Airborne Isr Market Report

Published Date: 03 February 2026 | Report Code: airborne-isr

Airborne Isr Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Airborne ISR market, illustrating insights on market size, segmentation, and trends from 2023 to 2033 to aid stakeholders in decision-making and strategic planning.

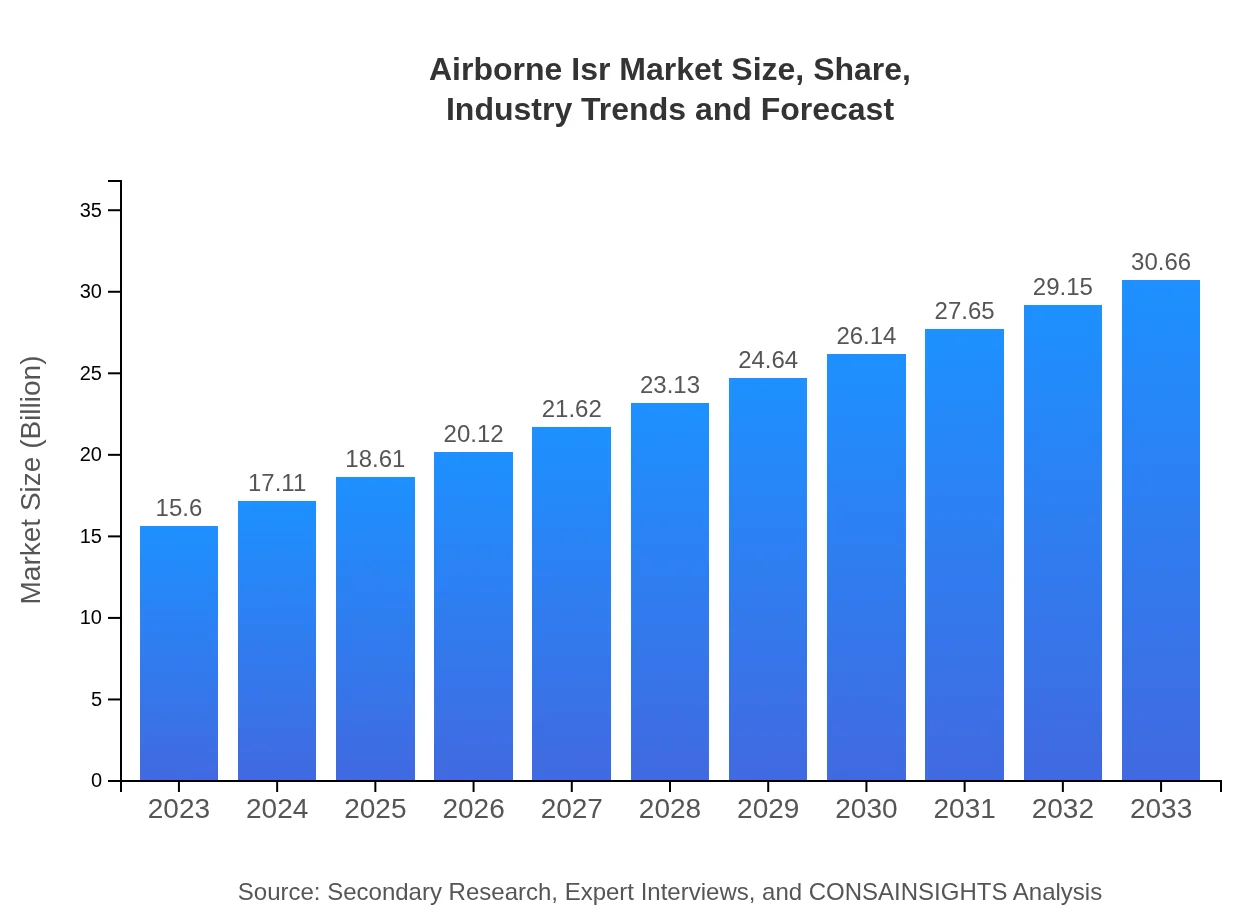

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.66 Billion |

| Top Companies | Northrop Grumman Corporation, General Atomics, Thales Group, Lockheed Martin, Raytheon Technologies |

| Last Modified Date | 03 February 2026 |

Airborne ISR Market Overview

Customize Airborne Isr Market Report market research report

- ✔ Get in-depth analysis of Airborne Isr market size, growth, and forecasts.

- ✔ Understand Airborne Isr's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airborne Isr

What is the Market Size & CAGR of Airborne ISR market in 2023?

Airborne ISR Industry Analysis

Airborne ISR Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airborne ISR Market Analysis Report by Region

Europe Airborne Isr Market Report:

Europe’s market for Airborne ISR is anticipated to expand from $5.35 billion in 2023 to $10.52 billion by 2033. Countries are increasingly focusing on autonomy and technological integration to bolster their ISR frameworks amid rising regional security threats.Asia Pacific Airborne Isr Market Report:

The Asia-Pacific region's Airborne ISR market was valued at $2.66 billion in 2023, with projections to reach $5.22 billion by 2033. This growth is driven by rising defense investments in countries like India and China, coupled with geopolitical tensions necessitating improved surveillance capabilities.North America Airborne Isr Market Report:

North America, particularly the U.S., dominates the Airborne ISR market, expected to grow from $5.46 billion in 2023 to $10.73 billion by 2033. This can be attributed to high defense spending and ongoing modernization of military capabilities.South America Airborne Isr Market Report:

Airborne ISR in South America is slated to grow from $1.45 billion in 2023 to $2.85 billion by 2033. Growing concerns over drug trafficking and organized crime have led nations in this region to invest more in ISR capabilities.Middle East & Africa Airborne Isr Market Report:

The Middle East and Africa region are projected to witness growth from $0.68 billion in 2023 to $1.34 billion by 2033 as the need for intelligence gathering amidst regional conflicts drives investment in ISR technologies.Tell us your focus area and get a customized research report.

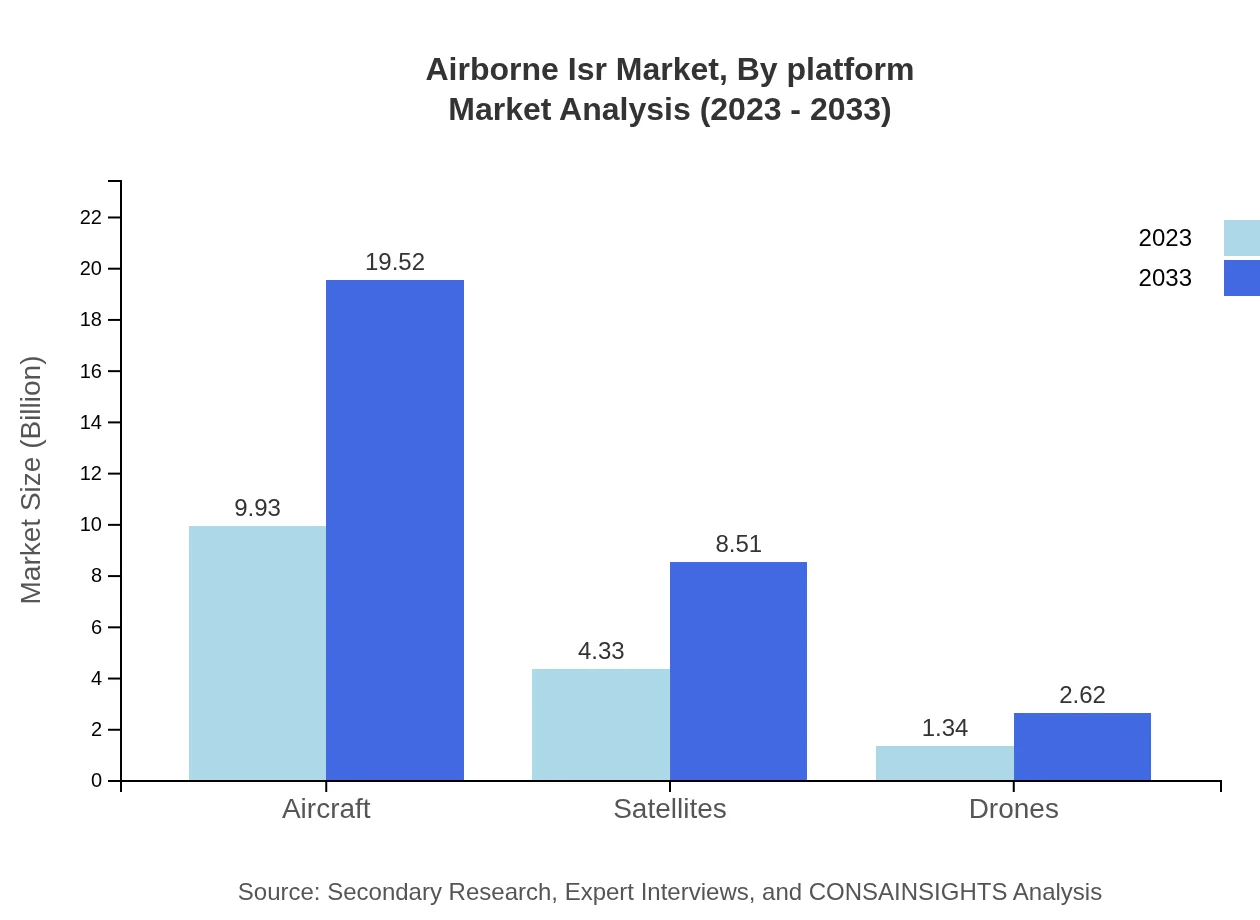

Airborne Isr Market Analysis By Platform

In 2023, the platforms segment of the Airborne ISR market accounted for a significant share, with aircraft leading at $9.93 billion. By 2033, this segment is expected to grow to $19.52 billion, highlighting the continued reliance on manned aircraft for surveillance. Satellites are also notable, increasing from $4.33 billion to $8.51 billion, while drones are anticipated to expand from $1.34 billion to $2.62 billion as technology advances.

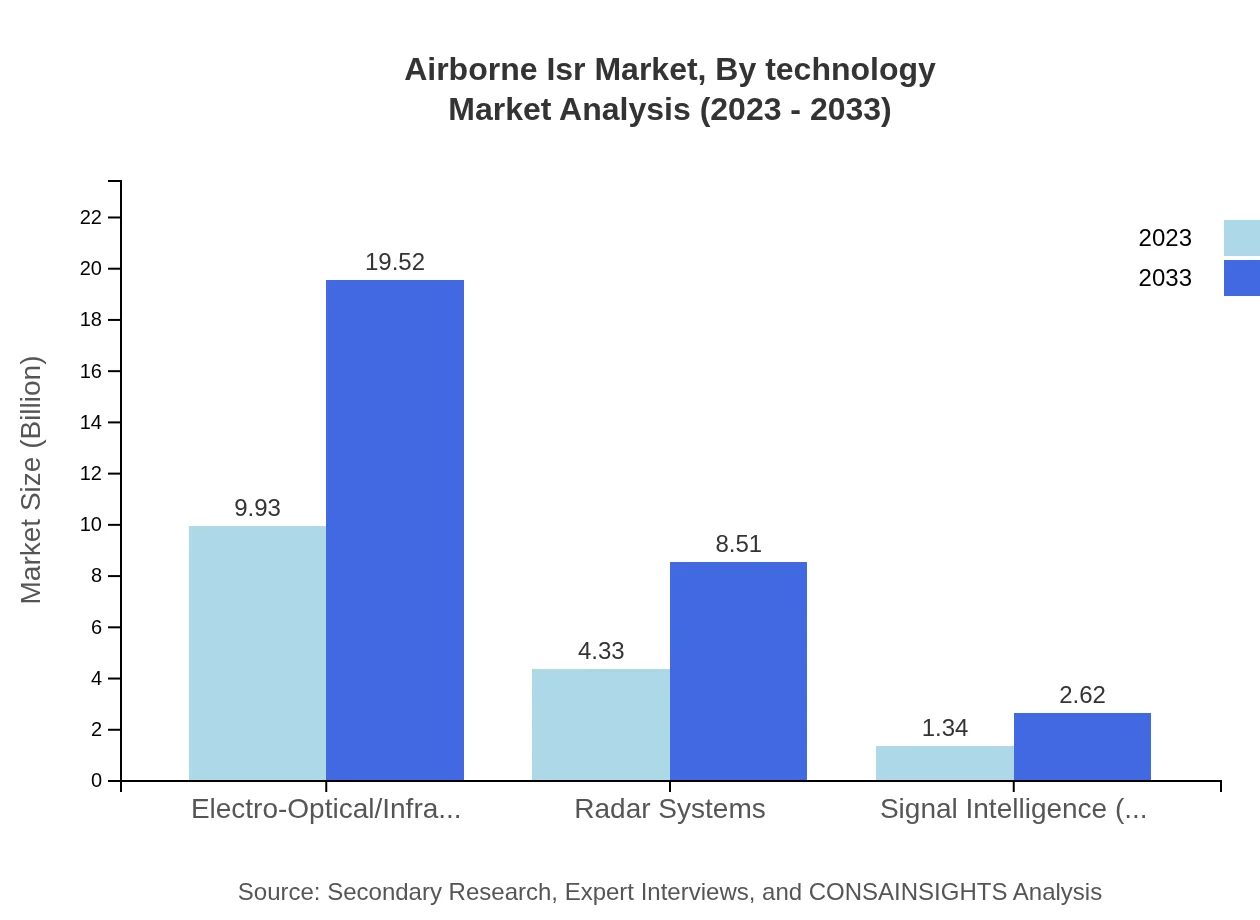

Airborne Isr Market Analysis By Technology

The Airborne ISR market is being driven predominantly by electro-optical/infrared (EO/IR) sensors, currently valued at $9.93 billion and anticipated to reach $19.52 billion by 2033. This indicates their critical importance in surveillance. Radar systems and signal intelligence technologies also play vital roles, growing in tandem as the scope of ISR evolves to include more advanced sensing technologies.

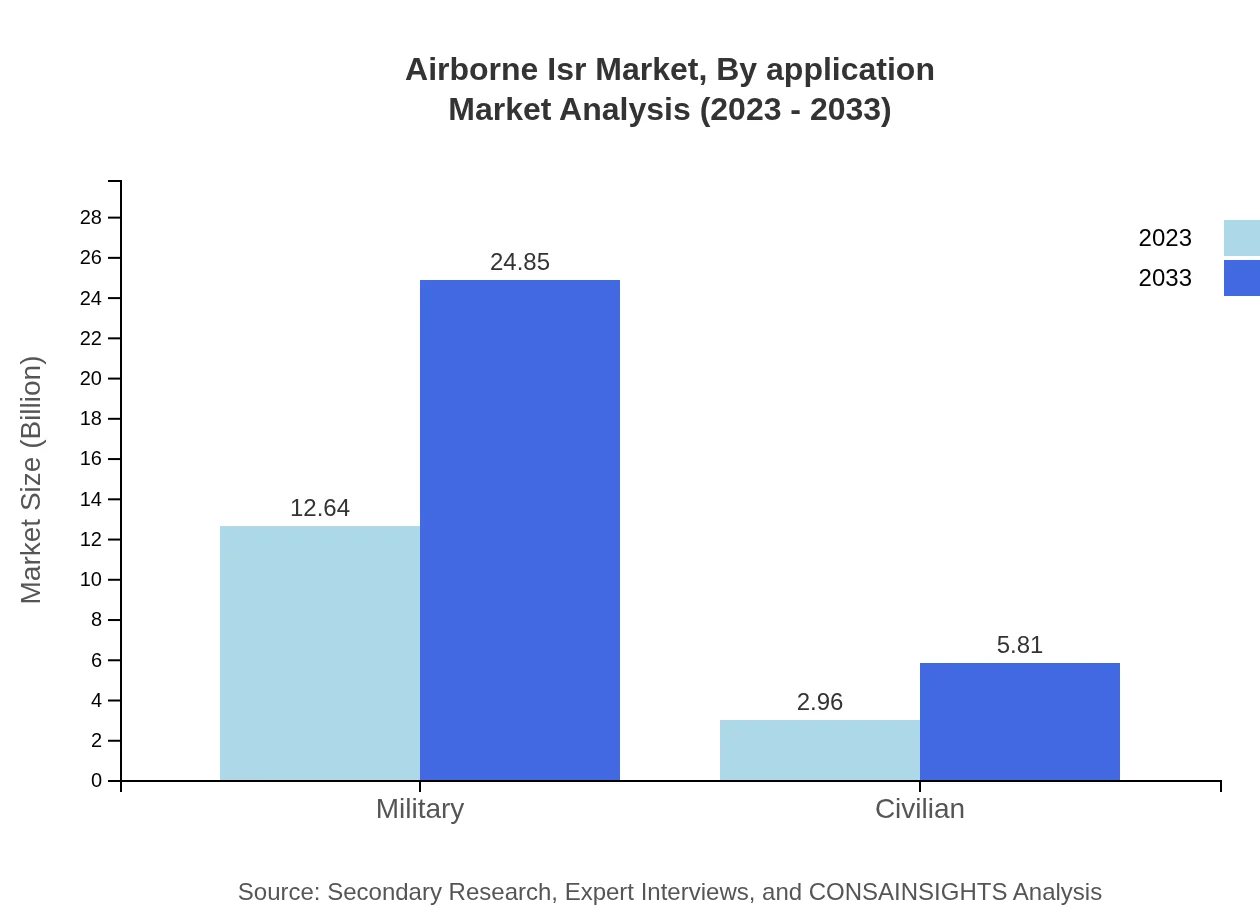

Airborne Isr Market Analysis By Application

The military application holds the largest portion of the Airborne ISR market, estimated at $12.64 billion in 2023 and expected to double to $24.85 billion in 2033. Civilian applications are emerging, presently valued at $2.96 billion, with a projected value of $5.81 billion, reflecting growing interest in non-military ISR uses such as environmental monitoring and disaster response.

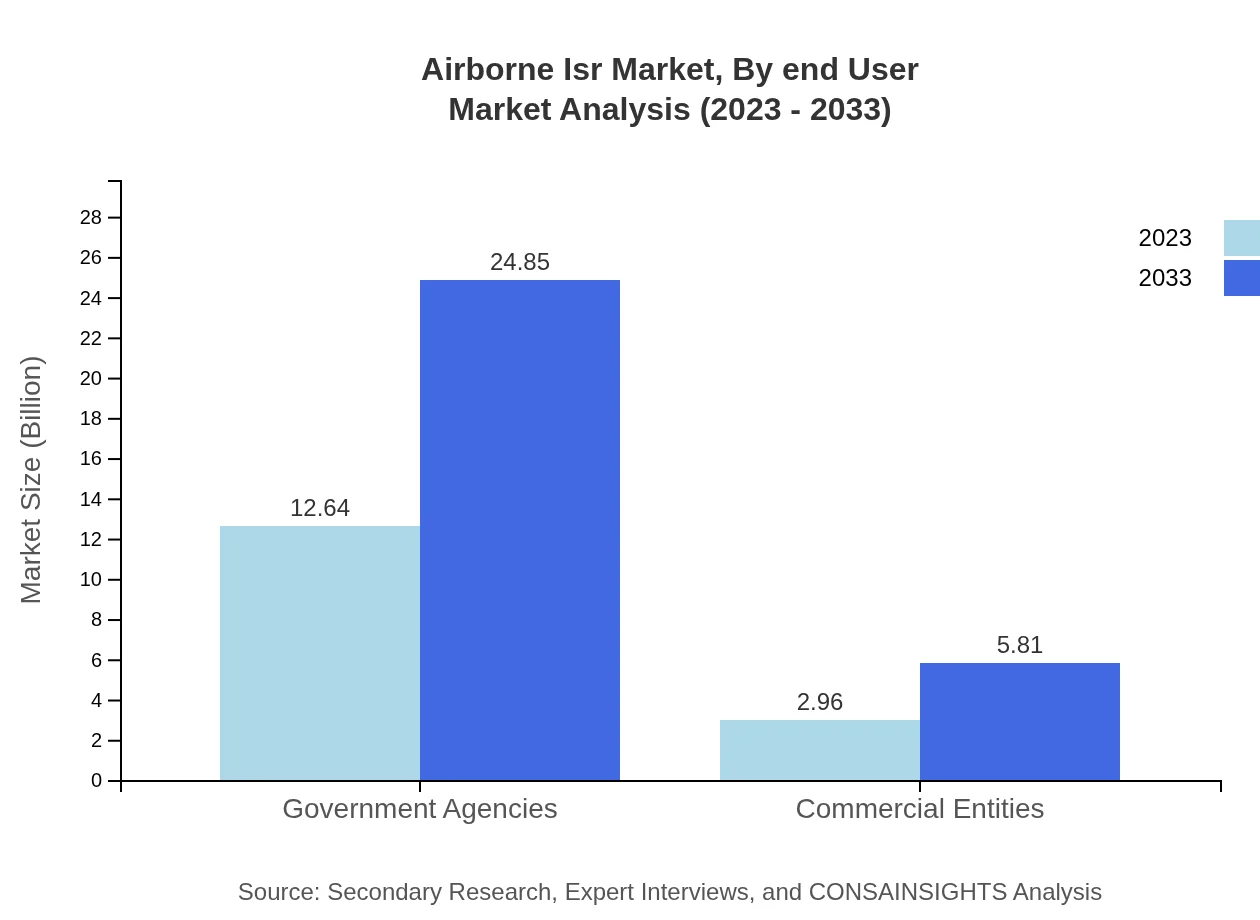

Airborne Isr Market Analysis By End User

Government agencies dominate the Airborne ISR market, holding a market size of $12.64 billion in 2023 with an expected growth to $24.85 billion by 2033. Commercial entities, though smaller at $2.96 billion, are also expected to see growth to $5.81 billion, indicating a gradual diversification of ISR applications.

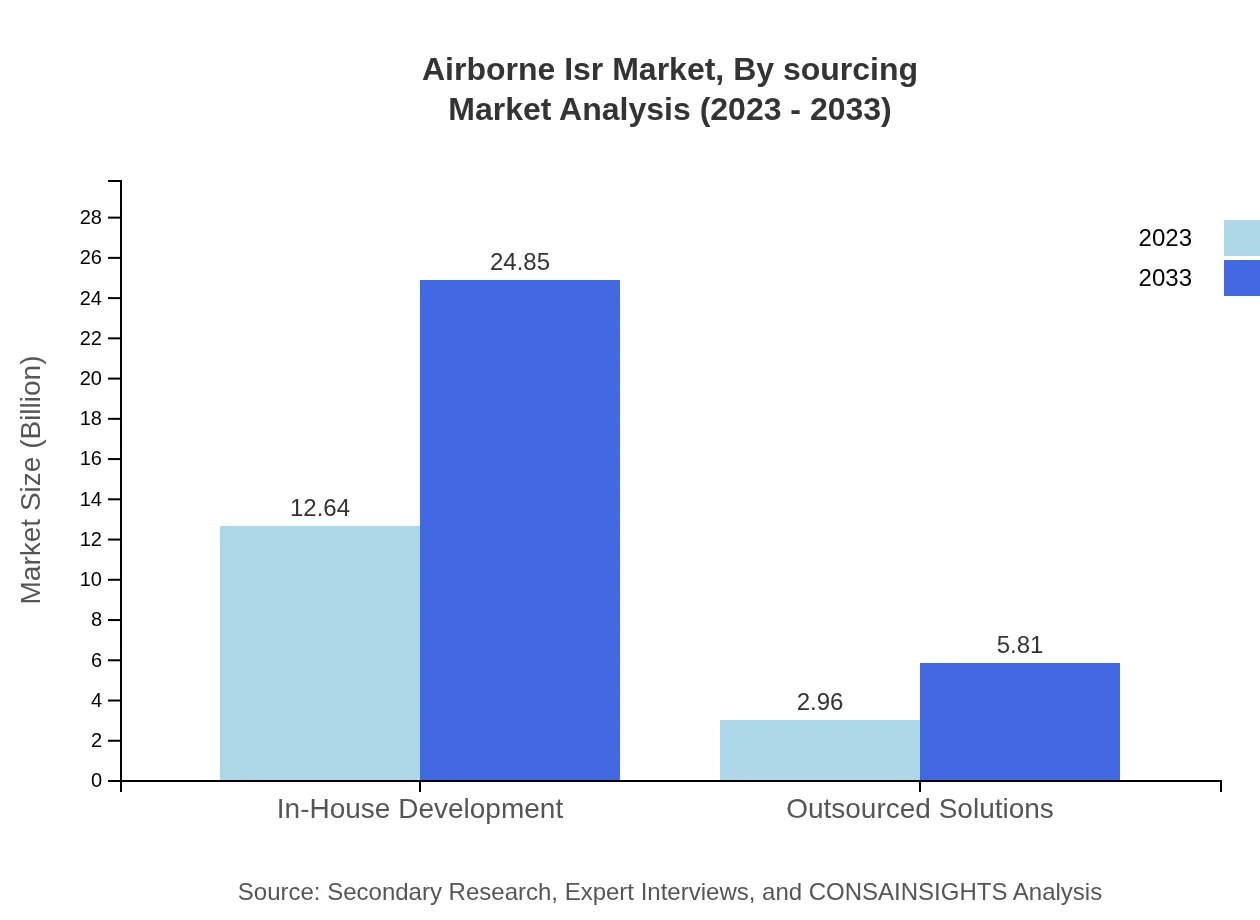

Airborne Isr Market Analysis By Sourcing

In-house development dominates the sourcing landscape, currently at $12.64 billion and projected to reach $24.85 billion by 2033. This trend indicates a strong preference for customized ISR solutions among military users, while outsourced solutions, starting from $2.96 billion, are also expected to grow to $5.81 billion, highlighting a balanced approach to meeting ISR capabilities.

Airborne ISR Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airborne ISR Industry

Northrop Grumman Corporation:

A leading global aerospace and defense technology company, Northrop Grumman excels in providing advanced ISR solutions, particularly through unmanned systems and sensor technologies.General Atomics:

Specializing in unmanned aircraft systems, General Atomics provides innovative ISR platforms, including the Predator and Reaper, which are widely used in military operations.Thales Group:

A pioneering technology that delivers secure communication and intelligence solutions for airborne ISR, Thales is key in integrating new technologies across military and civilian sectors.Lockheed Martin:

With a diverse portfolio of defense equipment and advanced capabilities in ISR technologies, Lockheed Martin plays a crucial role in enhancing situational awareness for clients worldwide.Raytheon Technologies:

A major player in radar and sensor technologies, Raytheon Technologies includes several ISR solution offerings that assist military operations in real-time.We're grateful to work with incredible clients.

FAQs

What is the market size of airborne ISR?

The airborne ISR market is projected to reach approximately $15.6 billion in 2023, with a robust CAGR of 6.8%, indicating significant growth potential leading up to 2033.

What are the key market players or companies in the airborne ISR industry?

Key players in the airborne ISR market include major defense contractors and technology firms specializing in military applications, leveraging advanced technologies such as drones and radar systems to provide surveillance solutions.

What are the primary factors driving the growth in the airborne ISR industry?

Growth is driven by the increasing demand for surveillance, safety, and intelligence in military operations, coupled with advancements in drone technology and governmental investments in radar and sensor systems.

Which region is the fastest Growing in the airborne ISR?

The North America region is poised to be the fastest-growing segment of the airborne ISR market, projected to grow from $5.46 billion in 2023 to $10.73 billion by 2033, followed closely by Europe.

Does ConsaInsights provide customized market report data for the airborne ISR industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the airborne ISR industry, providing detailed insights and analyses.

What deliverables can I expect from this airborne ISR market research project?

Deliverables include comprehensive market analysis reports, forecasts, segmented data by region and application, along with actionable insights tailored to strategic business decisions.

What are the market trends of airborne ISR?

Current trends include increasing integration of AI in surveillance systems, growth in unmanned aerial vehicles (UAVs), and expanded use of hybrid aircraft technologies to enhance ISR capabilities.