Aircraft Auxiliary Power Unit Market Report

Published Date: 03 February 2026 | Report Code: aircraft-auxiliary-power-unit

Aircraft Auxiliary Power Unit Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aircraft Auxiliary Power Unit market from 2023 to 2033, focusing on market trends, size, segmentation, and regional insights while highlighting key players and future forecasts.

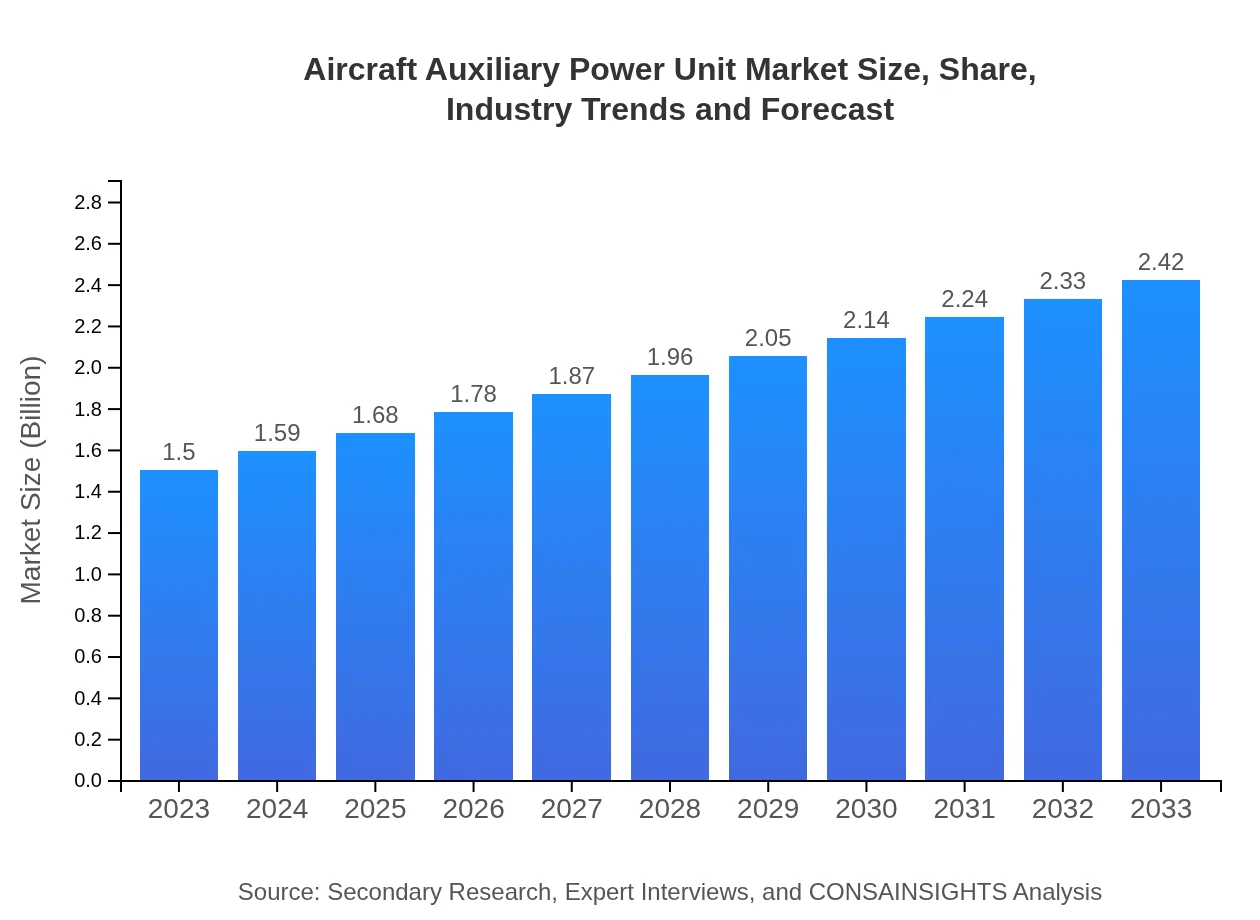

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $2.42 Billion |

| Top Companies | Honeywell Aerospace, UTC Aerospace Systems, Safran, Bergstrom Inc. |

| Last Modified Date | 03 February 2026 |

Aircraft Auxiliary Power Unit Market Overview

Customize Aircraft Auxiliary Power Unit Market Report market research report

- ✔ Get in-depth analysis of Aircraft Auxiliary Power Unit market size, growth, and forecasts.

- ✔ Understand Aircraft Auxiliary Power Unit's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Auxiliary Power Unit

What is the Market Size & CAGR of Aircraft Auxiliary Power Unit market in 2023?

Aircraft Auxiliary Power Unit Industry Analysis

Aircraft Auxiliary Power Unit Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Auxiliary Power Unit Market Analysis Report by Region

Europe Aircraft Auxiliary Power Unit Market Report:

The European APU market is anticipated to grow from $0.53 billion in 2023 to $0.86 billion by 2033, driven by the region’s focus on sustainability, cooperation among major airlines for shared technologies, and a strong emphasis on reducing operational costs.Asia Pacific Aircraft Auxiliary Power Unit Market Report:

In the Asia Pacific region, the APU market is expected to grow from $0.25 billion in 2023 to $0.40 billion by 2033. This growth is driven by rapid urbanization, increasing disposable incomes, and an expanding aviation sector fueled by a rise in low-cost carriers.North America Aircraft Auxiliary Power Unit Market Report:

North America holds a significant share of the APU market, projected to grow from $0.52 billion in 2023 to $0.83 billion in 2033. The region benefits from a high density of aircraft operations, investment in technological innovations, and stringent regulations pushing for increased fuel efficiency.South America Aircraft Auxiliary Power Unit Market Report:

The South American APU market is projected to increase from $0.08 billion in 2023 to $0.13 billion in 2033. The growth represents a gradual recovery of air travel post-pandemic and enhanced investments in the modernization of the existing fleet.Middle East & Africa Aircraft Auxiliary Power Unit Market Report:

The Middle East and Africa's APU market is expected to move from $0.12 billion in 2023 to $0.20 billion by 2033, aided by the expansion of the aviation industry, particularly in the Gulf States, and a robust demand for new commercial aircraft.Tell us your focus area and get a customized research report.

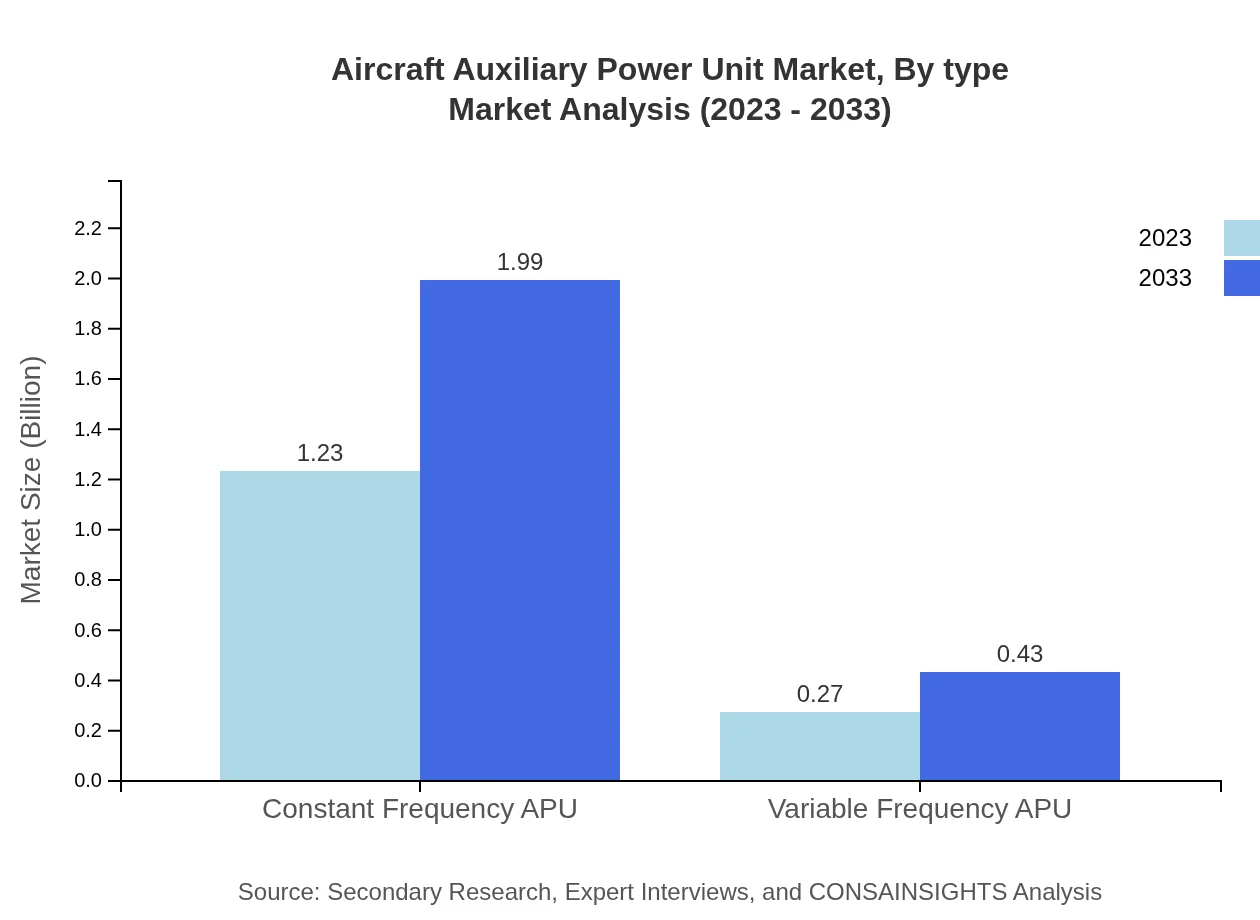

Aircraft Auxiliary Power Unit Market Analysis By Type

The APU market by type displays significant growth prospects over the forecast period. Constant Frequency APUs dominate the market with a size of $1.23 billion in 2023, projected to rise to $1.99 billion in 2033, holding an 82.07% share. Meanwhile, Variable Frequency APUs are expected to grow from $0.27 billion to $0.43 billion, representing a 17.93% share, indicating a shift towards more flexible power systems.

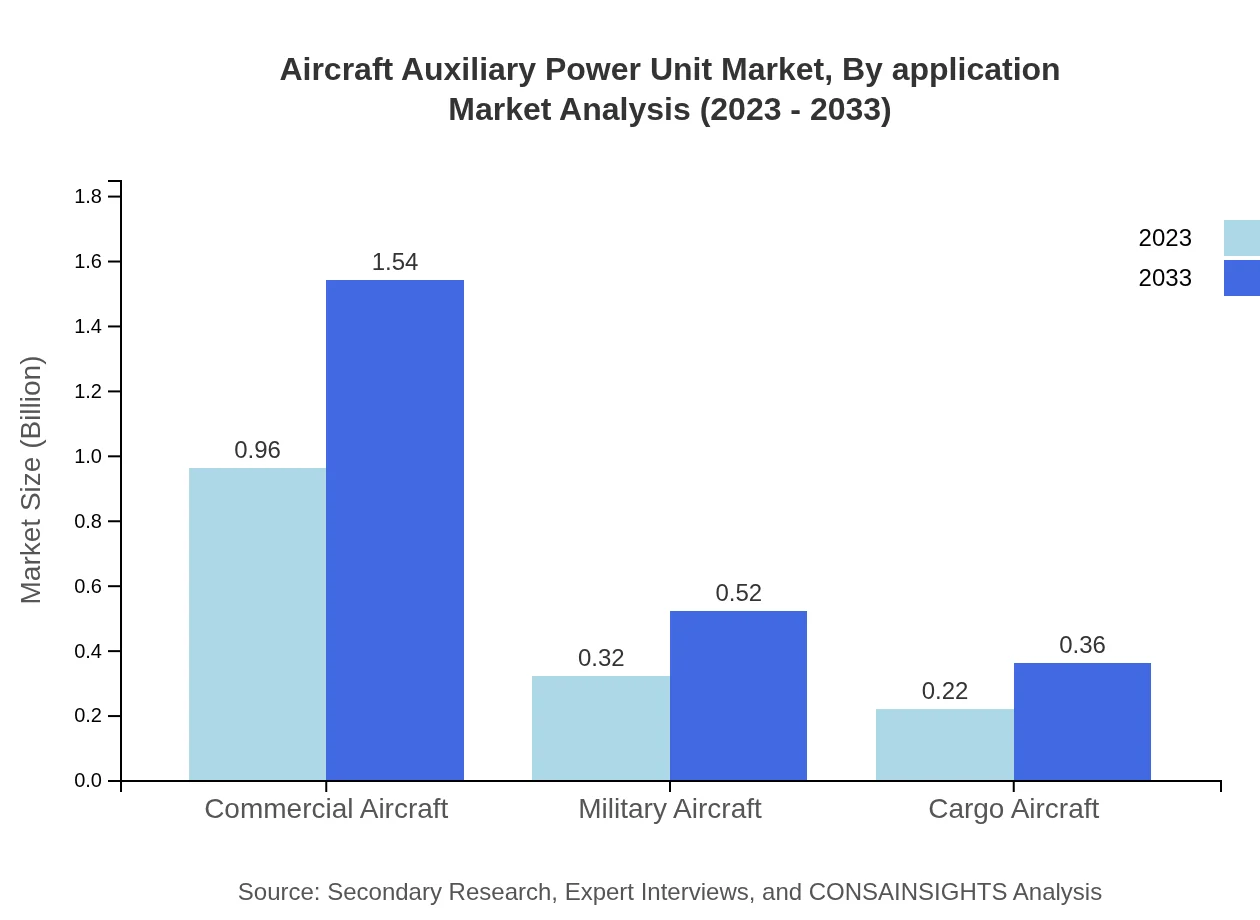

Aircraft Auxiliary Power Unit Market Analysis By Application

The commercial aircraft segment is prominently leading the APU market, with the size projected to increase from $0.96 billion in 2023 to $1.54 billion by 2033, maintaining a share of 63.8%. Military aircraft contributions are also noteworthy, moving from $0.32 billion to $0.52 billion, while the cargo aircraft segment is expected to grow from $0.22 billion to $0.36 billion, together reflecting a diversification of applications.

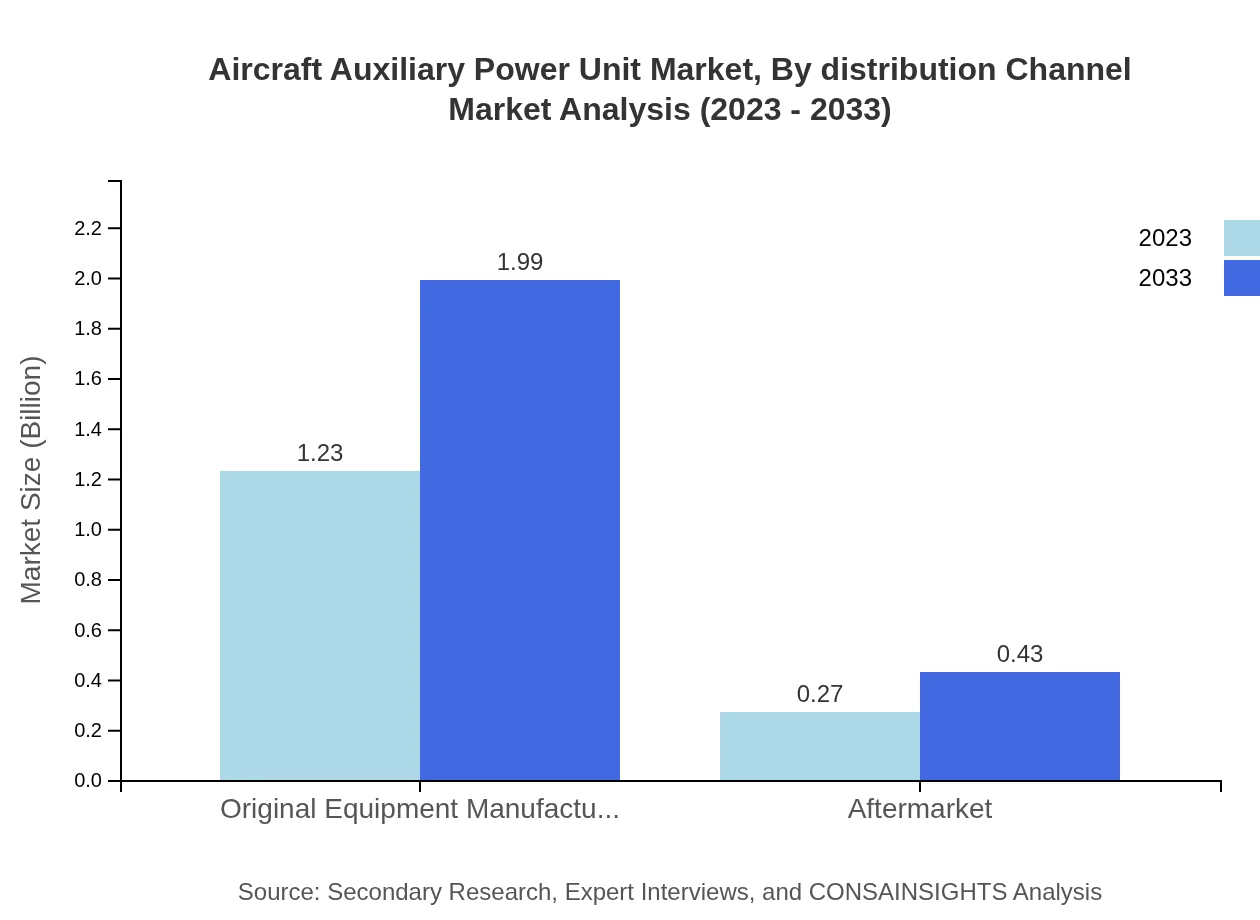

Aircraft Auxiliary Power Unit Market Analysis By Distribution Channel

The APU market distribution is categorized into OEM and aftermarket segments, with the OEM segment significantly leading, from $1.23 billion in 2023 to $1.99 billion by 2033, accounting for a robust 82.07% share. The aftermarket is anticipated to expand from $0.27 billion to $0.43 billion, illustrating the importance of maintenance and support services in enhancing APU lifecycle.

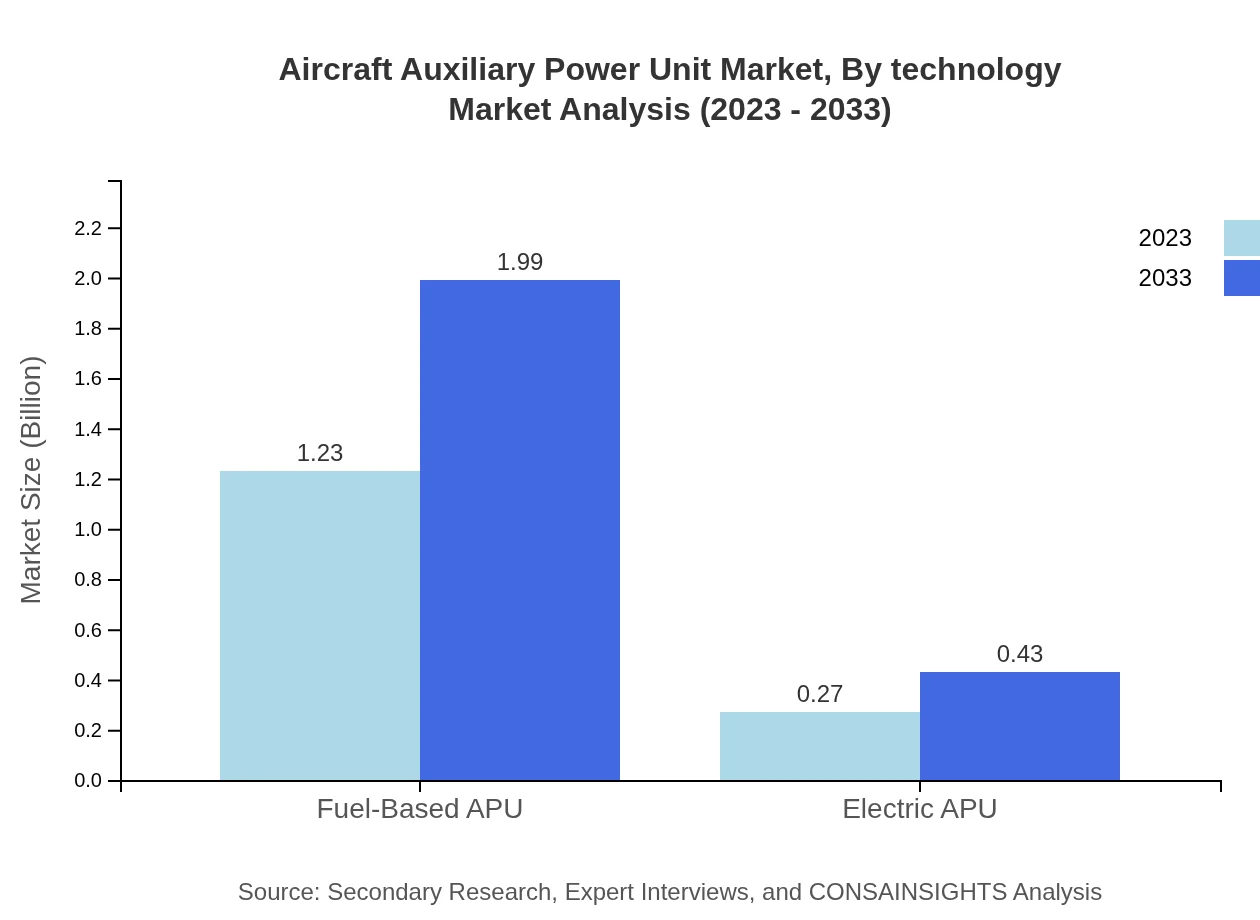

Aircraft Auxiliary Power Unit Market Analysis By Technology

The APU technology segment highlights rapid advancements, especially in electric and hybrid systems. These technologies are witnessing increased investments and R&D efforts aimed at reducing energy consumption and emissions, offering a competitive edge in environmentally-conscious markets.

Aircraft Auxiliary Power Unit Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Auxiliary Power Unit Industry

Honeywell Aerospace:

Honeywell is a global leader in aerospace systems, developing advanced APUs that enhance efficiency and reduce emissions, bolstering its market share.UTC Aerospace Systems:

Part of Raytheon Technologies, UTC Aerospace is known for its innovative power solutions, providing APUs designed to maximize aircraft performance.Safran:

Safran is a key player in the APU market, known for its cutting-edge technologies and commitment to reducing environmental impacts.Bergstrom Inc.:

Bergstrom specializes in thermal and electrical systems for aircraft, including efficient APU solutions for various aircraft types.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Auxiliary Power Unit?

The global market size for aircraft auxiliary power units (APUs) was valued at $1.5 billion in 2023, with a projected CAGR of 4.8% from 2023 to 2033, ensuring a steady growth trajectory in the aerospace industry.

What are the key market players or companies in the aircraft Auxiliary Power Unit industry?

Key players in the aircraft auxiliary power unit industry include major OEMs and aftermarket suppliers. Companies such as Honeywell Aerospace, Pratt & Whitney, and Safran are significant contributors, driving innovation and market growth.

What are the primary factors driving the growth in the aircraft Auxiliary Power Unit industry?

Factors driving growth include the increasing demand for efficient energy sources in aircraft, advancements in APU technology, and the rising number of aircraft deliveries globally, alongside a focus on reducing environmental impact.

Which region is the fastest Growing in the aircraft Auxiliary Power Unit?

In the aircraft auxiliary power unit market, Europe is projected to grow from $0.53 billion in 2023 to $0.86 billion by 2033, emerging as the fastest-growing region due to high air travel demand and technological advancements.

Does ConsaInsights provide customized market report data for the aircraft Auxiliary Power Unit industry?

Yes, ConsaInsights offers tailored market research reports for the aircraft auxiliary power unit industry, catering to specific client needs, including customized analysis, data segmentation, and forecasts that align with business strategies.

What deliverables can I expect from this aircraft Auxiliary Power Unit market research project?

From this market research project, expect detailed insights including market size estimations, segment analysis, growth forecasts, competitive landscape profiles, and trends in technology development for aircraft auxiliary power units.

What are the market trends of aircraft Auxiliary Power Unit?

Current trends in the aircraft auxiliary power unit market include a shift towards more fuel-efficient and electric APUs, increased integration of digital technologies, and a growing emphasis on sustainability and reduced emissions in aviation.