Airborne Electronic Warfare Market Report

Published Date: 03 February 2026 | Report Code: airborne-electronic-warfare

Airborne Electronic Warfare Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Airborne Electronic Warfare market from 2023 to 2033, offering insights into market size, growth forecasts, segmentation, regional analysis, key players, and technology trends impacting the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

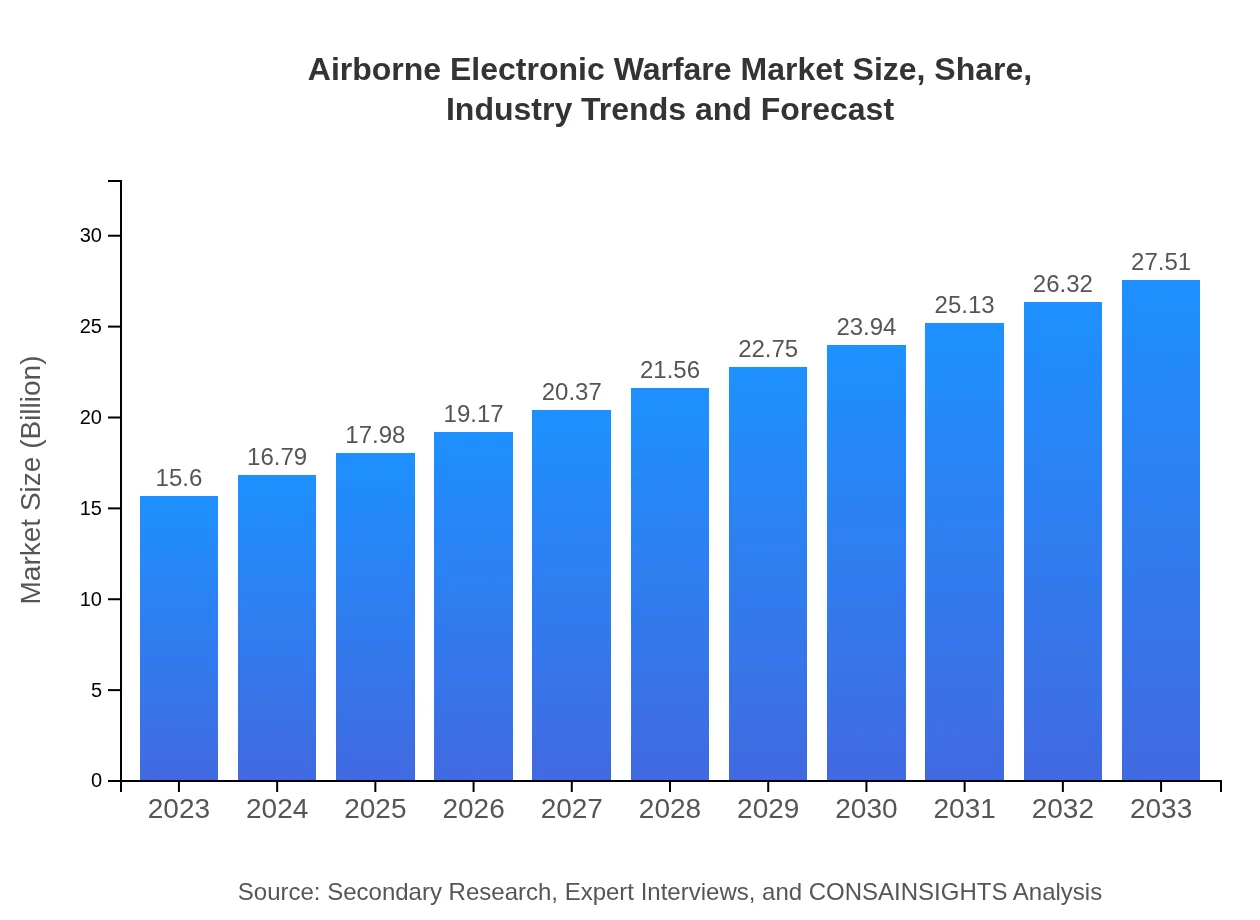

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $27.51 Billion |

| Top Companies | Northrop Grumman Corporation, Raytheon Technologies, BAE Systems, Leonardo S.p.A, L3Harris Technologies |

| Last Modified Date | 03 February 2026 |

Airborne Electronic Warfare Market Overview

Customize Airborne Electronic Warfare Market Report market research report

- ✔ Get in-depth analysis of Airborne Electronic Warfare market size, growth, and forecasts.

- ✔ Understand Airborne Electronic Warfare's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airborne Electronic Warfare

What is the Market Size & CAGR of Airborne Electronic Warfare market in 2023?

Airborne Electronic Warfare Industry Analysis

Airborne Electronic Warfare Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airborne Electronic Warfare Market Analysis Report by Region

Europe Airborne Electronic Warfare Market Report:

The European market is expected to grow from $4.63 billion in 2023 to $8.16 billion by 2033. Heightened European defense initiatives and collaborative projects to enhance regional security are significant factors contributing to market growth.Asia Pacific Airborne Electronic Warfare Market Report:

In 2023, the Airborne Electronic Warfare market in the Asia Pacific is projected to reach $3.20 billion, growing to $5.64 billion by 2033. The region is experiencing increased defense spending driven by territorial disputes and military modernization efforts, particularly in countries like China, India, and Japan.North America Airborne Electronic Warfare Market Report:

North America stands as a major market for Airborne Electronic Warfare, with an estimated value of $5.13 billion in 2023, projected to reach $9.04 billion by 2033. United States military investments in cutting-edge EW technologies and the continuous evolution of NATO frameworks are key drivers of growth in this region.South America Airborne Electronic Warfare Market Report:

The South American market for Airborne Electronic Warfare is expected to grow from $1.04 billion in 2023 to $1.84 billion by 2033. The rising need for enhanced border security and counter-narcotics operations is fueling demand for electronic warfare capabilities.Middle East & Africa Airborne Electronic Warfare Market Report:

In the Middle East and Africa, the Airborne Electronic Warfare market is projected to grow from $1.61 billion in 2023 to $2.83 billion by 2033. This growth is attributed to regional conflicts and the demand for advanced military capabilities to address security challenges.Tell us your focus area and get a customized research report.

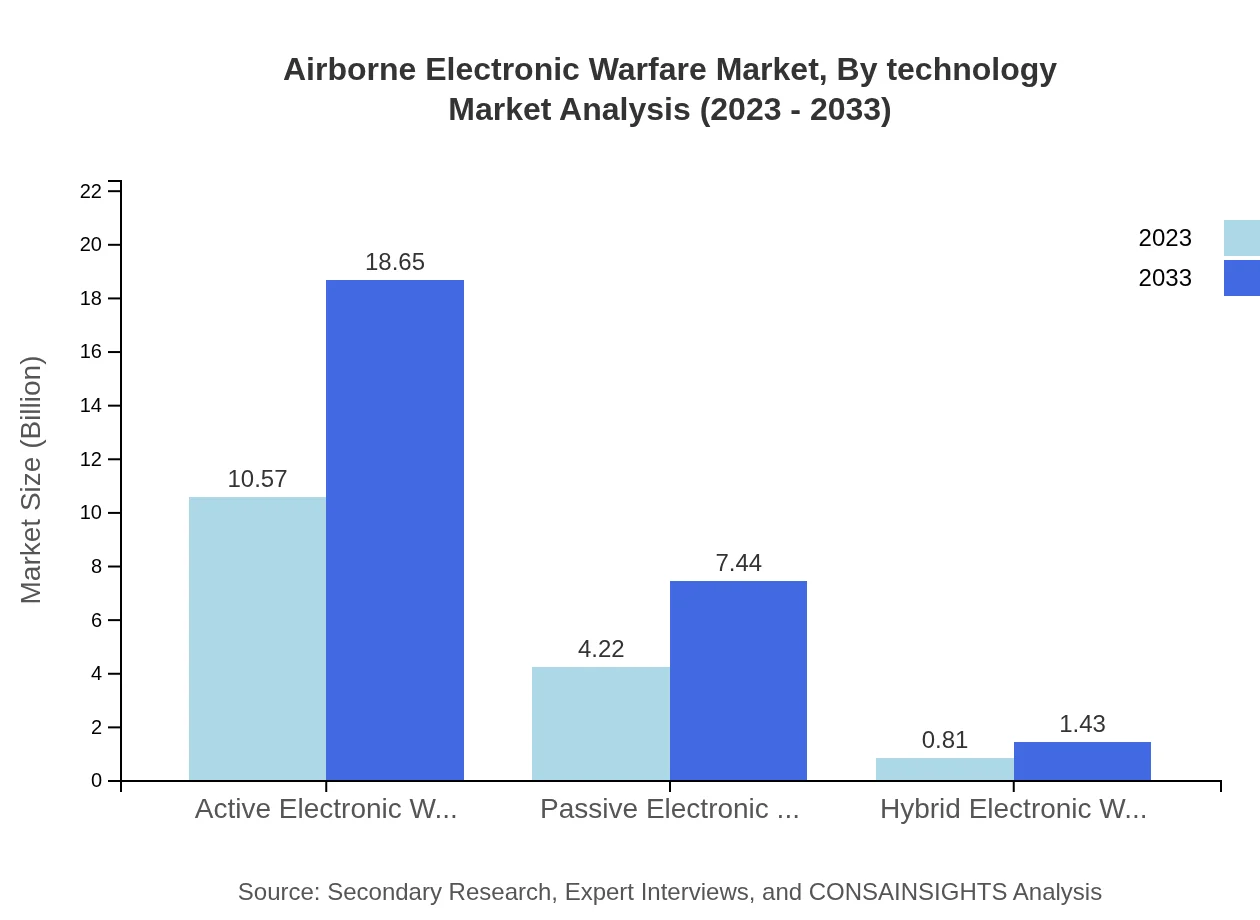

Airborne Electronic Warfare Market Analysis By Technology

The technology segmentation of the market includes Active Electronic Warfare, Passive Electronic Warfare, and Hybrid Electronic Warfare. The Active Electronic Warfare segment is anticipated to dominate the market, accounting for approximately 67.77% of market share in 2023, growing steadily as military forces seek to actively disrupt enemy systems.

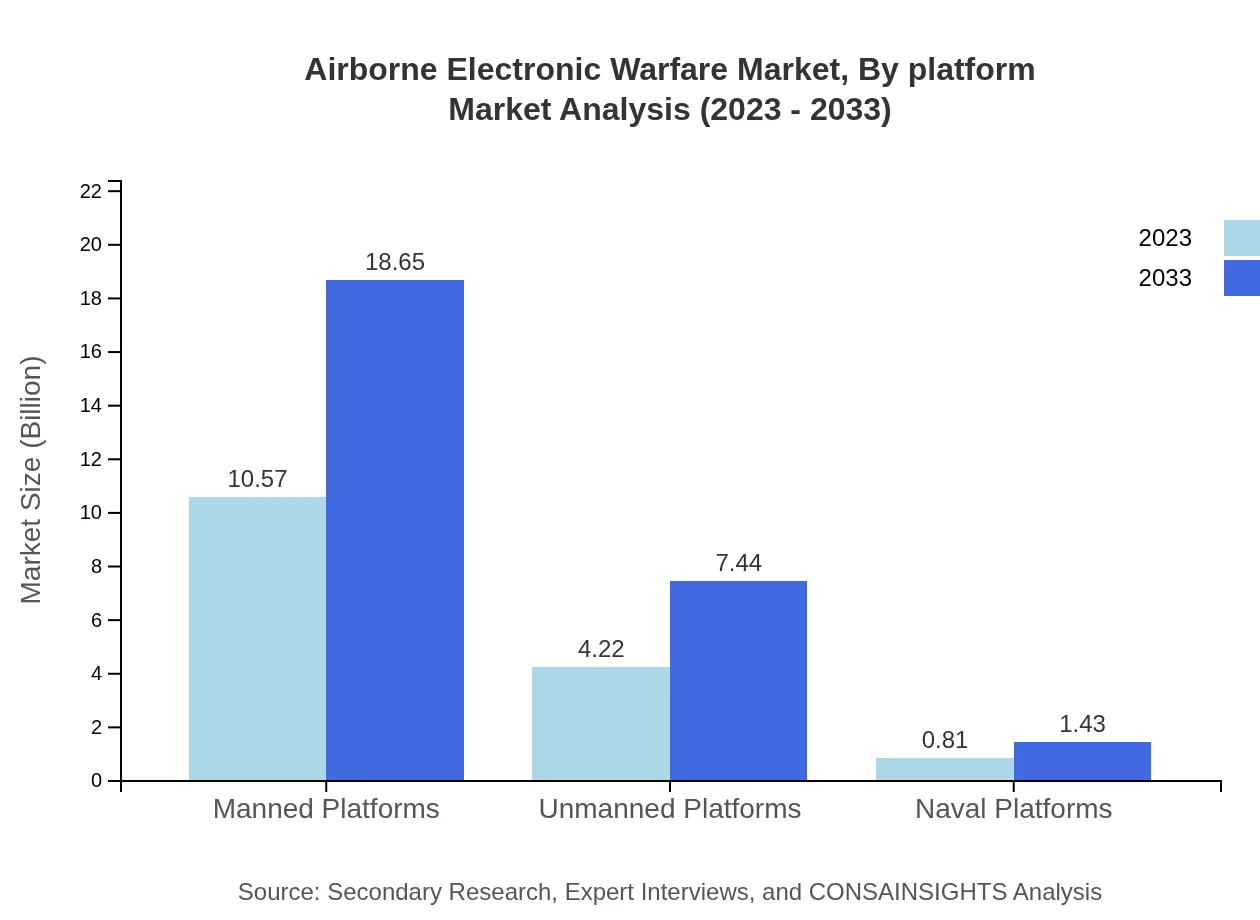

Airborne Electronic Warfare Market Analysis By Platform

Manned platforms are predominant in the Airborne Electronic Warfare market, representing 67.77% of the share in 2023. However, the growth of unmanned platforms is notable due to their operational advantages in high-risk environments, forecasted to reach 27.05% of market share as technological advancements continue.

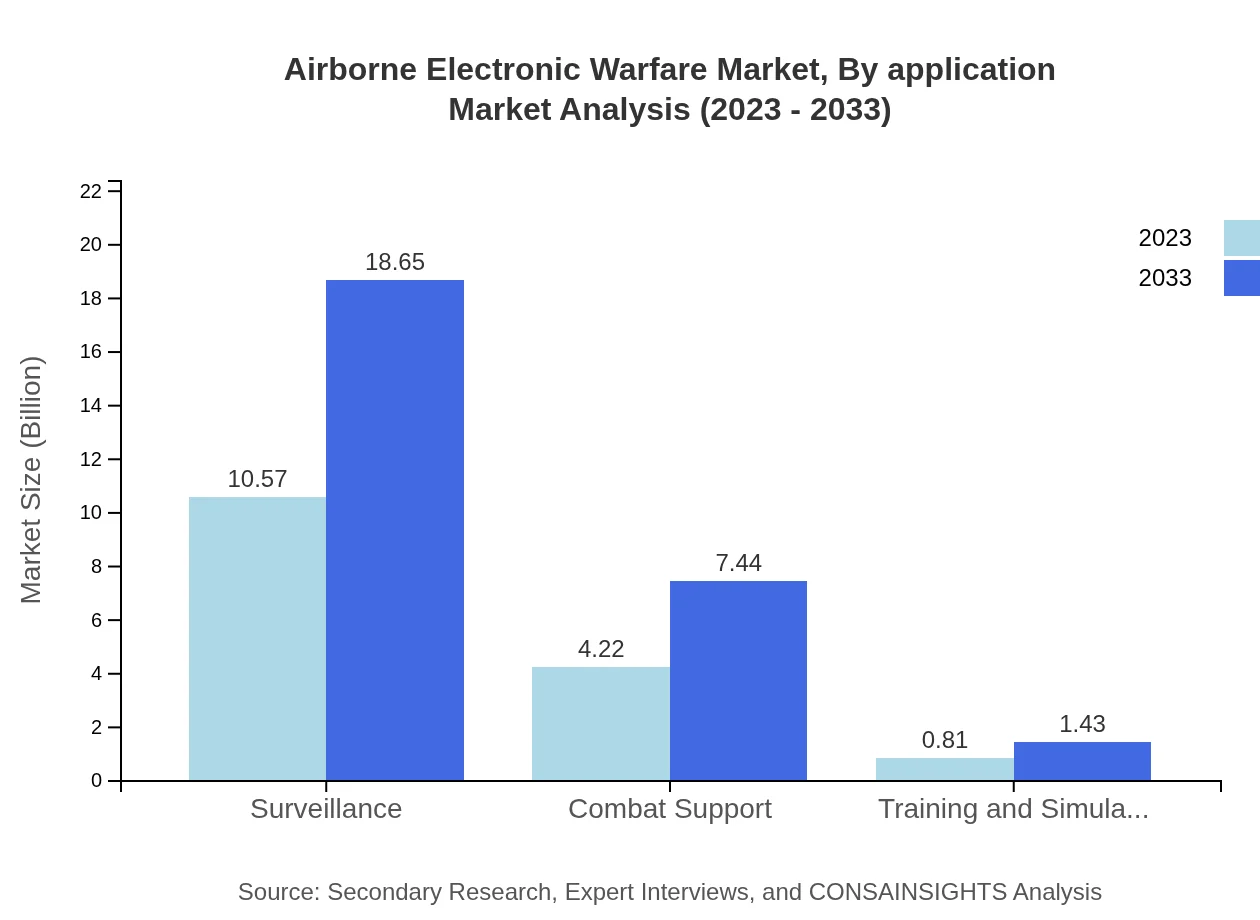

Airborne Electronic Warfare Market Analysis By Application

Applications of Airborne Electronic Warfare include surveillance, combat support, and training and simulation. Surveillance applications dominate the market with a 67.77% share in 2023, reflecting an increased focus on intelligence-gathering and situational awareness in defense operations.

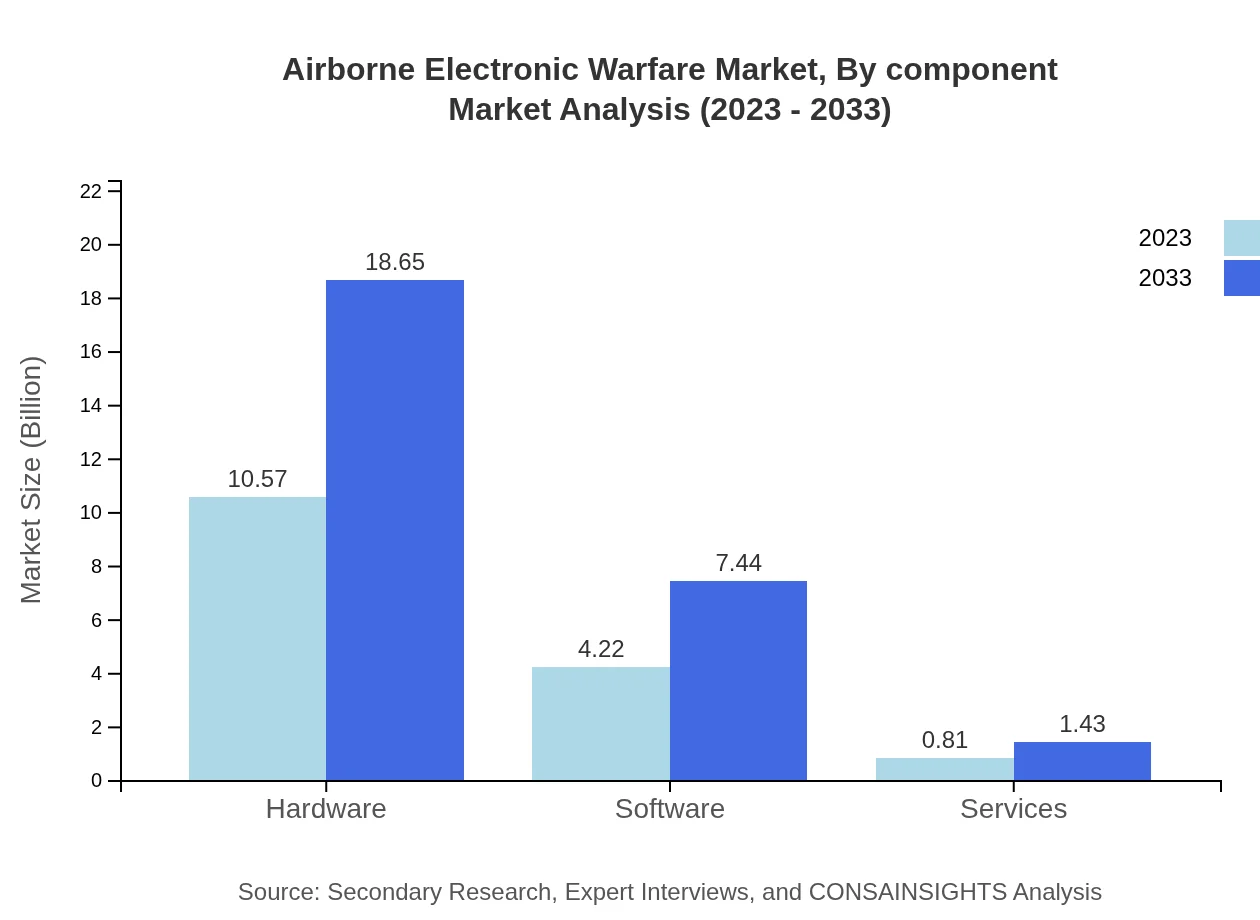

Airborne Electronic Warfare Market Analysis By Component

Components of the Airborne Electronic Warfare systems encompass hardware, software, and services. Hardware accounts for 67.77% of the market share in 2023, primarily due to the robust demand for physical systems and their integration into existing defense infrastructures.

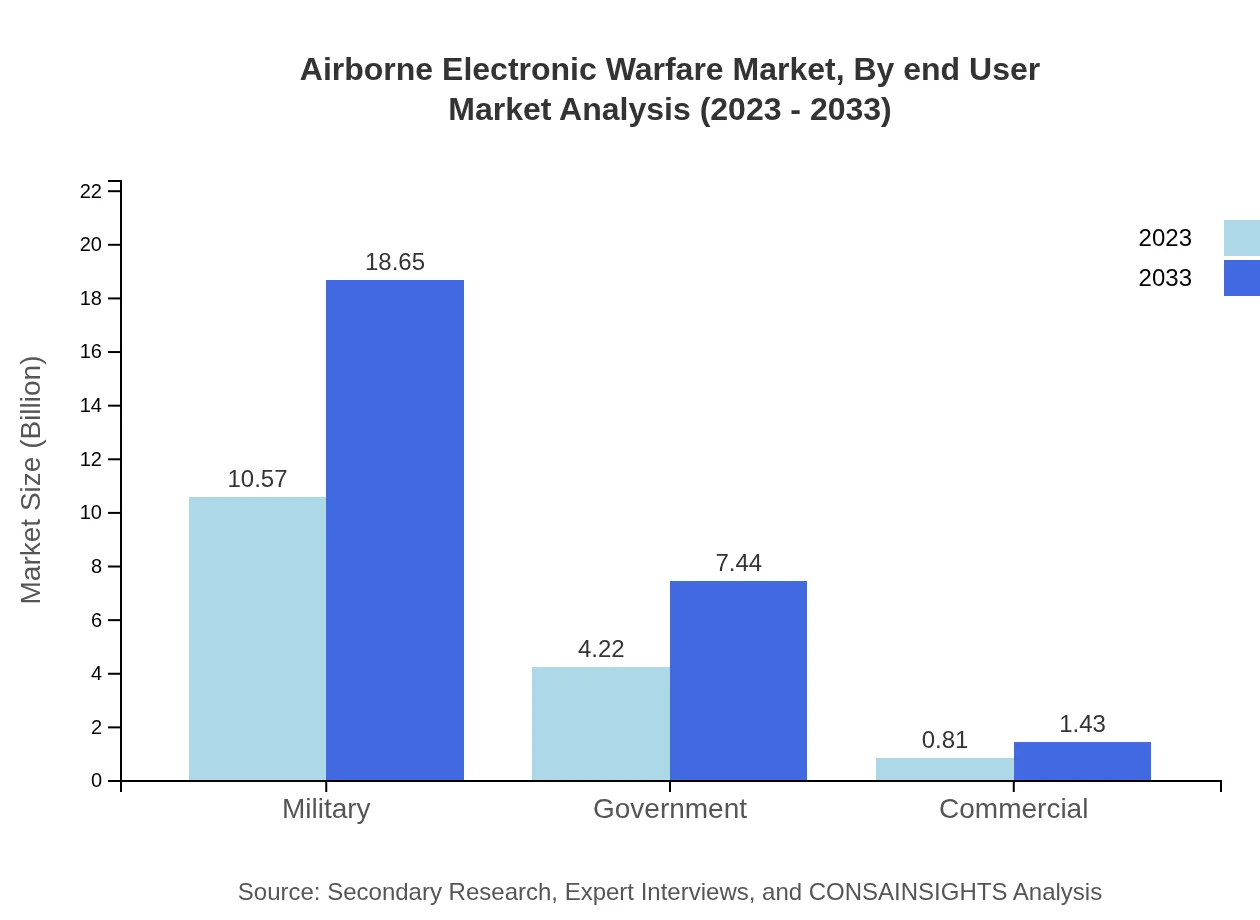

Airborne Electronic Warfare Market Analysis By End User

End-users of Airborne Electronic Warfare solutions mainly include military forces, government agencies, and commercial entities. The military sector leads the market, comprising 67.77% of the total share in 2023, driven by the need for advanced capabilities to counter complex threats and enhance national security.

Airborne Electronic Warfare Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airborne Electronic Warfare Industry

Northrop Grumman Corporation:

A leading aerospace and defense technology company known for its advanced electronic warfare systems and tactical solutions.Raytheon Technologies:

A major player in defense contracting, Raytheon specializes in robust electronic warfare systems and innovative defense technologies.BAE Systems:

A global defense, security, and aerospace company, BAE Systems provides superior airborne electronic warfare solutions and services.Leonardo S.p.A:

An international aerospace and defense manufacturer involved in developing cutting-edge electronic warfare systems.L3Harris Technologies:

A key technology player in the defense sector, L3Harris offers advanced electronic systems crucial for electronic warfare operations.We're grateful to work with incredible clients.

FAQs

What is the market size of airborne Electronic Warfare?

The airborne electronic warfare market is projected to reach USD 15.6 billion by 2033, growing at a CAGR of 5.7% from its current size in 2023.

What are the key market players or companies in this airborne Electronic Warfare industry?

The key market players include Northrop Grumman Corporation, Raytheon Company, L3Harris Technologies, BAE Systems, and Leonardo S.p.A., who are leaders in technology development and innovation.

What are the primary factors driving the growth in the airborne Electronic Warfare industry?

Key growth drivers include increasing military spending globally, advancements in electronic warfare technologies, and the rising need for comprehensive defense solutions due to geopolitical tensions.

Which region is the fastest Growing in the airborne Electronic Warfare?

The Asia Pacific region is the fastest-growing market, projected to grow from USD 3.20 billion in 2023 to USD 5.64 billion by 2033, driven by rising defense budgets and modernization plans.

Does ConsaInsights provide customized market report data for the airborne Electronic Warfare industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, covering various aspects of the airborne electronic warfare industry to assist clients in strategic planning.

What deliverables can I expect from this airborne Electronic Warfare market research project?

Expected deliverables include comprehensive market analysis reports, segment insights, competitive landscape assessments, and regional market shares, enabling informed decision-making.

What are the market trends of airborne Electronic Warfare?

Current trends include increased adoption of unmanned platforms, heightened investment in active electronic warfare capabilities, and the integration of AI technology for enhanced operational effectiveness.