Airborne Lidar Market Report

Published Date: 31 January 2026 | Report Code: airborne-lidar

Airborne Lidar Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Airborne Lidar market from 2023 to 2033, covering market dynamics, size, segmentation, technological advancements, and regional insights to aid stakeholders in decision-making.

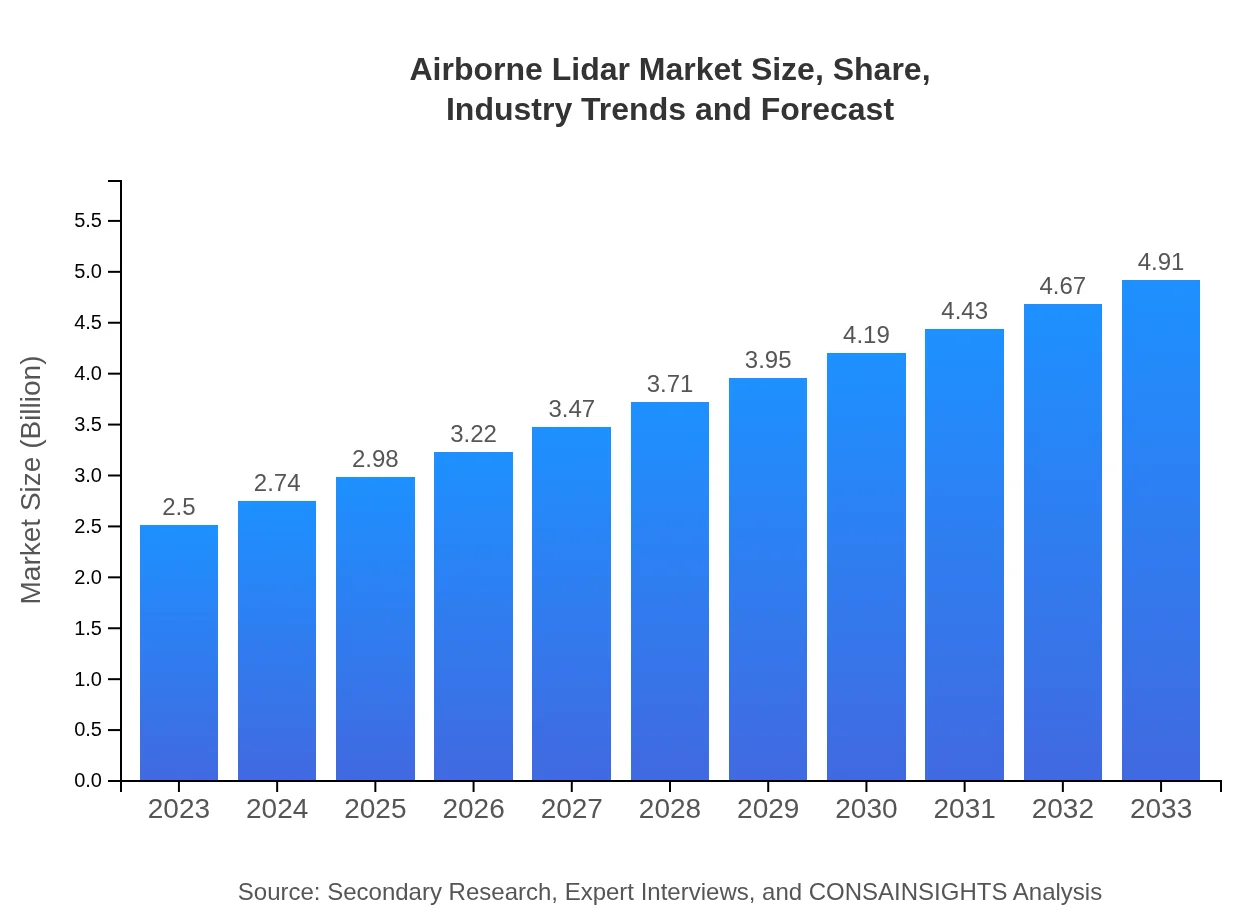

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Leica Geosystems (part of Hexagon), Teledyne Technologies (Optech), RIEGL Laser Measurement Systems, Quantum Spatial, Fugro |

| Last Modified Date | 31 January 2026 |

Airborne Lidar Market Overview

Customize Airborne Lidar Market Report market research report

- ✔ Get in-depth analysis of Airborne Lidar market size, growth, and forecasts.

- ✔ Understand Airborne Lidar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airborne Lidar

What is the Market Size & CAGR of the Airborne Lidar market in 2023?

Airborne Lidar Industry Analysis

Airborne Lidar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airborne Lidar Market Analysis Report by Region

Europe Airborne Lidar Market Report:

The European market is forecasted to grow from $0.60 billion in 2023 to $1.19 billion by 2033, driven by robust regulations promoting environmental conservation and the increasing adoption of Lidar in urban planning.Asia Pacific Airborne Lidar Market Report:

The Asia Pacific region is expected to grow significantly, from a market size of $0.48 billion in 2023 to $0.95 billion in 2033, driven by increasing government investments in infrastructure and urban development projects.North America Airborne Lidar Market Report:

North America is the largest market, projected to expand from $0.97 billion in 2023 to $1.91 billion in 2033. The region's advanced technological infrastructure and a strong emphasis on innovation are key growth factors.South America Airborne Lidar Market Report:

In South America, the market size is anticipated to grow from $0.10 billion in 2023 to $0.21 billion by 2033. The growth is attributed to rising demand for forestry and environmental monitoring solutions.Middle East & Africa Airborne Lidar Market Report:

The Middle East and Africa market is expected to grow from $0.34 billion in 2023 to $0.66 billion in 2033. This growth is primarily due to governmental initiatives focused on modernization and environmental studies.Tell us your focus area and get a customized research report.

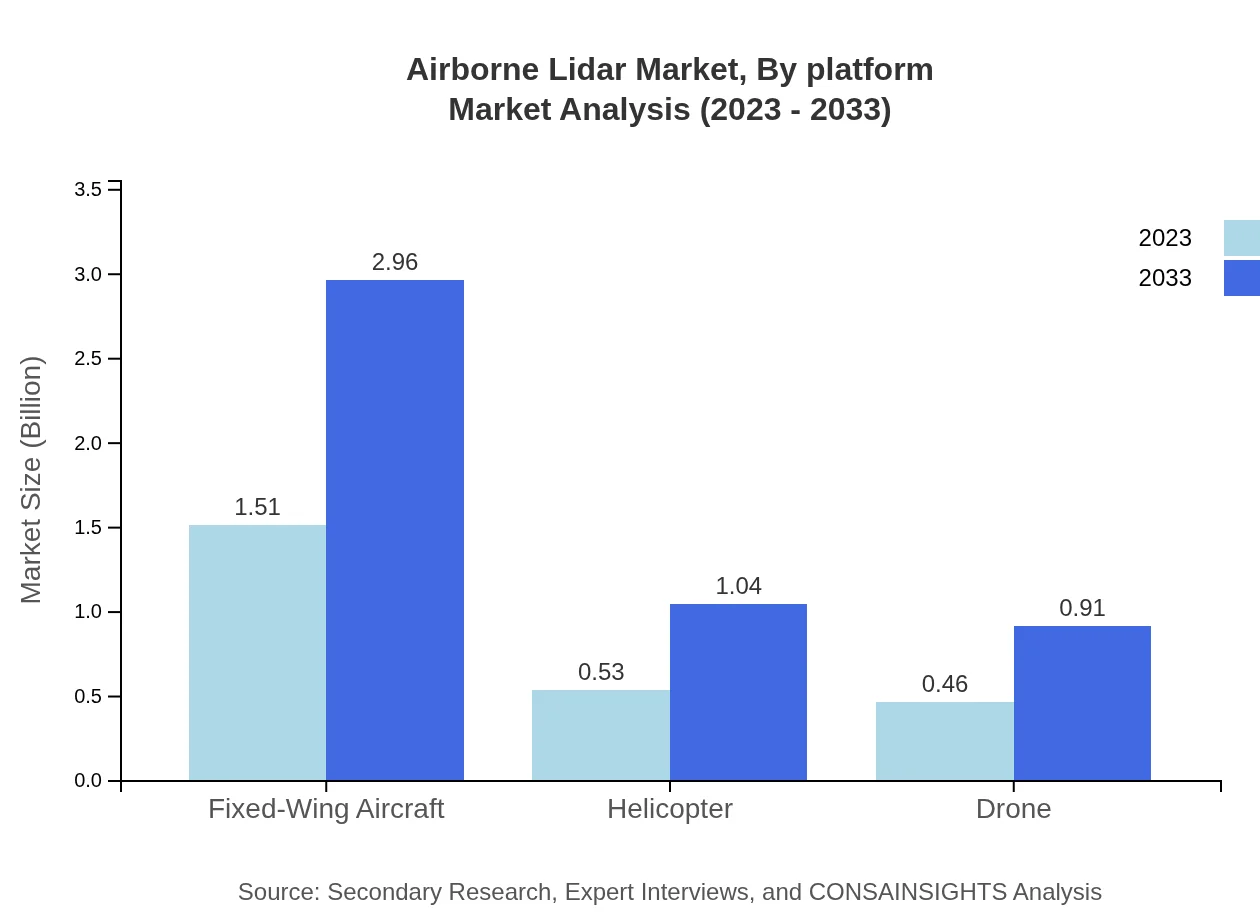

Airborne Lidar Market Analysis By Platform

The market is segmented into three primary platforms: fixed-wing aircraft, helicopters, and drones. Fixed-wing aircraft dominate the platform market due to their extensive range and efficiency, expected to grow from $1.51 billion in 2023 to $2.96 billion in 2033, capturing 60.32% market share. Helicopters follow with a projected growth from $0.53 billion to $1.04 billion, while drones are also gaining traction as low-cost alternatives.

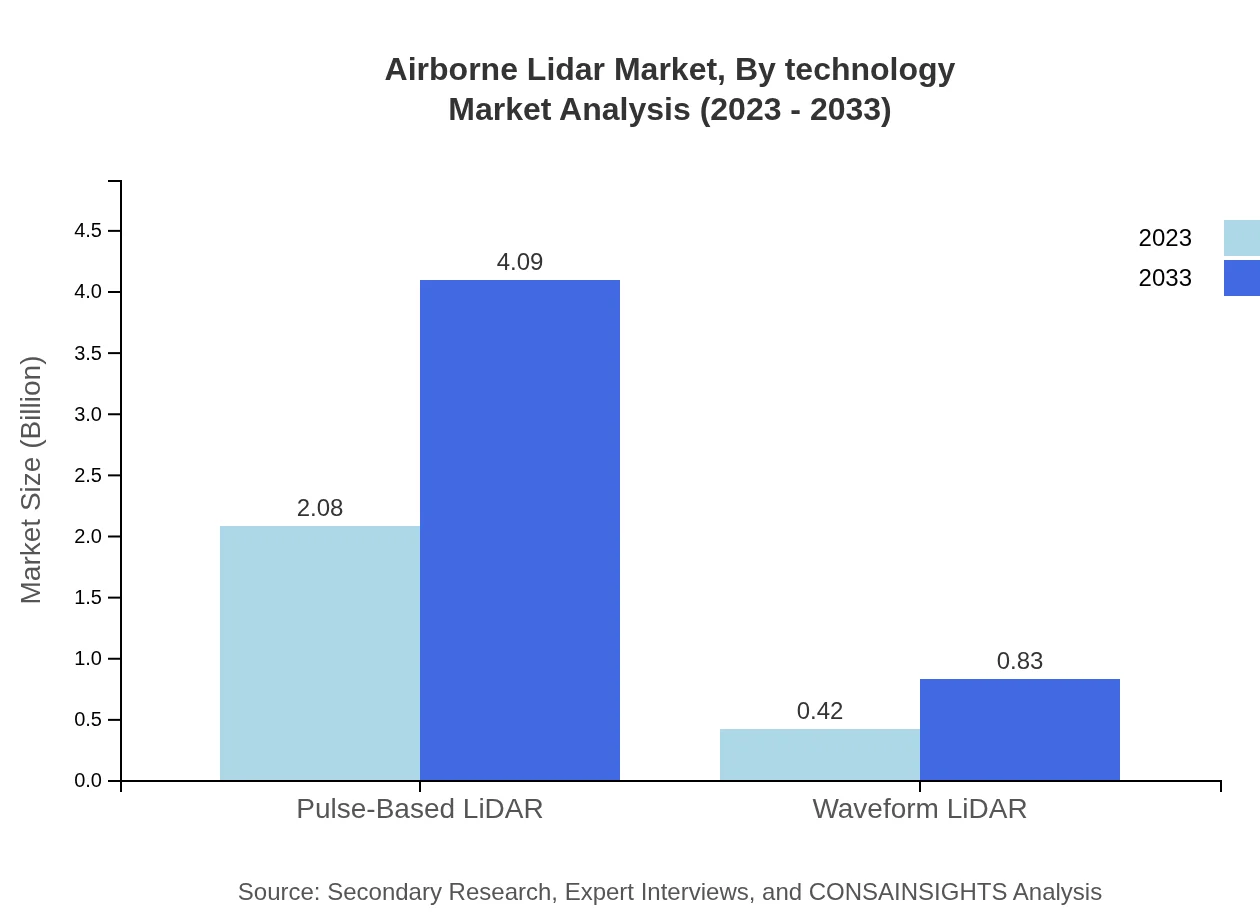

Airborne Lidar Market Analysis By Technology

In terms of technology, the Pulse-Based LiDAR segment leads, contributing significantly with a market size of $2.08 billion and commanding 83.19% share in 2023. Waveform LiDAR, while smaller, is also growing with advancements in imaging technology, expected to rise from $0.42 billion in 2023 to $0.83 billion by 2033.

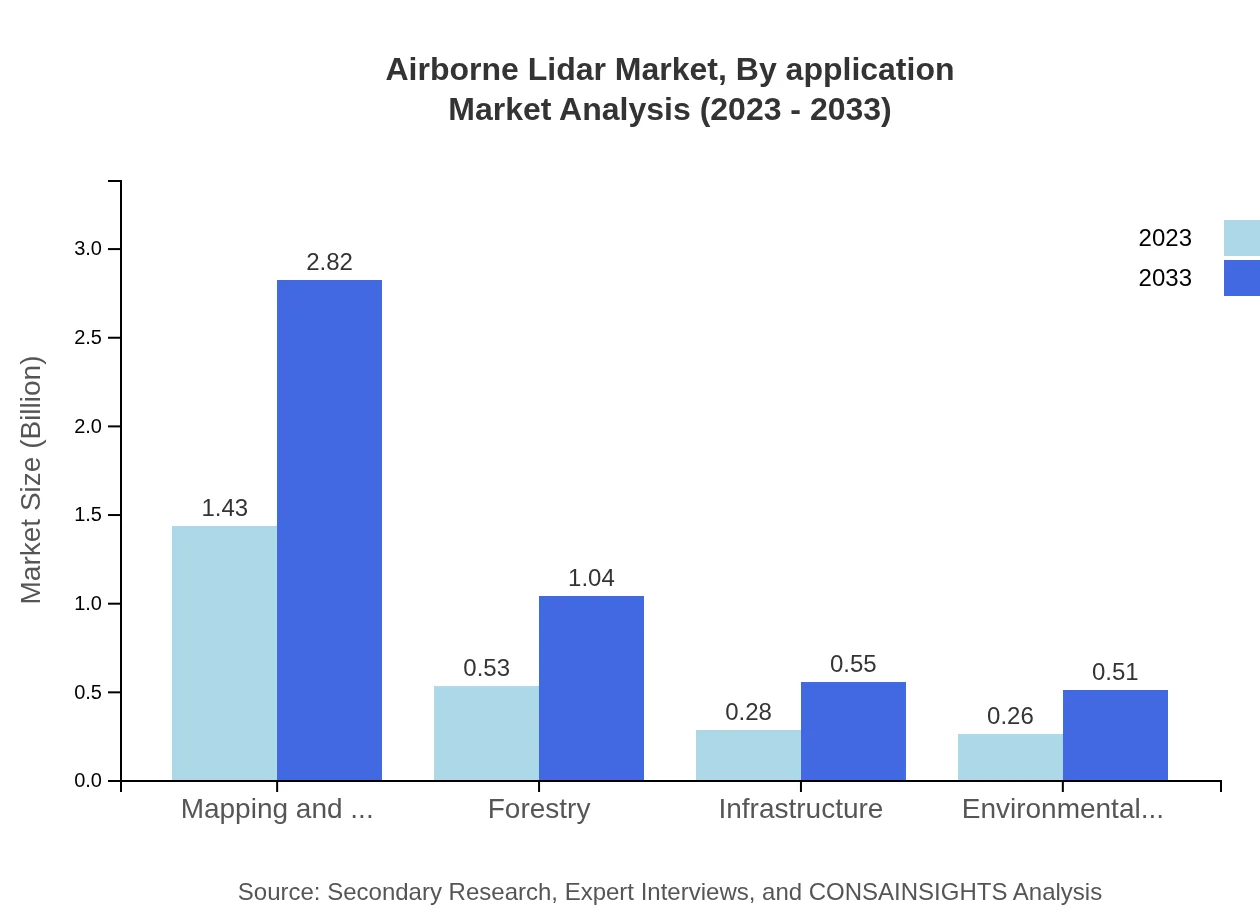

Airborne Lidar Market Analysis By Application

Major applications of Airborne Lidar include mapping and surveying, forestry, and environmental studies. The mapping and surveying segment is projected to grow from $1.43 billion in 2023 to $2.82 billion by 2033, dominating the market with a 57.34% share. Forestry and environmental studies are also significant, capturing 21.09% and 10.38% market shares respectively in 2023.

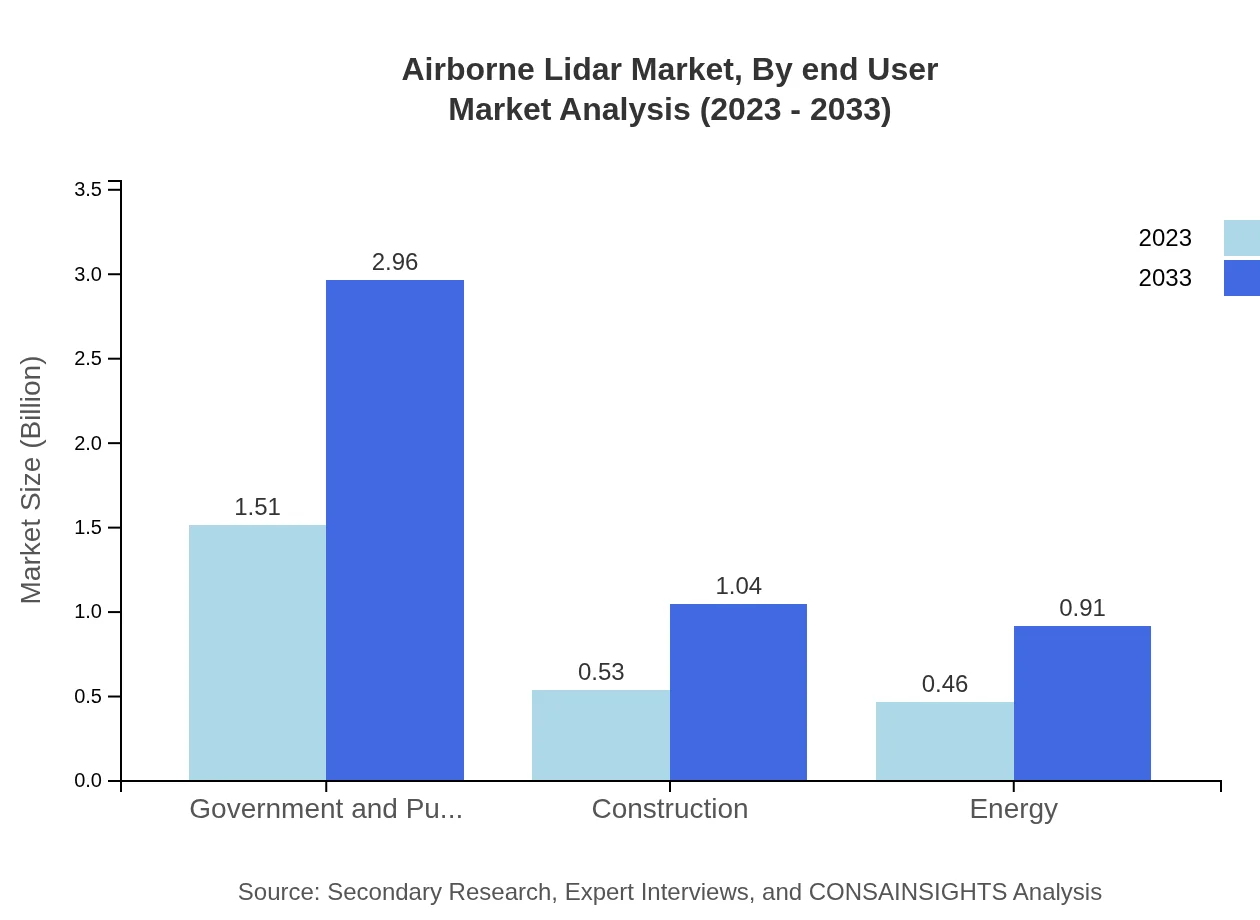

Airborne Lidar Market Analysis By End User

Key end-users include government and public sector entities, construction firms, and energy companies. The government sector is projected to grow from $1.51 billion to $2.96 billion, while the construction segment is expected to reach $1.04 billion by 2033. The energy sector, though smaller, shows substantial growth potential, driven by renewable energy projects.

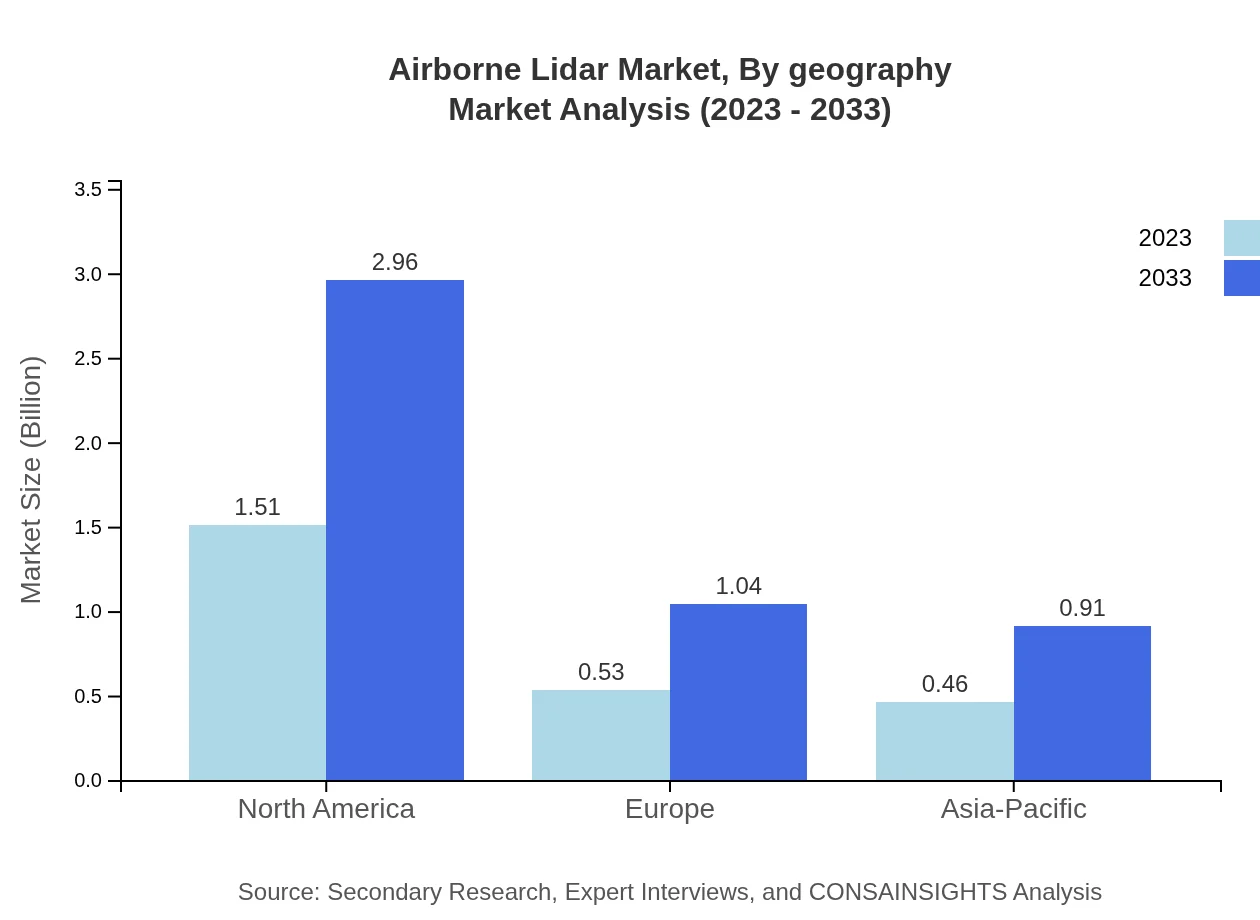

Airborne Lidar Market Analysis By Geography

Geographically, North America remains the leader, but Asia Pacific is catching up with increasing investment in technology. Europe’s focus on green initiatives positions it well for growth. South America and Middle East & Africa, while smaller markets, are also poised for growth due to infrastructural developments.

Airborne Lidar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airborne Lidar Industry

Leica Geosystems (part of Hexagon):

Leica Geosystems is a prominent player in the development of geospatial measurement technologies, providing innovative solutions for Lidar data acquisition and processing.Teledyne Technologies (Optech):

Teledyne Technologies specializes in advanced imaging and Lidar technologies, helping to drive industry standards through research and development of high-performance systems.RIEGL Laser Measurement Systems:

RIEGL is known for the development of cutting-edge Lidar solutions and has a strong footprint in various applications across sectors including surveying and forestry.Quantum Spatial:

Quantum Spatial offers comprehensive geospatial data services that leverage Lidar technology for mapping and environmental studies.Fugro:

Fugro is a global leader in geo-data and provides Lidar services focused on infrastructure, environmental management, and land-use planning.We're grateful to work with incredible clients.

FAQs

What is the market size of airborne Lidar?

The global airborne Lidar market is projected to grow from $2.5 billion in 2023 to significant figures by 2033, with a CAGR of 6.8%. This growth is anticipated due to increasing applications across various industries.

What are the key market players or companies in this airborne Lidar industry?

Key players in the airborne Lidar market include major companies dedicated to aerial mapping, surveying, and remote sensing technologies. These companies are pivotal in driving innovation and market growth through advanced Lidar solutions.

What are the primary factors driving the growth in the airborne Lidar industry?

The growth of the airborne Lidar industry is driven by increasing demand for accurate mapping and surveying solutions, advancements in Lidar technology, and the growing need for effective environmental monitoring and management.

Which region is the fastest Growing in the airborne Lidar?

North America is identified as the fastest-growing region in the airborne Lidar market, with a market size expanding from $0.97 billion in 2023 to $1.91 billion by 2033, reflecting substantial investments in infrastructure and technology.

Does ConsaInsights provide customized market report data for the airborne Lidar industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the airborne Lidar industry, ensuring that clients receive comprehensive insights relevant to their unique business needs.

What deliverables can I expect from this airborne Lidar market research project?

Deliverables from the airborne Lidar market research project include detailed reports, market analysis, segment data, regional insights, forecast timelines, and competitive landscape assessments to guide strategic decisions.

What are the market trends of airborne Lidar?

Current trends in the airborne Lidar market include the integration of Lidar with drone technology, increased use in urban planning and infrastructure projects, and a focus on sustainability in surveying practices.