Aircraft Cargo Systems Market Report

Published Date: 03 February 2026 | Report Code: aircraft-cargo-systems

Aircraft Cargo Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Cargo Systems market, covering key insights, market sizes, trends, and forecasts from 2023 to 2033. It encompasses regional analyses, segment breakdowns, and technological advancements impacting the industry.

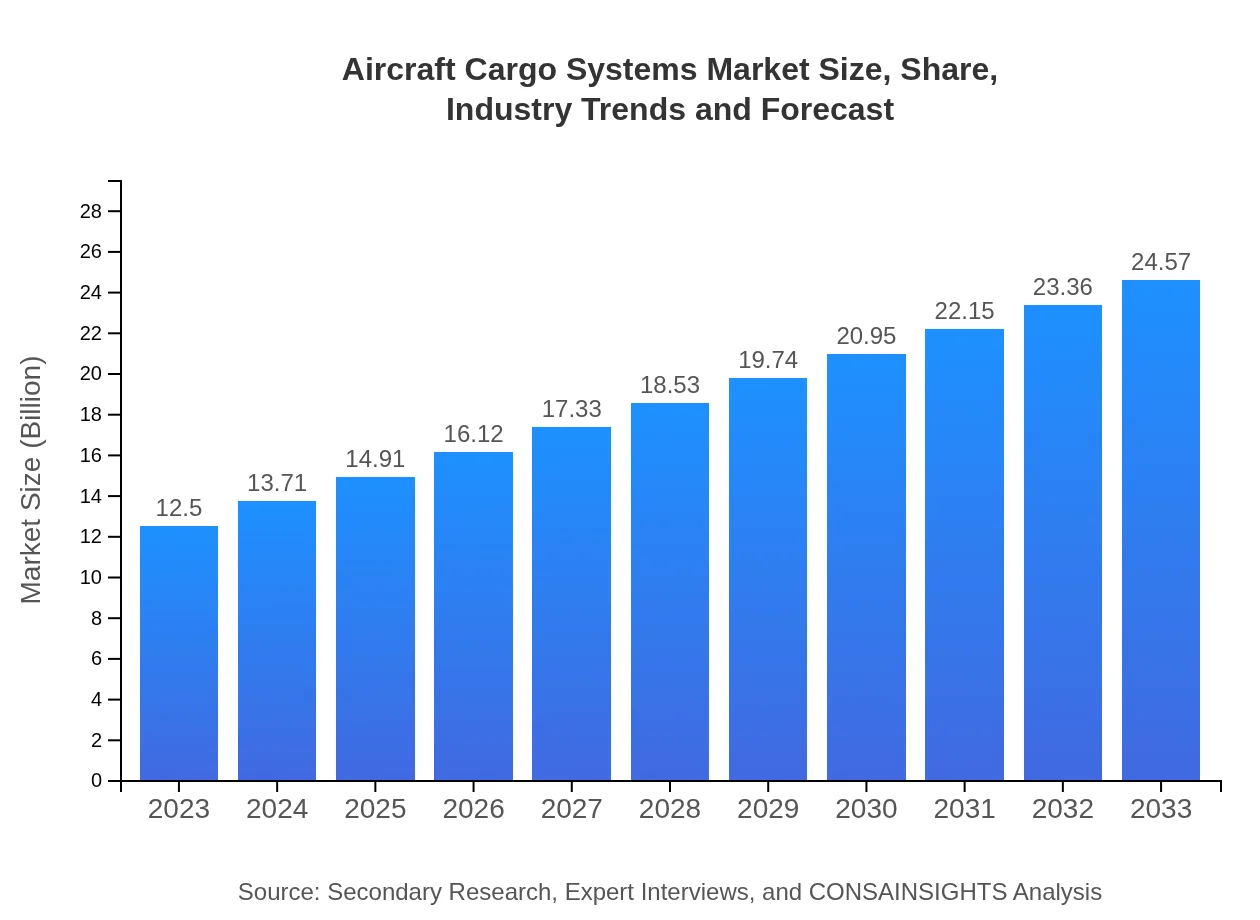

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Honeywell International Inc., Raytheon Technologies Corporation, Collins Aerospace, Lufthansa Technik AG |

| Last Modified Date | 03 February 2026 |

Aircraft Cargo Systems Market Overview

Customize Aircraft Cargo Systems Market Report market research report

- ✔ Get in-depth analysis of Aircraft Cargo Systems market size, growth, and forecasts.

- ✔ Understand Aircraft Cargo Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Cargo Systems

What is the Market Size & CAGR of Aircraft Cargo Systems market in 2023?

Aircraft Cargo Systems Industry Analysis

Aircraft Cargo Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Cargo Systems Market Analysis Report by Region

Europe Aircraft Cargo Systems Market Report:

The European market is also significant, estimated at $3.25 billion in 2023 and expected to reach $6.38 billion by 2033. Factors such as stringent safety regulations in air transport and a shift towards greener logistics solutions are influencing market growth. The region's focus on innovation and improving efficiency in cargo operations is notable.Asia Pacific Aircraft Cargo Systems Market Report:

The Asia Pacific region, valued at $2.64 billion in 2023, is expected to grow to $5.19 billion by 2033. This growth is driven by the increasing volume of air cargo shipping and robust investments in air transport infrastructure across countries like China and India. The expanding middle class and the burgeoning e-commerce market further drive demand for efficient cargo systems in the region.North America Aircraft Cargo Systems Market Report:

North America dominates the Aircraft Cargo Systems market, with a forecasted market size of $4.51 billion in 2023, growing to $8.87 billion by 2033. The region's growth trajectory is propelled by the high demand for air freight services, the presence of major logistics firms, and a strong economy that supports advanced supply chain solutions.South America Aircraft Cargo Systems Market Report:

In South America, the market size is projected to rise from $1.00 billion in 2023 to $1.97 billion by 2033. Growth in this region is supported by increasing trade activities, albeit at a slower pace compared to other regions. The development of airport facilities and improved air transport logistics is bolstering the demand for advanced cargo systems.Middle East & Africa Aircraft Cargo Systems Market Report:

The Middle East and Africa market is projected to grow from $1.10 billion in 2023 to $2.16 billion by 2033. The region is becoming a significant logistics hub, capitalizing on its strategic location between Europe, Asia, and Africa. Investments in aviation infrastructure and burgeoning tourism are boosting the demand for aircraft cargo systems.Tell us your focus area and get a customized research report.

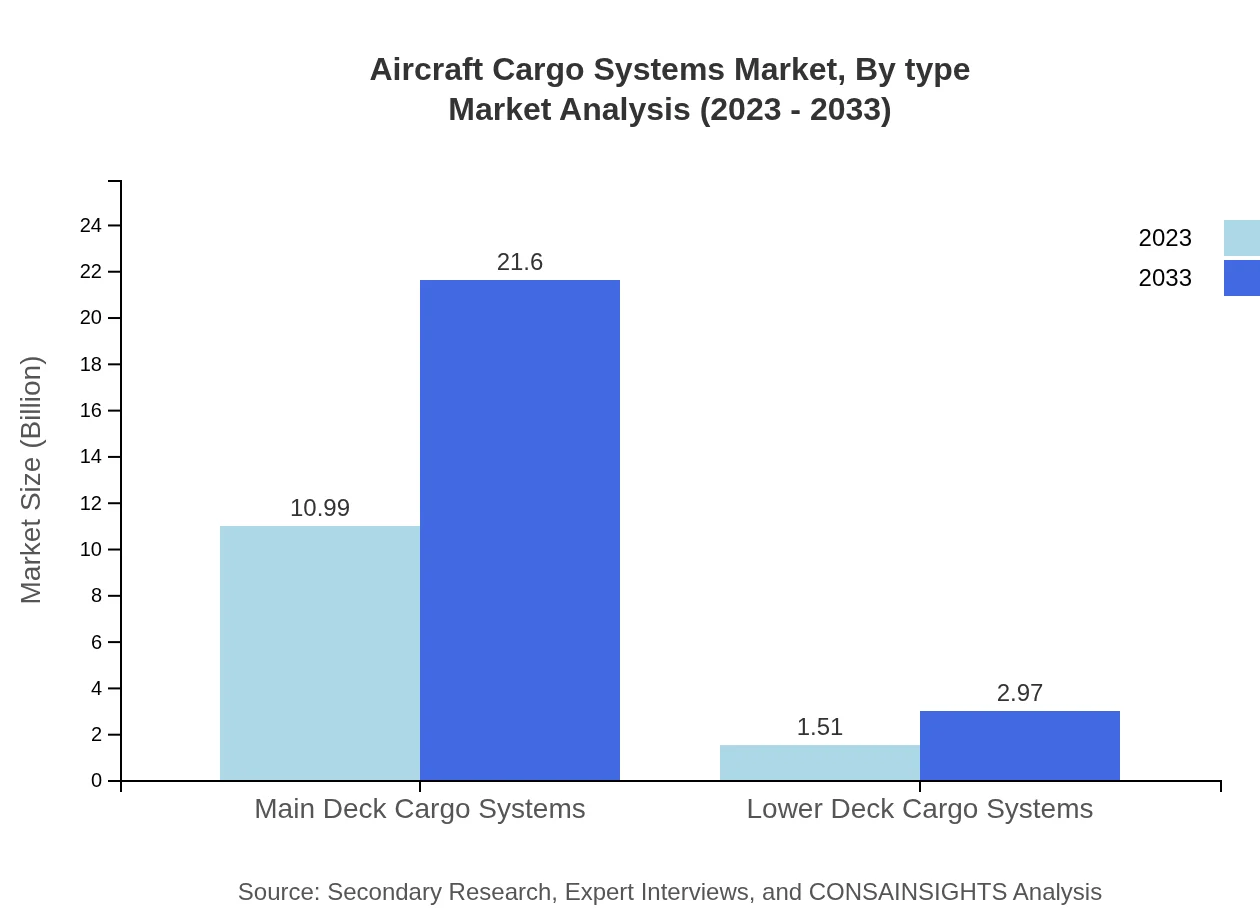

Aircraft Cargo Systems Market Analysis By Type

In terms of product types, the Main Deck Cargo Systems segment is leading with a market size of $10.99 billion in 2023, projected to grow to $21.60 billion by 2033, capturing a significant market share of 87.92%. Conversely, Lower Deck Cargo Systems, valued at $1.51 billion in 2023, will rise to $2.97 billion by 2033, holding a market share of 12.08%. Furthermore, segments such as Automated Cargo Systems and Manual Cargo Systems will exhibit similar growth patterns.

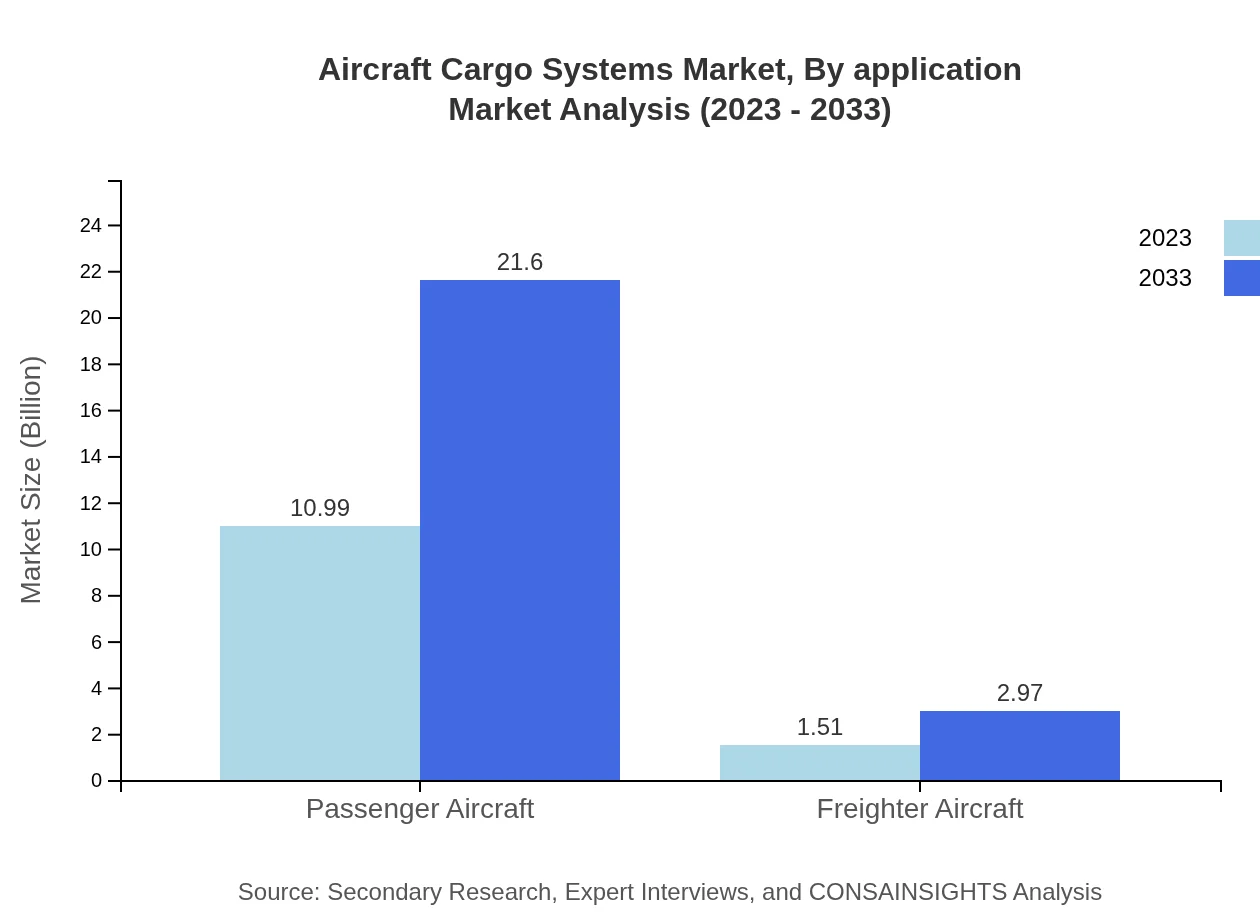

Aircraft Cargo Systems Market Analysis By Application

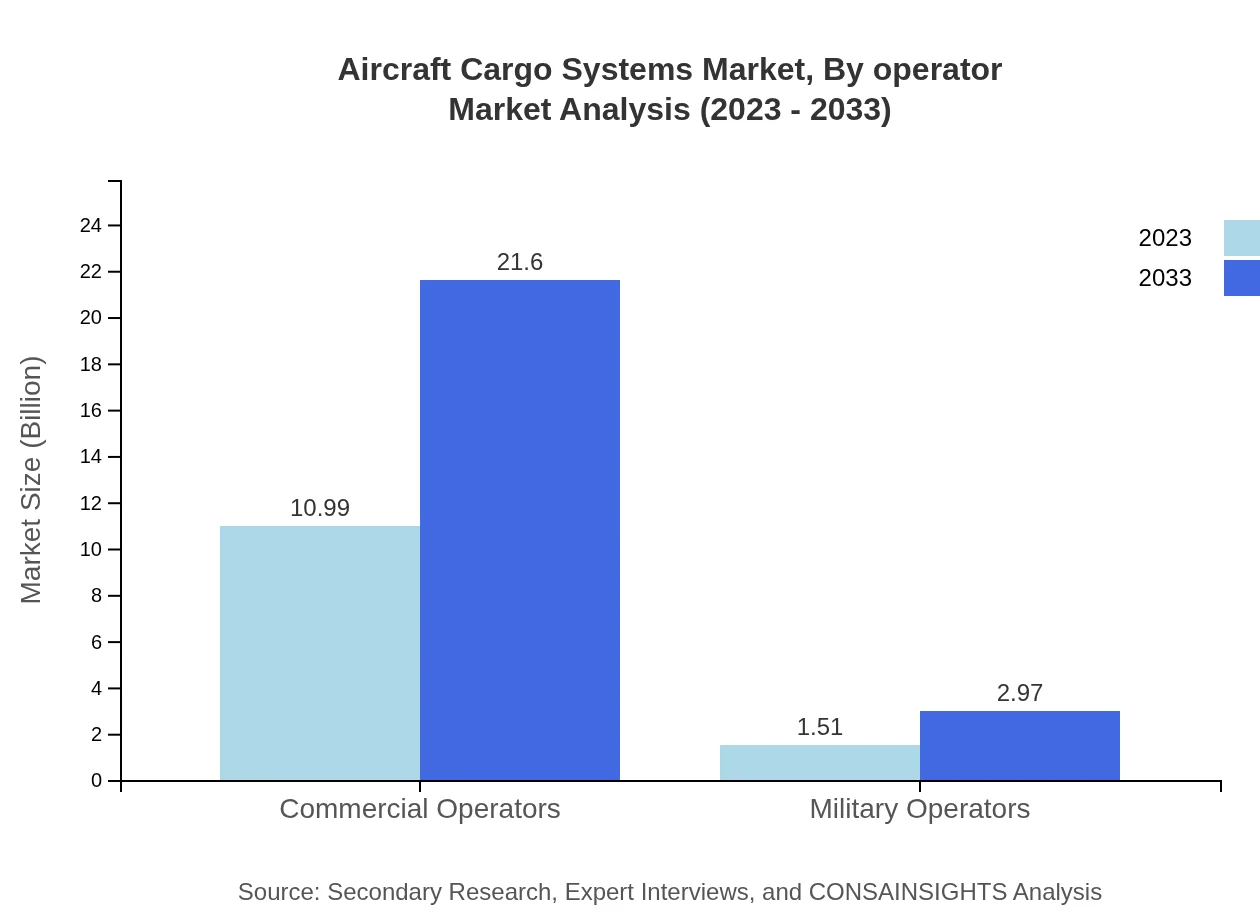

The Aircraft Cargo Systems market by application is segmented into Commercial Operators and Military Operators. The Commercial Operators segment leads with a market size of $10.99 billion in 2023, expected to reach $21.60 billion by 2033, representing a steady growth rate. Conversely, the Military Operators segment, starting at $1.51 billion in 2023, is estimated to reach $2.97 billion by 2033.

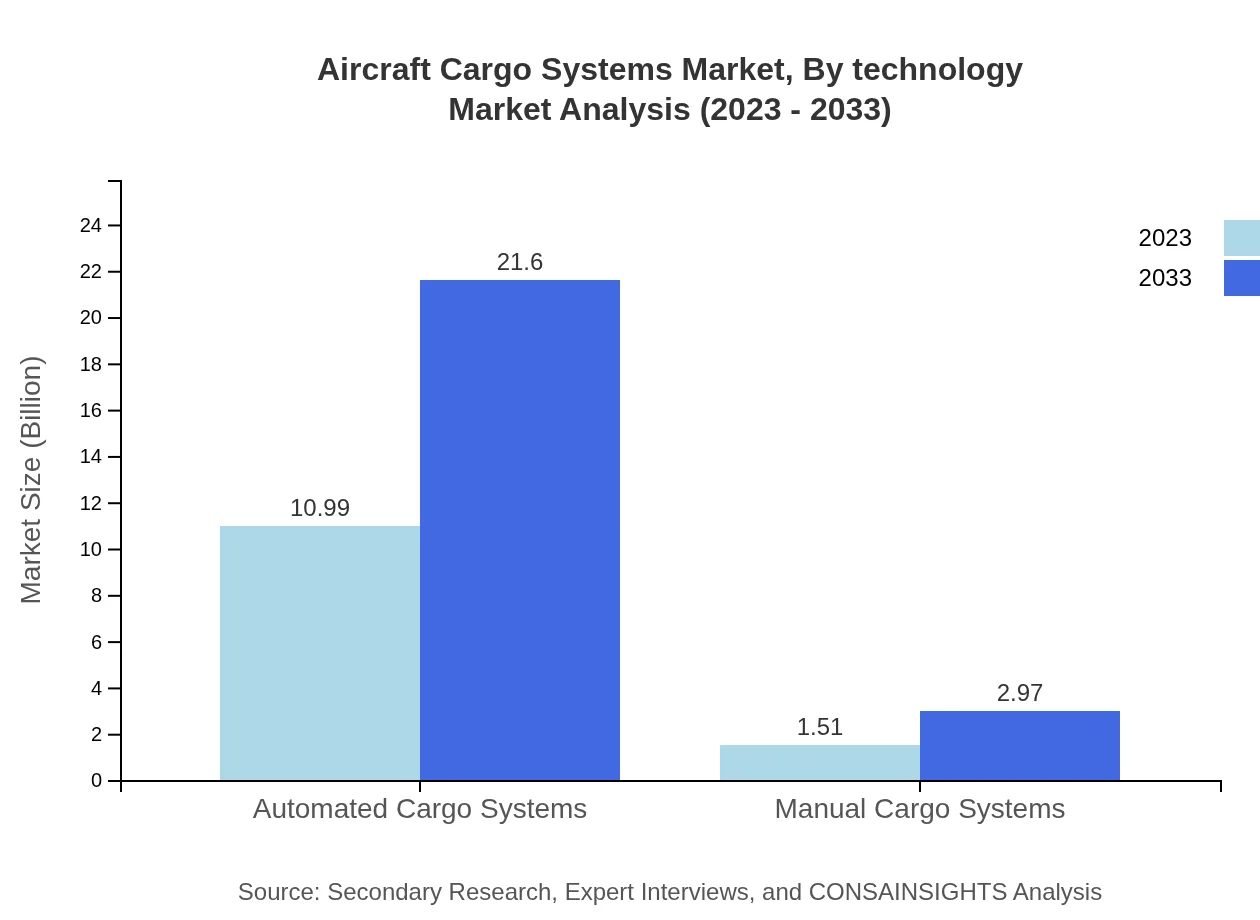

Aircraft Cargo Systems Market Analysis By Technology

Regarding technology, the market is dominated by Automated Cargo Systems, beginning at $10.99 billion in 2023 and projected to expand to $21.60 billion by 2033. The Manual Cargo Systems, valued at $1.51 billion in 2023, is expected to grow to $2.97 billion by 2033, indicating a shift towards automation-driven solutions in cargo handling.

Aircraft Cargo Systems Market Analysis By Configuration

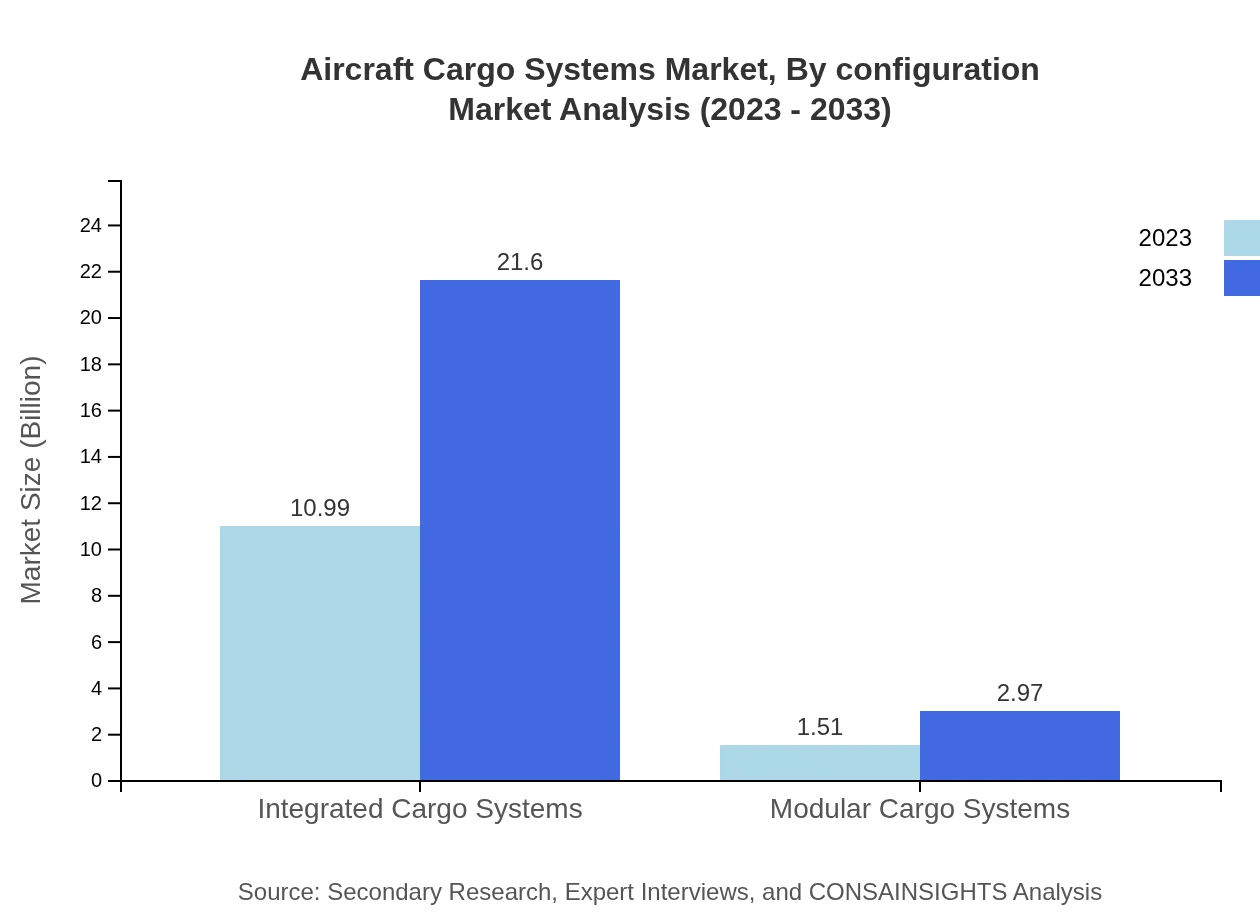

The configuration segment analyzes various types of cargo systems used in aircraft operations, including Integrated Cargo Systems and Modular Cargo Systems. The Integrated Cargo Systems currently holds a large share, starting from $10.99 billion in 2023 to $21.60 billion by 2033, while Modular Cargo Systems are set to grow from $1.51 billion to $2.97 billion in the same timeframe.

Aircraft Cargo Systems Market Analysis By Operator

This segment evaluates the performance of the Aircraft Cargo Systems market under different operational setups, emphasizing Commercial Operators and Military Operators' shared growth patterns. Commercial Operators dominate significantly with expected growth from $10.99 billion to $21.60 billion by 2033, while Military Operators are forecasted to increase from $1.51 billion to $2.97 billion.

Aircraft Cargo Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Cargo Systems Industry

Honeywell International Inc.:

Honeywell provides integrated cargo solutions that improve efficiency and safety across cargo operations in aviation.Raytheon Technologies Corporation:

Raytheon Technologies specializes in advanced cargo systems and equipment, enabling innovative solutions for air transport.Collins Aerospace:

Collins Aerospace offers comprehensive cargo management solutions and cargo handling systems with a focus on automation and efficiency.Lufthansa Technik AG:

Lufthansa Technik AG provides extensive cargo handling services and solutions for commercial and freighter aircraft.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft cargo systems?

The global aircraft cargo systems market is projected to reach $12.5 billion by 2033, growing at a CAGR of 6.8%. In 2023, the market size stands at approximately $12.5 billion, indicating robust growth prospects in the aviation sector.

What are the key market players or companies in the aircraft cargo systems industry?

Key players in the aircraft cargo systems market include Boeing, Airbus, Thyssenkrupp AG, and Saudia Aerospace Engineering Industries. These companies are pivotal in driving innovations and improvements in cargo systems technology.

What are the primary factors driving the growth in the aircraft cargo systems industry?

The growth of the aircraft cargo systems market is primarily driven by an increase in air freight demand, technological advancements, and the rising need for efficient logistics solutions in supply chains across industries.

Which region is the fastest Growing in the aircraft cargo systems market?

The Asia Pacific region exhibits the fastest growth in the aircraft cargo systems market, projected to grow from $2.64 billion in 2023 to $5.19 billion by 2033, driven by rising trade activities and expanding air cargo capacities.

Does ConsaInsights provide customized market report data for the aircraft cargo systems industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the aircraft cargo systems industry, ensuring that clients receive relevant insights and analysis for informed decision-making.

What deliverables can I expect from this aircraft cargo systems market research project?

Deliverables from the aircraft cargo systems market research project include comprehensive market reports, segment analysis, regional insights, and trend forecasts, equipping stakeholders with essential data for strategic planning.

What are the market trends of aircraft cargo systems?

Key trends in the aircraft cargo systems market include the shift towards automation, the adoption of integrated cargo systems, and a growing emphasis on sustainability in logistics operations.