Air Starter Market Report

Published Date: 22 January 2026 | Report Code: air-starter

Air Starter Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Air Starter market, offering insights into market size, trends, regional analysis, and forecasts from 2023 to 2033. It highlights the key segments, competitive landscape, and emerging technologies shaping the industry.

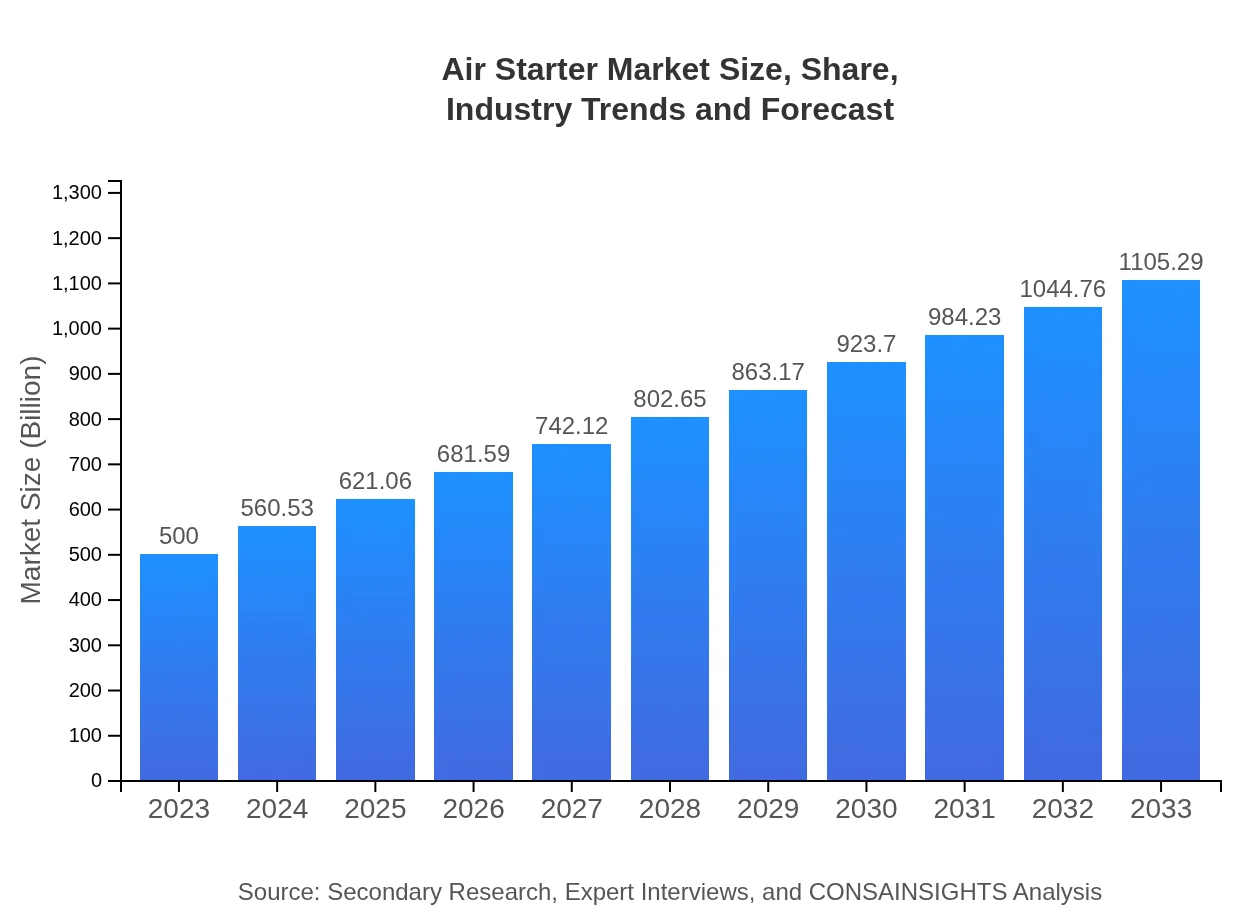

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 8% |

| 2033 Market Size | $1105.29 Million |

| Top Companies | Ingersoll Rand, Parker Hannifin, Westport Fuel Systems, JRC Engineering |

| Last Modified Date | 22 January 2026 |

Air Starter Market Overview

Customize Air Starter Market Report market research report

- ✔ Get in-depth analysis of Air Starter market size, growth, and forecasts.

- ✔ Understand Air Starter's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Air Starter

What is the Market Size & CAGR of Air Starter market in 2023-2033?

Air Starter Industry Analysis

Air Starter Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Air Starter Market Analysis Report by Region

Europe Air Starter Market Report:

Europe, estimated at $121.60 million in 2023, is projected to grow to $268.81 million by 2033. The stringent regulations regarding emissions alongside the shift towards advanced technological solutions in aerospace and automotive sectors support this growth.Asia Pacific Air Starter Market Report:

The Asia Pacific region is expected to witness significant growth, with the market projected to grow from $106.50 million in 2023 to $235.43 million by 2033. Rising industrial activities and demand for reliable starting solutions in countries like China and India are key drivers of this growth.North America Air Starter Market Report:

North America holds a significant market share, with a valuation of $163.10 million in 2023, expected to reach $360.55 million by 2033. The presence of major aerospace and automotive industries in this region drives steady demand for air starter solutions.South America Air Starter Market Report:

In South America, the Air Starter market is anticipated to grow from $49.55 million in 2023 to $109.53 million by 2033, primarily fueled by developments in the mining and construction industries where air starters are increasingly utilized.Middle East & Africa Air Starter Market Report:

The Middle East and Africa region is expected to grow from $59.25 million in 2023 to $130.98 million by 2033. Increased investments in oil & gas exploration and heightened utilization of air starters in these sectors are contributing to market growth.Tell us your focus area and get a customized research report.

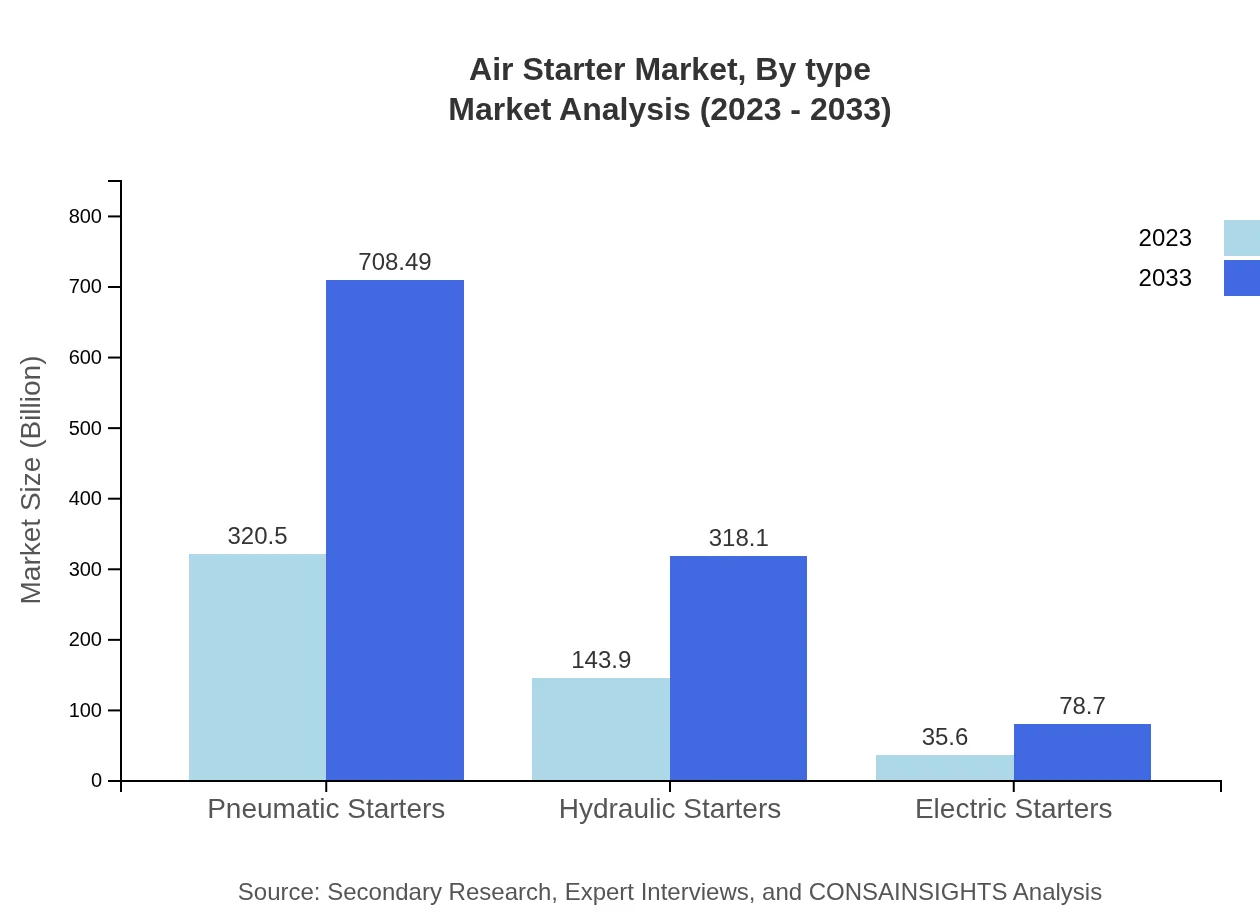

Air Starter Market Analysis By Type

The Air Starter market by type includes Pneumatic Starters, Hydraulic Starters, and Electric Starters. Pneumatic starters dominate the market, with a size of $320.50 million in 2023 and projected to grow to $708.49 million by 2033. Hydraulic starters follow with a current market size of $143.90 million, expected to reach $318.10 million in a decade. Electric starters, while smaller, are gaining traction, growing from $35.60 million in 2023 to $78.70 million by 2033.

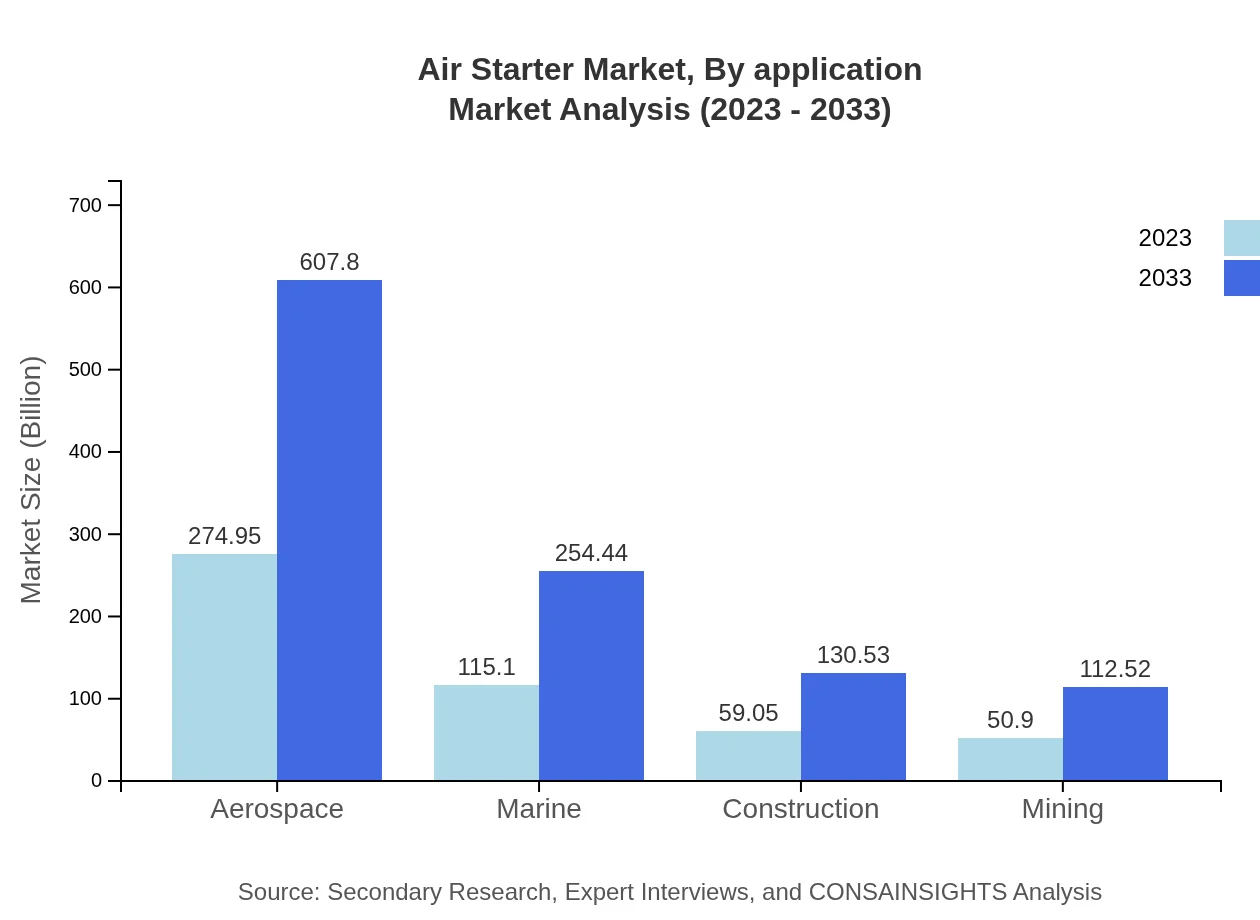

Air Starter Market Analysis By Application

The key applications of air starters include aerospace, marine, construction, and mining. The aerospace segment leads the application market with a size of $274.95 million in 2023 and expected growth to $607.80 million by 2033. Marine applications also reflect substantial growth potential, moving from $115.10 million to $254.44 million during the same period.

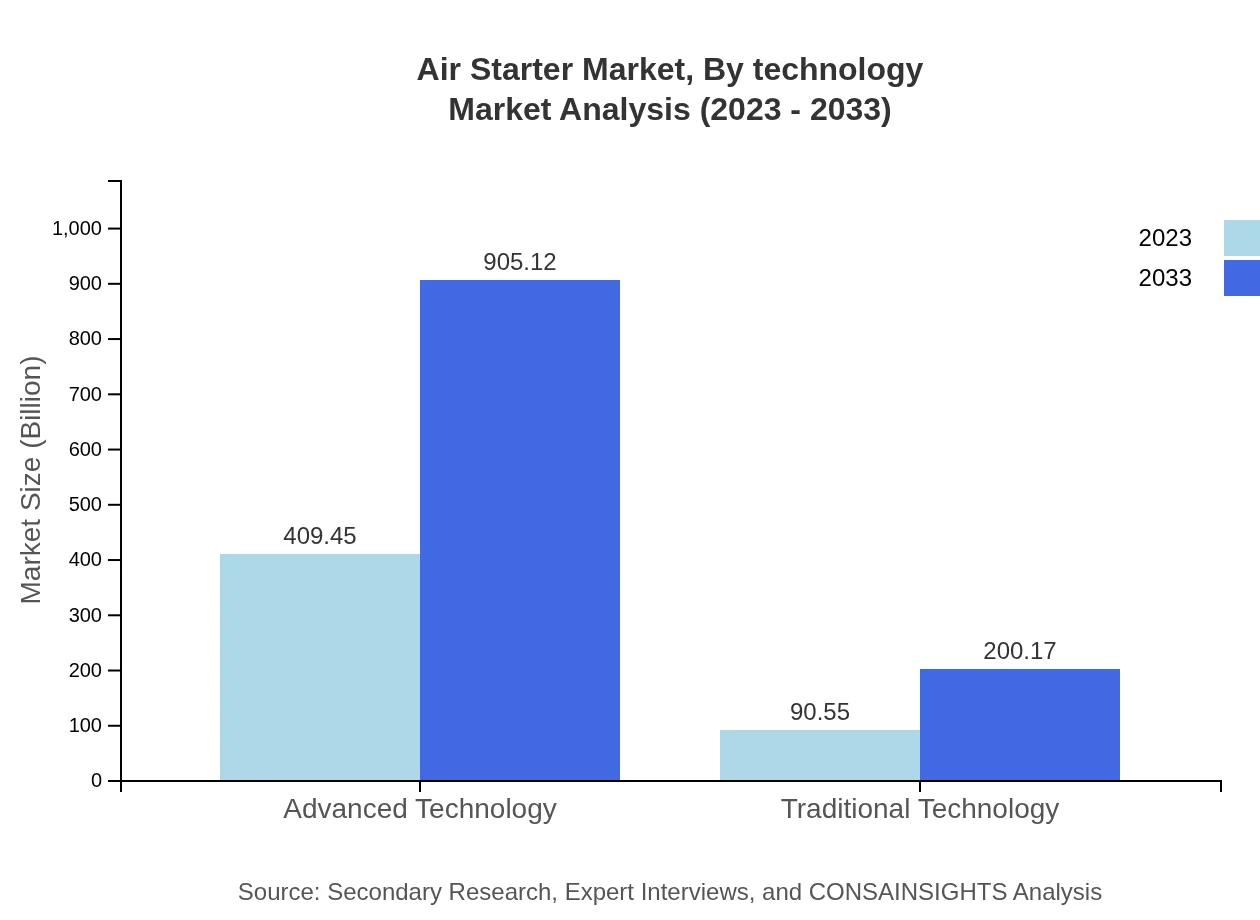

Air Starter Market Analysis By Technology

The air starter technology market is categorized into Advanced Technology and Traditional Technology. Advanced technology accounts for the majority, showcasing a market size of $409.45 million in 2023 and anticipated to double to $905.12 million by 2033. Traditional technology, on the other hand, shows slower growth from $90.55 million to $200.17 million, as industries gradually adopt advanced systems.

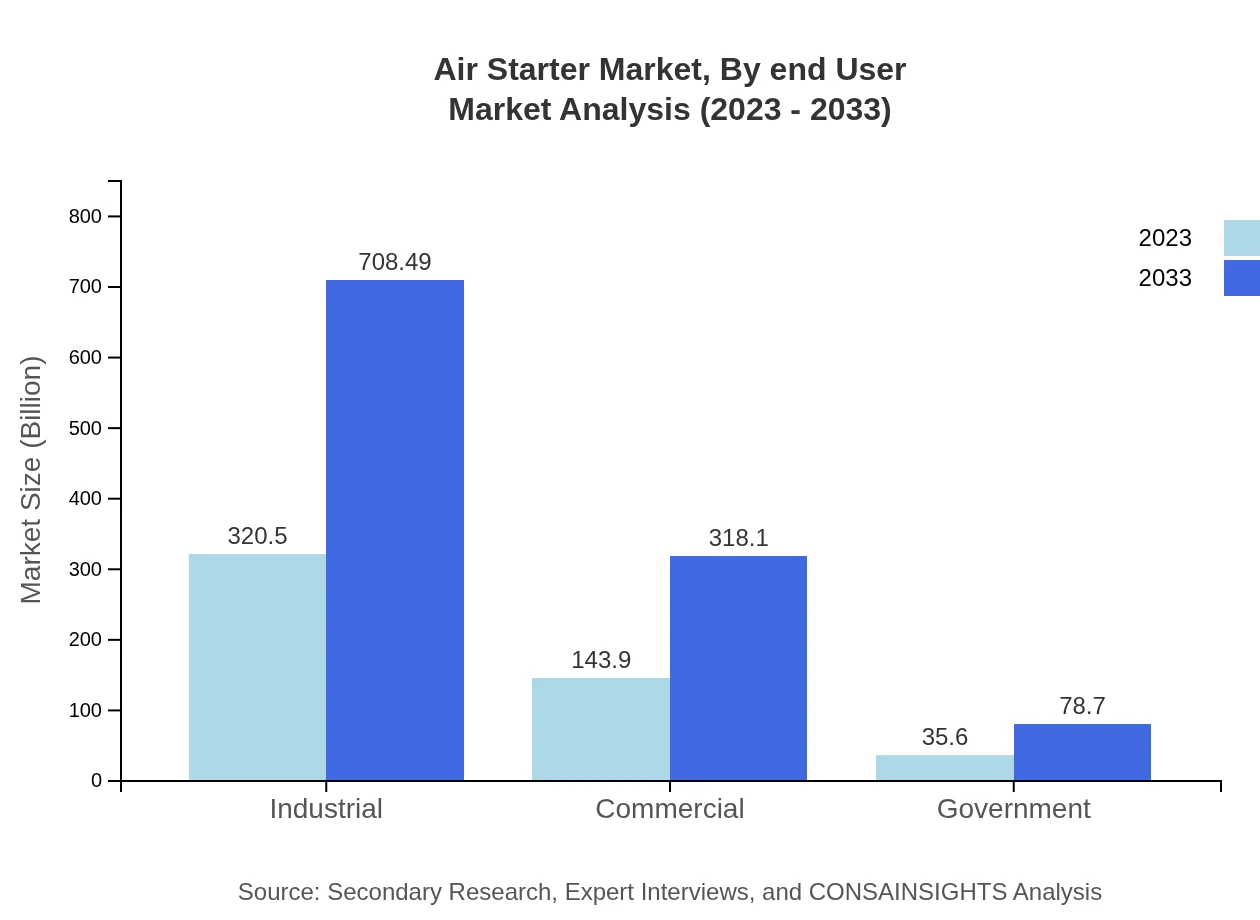

Air Starter Market Analysis By End User

Key end-user segments include Industrial, Commercial, and Government sectors. The industrial segment holds the largest market share at $320.50 million in 2023, growing to $708.49 million by 2033, driven by demand in manufacturing and oil & gas applications. The commercial sector is also substantial, with a growth trajectory from $143.90 million to $318.10 million over the same period.

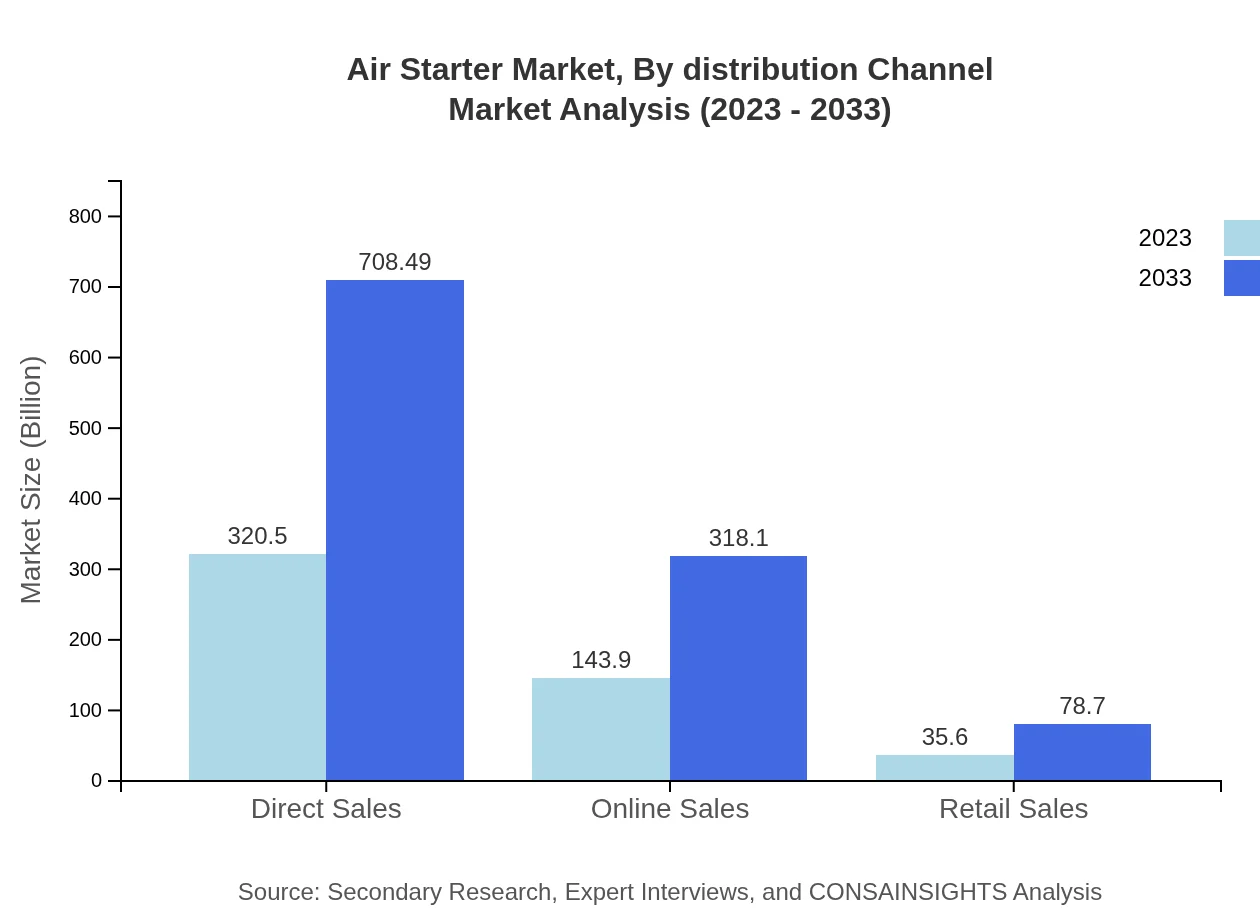

Air Starter Market Analysis By Distribution Channel

Distribution channels are segmented into Direct Sales, Online Sales, and Retail Sales. Direct sales dominate with $320.50 million in 2023, and expected growth to $708.49 million by 2033, signifying direct manufacturer-consumer relationships. Online sales are becoming increasingly significant, rising from $143.90 million to $318.10 million, catering to the growing e-commerce trend.

Air Starter Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Air Starter Industry

Ingersoll Rand:

A leading provider of air starter systems known for innovative pneumatic solutions, particularly in the aerospace and industrial sectors.Parker Hannifin:

Specializing in motion and control technologies, Parker Hannifin is recognized for its high-quality hydraulic starters widely used across various industries.Westport Fuel Systems:

A key player in the air starter market focusing on advanced electric starter technologies that provide efficient energy solutions for vehicles.JRC Engineering:

A niche firm providing customized starter solutions for marine applications, ensuring reliability and performance in harsh environments.We're grateful to work with incredible clients.

FAQs

What is the market size of air Starter?

The global air-starter market is valued at approximately 500 million USD in 2023, with a projected CAGR of 8% from 2023 to 2033. By 2033, the market size is expected to grow significantly, reflecting the increasing demand for efficient starting systems.

What are the key market players or companies in this air Starter industry?

Key players in the air-starter industry include leading manufacturers and suppliers specializing in pneumatic, hydraulic, and electric starters. These companies focus on innovation and quality to maintain competitive advantages in the expanding market, catering to various sectors.

What are the primary factors driving the growth in the air Starter industry?

The growth of the air-starter industry is driven by increased automation in industrial processes, the rise of renewable energy sectors, and advancements in starter technology. Moreover, a focus on energy efficiency and reduced emissions is boosting market demand.

Which region is the fastest Growing in the air Starter?

The Asia Pacific region is projected to be the fastest-growing market for air-starters. By 2033, its market size is expected to reach 235.43 million USD, supported by industrialization, infrastructure development, and rising energy needs in emerging economies.

Does ConsaInsights provide customized market report data for the air Starter industry?

Yes, ConsaInsights offers customized market report data specifically tailored for the air-starter industry. Clients can request detailed insights and analytics to meet their specific needs and to facilitate informed decision-making.

What deliverables can I expect from this air Starter market research project?

From the air-starter market research project, expect comprehensive deliverables including an in-depth market analysis report, segment-wise breakdown, competitive landscape assessment, growth forecasts, and actionable insights to guide strategic planning.

What are the market trends of air Starter?

Market trends in the air-starter industry indicate a shift towards advanced technologies and sustainable solutions. Growth in automated systems, adaptation of digital technologies, and a rising preference for energy-efficient starters are key indicators shaping the future.