Aircraft Battery Market Report

Published Date: 03 February 2026 | Report Code: aircraft-battery

Aircraft Battery Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the global Aircraft Battery market, outlining current trends, forecasts from 2023 to 2033, and insights into market dynamics, segmentation, and regional performances.

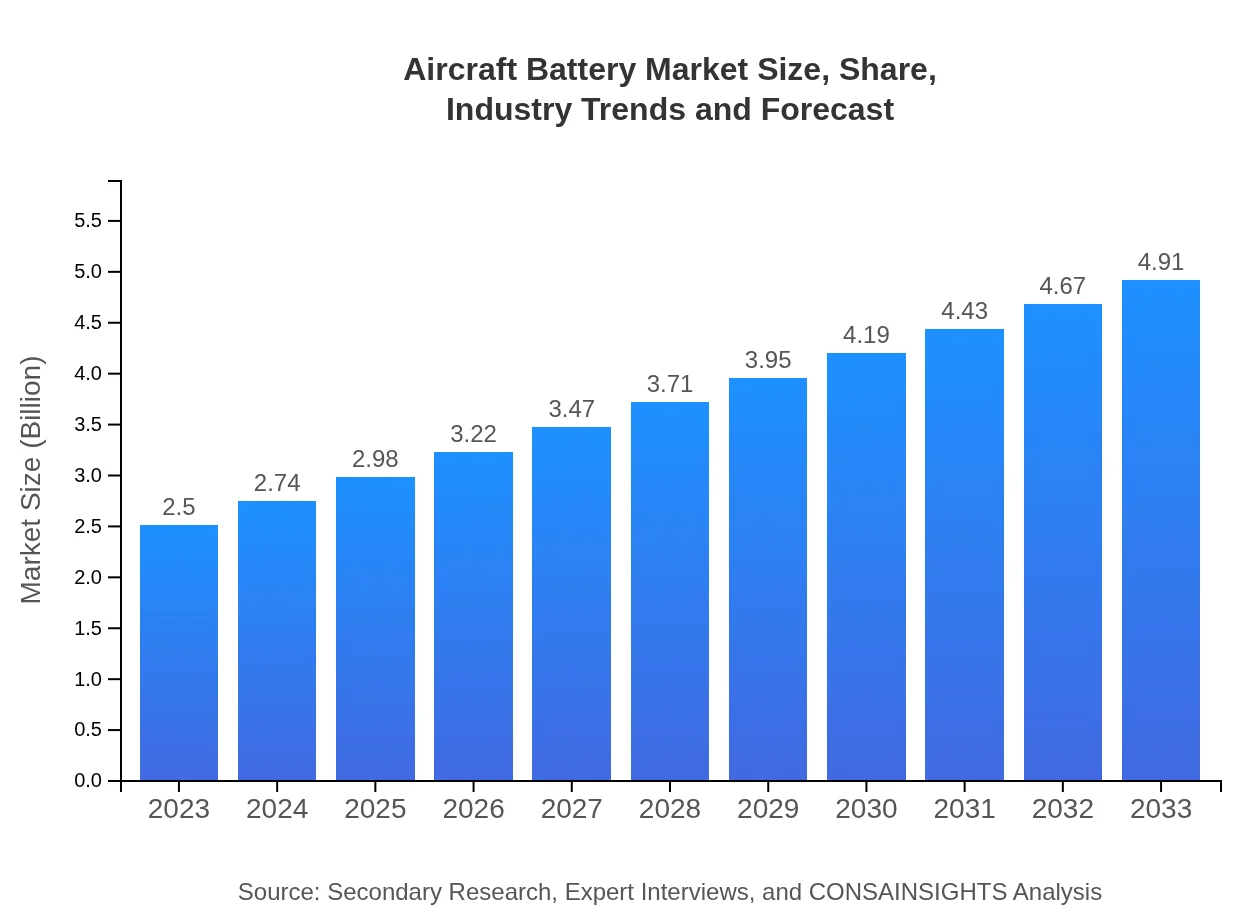

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Saft Groupe S.A., Aerospace Energy, EnerSys, Aviators & Aerospace Co. |

| Last Modified Date | 03 February 2026 |

Aircraft Battery Market Overview

Customize Aircraft Battery Market Report market research report

- ✔ Get in-depth analysis of Aircraft Battery market size, growth, and forecasts.

- ✔ Understand Aircraft Battery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Battery

What is the Market Size & CAGR of Aircraft Battery market in 2023?

Aircraft Battery Industry Analysis

Aircraft Battery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Battery Market Analysis Report by Region

Europe Aircraft Battery Market Report:

Europe’s Aircraft Battery market is projected to experience steady growth, from USD 0.76 billion in 2023 to USD 1.50 billion by 2033. With stringent environmental regulations and a strong emphasis on reducing carbon emissions, the EU is pushing for more electric and hybrid aircraft, influencing battery demand.Asia Pacific Aircraft Battery Market Report:

The Asia Pacific region is experiencing significant growth in the Aircraft Battery market owing to increased air travel and government initiatives to boost aviation infrastructure. In 2023, the market size is estimated at USD 0.48 billion, forecasted to grow to USD 0.94 billion by 2033, driven by rising demand for commercial aircraft and military upgrades.North America Aircraft Battery Market Report:

North America remains a leading market for Aircraft Batteries, attributed to the presence of major aircraft manufacturers and a strong focus on innovation. The market is projected to grow from USD 0.82 billion in 2023 to USD 1.61 billion by 2033, supported by advancements in battery technology and increasing safety regulations.South America Aircraft Battery Market Report:

South America presents a nascent but growing market for Aircraft Batteries, projected to increase from USD 0.20 billion in 2023 to USD 0.38 billion in 2033. Increased investments in regional airlines and modernization of military fleets are essential factors contributing to this growth.Middle East & Africa Aircraft Battery Market Report:

The Middle East and Africa region is emerging as a promising market for Aircraft Batteries, anticipated to grow from USD 0.24 billion in 2023 to USD 0.48 billion by 2033. This growth is spurred by investments in aviation infrastructure and the role of regional airlines in promoting air travel.Tell us your focus area and get a customized research report.

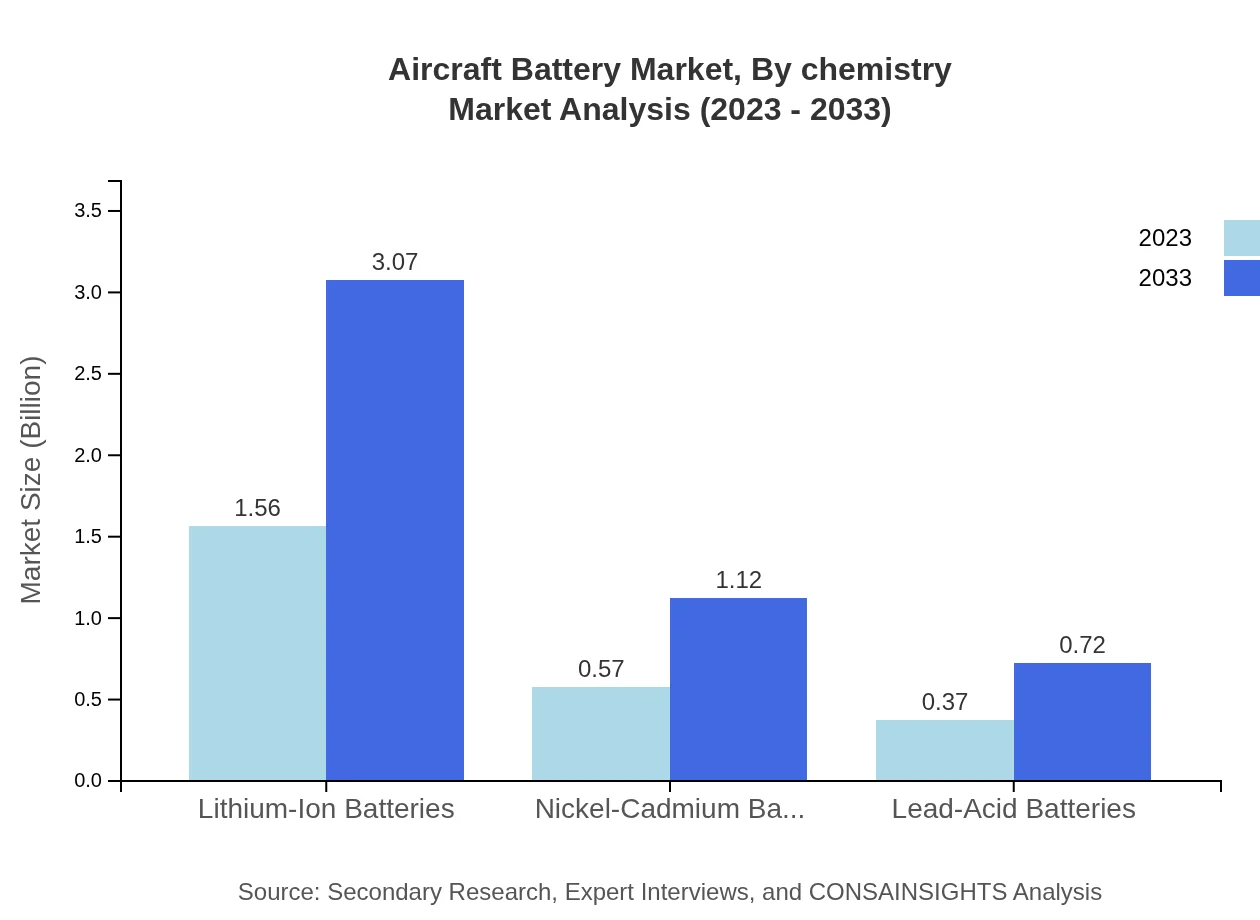

Aircraft Battery Market Analysis By Chemistry

Lithium-Ion Batteries dominate the Aircraft Battery market, holding a market size of USD 1.56 billion in 2023, and projected to reach USD 3.07 billion by 2033, maintaining a market share of 62.56%. Nickel-Cadmium Batteries, with a size of USD 0.57 billion in 2023, are expected to grow to USD 1.12 billion by 2033. Lead-Acid Batteries, though declining, still hold a segment with significant applications, growing from USD 0.37 billion in 2023 to USD 0.72 billion in 2033.

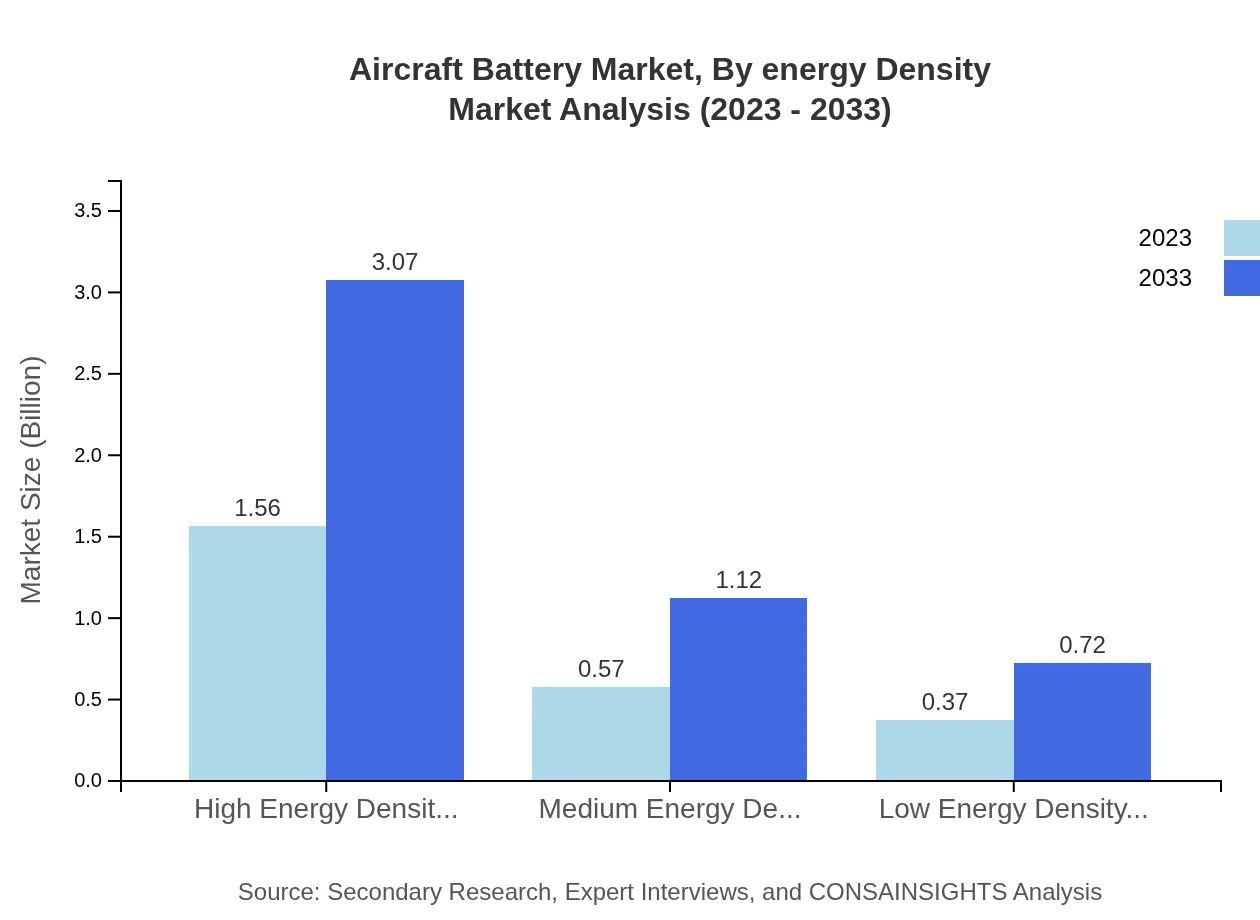

Aircraft Battery Market Analysis By Energy Density

High Energy Density Batteries represent the largest market share at USD 1.56 billion in 2023, projected to double to USD 3.07 billion by 2033, ensuring efficiency in aircraft operations. Medium Energy Density Batteries, currently at USD 0.57 billion, are expected to increase to USD 1.12 billion. Low Energy Density Batteries, with a size of USD 0.37 billion in 2023, are projected to reach USD 0.72 billion, serving specific applications primarily in older aircraft models.

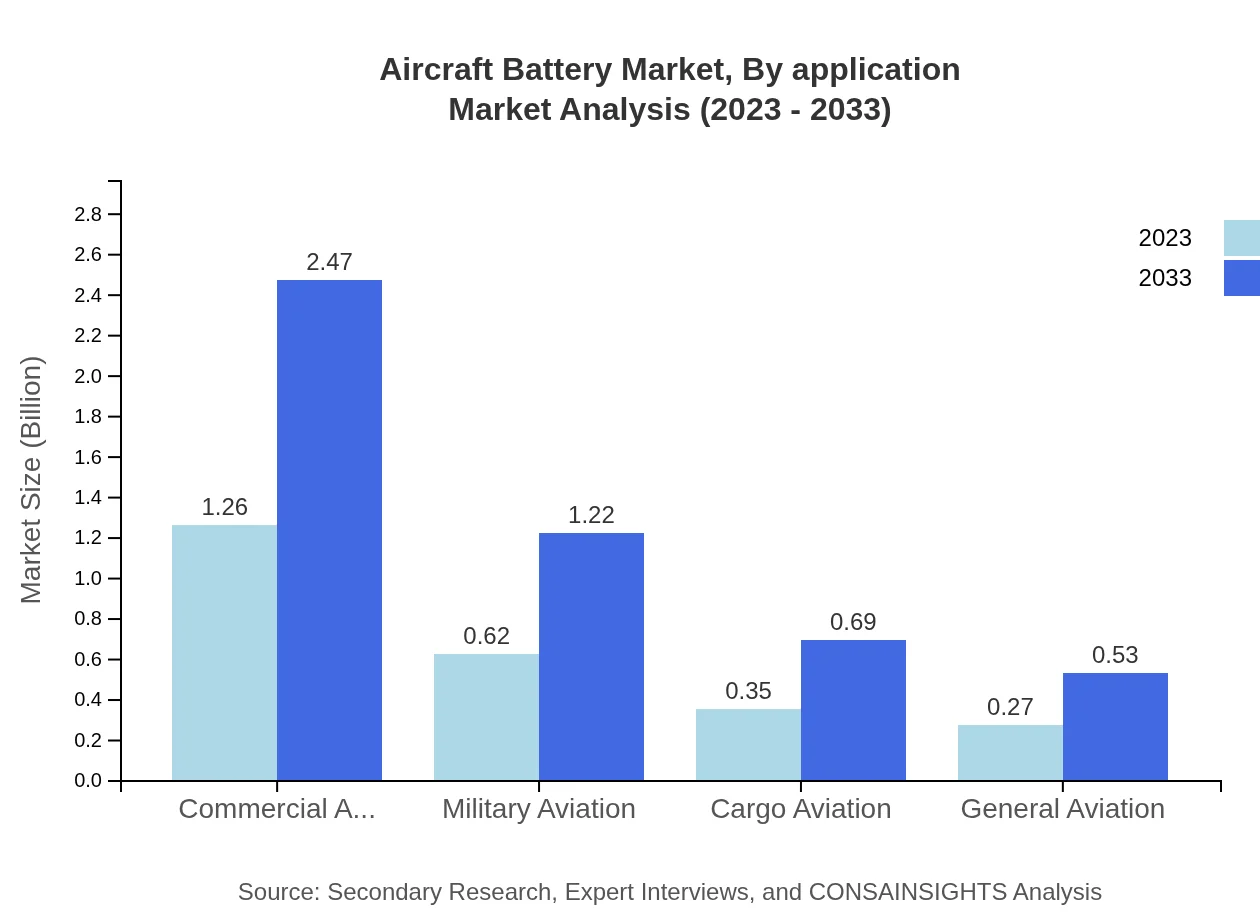

Aircraft Battery Market Analysis By Application

Commercial Aviation remains the largest segment, valued at USD 1.26 billion in 2023, and expected to grow to USD 2.47 billion by 2033, representing a substantial market share of 50.32%. Military Aviation and Cargo Aviation also showcase growth, from USD 0.62 billion to USD 1.22 billion and USD 0.35 billion to USD 0.69 billion, respectively. General Aviation, holding a smaller slice, will grow from USD 0.27 billion to USD 0.53 billion.

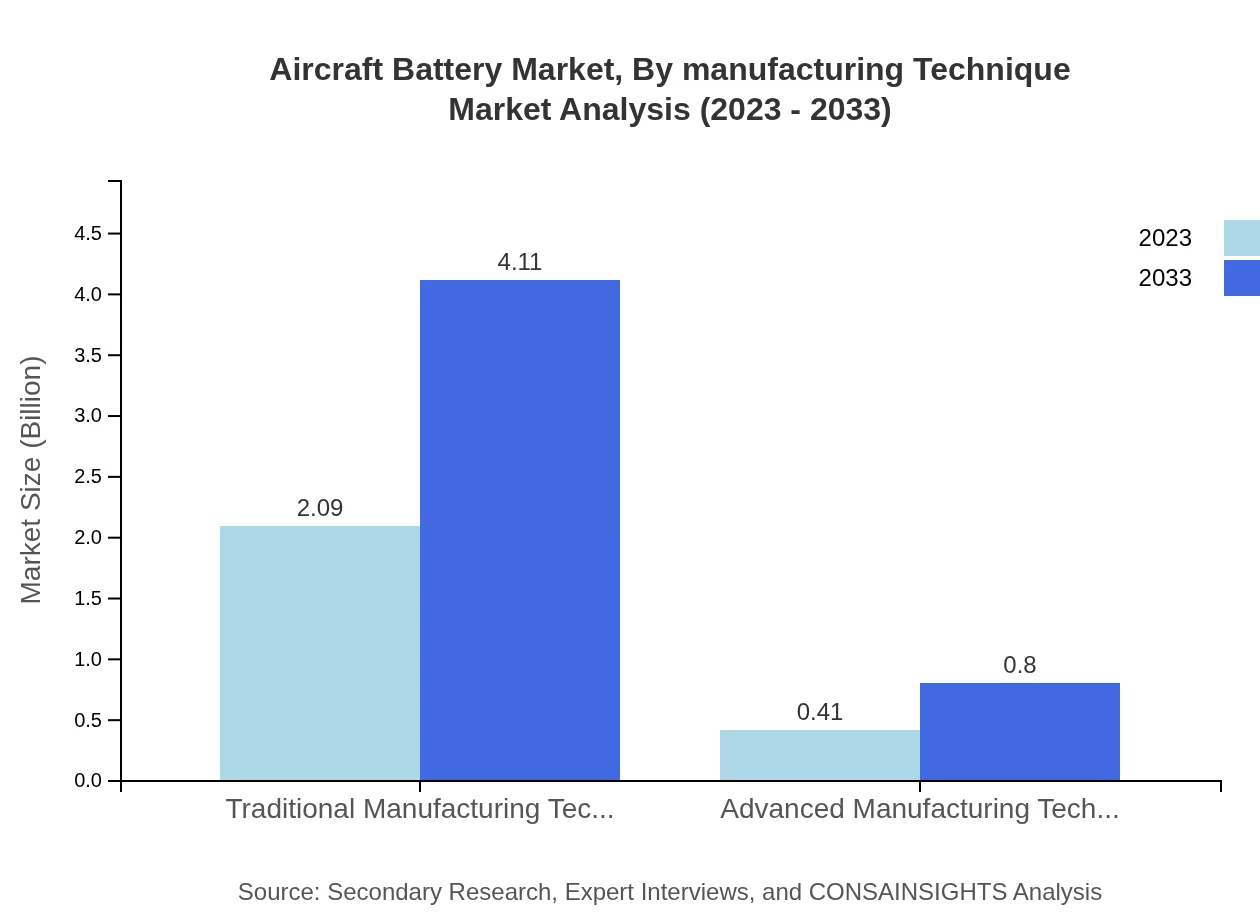

Aircraft Battery Market Analysis By Manufacturing Technique

The market analysis reveals Traditional Manufacturing Techniques as the most prevalent, with a market size of USD 2.09 billion in 2023, projected to increase to USD 4.11 billion by 2033. Advanced Manufacturing Techniques currently account for USD 0.41 billion but are anticipated to expand as the industry embraces innovation.

Aircraft Battery Market Analysis By Regulatory Framework

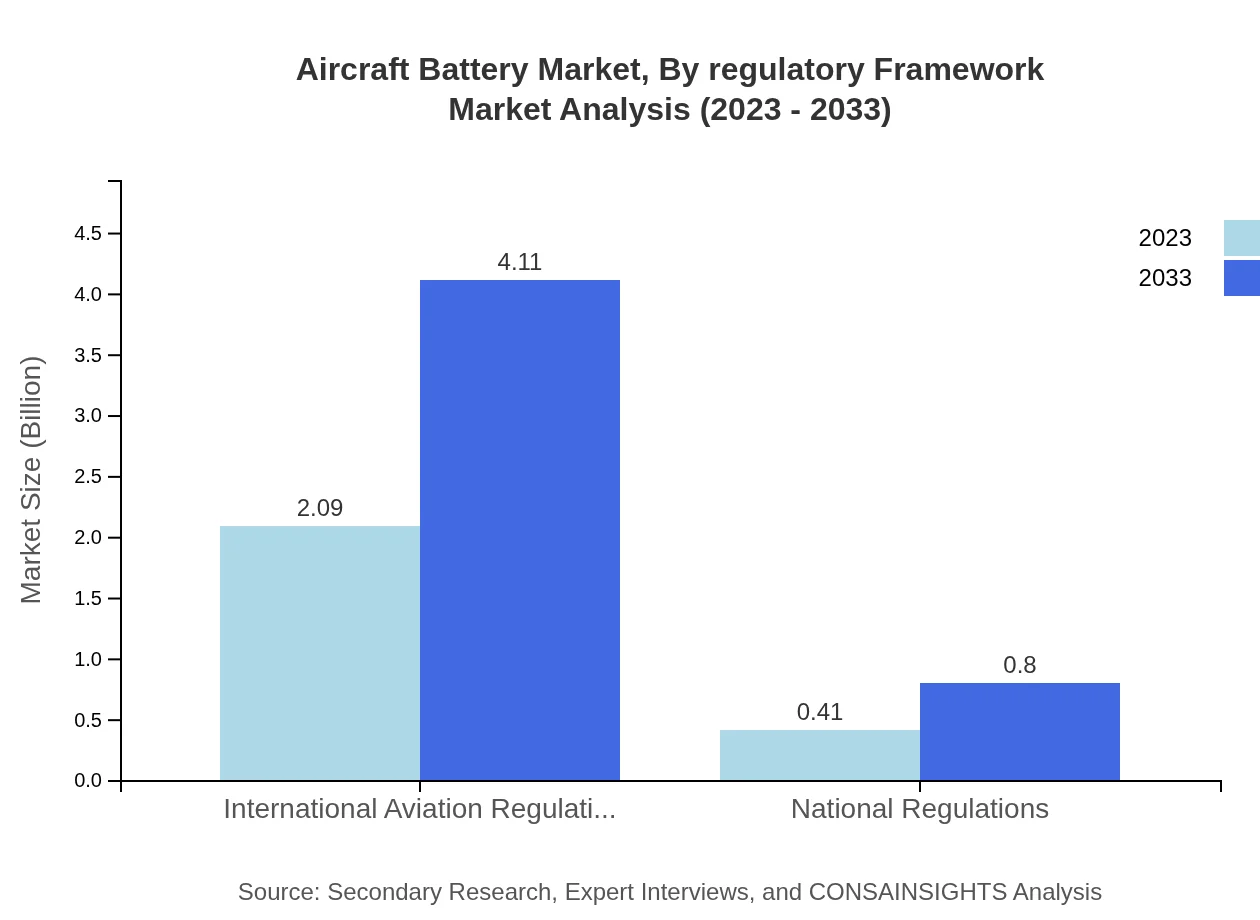

International Aviation Regulations govern a large portion of the market, with growth from USD 2.09 billion in 2023 to USD 4.11 billion by 2033. National Regulations, while smaller in comparison, are expected to grow from USD 0.41 billion to USD 0.80 billion, indicating the importance of compliance in solution offerings.

Aircraft Battery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Battery Industry

Saft Groupe S.A.:

A key player in advanced battery systems, Saft specializes in Li-ion battery technologies for aviation, with strong emphasis on R&D and sustainable solutions.Aerospace Energy:

Known for innovative battery designs, Aerospace Energy focuses on energy density and efficiency, providing solutions for commercial and military aviation.EnerSys:

EnerSys is an established energy solutions provider, recognized for its comprehensive battery technologies and reliable services across various aviation segments.Aviators & Aerospace Co.:

Aviators & Aerospace offers bespoke battery solutions focused on performance and safety, enhancing aircraft operation efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of Aircraft Battery?

The Aircraft Battery market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 6.8%. By 2033, the market is expected to experience notable growth as demand for advanced battery technologies increases.

What are the key market players or companies in the Aircraft Battery industry?

Key players in the Aircraft Battery industry include major manufacturers such as Saft Groupe S.A., A123 Systems, Inc., and Concorde Battery Corporation. These companies dominate through innovative technologies and partnerships in aviation sector advancements.

What are the primary factors driving the growth in the Aircraft Battery industry?

The growth of the Aircraft Battery industry is chiefly driven by the increasing demand for lightweight batteries, advancements in battery technology, and the rise of electric and hybrid aircraft. Regulatory frameworks promoting eco-friendly solutions also contribute significantly to this growth.

Which region is the fastest Growing in the Aircraft Battery market?

North America is the fastest-growing region in the Aircraft Battery market, expected to grow from $0.82 billion in 2023 to $1.61 billion by 2033. Other notable regions include Europe and Asia Pacific, each showing substantial growth rates.

Does ConsaInsights provide customized market report data for the Aircraft Battery industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the Aircraft Battery industry, ensuring clients receive relevant insights and comprehensive analyses for strategic decision-making.

What deliverables can I expect from this Aircraft Battery market research project?

Deliverables from the Aircraft Battery market research project typically include detailed market analysis reports, segmentation studies, competitive landscape evaluations, and forecasts for market trends and growth opportunities.

What are the market trends of Aircraft Battery?

Current market trends in the Aircraft Battery industry include a shift towards lithium-ion batteries, increasing adoption of renewable energy sources, and innovative manufacturing techniques aimed at enhancing battery performance and efficiency.