Air Compressor Market Report

Published Date: 22 January 2026 | Report Code: air-compressor

Air Compressor Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Air Compressor market, focusing on critical insights and data from 2023 to 2033. It covers market size, trends, technological advancements, regional analysis, and forecasts to equip stakeholders with valuable knowledge for strategic decision-making.

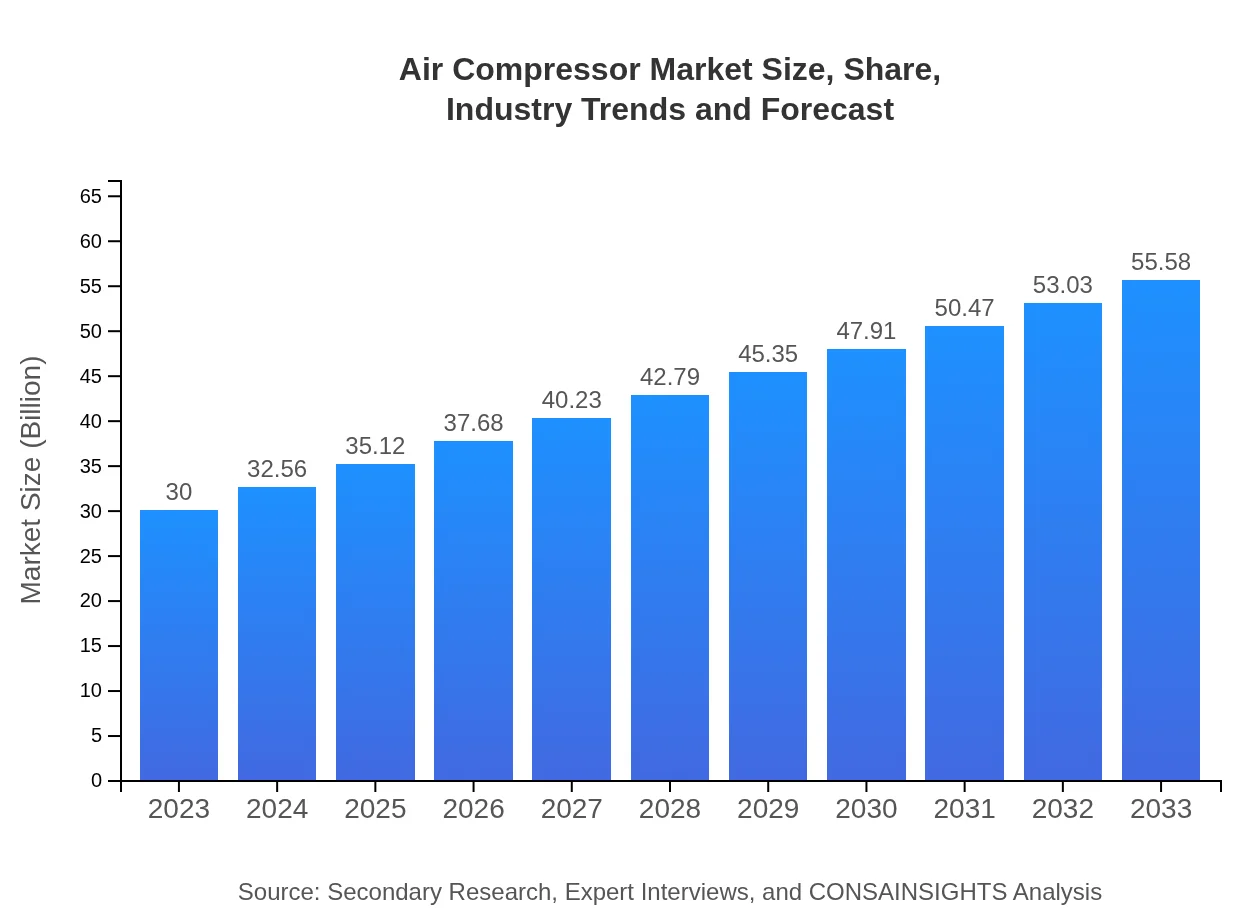

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $55.58 Billion |

| Top Companies | Atlas Copco, Ingersoll Rand, Kaeser Kompressoren, Compressor Products International |

| Last Modified Date | 22 January 2026 |

Air Compressor Market Overview

Customize Air Compressor Market Report market research report

- ✔ Get in-depth analysis of Air Compressor market size, growth, and forecasts.

- ✔ Understand Air Compressor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Air Compressor

What is the Market Size & CAGR of Air Compressor market in 2023?

Air Compressor Industry Analysis

Air Compressor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Air Compressor Market Analysis Report by Region

Europe Air Compressor Market Report:

Europe's Air Compressor market, valued at $9.46 billion in 2023, is projected to grow to $17.53 billion by 2033. Increased environmental regulations and a shift towards sustainable industrial practices fuel demand for energy-efficient air compressors in the region.Asia Pacific Air Compressor Market Report:

The Asia Pacific region, with a market size of $5.80 billion in 2023, is projected to reach $10.74 billion by 2033. The rapid industrialization and rising manufacturing activities in countries like China and India are primary drivers of this growth, with a significant focus on automation and energy efficiency in industrial processes.North America Air Compressor Market Report:

North America is a leading market with a size of $10.23 billion in 2023, anticipated to expand to $18.95 billion by 2033. The region's robust manufacturing base, coupled with technology adoption in processes requiring compressed air, drives this substantial market growth.South America Air Compressor Market Report:

In South America, the Air Compressor market is valued at $0.88 billion in 2023, expected to grow to $1.63 billion by 2033. Factors contributing to this growth include urbanization and increased investments in infrastructure projects, especially in the oil and gas sector.Middle East & Africa Air Compressor Market Report:

The Middle East and Africa market stands at $3.63 billion in 2023, projected to grow to $6.73 billion by 2033, driven by growth in the construction and oil industries, necessitating advanced air compression solutions.Tell us your focus area and get a customized research report.

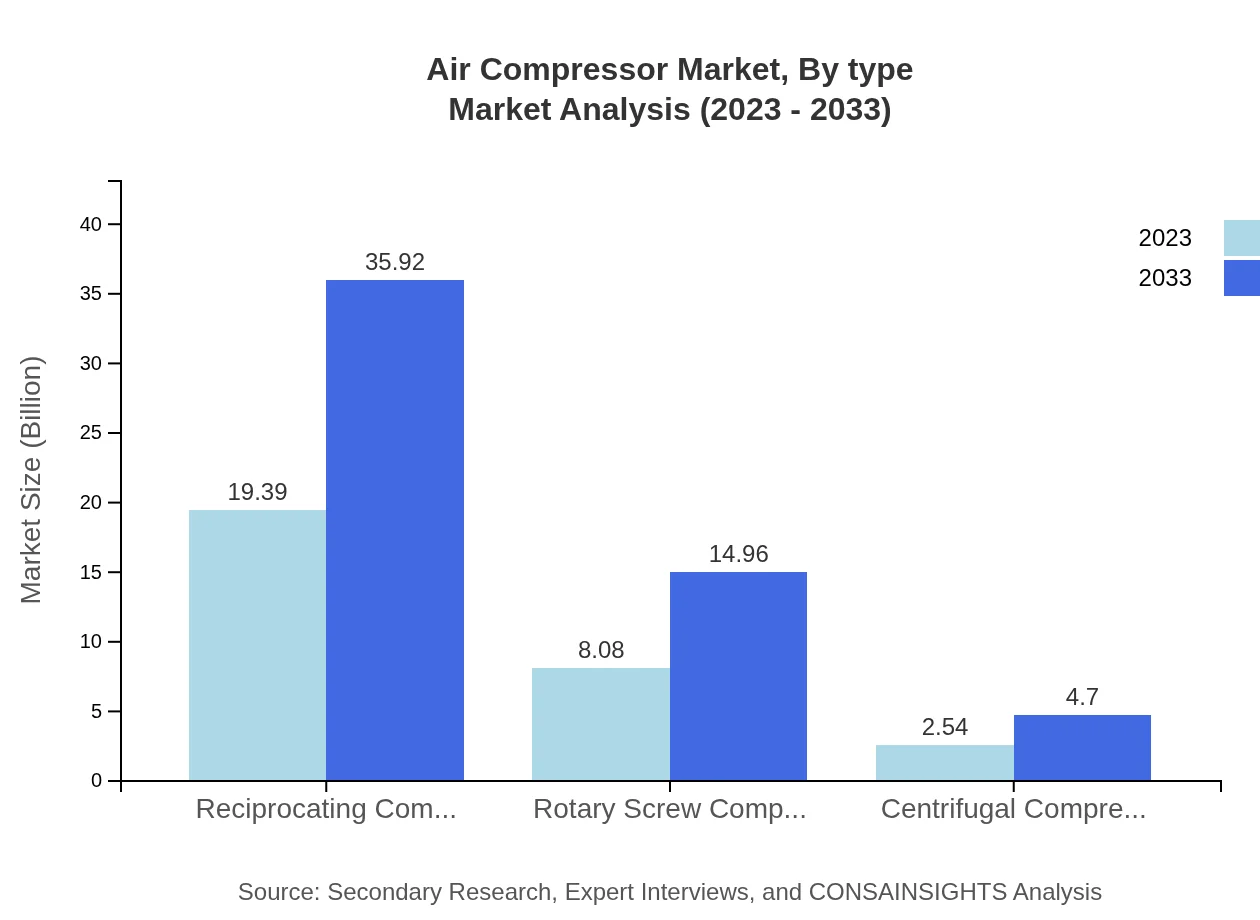

Air Compressor Market Analysis By Type

The Air Compressor market segmentation by type reveals that in 2023, reciprocating compressors hold a substantial market size of $19.39 billion, projected to increase to $35.92 billion by 2033. They account for 64.62% market share in both years. Rotary screw compressors follow with a size of $8.08 billion in 2023, expanding to $14.96 billion by 2033, holding 26.92% of the market. Centrifugal compressors sit at $2.54 billion in 2023 and are expected to grow to $4.70 billion by 2033, maintaining an 8.46% market share.

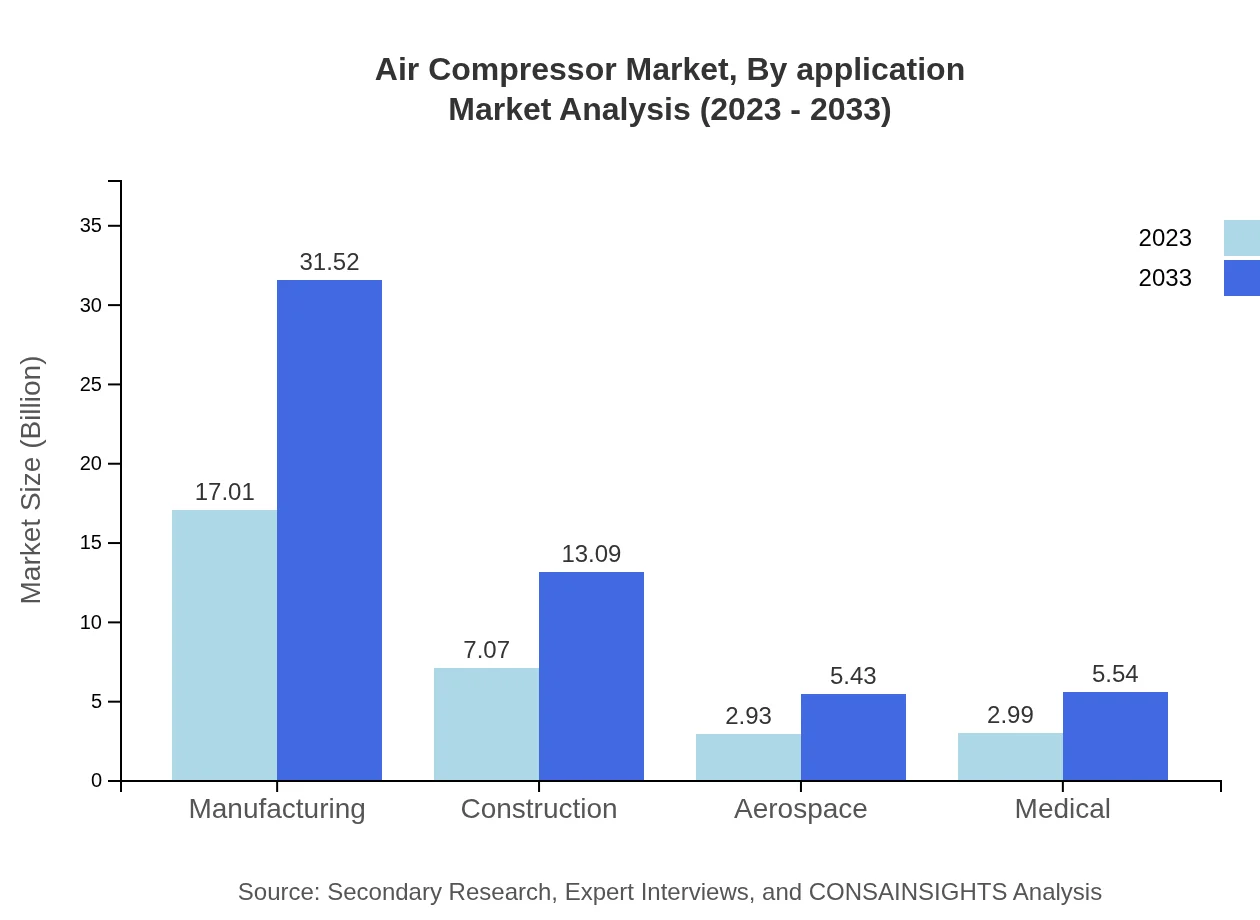

Air Compressor Market Analysis By Application

In the application segment, manufacturing leads with a size of $17.01 billion in 2023, expected to reach $31.52 billion by 2033, capturing 56.71% of the market. The construction sector, valued at $7.07 billion in 2023, is projected to grow to $13.09 billion by 2033, claiming 23.55% market share. Aerospace and medical applications follow with sizes of $2.93 billion and $2.99 billion in 2023, respectively, signifying increased demand for precision and safety standards across applications.

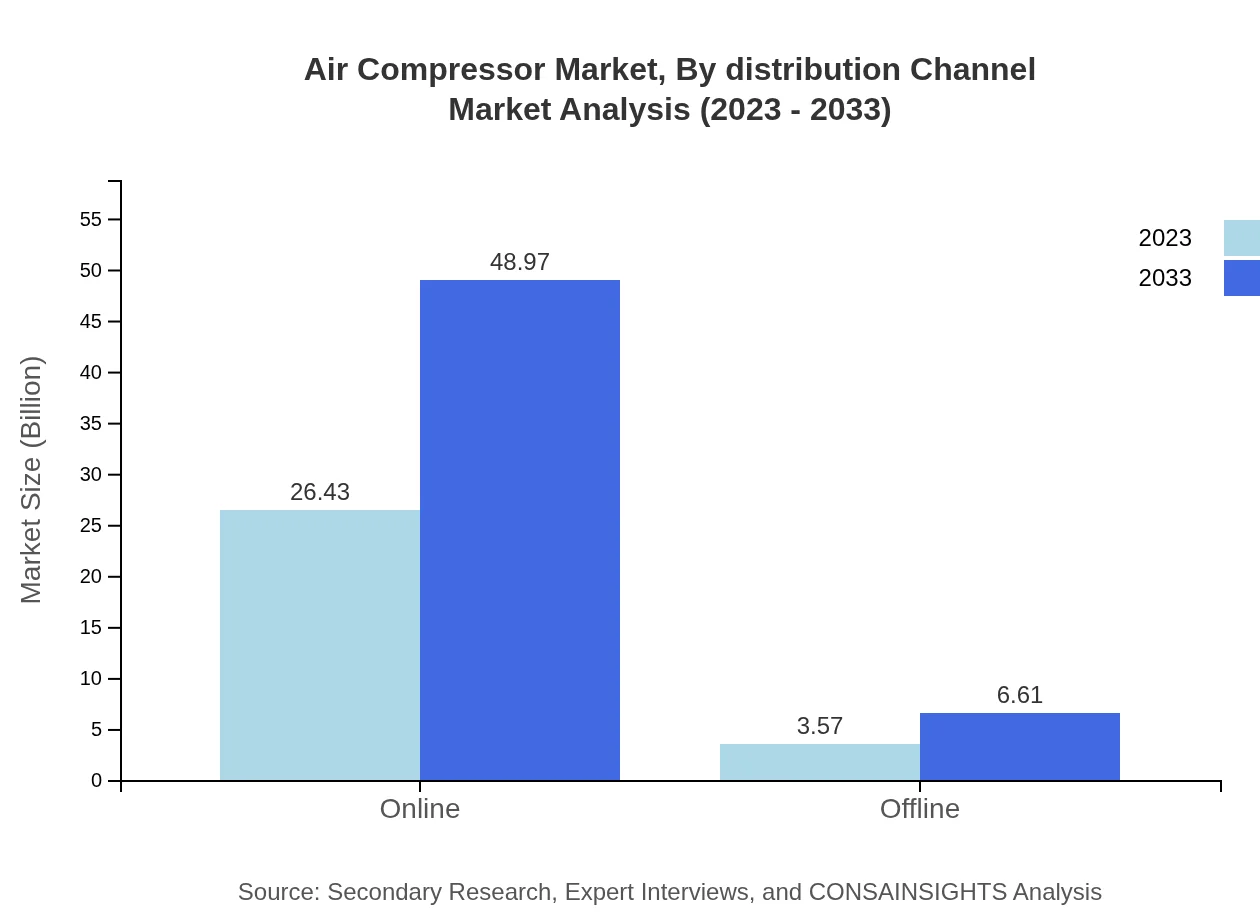

Air Compressor Market Analysis By Distribution Channel

Distribution channels for the Air Compressor market are segmented into online and offline sales. Online channels are prominent, accounting for $26.43 billion in 2023 and expected to grow to $48.97 billion by 2033, representing 88.11% market share. Offline channels, valued at $3.57 billion in 2023, are expected to reach $6.61 billion by 2033, representing 11.89% market share, reflecting a gradual shift towards digital purchasing experiences.

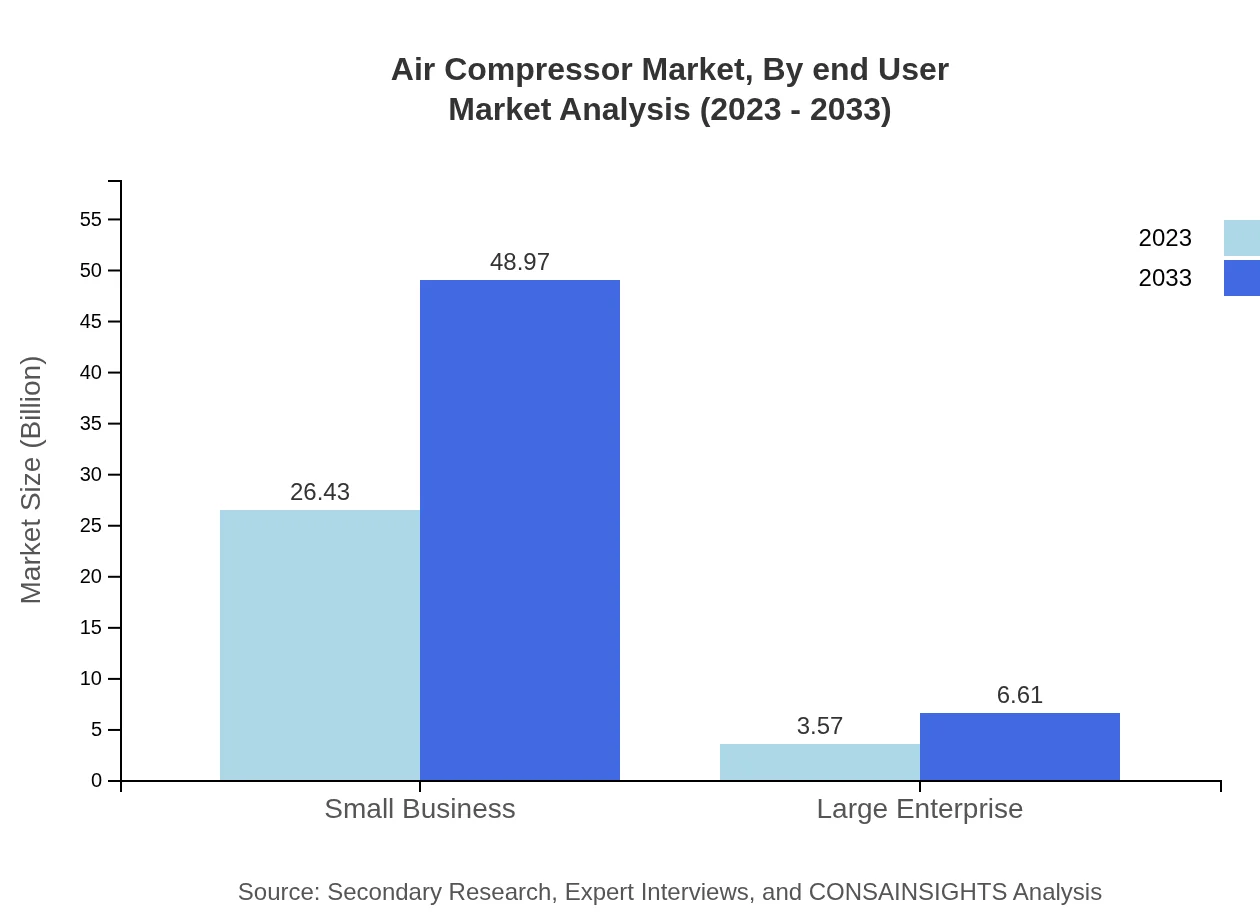

Air Compressor Market Analysis By End User

The end-user segmentation of the market underscores the dominance of small businesses, valued at $26.43 billion in 2023, growing to $48.97 billion by 2033, with a market share of 88.11%. Large enterprises account for $3.57 billion in 2023, expected to increase to $6.61 billion by 2033, representing 11.89% market share. This reflects small businesses' more extensive utilization of compressed air compared to large corporations in their operational practices.

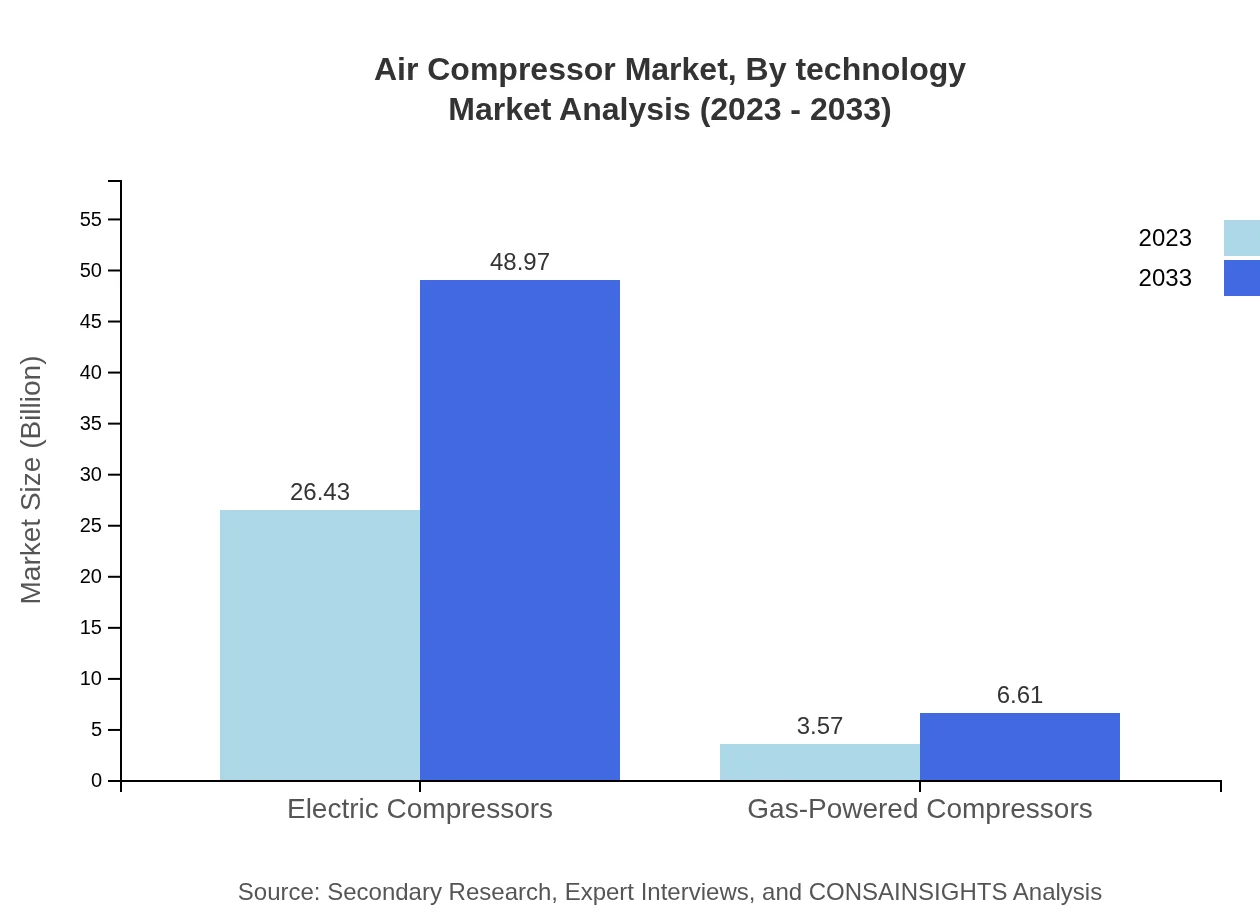

Air Compressor Market Analysis By Technology

Regarding technology, electric compressors lead the market with a size of $26.43 billion in 2023, anticipated to reach $48.97 billion by 2033, capturing an 88.11% market share. Gas-powered compressors, valued at $3.57 billion in 2023, are expected to grow to $6.61 billion by 2033, signifying their niche applications in specific industries requiring mobility and flexibility.

Air Compressor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Air Compressor Industry

Atlas Copco:

A leading manufacturer of air compressors and vacuum solutions, Atlas Copco emphasizes energy efficiency and innovative products tailored for various industrial applications.Ingersoll Rand:

Ingersoll Rand is renowned for its broad range of air compressor technologies and solutions across sectors such as manufacturing, automotive, and construction, focusing on sustainability and innovation.Kaeser Kompressoren:

A globally recognized company, Kaeser Kompressoren specializes in rotary screw and reciprocating compressors, known for their energy efficient and durable compressor systems.Compressor Products International:

Compressor Products International manufactures high-quality compressor components, providing solutions designed for efficiency and longevity in various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of air Compressor?

The air compressor market is projected to reach approximately $30 billion by 2033, growing at a CAGR of 6.2% from 2023. This growth indicates a robust demand across various sectors, coupled with technological advancements.

What are the key market players or companies in the air Compressor industry?

The air compressor industry features major players like Atlas Copco, Ingersoll Rand, and Kaeser Compressors. These companies dominate the market through innovation, extensive product ranges, and strong distribution networks globally.

What are the primary factors driving the growth in the air Compressor industry?

Key driving factors include increasing industrial activities, demand for energy-efficient solutions, and advancements in compressor technology. Additionally, growing sectors like construction and manufacturing contribute significantly to market expansion.

Which region is the fastest Growing in the air Compressor market?

The fastest-growing region in the air compressor market is Asia Pacific, projected to grow from $5.80 billion in 2023 to $10.74 billion by 2033. Factors include rapid industrialization and infrastructure development in emerging economies.

Does ConsaInsights provide customized market report data for the air Compressor industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the air compressor industry. This includes detailed insights on market trends, competitor analysis, and regional forecasts.

What deliverables can I expect from this air Compressor market research project?

Expect comprehensive reports including market size analytics, growth forecasts, competitive landscape, segmentation data, and regional analysis. Deliverables will provide actionable insights to inform strategic decisions.

What are the market trends of air Compressor?

Current trends in the air compressor market include a shift towards energy-efficient machines, increasing adoption of electric compressors, and growth in smart technology integrations for enhanced operational efficiency.