Aircraft Engine Mro Market Report

Published Date: 03 February 2026 | Report Code: aircraft-engine-mro

Aircraft Engine Mro Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Aircraft Engine Maintenance, Repair, and Overhaul (MRO) market, offering insights into growth trends, market segmentation, and key players from 2023 to 2033.

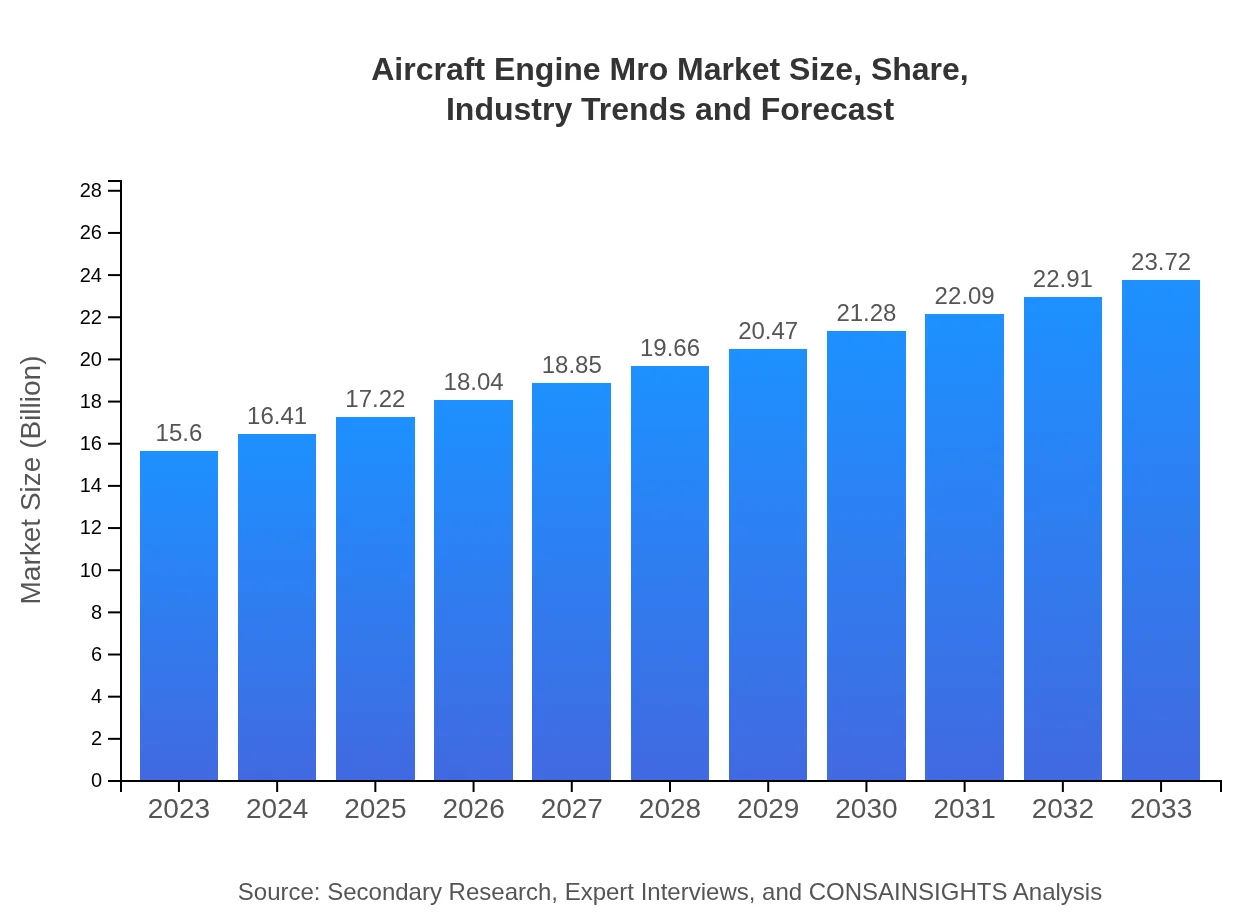

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $23.72 Billion |

| Top Companies | General Electric, Rolls-Royce, MTU Aero Engines, Safran Aircraft Engines, Honeywell Aerospace |

| Last Modified Date | 03 February 2026 |

Aircraft Engine MRO Market Overview

Customize Aircraft Engine Mro Market Report market research report

- ✔ Get in-depth analysis of Aircraft Engine Mro market size, growth, and forecasts.

- ✔ Understand Aircraft Engine Mro's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Engine Mro

What is the Market Size & CAGR of Aircraft Engine MRO market in 2023?

Aircraft Engine MRO Industry Analysis

Aircraft Engine MRO Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Engine MRO Market Analysis Report by Region

Europe Aircraft Engine Mro Market Report:

Europe's Aircraft Engine MRO market value is anticipated to grow from $4.41 billion in 2023 to approximately $6.71 billion by 2033. The region's stringent regulations and high safety standards compel airlines to invest heavily in MRO services, ensuring compliance and safety.Asia Pacific Aircraft Engine Mro Market Report:

In the Asia Pacific region, the Aircraft Engine MRO market is projected to grow from $2.86 billion in 2023 to approximately $4.35 billion by 2033. This growth is driven by the increasing air travel demand and the proliferation of new aircraft fleets in emerging markets like China and India. Strategic investments in aviation infrastructure further add to the momentum.North America Aircraft Engine Mro Market Report:

North America retains a leading position in the Aircraft Engine MRO market, with a size projected to grow from $6.03 billion in 2023 to $9.16 billion by 2033. Dominated by established players, innovation, technology adoption, and increasing aircraft fleets are setting the stage for sustained market growth.South America Aircraft Engine Mro Market Report:

The South American Aircraft Engine MRO market is estimated to expand from $1.00 billion in 2023 to $1.52 billion by 2033. As economies in this region stabilize and invest in enhancing air travel connectivity, the demand for MRO services is expected to rise, though challenges remain in terms of regulatory compliance and capacity building.Middle East & Africa Aircraft Engine Mro Market Report:

The Middle East and Africa region is expected to see its market size increase from $1.29 billion in 2023 to $1.97 billion by 2033. The region's growing importance as an aviation hub and investments in airline fleet expansions bolster this growth, despite underlying logistical challenges.Tell us your focus area and get a customized research report.

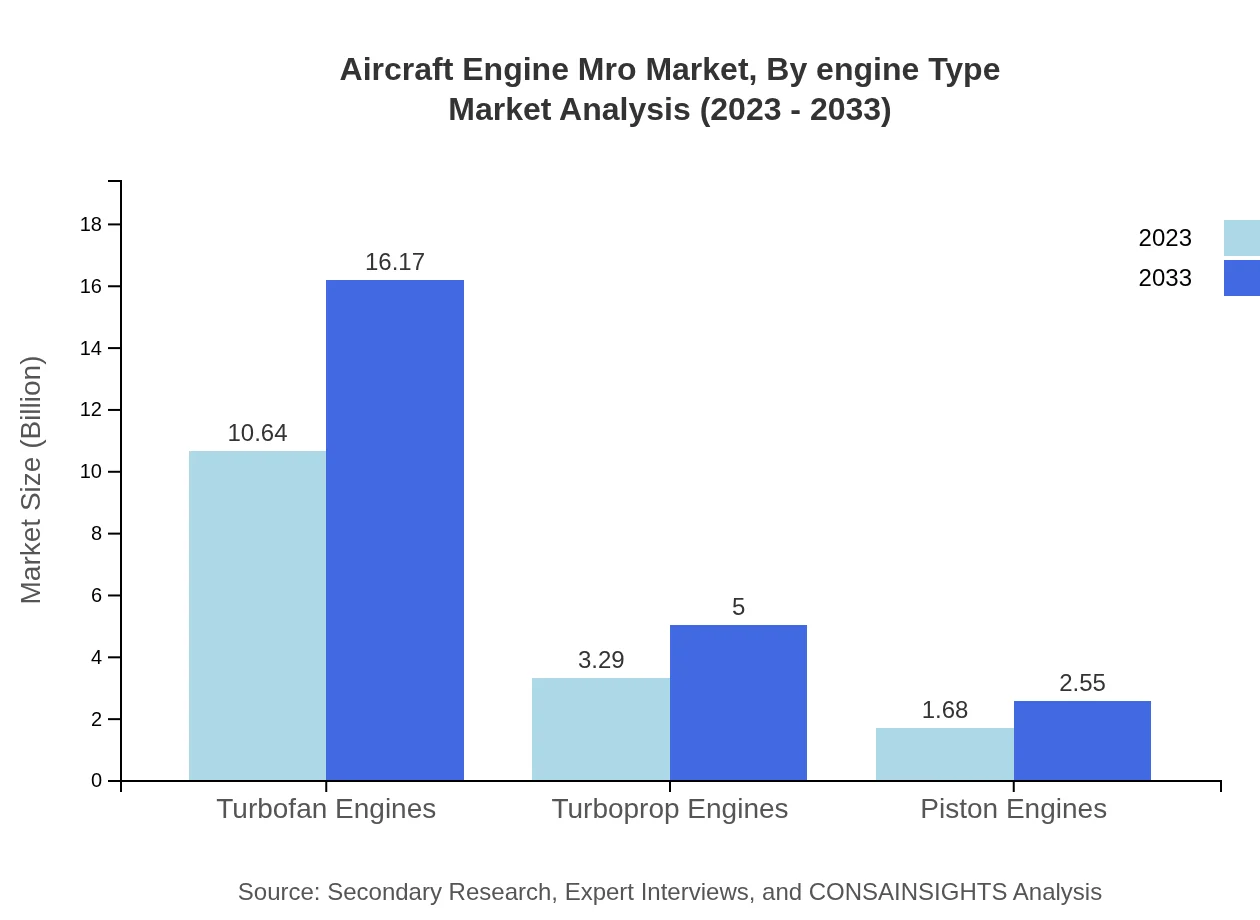

Aircraft Engine Mro Market Analysis By Engine Type

Breaking down the market by engine type, turbofan engines occupy the largest share of the MRO market, valued at $10.64 billion in 2023 and projected to reach $16.17 billion by 2033, driven largely by the expanding commercial aviation sector. Turboprop engines follow with a valuation of $3.29 billion in 2023 and expected growth to $5.00 billion by 2033, reflecting their utility in regional air travel. Piston engines, though smaller in value, are projected to increase from $1.68 billion to $2.55 billion as general aviation continues its growth.

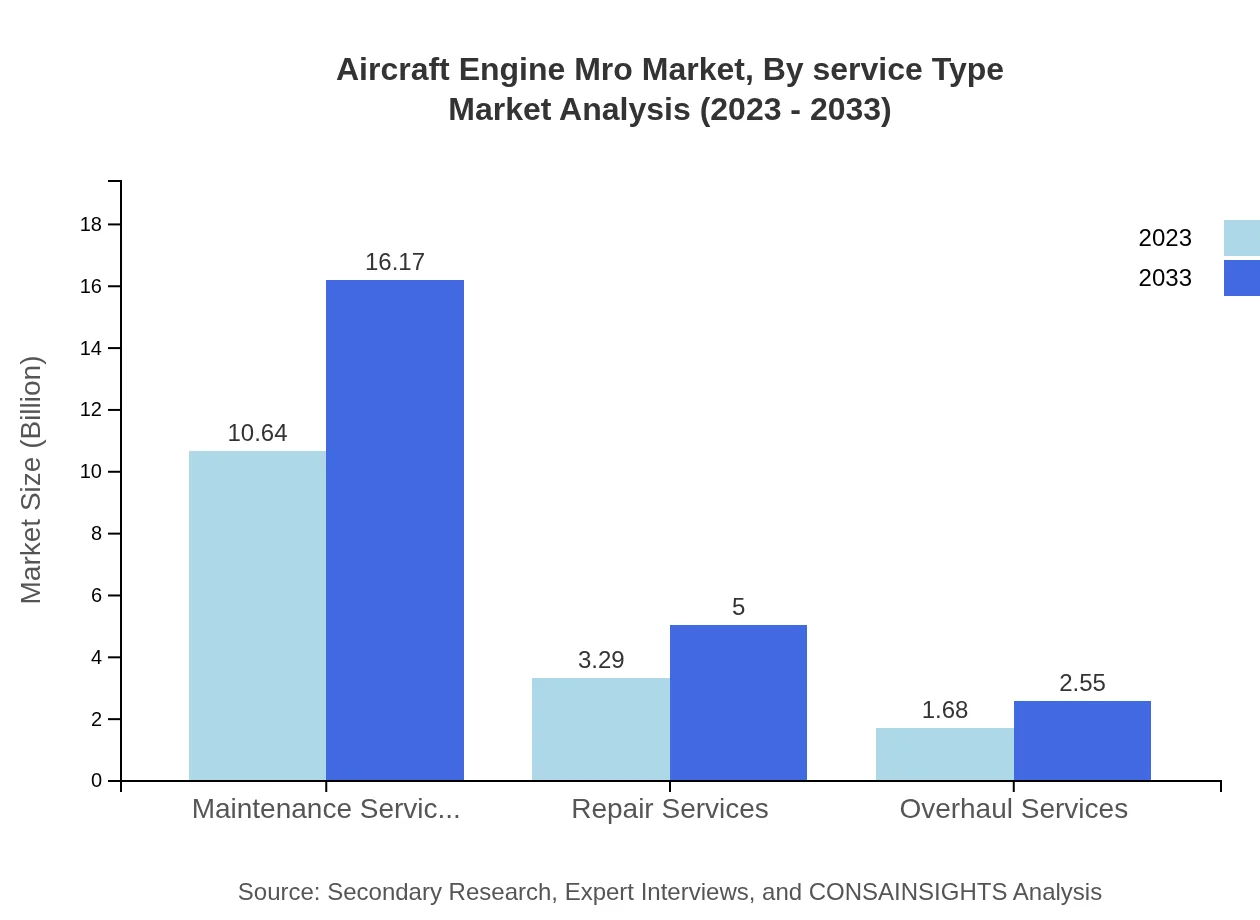

Aircraft Engine Mro Market Analysis By Service Type

Service types in the Aircraft Engine MRO market include maintenance services, repair services, and overhaul services. Maintenance services dominate the market, with a size of $10.64 billion in 2023 growing to $16.17 billion by 2033, highlighting the importance of preventive maintenance. Repair services are expected to grow from $3.29 billion to $5.00 billion, while overhaul services will grow from $1.68 billion to $2.55 billion, as airlines focus on maximizing engine lifecycle.

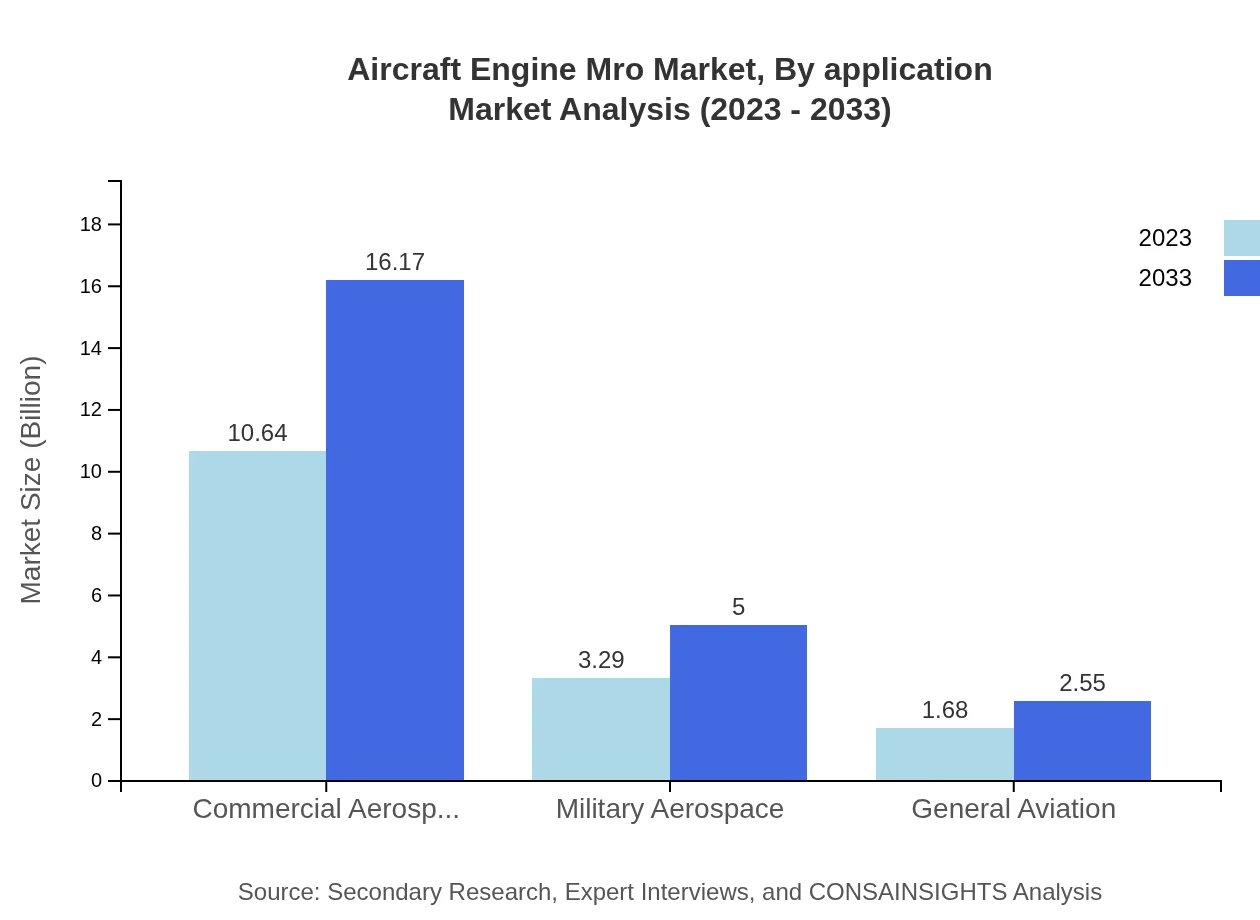

Aircraft Engine Mro Market Analysis By Application

The Aircraft Engine MRO market is segmented by application into commercial aerospace, military aerospace, and general aviation. The commercial aerospace segment leads with a size of $10.64 billion in 2023, expected to rise to $16.17 billion by 2033. The military segment is projected to grow from $3.29 billion to $5.00 billion, reflecting increasing defense budgets and modernization initiatives. General aviation will span from $1.68 billion to $2.55 billion, showing steady growth as personal and leisure air travel increases.

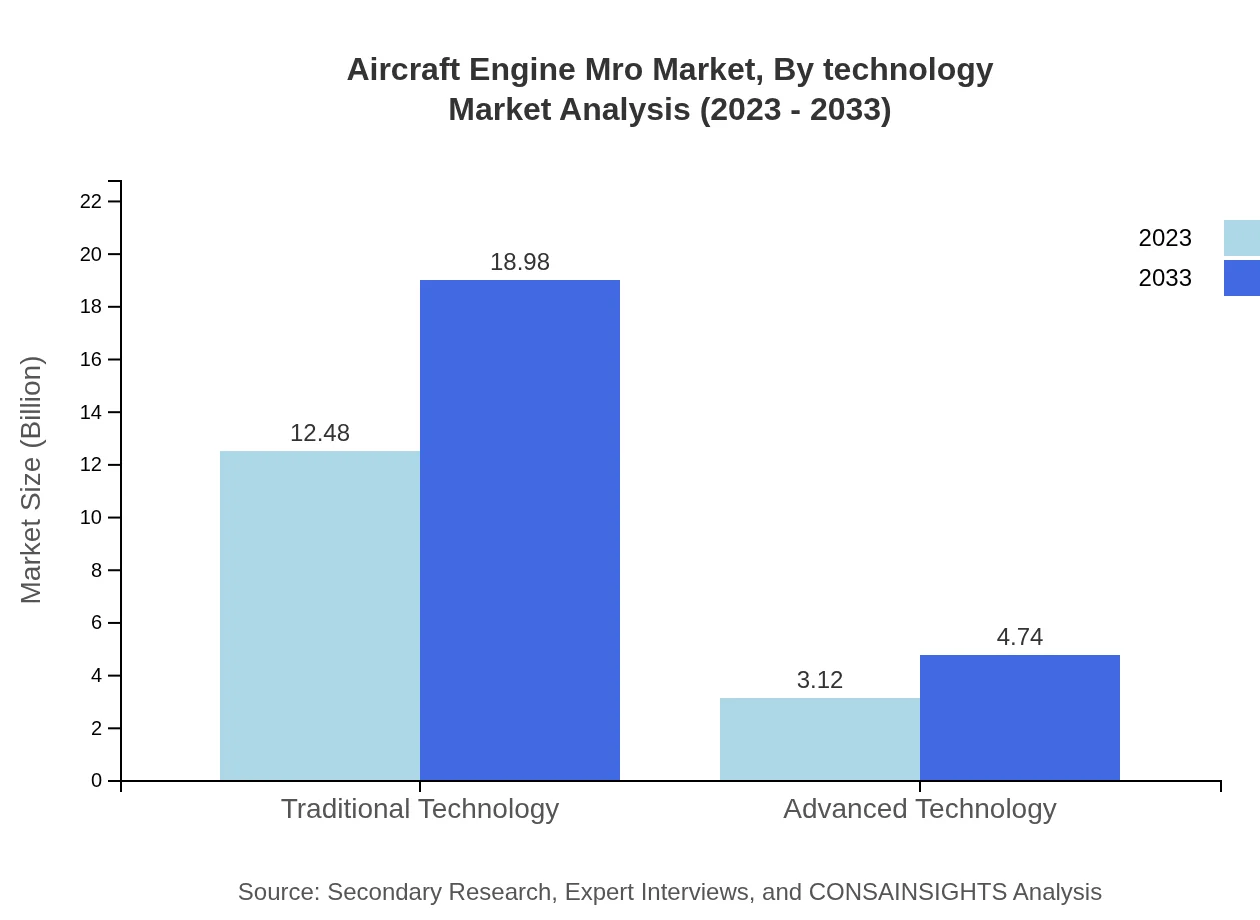

Aircraft Engine Mro Market Analysis By Technology

In terms of technology, the segment is divided between traditional and advanced technology approaches. The traditional technology segment is expected to grow from $12.48 billion in 2023 to $18.98 billion by 2033, while the advanced technology segment, although smaller, will rise from $3.12 billion to $4.74 billion, reflecting a growing emphasis on innovative repair technologies and processes.

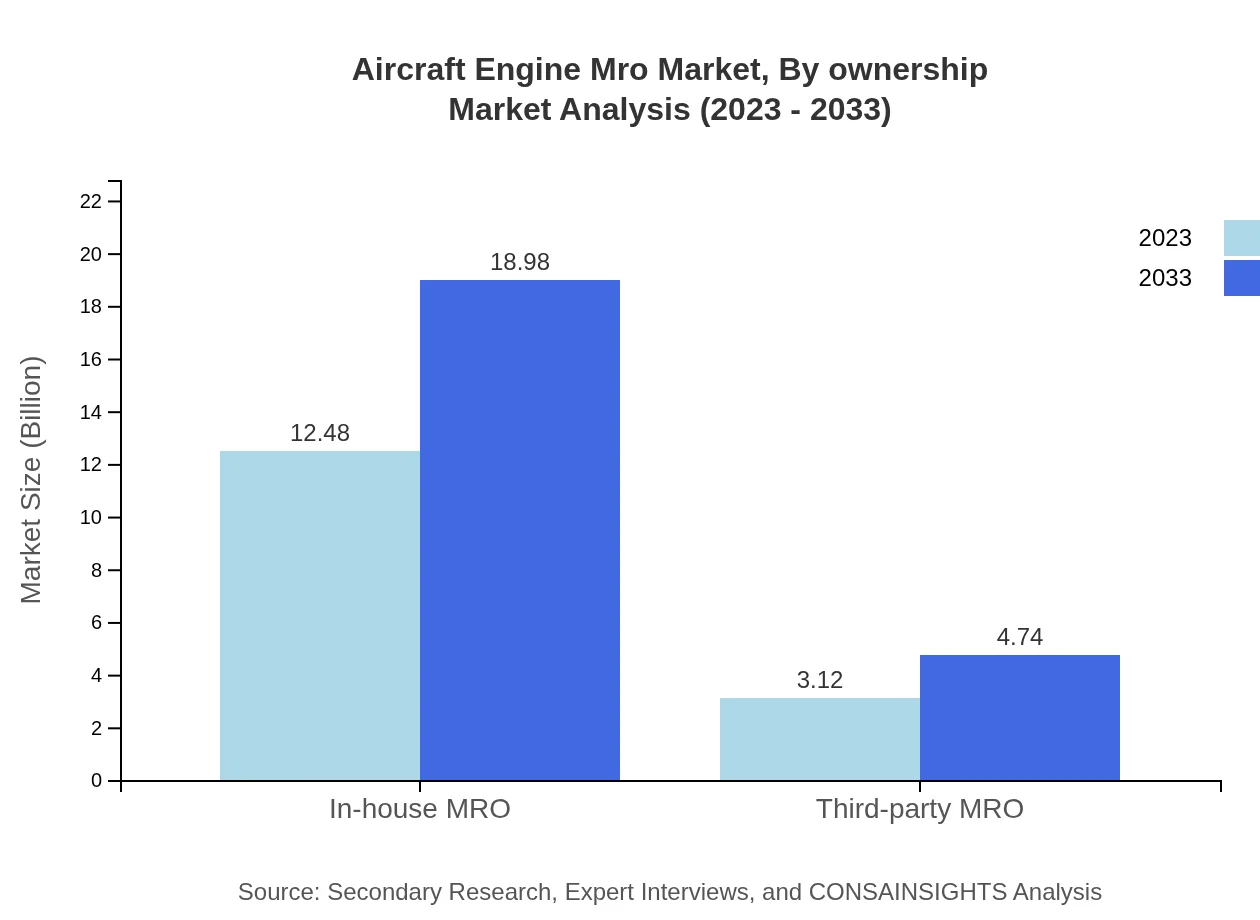

Aircraft Engine Mro Market Analysis By Ownership

The ownership model in the Aircraft Engine MRO market consists of in-house MRO and third-party MRO services. The in-house MRO segment is expected to maintain a significant share at 80.03% throughout the forecast period, while third-party MRO services will account for 19.97%. The total market size for in-house MRO is projected to grow from $12.48 billion in 2023 to $18.98 billion by 2033, and third-party MRO from $3.12 billion to $4.74 billion.

Aircraft Engine MRO Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Engine MRO Industry

General Electric:

A major player in the aerospace sector, General Electric provides a full suite of MRO services for aircraft engines, focusing on technological innovation and sustainability.Rolls-Royce:

Rolls-Royce specializes in high-performance aircraft engines and offers extensive MRO services, emphasizing reliability and customer satisfaction.MTU Aero Engines:

MTU Aero Engines is well known for its advanced technology in maintaining aircraft engines, ensuring efficiency and reduced downtime for clients.Safran Aircraft Engines:

Safran offers MRO services alongside engine manufacturing, providing customers with comprehensive solutions tailored to their operational requirements.Honeywell Aerospace:

Honeywell provides MRO solutions alongside innovative technologies, particularly in avionics and engine systems, enhancing aircraft performance.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Engine Mro?

The aircraft engine MRO market is valued at $15.6 billion in 2023. It is projected to grow at a CAGR of 4.2% until 2033. This growth is largely driven by increasing commercial air traffic and the rising number of aircraft in operation.

What are the key market players or companies in this aircraft Engine Mro industry?

Key players in the aircraft engine MRO market include major firms such as General Electric, Rolls-Royce, Pratt & Whitney, MTU Aero Engines, and Safran. These companies dominate the market due to their extensive experience and technological advancements.

What are the primary factors driving the growth in the aircraft Engine Mro industry?

Growth in the aircraft-engine MRO sector is driven by factors like increasing air travel demand, aging aircraft fleets, technological advancements in engines, and the need for efficient maintenance strategies to enhance operational reliability.

Which region is the fastest Growing in the aircraft Engine Mro?

North America is the fastest-growing region for aircraft engine MRO, projected to grow from $6.03 billion in 2023 to $9.16 billion by 2033. Asia-Pacific and Europe are also significant, reflecting strong demand and investments in aviation.

Does ConsaInsights provide customized market report data for the aircraft Engine Mro industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the aircraft engine MRO industry, providing focused insights that can aid in strategic decision-making and market positioning.

What deliverables can I expect from this aircraft Engine Mro market research project?

Clients can expect a comprehensive report detailing market size, growth forecasts, competitive analysis, and detailed segment insights including regional data breakdowns, along with actionable recommendations for market penetration strategies.

What are the market trends of aircraft Engine Mro?

Current market trends in aircraft-engine MRO include a shift towards digital solutions for predictive maintenance, greater emphasis on sustainability, and increasing outsourcing of MRO services, which are reshaping operational frameworks across the industry.