Aircraft Autopilot System Market Report

Published Date: 03 February 2026 | Report Code: aircraft-autopilot-system

Aircraft Autopilot System Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Aircraft Autopilot System market, analyzing key trends, market size, and projections from 2023 to 2033, alongside competitive dynamics and regional insights to provide a comprehensive outlook for stakeholders.

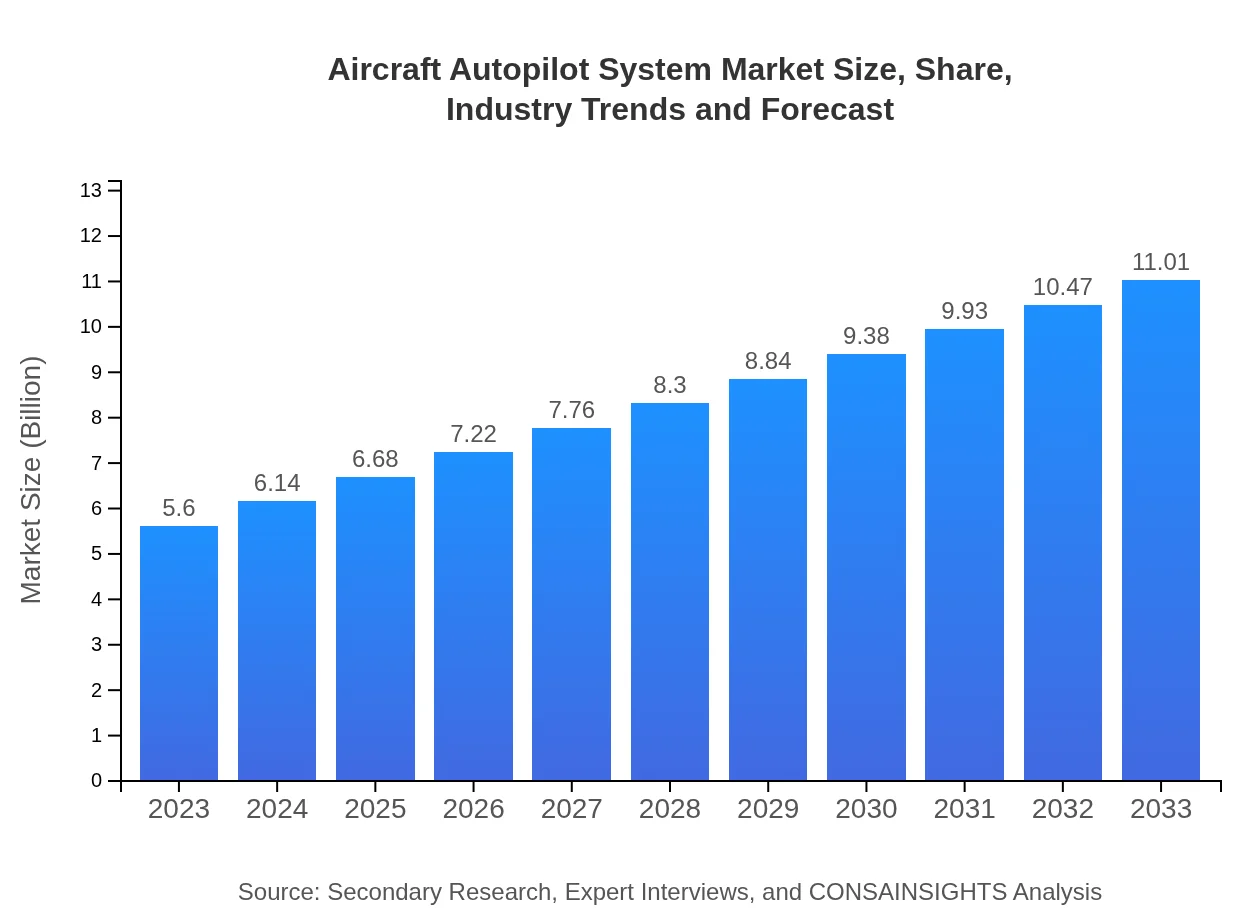

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Honeywell International Inc., Rockwell Collins, Inc., Garmin Ltd., BAE Systems |

| Last Modified Date | 03 February 2026 |

Aircraft Autopilot System Market Overview

Customize Aircraft Autopilot System Market Report market research report

- ✔ Get in-depth analysis of Aircraft Autopilot System market size, growth, and forecasts.

- ✔ Understand Aircraft Autopilot System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Autopilot System

What is the Market Size & CAGR of Aircraft Autopilot System market in 2023?

Aircraft Autopilot System Industry Analysis

Aircraft Autopilot System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

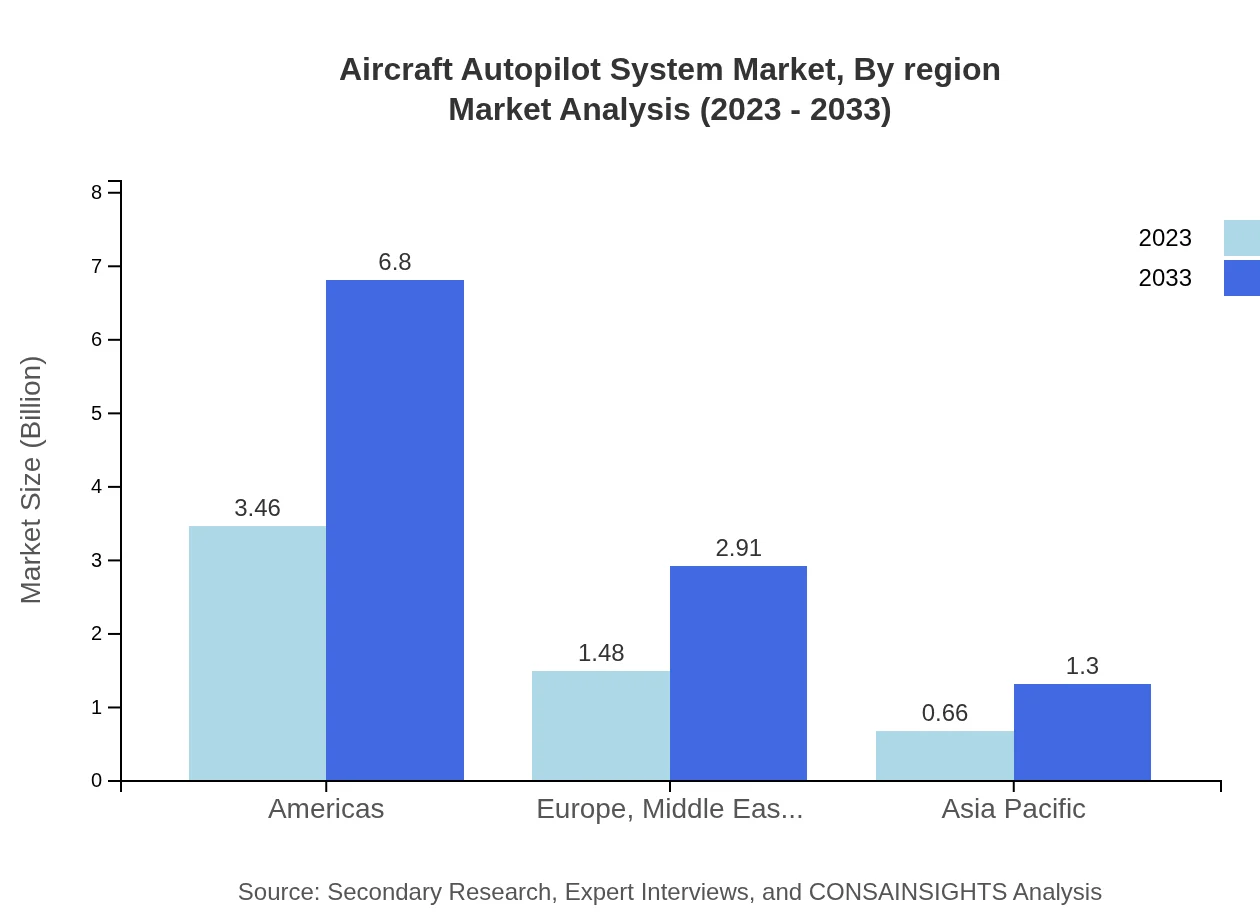

Aircraft Autopilot System Market Analysis Report by Region

Europe Aircraft Autopilot System Market Report:

Europe's market is anticipated to grow from $1.43 billion in 2023 to $2.81 billion by 2033, supported by the presence of key aircraft manufacturers and a strong commitment to advancing aviation safety. The European aerospace and defense sector is well-established, pushing the boundaries of autopilot technology further.Asia Pacific Aircraft Autopilot System Market Report:

The Asia Pacific region is witnessing significant growth with a market size expected to reach $2.29 billion by 2033, up from $1.17 billion in 2023. The rise in air travel demand and increasing investments in airports and airline fleets drive this growth. Countries like China and India are expanding their aviation infrastructure rapidly, creating lucrative opportunities for autopilot technology.North America Aircraft Autopilot System Market Report:

North America is the largest market for Aircraft Autopilot Systems, with a projected rise from $1.92 billion in 2023 to $3.78 billion by 2033. The region benefits from a mature aviation industry, high investment in R&D, and stringent safety regulations that promote advanced autopilot systems in both commercial and military applications.South America Aircraft Autopilot System Market Report:

In South America, the market is expected to grow from $0.44 billion in 2023 to $0.87 billion in 2033. The gradual improvement of the aviation sector, including increased air travel and tourism, is fostering demand for autopilot systems. However, economic fluctuation and varying governmental regulations pose challenges to consistent growth.Middle East & Africa Aircraft Autopilot System Market Report:

The Middle East and Africa market is set to increase from $0.64 billion in 2023 to $1.26 billion by 2033, driven by expanding airline operations and the necessity for improving air traffic management systems in rapidly growing economies. Investments in tourism and trade further enhance the relevance of sophisticated autopilot systems in this region.Tell us your focus area and get a customized research report.

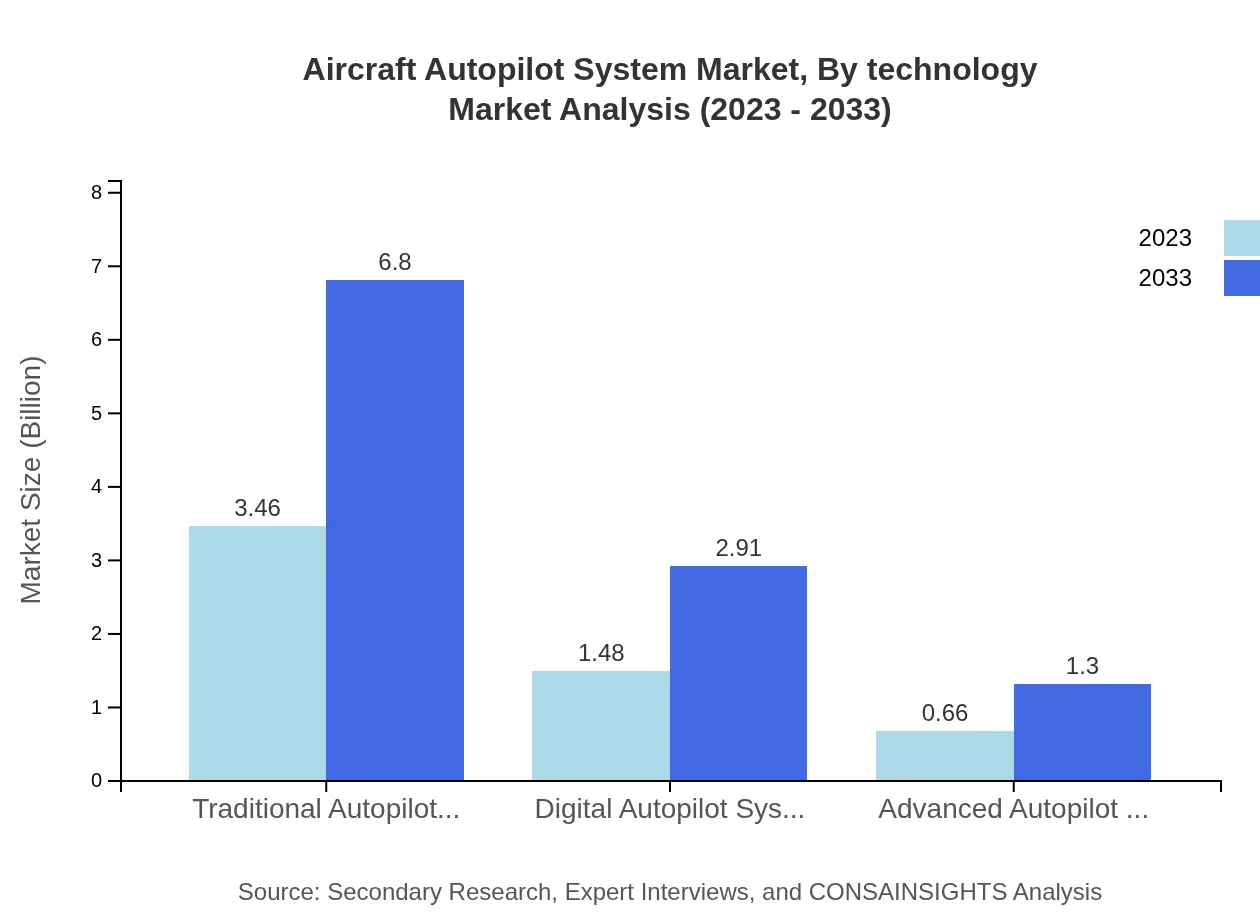

Aircraft Autopilot System Market Analysis By Technology

The market shows a significant preference for traditional autopilot systems, which hold a market share of 61.74% as of 2023, projected to grow steadily. Digital autopilot systems, while smaller in market share at 26.48%, are gaining traction due to their advanced capabilities. Advanced autopilot technologies, focusing on automation and increased reliability, are expected to capture an increasing percentage of the market as innovations continue.

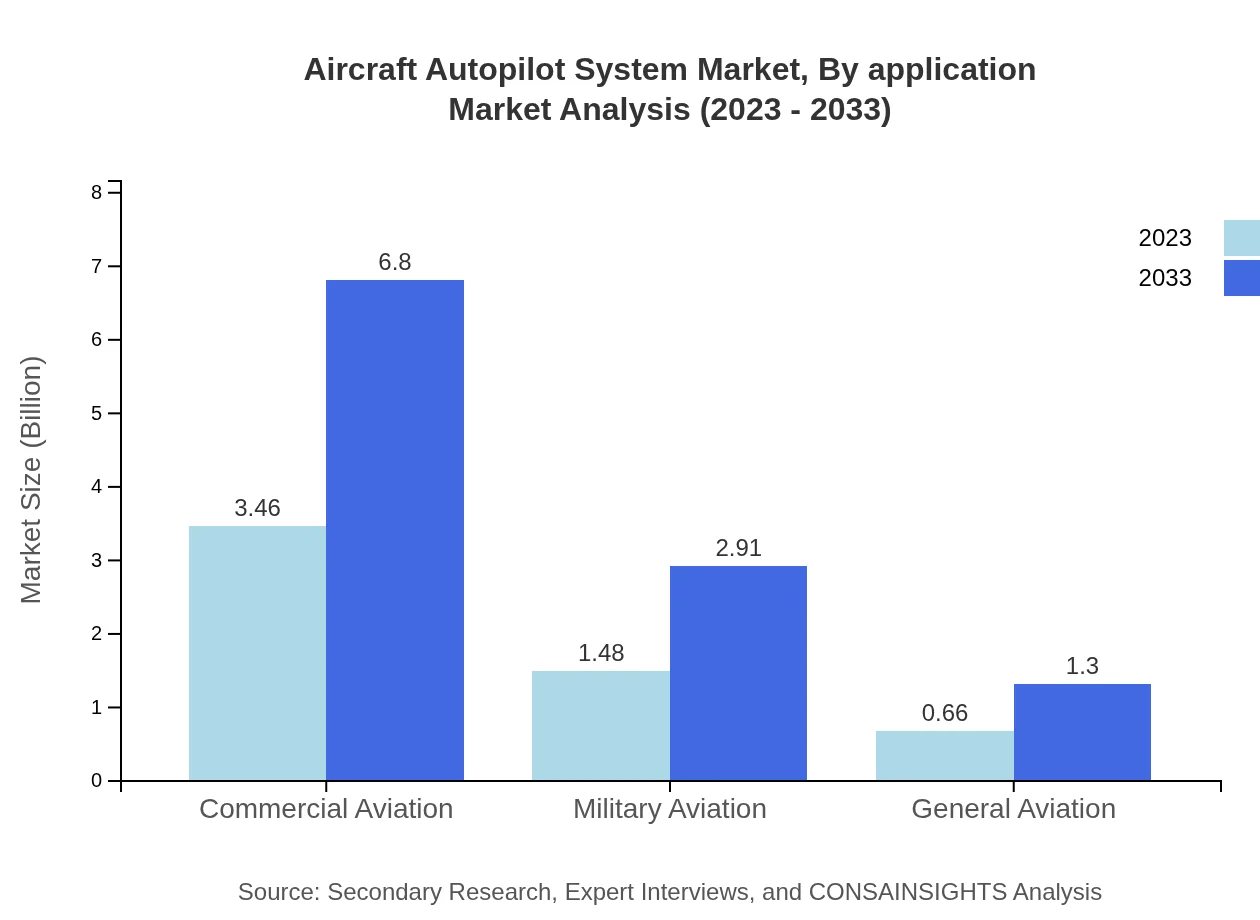

Aircraft Autopilot System Market Analysis By Application

In terms of applications, commercial aviation remains the dominant segment with a market share of 61.74% in 2023. Military aviation and general aviation account for 26.48% and 11.78% of the market respectively. Growing air passenger traffic is pushing commercial aviation demands higher, while military operations enhance the need for robust autopilot technologies.

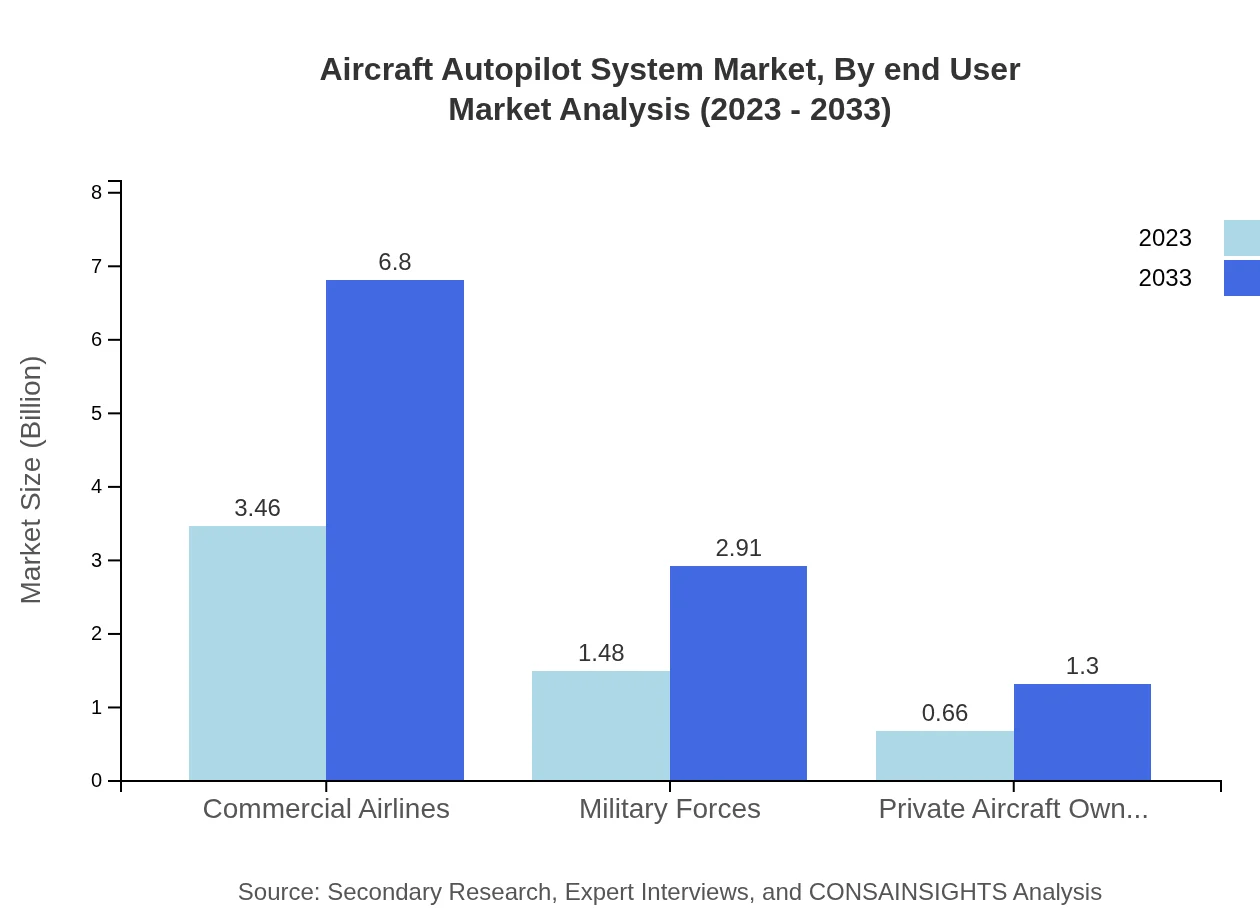

Aircraft Autopilot System Market Analysis By End User

Segmentation by end-user reflects the highest demand from commercial airlines, supported by increasing fleet sizes and modernization programs. Military forces follow closely to strengthen operational capabilities, while private aircraft owners show a steadily growing interest in advanced autopilot features to enhance safety and convenience.

Aircraft Autopilot System Market Analysis By Region

The regional analysis delineates North America and Europe as leading markets due to established aviation frameworks, while Asia Pacific is emerging rapidly. Opportunities exist in the Middle East and Africa attributed to increasing air travel, and attention to safety improvements.

Aircraft Autopilot System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Autopilot System Industry

Honeywell International Inc.:

Honeywell is a leading technology company that manufactures avionics products, including advanced autopilot systems widely used in commercial and military aircraft.Rockwell Collins, Inc.:

A prominent player in the civilian and military aerospace markets, Rockwell Collins offers innovative autopilot technologies that enhance flight navigation and operational safety.Garmin Ltd.:

Garmin provides a vast range of aviation systems, including autopilot solutions catering to general aviation and business aircraft, renowned for their reliability.BAE Systems:

BAE Systems focuses on defense and aerospace sectors, delivering cutting-edge autopilot systems that support military aircraft operations.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Autopilot System?

The aircraft autopilot system market is estimated to be valued at 5.6 billion in 2023, with a projected CAGR of 6.8% through to 2033, indicating substantial growth potential in the upcoming decade.

What are the key market players or companies in this aircraft Autopilot System industry?

Key players in the aircraft autopilot system market include major aerospace manufacturers and technology firms specializing in avionics systems. Their innovative solutions and partnerships contribute significantly to the overall market dynamics.

What are the primary factors driving the growth in the aircraft Autopilot System industry?

Growth in the aircraft autopilot system industry is primarily driven by advancements in aviation technology, increasing demand for automation in commercial aviation, and rising safety standards that necessitate sophisticated autopilot systems.

Which region is the fastest Growing in the aircraft Autopilot System?

The North American region is expected to exhibit the fastest growth in the aircraft autopilot system market, with a market size projected to increase from 1.92 billion in 2023 to 3.78 billion by 2033.

Does ConsaInsights provide customized market report data for the aircraft Autopilot System industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the aircraft autopilot system industry, allowing clients to gain insights and specific data relevant to their strategic decision-making.

What deliverables can I expect from this aircraft Autopilot System market research project?

From the aircraft autopilot system market research project, deliverables typically include comprehensive market size analyses, growth forecasts, competitive landscape assessments, and detailed segmentation information by region and application.

What are the market trends of aircraft Autopilot System?

Current market trends include a shift towards digital autopilot systems, increasing investment in advanced autopilot technologies, and a growing focus on enhancing user interface experiences for pilots across various aircraft types.