Airborne Surveillance Market Report

Published Date: 03 February 2026 | Report Code: airborne-surveillance

Airborne Surveillance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the airborne surveillance market, covering insights on market size, growth trends, regional performance, segmentation, and forecasts through the year 2033.

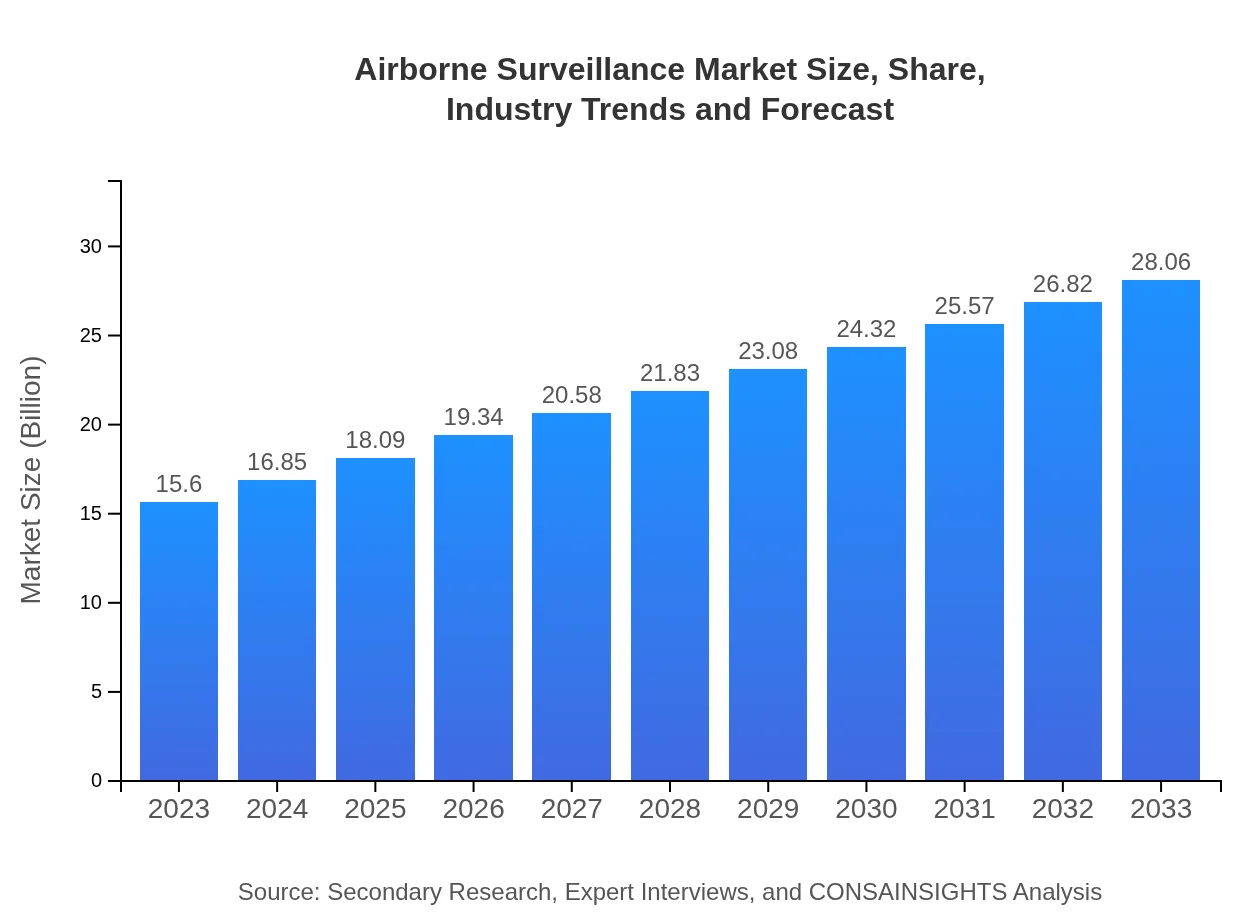

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 5.9% |

| 2033 Market Size | $28.06 Billion |

| Top Companies | BAE Systems, Northrop Grumman, Lockheed Martin, Elbit Systems, General Dynamics |

| Last Modified Date | 03 February 2026 |

Airborne Surveillance Market Overview

Customize Airborne Surveillance Market Report market research report

- ✔ Get in-depth analysis of Airborne Surveillance market size, growth, and forecasts.

- ✔ Understand Airborne Surveillance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airborne Surveillance

What is the Market Size & CAGR of Airborne Surveillance market in 2023?

Airborne Surveillance Industry Analysis

Airborne Surveillance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airborne Surveillance Market Analysis Report by Region

Europe Airborne Surveillance Market Report:

Europe's market is projected to grow from $5.44 billion in 2023 to $9.78 billion by 2033, driven by several nations enhancing their border security and surveillance operations amid geopolitical tensions.Asia Pacific Airborne Surveillance Market Report:

In Asia Pacific, the airborne surveillance market is projected to grow from $2.88 billion in 2023 to $5.19 billion by 2033. Countries like China and India are enhancing their defense capabilities, significantly investing in surveillance technologies.North America Airborne Surveillance Market Report:

North America holds a significant market share valued at $5.22 billion in 2023, anticipated to reach $9.40 billion by 2033. The U.S. government and defense contractors are major contributors, with ongoing investments in advanced surveillance technologies.South America Airborne Surveillance Market Report:

The South American market is expected to increase from $1.15 billion in 2023 to $2.07 billion in 2033. Brazil and Argentina are key players looking to strengthen their surveillance infrastructure amid rising security concerns.Middle East & Africa Airborne Surveillance Market Report:

The Middle East and Africa market is estimated to increase from $0.90 billion in 2023 to $1.62 billion by 2033. Growing militarization and security threats are pushing investments in aerial surveillance technologies in countries like Saudi Arabia and UAE.Tell us your focus area and get a customized research report.

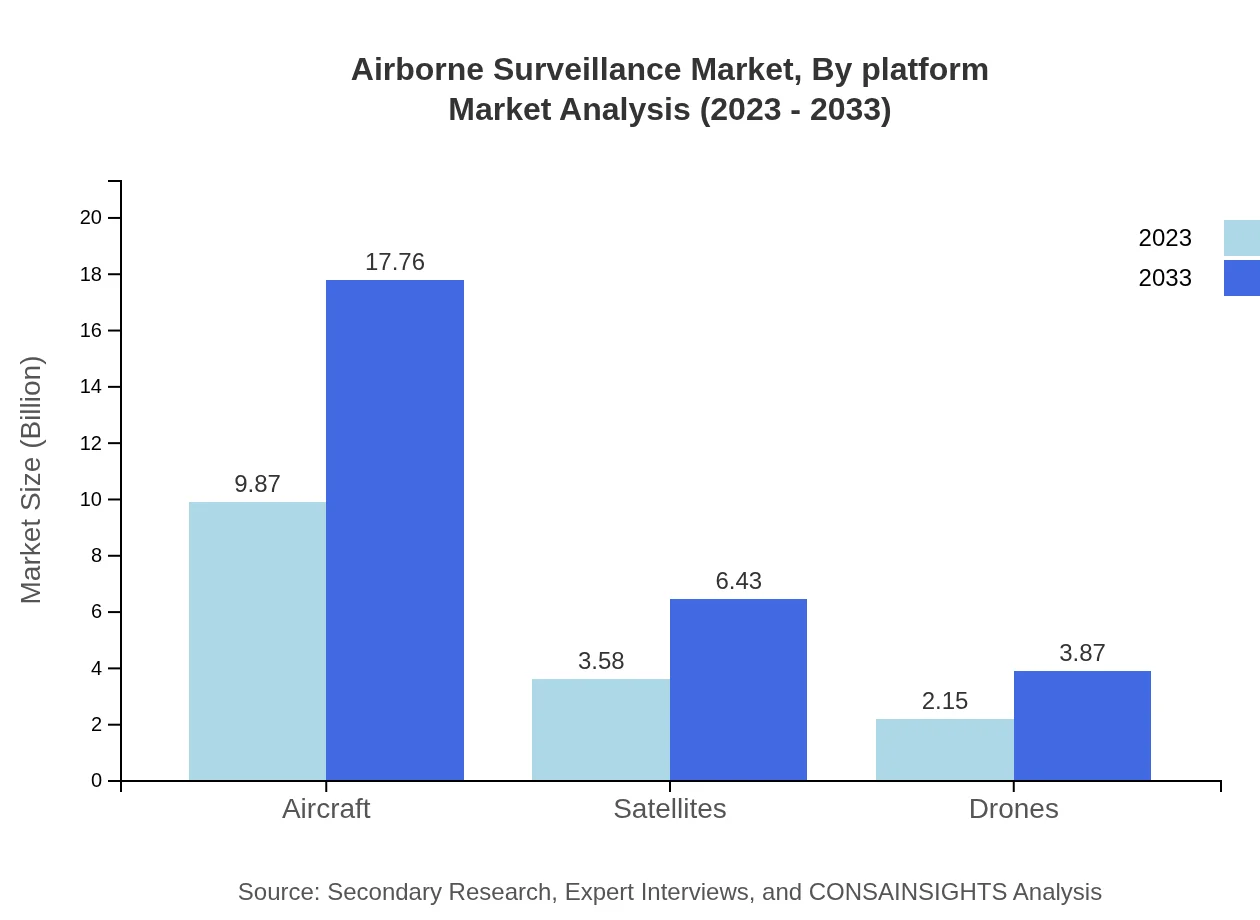

Airborne Surveillance Market Analysis By Platform

The major platforms in the airborne surveillance market include aircraft, satellites, and drones. In 2023, aircraft systems dominate the market, valued at approximately $9.87 billion, with a forecasted increase to $17.76 billion by 2033. Satellites represent a significant share as well, with a market size climbing from $3.58 billion to $6.43 billion in the same period. Drones, while smaller in size at $2.15 billion in 2023, are projected to grow to $3.87 billion due to their expanding role in commercial applications.

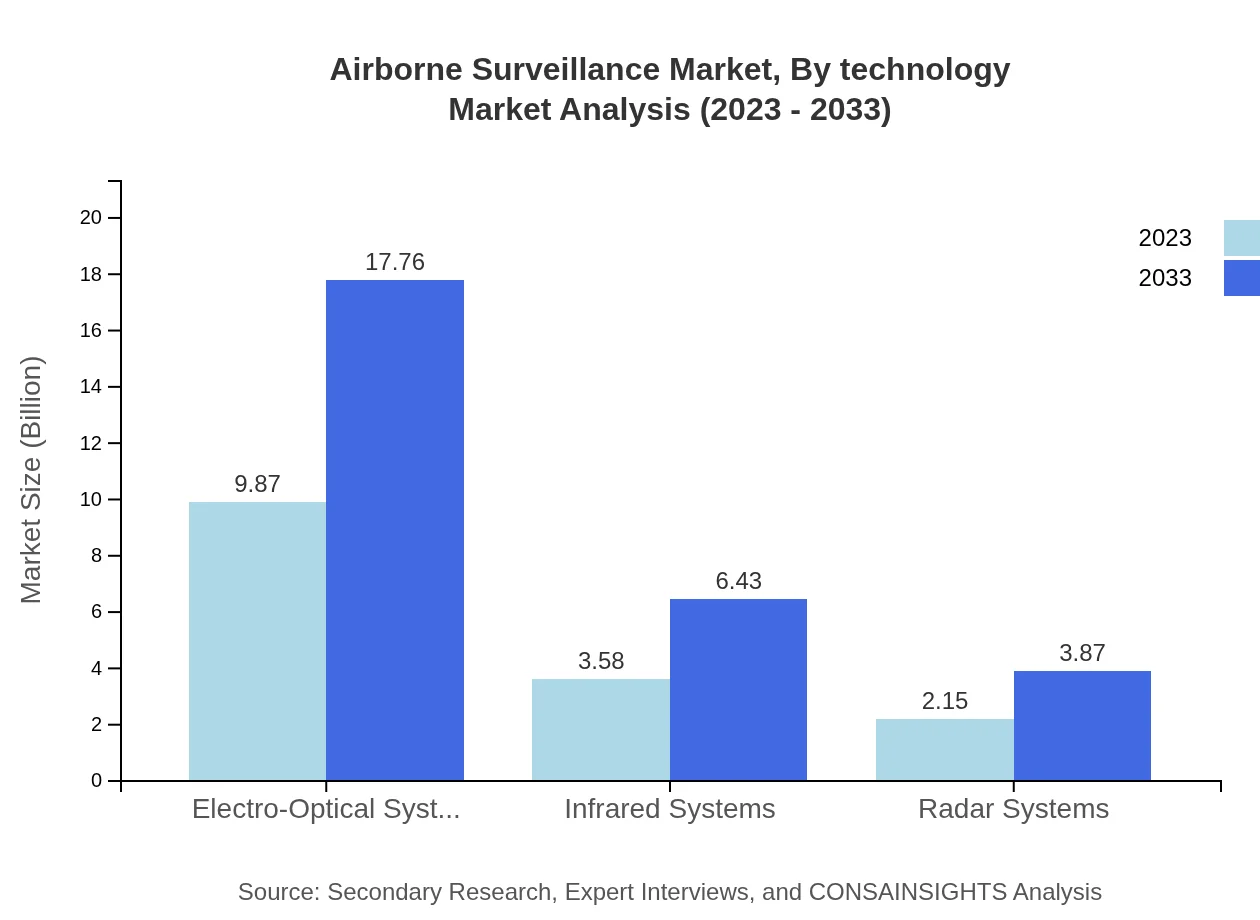

Airborne Surveillance Market Analysis By Technology

Technologies in the airborne surveillance market include electro-optical systems, infrared systems, and radar systems. Electro-optical systems lead the market with a size of $9.87 billion in 2023 and an expected rise to $17.76 billion by 2033, driven by their effectiveness in various conditions. Infrared systems come next, growing from $3.58 billion to $6.43 billion, while radar systems are projected to increase from $2.15 billion to $3.87 billion, reflecting their critical role in military applications.

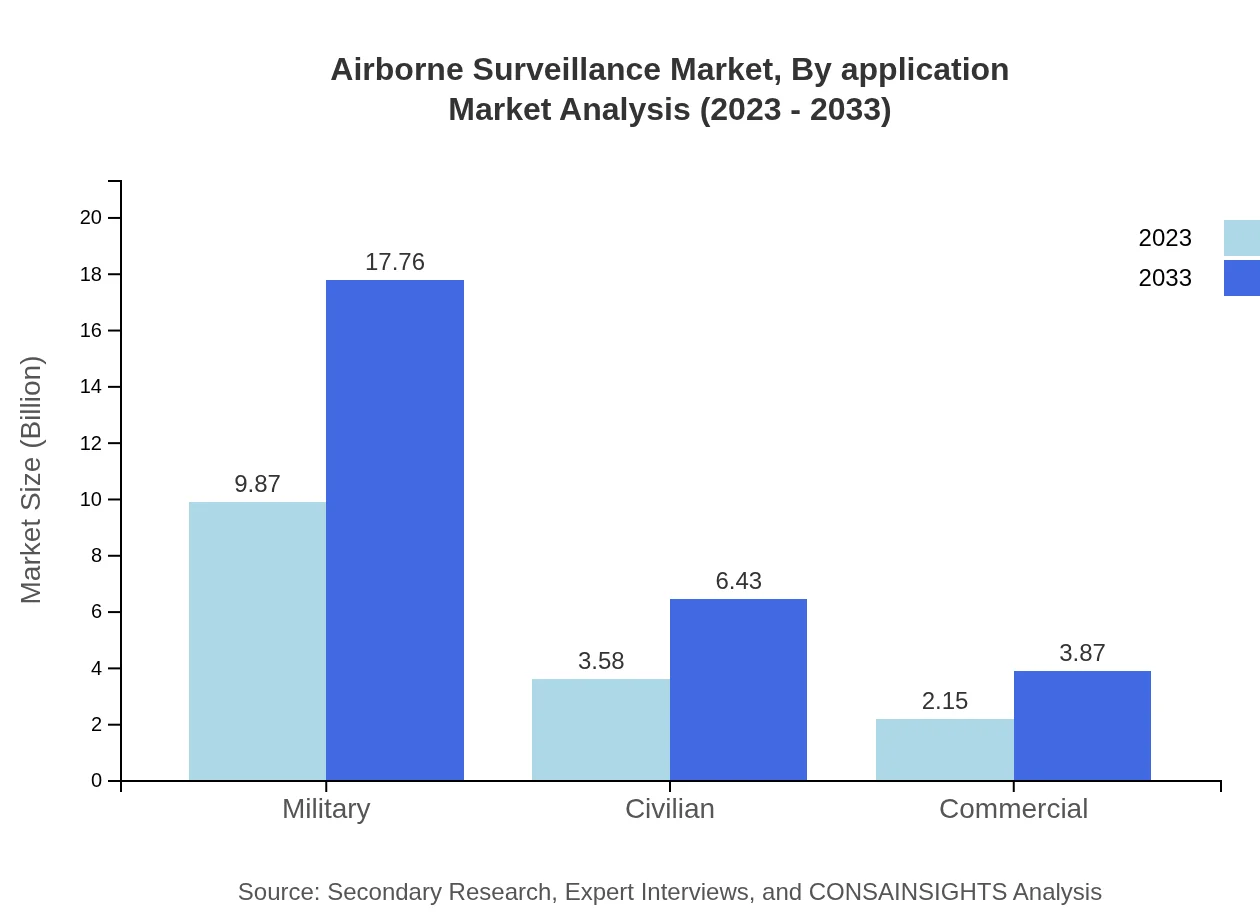

Airborne Surveillance Market Analysis By Application

The applications of airborne surveillance span military and civilian arenas. Military applications dominate, projected to grow from $9.87 billion in 2023 to $17.76 billion by 2033. Civilian applications, while smaller, are also growing expeditiously, expected to reach $6.43 billion from $3.58 billion over the forecast period. Research organizations are particularly driving advancements in aerial surveillance technologies for environmental monitoring.

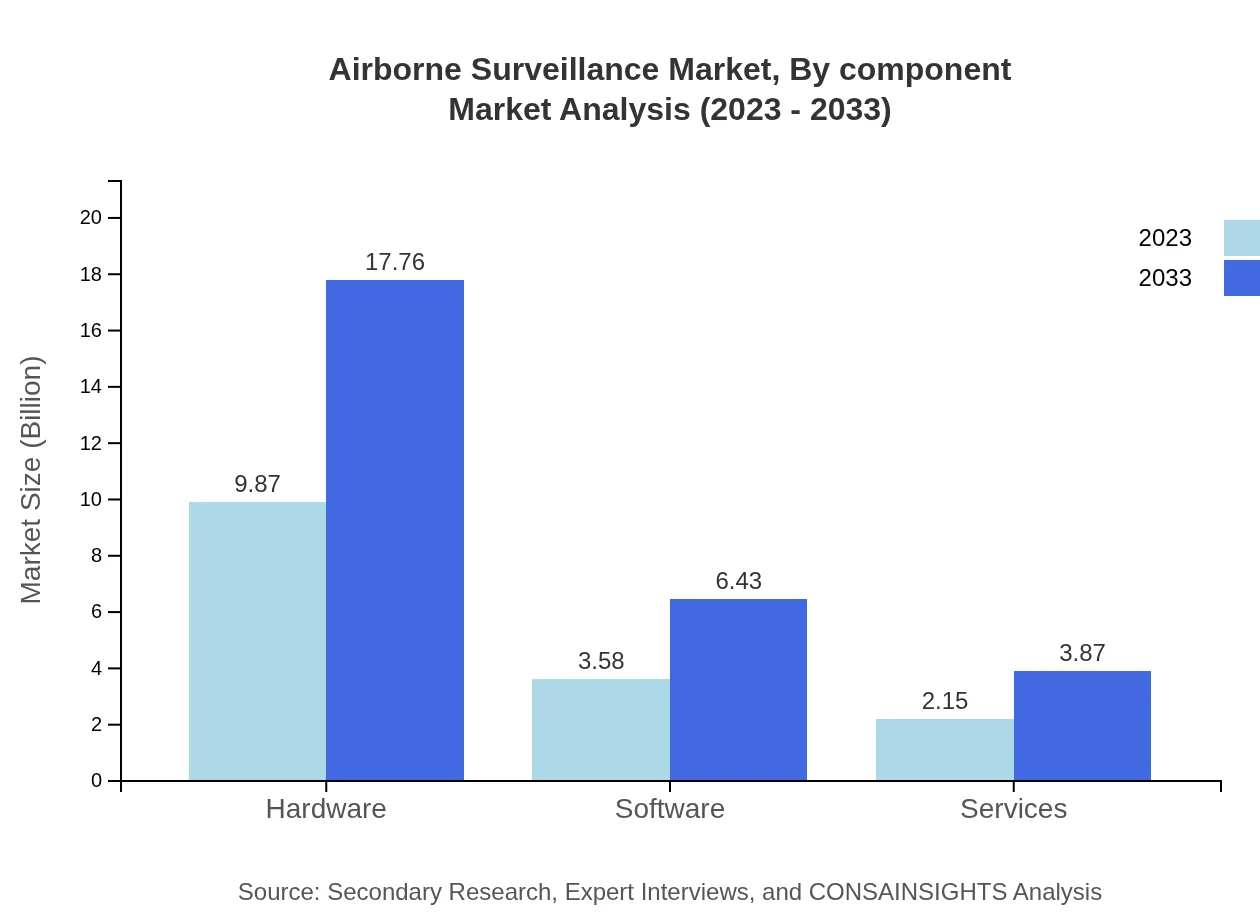

Airborne Surveillance Market Analysis By Component

Components of airborne surveillance systems include hardware, software, and services. The hardware segment, particularly the core systems, leads the market with growth from $9.87 billion in 2023 to $17.76 billion by 2033. Software solutions, critical for data processing, are expected to grow from $3.58 billion to $6.43 billion. Services, which include installation and maintenance, will also see growth from $2.15 billion to $3.87 billion.

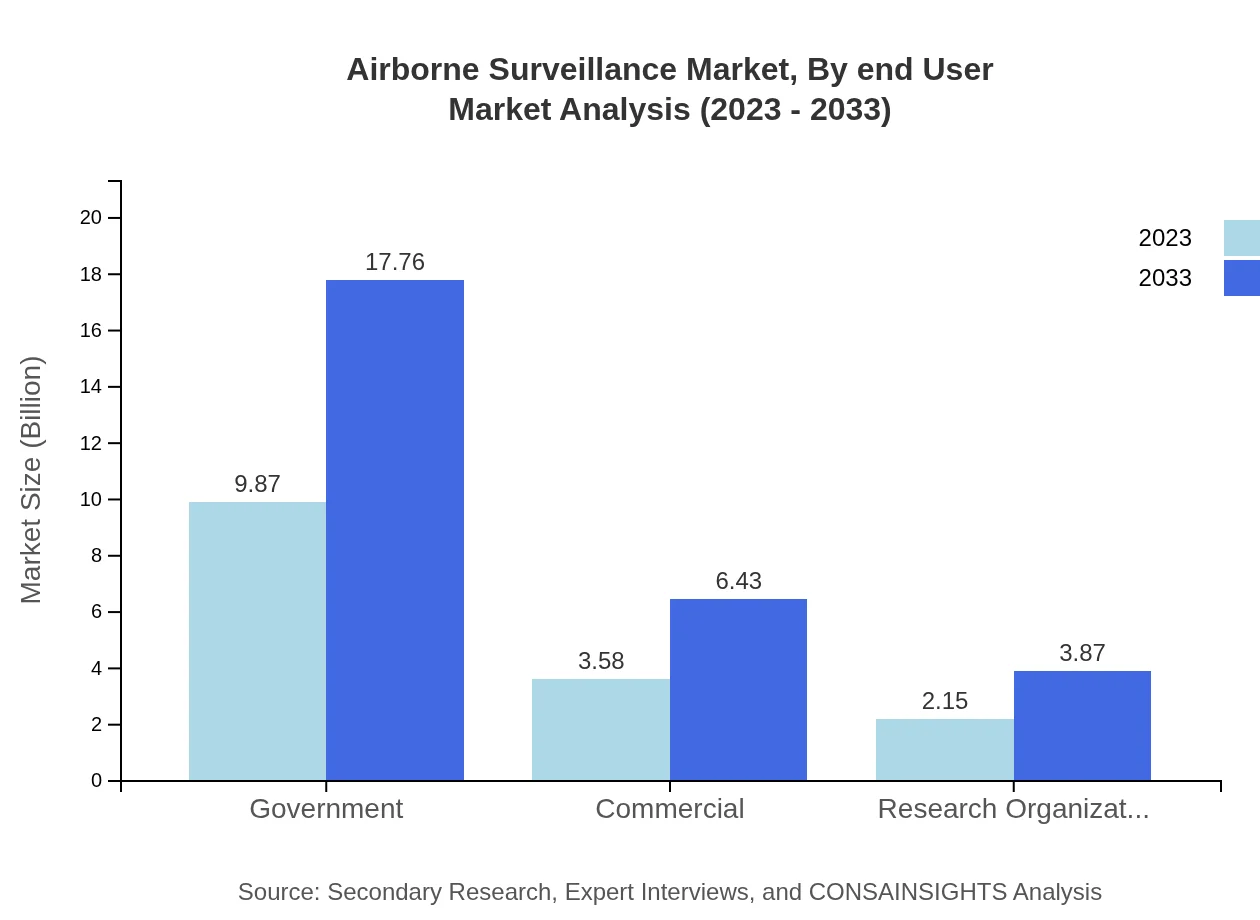

Airborne Surveillance Market Analysis By End User

End-users of airborne surveillance systems primarily include government, military, commercial, and research organizations. The government segment currently holds a share of approximately 63.29%, commanding a market size of $9.87 billion in 2023, projected to grow to $17.76 billion. The commercial segment, while smaller, is anticipated to grow steadily, increasing from $2.15 billion to $3.87 billion, as more businesses adopt aerial surveillance technologies.

Airborne Surveillance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airborne Surveillance Industry

BAE Systems:

A leading defense contractor supplies advanced airborne surveillance systems globally, focusing on electronics and software solutions.Northrop Grumman:

Known for developing award-winning aerospace technology, particularly in military drones and sensor systems for surveillance.Lockheed Martin:

Innovates in aerospace technology with a wide range of airborne surveillance products catered towards defense applications.Elbit Systems:

A global defense electronics company providing advanced airborne surveillance solutions, particularly in UAV systems.General Dynamics:

Offers cutting-edge surveillance and communication solutions enhancing situational awareness in military operations.We're grateful to work with incredible clients.

FAQs

What is the market size of airborne Surveillance?

The global airborne surveillance market is valued at approximately $15.6 billion in 2023, with an expected compound annual growth rate (CAGR) of 5.9%. By 2033, it is projected to grow significantly, reflecting increasing demand.

What are the key market players or companies in this airborne Surveillance industry?

Key players in the airborne surveillance industry include major defense contractors and technology firms that specialize in aircraft, drones, and surveillance equipment. These companies lead in technological innovations and often form partnerships with government agencies.

What are the primary factors driving the growth in the airborne Surveillance industry?

Growth in the airborne surveillance industry is driven by rising security needs, advancements in UAV technologies, and investments in military modernization. Increasing demand for border security and surveillance in urban areas further propels market expansion.

Which region is the fastest Growing in the airborne Surveillance market?

The North America region is currently the fastest-growing in the airborne surveillance market, with a projected growth from $5.22 billion in 2023 to $9.40 billion in 2033, indicating strong demands for security and defense capabilities.

Does ConsaInsights provide customized market report data for the airborne Surveillance industry?

Yes, ConsaInsights offers customized market report data within the airborne surveillance industry, allowing clients to tailor research insights according to specific geographical areas, market segments, and technology advancements.

What deliverables can I expect from this airborne Surveillance market research project?

Expect comprehensive deliverables from the airborne surveillance project, including market analysis reports, segmentation data, competitor assessments, and trend forecasts, providing strategic insights for informed decision-making.

What are the market trends of airborne Surveillance?

Current market trends in airborne surveillance include a shift towards drone usage, advancing technologies in satellite imagery, and increasing integration of AI for real-time data processing, driving efficiency and operational effectiveness.