Airborne Telemetry Market Report

Published Date: 03 February 2026 | Report Code: airborne-telemetry

Airborne Telemetry Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Airborne Telemetry market from 2023 to 2033, offering insights into market size, growth trends, segmentation, regional analysis, and key industry players, highlighting future forecasts and emerging technologies.

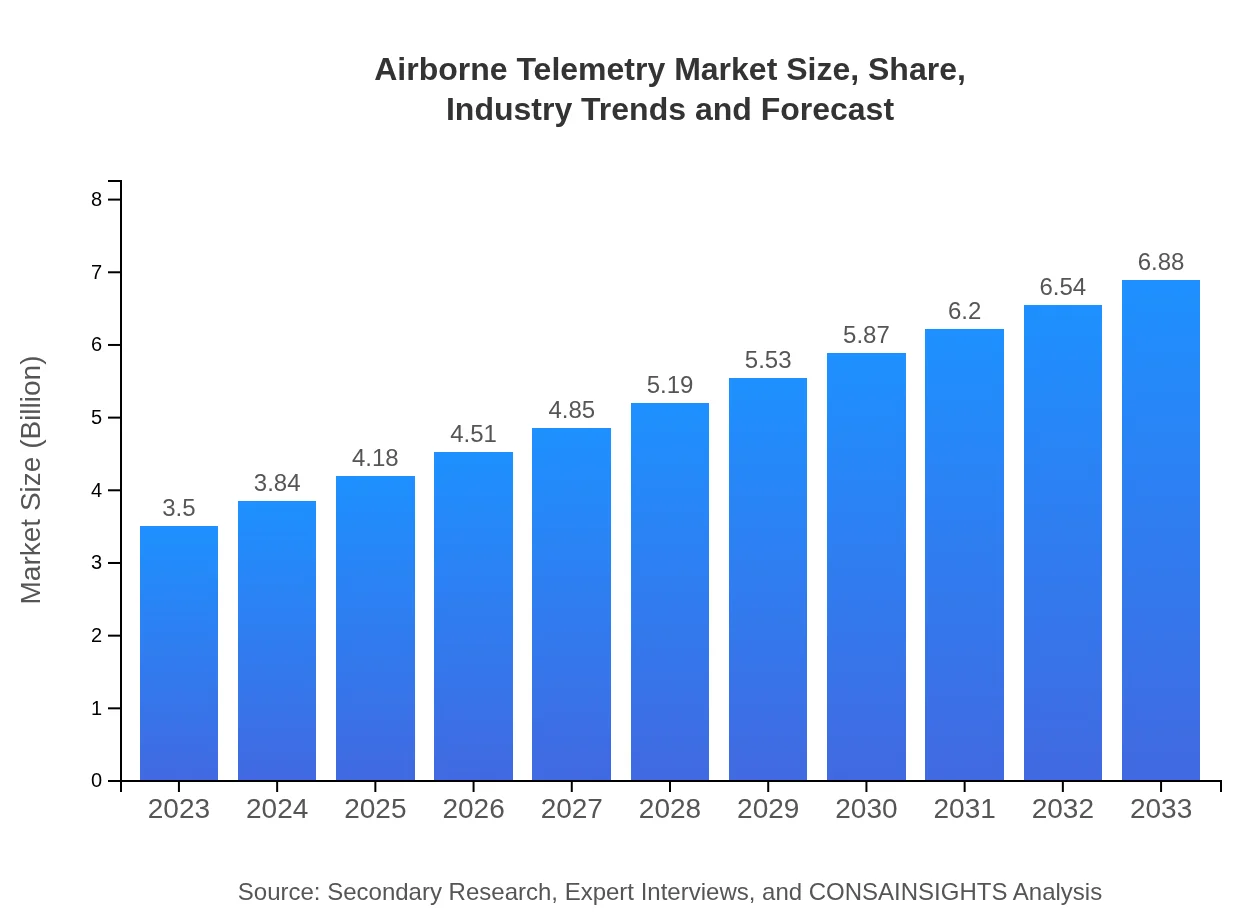

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Honeywell International Inc., Raytheon Technologies Corporation, Northrop Grumman Corporation, Boeing , Textron Inc. |

| Last Modified Date | 03 February 2026 |

Airborne Telemetry Market Overview

Customize Airborne Telemetry Market Report market research report

- ✔ Get in-depth analysis of Airborne Telemetry market size, growth, and forecasts.

- ✔ Understand Airborne Telemetry's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airborne Telemetry

What is the Market Size & CAGR of Airborne Telemetry market in 2023 and 2033?

Airborne Telemetry Industry Analysis

Airborne Telemetry Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airborne Telemetry Market Analysis Report by Region

Europe Airborne Telemetry Market Report:

Europe's Airborne Telemetry market is projected to grow from $1.13 billion in 2023 to $2.22 billion by 2033, bolstered by stringent regulations in aviation and a focus on enhancing defense mechanisms.Asia Pacific Airborne Telemetry Market Report:

In 2023, Asia Pacific's Airborne Telemetry market is valued at $0.63 billion, projected to double to $1.24 billion by 2033, driven by rising demand for UAV technology and investments in defense capabilities.North America Airborne Telemetry Market Report:

North America holds a significant share, valued at $1.29 billion in 2023, anticipated to reach $2.53 billion by 2033. The growth is fuelled by advanced military programs and expanding commercial applications of airborne telemetry.South America Airborne Telemetry Market Report:

The South American market is currently valued at $0.21 billion in 2023 and is anticipated to reach $0.42 billion by 2033, with growth influenced by increased agricultural activity utilizing UAVs for monitoring.Middle East & Africa Airborne Telemetry Market Report:

In the Middle East and Africa, the market is set to increase from $0.24 billion in 2023 to $0.47 billion by 2033, as countries invest in modernizing their air defense systems and improve aerial monitoring capabilities.Tell us your focus area and get a customized research report.

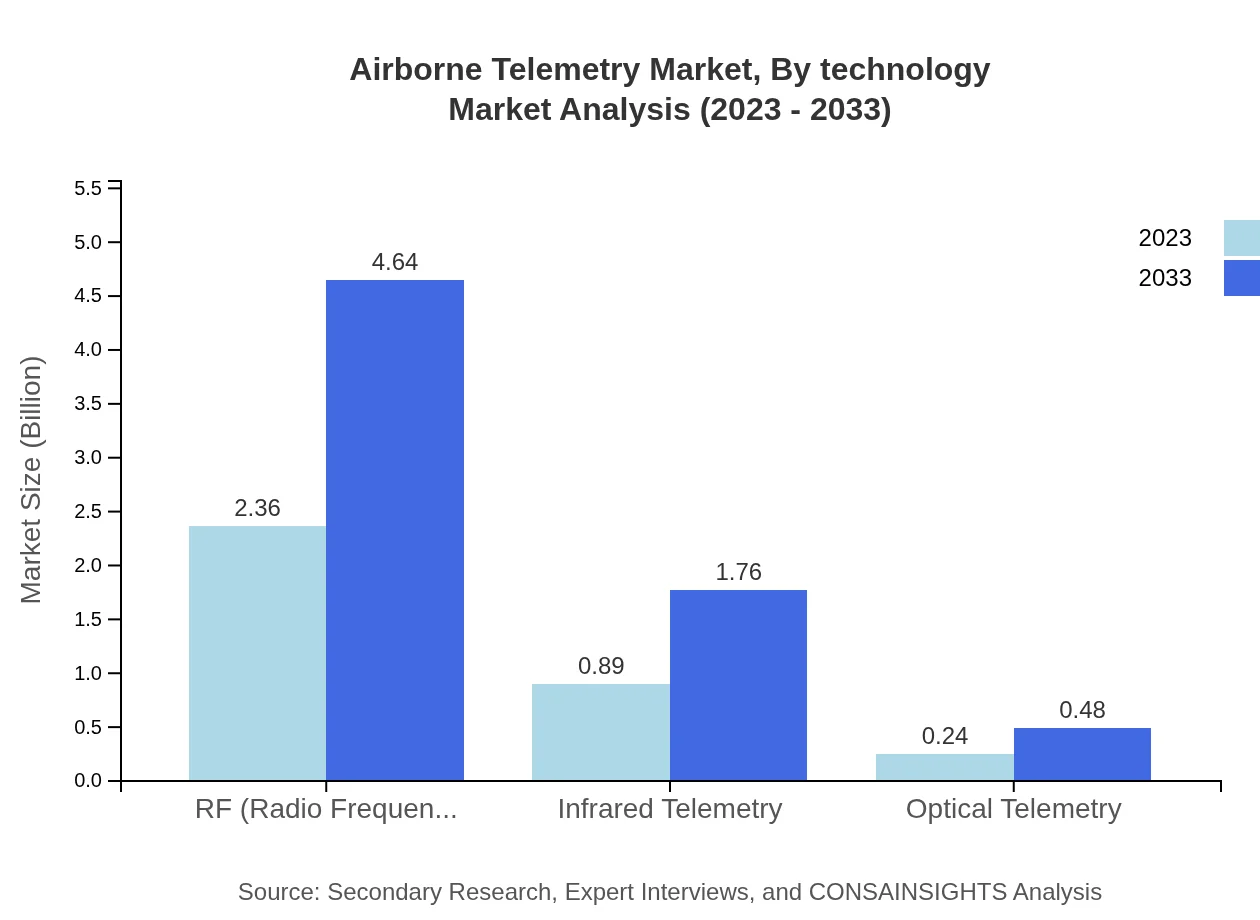

Airborne Telemetry Market Analysis By Technology

The Airborne Telemetry market by technology includes RF, Infrared, and Optical telemetry systems. RF Telemetry dominates with a share of 67.48% in 2023, growing to 67.48% by 2033, indicating consistent demand for effective data transmission. Infrared Telemetry, holding 25.57%, is pivotal in applications requiring stealth, while Optical Telemetry is gaining traction for its high precision and reliability.

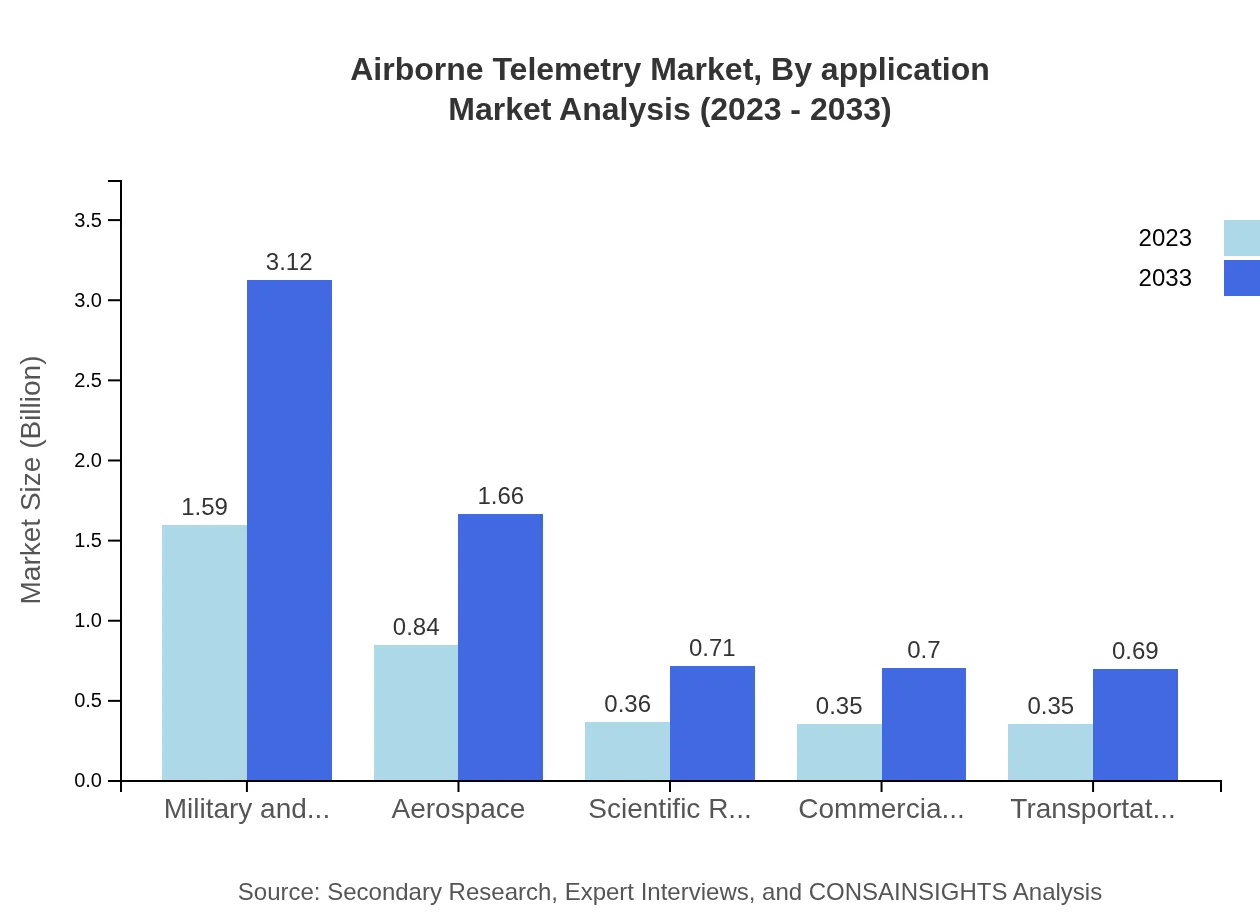

Airborne Telemetry Market Analysis By Application

The application segments primarily consist of military and defense, aerospace, and scientific research. The military dominates the market with a 45.42% share, followed by aerospace at 24.14% and scientific research at 10.3%. The increasing need for surveillance and monitoring in defense significantly contributes to this usage.

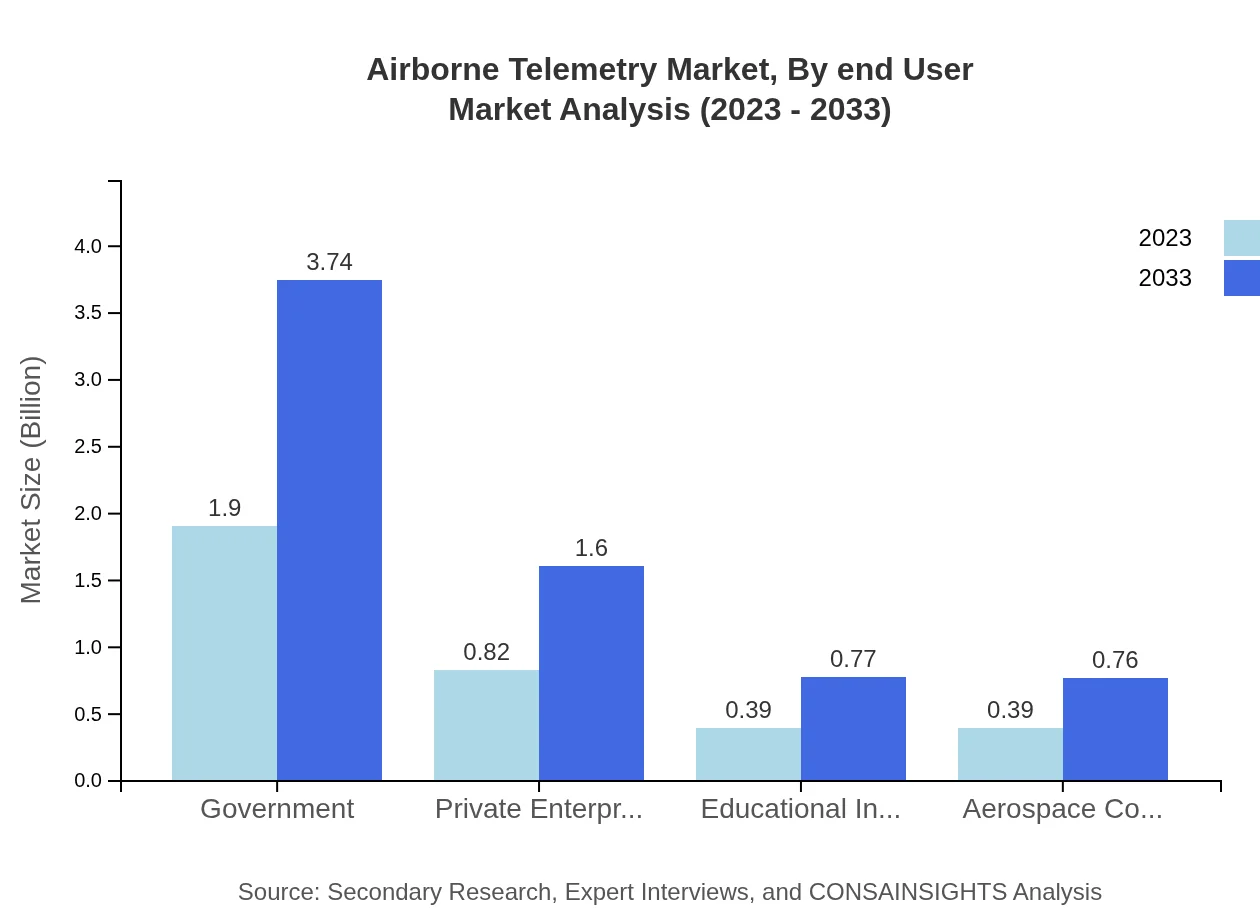

Airborne Telemetry Market Analysis By End User

Key end-users include government entities, private enterprises, and educational institutions. Government entities are projected to maintain a significant market share of 54.35% by 2033, reflecting demand for telemetry within public sector operations. Private enterprises follow closely with a focus on commercial applications and technological advancements in non-military sectors.

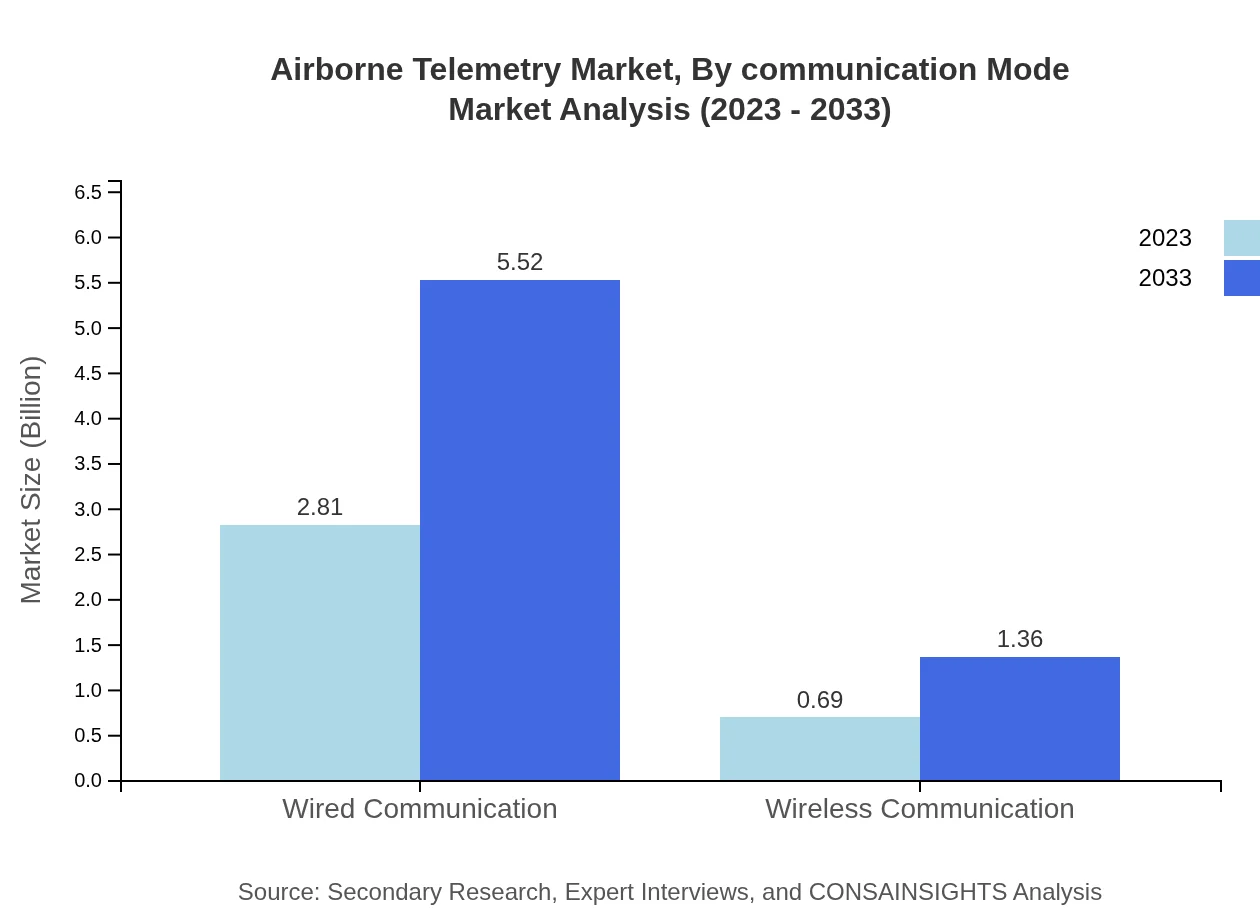

Airborne Telemetry Market Analysis By Communication Mode

In terms of communication modes, wired communication dominates the market with an 80.26% share due to its reliability and speed in data transfer. Wireless communication, although lower at 19.74%, is seeing growth driven by advancements in wireless technologies and the need for flexible communication modes.

Airborne Telemetry Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airborne Telemetry Industry

Honeywell International Inc.:

A key player in airborne telemetry solutions, specializing in navigation and communications systems for military and commercial applications.Raytheon Technologies Corporation:

Known for advanced defense technologies, Raytheon develops cutting-edge airborne telemetry systems critical for military operations.Northrop Grumman Corporation:

Offers powerful telemetry solutions focusing on aerospace and defense, enhancing data collection and analytics.Boeing :

Engages in the development of telemetry systems within aerospace, leveraging their extensive experience in aviation technology.Textron Inc.:

Focuses on defense and security solutions, providing robust telemetry systems for unmanned aerial systems.We're grateful to work with incredible clients.

FAQs

What is the market size of airborne Telemetry?

The global airborne telemetry market is valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching notable expansion by 2033.

What are the key market players or companies in this airborne Telemetry industry?

Key market players in the airborne telemetry industry include leading aerospace manufacturers, data communication firms, and innovative technology companies known for developing advanced telemetry systems.

What are the primary factors driving the growth in the airborne telemetry industry?

Growth in the airborne telemetry market is driven by increasing investments in defense technologies, advancements in wireless communication, rising demand for data accuracy in aerospace and scientific ventures, and a surge in smart technology adoption.

Which region is the fastest Growing in the airborne telemetry?

The fastest-growing region in the airborne telemetry market is North America, with a market size of $1.29 billion in 2023, projected to nearly double to $2.53 billion by 2033.

Does ConsaInsights provide customized market report data for the airborne Telemetry industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and requirements, ensuring insights that are aligned with individual business objectives in the airborne telemetry industry.

What deliverables can I expect from this airborne Telemetry market research project?

Expect comprehensive deliverables, including market analysis reports, trend assessments, competitive landscape evaluations, and detailed segmentation data for the airborne telemetry industry.

What are the market trends of airborne Telemetry?

Current trends in the airborne telemetry market include increased integration of AI technologies, a shift towards real-time data analytics, growing emphasis on regulatory compliance, and innovation in telemetry systems for various applications.