Aircraft Computers Market Report

Published Date: 03 February 2026 | Report Code: aircraft-computers

Aircraft Computers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Computers market, covering insights into market size, CAGR, current trends, and forecasts spanning the years 2023 to 2033. It aims to equip stakeholders with essential data for strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

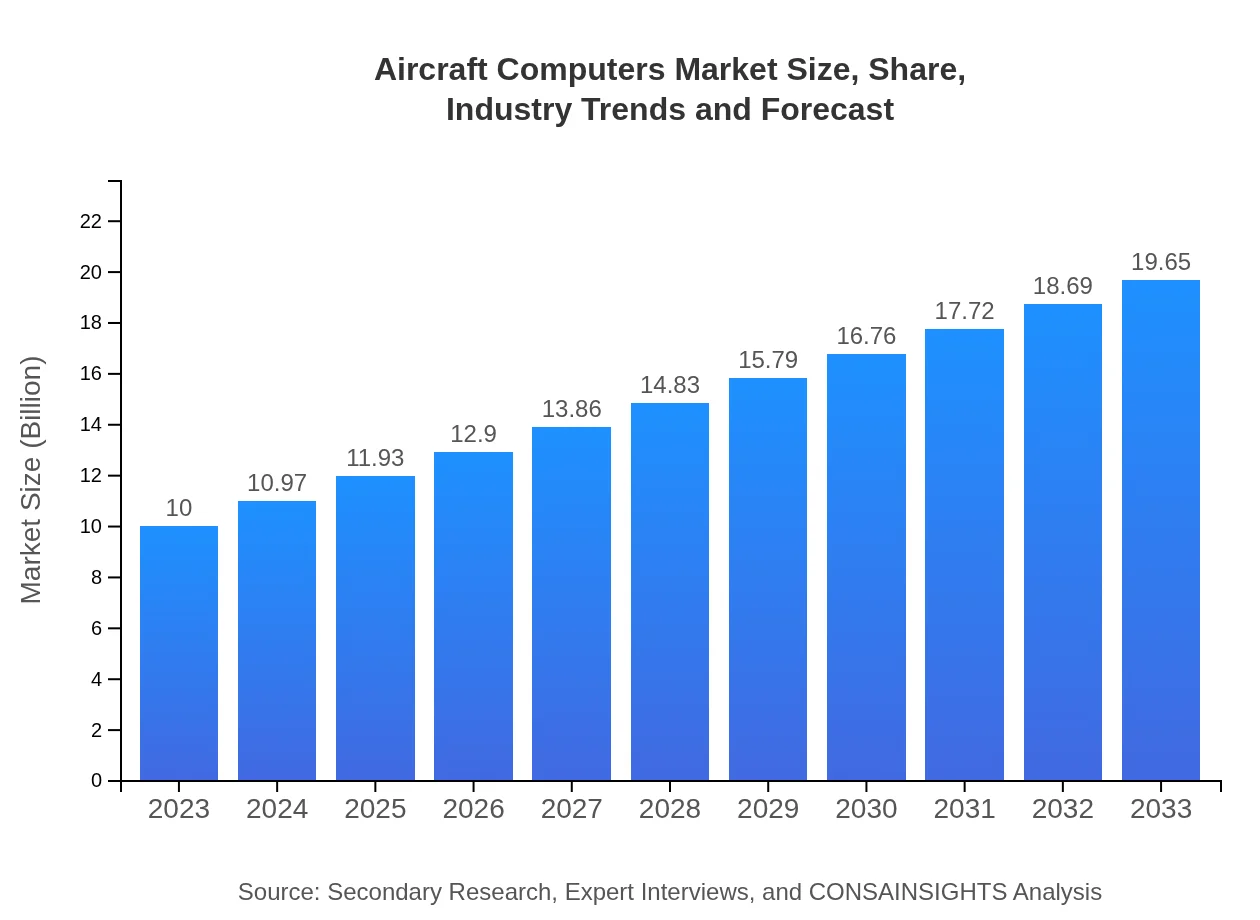

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $19.65 Billion |

| Top Companies | Honeywell International Inc., Thales Group, General Electric Company, Raytheon Technologies, BAE Systems |

| Last Modified Date | 03 February 2026 |

Aircraft Computers Market Overview

Customize Aircraft Computers Market Report market research report

- ✔ Get in-depth analysis of Aircraft Computers market size, growth, and forecasts.

- ✔ Understand Aircraft Computers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Computers

What is the Market Size & CAGR of Aircraft Computers market in 2023?

Aircraft Computers Industry Analysis

Aircraft Computers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Computers Market Analysis Report by Region

Europe Aircraft Computers Market Report:

The European market size for Aircraft Computers was around $2.75 billion in 2023, forecasted to grow to $5.41 billion by 2033. The region is witnessing significant investments in sustainable aviation solutions and a shift towards digital aircraft, which is impacting the growth of aircraft computers. The presence of major manufacturers and suppliers also bolsters market development.Asia Pacific Aircraft Computers Market Report:

The Asia Pacific region is projected to exhibit strong market growth, with an estimated market size of $1.93 billion in 2023, expected to reach $3.79 billion by 2033. This growth is driven by rising air traffic demand, increasing investments in aviation infrastructure, and a burgeoning aerospace manufacturing sector, particularly in countries like China and India. Regional governments are also enhancing defense capabilities, leading to increased demand for military aircraft systems.North America Aircraft Computers Market Report:

North America represented the largest Aircraft Computers market, with a size of $3.34 billion in 2023, projected to grow to approximately $6.56 billion by 2033. The U.S. aviation sector, characterized by technological leadership and a robust defense industry, drives demand for advanced aircraft systems, alongside continuous upgrades and retrofitting of older fleets.South America Aircraft Computers Market Report:

In South America, the Aircraft Computers market is anticipated to grow from $0.99 billion in 2023 to $1.94 billion by 2033. Growth in this region is attributed to improvements in regional connectivity, increasing domestic and international travel, and a focus on modernizing aviation technologies. Brazil, being the largest market, is central to these advancements.Middle East & Africa Aircraft Computers Market Report:

The Middle East and Africa market for Aircraft Computers is estimated to grow from $1.00 billion in 2023 to $1.96 billion by 2033. This growth is linked to the UAE's aggressive expansion in aviation and tourism, alongside military enhancements seen in several countries. The region aims to standardize and integrate advanced aeronautical technologies, driving demand for sophisticated computing solutions.Tell us your focus area and get a customized research report.

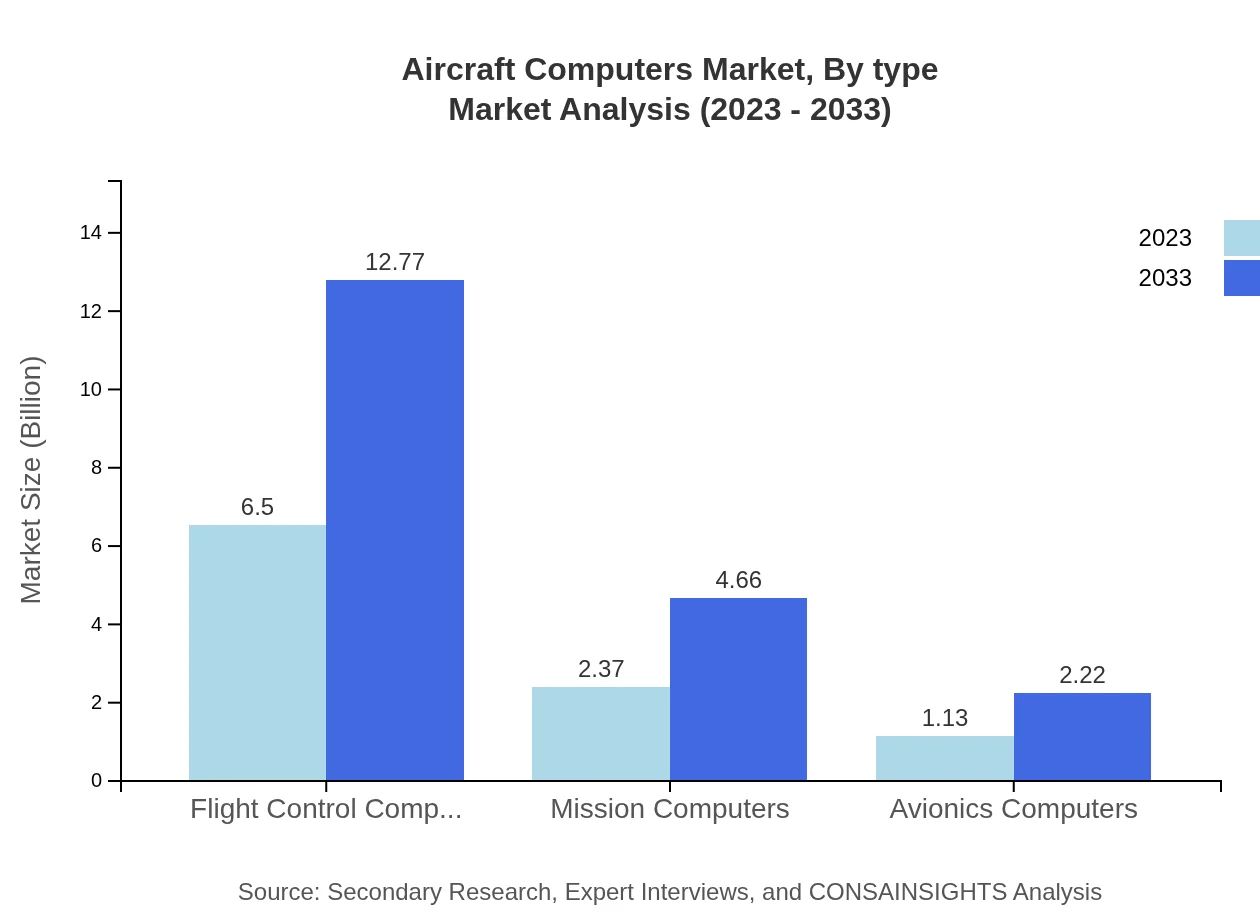

Aircraft Computers Market Analysis By Type

The market is significantly influenced by various computer types. Flight control computers dominate the landscape, expected to grow from $6.50 billion in 2023 to $12.77 billion by 2033, accounting for 64.96% of the market share throughout the forecast period. Mission computers follow, growing from $2.37 billion to $4.66 billion (23.72% share), while avionics computers represent $1.13 billion, increasing to $2.22 billion (11.32% share). Embedded systems are substantial players, particularly as Original Equipment Manufacturers (OEMs) commit to advanced technology cohorts.

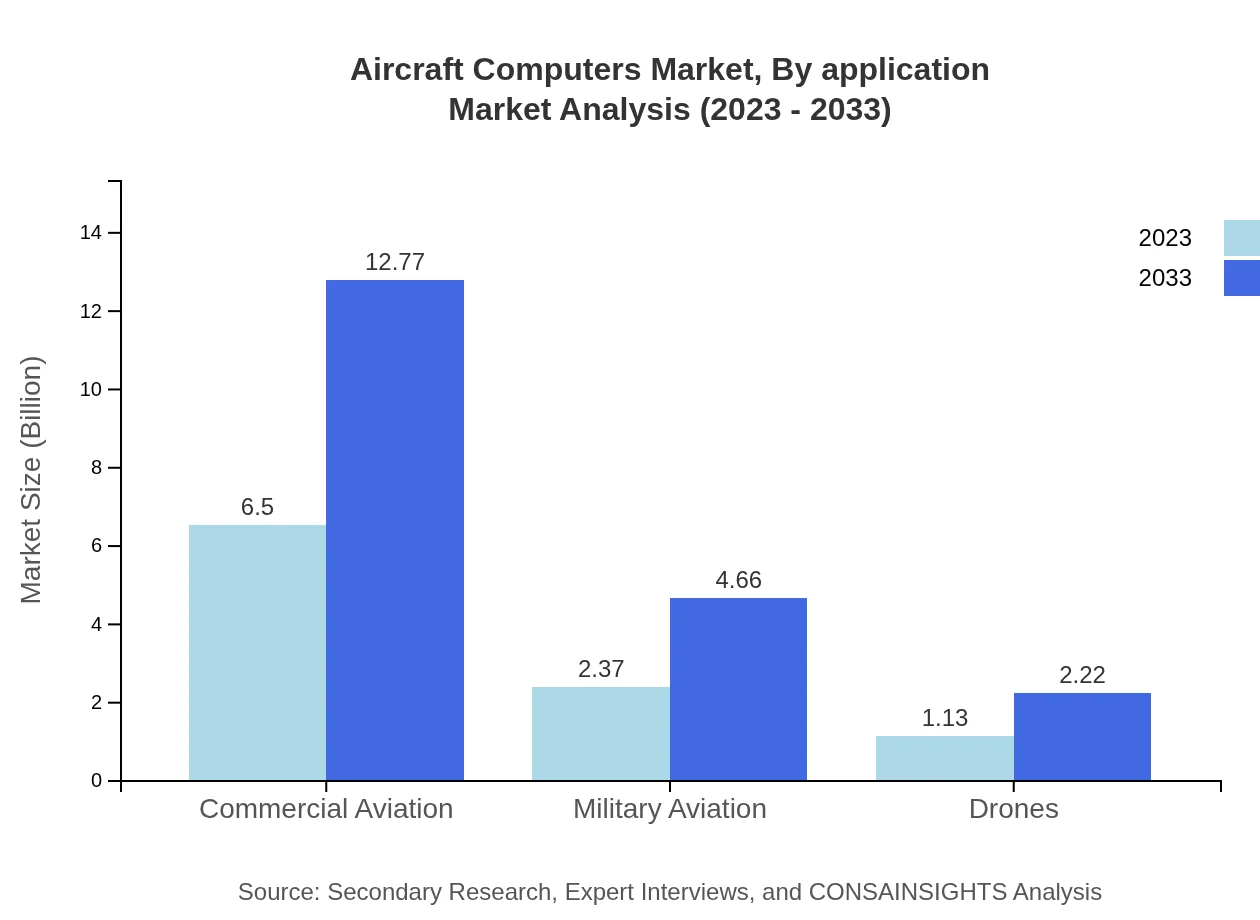

Aircraft Computers Market Analysis By Application

Segments include commercial aviation, military aviation, and drone applications. Commercial aviation commands the majority market share, growing from $6.50 billion in 2023 to $12.77 billion in 2033 (64.96% share), reflecting the resilience of the passenger air travel sector. Military aviation remains a key growth area due to rising defense budgets, while drones are an emerging segment with increasing applications in both commercial and defense sectors.

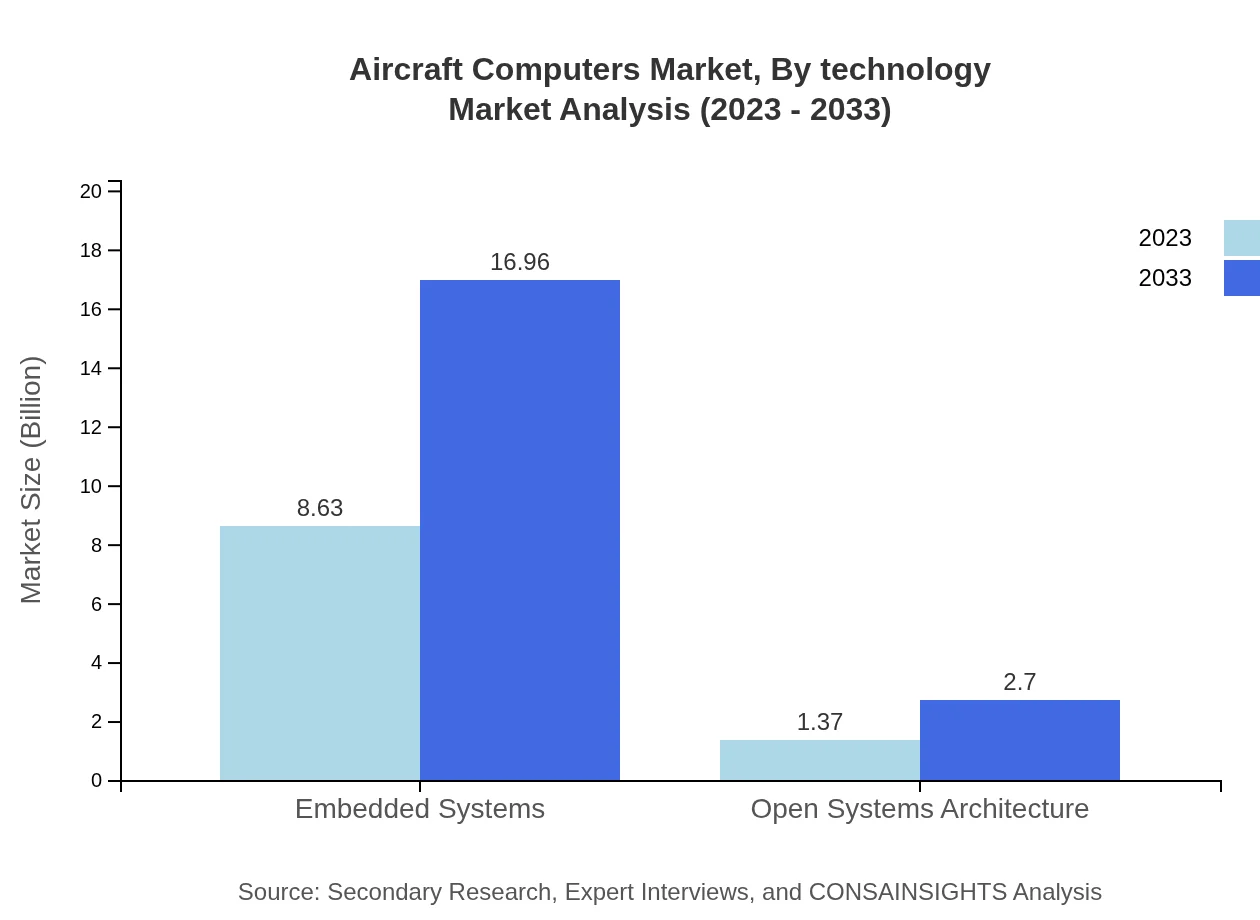

Aircraft Computers Market Analysis By Technology

The integration of open systems architecture and embedded systems technology drives development. Embedded systems hold significant sway overall, maintaining an 86.28% share and expected to grow from $8.63 billion to $16.96 billion. Open systems architecture, while smaller, is likely to increase as standardization in system designs becomes more critical, growing from $1.37 billion to $2.70 billion.

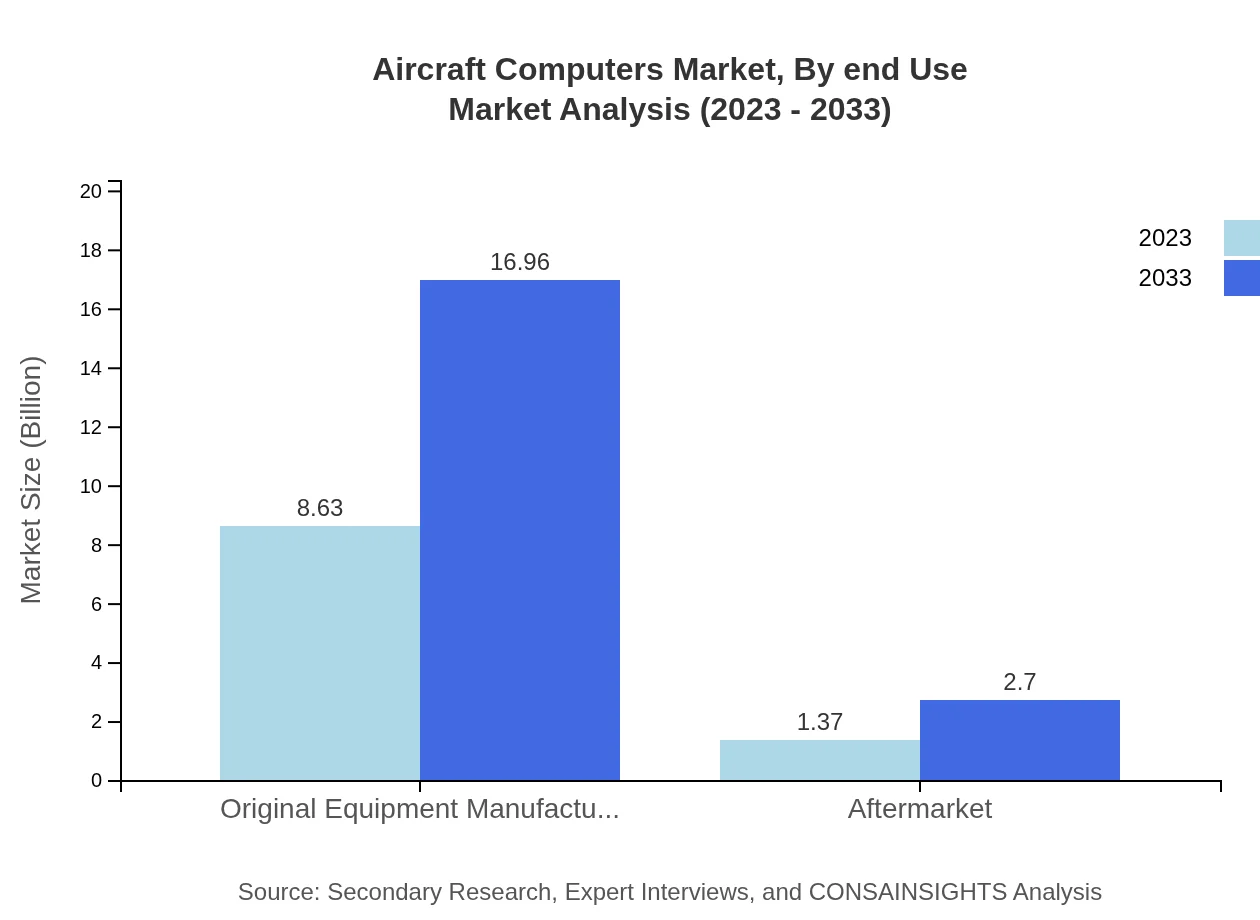

Aircraft Computers Market Analysis By End Use

End-use segments include direct sales and distributors. Direct sales are major contributors with a market value of $8.63 billion in 2023, anticipated to grow to $16.96 billion by 2033, reflecting OEM strategies. Distributors cater to aftermarket needs, expected to see a rise from $1.37 billion to $2.70 billion.

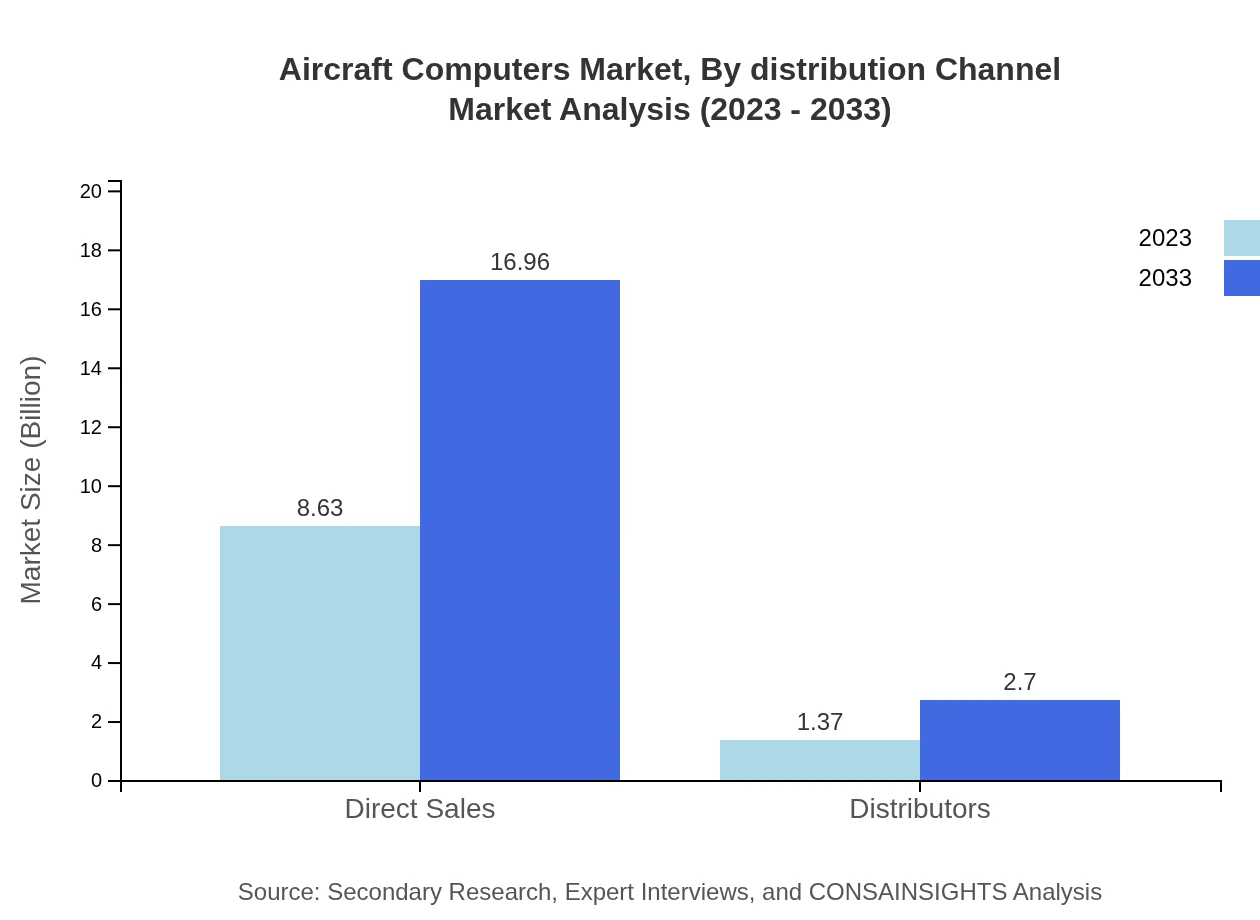

Aircraft Computers Market Analysis By Distribution Channel

Distribution channels delineate market access strategies, with high focus on OEMs as primary suppliers in the market landscape. These channels ensure timely supply of advanced computer systems amid increasing demand, enhancing global aviation operations while mitigating pressures on the supply chain.

Aircraft Computers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Computers Industry

Honeywell International Inc.:

A prominent player in avionics, providing flight control systems, navigation and guidance technologies, and other critical aircraft computing solutions.Thales Group:

Specializes in advanced avionics and flight management systems, contributing significantly to both civilian and military aircraft computing services.General Electric Company:

Offers various aviation technologies, including aircraft engine controls and integrated avionics systems that enhance operational efficiency.Raytheon Technologies:

Focuses on defense technologies, with extensive offerings in flight guidance and avionics solutions for military aircraft.BAE Systems:

Delivers advanced computing technologies for both military and commercial aviation, emphasizing safety and operational effectiveness.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Computers?

The aircraft computers market is valued at approximately $10 billion in 2023 and is expected to grow at a CAGR of 6.8%, reaching significant milestones in the next decade.

What are the key market players or companies in the aircraft Computers industry?

Key players in the aircraft computers market include established firms like Honeywell, Boeing, and Lockheed Martin, providing a variety of computer systems essential for aviation safety and efficiency.

What are the primary factors driving the growth in the aircraft Computers industry?

Factors driving growth in the aircraft computers industry include increasing demand for advanced avionics, safety regulations, and the rise in military and commercial aviation operations.

Which region is the fastest Growing in the aircraft Computers?

The North America region is currently the fastest-growing area in the aircraft computers market, with market projections increasing from $3.34 billion in 2023 to $6.56 billion in 2033.

Does ConsaInsights provide customized market report data for the aircraft Computers industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the aircraft computers industry, ensuring relevant insights and analytics.

What deliverables can I expect from this aircraft Computers market research project?

Expect comprehensive market analysis reports, detailed segment breakdowns, regional insights, competitive landscape evaluation, and actionable recommendations for strategic decision-making.

What are the market trends of aircraft Computers?

Emerging trends in the aircraft computers market include the integration of AI in avionics, emphasis on cybersecurity in aircraft systems, and growth in the demand for unmanned drones.