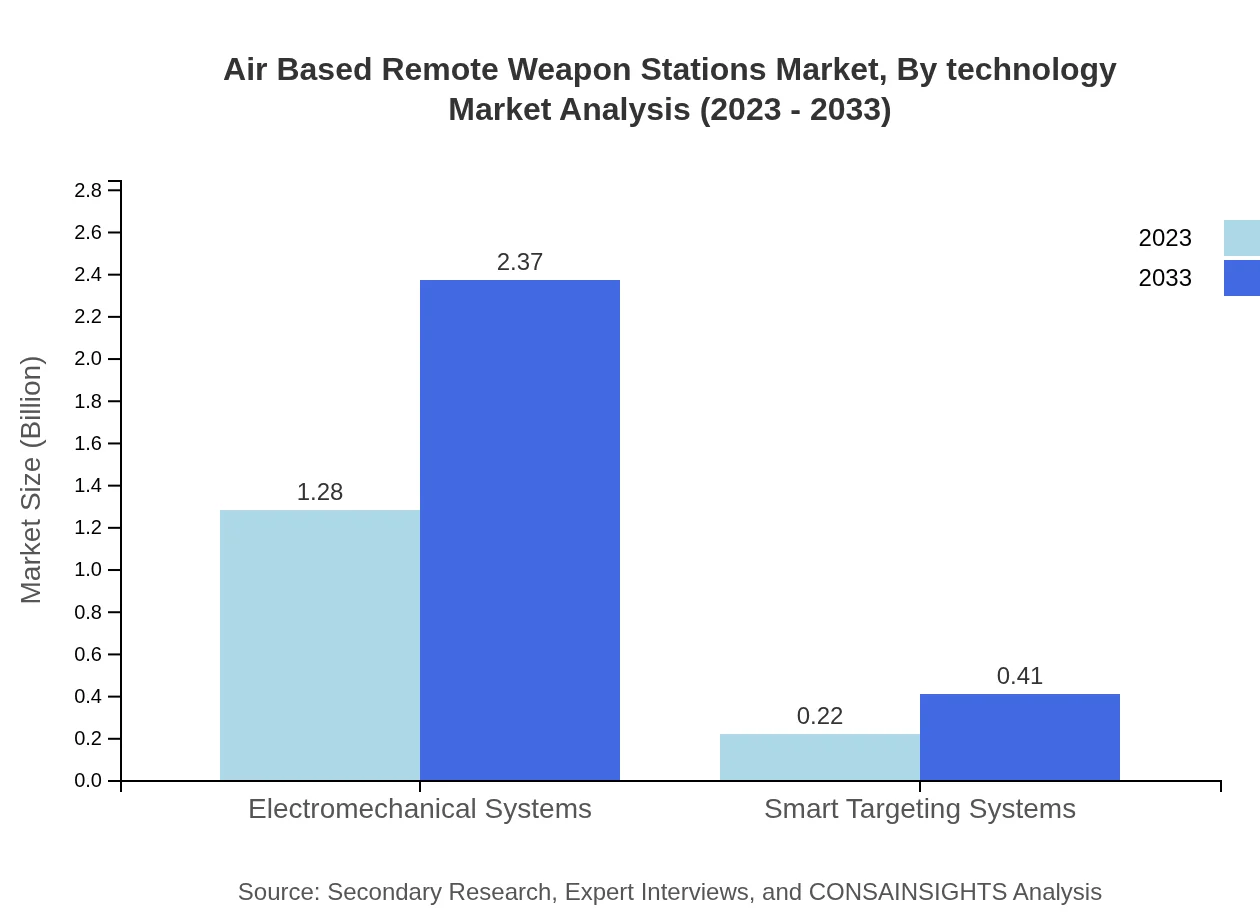

Air Based Remote Weapon Stations Market Analysis By Technology

Electromechanical systems constitute a significant portion of the market, increasing from USD 1.28 billion in 2023 to USD 2.37 billion by 2033, owing to their reliability and effectiveness. Smart targeting systems are projected to see growth from USD 0.22 billion to USD 0.41 billion, highlighting the escalating importance of precision in military operations.

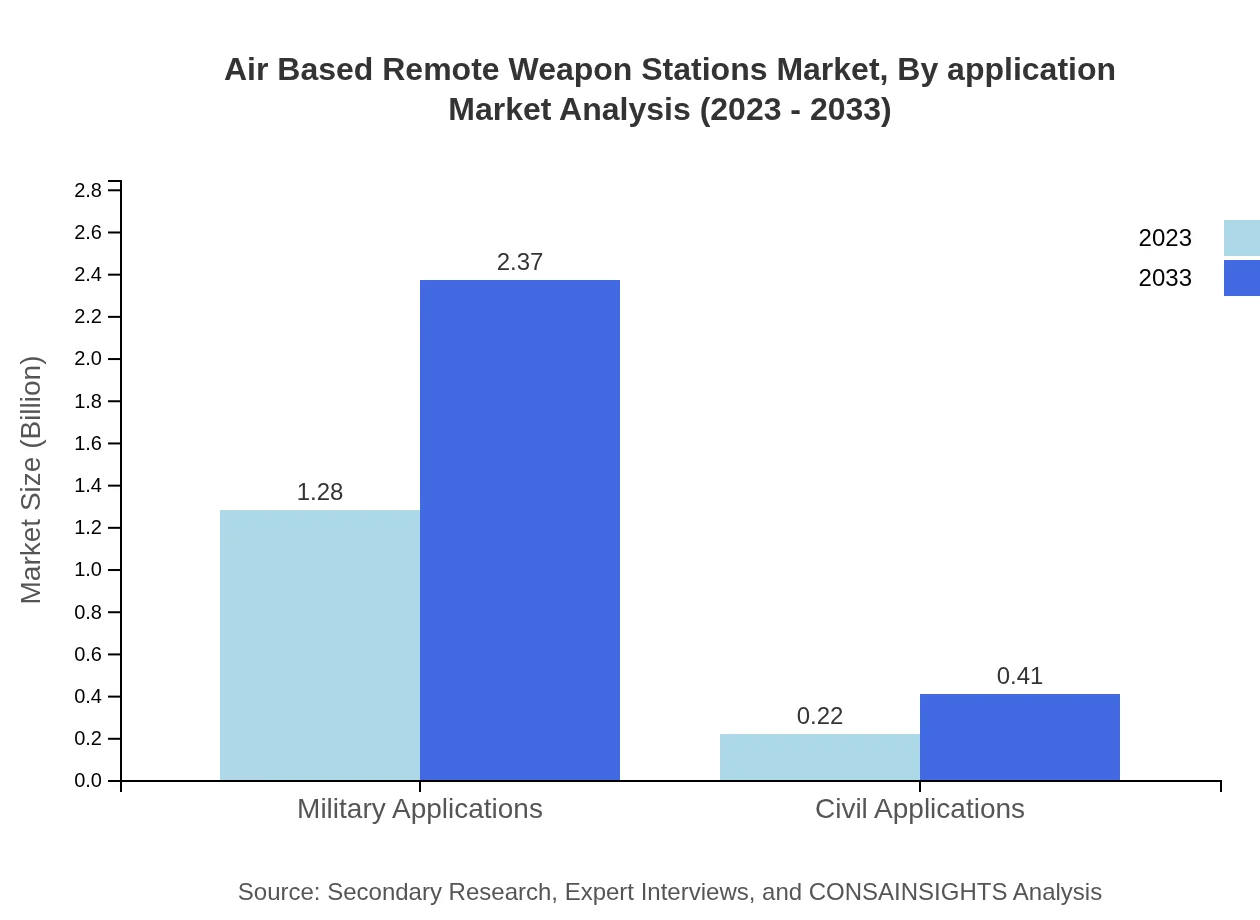

Air Based Remote Weapon Stations Market Analysis By Application

Military applications dominate this sector, currently valued at USD 1.28 billion and expected to rise to USD 2.37 billion by 2033 as global military forces continue to invest in advanced combat technologies. Civil applications, while smaller, will expand from USD 0.22 billion to USD 0.41 billion as non-military uses for air-based weapon systems gain traction.

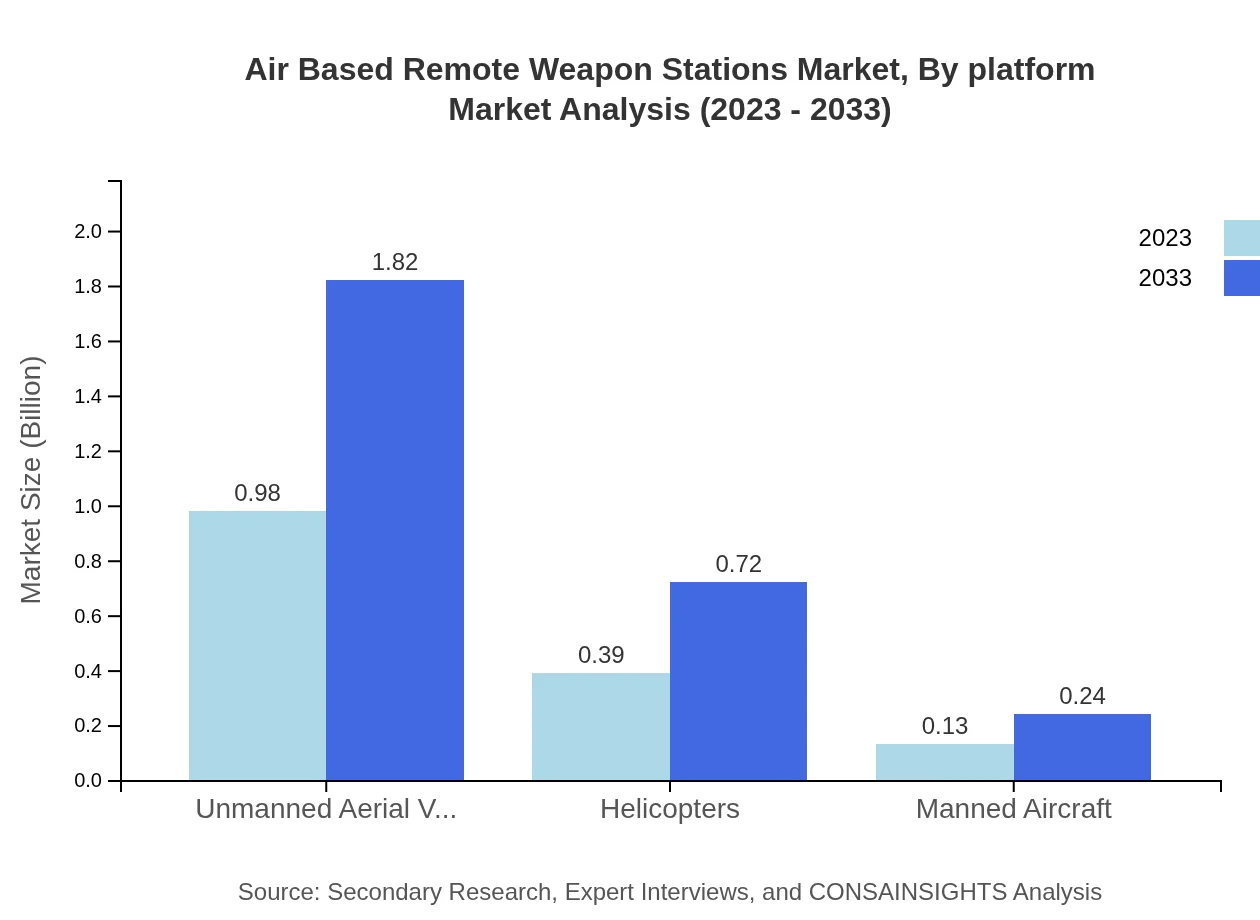

Air Based Remote Weapon Stations Market Analysis By Platform

The market by platform includes unmanned aerial vehicles (UAVs), helicopters, and manned aircraft. UAVs currently hold the largest market share with USD 0.98 billion in 2023, expected to grow to USD 1.82 billion by 2033. Helicopters, having a robust market presence, will expand from USD 0.39 billion to USD 0.72 billion, while manned aircraft are projected to increase from USD 0.13 billion to USD 0.24 billion.

Air Based Remote Weapon Stations Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Air Based Remote Weapon Stations Industry

Northrop Grumman:

A key player in aerospace and defense, Northrop Grumman provides advanced Air Based Remote Weapon Stations that enhance situational awareness and operational capabilities.General Dynamics:

General Dynamics is renowned for designing innovative defense systems including advanced weapon stations for manned and unmanned aerial platforms.Lockheed Martin:

Lockheed Martin develops cutting-edge technologies for military applications, including Air Based Remote Weapon Stations that contribute to national security.We're grateful to work with incredible clients.

FAQs

What is the market size of air Based remote weapon stations?

The air-based remote weapon stations market is valued at approximately $1.5 billion as of 2023, with a projected CAGR of 6.2% through 2033, reflecting significant growth potential in both military and defense applications.

What are the key market players or companies in this air Based remote weapon stations industry?

Key players in the air-based remote weapon stations market include major defense contractors and technology firms specializing in aerospace and military technology, which are crucial for advancing innovative systems and solutions within this sector.

What are the primary factors driving the growth in the air Based remote weapon stations industry?

Growth in the air-based remote weapon stations industry is primarily driven by the increasing demand for advanced military systems, rising defense budgets, and the growing emphasis on unmanned and automated warfare capabilities.

Which region is the fastest Growing in the air Based remote weapon stations market?

North America is the fastest-growing region in the air-based remote weapon stations market, projected to increase from $0.58 billion in 2023 to $1.07 billion by 2033, showcasing robust defense spending and technological advancements.

Does ConsaInsights provide customized market report data for the air Based remote weapon stations industry?

Yes, ConsaInsights offers customized market report data for the air-based remote weapon stations industry, tailored to specific client requirements, allowing for a detailed understanding of market dynamics and opportunities.

What deliverables can I expect from this air Based remote weapon stations market research project?

Expect comprehensive market analysis reports, including insights on market size, segmentation, competitive landscape, regional analysis, and trends in the air-based remote weapon stations market, aiding informed decision-making.

What are the market trends of air Based remote weapon stations?

Current trends in the air-based remote weapon stations market include advancements in drone technology, increased integration of AI in target acquisition systems, and a shift towards portable and mobile-mounted solutions.