Aircraft Arresting System Market Report

Published Date: 03 February 2026 | Report Code: aircraft-arresting-system

Aircraft Arresting System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aircraft Arresting System market from 2023 to 2033, focusing on market trends, size, segmentation, and regional insights, offering valuable forecasts and strategic guidance for stakeholders.

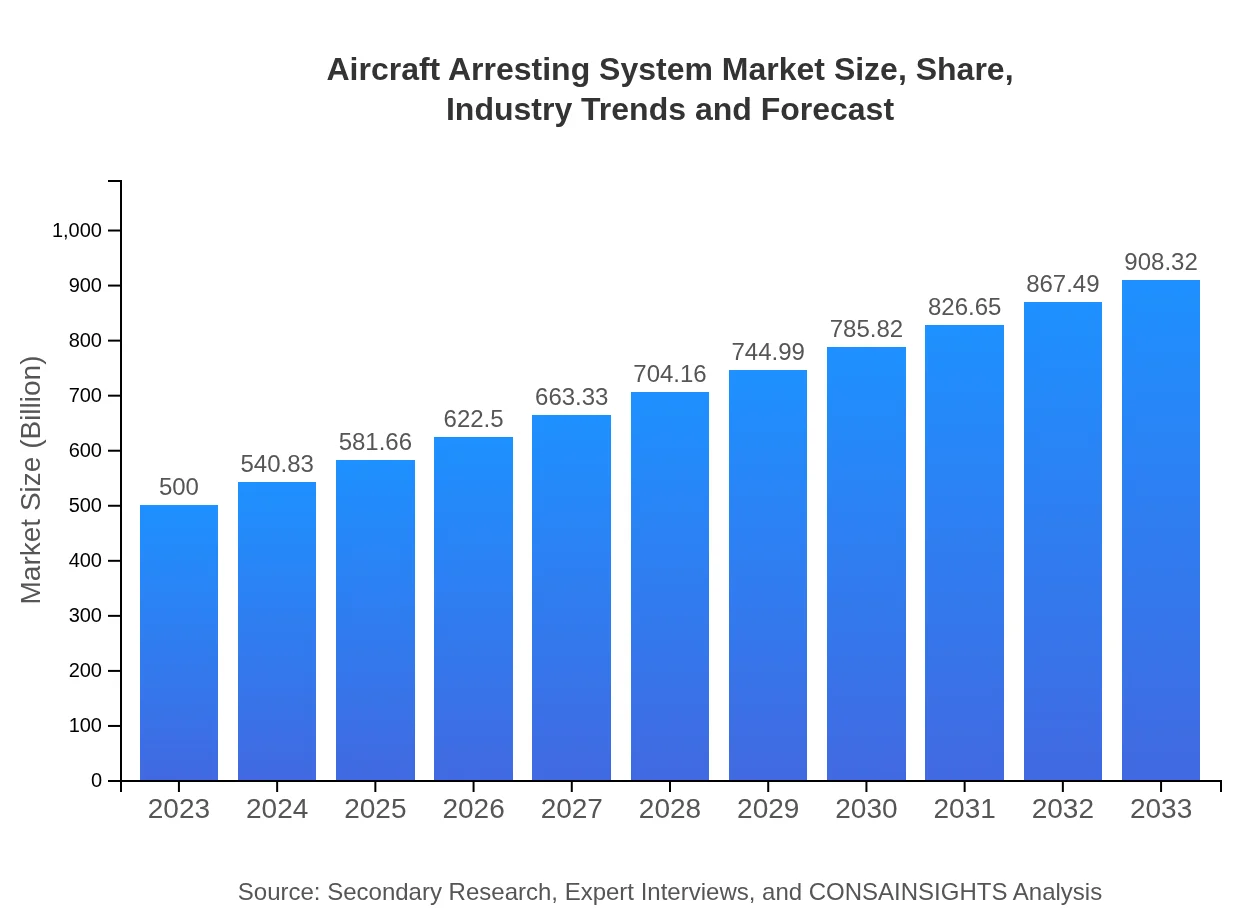

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $908.32 Million |

| Top Companies | General Dynamics, Boeing , Safran, Elbit Systems |

| Last Modified Date | 03 February 2026 |

Aircraft Arresting System Market Overview

Customize Aircraft Arresting System Market Report market research report

- ✔ Get in-depth analysis of Aircraft Arresting System market size, growth, and forecasts.

- ✔ Understand Aircraft Arresting System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Arresting System

What is the Market Size & CAGR of Aircraft Arresting System market in 2023?

Aircraft Arresting System Industry Analysis

Aircraft Arresting System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Arresting System Market Analysis Report by Region

Europe Aircraft Arresting System Market Report:

The European market is anticipated to grow from $120.80 million in 2023 to $219.45 million in 2033, driven by stringent aviation safety regulations and a shift towards modernized air traffic control systems. The demand for enhanced safety measures in both military and civilian sectors is propelling investments in advanced Aircraft Arresting Systems.Asia Pacific Aircraft Arresting System Market Report:

The Asia Pacific region is witnessing considerable growth, with the market projected to grow from $100.55 million in 2023 to $182.66 million in 2033. This surge is primarily driven by a growing aerospace sector and increased investments in airport infrastructure across countries like India, China, and Japan. Enhanced safety regulations further compel airports to adopt advanced arresting systems.North America Aircraft Arresting System Market Report:

North America accounts for the largest market share, with projections rising from $191.10 million in 2023 to $347.16 million by 2033. The presence of major defense contractors and a robust commercial aviation sector fuel growth in this region, alongside increasing government investments in modernizing aging airport systems.South America Aircraft Arresting System Market Report:

In South America, the Aircraft Arresting System market is expected to increase from $49.30 million in 2023 to $89.56 million in 2033. The growth is supported by a decline in air travel disruption incidents and a renewed focus on enhancing airport safety standards through advanced landing technologies.Middle East & Africa Aircraft Arresting System Market Report:

The Middle East and Africa region is projected to experience growth with the market advancing from $38.25 million in 2023 to $69.49 million in 2033. Increasing air traffic and ongoing airport expansions drive the demand for reliable aircraft safety equipment amidst rising global security concerns.Tell us your focus area and get a customized research report.

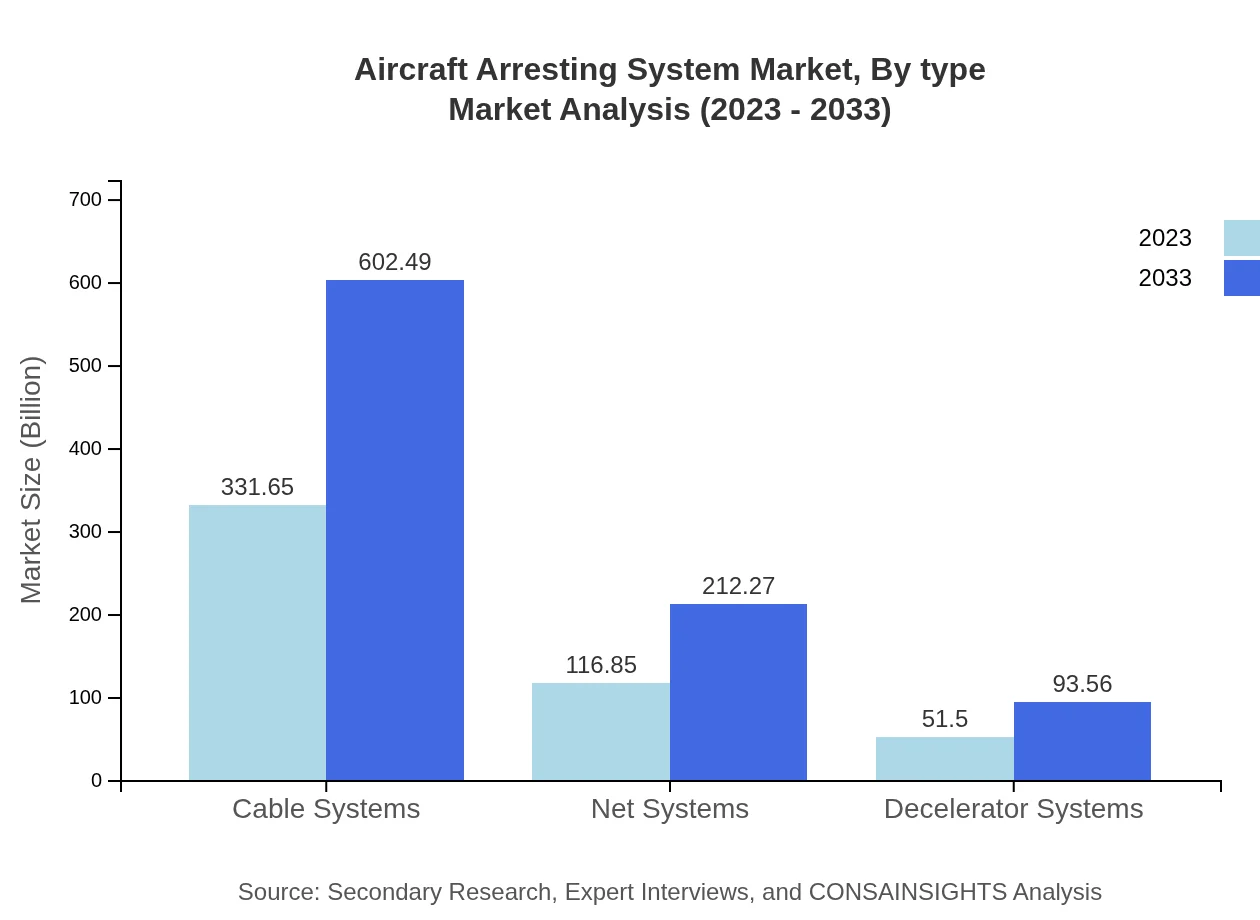

Aircraft Arresting System Market Analysis By Type

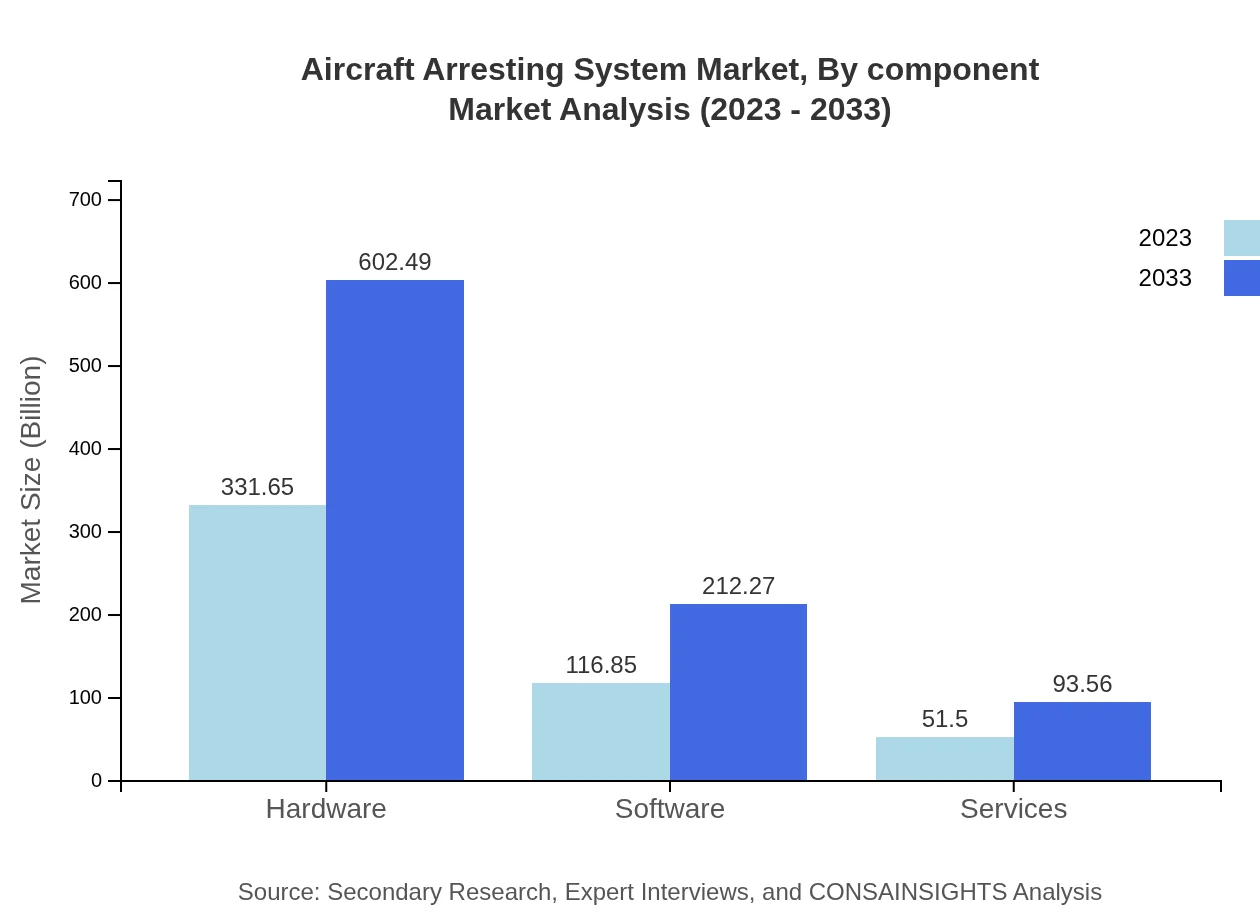

In the Aircraft Arresting System market, Cable Systems are leading, with a size of $331.65 million in 2023, expected to reach $602.49 million in 2033, representing a steady market share. Net Systems follow with $116.85 million rising to $212.27 million, while Decelerator Systems grow from $51.50 million to $93.56 million in the same period.

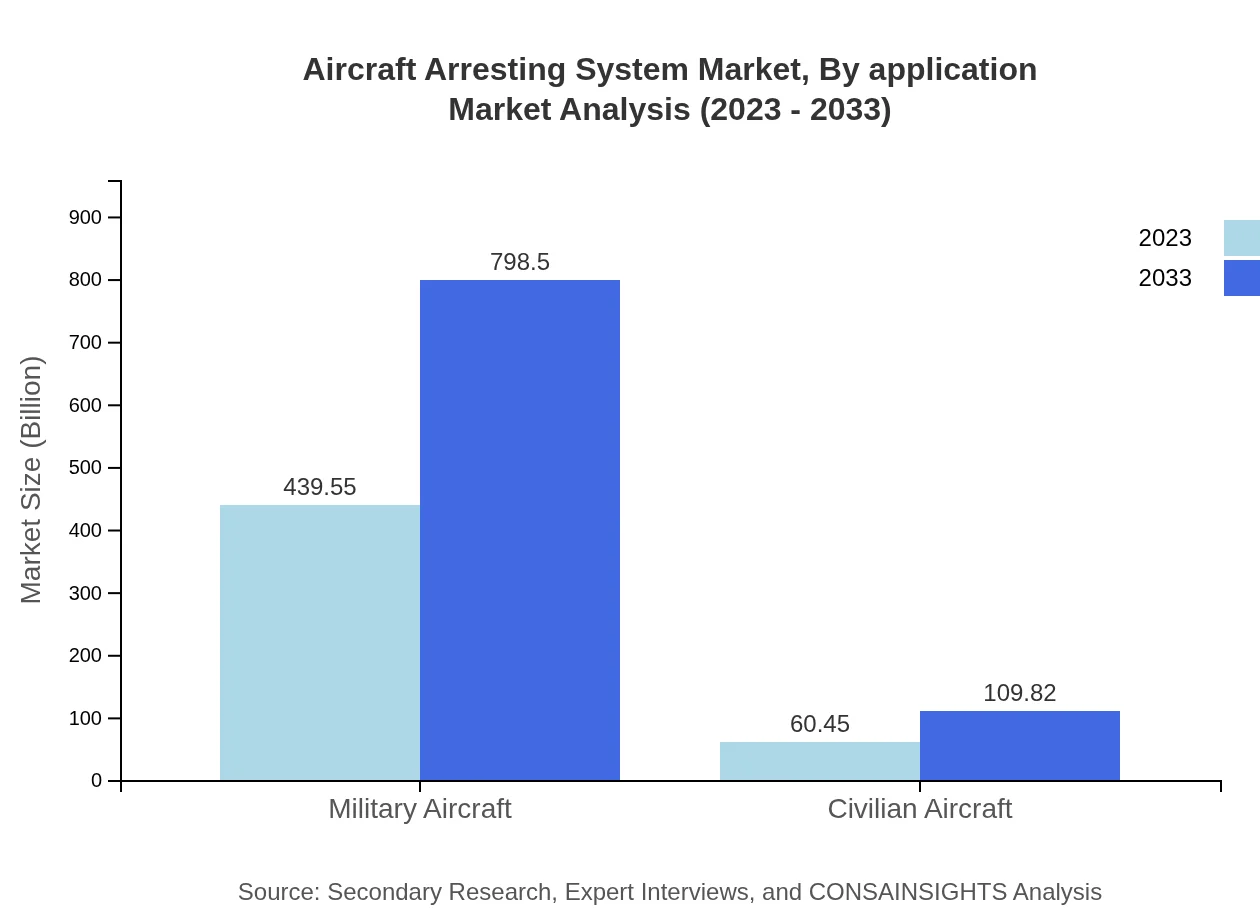

Aircraft Arresting System Market Analysis By Application

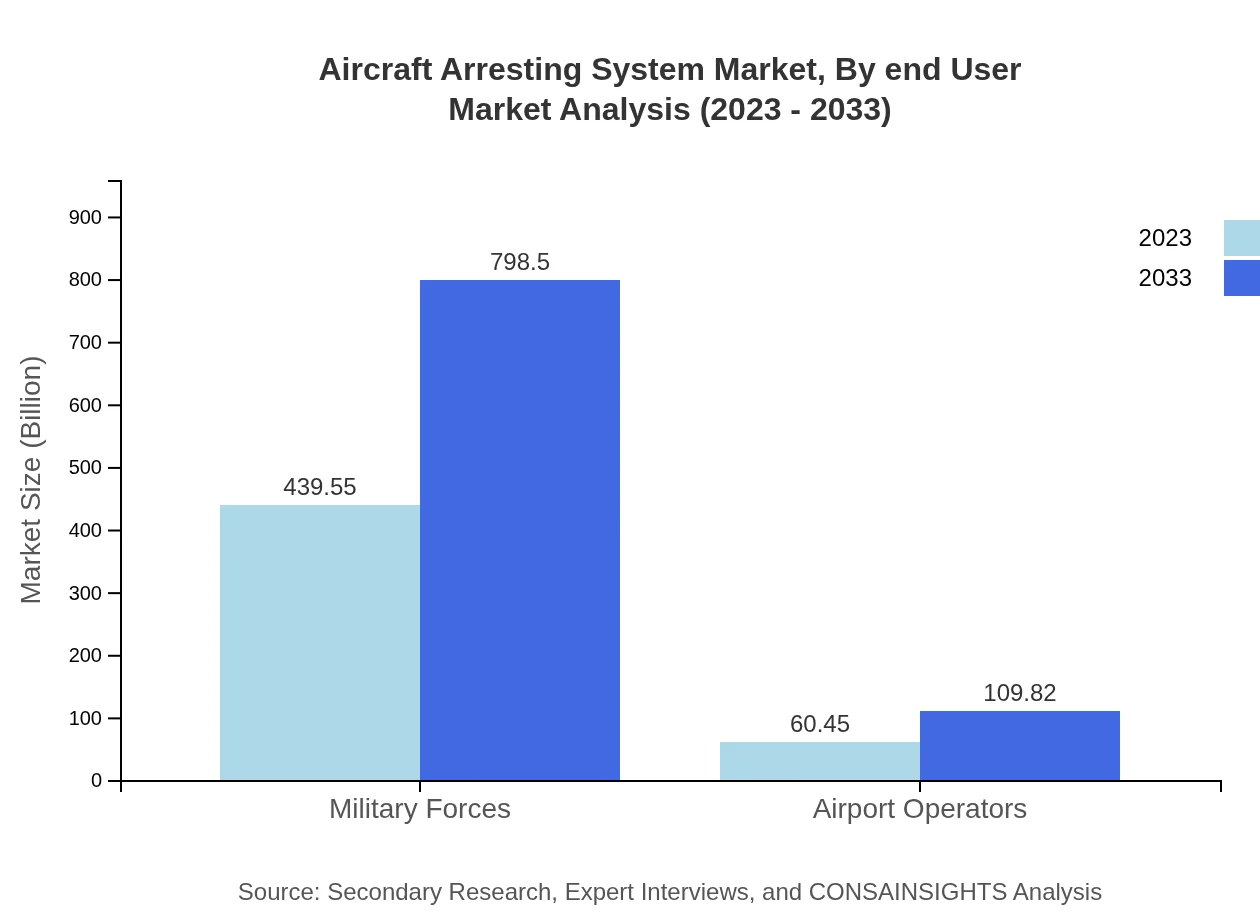

The application segment analyzes the use of Aircraft Arresting Systems in Military and Civilian aircraft. Military Forces dominate, contributing approximately 87.91% share with a market size of $439.55 million in 2023, and expected to reach $798.50 million in 2033. Airport Operators, while smaller, are also significant, increasing from $60.45 million to $109.82 million.

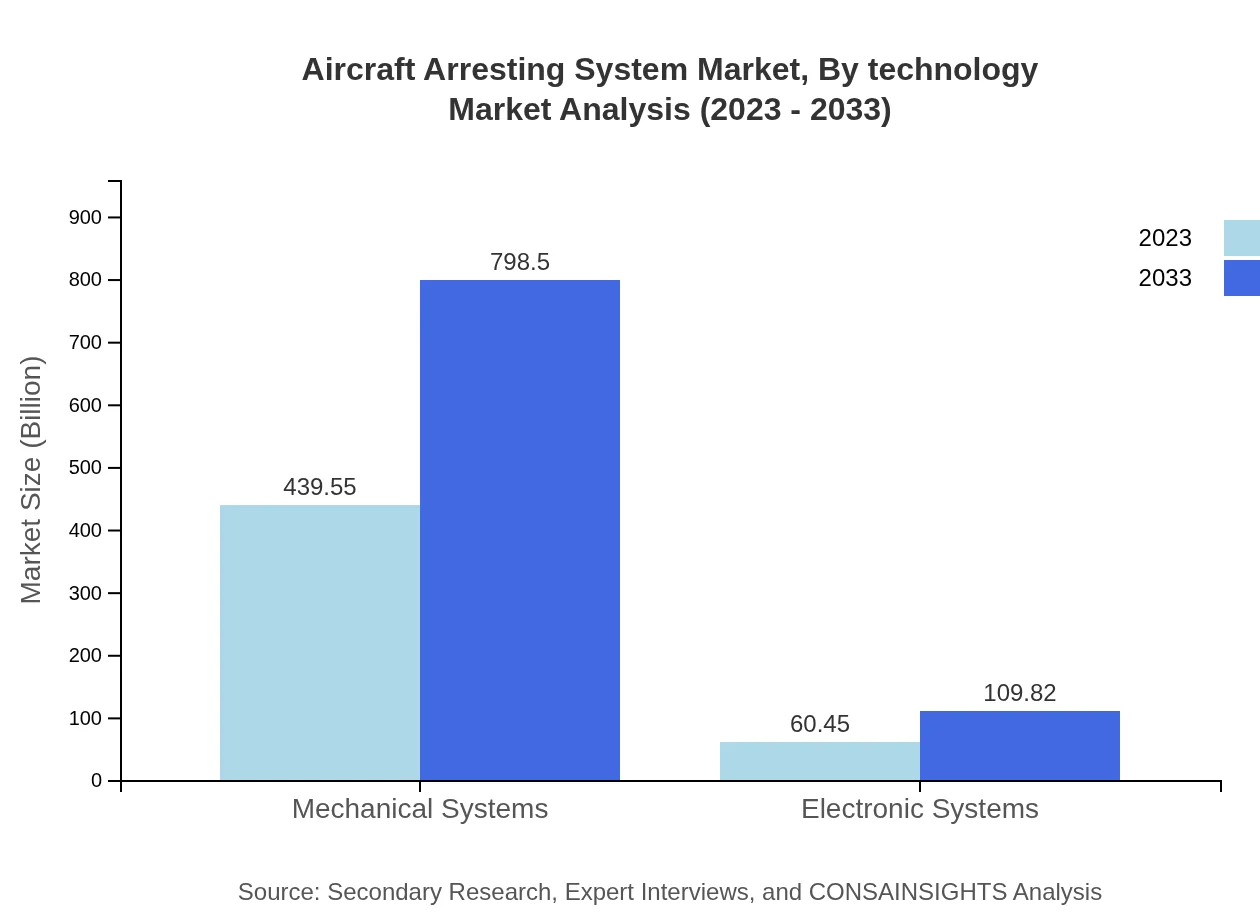

Aircraft Arresting System Market Analysis By Technology

Technological advancements in software and hardware for Steering and Control systems are notable. Hardware systems include components like cables and mechanical systems, with revenues of $331.65 million and $439.55 million in 2023, expected to grow significantly by 2033.

Aircraft Arresting System Market Analysis By End User

Key end-users in the Aircraft Arresting System market are Military Forces and Airport Operators. Military applications are paramount, with a market size of approximately $439.55 million in 2023, representing nearly 87.91% of the entire market. Airport installations contribute the remaining share and are expected to grow steadily.

Aircraft Arresting System Market Analysis By Component

The market, categorized into components like Mechanical Systems, Electronic Systems, and Services, features Mechanical Systems as the backbone, generating $439.55 million in 2023. Alongside, both Electronic Systems and Services showcase promising growth patterns as advanced technologies integrate into operational frameworks.

Aircraft Arresting System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Arresting System Industry

General Dynamics:

General Dynamics is a leading aerospace and defense company, known for developing advanced arresting gear systems for military applications, enhancing safety and operational efficiencies.Boeing :

Boeing, a major player in aerospace manufacturing, provides innovative aircraft arresting systems integrated into various military and commercial aircraft, ensuring safe landings under any circumstance.Safran:

Safran specializes in aircraft systems, offering cutting-edge arresting technologies that improve landing processes and reduce accidents.Elbit Systems:

Elbit Systems is a defense electronics company that has developed advanced arresting systems for military jets, emphasizing performance and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Arresting System?

The Aircraft Arresting System market is valued at approximately $500 million in 2023 and is projected to grow at a CAGR of 6% through 2033, indicating a strong growth trajectory in the aerospace industry.

What are the key market players or companies in this aircraft Arresting System industry?

Key players in the Aircraft Arresting System market include major defense contractors and aerospace manufacturers specializing in landing gear technology and emergency landing systems, contributing to advancements in aviation safety.

What are the primary factors driving the growth in the aircraft Arresting System industry?

Factors driving growth include increasing air traffic, rising concerns over aviation safety, and technological advancements in aircraft landing systems, necessitating efficient aircraft arresting solutions to enhance operational safety.

Which region is the fastest Growing in the aircraft Arresting System?

North America is the fastest-growing region, with the market expected to escalate from $191.10 million in 2023 to $347.16 million by 2033, supported by robust military investments and airport infrastructure upgrades.

Does ConsaInsights provide customized market report data for the aircraft Arresting System industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, providing detailed insights into market dynamics, trends, and competitive landscapes within the aircraft arresting system industry.

What deliverables can I expect from this aircraft Arresting System market research project?

Deliverables include comprehensive market analysis reports, growth forecasts, competitive landscapes, segment data (including cable and net systems), and regional insights to aid strategic decision-making.

What are the market trends of aircraft Arresting System?

Trends include a shift toward advanced cable systems, with projected growth from $331.65 million in 2023 to $602.49 million by 2033, reflecting increased adoption of technology in safety solutions for aircraft.