Air Freight Market Report

Published Date: 02 February 2026 | Report Code: air-freight

Air Freight Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Air Freight market, covering trends, forecasts, market segmentation, and regional insights from 2023 to 2033.

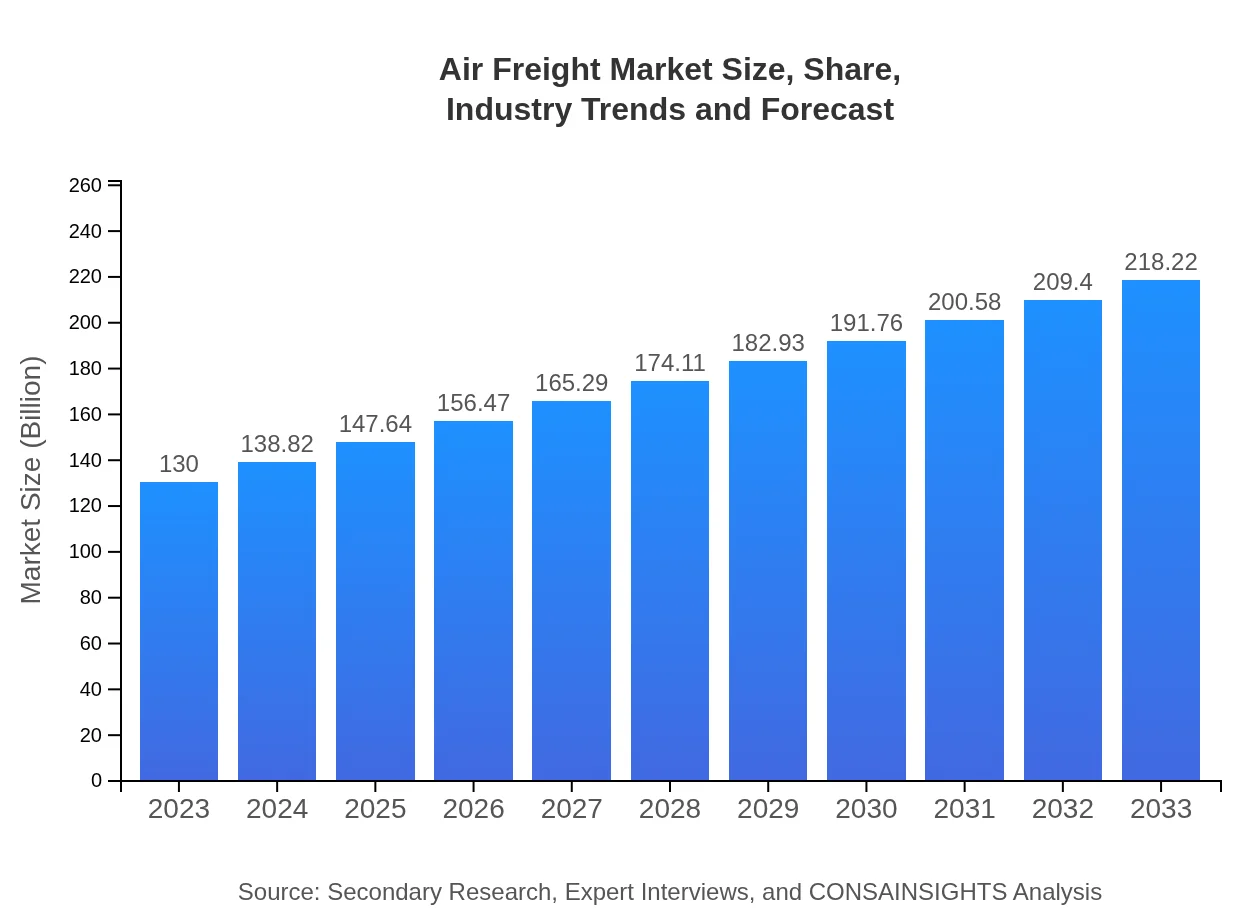

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $130.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $218.22 Billion |

| Top Companies | DHL, FedEx , UPS, Emirates SkyCargo, Kuehne + Nagel |

| Last Modified Date | 02 February 2026 |

Air Freight Market Overview

Customize Air Freight Market Report market research report

- ✔ Get in-depth analysis of Air Freight market size, growth, and forecasts.

- ✔ Understand Air Freight's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Air Freight

What is the Market Size & CAGR of Air Freight market in 2023?

Air Freight Industry Analysis

Air Freight Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Air Freight Market Analysis Report by Region

Europe Air Freight Market Report:

Europe's air freight market is also set for growth, projected to rise from $33.45 billion in 2023 to $56.15 billion in 2033. The region benefits from established logistics networks and high demand from industries such as manufacturing, fashion, and pharmaceuticals.Asia Pacific Air Freight Market Report:

The Asia Pacific region is experiencing rapid growth in air freight, projected to reach $41.72 billion by 2033, up from $24.86 billion in 2023. Major factors contributing to this trend include increased trade activities, booming e-commerce, and significant investments in logistics infrastructure.North America Air Freight Market Report:

North America remains one of the largest air freight markets, with a projected size of $82.79 billion by 2033, growing from $49.32 billion in 2023. The robust demand from e-commerce and industries like pharmaceuticals and automotive significantly drives market dynamics in this region.South America Air Freight Market Report:

South America shows promising growth in air freight, with an increase from $10.78 billion in 2023 to $18.09 billion by 2033. The growth is fostered by the rise in exports and technological advancements in logistics, making shipping solutions more efficient.Middle East & Africa Air Freight Market Report:

The Middle East and Africa air freight market will grow from $11.60 billion in 2023 to $19.47 billion by 2033, driven by a burgeoning tourism sector and investments in logistics capabilities, which enhance the ability to handle cargo flows effectively.Tell us your focus area and get a customized research report.

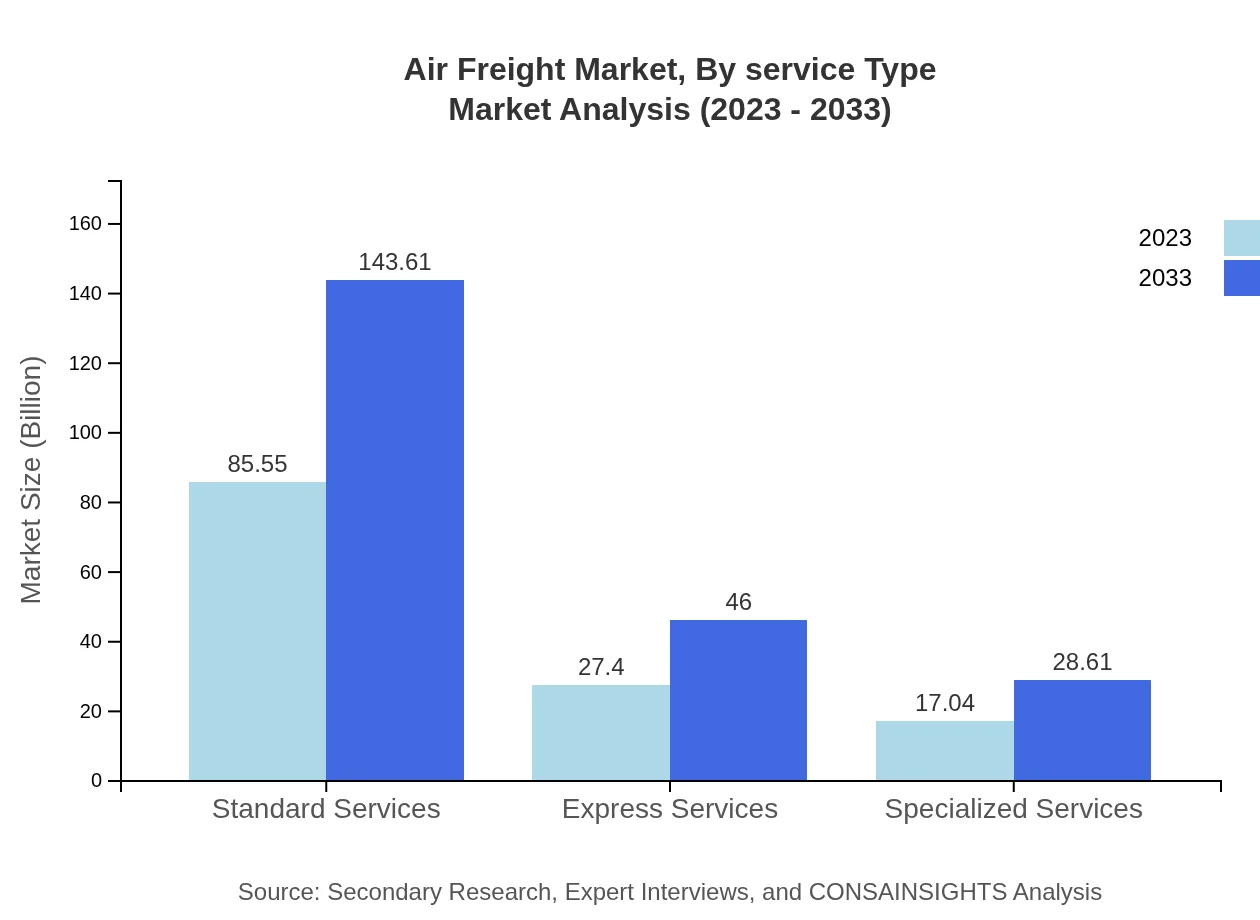

Air Freight Market Analysis By Service Type

The service type segmentation reveals that Standard Services and Express Services dominate the market, with Standard Services expected to maintain a market share of 65.81% by 2033. Express Services are projected to see significant growth as e-commerce continues to expand, rising from $27.40 million in 2023 to $46 million in 2033.

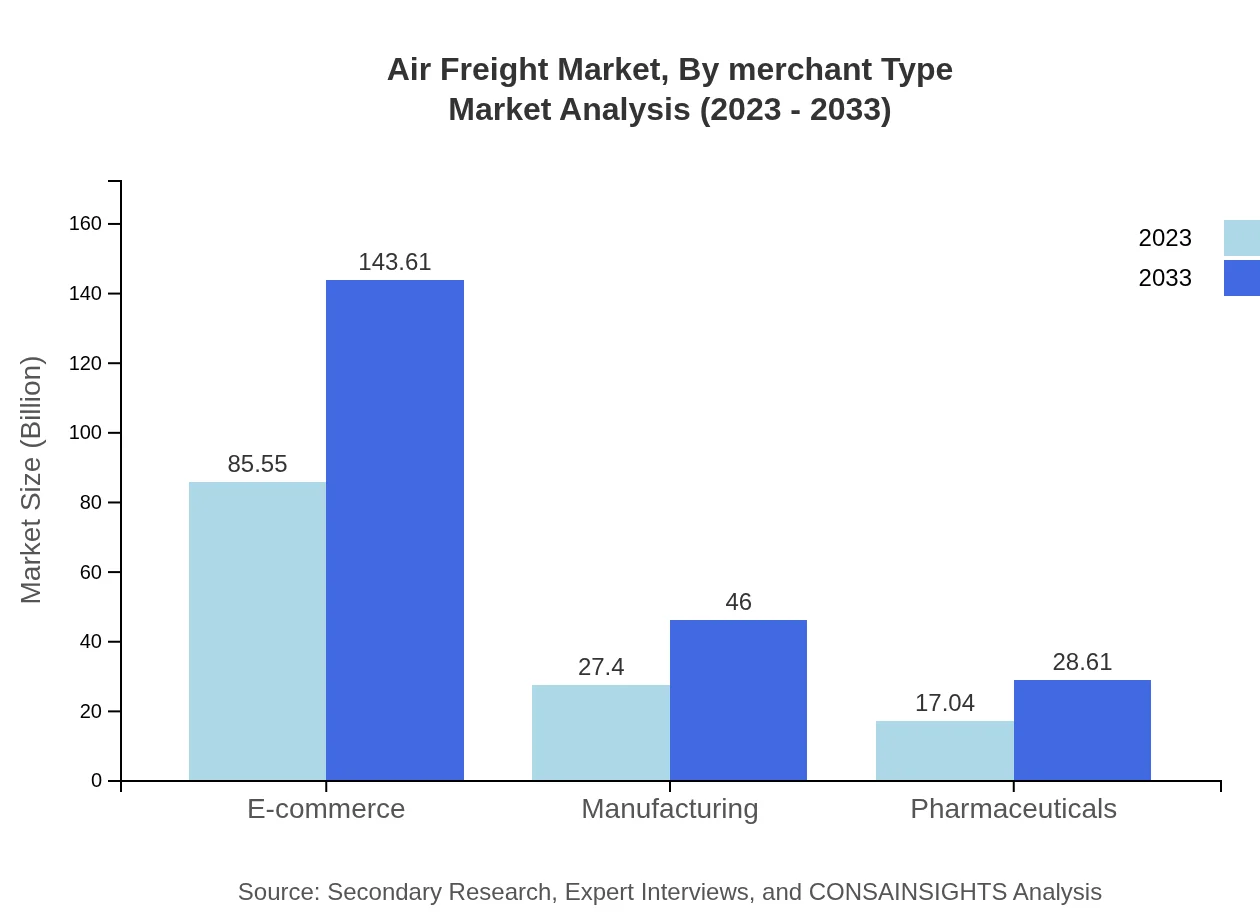

Air Freight Market Analysis By Merchant Type

E-commerce is leading the merchant-type segmentation, projected to hold a market share of 65.81% in 2033, while sectors such as Pharmaceuticals and Automotive are important contributors. Understanding merchant needs will be key for tailored logistics services.

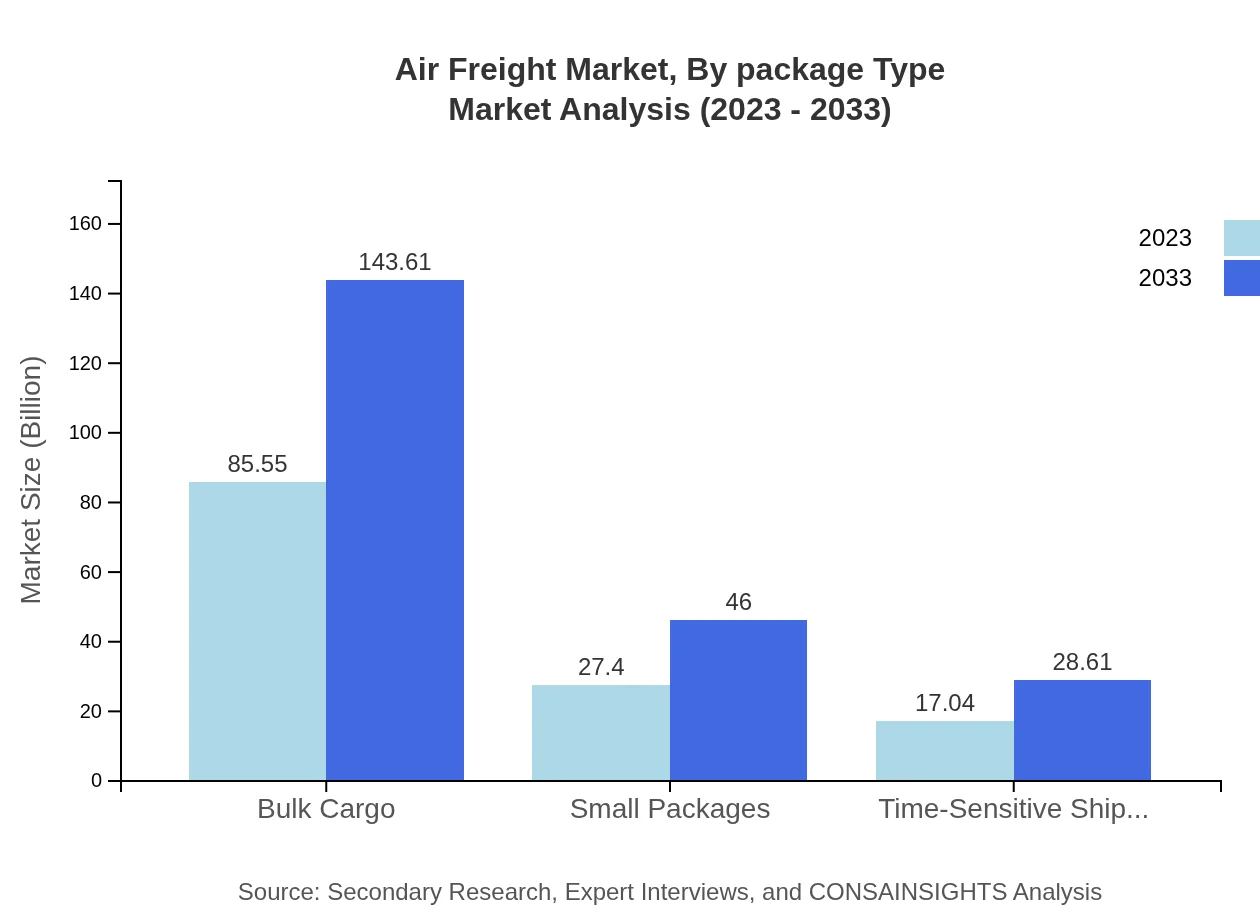

Air Freight Market Analysis By Package Type

In terms of package type, Bulk Cargo remains significant, with expectations to rise from $85.55 million in 2023 to $143.61 million in 2033. The focus on efficient processing and handling of different package types will be pivotal as customization becomes the norm.

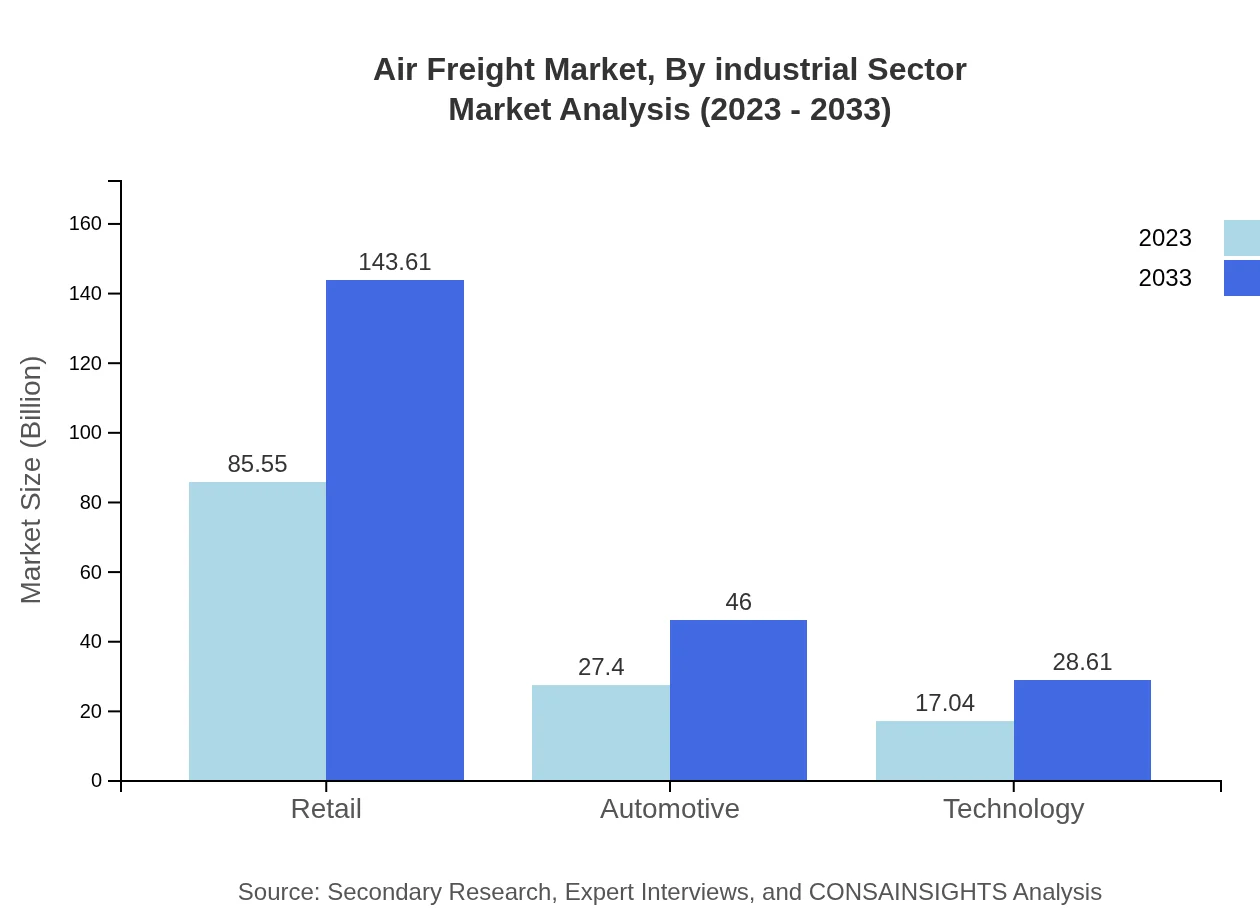

Air Freight Market Analysis By Industrial Sector

Retail and Manufacturing sectors give substantial contributions, with retail projected to remain a strong segment. The forecast highlights a cumulative shift towards digital trade models influencing the overall industry structure.

Air Freight Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Air Freight Industry

DHL:

A global leader in the logistics sector, DHL offers express and freight solutions worldwide and is renowned for its innovative technology and customer-focused services.FedEx :

FedEx promotes international express transportation and logistics solutions, recognized for its extensive air transport networks and commitment to efficiency and reliability.UPS:

UPS provides comprehensive logistics and supply chain solutions, focusing on sustainability and diverse customer service tailored to various industrial needs.Emirates SkyCargo:

The air freight division of Emirates Airlines operates a fleet of dedicated freighters, specializing in pharmaceutical, perishable, and time-sensitive shipments, widely recognized for reliable and quality service.Kuehne + Nagel:

Kuehne + Nagel is a prominent logistics service provider with a strong focus on sea and air freight, providing innovative solutions tailored to various markets including automotive and high-tech.We're grateful to work with incredible clients.

FAQs

What is the market size of air Freight?

The global air-freight market was valued at approximately $130 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.2%. This growth indicates steady demand and expansion in the air-freight sector over the next decade.

What are the key market players or companies in this air Freight industry?

Key players in the air-freight industry include major airlines and logistics companies such as FedEx, UPS, DHL, and Emirates SkyCargo. These companies dominate market share and influence industry standards and innovations.

What are the primary factors driving the growth in the air Freight industry?

Growth in the air-freight sector is primarily driven by the rise of e-commerce, increased demand for quick delivery services, globalization of trade, and advancements in air cargo technologies. Additionally, the growing pharmaceutical sector contributes to this expansion.

Which region is the fastest Growing in the air Freight?

The fastest-growing region in the air-freight industry is North America, expected to rise from $49.32 billion in 2023 to $82.79 billion by 2033. This region benefits from a robust logistics infrastructure and high demand for fast delivery.

Does ConsaInsights provide customized market report data for the air Freight industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the air-freight industry, allowing businesses to access insights relevant to their operational focus and strategic planning.

What deliverables can I expect from this air Freight market research project?

Deliverables from an air-freight market research project typically include detailed market analysis, segmentation insights, competitive landscape overview, regional growth forecasts, and actionable recommendations for strategic initiatives.

What are the market trends of air Freight?

Current market trends in air-freight include the increasing reliance on e-commerce for shipping, adoption of technology in logistics like automation, focus on sustainability in shipping practices, and growing demand for temperature-controlled shipments, especially in pharmaceuticals.