Aircraft Antenna Market Report

Published Date: 31 January 2026 | Report Code: aircraft-antenna

Aircraft Antenna Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aircraft Antenna market, covering insights on market size, trends, and forecasts from 2023 to 2033. It explores industry dynamics, regional performance, and competitive landscape, helping stakeholders make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

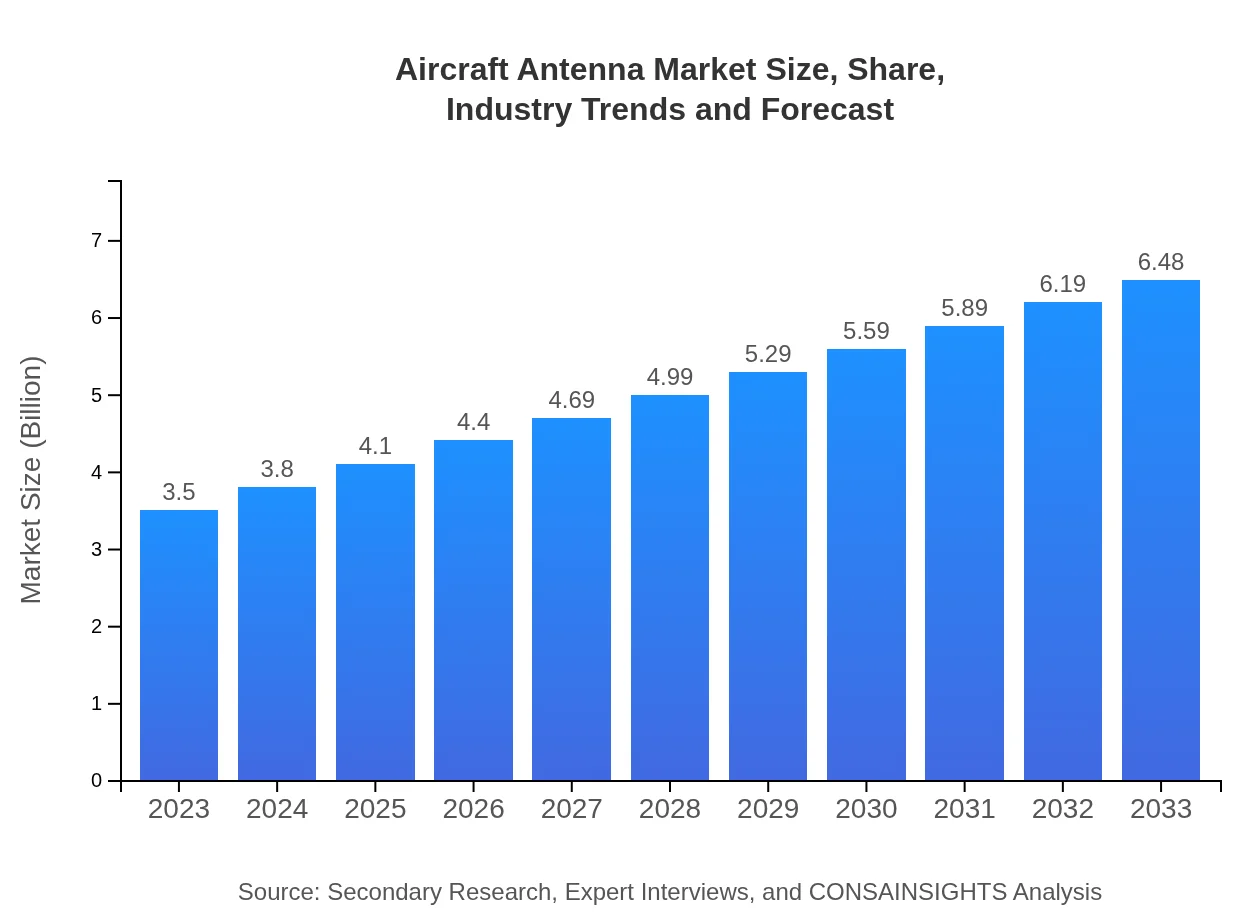

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $6.48 Billion |

| Top Companies | Honeywell Aerospace, Rockwell Collins (now part of Collins Aerospace), Raytheon Technologies, Thales Group, L3Harris Technologies |

| Last Modified Date | 31 January 2026 |

Aircraft Antenna Market Overview

Customize Aircraft Antenna Market Report market research report

- ✔ Get in-depth analysis of Aircraft Antenna market size, growth, and forecasts.

- ✔ Understand Aircraft Antenna's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Antenna

What is the Market Size & CAGR of Aircraft Antenna market in 2023?

Aircraft Antenna Industry Analysis

Aircraft Antenna Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Antenna Market Analysis Report by Region

Europe Aircraft Antenna Market Report:

Europe's market is anticipated to rise from $0.90 billion in 2023 to $1.67 billion by 2033. The emphasis on aviation safety and security, along with high demand for commercial aircraft, is driving significant investments in advanced antenna technologies across the region.Asia Pacific Aircraft Antenna Market Report:

In the Asia Pacific region, the Aircraft Antenna market is projected to grow from $0.70 billion in 2023 to $1.30 billion by 2033, driven by rising air travel demand and technological advancements in aviation. Increased investment in defense by countries such as India and Japan is also contributing to market growth.North America Aircraft Antenna Market Report:

In North America, the market will grow from $1.30 billion in 2023 to approximately $2.40 billion by 2033, fueled primarily by the presence of major aircraft manufacturers and defense contractors. The region leads in technological innovations in antenna systems, with strong investment in aerospace and defense sectors.South America Aircraft Antenna Market Report:

South America's Aircraft Antenna market is expected to increase from $0.33 billion in 2023 to $0.60 billion by 2033, as regional airlines expand operations and modernization efforts in military aviation increase. Challenges such as economic fluctuations and limited infrastructure may temper growth.Middle East & Africa Aircraft Antenna Market Report:

The Aircraft Antenna market in the Middle East and Africa will grow from $0.28 billion in 2023 to $0.52 billion by 2033. Expansion of airlines in the region and rising defense spending are pivotal for the market. However, logistical challenges may hinder faster growth.Tell us your focus area and get a customized research report.

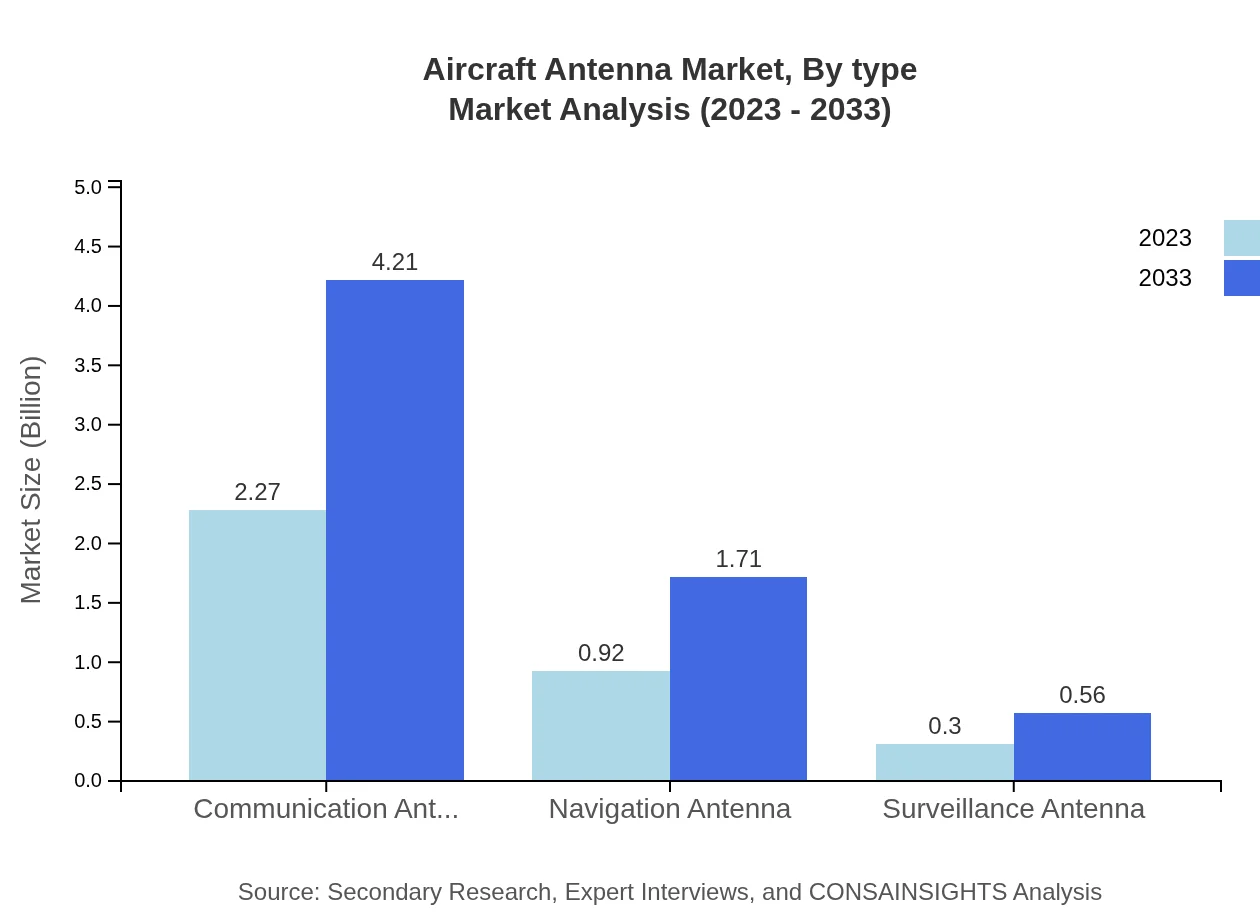

Aircraft Antenna Market Analysis By Type

In terms of type, communication antennas dominate the market, valued at $2.27 billion in 2023, expected to reach $4.21 billion by 2033, capturing 64.98% market share. Navigation antennas follow, growing from $0.92 billion to $1.71 billion over the same period, holding 26.38% market share, while surveillance antennas represent a smaller segment, valued at $0.30 billion in 2023, to $0.56 billion by 2033, with an 8.64% market share.

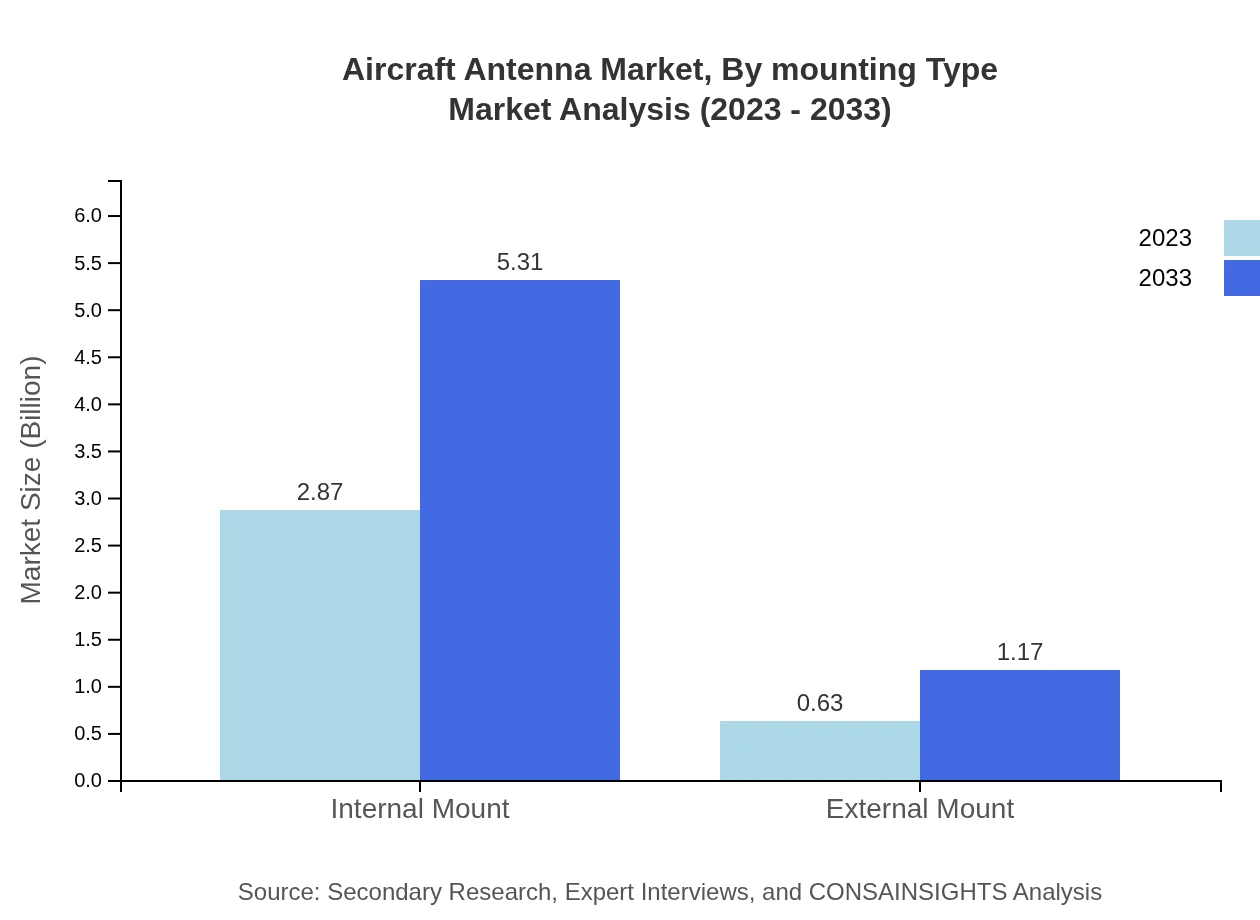

Aircraft Antenna Market Analysis By Mounting Type

Segmenting by mounting type, internal mount antennas are the most prominent, valued at $2.87 billion in 2023, predicted to rise to $5.31 billion by 2033, holding a significant share of 81.95%. External mount antennas are anticipated to grow from $0.63 billion to $1.17 billion, capturing 18.05% market share.

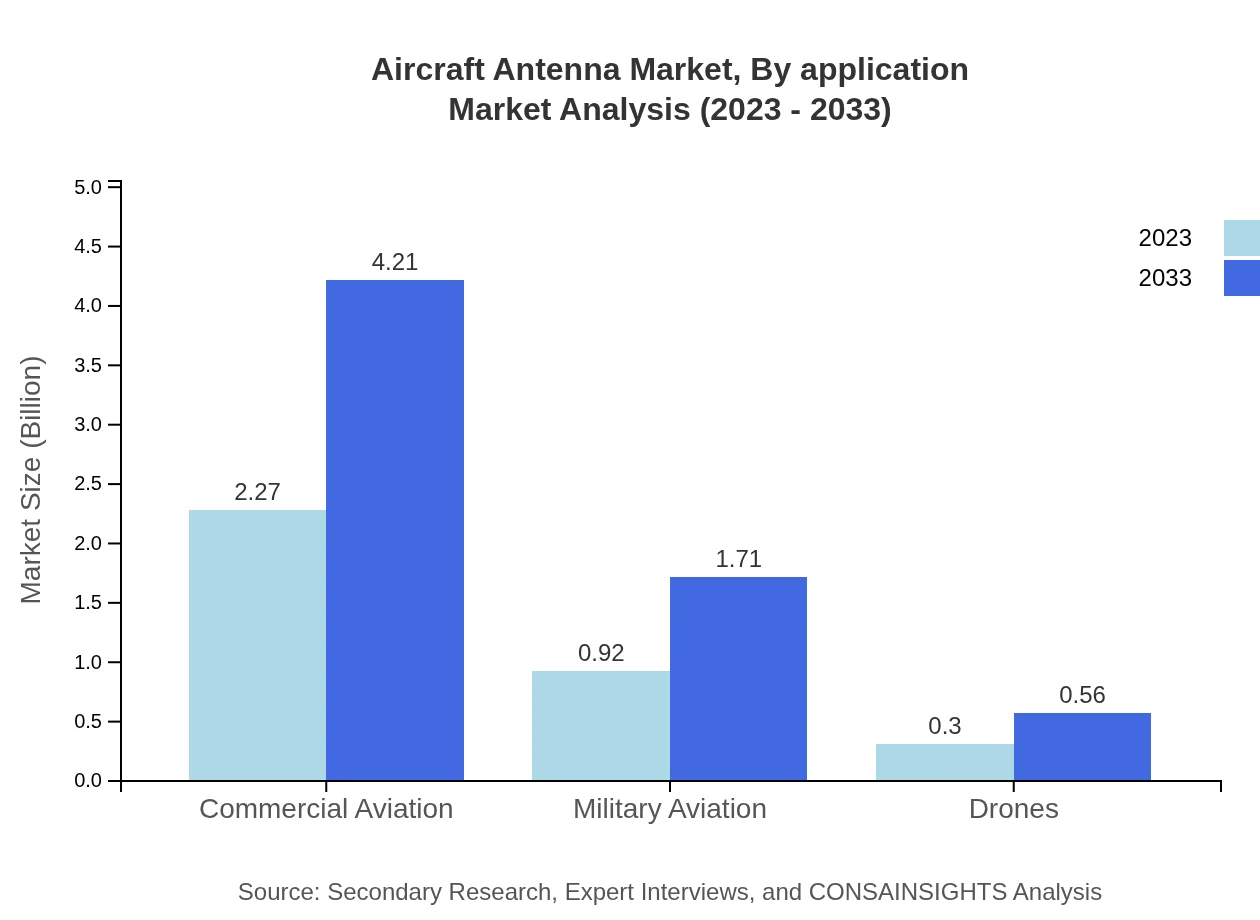

Aircraft Antenna Market Analysis By Application

On the application side, commercial aviation holds the largest market share, valued at $2.27 billion in 2023, expected to increase to $4.21 billion by 2033 with a 64.98% share. Military aviation follows, growing from $0.92 billion to $1.71 billion, securing 26.38% market share, while drone applications are projected to grow from $0.30 billion to $0.56 billion by 2033, representing 8.64% share.

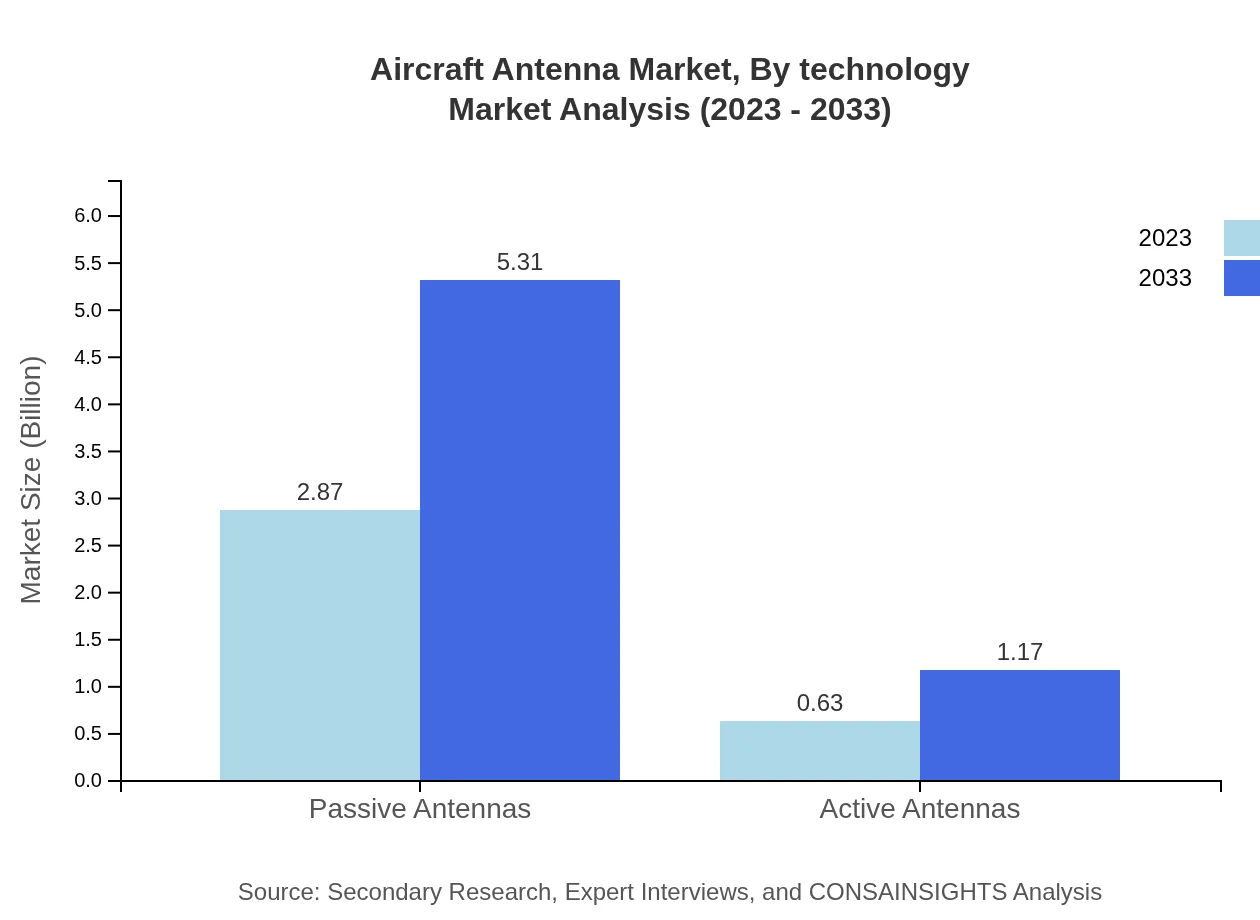

Aircraft Antenna Market Analysis By Technology

Technologically, passive antennas lead the market with a size of $2.87 billion in 2023, expanding to $5.31 billion by 2033, claiming an impressive 81.95% market share. Active antennas have a more modest growth trajectory, moving from $0.63 billion to 1.17 billion and capturing 18.05% market share.

Aircraft Antenna Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Antenna Industry

Honeywell Aerospace:

Honeywell is a significant player in the aviation sector, known for providing various antenna technology solutions that enhance aircraft performance and safety.Rockwell Collins (now part of Collins Aerospace):

Collins Aerospace leads in the field of advanced avionics and antenna technology, contributing significantly to the integration of communication systems in modern aircraft.Raytheon Technologies:

Raytheon is renowned for its aerospace and defense solutions, including sophisticated antenna systems catering to military and commercial markets.Thales Group:

Thales Group specializes in high-performance communication technology for aviation applications, focusing on both civil and defense markets.L3Harris Technologies:

L3Harris is a major provider of communication systems and antennas, driving innovation in avionics and aerospace communications.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Antenna?

The aircraft antenna market is valued at approximately $3.5 billion in 2023, with a projected CAGR of 6.2%. It is expected to experience significant growth, reflecting rising demand in the aviation sector over the next decade.

What are the key market players or companies in this aircraft Antenna industry?

Key players in the aircraft antenna industry include major aerospace manufacturers and technology companies that focus on aviation communication and navigation solutions. Leading firms drive innovation and market expansion, establishing strategic partnerships to enhance product offerings.

What are the primary factors driving the growth in the aircraft Antenna industry?

Growth in the aircraft antenna industry is driven by increasing air traffic, technological advancements, and the demand for better communication systems. Improvements in navigation and surveillance technologies further propel the market forward, enhancing operational efficiency and safety.

Which region is the fastest Growing in the aircraft Antenna?

Asia Pacific is the fastest-growing region in the aircraft antenna market, expanding from $0.70 billion in 2023 to an estimated $1.30 billion by 2033. Rapid aviation growth, increased investment, and modernization efforts contribute to this regional surge.

Does ConsaInsights provide customized market report data for the aircraft Antenna industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the aircraft antenna industry. Clients can obtain insights relevant to their market segments, geographical focus, and competitive analysis, ensuring informed decision-making.

What deliverables can I expect from this aircraft Antenna market research project?

Deliverables from the market research project will include detailed reports, market analysis, regional insights, competitive landscape assessments, and segment performance evaluations. Custom analyses can also be provided based on client-specific requirements.

What are the market trends of aircraft Antenna?

Market trends in the aircraft antenna sector include the increasing adoption of passive and active antennas, advancements in communication and navigation technologies, and a growing focus on wireless connectivity. These trends indicate a shift toward sophisticated systems for commercial and military applications.