Aircraft Electrical Systems Market Report

Published Date: 03 February 2026 | Report Code: aircraft-electrical-systems

Aircraft Electrical Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aircraft Electrical Systems market, covering trends, insights, and forecasts from 2023 to 2033. Key data on market size, segmentation, regional analysis, and industry leaders are included to offer a comprehensive understanding of the market dynamics.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

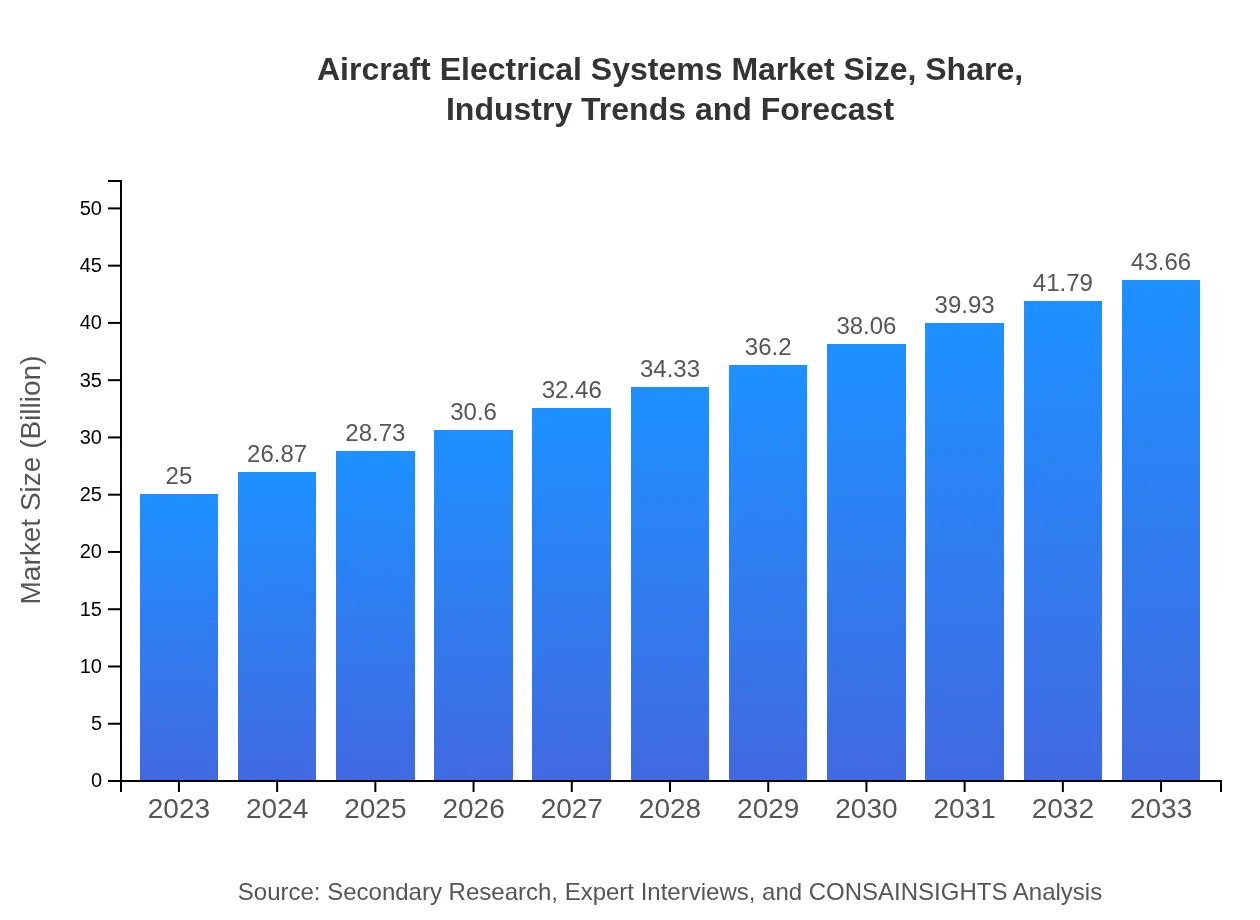

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $43.66 Billion |

| Top Companies | Honeywell International Inc., General Electric Company, Thales Group, Boeing Company |

| Last Modified Date | 03 February 2026 |

Aircraft Electrical Systems Market Overview

Customize Aircraft Electrical Systems Market Report market research report

- ✔ Get in-depth analysis of Aircraft Electrical Systems market size, growth, and forecasts.

- ✔ Understand Aircraft Electrical Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Electrical Systems

What is the Market Size & CAGR of Aircraft Electrical Systems market in 2023?

Aircraft Electrical Systems Industry Analysis

Aircraft Electrical Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Electrical Systems Market Analysis Report by Region

Europe Aircraft Electrical Systems Market Report:

The European market for Aircraft Electrical Systems is projected to grow from $6.07 billion in 2023 to $10.60 billion by 2033. Investment in green aviation technologies and aerospace modernization projects are expected to propel this market forward.Asia Pacific Aircraft Electrical Systems Market Report:

In the Asia-Pacific region, the Aircraft Electrical Systems market is expected to grow from $4.94 billion in 2023 to $8.63 billion by 2033. The growth is driven by rising air traffic, government initiatives to improve aviation infrastructure, and increasing investments in defense and military aviation.North America Aircraft Electrical Systems Market Report:

North America dominates the Aircraft Electrical Systems market, anticipating growth from $9.53 billion in 2023 to $16.63 billion by 2033. The region's strong emphasis on advanced military aviation systems and the presence of key OEMs significantly contribute to its leading market position.South America Aircraft Electrical Systems Market Report:

The South American market for Aircraft Electrical Systems is also on the rise, with a market size projected to expand from $1.63 billion in 2023 to $2.85 billion by 2033. The increase in regional air travel and the expansion of low-cost carriers are key factors fueling this growth.Middle East & Africa Aircraft Electrical Systems Market Report:

The Middle East and Africa region is experiencing growth in the Aircraft Electrical Systems market, with a rise from $2.83 billion in 2023 to $4.95 billion by 2033. Increasing defense budgets and a growing emphasis on commercial aviation in developing nations are major contributors to the expansion.Tell us your focus area and get a customized research report.

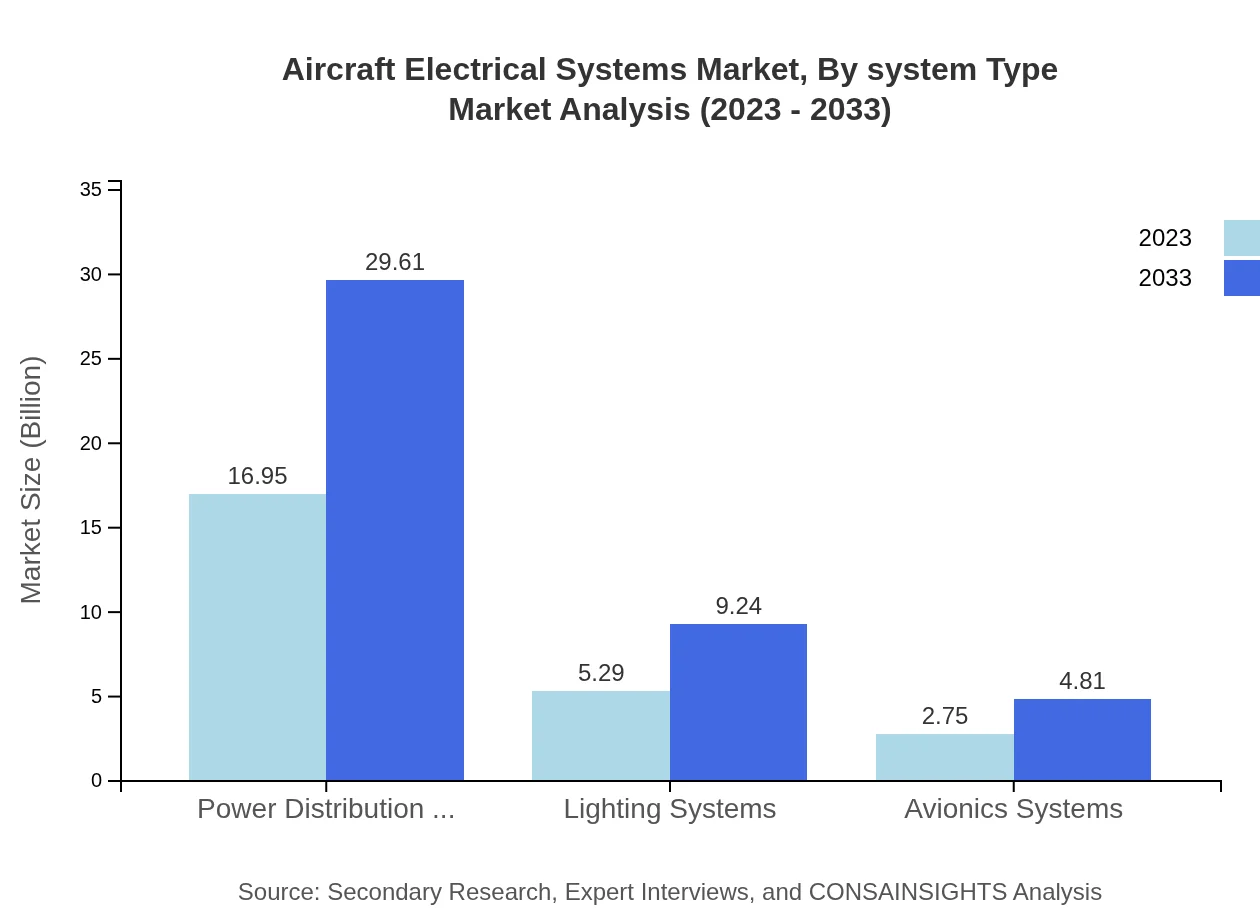

Aircraft Electrical Systems Market Analysis By System Type

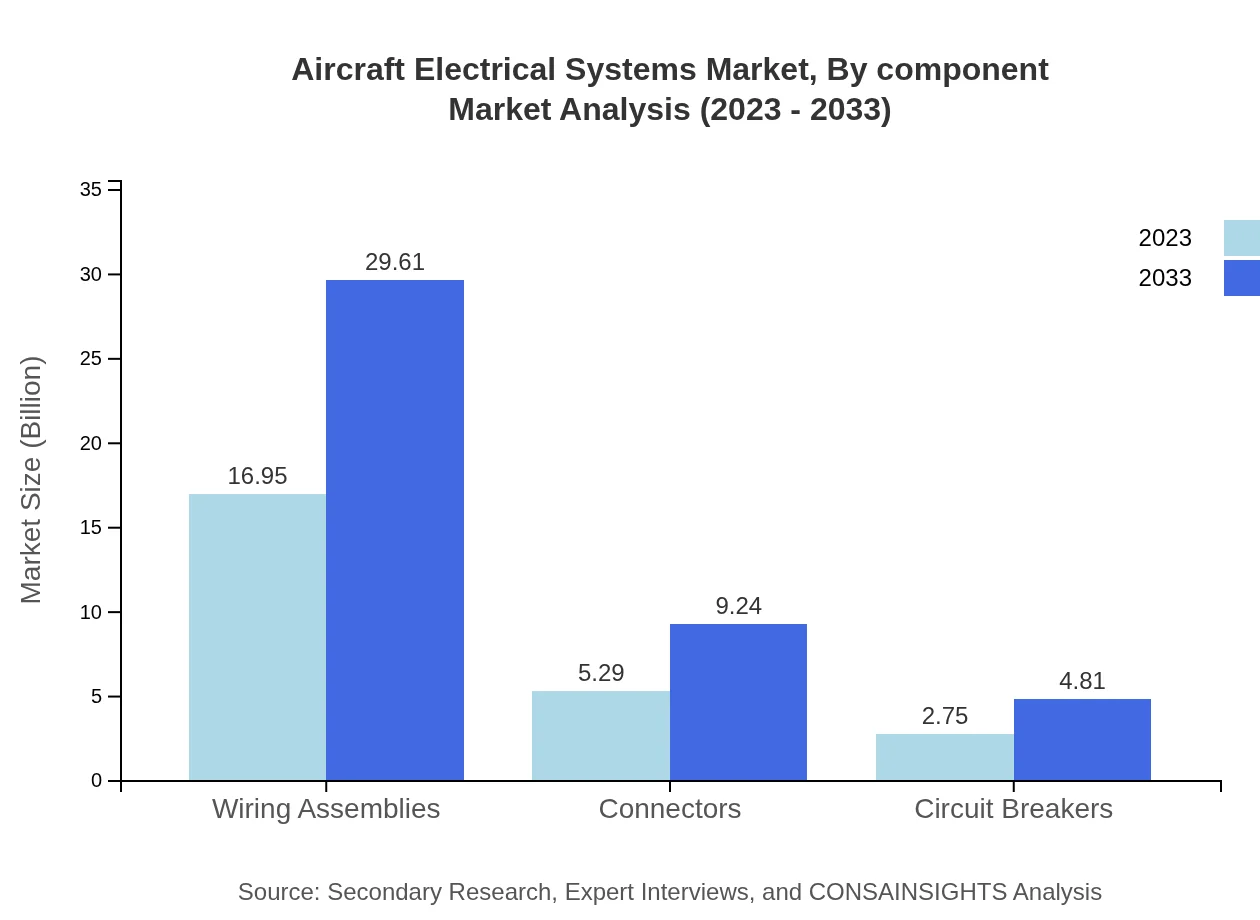

The market for Aircraft Electrical Systems by system type includes segments such as wiring assemblies, power distribution systems, avionics systems, and lighting systems. Wiring assemblies dominate the segment with a market size of $16.95 billion in 2023 and expected growth to $29.61 billion by 2033, indicating their crucial role in overall aircraft operations, accounting for 67.82% of the market share.

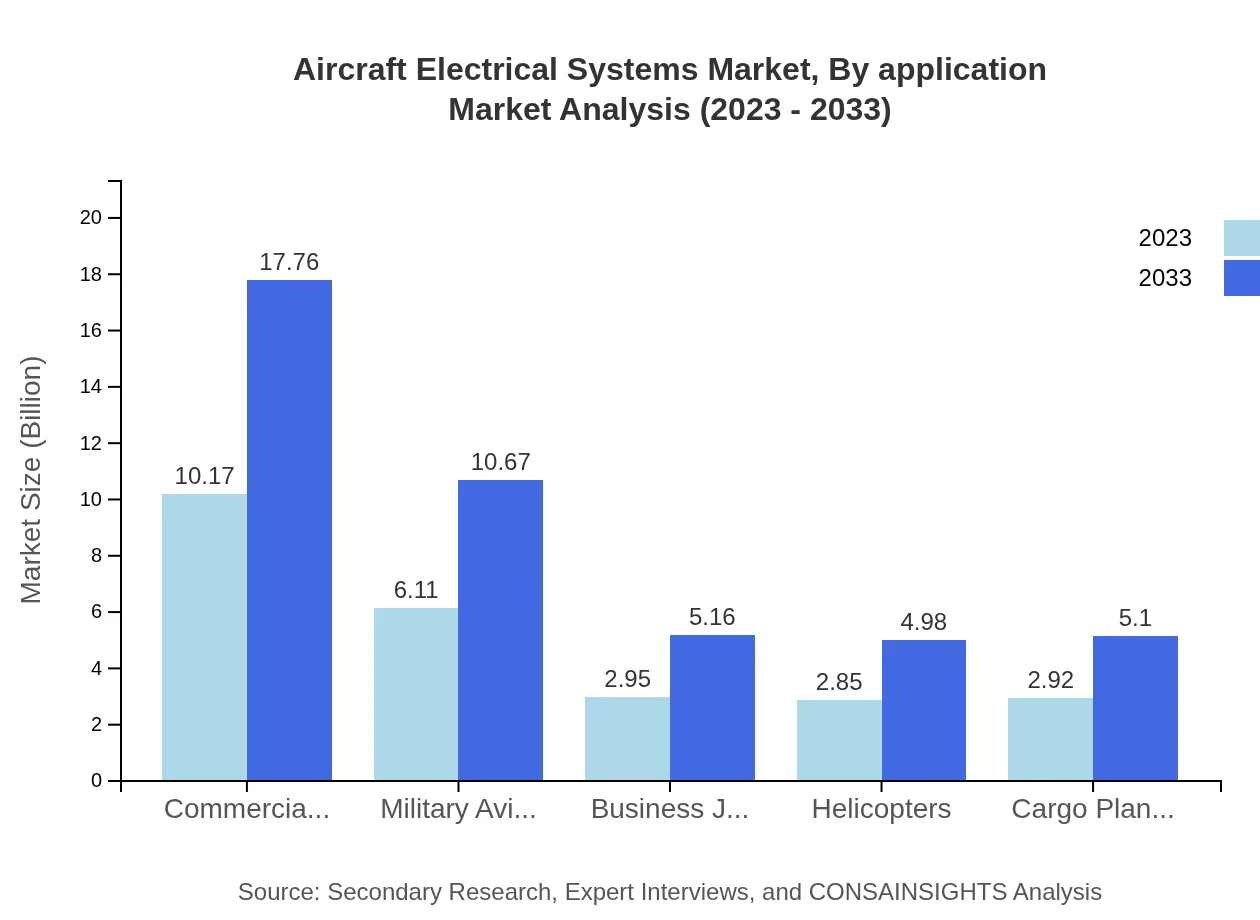

Aircraft Electrical Systems Market Analysis By Application

The Aircraft Electrical Systems market is segmented by application into commercial aviation, military aviation, and business jets. The commercial aviation segment is significant, growing from $10.17 billion in 2023 to $17.76 billion by 2033, accounting for 40.67% of the overall market share, emphasizing the demand for robust electrical systems in passenger aircraft.

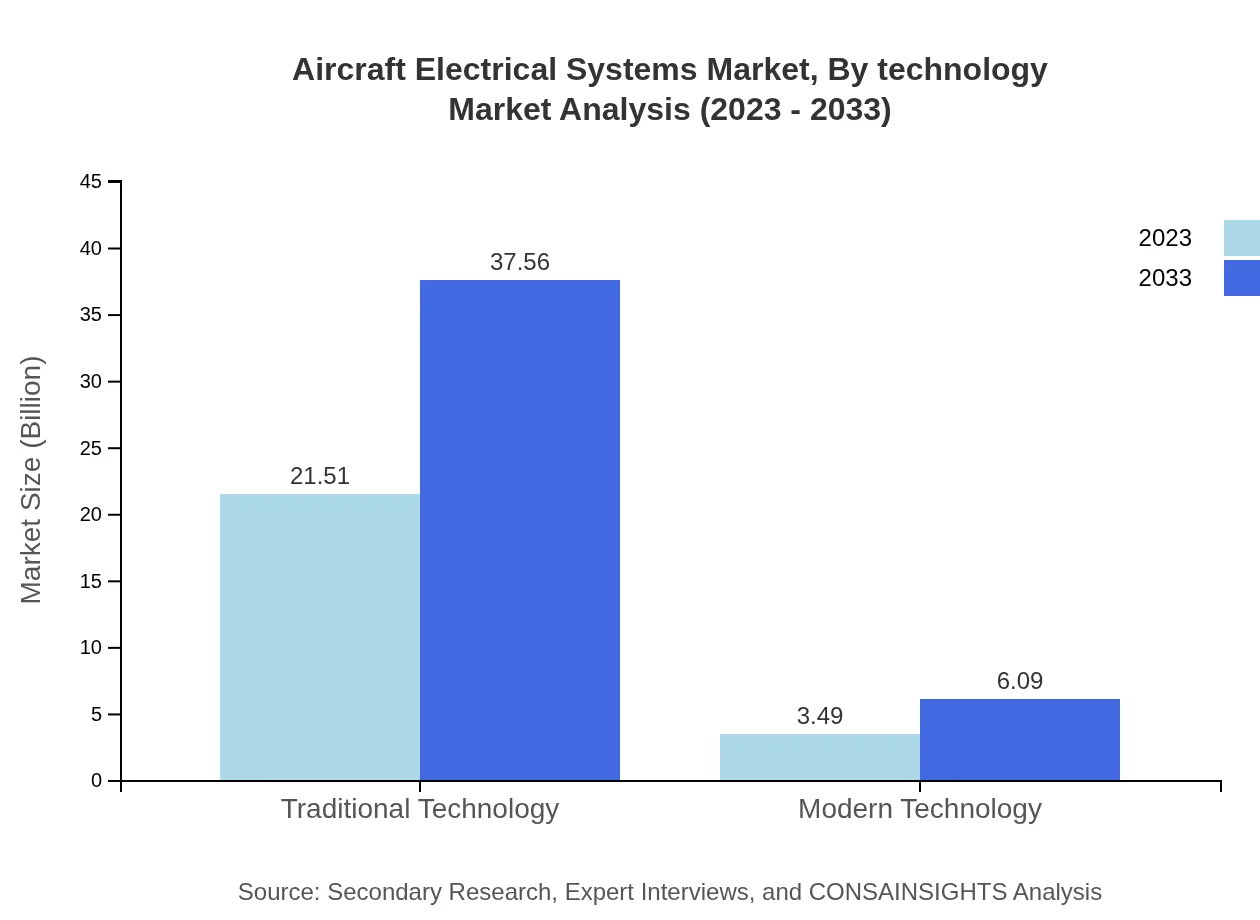

Aircraft Electrical Systems Market Analysis By Technology

The technology segment showcases traditional and modern technologies in Aircraft Electrical Systems. Traditional technology will maintain a dominant position in the market, with a projected size of $21.51 billion in 2023 reaching $37.56 billion by 2033, commanding an 86.04% share. However, modern technology is anticipated to gain traction as innovations emerge, reflecting a shift towards more efficient and integrated systems.

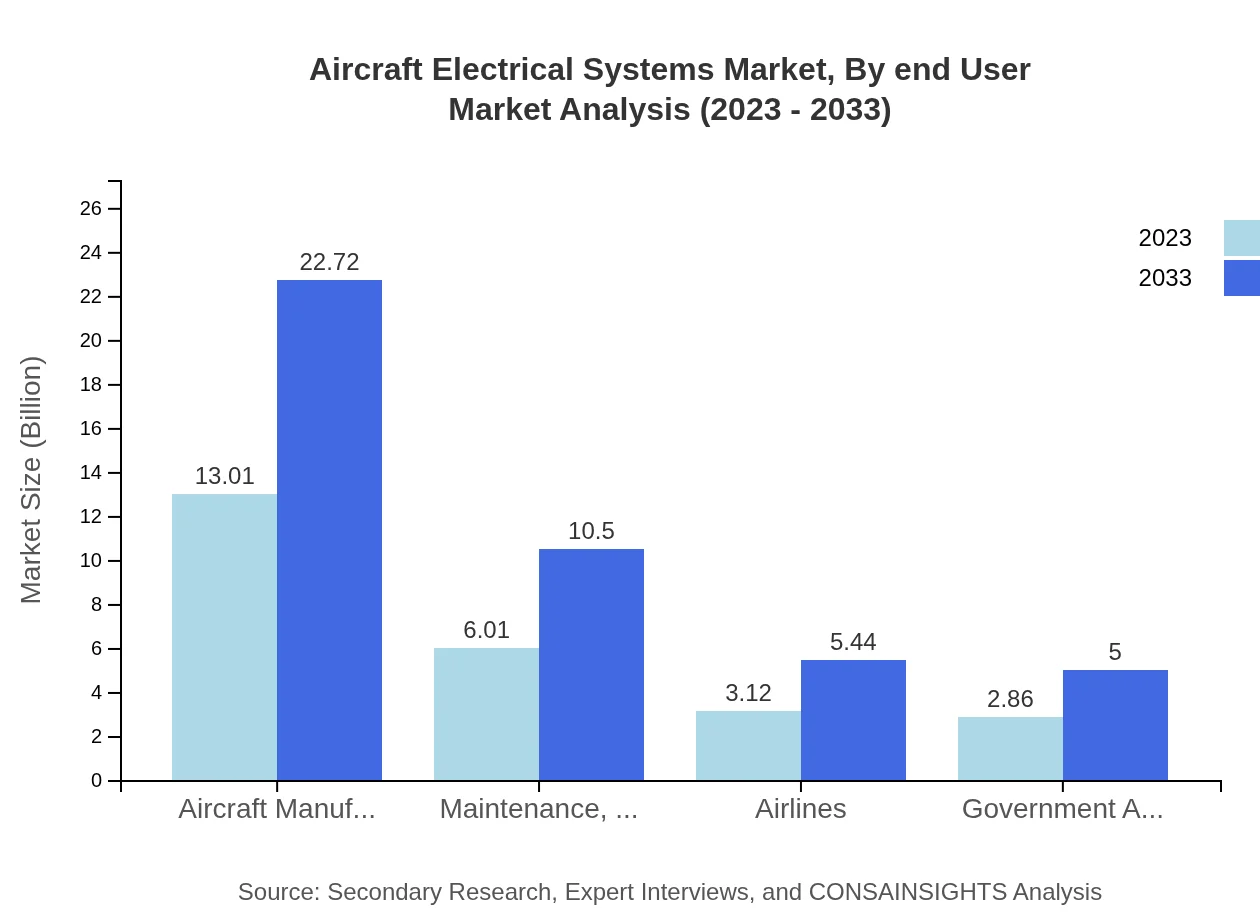

Aircraft Electrical Systems Market Analysis By End User

End-users in the Aircraft Electrical Systems market comprise aircraft manufacturers, airlines, government agencies, and maintenance, repair, and overhaul (MRO) service providers. Aircraft manufacturers lead this segment with a market size of $13.01 billion in 2023, growing to $22.72 billion by 2033, equivalent to 52.03% of the total market share.

Aircraft Electrical Systems Market Analysis By Component

Components of Aircraft Electrical Systems include connectors, circuit breakers, and power distribution units. Connectors account for a market size of $5.29 billion in 2023, anticipated to grow to $9.24 billion by 2033, while circuit breakers are expected to increase from $2.75 billion to $4.81 billion, highlighting the evolving technology and demand for reliable components.

Aircraft Electrical Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Electrical Systems Industry

Honeywell International Inc.:

Honeywell is a premier aerospace company, manufacturing various aircraft electrical systems and solutions focused on improving the performance and efficiency of aerospace operations.General Electric Company:

General Electric has a solid foothold in the aerospace industry, providing innovative electrical systems that address the complex needs of modern aircraft.Thales Group:

Thales is renowned for its advanced avionics and aircraft electrical systems, emphasizing safety, security, and connectivity in the aviation market.Boeing Company:

Boeing, a leader in aerospace manufacturing, produces critical aircraft electrical components that enhance operational reliability and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft electrical systems?

The Aircraft Electrical Systems Market is projected to grow from $25 billion in 2023, with a CAGR of 5.6%, indicating robust growth potential leading up to 2033.

What are the key market players or companies in this aircraft electrical systems industry?

The key players in the aircraft electrical systems industry include major manufacturers such as Honeywell, Boeing, Rockwell Collins, and Thales, which dominate the market through innovation in technology and robust supply chains.

What are the primary factors driving the growth in the aircraft electrical systems industry?

The growth is driven by the increasing demand for advanced aircraft, the push for fuel efficiency, and the development of reliable electrical technologies enhancing safety and performance across the aviation sector.

Which region is the fastest Growing in the aircraft electrical systems?

North America is the fastest-growing region, with a market size expected to rise from $9.53 billion in 2023 to $16.63 billion by 2033, driven by high military and commercial aviation activities.

Does ConsaInsights provide customized market report data for the aircraft electrical systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the aircraft electrical systems industry, ensuring that stakeholders receive personalized insights for strategic decision-making.

What deliverables can I expect from this aircraft electrical systems market research project?

Expect comprehensive reports including market size analytics, growth forecasts, competitor analysis, regional insights, and segment breakdowns for informed business strategy development.

What are the market trends of aircraft electrical systems?

Key trends include a shift towards modular designs, the integration of green technologies for sustainability, and increased reliance on digital solutions for enhanced performance and reliability.