Aircraft Engine Blades Market Report

Published Date: 03 February 2026 | Report Code: aircraft-engine-blades

Aircraft Engine Blades Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Aircraft Engine Blades market, providing comprehensive insights on market dynamics, growth prospects, and trends from 2023 to 2033. It includes detailed segmentation analysis and regional assessments to guide stakeholders in making informed decisions.

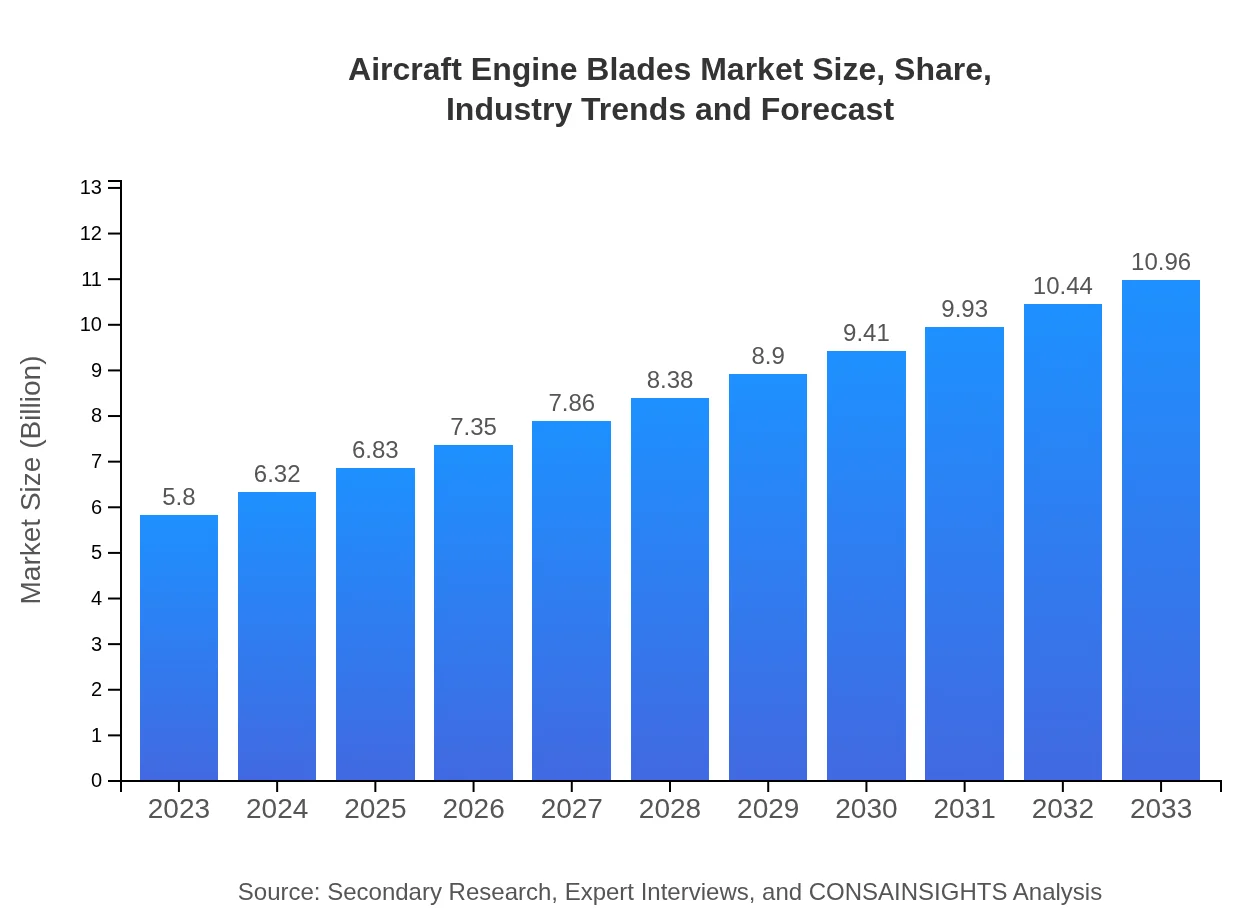

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 6.4% |

| 2033 Market Size | $10.96 Billion |

| Top Companies | General Electric (GE), Rolls-Royce Holdings, Pratt & Whitney, Safran, Honeywell Aerospace |

| Last Modified Date | 03 February 2026 |

Aircraft Engine Blades Market Overview

Customize Aircraft Engine Blades Market Report market research report

- ✔ Get in-depth analysis of Aircraft Engine Blades market size, growth, and forecasts.

- ✔ Understand Aircraft Engine Blades's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Engine Blades

What is the Market Size & CAGR of Aircraft Engine Blades market in 2033?

Aircraft Engine Blades Industry Analysis

Aircraft Engine Blades Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Engine Blades Market Analysis Report by Region

Europe Aircraft Engine Blades Market Report:

The European market is poised for growth, expected to expand from USD 1.88 billion in 2023 to USD 3.55 billion by 2033, driven by advancements in technology, a focus on environmental sustainability, and partnerships between countries for joint aerospace programs.Asia Pacific Aircraft Engine Blades Market Report:

The Asia-Pacific region is projected to experience significant growth, with the market size expanding from USD 1.11 billion in 2023 to USD 2.09 billion by 2033. This growth is mainly driven by escalating air travel demand, increasing urbanization, and robust investments in aviation infrastructure.North America Aircraft Engine Blades Market Report:

North America remains the largest market, with a size expected to grow from USD 1.89 billion in 2023 to USD 3.57 billion by 2033. This expansion can be credited to the presence of major aerospace manufacturers, increased military spending, and continuous R&D investments focused on innovative engine designs.South America Aircraft Engine Blades Market Report:

In South America, the market is forecasted to increase from USD 0.54 billion in 2023 to USD 1.02 billion by 2033. The growth is attributed to the enhancement of regional airlines and burgeoning demand for fuel-efficient aircraft as aviation expands in this developing region.Middle East & Africa Aircraft Engine Blades Market Report:

In the Middle East and Africa, growth is anticipated with a market increase from USD 0.39 billion in 2023 to USD 0.74 billion by 2033, as regional players strengthen their aviation sectors, emphasizing newer technologies and efficiency improvements.Tell us your focus area and get a customized research report.

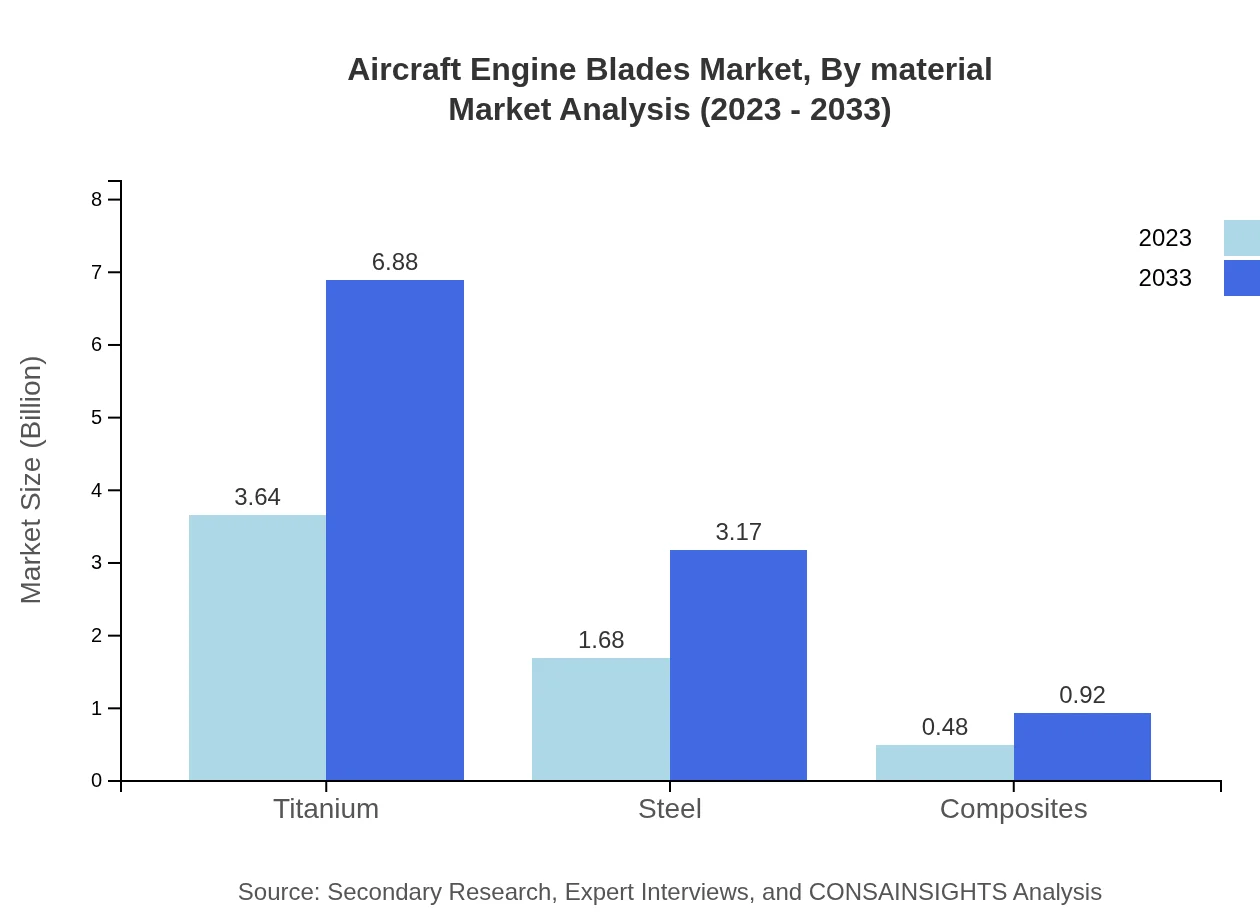

Aircraft Engine Blades Market Analysis By Material

The Aircraft Engine Blades market is primarily segmented by material into titanium, steel, and composites. Titanium remains dominant, spearheading innovations with a market size of USD 3.64 billion in 2023, expected to expand to USD 6.88 billion by 2033. Steel makes up a significant portion as well, valued at USD 1.68 billion in 2023, projected to grow to USD 3.17 billion. Composites, while currently lower in market share, show promise for future applications in new engine designs.

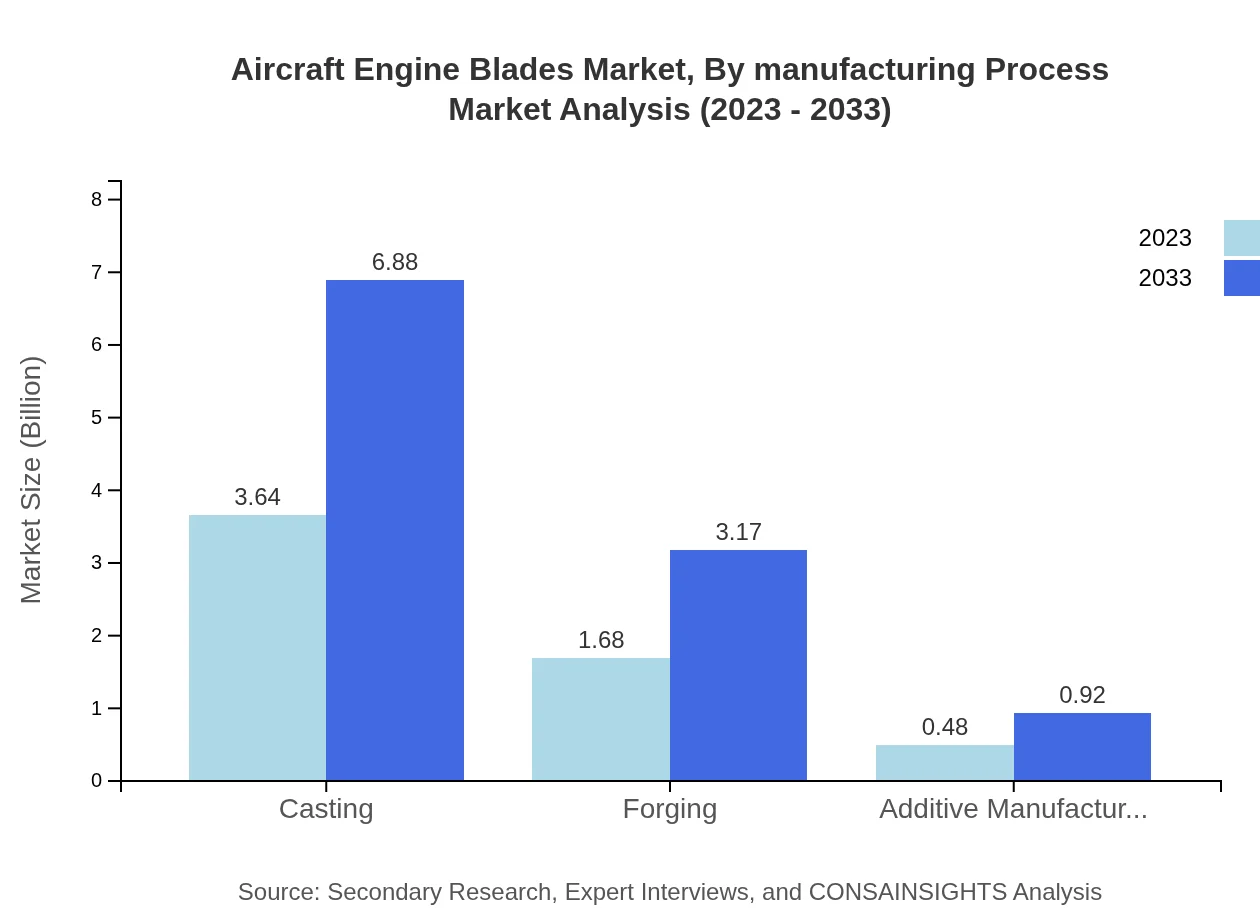

Aircraft Engine Blades Market Analysis By Manufacturing Process

The manufacturing processes for aircraft engine blades include casting, forging, and additive manufacturing. Casting leads the market with a size of USD 3.64 billion in 2023, anticipated to grow to USD 6.88 billion by 2033. Forging and additive manufacturing also play critical roles, with market sizes of USD 1.68 billion and USD 0.48 billion, respectively, increasing steadily as technology advances.

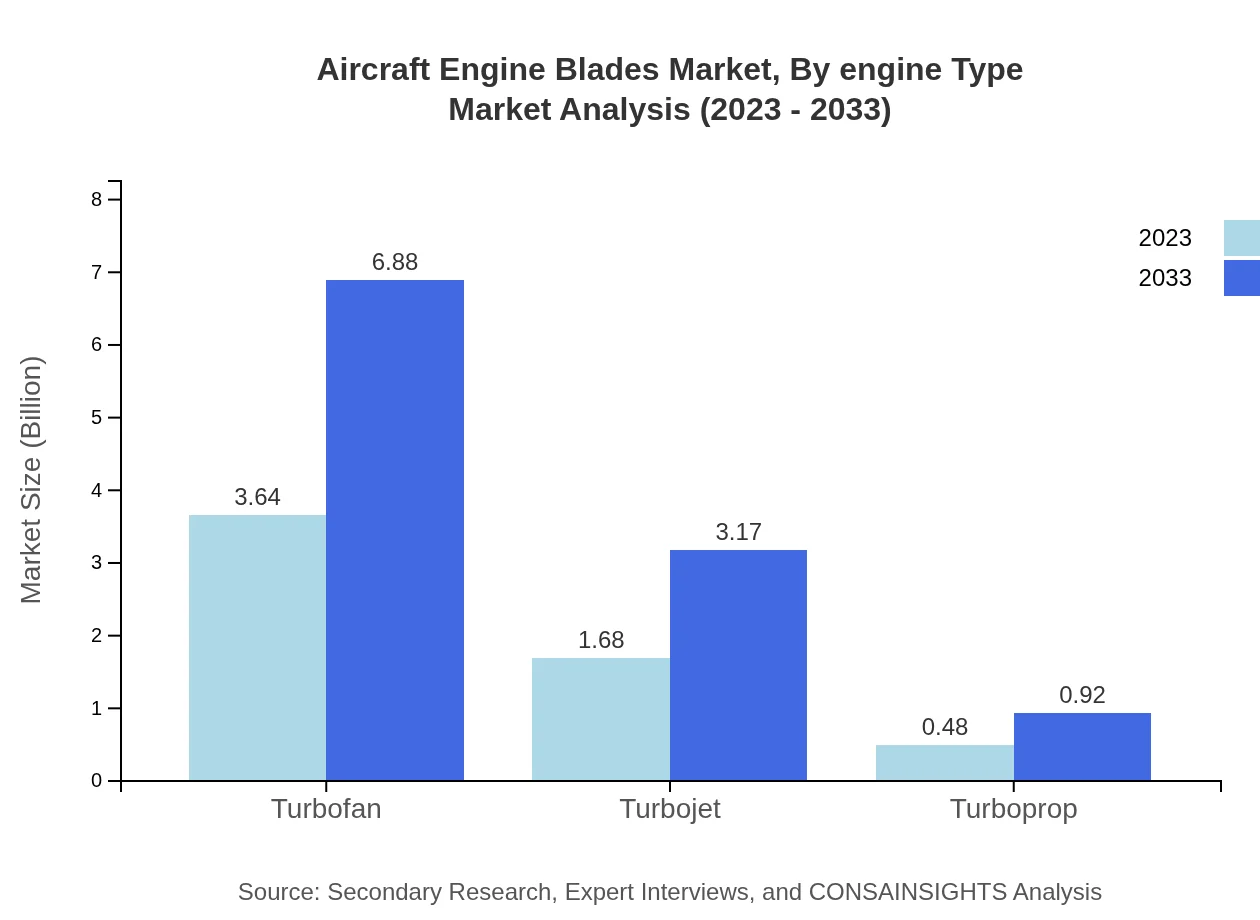

Aircraft Engine Blades Market Analysis By Engine Type

The Aircraft Engine Blades market is also segmented by engine type: turbofan, turbojet, and turboprop. Turbofan blades dominate the segment with a current market of USD 3.64 billion, growing to USD 6.88 billion by 2033, due to their applications in commercial aviation. Turbojet and turboprop blades are also relevant with sizes of USD 1.68 billion and USD 0.48 billion, respectively, and expected to see increment in subsequent years.

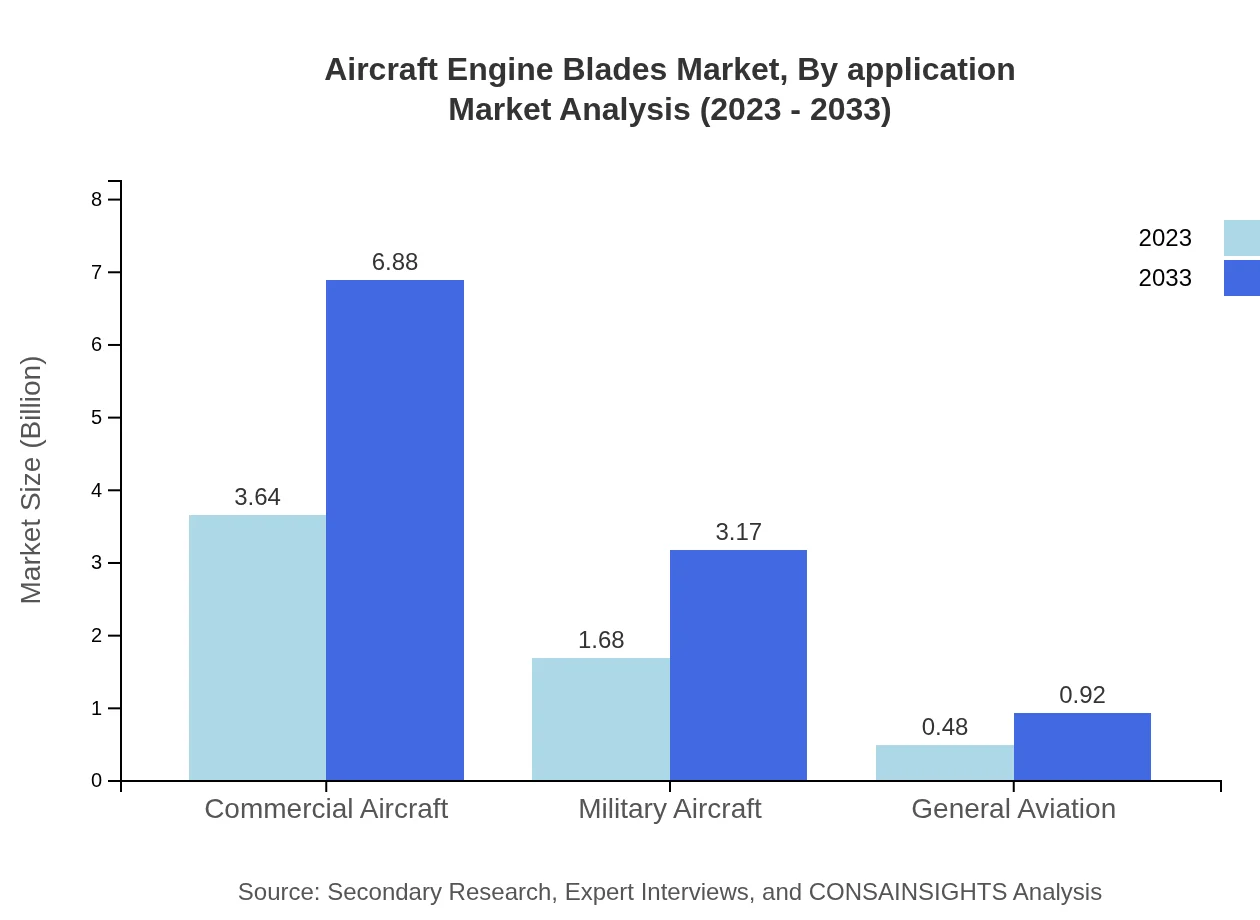

Aircraft Engine Blades Market Analysis By Application

The application segmentation reveals that commercial aircraft account for the largest share, valued at USD 3.64 billion in 2023 and forecasted to reach USD 6.88 billion by 2033. Military aircraft and general aviation follow, with market sizes of USD 1.68 billion and USD 0.48 billion, respectively, highlighting the comprehensive needs across the aviation sector.

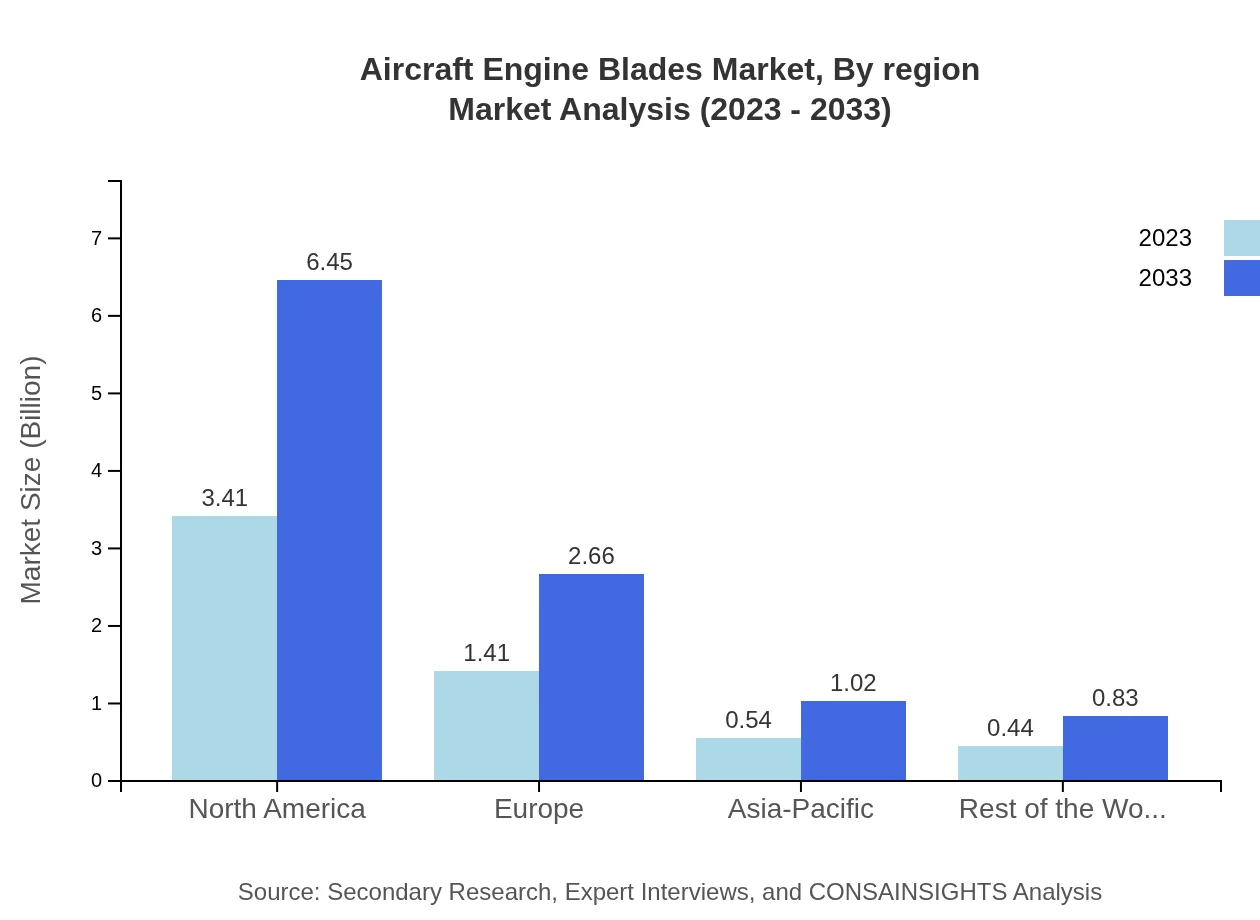

Aircraft Engine Blades Market Analysis By Region

The regional analysis showcases varying growth dynamics, with North America leading currently, followed by Europe and the Asia-Pacific. Each region is adapting to unique market needs, influenced by local demands and innovation trajectories, which necessitates diverse strategies from manufacturers.

Aircraft Engine Blades Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Engine Blades Industry

General Electric (GE):

A leading manufacturer of jet engines and components known for their advancements in technology and fuel efficiency.Rolls-Royce Holdings:

A major aerospace and defense player, providing high-performance engines and a range of services to customers globally.Pratt & Whitney:

Part of Raytheon Technologies, Pratt & Whitney designs innovative aerospace engines that deliver exceptional performance.Safran:

A French multinational that produces aerospace propulsion and equipment, specializing in both civil and military aviation.Honeywell Aerospace:

Offers advanced technologies and services in the aerospace sector, focusing on enhancing the efficiency and safety of aircraft.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft engine blades?

The global aircraft engine blades market is valued at approximately $5.8 billion in 2023, with a projected CAGR of 6.4% from 2023 to 2033.

What are the key market players or companies in the aircraft engine blades industry?

The aircraft engine blades market includes prominent companies such as General Electric, Pratt & Whitney, Rolls-Royce, Safran, and MTU Aero Engines. These players focus on innovation and efficiency in blade manufacturing.

What are the primary factors driving the growth in the aircraft engine blades industry?

Key growth factors include the increasing air traffic demand, advancements in aircraft technology, and the rising need for fuel-efficient engines, which necessitate better performance from engine blades.

Which region is the fastest Growing in the aircraft engine blades market?

The Asia-Pacific region is expected to exhibit significant growth, with a market size increasing from $1.11 billion in 2023 to $2.09 billion by 2033, driven by rising air travel and airline expansion.

Does ConsaInsights provide customized market report data for the aircraft engine blades industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, allowing clients to obtain detailed insights into the aircraft engine blades industry metrics and forecasts.

What deliverables can I expect from this aircraft engine blades market research project?

Expect comprehensive deliverables, including market analysis, forecasts, competitive landscape reports, regional analysis, and insights on trends impacting the aircraft engine blades industry.

What are the market trends of aircraft engine blades?

Notable trends include the shift toward lightweight materials, innovations in blade design for enhanced aerodynamics, and a growing focus on sustainable aviation solutions in engine manufacturing.