Aircraft Actuators Market Report

Published Date: 22 January 2026 | Report Code: aircraft-actuators

Aircraft Actuators Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Actuators market from 2023 to 2033, highlighting market size, growth trends, regional insights, and key players. It offers valuable insights for stakeholders to understand current and future market dynamics.

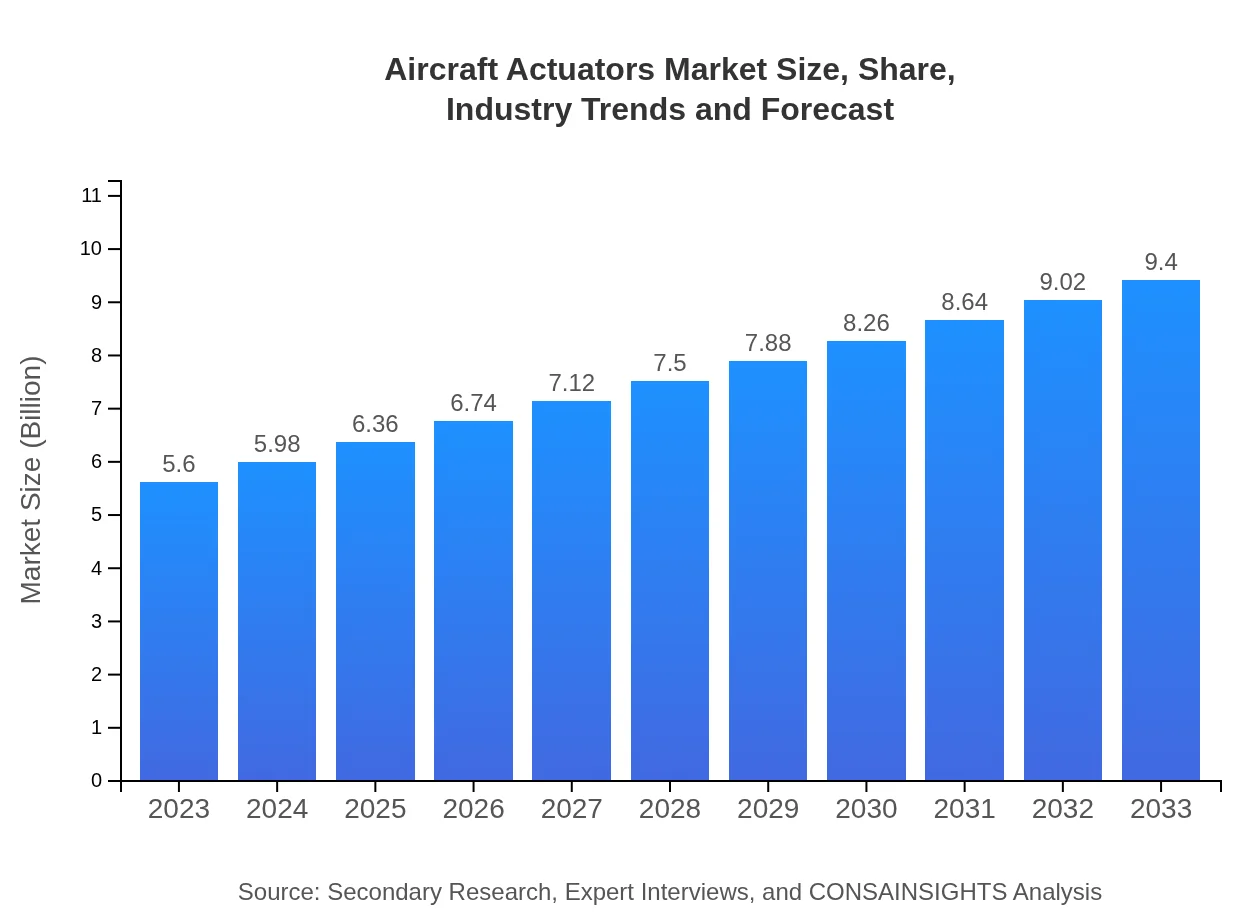

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $9.40 Billion |

| Top Companies | Honeywell Aerospace, Moog Inc., Boeing , Parker Hannifin |

| Last Modified Date | 22 January 2026 |

Aircraft Actuators Market Overview

Customize Aircraft Actuators Market Report market research report

- ✔ Get in-depth analysis of Aircraft Actuators market size, growth, and forecasts.

- ✔ Understand Aircraft Actuators's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Actuators

What is the Market Size & CAGR of Aircraft Actuators market in 2023?

Aircraft Actuators Industry Analysis

Aircraft Actuators Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Actuators Market Analysis Report by Region

Europe Aircraft Actuators Market Report:

The European market for aircraft actuators is anticipated to grow from USD 1.55 billion in 2023 to USD 2.60 billion by 2033. The emphasis on sustainable aviation and technological advancements in new aircraft models is leading to an increased demand for innovative actuator technologies.Asia Pacific Aircraft Actuators Market Report:

The Asia Pacific region is poised for significant growth, with a market size projected to reach USD 1.90 billion by 2033 from USD 1.13 billion in 2023. This growth is fueled by increasing investments in aircraft manufacturing and expanding airline capacities across countries such as China and India, focusing on modern, fuel-efficient aircraft.North America Aircraft Actuators Market Report:

North America dominates the aircraft actuators market, with a projected increase from USD 1.96 billion in 2023 to USD 3.28 billion by 2033. The strong presence of established aerospace companies and a well-developed aviation infrastructure are primary factors driving this growth.South America Aircraft Actuators Market Report:

The South American aircraft actuators market is expected to grow from USD 0.44 billion in 2023 to USD 0.74 billion by 2033. Key drivers include infrastructure upgrades and the rising demand for commercial aviation in burgeoning economies like Brazil and Argentina, facilitating growth in the aviation sector.Middle East & Africa Aircraft Actuators Market Report:

The Middle East and Africa region's market is set to rise from USD 0.52 billion in 2023 to USD 0.88 billion by 2033, driven primarily by the expansion of aviation markets in the Gulf Cooperation Council (GCC) states, as they invest heavily in enhancing their aviation capabilities.Tell us your focus area and get a customized research report.

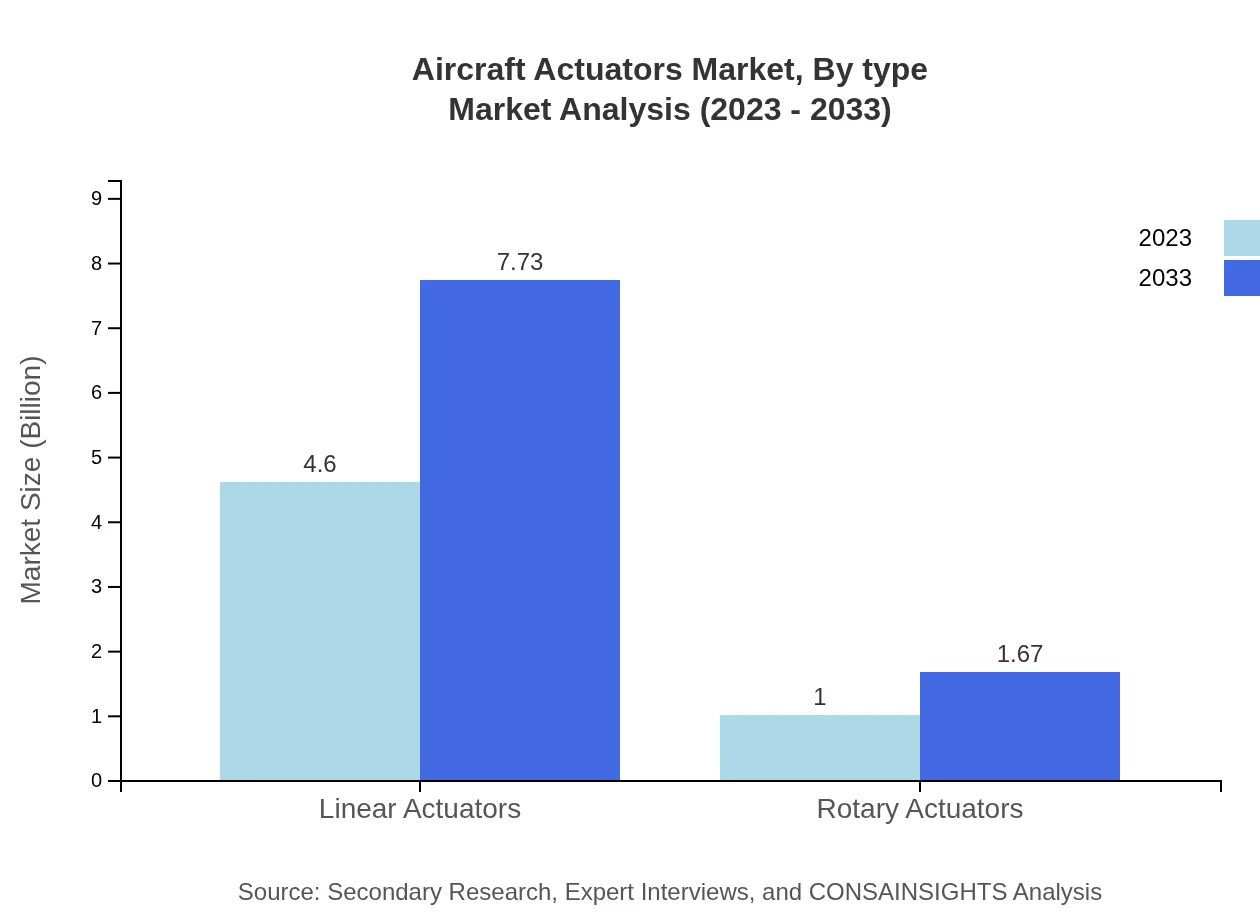

Aircraft Actuators Market Analysis By Type

Linear actuators constitute a significant portion of the market, expected to reach USD 7.73 billion in 2033 from USD 4.60 billion in 2023. Rotary actuators are also notable, anticipated to grow from USD 1.00 billion to USD 1.67 billion in the same period. Hydraulic actuators dominate the market share at 61.96% in 2023 and will remain significant as they are pivotal in high-load applications.

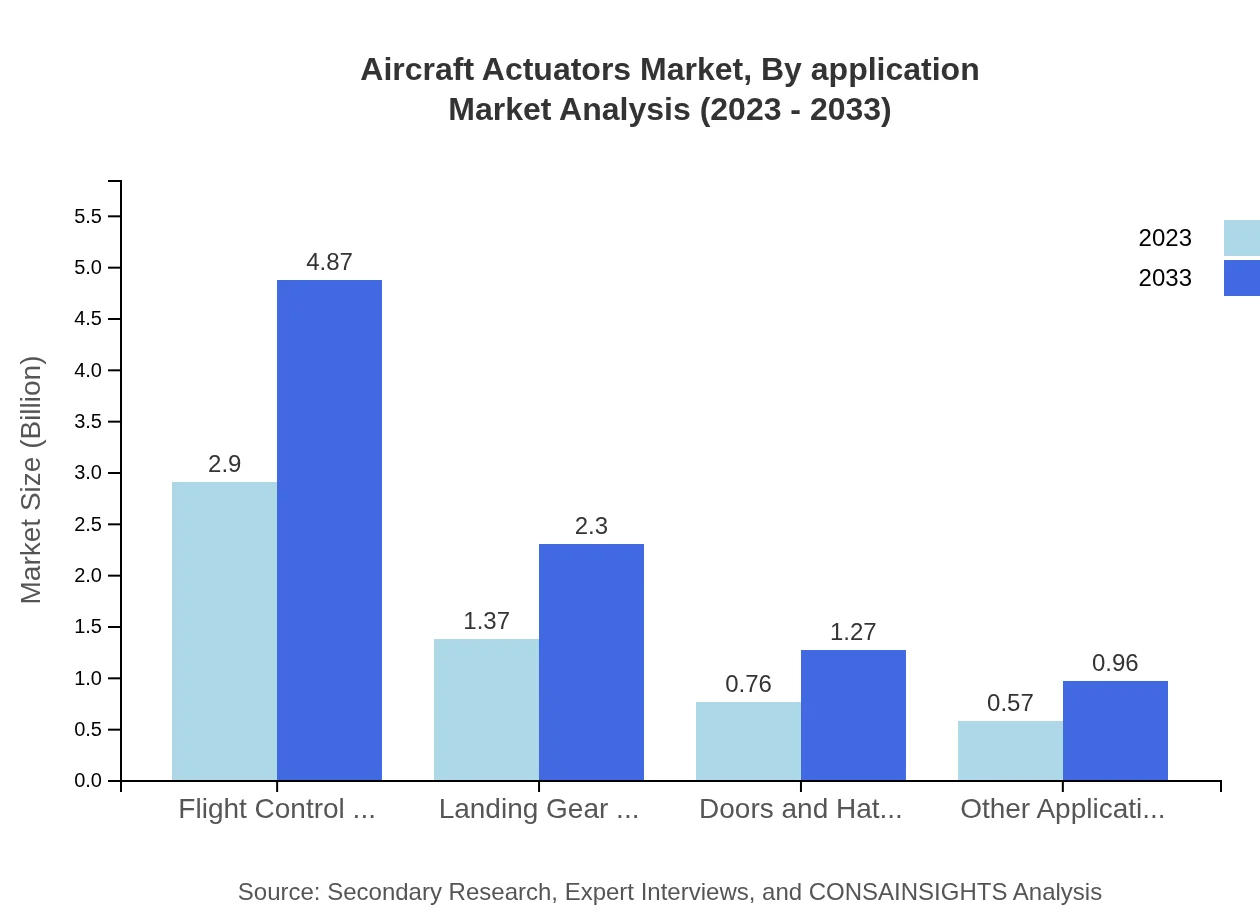

Aircraft Actuators Market Analysis By Application

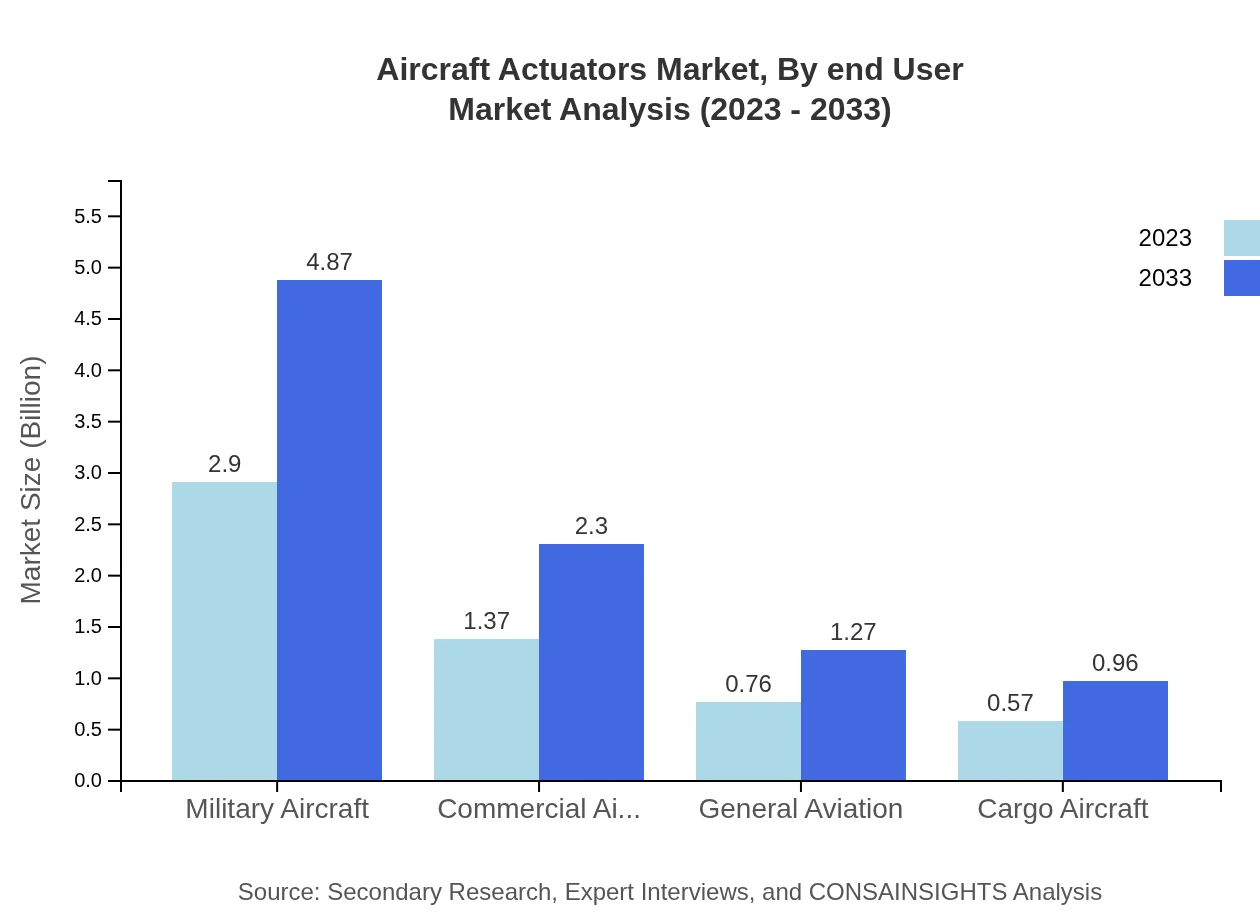

Military aircraft applications hold the largest market share, with an anticipated size rising from USD 2.90 billion to USD 4.87 billion by 2033. Commercial aircraft also present notable growth opportunities, particularly with rising travel demand, increasing from USD 1.37 billion to USD 2.30 billion. General aviation, land gear systems, and other applications are also contributing to growth, reflecting varying demand levels across segments.

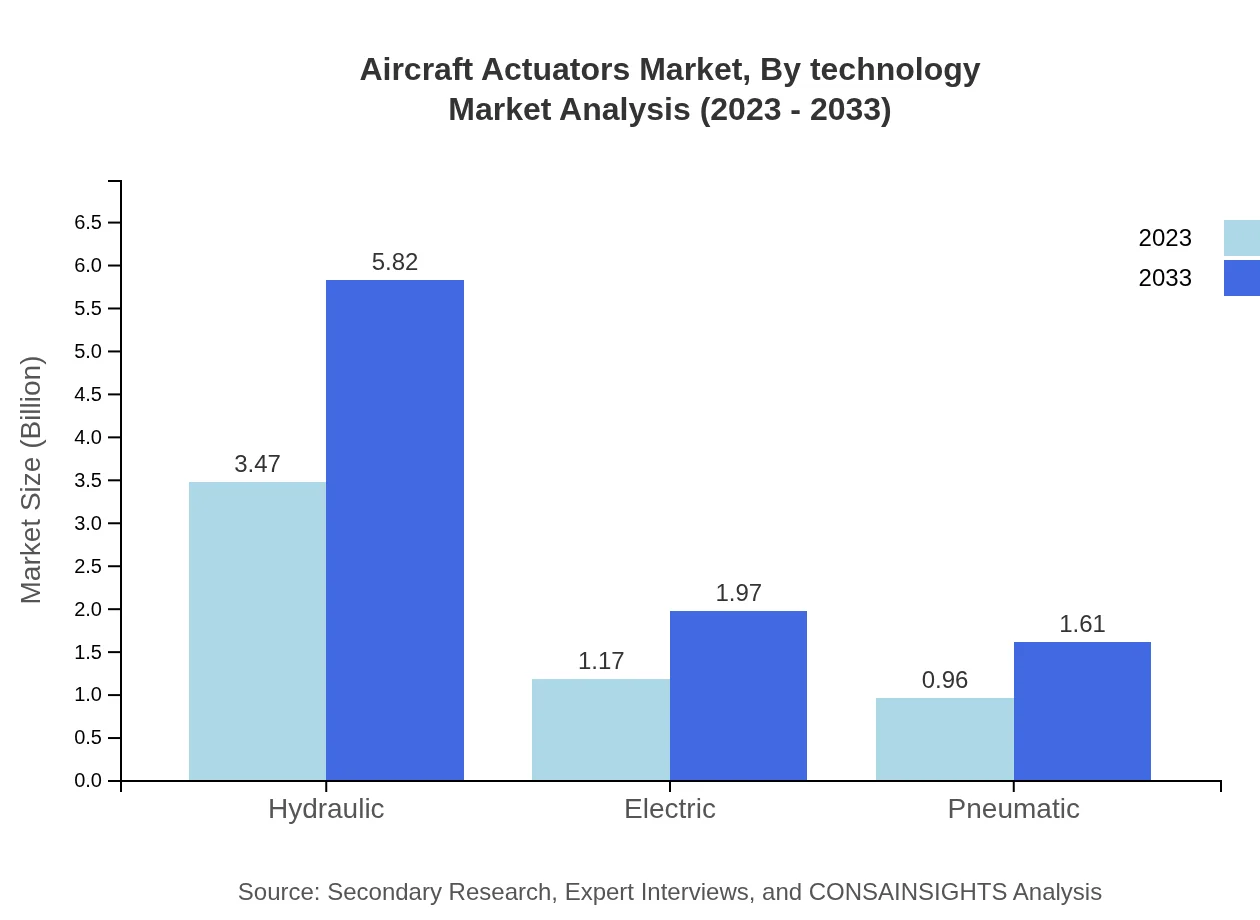

Aircraft Actuators Market Analysis By Technology

Hydraulic actuators currently represent a majority market share of 61.96%, driven by their application in critical flight control and landing gear systems. However, electric actuators, with an increasing share of 20.96% in 2023, are gaining traction due to their operational efficiency and lower maintenance needs, expected to grow significantly by 2033.

Aircraft Actuators Market Analysis By End User

The primary end-user market for aircraft actuators comprises commercial airlines, military organizations, and general aviation companies. The military segment is poised to expand, maintaining the largest market share due to ongoing investments in defense technology. Commercial aviation remains robust as airlines upgrade fleets to enhance operational efficiencies.

Aircraft Actuators Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Actuators Industry

Honeywell Aerospace:

A leader in aerospace technology, Honeywell specializes in providing advanced actuator systems and components that enhance aircraft safety and performance.Moog Inc.:

Moog is known for its precision motion control products, including comprehensive actuator solutions tailored for both military and commercial aircraft.Boeing :

Boeing, a leading aerospace manufacturer, also develops advanced actuator systems ensuring compliance with airworthiness regulatory standards.Parker Hannifin:

With a focus on motion and control technologies, Parker Hannifin provides hydraulic and electric actuators widely used in the aerospace industry.We're grateful to work with incredible clients.

FAQs

What is the market size of Aircraft Actuators?

The global market for aircraft actuators is projected to reach approximately $5.6 billion by 2023, with a compound annual growth rate (CAGR) of 5.2% anticipated over the next decade, indicating substantial growth and demand in the aerospace sector.

What are the key market players or companies in this Aircraft Actuators industry?

Key players in the aircraft actuators market include Rockwell Collins, Honeywell International Inc., Moog Inc., and Safran S.A., among others, that are pivotal in product innovation and expansion strategies within this industry.

What are the primary factors driving the growth in the Aircraft Actuators industry?

Growth drivers for the aircraft actuators market include increased air travel demand, advancements in aircraft technology, a focus on fuel efficiency, and heightened defense spending, contributing to robust market expansion.

Which region is the fastest Growing in the Aircraft Actuators market?

The fastest-growing region in the aircraft actuators market is North America. The market is expected to grow from $1.96 billion in 2023 to $3.28 billion by 2033, reflecting a strong demand for advanced aviation technologies.

Does ConsaInsights provide customized market report data for the Aircraft Actuators industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the aircraft actuators industry, ensuring clients receive insights that align with their strategic objectives.

What deliverables can I expect from this Aircraft Actuators market research project?

Deliverables from the aircraft actuators market research project typically include comprehensive reports, market forecasts, competitive analysis, and segment-wise growth strategies, ensuring clients are well-informed.

What are the market trends of Aircraft Actuators?

Current trends in the aircraft actuators market include increasing adoption of electric actuators for efficiency, integration of smart technologies, and enhancements in safety mechanisms, all driving innovation and market competitiveness.