Air To Air Refueling Market Report

Published Date: 03 February 2026 | Report Code: air-to-air-refueling

Air To Air Refueling Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Air To Air Refueling market from 2023 to 2033, highlighting market trends, size, growth potential, and detailed regional insights. It aims to equip stakeholders with valuable data for strategic decision-making.

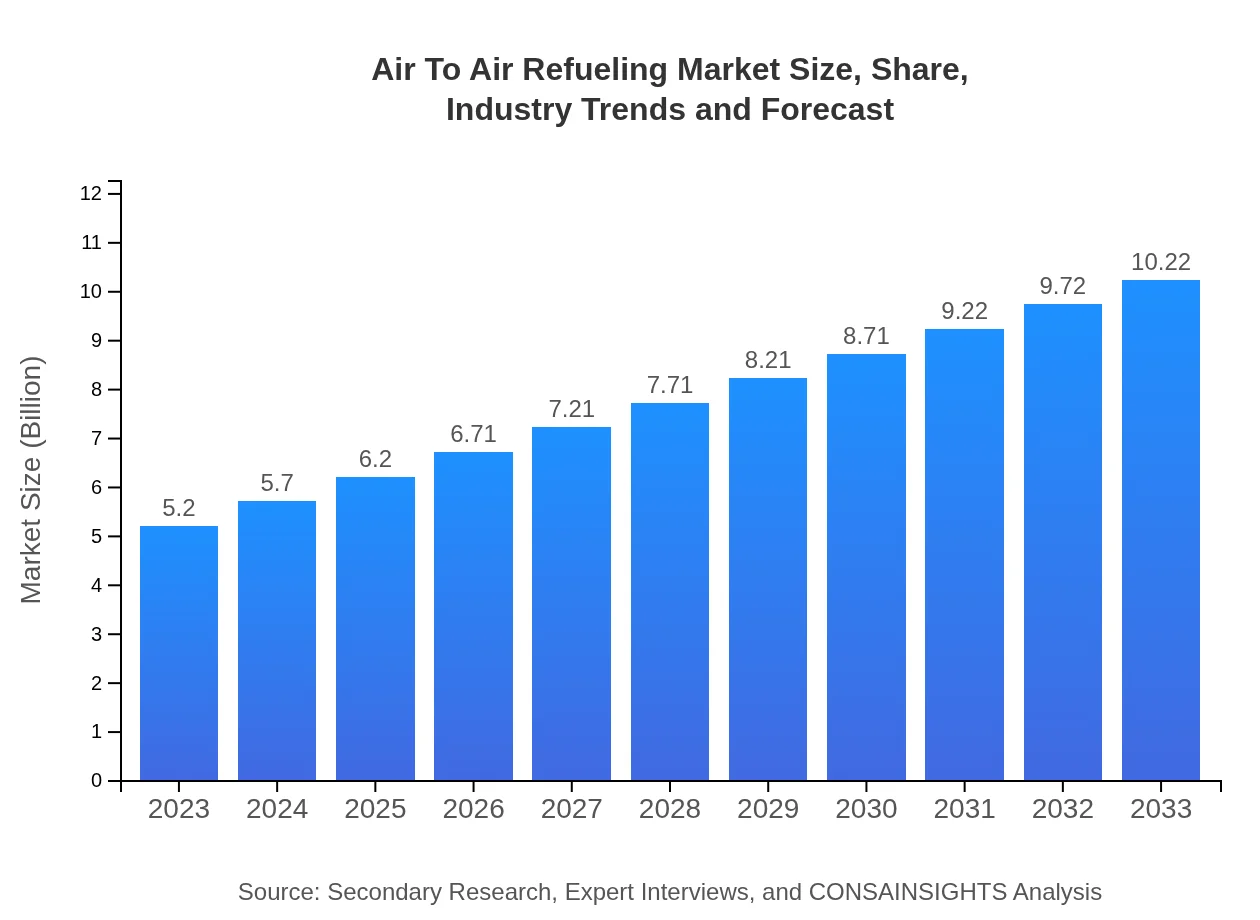

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Boeing , Lockheed Martin, Airbus, Northrop Grumman, General Dynamics |

| Last Modified Date | 03 February 2026 |

Air To Air Refueling Market Overview

Customize Air To Air Refueling Market Report market research report

- ✔ Get in-depth analysis of Air To Air Refueling market size, growth, and forecasts.

- ✔ Understand Air To Air Refueling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Air To Air Refueling

What is the Market Size & CAGR of the Air To Air Refueling market in 2023?

Air To Air Refueling Industry Analysis

Air To Air Refueling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Air To Air Refueling Market Analysis Report by Region

Europe Air To Air Refueling Market Report:

In Europe, the market size is anticipated to grow from $1.78 billion in 2023 to $3.49 billion by 2033, largely fueled by collaborative defense projects, modernization programs, and responses to geopolitical developments necessitating enhanced military readiness.Asia Pacific Air To Air Refueling Market Report:

The Asia Pacific region is projected to grow from $0.85 billion in 2023 to $1.68 billion in 2033, attributed to increasing defense budgets from nations like India and China, which are enhancing their aerial capabilities through advanced refueling systems. The strategic military partnerships in this region further support innovation and the enhancement of capabilities.North America Air To Air Refueling Market Report:

North America is expected to witness significant growth, with the market size expanding from $1.82 billion in 2023 to $3.58 billion in 2033. This growth is driven by the substantial investments from the U.S. military, technological advancements, and the presence of major players in the aerospace sector who are actively innovating in the refueling technology space.South America Air To Air Refueling Market Report:

In South America, the market is expected to increase slightly from $0.03 billion in 2023 to $0.05 billion by 2033. The growth is primarily driven by the increasing interest in strengthening national defense capabilities in response to regional instability, although it remains modest due to budget constraints.Middle East & Africa Air To Air Refueling Market Report:

The Middle East and Africa region is projected to grow from $0.72 billion in 2023 to $1.42 billion in 2033, driven by increasing military conflicts and the need for robust aerial capabilities. Investments in military systems and technologies in the region highlight the significance of air-to-air refueling systems.Tell us your focus area and get a customized research report.

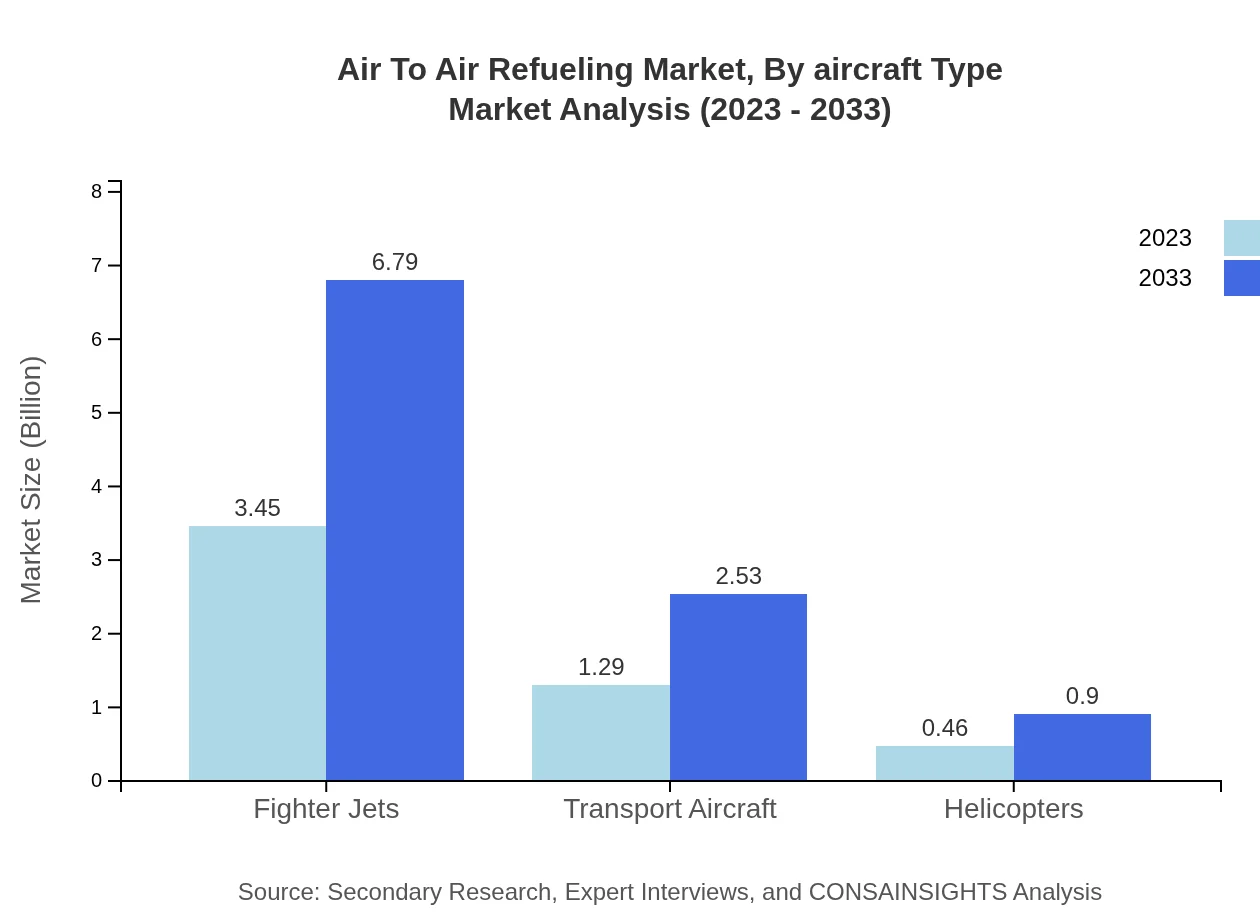

Air To Air Refueling Market Analysis By Aircraft Type

The segmentation by aircraft type is critical, with military applications dominating the market due to increased defense spending. Fighter jets represent the largest segment, contributing significantly to market size, projected to increase from $3.45 billion in 2023 to $6.79 billion in 2033. Transport aircraft and helicopters follow, showcasing the diverse applications of air-to-air refueling in contemporary air operations.

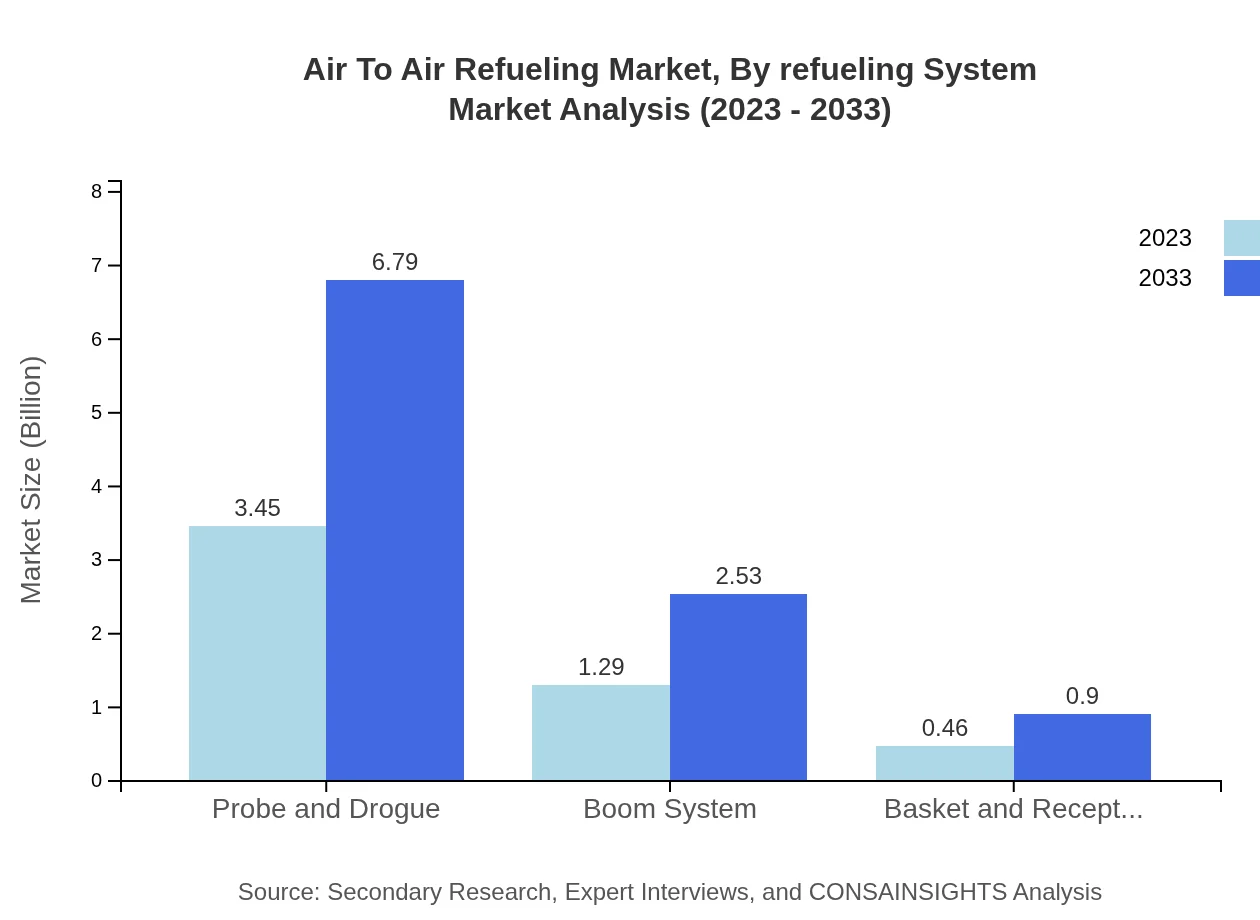

Air To Air Refueling Market Analysis By Refueling System

The market is divided between probe and drogue systems, accounting for a majority share of 66.41%, and boom systems, which represent 24.77%. This division reflects the operational preferences of various military fleets worldwide, influencing the demand and growth trajectory of specific refueling systems.

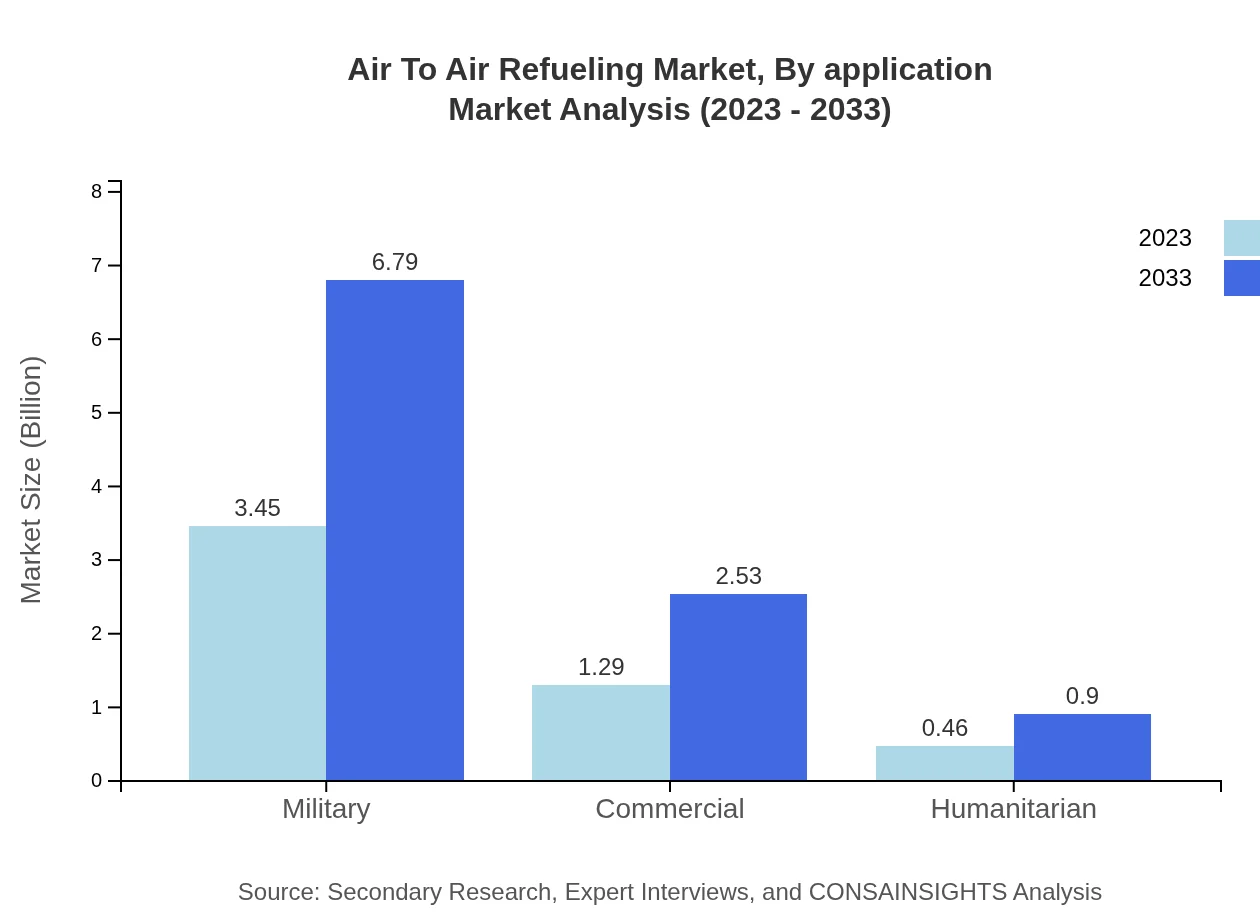

Air To Air Refueling Market Analysis By Application

The market can also be analyzed by application, primarily driven by military uses, which account for approximately 66.41% of the market share in 2023. The commercial segment is growing steadily, spurred on by rising interest from private sector entities and humanitarian missions.

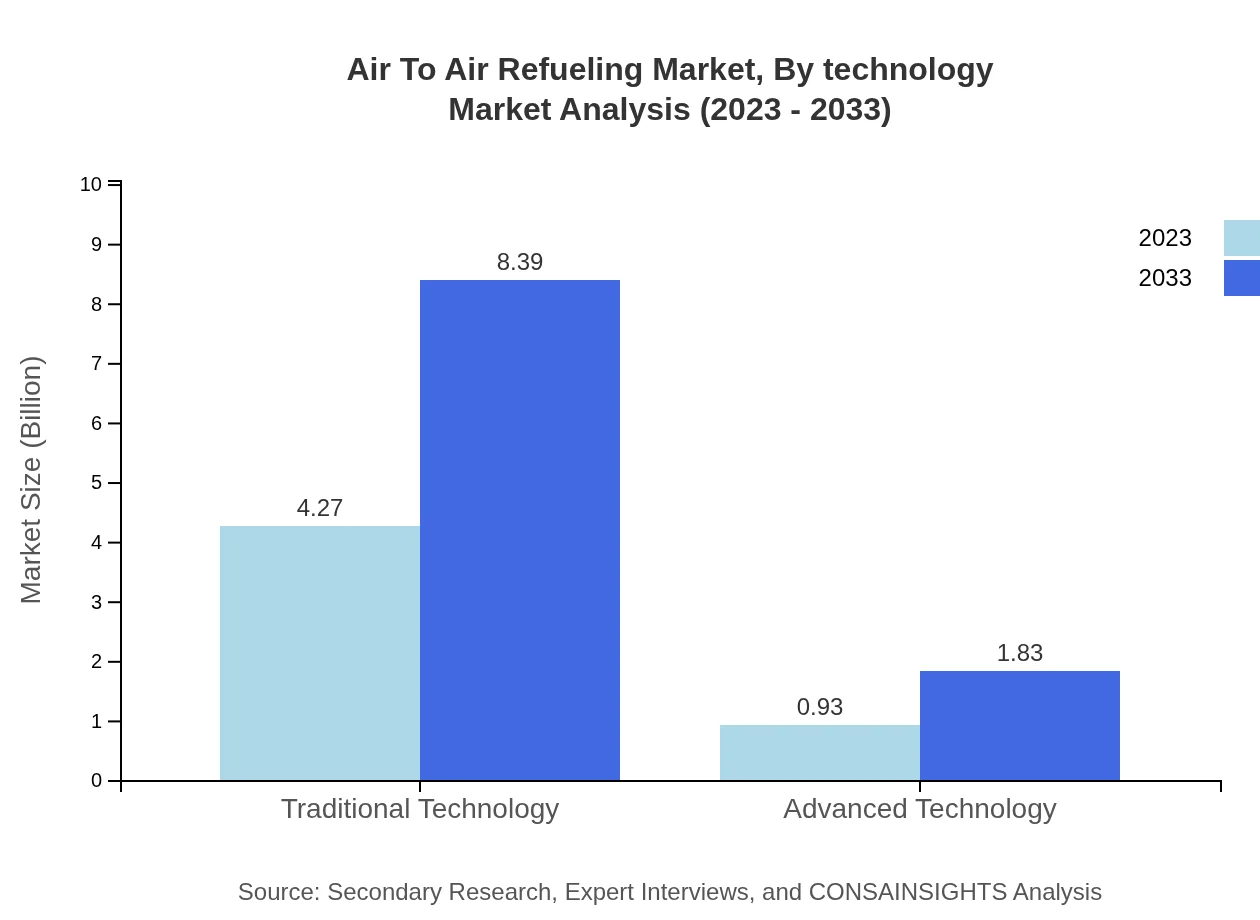

Air To Air Refueling Market Analysis By Technology

Traditional refueling technologies remain the dominant approach, but there is an increasing trend towards advanced technologies that enhance efficiency and reduce costs. The transition towards automated and smarter systems is gradually altering the market landscape.

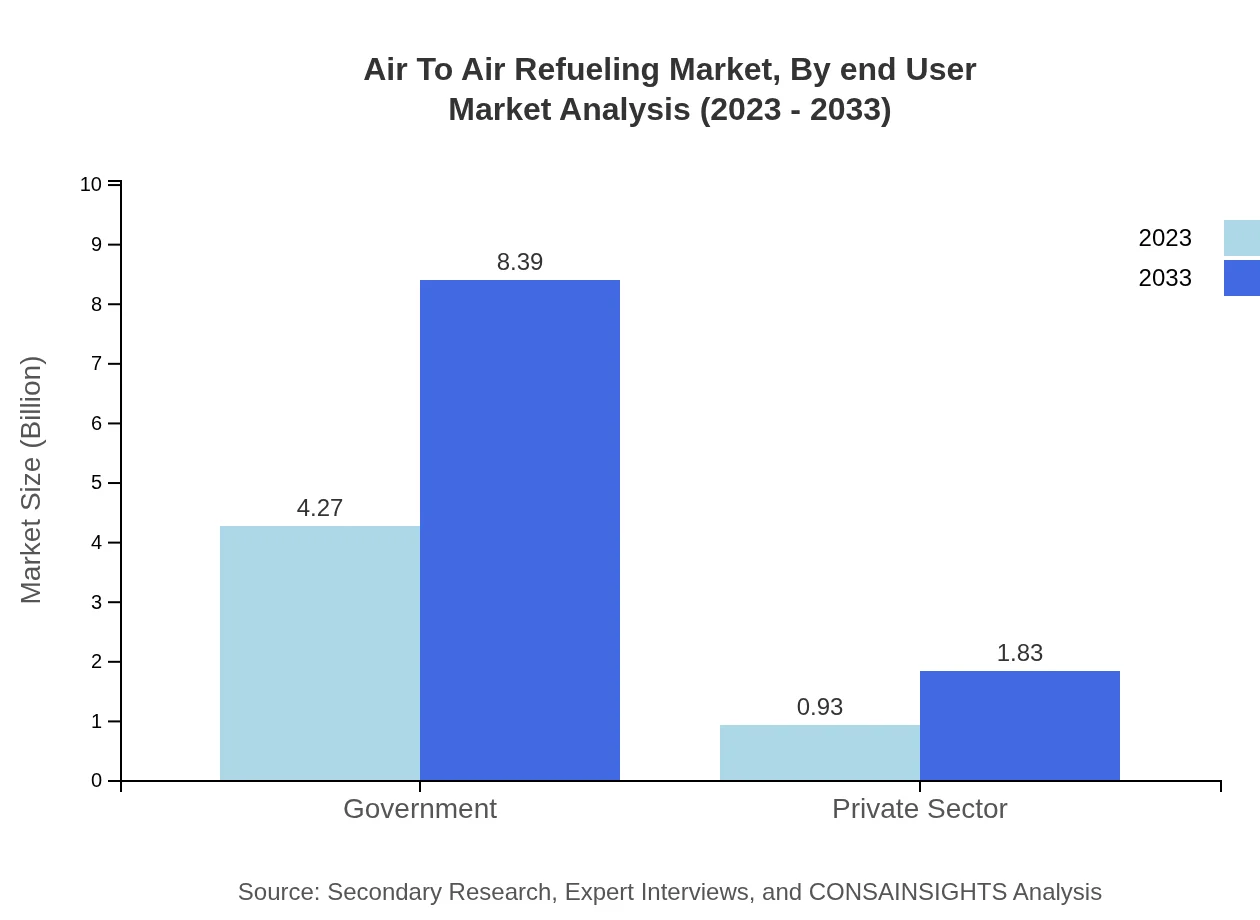

Air To Air Refueling Market Analysis By End User

The delineation between government and private sector end-users helps illustrate market dynamics. Government entities dominate with an 82.09% market share, while the private sector's role is expanding gradually, particularly in commercial aircraft applications, contributing to evolving demand patterns.

Air To Air Refueling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Air To Air Refueling Industry

Boeing :

Boeing is a leading player in the aerospace sector, providing advanced aerial refueling solutions through its KC-46 Pegasus platform, known for its state-of-the-art technology and integrated capabilities.Lockheed Martin:

Lockheed Martin is a key player in defense technologies, offering innovative refueling tankers and systems, including the HC-130, enhancing military operational efficiency.Airbus:

Airbus is recognized for its A330 MRTT, a versatile aircraft providing air-to-air refueling capabilities to multiple nations and enhancing joint operational capabilities.Northrop Grumman:

Northrop Grumman provides advanced military aircraft and refueling systems, focusing on technological innovations that meet the evolving demands of military operations.General Dynamics:

General Dynamics plays a significant role in defense contracting, contributing advanced systems and solutions for air-to-air refueling requirements globally.We're grateful to work with incredible clients.

FAQs

What is the market size of air To Air refueling?

The air-to-air refueling market is projected to reach $5.2 billion by 2033, growing at a CAGR of 6.8%. This expansion reflects the increasing demand for advanced aerial refueling systems in military and commercial aviation.

What are the key market players or companies in the air To Air refueling industry?

Key players in the air-to-air refueling industry include Boeing, Airbus, Northrop Grumman, and others. These companies dominate the market with innovative technologies and strategic partnerships that enhance operational efficiency in aerial refueling.

What are the primary factors driving the growth in the air To Air refueling industry?

Growth in the air-to-air refueling industry is driven by increasing military expenditure, the need for efficient fuel management in military operations, and advancements in technology that enhance refueling capabilities and aircraft performance.

Which region is the fastest Growing in the air To Air refueling market?

North America is the fastest-growing region in the air-to-air refueling market, with a market size projected to increase from $1.82 billion in 2023 to $3.58 billion by 2033, driven by military modernization and advancements in aerial refueling technologies.

Does ConsaInsights provide customized market report data for the air To Air refueling industry?

Yes, ConsaInsights offers tailored market report data for the air-to-air refueling industry, allowing clients to access specific insights, trends, and projections based on unique business needs and regional markets.

What deliverables can I expect from this air To Air refueling market research project?

Expect comprehensive reports detailing market size, growth projections, competitive landscape, and segmentation analysis by technology and region, enabling informed strategic decisions based on thorough data.

What are the market trends of air To Air refueling?

Current trends in the air-to-air refueling market include an emphasis on advanced technology adoption, increased collaborations between military and commercial sectors, and a focus on sustainability and efficiency in aerial refueling operations.