Airborne Radars Market Report

Published Date: 22 January 2026 | Report Code: airborne-radars

Airborne Radars Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Airborne Radars market, showcasing market size, key trends, segmentation, regional insights, and future forecasts from 2023 to 2033.

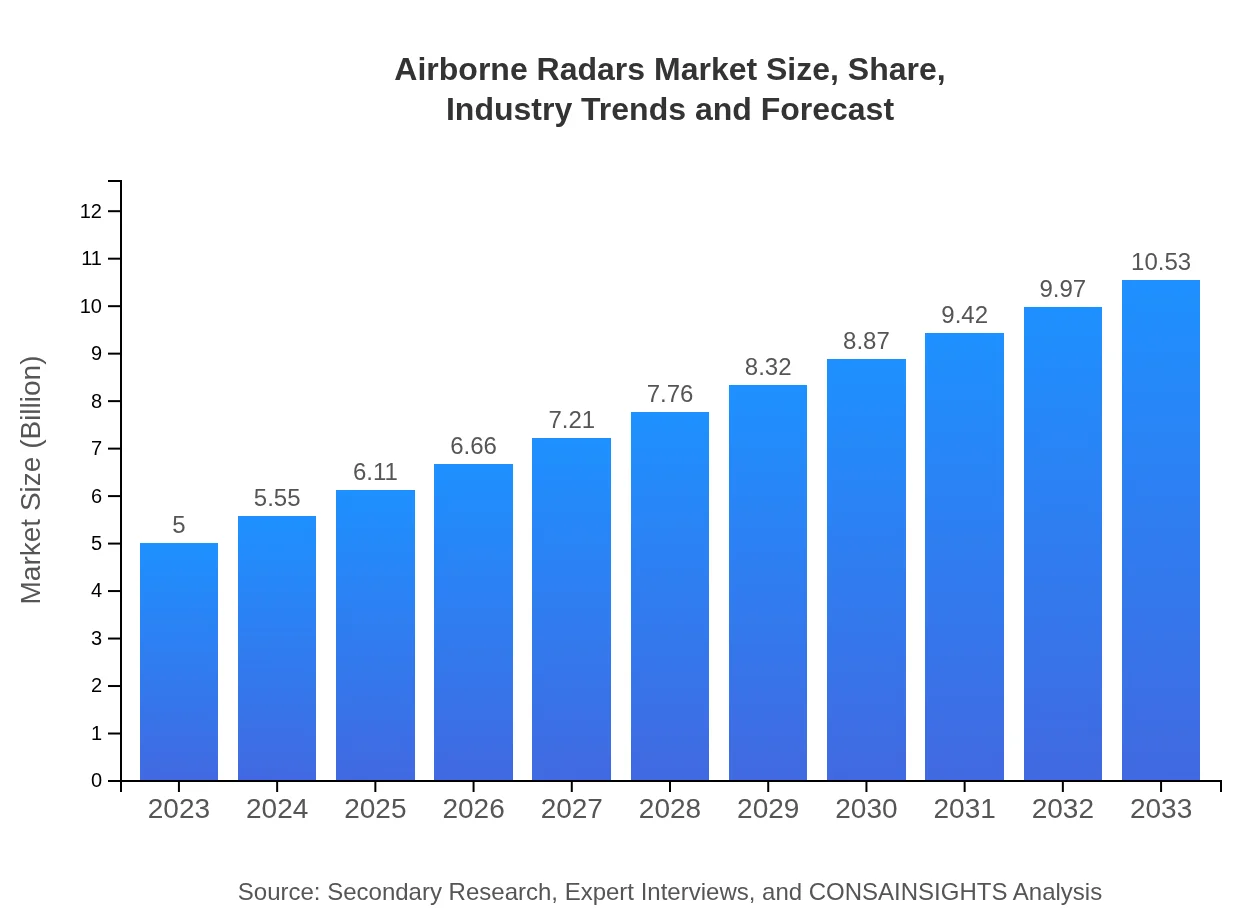

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.53 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Northrop Grumman, Thales Group |

| Last Modified Date | 22 January 2026 |

Airborne Radars Market Overview

Customize Airborne Radars Market Report market research report

- ✔ Get in-depth analysis of Airborne Radars market size, growth, and forecasts.

- ✔ Understand Airborne Radars's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airborne Radars

What is the Market Size & CAGR of Airborne Radars market in 2033?

Airborne Radars Industry Analysis

Airborne Radars Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airborne Radars Market Analysis Report by Region

Europe Airborne Radars Market Report:

Europe's Airborne Radars market is set to rise from $1.71 billion in 2023 to $3.60 billion by 2033. Increased defense cooperation among EU nations and investments in security measures against regional threats are significant growth catalysts.Asia Pacific Airborne Radars Market Report:

The Asia Pacific region is expected to grow from $0.92 billion in 2023 to $1.93 billion by 2033, driven by increasing defense budgets and modernization programs in countries like India, China, and Japan. The growing interest in UAV development also contributes significantly to this market.North America Airborne Radars Market Report:

North America, particularly the United States, dominates the market, with a forecasted growth from $1.66 billion in 2023 to $3.48 billion by 2033. Technological advancements and high defense spending are key drivers of this robust growth.South America Airborne Radars Market Report:

In South America, the Airborne Radars market is anticipated to increase from $0.32 billion in 2023 to $0.67 billion in 2033. The growth is primarily attributed to investments in military capabilities and collaborative programs with global defense organizations.Middle East & Africa Airborne Radars Market Report:

The Middle East and Africa market will expand from $0.40 billion in 2023 to $0.85 billion by 2033. This growth is supported by regional tensions requiring advanced surveillance technology to enhance defense capabilities.Tell us your focus area and get a customized research report.

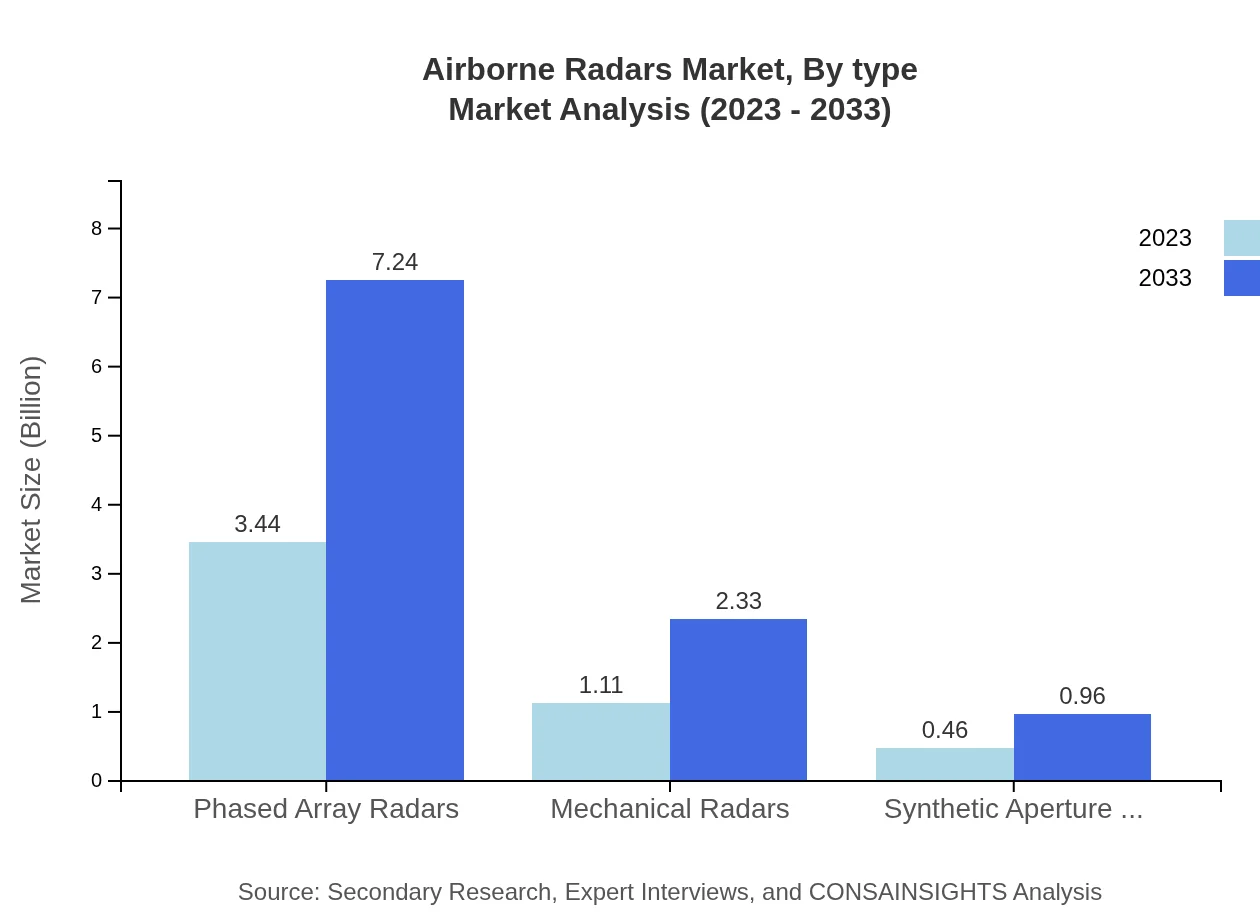

Airborne Radars Market Analysis By Type

Phased Array Radars will grow robustly from $3.44 billion in 2023 to $7.24 billion by 2033. They are anticipated to maintain a 68.76% market share throughout this period. Mechanical Radars are projected to rise from $1.11 billion to $2.33 billion, holding a 22.11% share, while Synthetic Aperture Radars will show growth from $0.46 billion to $0.96 billion, capturing a 9.13% share.

Airborne Radars Market Analysis By Application

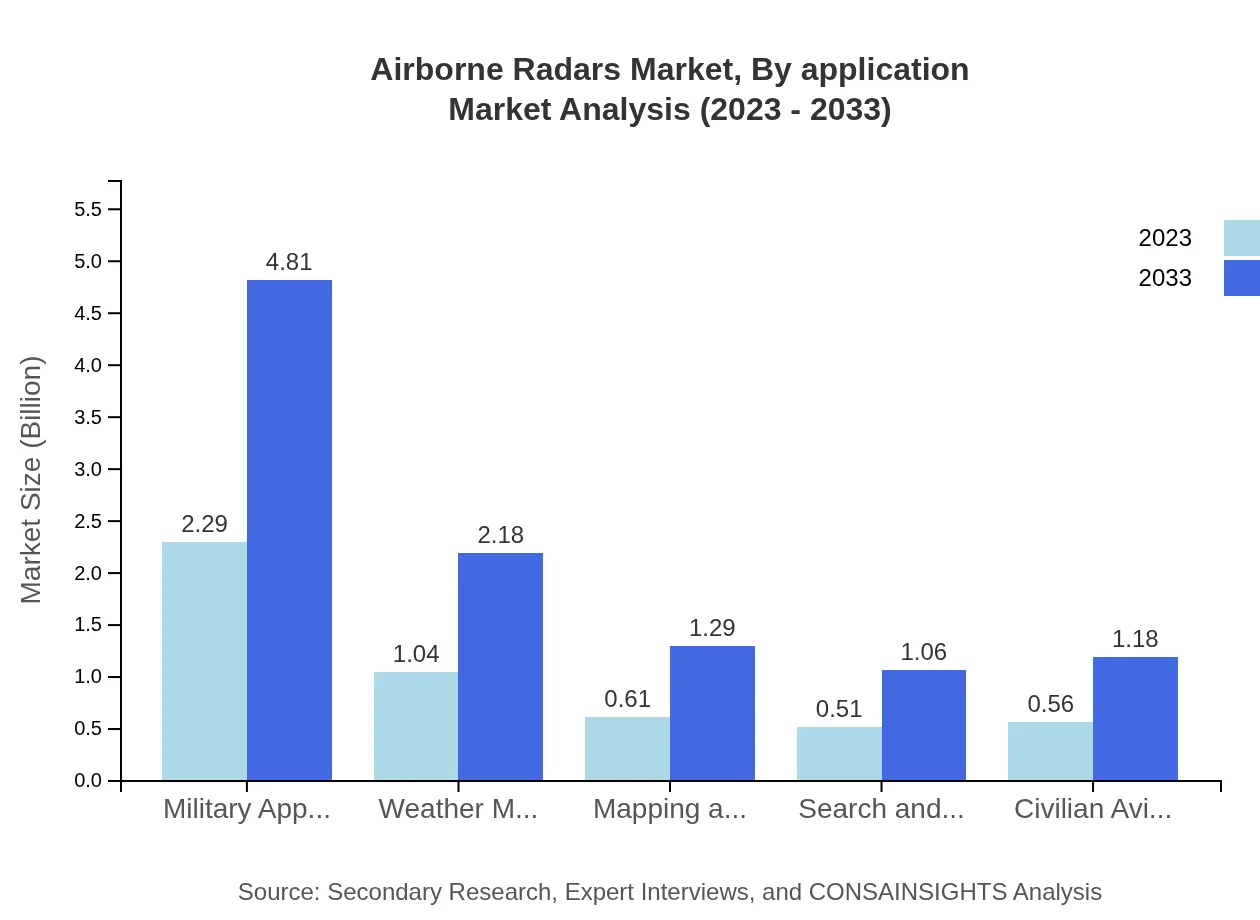

Military applications remain the most significant, expanding from $2.29 billion in 2023 to $4.81 billion by 2033, accounting for 45.71% of the market share. Weather monitoring is also notable, growing from $1.04 billion to $2.18 billion at 20.74% share. Mapping and surveying, along with search and rescue operations, are expanding in response to increasing needs for precision in these areas.

Airborne Radars Market Analysis By Technology

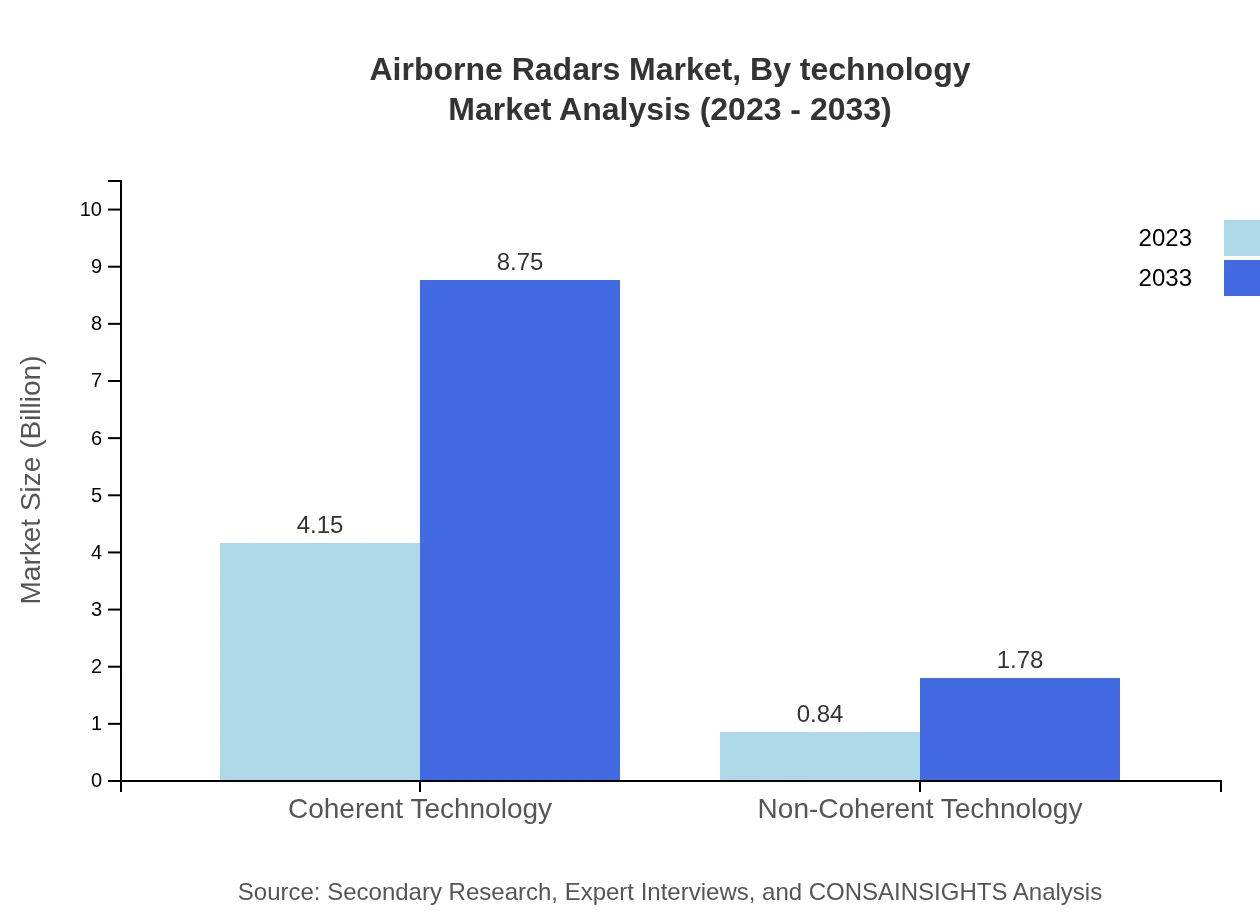

Coherent technology dominates the market, increasing from $4.15 billion in 2023 to $8.75 billion by 2033 with an 83.1% share. Non-coherent technology is also growing, albeit slower, from $0.84 billion to $1.78 billion with a 16.9% share, reflecting a diverse array of user needs.

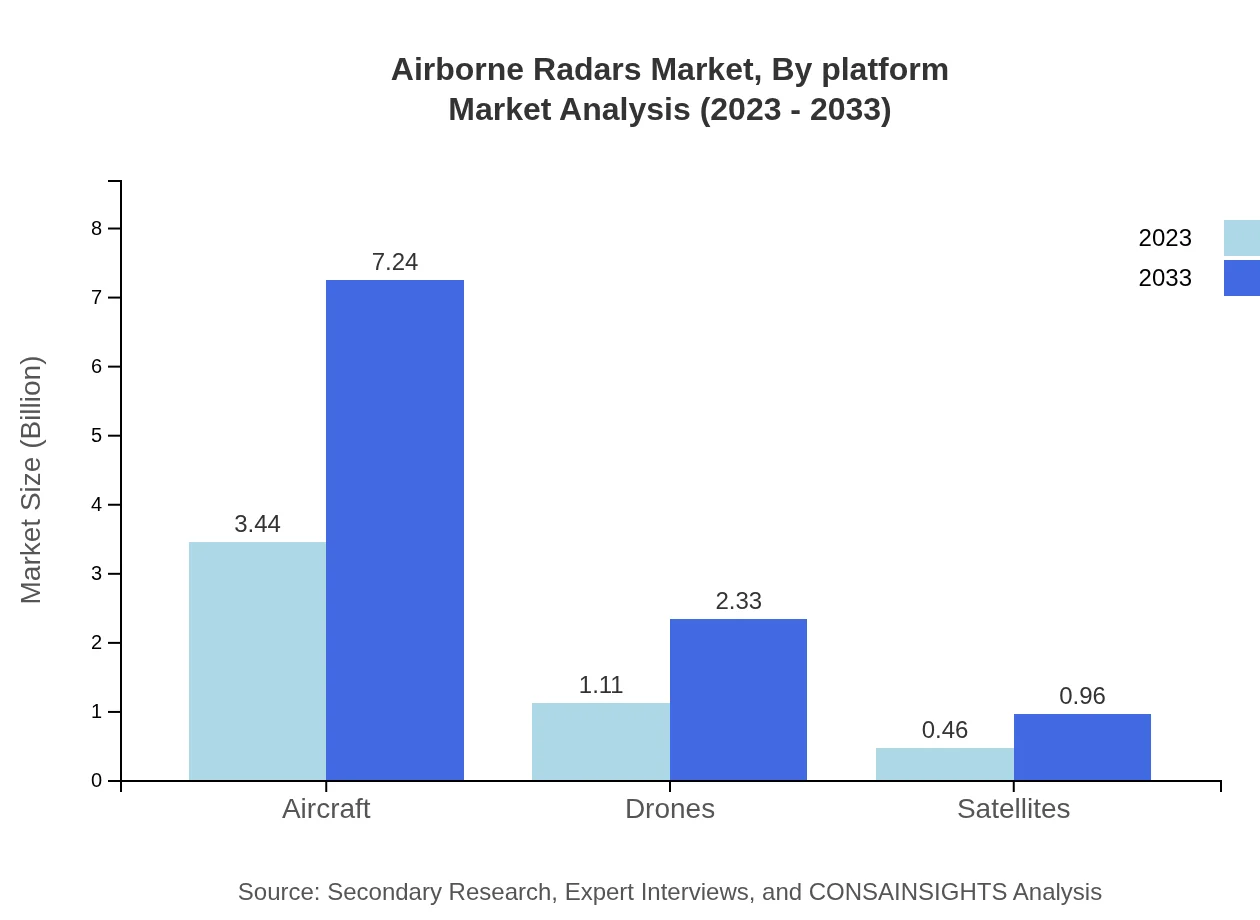

Airborne Radars Market Analysis By Platform

The market for airborne radars on aircraft is substantial, growing from $3.44 billion to $7.24 billion. Drones show vital importance too, escalating from $1.11 billion to $2.33 billion, while satellites, although smaller at $0.46 billion, are expected to increase to $0.96 billion, indicating growing applications in environmental and defense monitoring.

Airborne Radars Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airborne Radars Industry

Lockheed Martin:

A leading aerospace and defense company, Lockheed Martin is known for its advancements in radar technology, particularly in defense applications, providing systems that enhance situational awareness.Raytheon Technologies:

Raytheon Technologies specializes in defense and aerospace systems, with a strong portfolio in radar technology that supports air surveillance and missile defense operations.Northrop Grumman:

Northrop Grumman's radar systems contribute to military and commercial applications, focusing on advanced sensing and surveillance capabilities.Thales Group:

Thales Group delivers innovative radar solutions across various sectors, including military, safety, and security, emphasizing high-performance systems.We're grateful to work with incredible clients.

FAQs

What is the market size of airborne Radars?

The global airborne radars market is projected to grow from $5 billion in 2023 to significantly increase by 2033, with a CAGR of 7.5%. Continued developments in radar technology are a primary growth driver.

What are the key market players or companies in this airborne Radars industry?

Key market players in the airborne radars industry include leading aerospace and defense companies such as Lockheed Martin, Northrop Grumman, Raytheon Technologies, Thales Group, and BAE Systems, each contributing advanced radar technologies.

What are the primary factors driving the growth in the airborne Radars industry?

Key drivers of growth in the airborne radars market include increased defense expenditures, advancements in radar technology, growing demand for unmanned aerial vehicles (UAVs), and applications in weather monitoring and disaster management.

Which region is the fastest Growing in the airborne Radars?

Among various regions, Europe is the fastest-growing market for airborne radars, expected to expand from $1.71 billion in 2023 to $3.60 billion by 2033. North America and Asia Pacific also demonstrate robust growth potential.

Does ConsaInsights provide customized market report data for the airborne Radars industry?

Yes, ConsaInsights offers customized market report data for the airborne-radars industry, catering to specific client requirements including market dynamics, segment insights, and regional analyses tailored to strategic business needs.

What deliverables can I expect from this airborne Radars market research project?

Deliverables include a comprehensive market report, segments analysis, trend forecasts, competitive landscape, and tailored recommendations for strategic planning, ensuring a thorough understanding of the airborne radars market.

What are the market trends of airborne Radars?

Current trends in the airborne radars market include increased adoption of phased array technology, growing emphasis on military applications, integration of AI, and expansion into emerging markets for improved surveillance capabilities.