Airborne Optronics Market Report

Published Date: 03 February 2026 | Report Code: airborne-optronics

Airborne Optronics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Airborne Optronics market, encompassing insights on market size, growth trends, and key drivers from 2023 to 2033. It includes regional market evaluations, product analysis, technology trends, and profiles of leading companies in the industry.

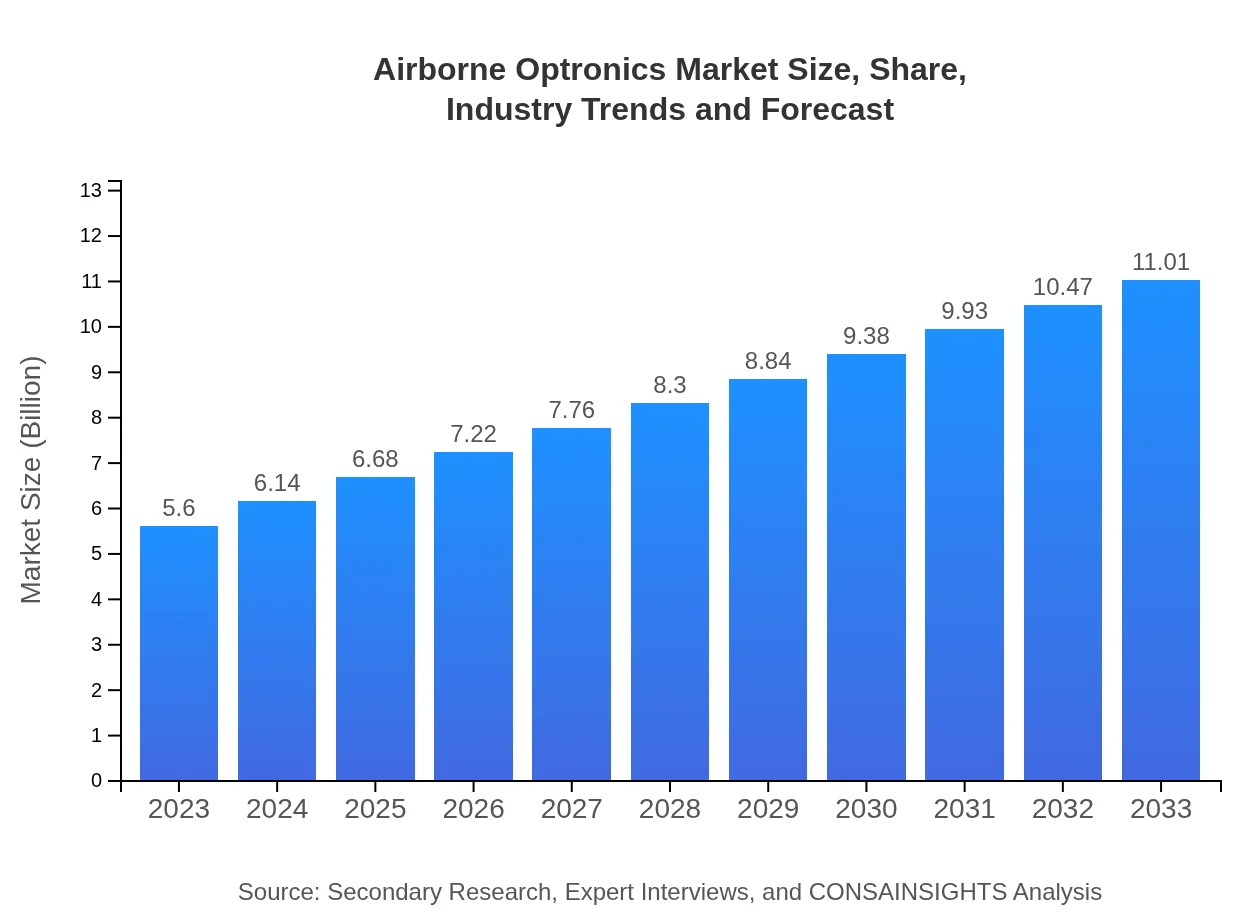

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Thales Group, Northrop Grumman Corporation, Raytheon Technologies, BAE Systems |

| Last Modified Date | 03 February 2026 |

Airborne Optronics Market Overview

Customize Airborne Optronics Market Report market research report

- ✔ Get in-depth analysis of Airborne Optronics market size, growth, and forecasts.

- ✔ Understand Airborne Optronics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airborne Optronics

What is the Market Size & CAGR of Airborne Optronics market in 2023?

Airborne Optronics Industry Analysis

Airborne Optronics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airborne Optronics Market Analysis Report by Region

Europe Airborne Optronics Market Report:

The European market is anticipated to grow from $1.72 billion in 2023 to $3.39 billion by 2033. The need for enhanced security in light of geopolitical tensions and international cooperation on defense projects is driving investments in airborne optronics technologies.Asia Pacific Airborne Optronics Market Report:

The Asia Pacific region is poised for substantial growth, with a market valuation projected to rise from $1.05 billion in 2023 to $2.07 billion by 2033, driven by an increase in defense budgets and advancements in drone technology. Countries like India and China are investing heavily in airborne surveillance systems, addressing their strategic defense needs.North America Airborne Optronics Market Report:

North America dominates the market with a growth trajectory from $2.06 billion in 2023 to $4.04 billion in 2033. The United States is leading the charge, with significant investments in military modernization programs and advanced aerial surveillance technologies.South America Airborne Optronics Market Report:

South America, though a smaller market segment, is expected to see growth from $0.27 billion in 2023 to $0.53 billion by 2033. Increased focus on border security and combating drug trafficking is propelling demand for airborne optronics solutions in the region.Middle East & Africa Airborne Optronics Market Report:

The Middle East and Africa region is forecasted to see growth from $0.50 billion in 2023 to $0.98 billion by 2033. Ongoing conflicts in the region and a focus on strengthening defense capabilities are propelling demand for airborne surveillance systems.Tell us your focus area and get a customized research report.

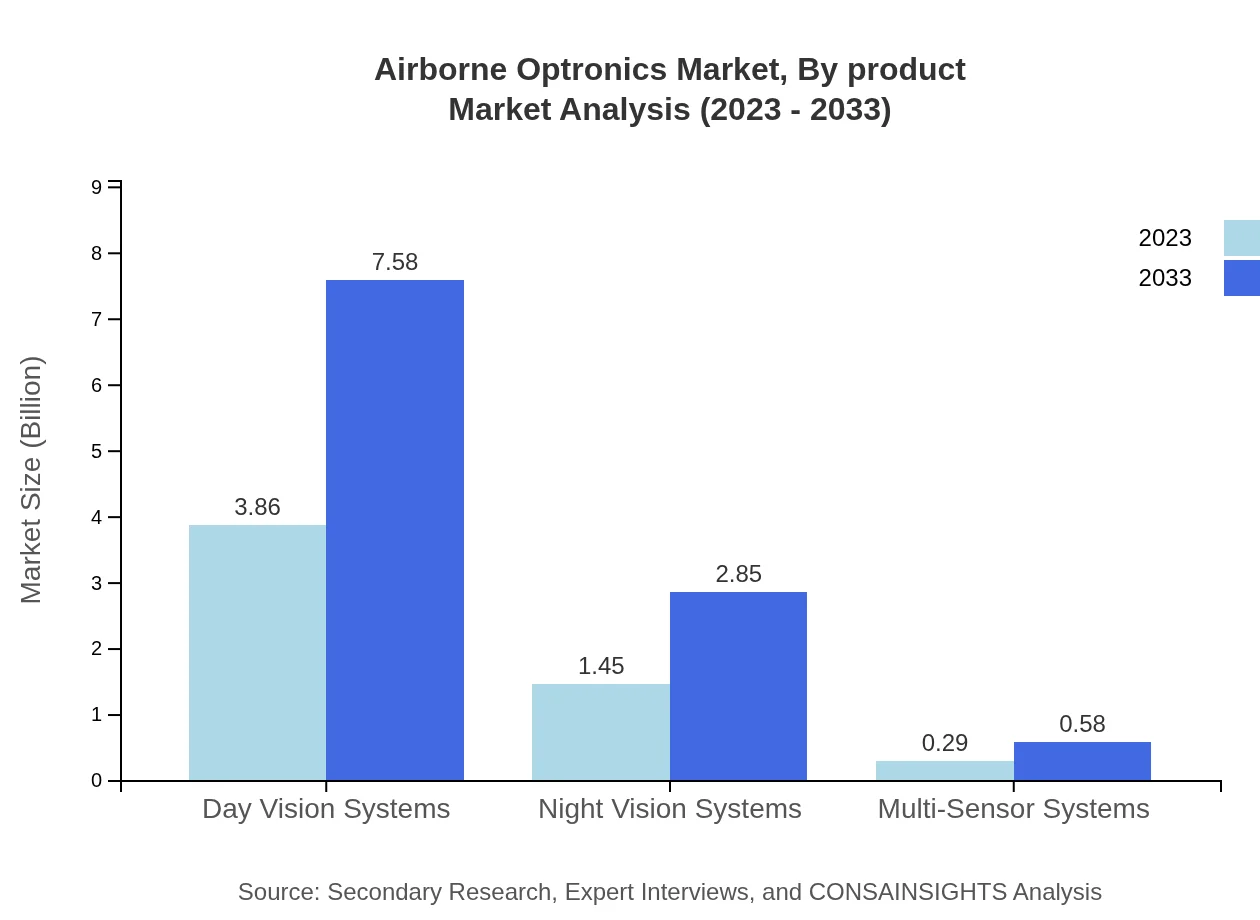

Airborne Optronics Market Analysis By Product

The Airborne Optronics market by product type includes Day Vision Systems, Night Vision Systems, and Multi-Sensor Systems. Day Vision Systems are leading the market with a valuation of $3.86 billion in 2023, expected to reach $7.58 billion by 2033, largely due to their prominent applications in military and civilian aircraft. Night Vision Systems follow closely with a projected increase from $1.45 billion to $2.85 billion during the same period, while Multi-Sensor Systems are expected to grow from $0.29 billion to $0.58 billion, meeting the demand for more integrated surveillance solutions.

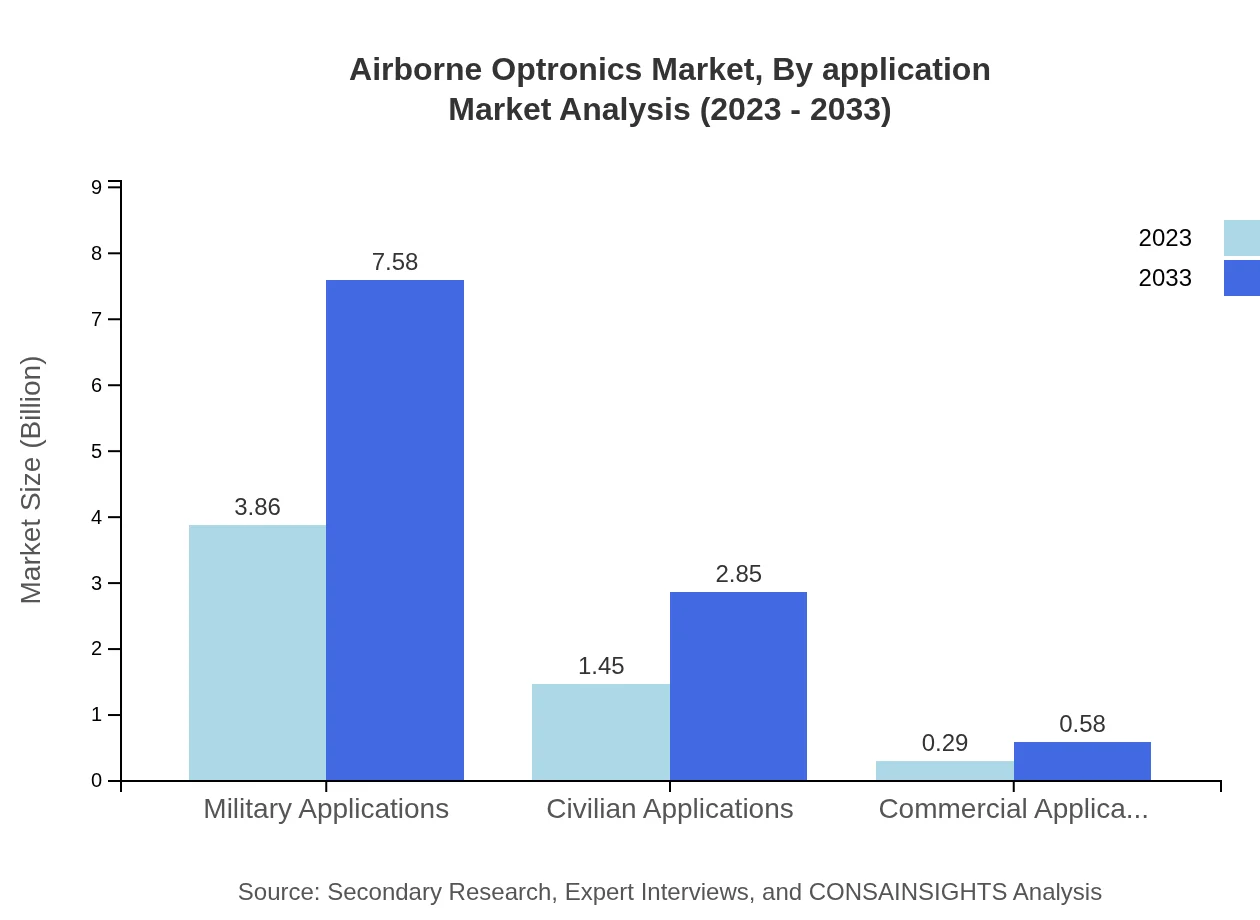

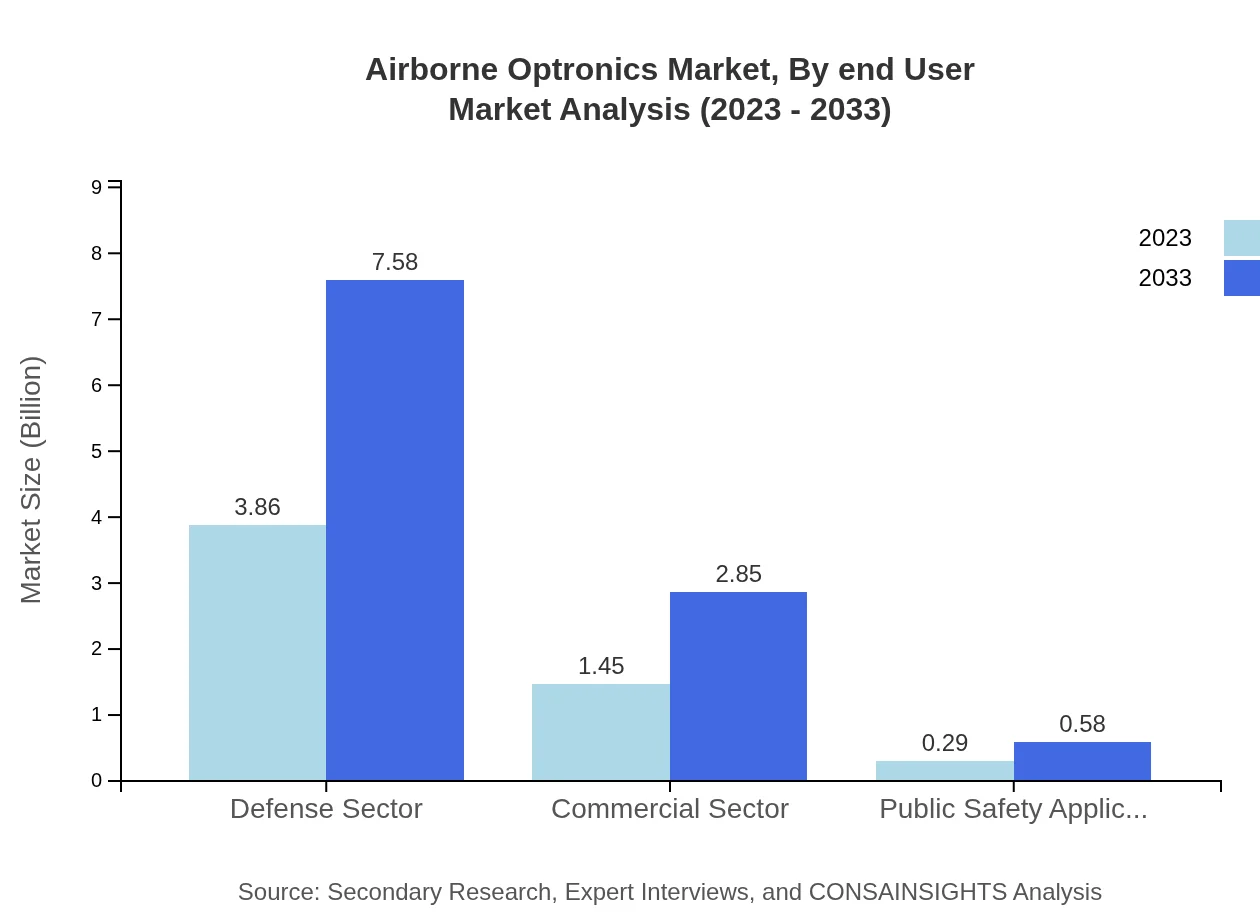

Airborne Optronics Market Analysis By Application

In the application segment, the Defense Sector dominates with an expected market size of $3.86 billion in 2023 and anticipated growth to $7.58 billion by 2033. The Commercial Sector is projected to grow from $1.45 billion to $2.85 billion, driven by the adoption of civilian drones and aviation enhancements. Additionally, Public Safety Applications are expected to see growth from $0.29 billion to $0.58 billion as emergency services increasingly rely on airborne optronics for situational awareness.

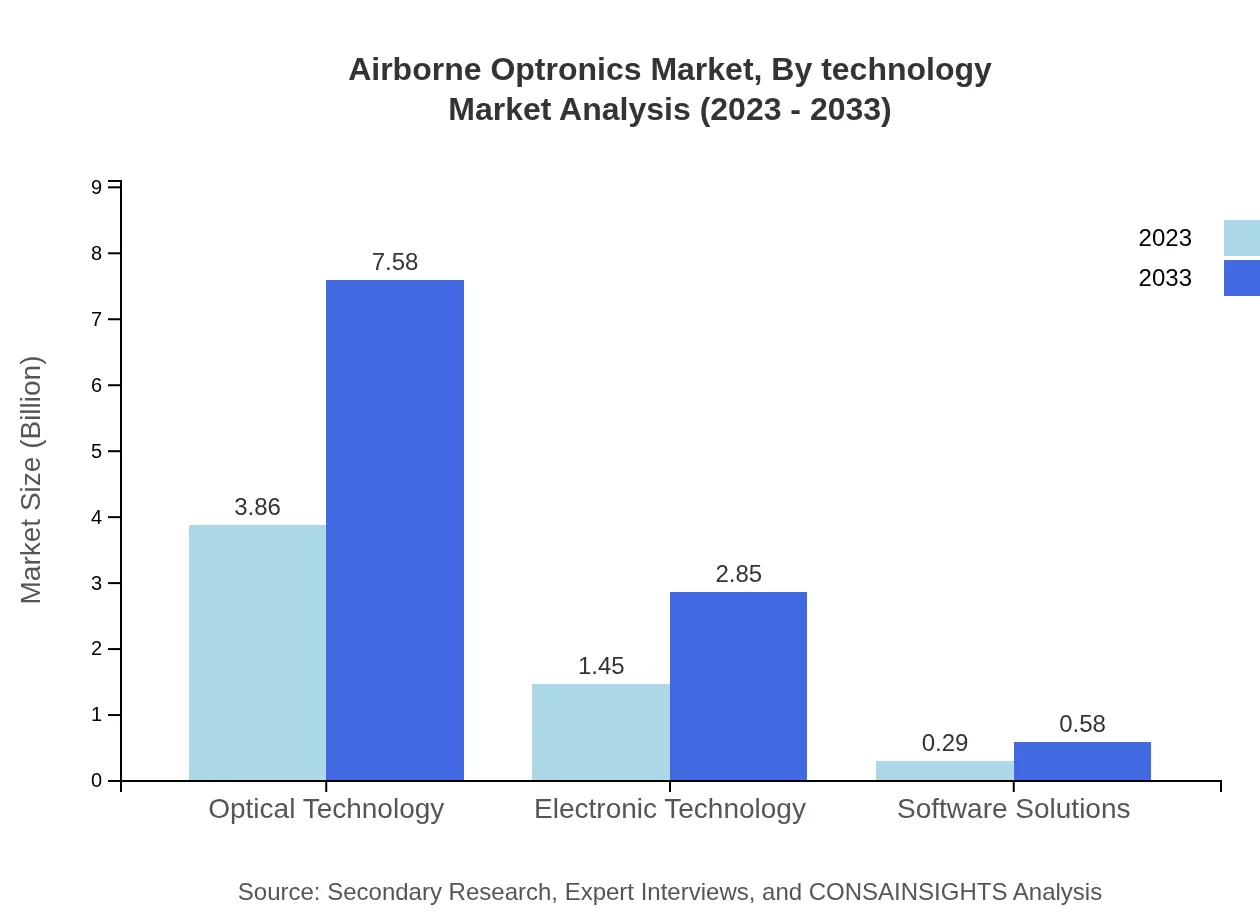

Airborne Optronics Market Analysis By Technology

The technological innovations in the Airborne Optronics market include Optical Technology, which leads with a market size of $3.86 billion in 2023, projected to double by 2033. Electronic Technology, currently valued at $1.45 billion, is expected to grow significantly, driven by advances in image processing and sensor technologies. Software Solutions that support data analysis and processing are also gaining traction, with a market potential expanding from $0.29 billion to $0.58 billion.

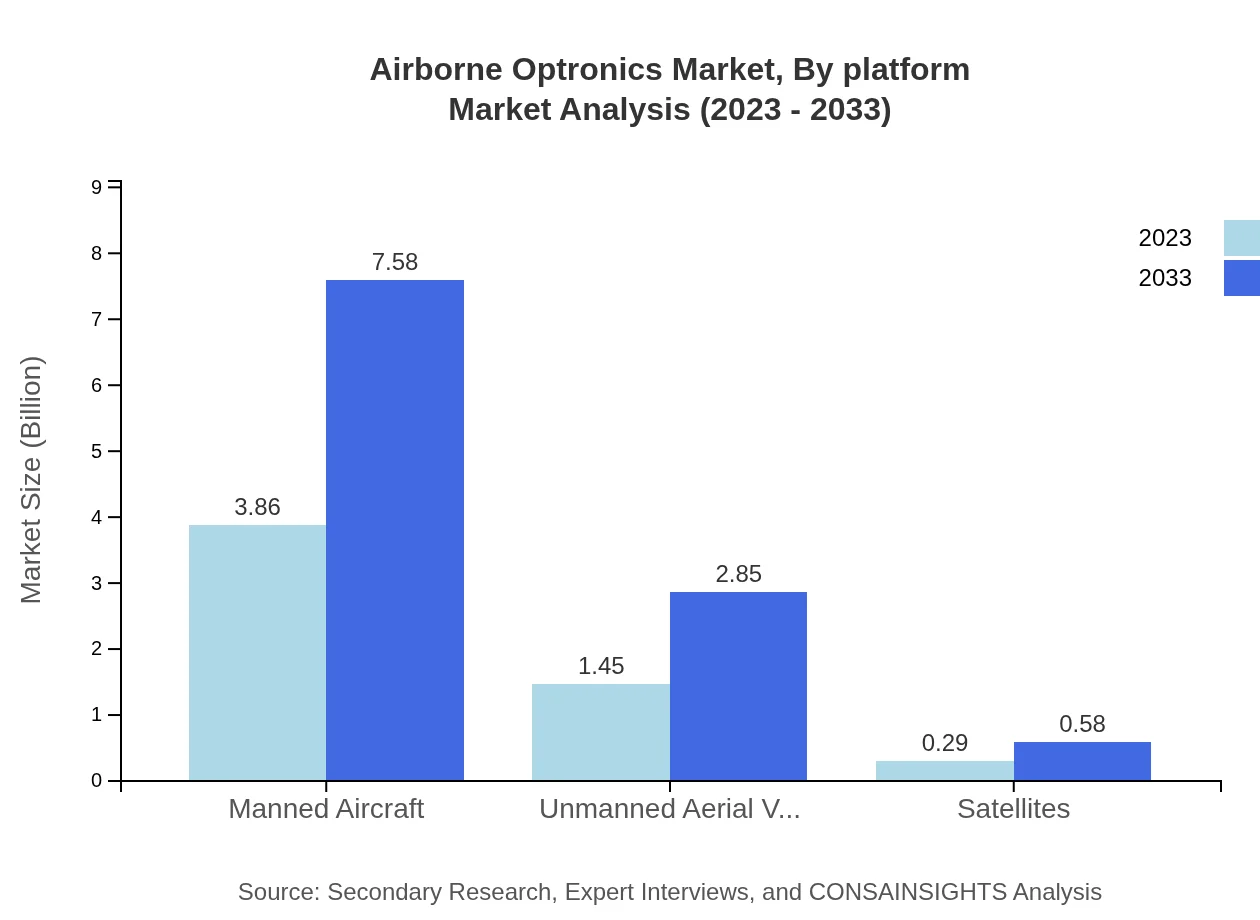

Airborne Optronics Market Analysis By Platform

In terms of platform analysis, Manned Aircraft currently holds a substantial market share of $3.86 billion in 2023, with expectations of reaching $7.58 billion by 2033. Unmanned Aerial Vehicles (UAVs) present a rapidly growing segment due to their increasing application in surveillance missions, projected to grow from $1.45 billion to $2.85 billion. Satellites also make an impact, with an expected increase from $0.29 billion to $0.58 billion as space surveillance gains importance.

Airborne Optronics Market Analysis By End User

The Airborne Optronics market by end-user is led by Military Applications, estimated to be valued at $3.86 billion in 2023, expected to grow to $7.58 billion by 2033. In contrast, Civilian Applications, which include commercial and personal uses, are estimated to grow from $1.45 billion to $2.85 billion over the same period. The diversification of applications for airborne optronics in various sectors emphasizes the growing significance of these technologies.

Airborne Optronics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airborne Optronics Industry

Thales Group:

A major player in the aerospace and defense sector, Thales Group provides advanced airborne optronics systems for various applications, focusing on improving surveillance and reconnaissance capabilities.Northrop Grumman Corporation:

Known for its cutting-edge technology, Northrop Grumman develops advanced air and space optronics solutions, including sensor systems that enhance situational awareness for military and defense operations.Raytheon Technologies:

Raytheon specializes in advanced optics and imaging technologies, providing innovative airborne optronics solutions critical for defense and security applications worldwide.BAE Systems:

BAE Systems offers a wide range of airborne optronics systems designed for both military and commercial applications, emphasizing technological integration and operational effectiveness.We're grateful to work with incredible clients.

FAQs

What is the market size of airborne Optronics?

The global airborne optronics market is projected to reach approximately $5.6 billion by 2033, experiencing a compound annual growth rate (CAGR) of 6.8% from 2023 to 2033. This substantial growth indicates increased demand across various sectors.

What are the key market players or companies in this airborne Optronics industry?

Key players in the airborne optronics market include companies like Raytheon Technologies, Thales Group, Northrop Grumman, Leonardo S.p.A., and BAE Systems. These companies are known for their innovative technologies and extensive product portfolios in surveillance and reconnaissance.

What are the primary factors driving the growth in the airborne optronics industry?

The growth in the airborne optronics industry is primarily driven by the rising demand for advanced surveillance systems, increased defense budgets globally, and advancements in optical and electronic sensors. The increasing usage of drones for various applications further contributes to market expansion.

Which region is the fastest Growing in the airborne Optronics?

The fastest-growing region in the airborne optronics market is North America, projected to grow from $2.06 billion in 2023 to $4.04 billion by 2033. Europe and Asia Pacific also show significant growth, driven by technological advancements and increased defense expenditure.

Does ConsaInsights provide customized market report data for the airborne Optronics industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the airborne-optronics industry. This includes detailed analyses on market trends, competitive landscapes, and forecasts to help clients make informed decisions.

What deliverables can I expect from this airborne Optronics market research project?

From the airborne optronics market research project, clients can expect comprehensive reports that include market size estimations, growth forecasts, segment analysis, competitive landscape insights, and regional breakdowns. Customized data solutions are also available.

What are the market trends of airborne Optronics?

Key market trends in airborne optronics include the increasing integration of artificial intelligence and machine learning in surveillance systems, an uptick in the adoption of unmanned aerial vehicles (UAVs), and a rising focus on cybersecurity for these advanced technologies.