Airborne Collision Avoidance System Market Report

Published Date: 03 February 2026 | Report Code: airborne-collision-avoidance-system

Airborne Collision Avoidance System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Airborne Collision Avoidance System market, covering insights into market size, segmentation, regional trends, and future forecasts for the period 2023 to 2033.

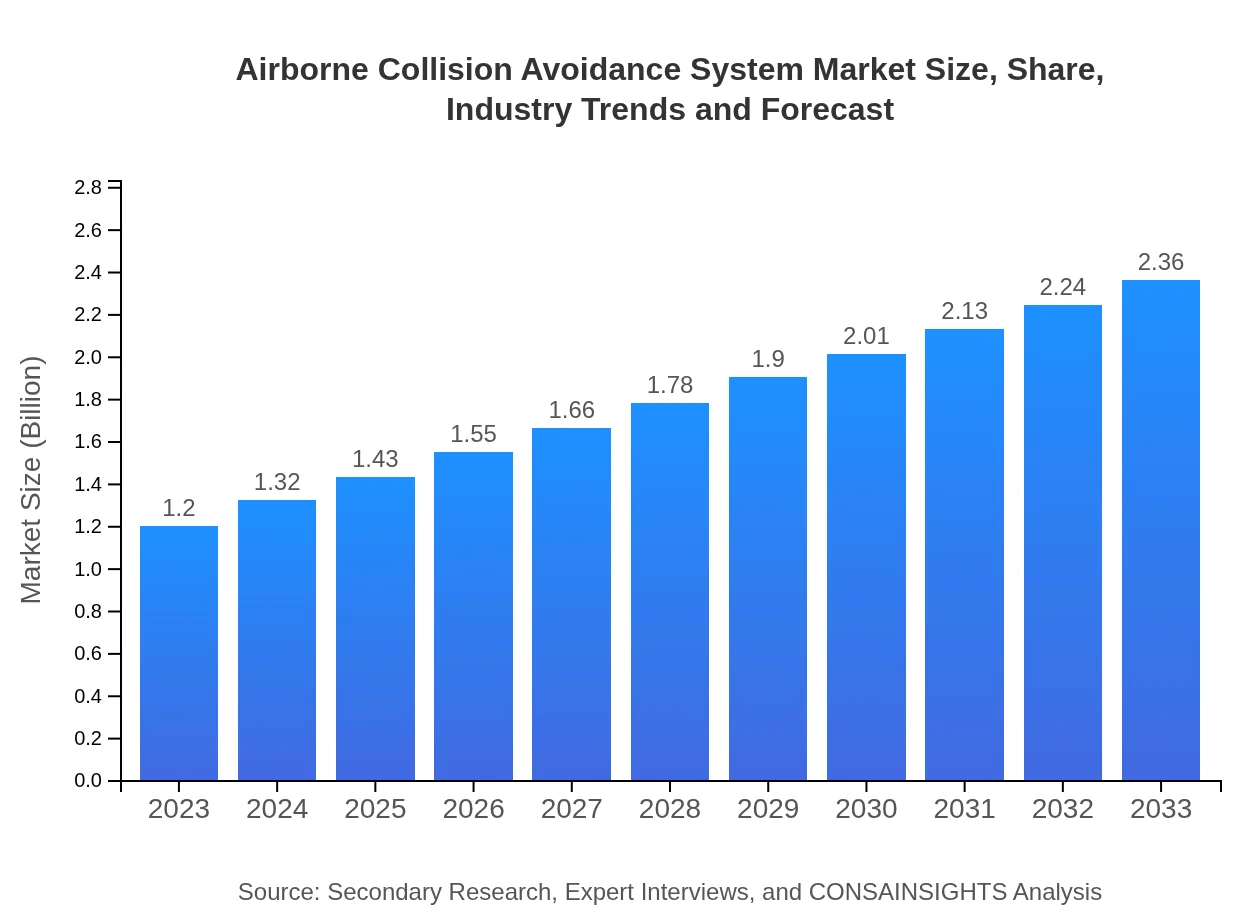

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.36 Billion |

| Top Companies | Honeywell International Inc., Raytheon Technologies Corporation, Thales Group, Garmin Ltd. |

| Last Modified Date | 03 February 2026 |

Airborne Collision Avoidance System Market Overview

Customize Airborne Collision Avoidance System Market Report market research report

- ✔ Get in-depth analysis of Airborne Collision Avoidance System market size, growth, and forecasts.

- ✔ Understand Airborne Collision Avoidance System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airborne Collision Avoidance System

What is the Market Size & CAGR of Airborne Collision Avoidance System market in 2023?

Airborne Collision Avoidance System Industry Analysis

Airborne Collision Avoidance System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airborne Collision Avoidance System Market Analysis Report by Region

Europe Airborne Collision Avoidance System Market Report:

The European ACAS market is set to rise from $0.40 billion in 2023 to $0.78 billion by 2033, led by strong regulatory frameworks and collaboration between industry stakeholders. The European Union's emphasis on aviation safety remains a key driver for market expansion, fostering innovations in collision avoidance technologies.Asia Pacific Airborne Collision Avoidance System Market Report:

In the Asia Pacific region, the ACAS market is anticipated to grow from $0.23 billion in 2023 to $0.45 billion by 2033, driven by rising air traffic and regulatory frameworks enhancing safety measures. Countries like China and India are expanding their aviation sectors rapidly, promoting the adoption of advanced collision avoidance systems.North America Airborne Collision Avoidance System Market Report:

In North America, the ACAS market will grow from $0.39 billion in 2023 to approximately $0.77 billion by 2033. This growth is attributed to stringent safety regulations and ongoing advancements in aerospace technology, particularly within commercial and military aviation sectors.South America Airborne Collision Avoidance System Market Report:

The South American market is projected to expand from $0.06 billion in 2023 to $0.11 billion in 2033, emphasizing technological upgrades in existing aircraft fleets. Increased investment by regional governments in aviation safety infrastructure is expected to bolster market growth in this area.Middle East & Africa Airborne Collision Avoidance System Market Report:

The Middle East and Africa region is expected to witness growth from $0.13 billion in 2023 to $0.25 billion by 2033. Increased regional conflicts have led to a greater focus on military air operations, elevating demand for efficient airborne collision avoidance systems to enhance operational safety.Tell us your focus area and get a customized research report.

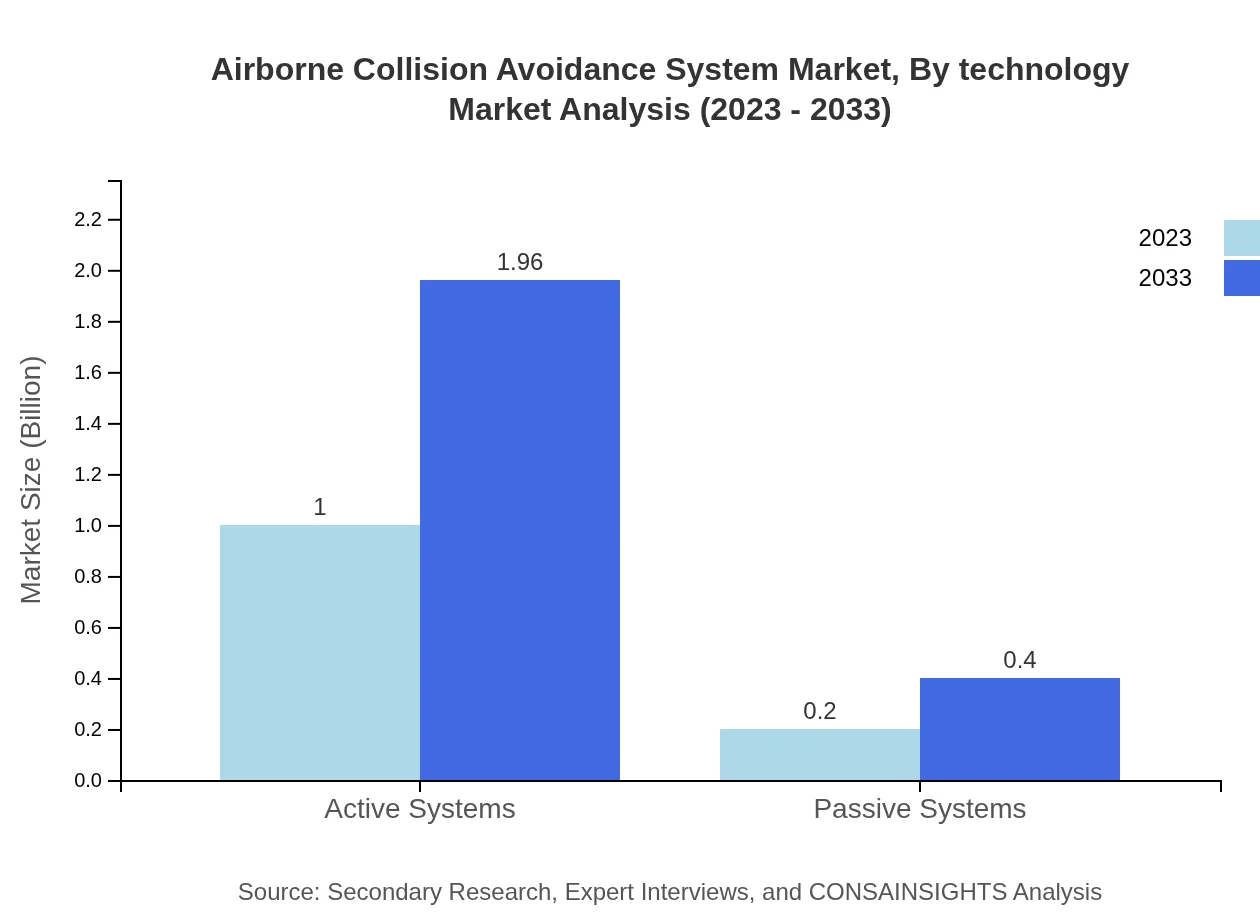

Airborne Collision Avoidance System Market Analysis By Technology

The technology segment of the ACAS market encompasses both active and passive systems. In 2023, active systems contribute $1.00 billion to the market size, retaining a share of approximately 83.15% and expected to increase to $1.96 billion by 2033. Passive systems, although smaller, hold a significant position, with a market size of $0.20 billion and a share of 16.85%, projected to grow to $0.40 billion in the future.

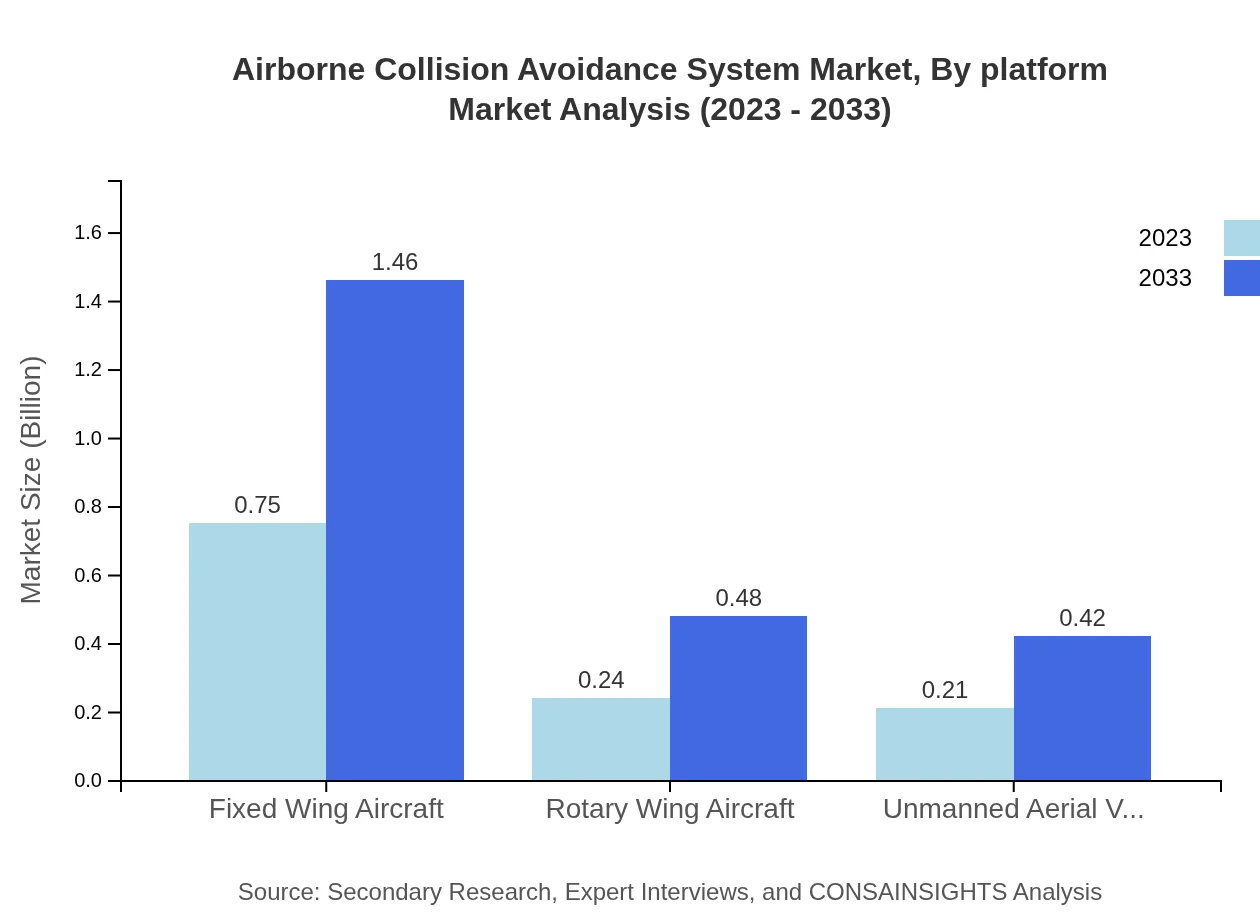

Airborne Collision Avoidance System Market Analysis By Platform

Examining market performance by platform, fixed-wing aircraft dominate, accounting for $0.75 billion in 2023, constituting 62.09% share. With advancements in technology, this segment is projected to reach $1.46 billion by 2033. Rotary and unmanned aerial vehicles (UAVs) are also crucial platforms, with respective shares of 20.29% and 17.62%.

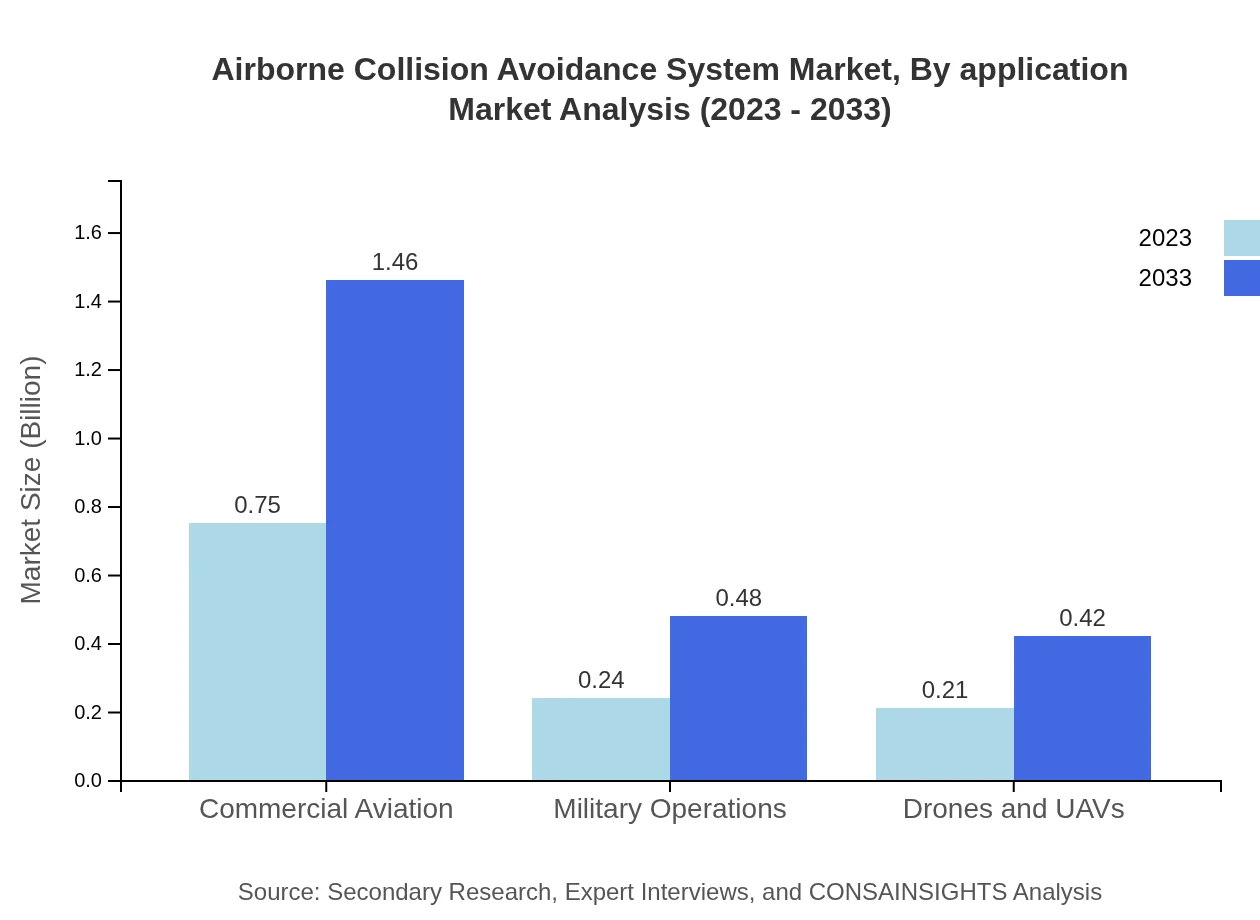

Airborne Collision Avoidance System Market Analysis By Application

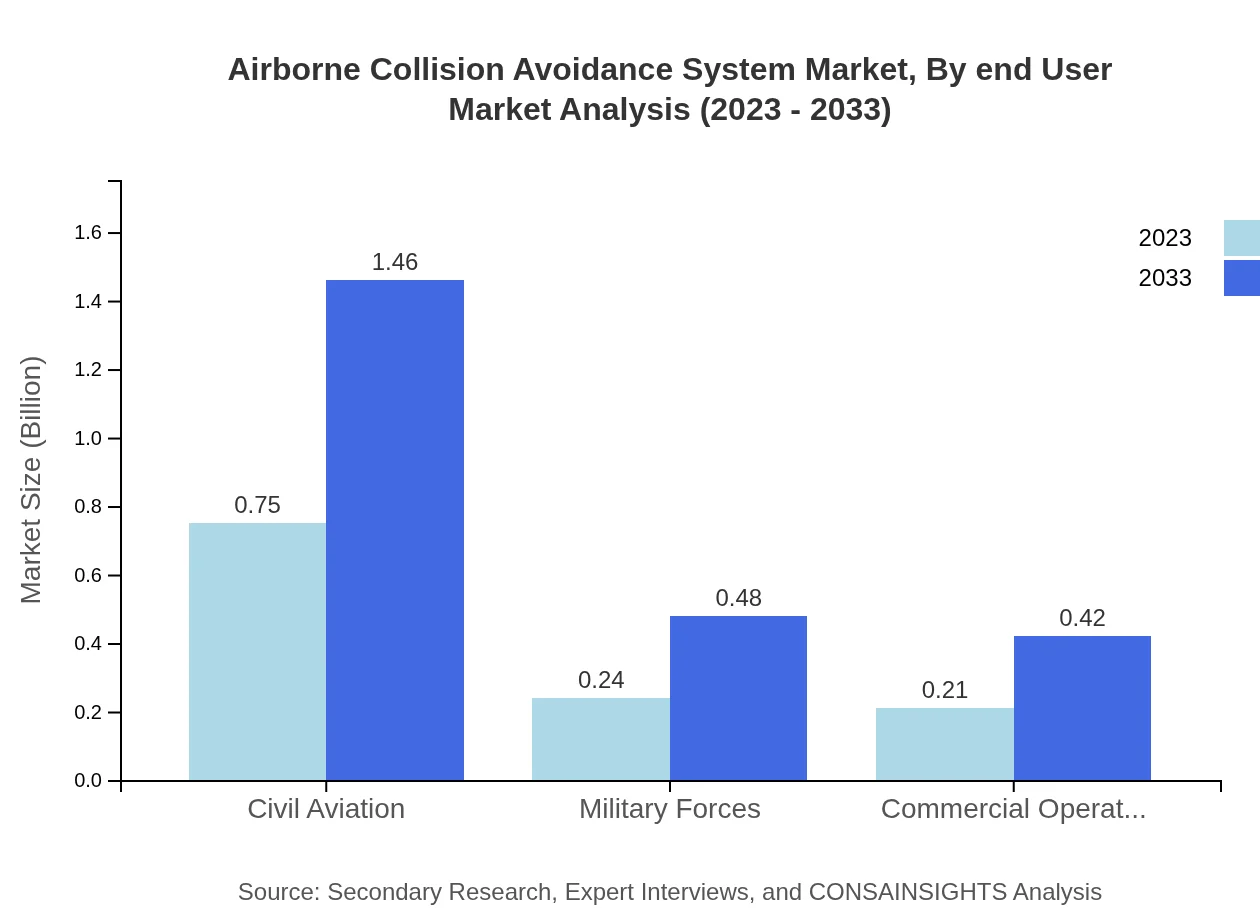

In terms of application, civil aviation holds the most considerable market potential, projected to grow from $0.75 billion in 2023 to $1.46 billion by 2033, maintaining a near-constant market share of 62.09%. Military operations, comprising a share of 20.29%, grow from $0.24 billion to $0.48 billion, driven by defense modernization programs.

Airborne Collision Avoidance System Market Analysis By End User

The end-user segment reveals that commercial operators are vital contributors, with market values of $0.21 billion in 2023 and $0.42 billion by 2033. This segment reflects growing awareness of safety protocols. Military end-users continue to lead with robust growth due to ongoing investments.

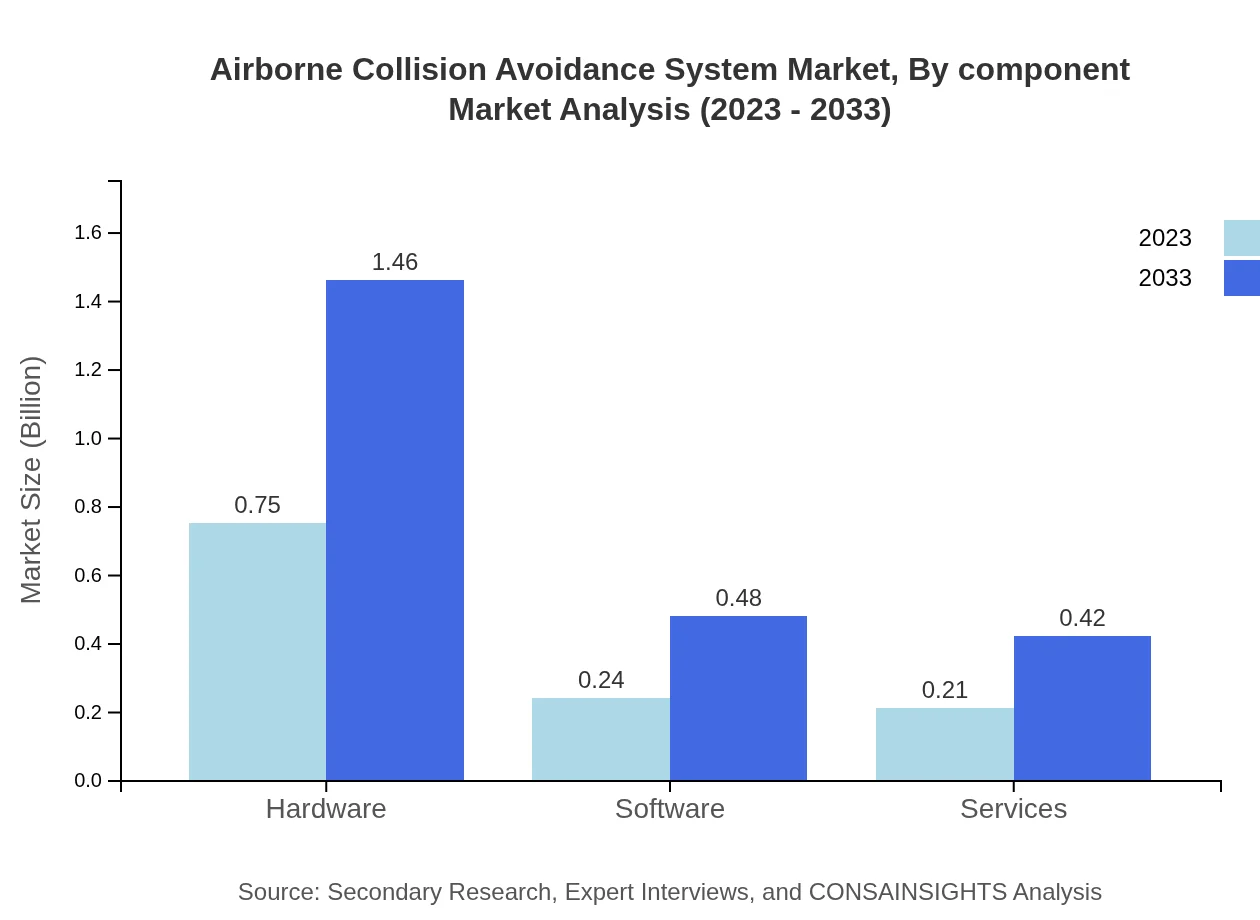

Airborne Collision Avoidance System Market Analysis By Component

The components of ACAS include hardware, software, and services, with hardware leading the market size at $0.75 billion in 2023. Growth across these components showcases the industry's push towards integrated solutions leveraging software and service components alongside hardware.

Airborne Collision Avoidance System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airborne Collision Avoidance System Industry

Honeywell International Inc.:

A leading player in the aviation sector known for its innovative technologies in collision avoidance systems and extensive global reach.Raytheon Technologies Corporation:

A major defense contractor offering advanced radar and sensor systems essential for airborne collision avoidance.Thales Group:

Thales provides aerospace tech solutions focusing on integrated air traffic systems and safety technologies.Garmin Ltd.:

A pioneer in avionics and navigation equipment, Garmin focuses on enhancing safety through innovative collision avoidance technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of Airborne Collision Avoidance System?

The Airborne Collision Avoidance System market is valued at approximately $1.2 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033. This growth is driven by advancements in aviation safety and increasing air traffic.

What are the key market players or companies in the Airborne Collision Avoidance System industry?

Key players in the Airborne Collision Avoidance System industry include major aerospace companies such as Honeywell International, Rockwell Collins, and Raytheon Technologies. These companies are at the forefront of innovation and development in collision avoidance technologies.

What are the primary factors driving the growth in the Airborne Collision Avoidance System industry?

The growth of the Airborne Collision Avoidance System industry is primarily driven by rising air traffic, stringent safety regulations, and advancements in technology that enhance aircraft safety and operational efficiency, fostering demand across various sectors.

Which region is the fastest Growing in the Airborne Collision Avoidance System?

The fastest-growing region for the Airborne Collision Avoidance System market is Europe, expected to grow from $0.40 billion in 2023 to $0.78 billion in 2033. North America also shows significant growth, reaching $0.77 billion by 2033.

Does ConsaInsights provide customized market report data for the Airborne Collision Avoidance System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Airborne Collision Avoidance System industry, enabling clients to obtain precise insights and analyses to support strategic decision-making.

What deliverables can I expect from this Airborne Collision Avoidance System market research project?

Deliverables from the Airborne Collision Avoidance System market research project include comprehensive reports, market forecasts, competitive analysis, segment breakdowns, and regional insights, all designed to inform strategic business decisions.

What are the market trends of Airborne Collision Avoidance System?

The Airborne Collision Avoidance System market trends indicate a shift towards integrating advanced technologies such as artificial intelligence and machine learning, enhancing real-time data processing capabilities and improving aircraft safety protocols.