Aircraft Doors Market Size, Share, Industry Trends and Forecast to 2033

This report covers a detailed analysis of the Aircraft Doors market, providing insights into market trends, forecasts from 2023 to 2033, and various segments driving the industry forward. It aims to equip stakeholders with essential data for informed decision-making.

| Metric | Value |

|---|---|

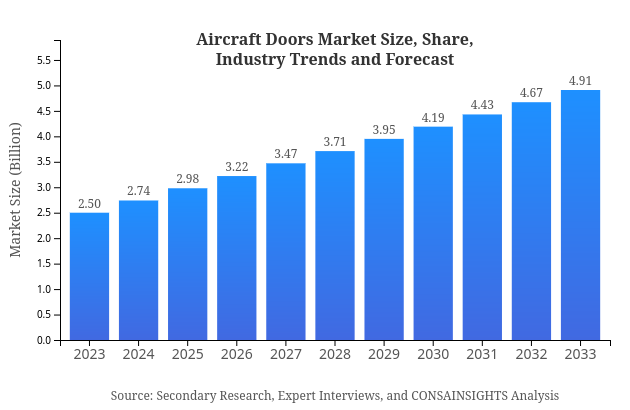

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Boeing , Airbus, Parker Hannifin, GKN Aerospace |

| Last Modified Date | 27 February 2025 |

Aircraft Doors Market Overview

What is the Market Size & CAGR of Aircraft Doors market in 2023?

Aircraft Doors Industry Analysis

Aircraft Doors Market Segmentation and Scope

Request a custom research report for industry.

Aircraft Doors Market Analysis Report by Region

Europe Aircraft Doors Market Report:

The European market for Aircraft Doors is forecasted to grow from USD 0.67 billion in 2023 to USD 1.31 billion by 2033, facilitated by innovation and updating of existing aircraft fleets to enhance safety.Asia Pacific Aircraft Doors Market Report:

In 2023, the Aircraft Doors market in the Asia Pacific region is valued at USD 0.49 billion, projected to grow to USD 0.96 billion by 2033, driven by rapid urbanization and significant investment in aerospace capabilities.North America Aircraft Doors Market Report:

North America dominates the market, with a 2023 value of USD 0.93 billion, expected to reach USD 1.82 billion by 2033, due to the presence of major manufacturers and high aircraft production rates.South America Aircraft Doors Market Report:

South America is anticipated to see a growth from USD 0.24 billion in 2023 to USD 0.48 billion by 2033. A developing airline market bolstered by increased air travel demand is fueling this growth.Middle East & Africa Aircraft Doors Market Report:

The Middle East and Africa region is expected to double from USD 0.17 billion in 2023 to USD 0.34 billion by 2033, supported by flourishing aviation markets in the Gulf states and expanding military initiatives.Request a custom research report for industry.

Aircraft Doors Market Analysis By Type

Global Aircraft Doors Market, By Type Market Analysis (2024 - 2033)

Passenger doors represented the largest segment in 2023, valued at USD 1.62 billion, with a market share of 64.79%. Cargo doors followed at USD 0.53 billion (21.27% share), while emergency exits accounted for USD 0.35 billion (13.94% share). This trend is expected to continue till 2033, with passenger doors projected to grow to USD 3.18 billion.

Aircraft Doors Market Analysis By Material

Global Aircraft Doors Market, By Material Market Analysis (2024 - 2033)

Aluminum remains the preferred choice for aircraft doors, covering 64.79% of the market in 2023, valued at USD 1.62 billion. Composite materials hold 21.27% market share (USD 0.53 billion), while steel accounts for 13.94% (USD 0.35 billion). By 2033, aluminum is expected to maintain its lead, with composites growing in significance due to their lightweight properties.

Aircraft Doors Market Analysis By Application

Global Aircraft Doors Market, By Application Market Analysis (2024 - 2033)

The commercial aircraft segment occupied a significant portion of the market with a value of USD 1.37 billion in 2023 (54.63% share). The military aircraft segment represents 21.80% (USD 0.55 billion), while business jets and helicopters account for 12.61% and 10.96%, respectively. By 2033, the commercial aircraft segment will likely witness further dominance, attributed to the increasing air travel demand.

Aircraft Doors Market Analysis By Manufacturer

Global Aircraft Doors Market, By Manufacturer Market Analysis (2024 - 2033)

OEMs are the leading players in the Aircraft Doors market, holding an 88.38% share in 2023, valued at USD 2.21 billion. Meanwhile, aftermarket suppliers take up 11.62% of the share (USD 0.29 billion) and are expected to see growth as the fleet ages and requires refurbishment.

Aircraft Doors Market Analysis By Technology

Global Aircraft Doors Market, By Technology Market Analysis (2024 - 2033)

Manual doors dominate the market with an 88.38% share valued at USD 2.21 billion in 2023, while automatic doors, although comprising a smaller segment, are growing in response to safety trends and consumer preferences for convenience.

Aircraft Doors Market Trends and Future Forecast

Request a custom research report for industry.

Global Market Leaders and Top Companies in Aircraft Doors Industry

Boeing :

A leading aerospace manufacturer, known for innovative technologies and high-quality aircraft components, including advanced door systems.Airbus:

A major player in the aerospace sector, Airbus develops a range of aircraft doors that comply with stringent safety and performance standards.Parker Hannifin:

Renowned for their motion and control technologies, Parker Hannifin specializes in door mechanisms that enhance reliability and efficiency.GKN Aerospace:

Specializes in aerospace components, GKN Aerospace is pivotal in developing lightweight and durable doors for modern aircraft.We're grateful to work with incredible clients.

Related Industries

FAQs

What is the market size of aircraft Doors?

The global aircraft doors market is projected to reach approximately USD 2.5 billion by 2033, growing at a CAGR of 6.8% from 2023. This indicates a robust demand within the aerospace sector for efficient and reliable door systems.

What are the key market players or companies in the aircraft Doors industry?

Key players in the aircraft doors market include major aerospace manufacturers, Original Equipment Manufacturers (OEMs), and specialized suppliers. These companies play a critical role in innovation and maintaining quality standards required for aviation doors.

What are the primary factors driving the growth in the aircraft Doors industry?

Key growth drivers for the aircraft doors industry include increasing air travel demand, advancements in aerospace technologies, and a focus on safety and efficiency. Regulatory measures are also pushing for enhanced designs and materials, further propelling the market.

Which region is the fastest Growing in the aircraft Doors market?

The fastest-growing region within the aircraft doors market is anticipated to be North America, with its market size projected to expand from USD 0.93 billion in 2023 to USD 1.82 billion by 2033, indicating a strong aviation infrastructure and increasing aircraft production.

Does ConsaInsights provide customized market report data for the aircraft Doors industry?

Yes, ConsaInsights offers customized market report data for the aircraft doors industry. This includes tailored insights and analytics to cater to specific requirements and strategic objectives for businesses in the aerospace sector.

What deliverables can I expect from this aircraft Doors market research project?

Deliverables from the aircraft doors market research project include detailed market analysis, trend forecasts, segment insights, competitive landscape assessments, and data-driven recommendations. These will provide a comprehensive overview of the aircraft doors ecosystem.

What are the market trends of aircraft Doors?

Current trends in the aircraft doors market include a shift towards lightweight materials such as composites, the rise of automation in door mechanisms, and increased focus on safety features. Sustainability is also influencing design choices, aligning with global aviation goals.