Airborne Satcom Market Report

Published Date: 31 January 2026 | Report Code: airborne-satcom

Airborne Satcom Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Airborne Satcom market from 2023 to 2033, covering market size, growth trends, and key dynamics influencing the industry. Insights into regional performance, segmentation, and forecasts are also included to aid understanding of future growth potential.

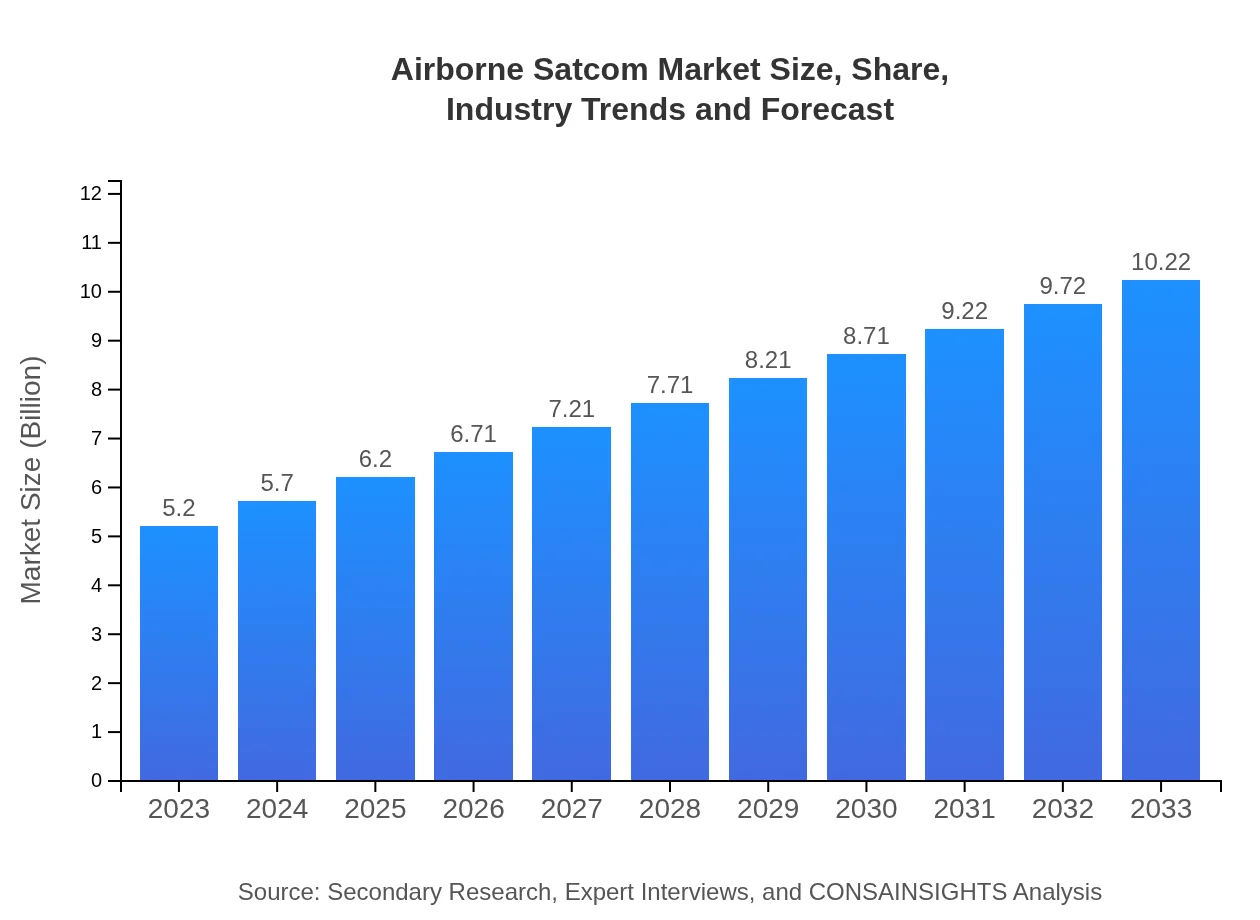

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Northrop Grumman, Honeywell Aerospace, Iridium Communications, L3Harris Technologies |

| Last Modified Date | 31 January 2026 |

Airborne Satcom Market Overview

Customize Airborne Satcom Market Report market research report

- ✔ Get in-depth analysis of Airborne Satcom market size, growth, and forecasts.

- ✔ Understand Airborne Satcom's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airborne Satcom

What is the Market Size & CAGR of Airborne Satcom market in 2023?

Airborne Satcom Industry Analysis

Airborne Satcom Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airborne Satcom Market Analysis Report by Region

Europe Airborne Satcom Market Report:

In Europe, the market is set to grow from $1.60 billion in 2023 to $3.14 billion by 2033. The need for compliance with stricter regulations on communication capabilities and the burgeoning market for business jets are significant contributors to this region's expansion.Asia Pacific Airborne Satcom Market Report:

In the Asia-Pacific region, the Airborne Satcom market is anticipated to grow from $1.02 billion in 2023 to $2.00 billion by 2033. The rising number of air passengers and investments in aviation infrastructure contribute to this growth. Additionally, countries like China and India are expanding their military capabilities, further boosting the demand for airborne communication systems.North America Airborne Satcom Market Report:

North America remains the largest market for Airborne Satcom, projected to grow from $1.79 billion in 2023 to $3.52 billion by 2033. Strong demand from both commercial airlines and military applications, coupled with advancements in satellite technologies, bolsters this region's growth momentum.South America Airborne Satcom Market Report:

The South American Airborne Satcom market is expected to increase from $0.15 billion in 2023 to $0.30 billion by 2033. Factors driving this market include an increase in air travel demand and investment in aviation technology. However, economic challenges may pose risks to sustained growth.Middle East & Africa Airborne Satcom Market Report:

The Middle East and Africa region is expected to see growth from $0.64 billion in 2023 to $1.26 billion by 2033. Increased military spending and a growing market for private aviation are key factors driving the demand for airborne satcom solutions.Tell us your focus area and get a customized research report.

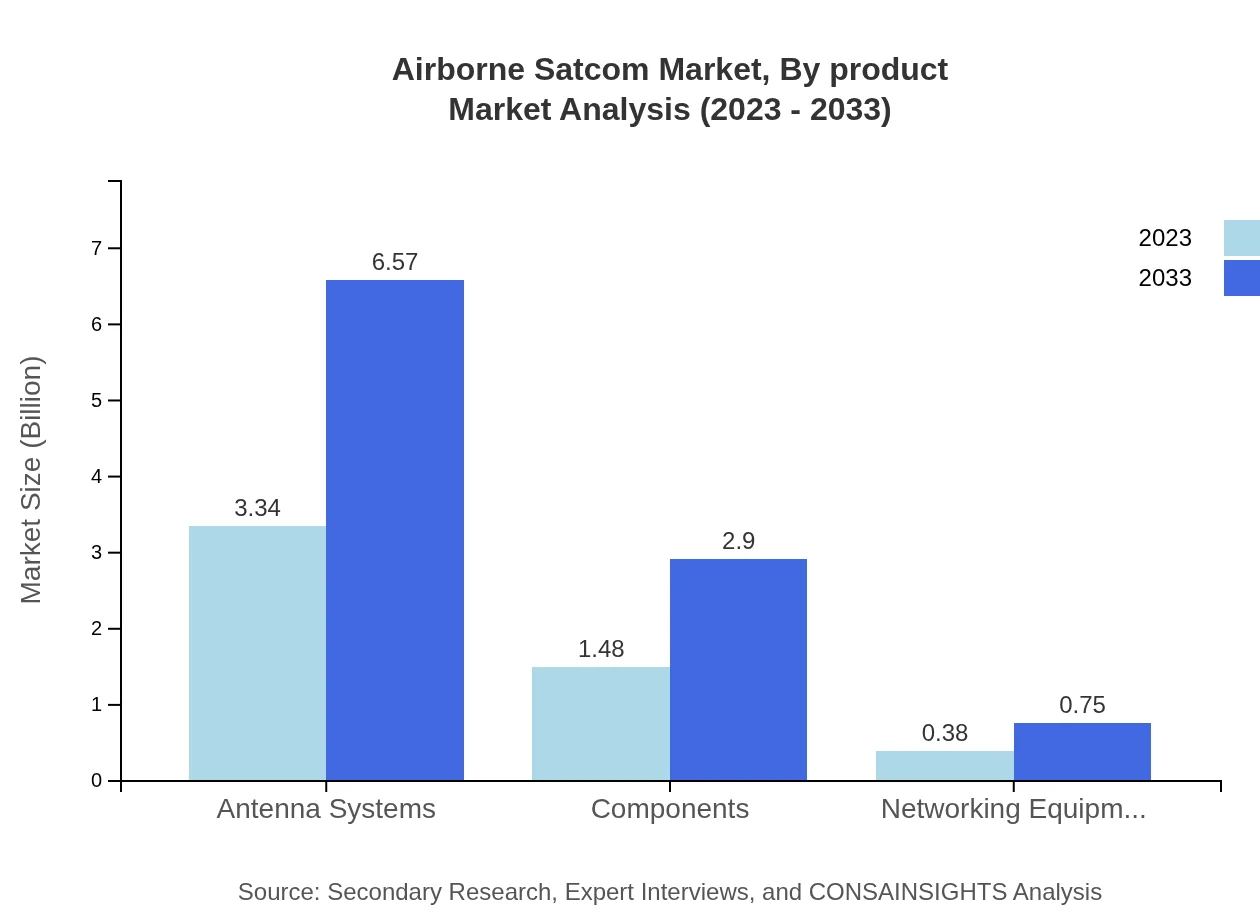

Airborne Satcom Market Analysis By Product

The product segmentation includes Antenna Systems, Components, and Networking Equipment. Antenna Systems dominate the market with a size of $3.34 billion in 2023, projected to reach $6.57 billion by 2033, capturing 64.28% of the market share throughout the forecast period. Components and Networking Equipment sizes are $1.48 billion and $0.38 billion in 2023 respectively, also anticipated to see substantial growth.

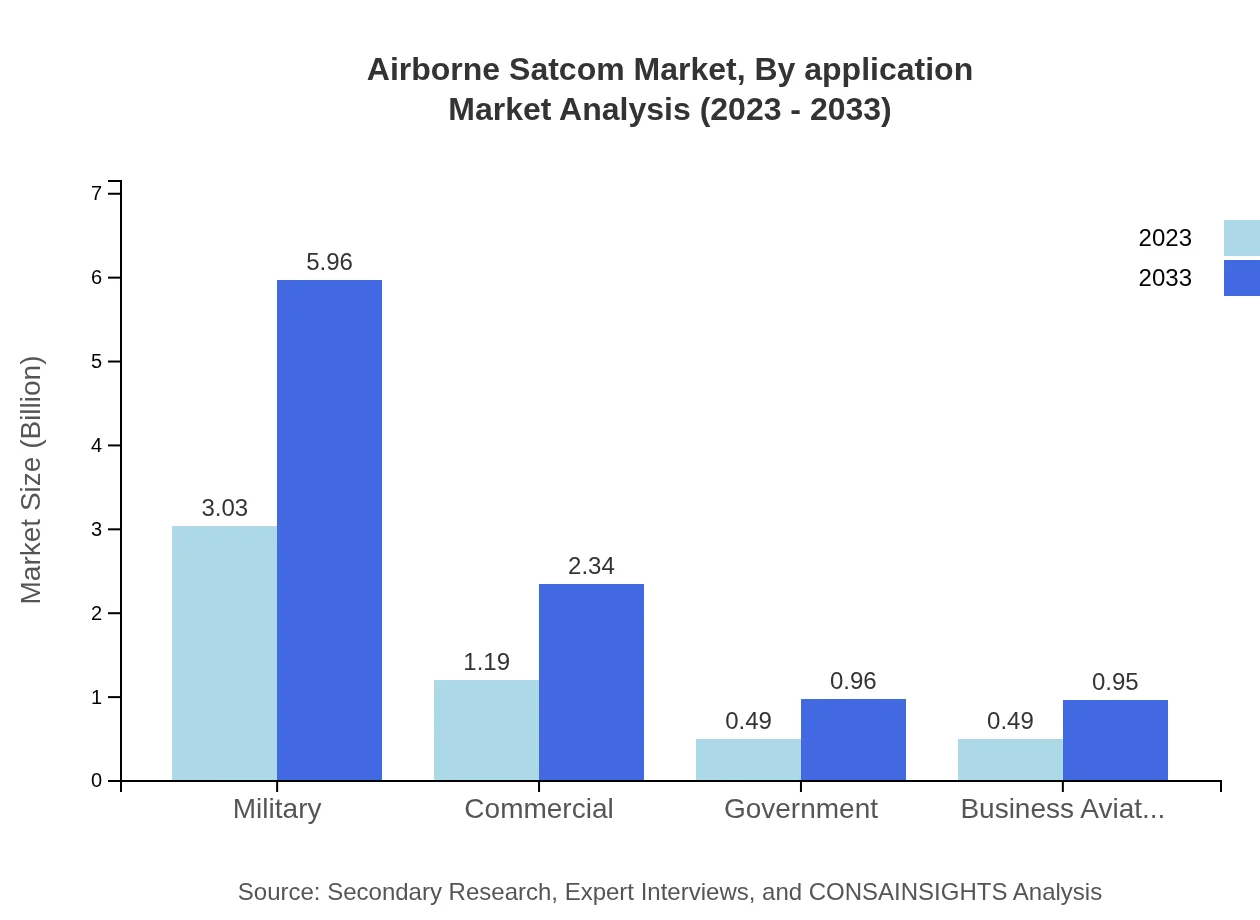

Airborne Satcom Market Analysis By Application

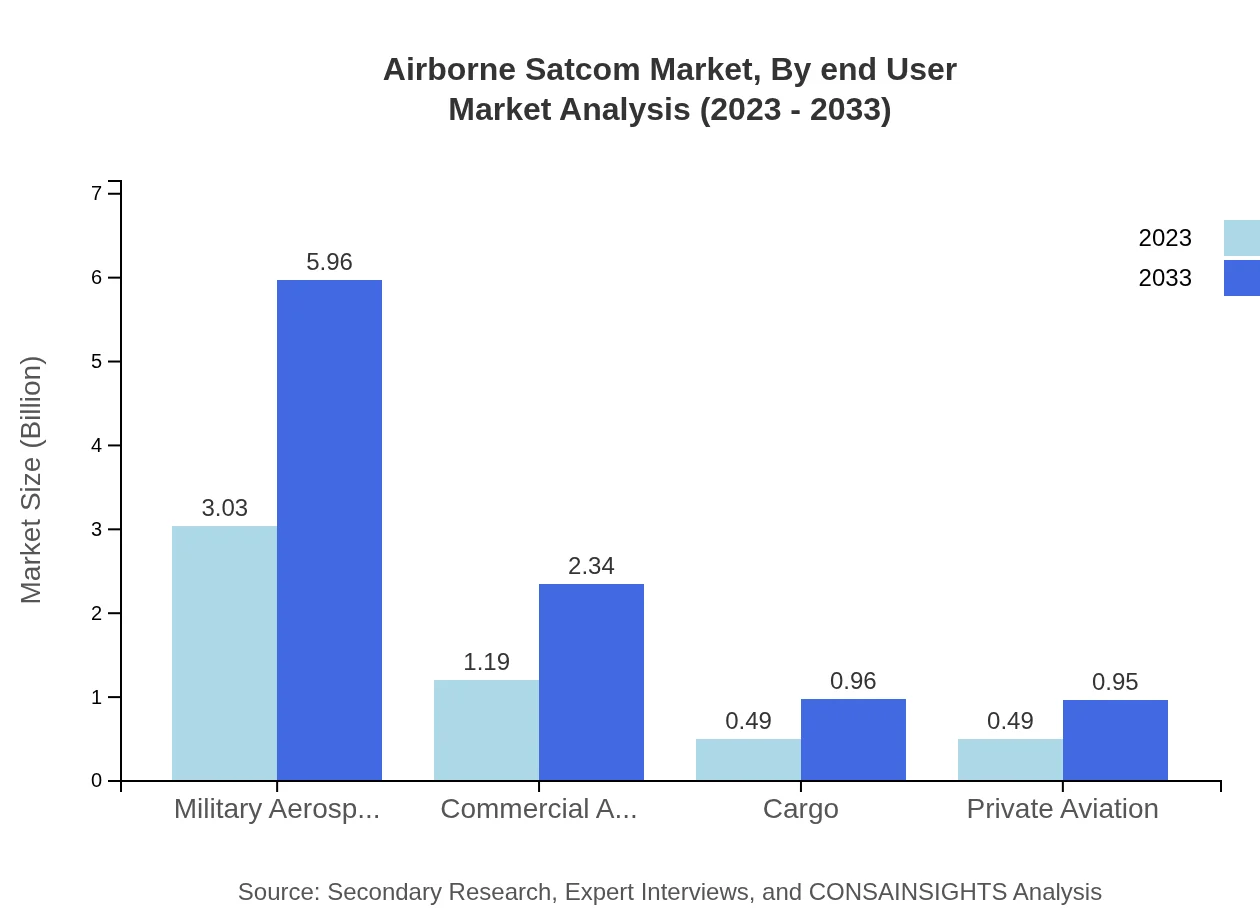

The application segmentation distinguishes between Military Aerospace and Commercial Aerospace. Military Aerospace holds a significant market size of $3.03 billion in 2023, projected to grow to $5.96 billion by 2033, maintaining a share of 58.31%. Commercial Aerospace, valued at $1.19 billion in 2023, is expected to grow to $2.34 billion by 2033, accounting for a share of 22.93%.

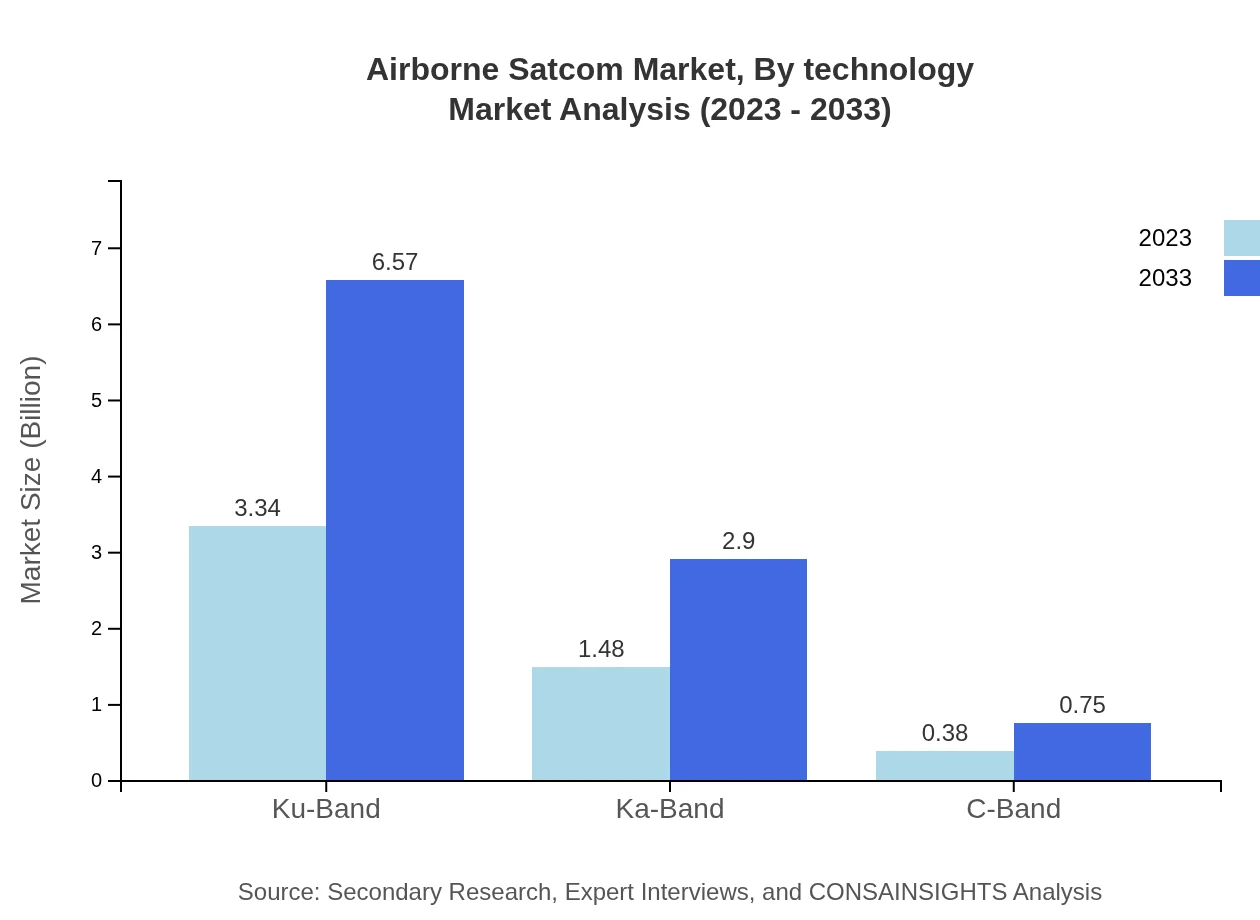

Airborne Satcom Market Analysis By Technology

The technology segment is categorized primarily into Ku-Band, Ka-Band, and C-Band. Ku-Band leads this segment with a size of $3.34 billion in 2023 and maintains a share of 64.28% by 2033. Ka-Band, valued at $1.48 billion in 2023, is projected to grow steadily, capturing 28.4% market share, while C-Band is smaller, contributing to the remaining market dynamics.

Airborne Satcom Market Analysis By End User

End-user segmentation includes Military, Commercial, Government, and Business Aviation. Military is a dominant sector with a size of $3.03 billion in 2023, holding a share of 58.31%. Commercial end-users see a size of $1.19 billion in 2023 with projected growth, while Government and Business Aviation segments reflect substantial opportunities, contributing to market diversity.

Airborne Satcom Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airborne Satcom Industry

Northrop Grumman:

A leading defense contractor that provides airborne communication systems for military applications, focusing on satellite technology and advanced communication solutions.Honeywell Aerospace:

A major player in the aviation industry, Honeywell delivers integrated communication solutions for both commercial and military aircraft, enhancing connectivity and operational efficiency.Iridium Communications:

Specializes in satellite communications for airborne applications, providing secure and reliable communication services globally, serving both military and civilian markets.L3Harris Technologies:

Focused on developing advanced airborne communication systems that enhance satellite connectivity, serving a wide range of military and commercial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of airborne Satcom?

The airborne-satcom market is projected to reach a size of $5.2 billion by 2033, with a compound annual growth rate (CAGR) of 6.8% from 2023. This growth reflects increased demand for satellite communication in aviation across global regions.

What are the key market players or companies in this airborne Satcom industry?

Key players in the airborne-satcom market include major aerospace and technology companies specializing in satellite communications, such as Boeing, Thales Group, Northrop Grumman, and Viasat. These companies are leading innovators in avionics and satcom solutions for aviation.

What are the primary factors driving the growth in the airborne Satcom industry?

Key growth drivers include increasing air travel demand, advancements in satellite technology, and enhanced connectivity solutions. The need for real-time data transmission in commercial and military aviation is expanding, driving investment in airborne satcom solutions.

Which region is the fastest Growing in the airborne Satcom?

The fastest-growing region in the airborne-satcom market is North America, projected to grow from $1.79 billion in 2023 to $3.52 billion by 2033, followed closely by the Asia-Pacific region, which is expected to double its market size during the same period.

Does ConsaInsights provide customized market report data for the airborne Satcom industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to specific client needs in the airborne-satcom industry. This includes in-depth analysis, market segmentation, and insights pertinent to regional and product-specific trends.

What deliverables can I expect from this airborne Satcom market research project?

Clients can expect detailed reports including market size estimates, segment analyses, competitive landscape overview, regional growth insights, and actionable recommendations to assist decision-making in the airborne-satcom industry.

What are the market trends of airborne Satcom?

Current trends in the airborne-satcom market include a shift towards higher frequency bands like Ka-band for better data rates, increased demand for in-flight connectivity, and the rise of unmanned aerial vehicles (UAVs) leveraging advanced satellite communication technology.