Air Data Systems Market Report

Published Date: 03 February 2026 | Report Code: air-data-systems

Air Data Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Air Data Systems market, covering trends, forecasts, and regional insights for the period from 2023 to 2033. Detailed information includes market size, segmentation, leading companies, and future challenges.

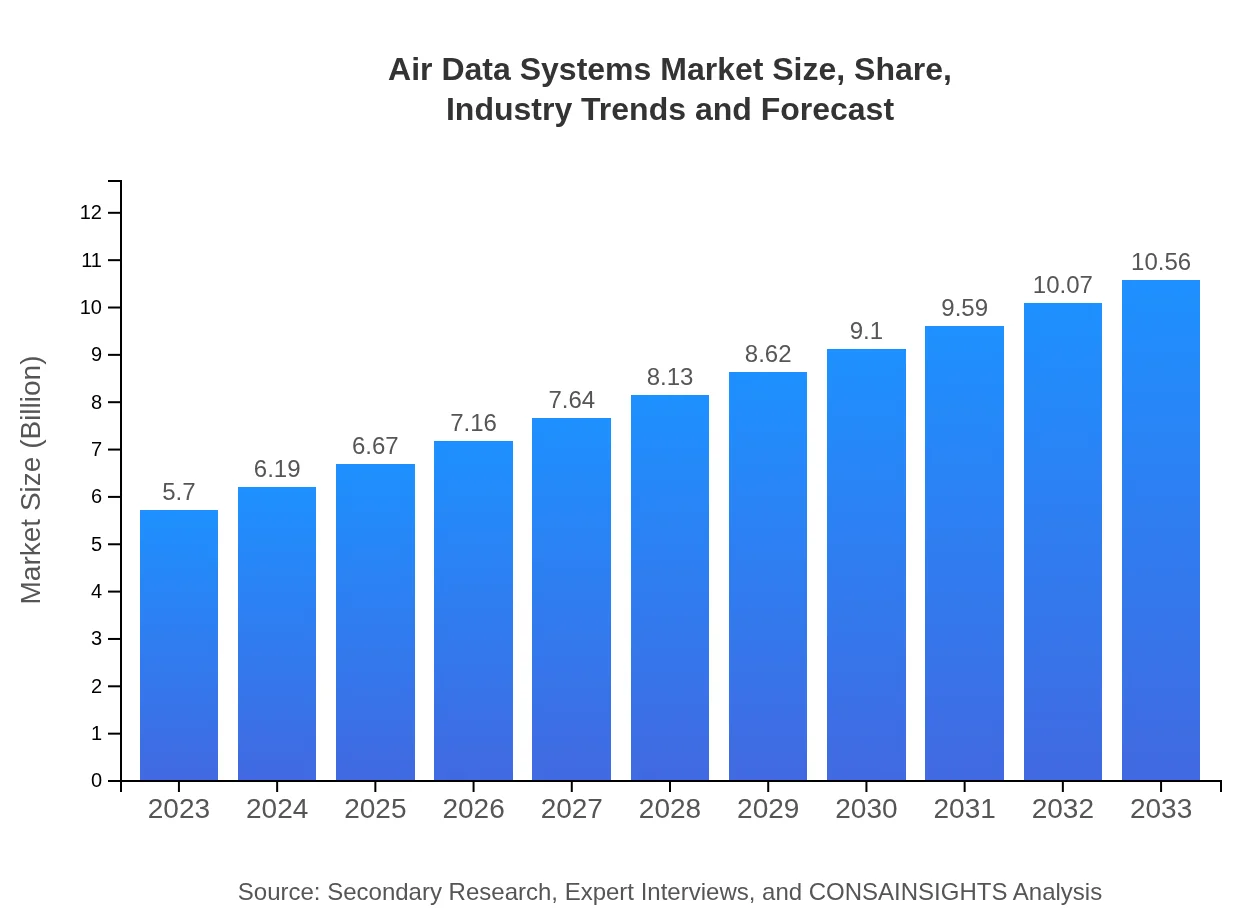

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.70 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.56 Billion |

| Top Companies | Honeywell Aerospace, Thales Group, Rockwell Collins (Collins Aerospace), Northrop Grumman |

| Last Modified Date | 03 February 2026 |

Air Data Systems Market Overview

Customize Air Data Systems Market Report market research report

- ✔ Get in-depth analysis of Air Data Systems market size, growth, and forecasts.

- ✔ Understand Air Data Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Air Data Systems

What is the Market Size & CAGR of Air Data Systems market in 2023?

Air Data Systems Industry Analysis

Air Data Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Air Data Systems Market Analysis Report by Region

Europe Air Data Systems Market Report:

Europe’s market for Air Data Systems stands at $1.77 billion in 2023, anticipated to reach $3.28 billion by 2033. The European market benefits from stringent safety regulations and technological advancements in air data services, spurring growth across various aviation sectors.Asia Pacific Air Data Systems Market Report:

In 2023, the Air Data Systems market in the Asia Pacific region is valued at $1.08 billion, with expectations to grow to $2.01 billion by 2033. The region is witnessing substantial demand due to increasing passenger air traffic, with countries like China and India heavily investing in expanding their aviation infrastructure.North America Air Data Systems Market Report:

North America encompasses a market size of $1.97 billion in 2023, expected to increase to $3.65 billion by 2033. The region is a leader in aeronautical innovation, with significant investments from companies and government bodies into state-of-the-art air data technologies.South America Air Data Systems Market Report:

The South American market for Air Data Systems is estimated at $0.22 billion in 2023, projected to rise to $0.40 billion by 2033. Growth is driven by regional efforts to bolster air traffic management and reduce operational costs in the aviation sector.Middle East & Africa Air Data Systems Market Report:

In the Middle East and Africa, the market value is $0.66 billion in 2023, forecasted to grow to $1.22 billion by 2033. The region is investing heavily in the aviation sector, with new airports and airline expansion projects driving demand for advanced air data systems.Tell us your focus area and get a customized research report.

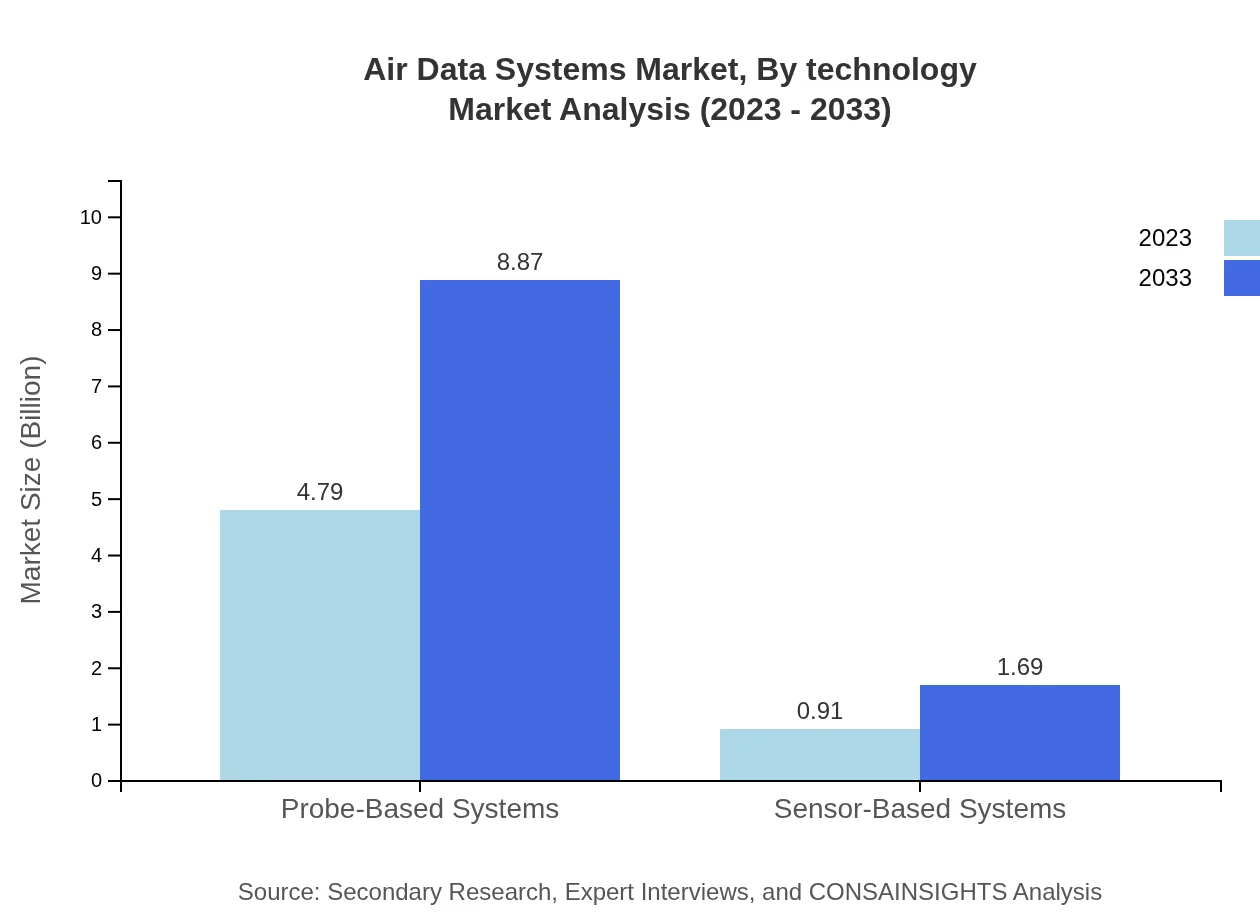

Air Data Systems Market Analysis By Technology

The market is largely driven by probe-based systems, making up 84% of the current segment share. In 2023, the probe-based systems segment is sized at $4.79 billion, projected to grow to $8.87 billion by 2033. Sensor-based systems hold a smaller share yet are essential for newer technologies, currently valued at $0.91 billion and expected to double by 2033.

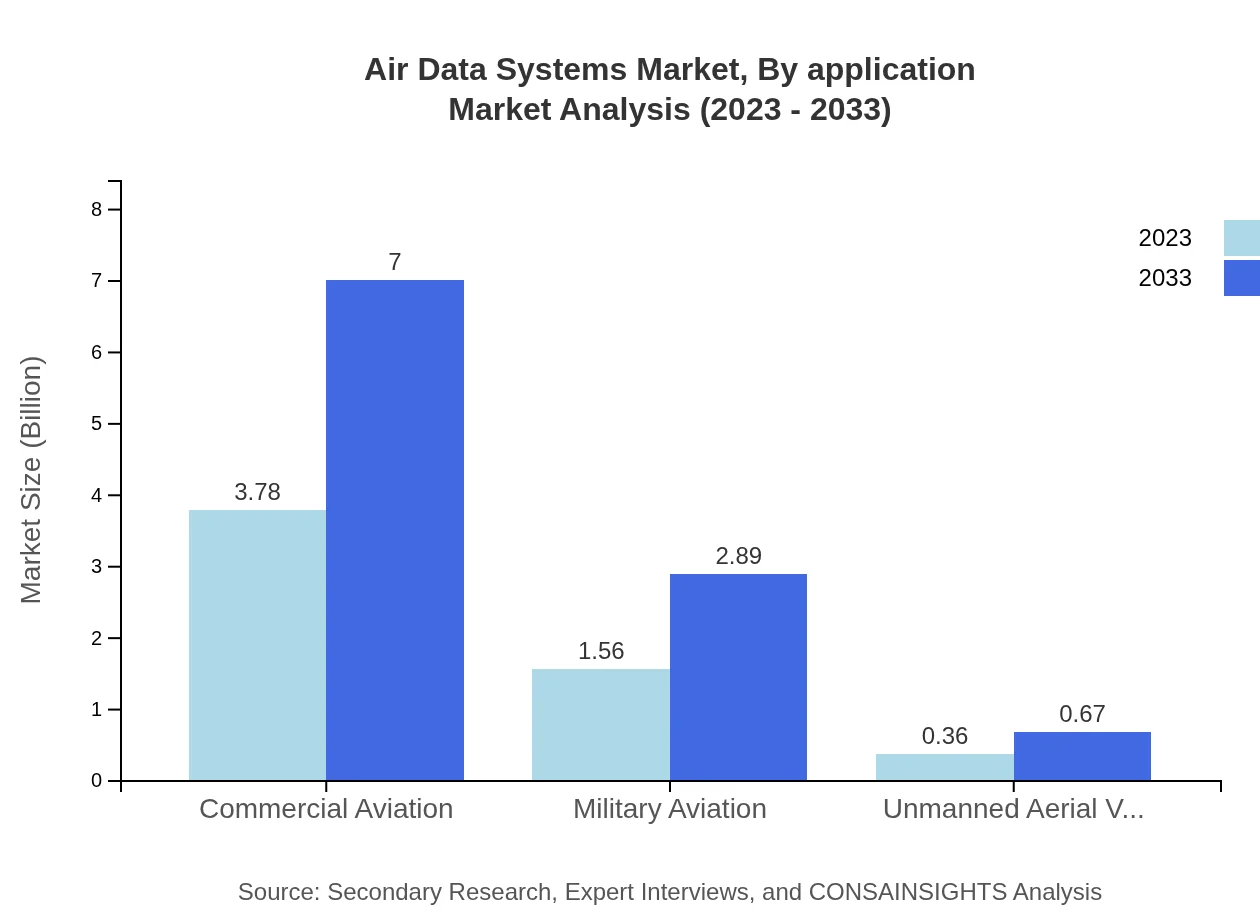

Air Data Systems Market Analysis By Application

Commercial aviation accounts for approximately 66% of the market share, maintaining a market value of $3.78 billion in 2023 and forecasting growth to $7.00 billion by 2033. Military applications are vital, representing 27.38%, and expected to grow alongside increasing defense budgets.

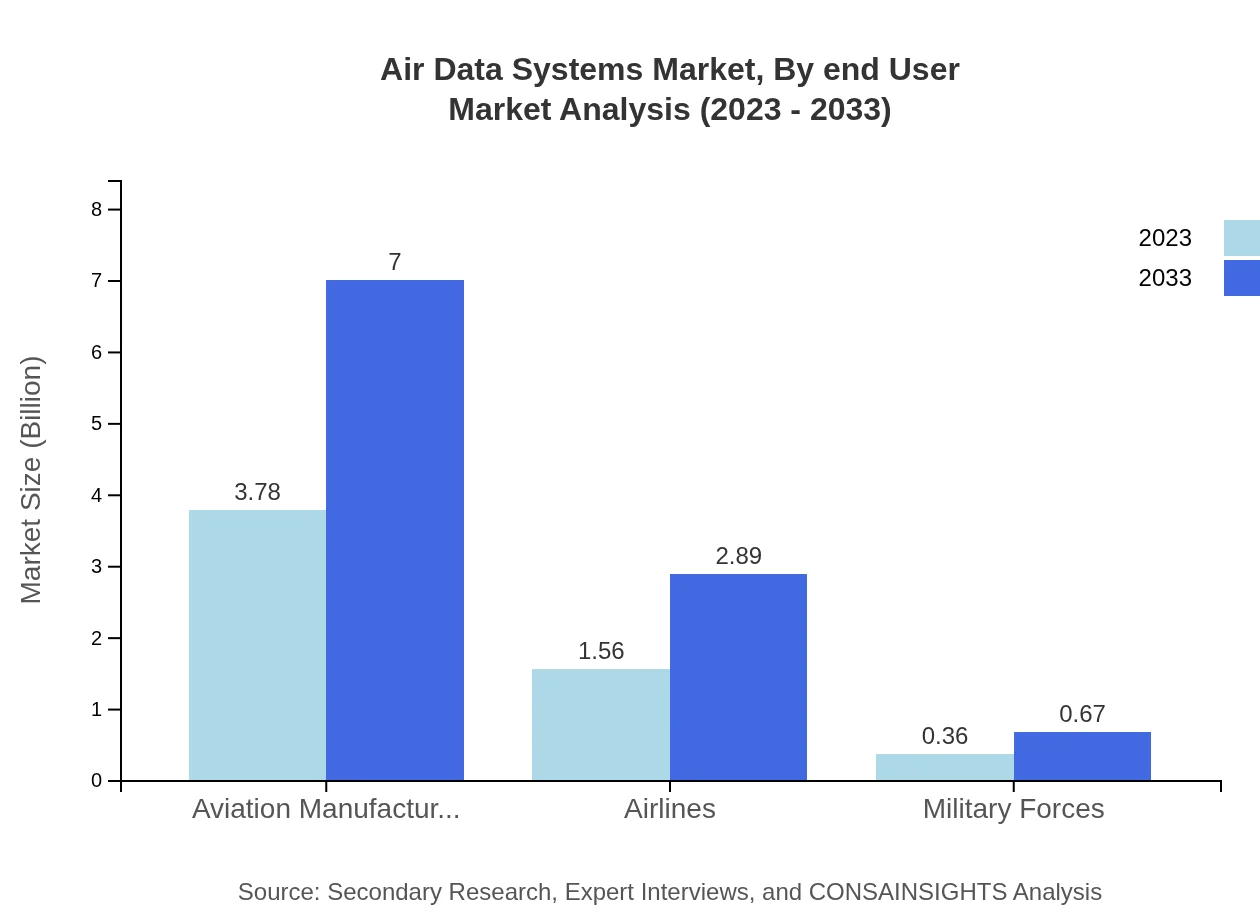

Air Data Systems Market Analysis By End User

The primary end-users include commercial airlines and military forces, accounting for 94% of the segment. Investment in upgrading avionics is expected to boost revenue significantly through 2033.

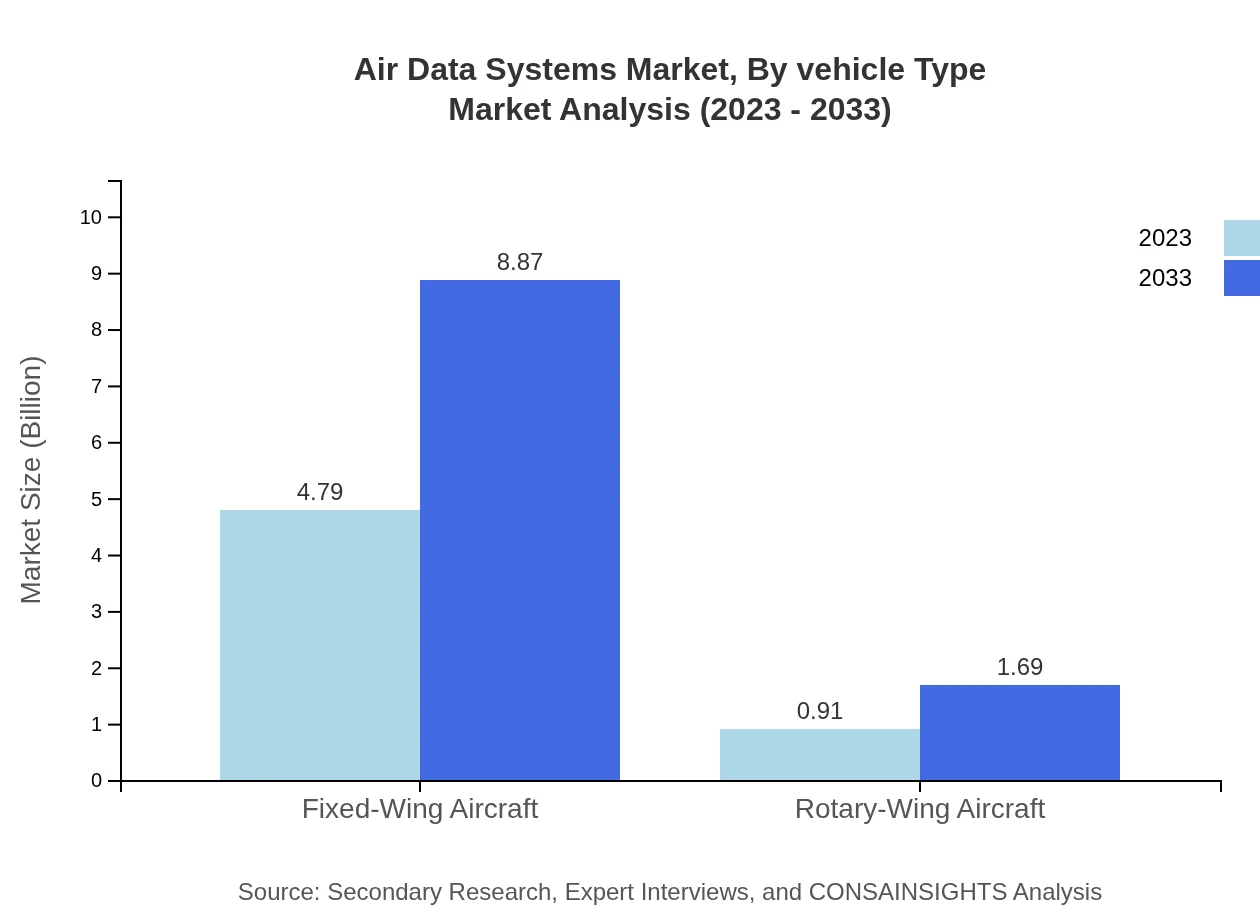

Air Data Systems Market Analysis By Vehicle Type

Commercial aviation vehicles dominate with a market size of $3.78 billion in 2023, while military vehicles are poised for growth. Fixed-wing aircraft hold a significant share, showing robust performance and projected growth, whereas the rotary-wing category is seeing increased attention.

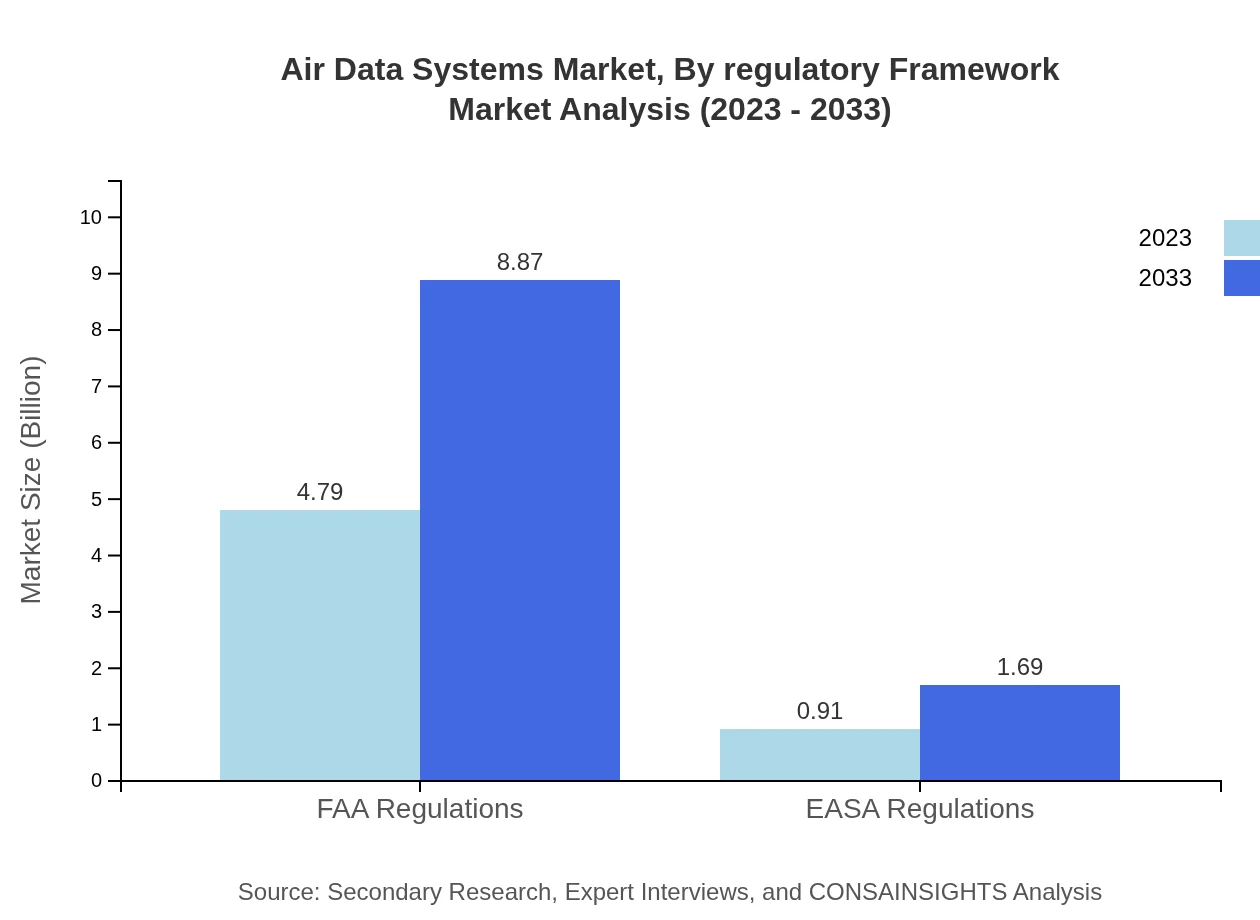

Air Data Systems Market Analysis By Regulatory Framework

Regulatory frameworks such as FAA and EASA standards govern the market, with FAA regulations comprising 84% of the market share. Compliance with these regulations ensures safety, reliability, and performance, critical factors in the industry.

Air Data Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Air Data Systems Industry

Honeywell Aerospace:

A key player in aerospace technology, Honeywell provides a broad range of Air Data Systems and avionic solutions, known for their high reliability and innovation.Thales Group:

Thales is known for its cutting-edge air data and avionics systems, focusing on enhancing safety and efficiency in aviation operations.Rockwell Collins (Collins Aerospace):

Collins Aerospace leads in integration and smart technologies in air data measurement, catering to both commercial and military sectors.Northrop Grumman:

Northrop Grumman is influential in the military aviation segment, providing comprehensive air data systems that meet strict defense requirements.We're grateful to work with incredible clients.

FAQs

What is the market size of air Data Systems?

The air data systems market is projected to reach approximately $5.7 billion by 2033, with a compound annual growth rate (CAGR) of 6.2% from 2023. This indicates a robust growth trajectory driven by increasing demand for advanced aviation technologies.

What are the key market players or companies in this air Data Systems industry?

Key market players in the air data systems industry include major aviation manufacturers and technology companies specializing in aerospace systems. Their innovative solutions and investments in R&D contribute significantly to the competitive landscape of this sector.

What are the primary factors driving the growth in the air Data Systems industry?

Driving factors include the rising demand for advanced avionics in commercial and military aircraft, increased investments in research and development, and the ongoing evolution of aerospace technologies aimed at enhancing safety and performance.

Which region is the fastest Growing in the air Data Systems?

The North America region is currently the fastest-growing market for air data systems, with an expected growth from $1.97 billion in 2023 to $3.65 billion by 2033, driven by innovation and high aircraft production rates.

Does ConsaInsights provide customized market report data for the air Data Systems industry?

Yes, ConsaInsights offers customized market report data tailored to the unique requirements of clients within the air data systems industry, providing insights that meet specific business needs and strategic interests.

What deliverables can I expect from this air Data Systems market research project?

Deliverables include comprehensive market analysis reports, segmentation insights, competitive landscape evaluations, and actionable recommendations, all designed to inform strategic decision-making in the air data systems market.

What are the market trends of air Data Systems?

Trends indicate a shift towards integration of sensor-based systems, increased focus on innovation in UAV technologies, and growing regulatory compliance driving advancements in aviation standards and air data systems.